Commerce Exam > Commerce Questions > determination of foreign exchange rate with t...

Start Learning for Free

determination of foreign exchange rate with the help of diagram

Verified Answer

determination of foreign exchange rate with the help of diagram Relate...

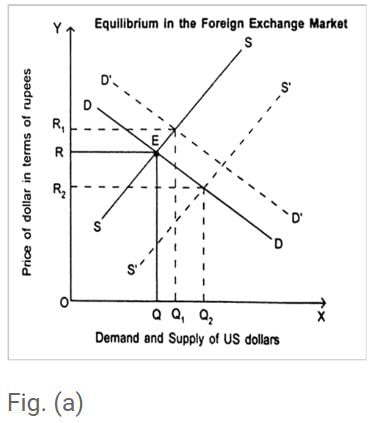

In a system of flexible exchange rate, the exchange rate of a currency (like price of a commodity) is freely determined by forces of demand and supply of foreign exchange in the foreign exchange market. Expressed graphically, the intersection of demand and the supply curves determines the equilibrium exchange rate and equilibrium quantity of foreign currency. This is called equilibrium in foreign exchange market. Let us assume that there are two countries–India and USA – and the exchange rate of their currencies, viz., rupee and dollar is to be determined. Presently, there is floating or flexible exchange regime in both India and USA. Therefore, the value of currency of each country in terms of the other currency depends upon the demand for and supply of their currencies as explained below.

(a) Demand for foreign exchange. Demand for foreign exchange is caused (i) to purchase abroad goods and services by domestic residents, (ii) to purchase assets abroad, (iii) to send gifts abroad, (iv) to invest directly in shops, factories abroad, (v) to purchase foreign currency in anticipation of earnings profit (speculation), (vi) to undertake foreign tour, etc. The demand curve is downward sloping due to inverse relationship between foreign exchange rate and its demand vide Fig.(a).

(b) Supply of foreign exchange. Supply of foreign exchange comes :

(i) when foreigners purchase home country's (say India's) goods and services through our exports, (ii) when foreigners make direct investment in bonds and equity shares of home country, (iii) when speculation cause inflow of foreign exchange, (iv) when foreign tourists come to home country, etc. The supply curve is upward sloping due to direct relationship between foreign exchange rate and its supply vide Fig.(a)

(c) Determination of exchange rate. The equilibrium exchange rate is determined at a point where demand for and supply of foreign exchange are equal. Graphically intersection of demand and supply curves determine the equilibrium exchange rate of foreign currency. At any particular time, the price at which demand for foreign currency (say, dollar) equals its supply is called equilibrium rate of exchange. It is proved with the help of following diagram. The price on the vertical axis is stated in terms of domestic currency (i.e., how many rupees for one US dollar). The horizontal axis measures quantity demanded or supplied of foreign exchange (i.e., dollars). In this figure, demand curve is downward sloping which shows that less foreign exchange is demanded when exchange rate increases. The reason is that rise in the price of foreign exchange (dollar) increases the rupee cost of foreign goods which make them more expensive. The result is fall in imports and demand for foreign exchange.

The supply curve is upward sloping which implies that supply of foreign exchange increases as the exchange rate increases. Home country's goods (here Indian goods) become cheaper to foreigners because rupee is depreciating in value. As a result demand for Indian goods increases. Thus our exports should increase as the exchange rate increases. This will bring greater supply of foreign exchange. Hence the supply of foreign exchange increases as the exchange rate increases which proves the slope of supply curve.

In Fig.(a) demand curve and supply curve of dollar intersect each other at point E which implies that at exchange rate of OR (QE), quantity demanded and supplied are equal (both being equal to OQ). Hence equilibrium exchange rate is OR and equilibrium quantity is OQ.

(d) Change in Exchange Rate. An increase in India's demand for US dollars, supply remaining the same will cause the demand curve DD to shift to D'D'. The resulting intersection will be at a higher exchange rate, i.e., exchange rate (price of dollar in terms of rupees) will rise from OR to OR1 (Say from $1 = र 50 to $1 = र 52). It shows depreciation of Indian currency (rupees) because more rupees (र 52 instead of र 50) are required to buy one US dollar. Thus depreciation of a currency means ‘a fall in the price of home currency’. Likewise an increase in supply of US dollar will cause supply curve SS to shift to S'S' and as a result exchange rate will fall from OR to OR2 (Say from $1 = र 50 to $1 = र 48). It indicates appreciation of Indian currency (rupees) because cost of US dollar in terms of rupee has now fallen, i.e., less rupees (र 48 instead of र 50) are required to buy one US dollar or a dollar fetches more rupees. Thus appreciation of currency means a rise in the price of home currency’.

Note: II may be noted that American dollars. British pounds, French francs and Japanese yen are considered Strong or Hard currencies as worldwide people have faith in their general acceptance as money. Indian Rupees and currencies of developing countries are considered Soft currencies since their exchange value is weak.

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

determination of foreign exchange rate with the help of diagram Relate...

Determining Foreign Exchange Rates with the Help of Diagram

Foreign exchange rates play a crucial role in international trade and finance. They determine the value of one currency in terms of another and influence the flow of goods, services, and capital between countries. The determination of foreign exchange rates can be better understood with the help of a diagram.

1. Demand and Supply of Foreign Exchange:

The foreign exchange market operates based on the forces of demand and supply. The demand for foreign exchange arises from individuals, businesses, and governments who want to purchase goods, services, or assets denominated in a foreign currency. The supply of foreign exchange comes from those who want to sell their currency in exchange for another currency.

2. Factors Affecting Demand and Supply:

Several factors influence the demand and supply of foreign exchange, including:

- Relative interest rates: Higher interest rates in a country attract foreign investors, increasing the demand for its currency.

- Inflation rates: High inflation erodes the value of a currency, decreasing its demand.

- Political stability: Countries with stable political systems are more attractive to foreign investors, increasing the demand for their currency.

- Economic indicators: Strong economic performance, such as high GDP growth and low unemployment, can increase the demand for a currency.

3. Equilibrium Exchange Rate:

The intersection of the demand and supply curves in the foreign exchange market determines the equilibrium exchange rate. At this rate, the quantity of foreign exchange demanded equals the quantity supplied. It represents the market-clearing rate where there is no excess demand or supply for foreign currency.

4. Appreciation and Depreciation:

Changes in the demand and supply of foreign exchange can lead to fluctuations in exchange rates. If the demand for a currency increases or the supply decreases, the currency will appreciate (increase in value) relative to other currencies. Conversely, if the demand decreases or the supply increases, the currency will depreciate (decrease in value).

5. Impact on Imports and Exports:

Exchange rate fluctuations affect a country's imports and exports. A stronger currency makes imports cheaper but exports more expensive, leading to an increase in imports and a decrease in exports. Conversely, a weaker currency makes exports cheaper but imports more expensive, resulting in an increase in exports and a decrease in imports.

In conclusion, the determination of foreign exchange rates is influenced by the interaction of demand and supply in the foreign exchange market. Various economic factors and indicators affect the demand and supply of currencies, leading to fluctuations in exchange rates. Understanding these dynamics is crucial for policymakers, businesses, and individuals involved in international trade and finance.

Foreign exchange rates play a crucial role in international trade and finance. They determine the value of one currency in terms of another and influence the flow of goods, services, and capital between countries. The determination of foreign exchange rates can be better understood with the help of a diagram.

1. Demand and Supply of Foreign Exchange:

The foreign exchange market operates based on the forces of demand and supply. The demand for foreign exchange arises from individuals, businesses, and governments who want to purchase goods, services, or assets denominated in a foreign currency. The supply of foreign exchange comes from those who want to sell their currency in exchange for another currency.

2. Factors Affecting Demand and Supply:

Several factors influence the demand and supply of foreign exchange, including:

- Relative interest rates: Higher interest rates in a country attract foreign investors, increasing the demand for its currency.

- Inflation rates: High inflation erodes the value of a currency, decreasing its demand.

- Political stability: Countries with stable political systems are more attractive to foreign investors, increasing the demand for their currency.

- Economic indicators: Strong economic performance, such as high GDP growth and low unemployment, can increase the demand for a currency.

3. Equilibrium Exchange Rate:

The intersection of the demand and supply curves in the foreign exchange market determines the equilibrium exchange rate. At this rate, the quantity of foreign exchange demanded equals the quantity supplied. It represents the market-clearing rate where there is no excess demand or supply for foreign currency.

4. Appreciation and Depreciation:

Changes in the demand and supply of foreign exchange can lead to fluctuations in exchange rates. If the demand for a currency increases or the supply decreases, the currency will appreciate (increase in value) relative to other currencies. Conversely, if the demand decreases or the supply increases, the currency will depreciate (decrease in value).

5. Impact on Imports and Exports:

Exchange rate fluctuations affect a country's imports and exports. A stronger currency makes imports cheaper but exports more expensive, leading to an increase in imports and a decrease in exports. Conversely, a weaker currency makes exports cheaper but imports more expensive, resulting in an increase in exports and a decrease in imports.

In conclusion, the determination of foreign exchange rates is influenced by the interaction of demand and supply in the foreign exchange market. Various economic factors and indicators affect the demand and supply of currencies, leading to fluctuations in exchange rates. Understanding these dynamics is crucial for policymakers, businesses, and individuals involved in international trade and finance.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics

Question Description

determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics.

determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics.

Solutions for determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics defined & explained in the simplest way possible. Besides giving the explanation of

determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics, a detailed solution for determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics has been provided alongside types of determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics theory, EduRev gives you an

ample number of questions to practice determination of foreign exchange rate with the help of diagram Related: Chapter Notes - Balance Of Payments And Foreign Exchange Rate, Class 12, Economics tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.