Commerce Exam > Commerce Questions > kay Ltd is a company manufacturing textiles i...

Start Learning for Free

kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss

Verified Answer

kay Ltd is a company manufacturing textiles it has a share capital of ...

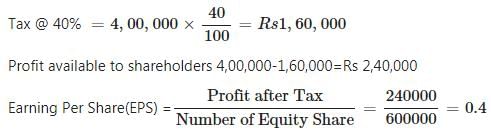

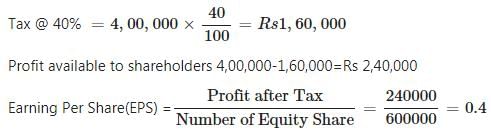

(a) Let the face value of equity share be Rs 10 each.

Profit before Interest & Tax Rs 8,00,000

Interest on 10% debentures Rs 4,00,000

Profit before Tax Profit before Interest and Tax - Interest

Profit before Tax 8,00,000 - 4,00,000 Rs 4,00,000

Thus, shareholders have lost after the issue of debentures as earning per share (EPS) has fallen from Rs 0.5 to Rs 0.4.

(b) Three factors which favour the issue of debentures by the company as part of its capital structure:

1. Good cash flow position: If the company has a good cash flow position, then issuing debentures is more favourable as compared issuing shares.

2. High tax rate: It is beneficial for the company to issue debentures if the tax rate is higher. This is because the interest paid by the company to its debenture holders is tax deductible.

3. Control: If the company does not want to dilute the control of management, then issuing debentures is the best for the company.

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

kay Ltd is a company manufacturing textiles it has a share capital of ...

Based on the information provided, the shareholders of Kay Ltd gained from the additional capital raised through issuing 10% debentures.

Here's the calculation to determine the gain:

1. Additional Capital Raised: Rs 40 lakh

2. Earnings per Share (EPS) of the previous year: Rs 0.50

3. Number of shares: Rs 60 lakh / Rs 0.50 = 120 lakh shares

4. Profit earned on capital employment: Rs 8 lakh

5. Tax paid at 40%: Rs 8 lakh * 0.40 = Rs 3.2 lakh

Now, let's calculate the gain:

- The company required additional capital of Rs 40 lakh, and it raised this capital by issuing 10% debentures. This means the company will pay an interest of 10% on this capital, which is Rs 40 lakh * 0.10 = Rs 4 lakh.

- After deducting the interest expense, the company's profit would be Rs 8 lakh - Rs 4 lakh = Rs 4 lakh.

- The company has 120 lakh shares, so the new EPS would be Rs 4 lakh / 120 lakh = Rs 0.0333 per share.

Comparing the new EPS with the previous EPS, we can see that the shareholders gained. The previous EPS was Rs 0.50, and the new EPS is Rs 0.0333. This indicates a decrease in earnings per share, which could be seen as a loss. However, it is important to consider that the company required additional capital for diversification purposes. The interest expense on the debentures reduced the overall profit but enabled the company to expand its operations and potentially increase its future earnings. Therefore, the shareholders gained from the additional capital raised.

Here's the calculation to determine the gain:

1. Additional Capital Raised: Rs 40 lakh

2. Earnings per Share (EPS) of the previous year: Rs 0.50

3. Number of shares: Rs 60 lakh / Rs 0.50 = 120 lakh shares

4. Profit earned on capital employment: Rs 8 lakh

5. Tax paid at 40%: Rs 8 lakh * 0.40 = Rs 3.2 lakh

Now, let's calculate the gain:

- The company required additional capital of Rs 40 lakh, and it raised this capital by issuing 10% debentures. This means the company will pay an interest of 10% on this capital, which is Rs 40 lakh * 0.10 = Rs 4 lakh.

- After deducting the interest expense, the company's profit would be Rs 8 lakh - Rs 4 lakh = Rs 4 lakh.

- The company has 120 lakh shares, so the new EPS would be Rs 4 lakh / 120 lakh = Rs 0.0333 per share.

Comparing the new EPS with the previous EPS, we can see that the shareholders gained. The previous EPS was Rs 0.50, and the new EPS is Rs 0.0333. This indicates a decrease in earnings per share, which could be seen as a loss. However, it is important to consider that the company required additional capital for diversification purposes. The interest expense on the debentures reduced the overall profit but enabled the company to expand its operations and potentially increase its future earnings. Therefore, the shareholders gained from the additional capital raised.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST

Question Description

kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST.

kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST.

Solutions for kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST defined & explained in the simplest way possible. Besides giving the explanation of

kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST, a detailed solution for kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST has been provided alongside types of kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST theory, EduRev gives you an

ample number of questions to practice kay Ltd is a company manufacturing textiles it has a share capital of Rs 60 lakh in the previous year it's earning per share was Rs 0.50 for diversification the company requires additional capital of Rs 40 lakh the company raised fund by issuing 10�bentures for the same during the year the company earned profit of Rs 8 lakh on capital employment it paid tax @40% state whether the shareholders gained or Liss Related: Indirect ,Short and Long Ans Questions (Q & A) - Ch-9 Financial management, Class 12 BST tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.