Commerce Exam > Commerce Questions > What is difference between fixed and floating...

Start Learning for Free

What is difference between fixed and floating charges?

Most Upvoted Answer

What is difference between fixed and floating charges?

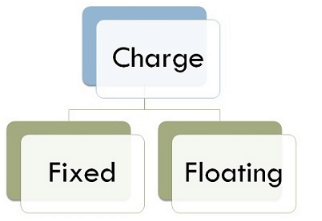

Charge refers to the collateral, given for securing the debt, by way of mortgage on the company’s assets. There are two kinds of charge, fixed charge, and floating charge. The former is a charge on the real asset of the company that is identifiable and ascertained when the charge is created. Conversely, the latter is slightly different, which is created over the the assets circulatory in nature, i.e. the charge is not attached to any definite property.

Companies borrow funds from banks, financial institutions and other companies in the form of loans to fulfill their monetary requiements. The moneylender demands security against the loan and so, the borrower creates a charge over the assets or lien on the property. In this context fixed charge and floating charge are often discussed. Before understanding creation of charge, one should know the difference between two types of charge.

difference between them are :

1. Fixed charge refers to a charge that can be ascertained with a specific asset, while creating it.

2. Static

3. Voluntary

4. A legal charge.

5. First

6. Non-Current Asset

7. The company has no right to deal with the property, but subject to certain exceptions.

Floating charge

1. Floating charge refers to a charge that is created on the assets of circulatory nature.

2. Dynamic

3. Compulsory

4. An equitable charge.

5. Second

6. Current Asset

7. The company can use or deal with asset, until crystallization.

Community Answer

What is difference between fixed and floating charges?

Current assets and fixed assets are located on a company's balance sheet, which consists of the assets of a company whether they are financed by equity or debt. Current assets are short-term assets, and fixed assets are long-term assets.

Current assets can be converted into cash is less than one year. Current assets are used for running the business and paying operational expenses. As a result, short-term assets like current assets are liquid meaning they can be easily converted into cash.

Current assets on a balance sheet may include the following:

Cash and cash equivalents like certificates of depositMarketable securities like equity or debt securitiesAccounts receivable, or money owed by customers to the company for sales that are typically paid in less than 90 daysInventory including finished goods and raw materialsPrepaid expenses

Fixed assets are long-term assets used by a company in producing its goods and services. Fixed assets have a useful life greater than one year. Fixed assets are listed on the balance sheet as property, plant, and equipment (PP&E). Fixed assets are also called tangible assets, meaning they have physical properties or can be touched.

Fixed assets can include the following:

Vehicles like company cars and trucksOffice furnitureMachineryBuildingsLand

Current assets can be converted into cash is less than one year. Current assets are used for running the business and paying operational expenses. As a result, short-term assets like current assets are liquid meaning they can be easily converted into cash.

Current assets on a balance sheet may include the following:

Cash and cash equivalents like certificates of depositMarketable securities like equity or debt securitiesAccounts receivable, or money owed by customers to the company for sales that are typically paid in less than 90 daysInventory including finished goods and raw materialsPrepaid expenses

Fixed assets are long-term assets used by a company in producing its goods and services. Fixed assets have a useful life greater than one year. Fixed assets are listed on the balance sheet as property, plant, and equipment (PP&E). Fixed assets are also called tangible assets, meaning they have physical properties or can be touched.

Fixed assets can include the following:

Vehicles like company cars and trucksOffice furnitureMachineryBuildingsLand

|

Explore Courses for Commerce exam

|

|

Question Description

What is difference between fixed and floating charges? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between fixed and floating charges? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between fixed and floating charges?.

What is difference between fixed and floating charges? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between fixed and floating charges? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between fixed and floating charges?.

Solutions for What is difference between fixed and floating charges? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of What is difference between fixed and floating charges? defined & explained in the simplest way possible. Besides giving the explanation of

What is difference between fixed and floating charges?, a detailed solution for What is difference between fixed and floating charges? has been provided alongside types of What is difference between fixed and floating charges? theory, EduRev gives you an

ample number of questions to practice What is difference between fixed and floating charges? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.