Commerce Exam > Commerce Questions > What is difference between insurance and assu...

Start Learning for Free

What is difference between insurance and assurance?

Verified Answer

What is difference between insurance and assurance?

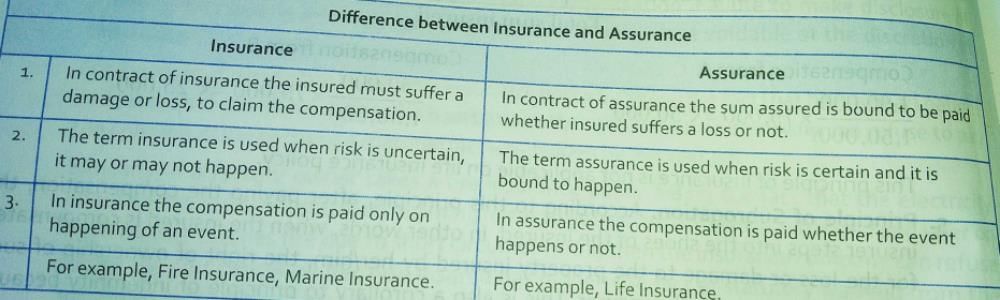

Assurance:

In contract of assurance the sum assured is bound to be paid whether insured suffers a loss or not.

It is used when risk is certain and is bound to happen.

In assurance the compensation is paid whether the event happens or not.

For example: Life Insurance.

Insurance:

In contract of insurance the insured must suffer a damage or loss, to claim the compensation.

It is used when risk is uncertain, it may or may not happen.

In insurance the compensation is paid only on happening of an event.

For example: Fire Insurance, Marine Insurance.

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

What is difference between insurance and assurance?

Community Answer

What is difference between insurance and assurance?

Insurance vs Assurance: Understanding the Differences

Introduction:

Insurance and assurance are two terms often used interchangeably, but they have distinct meanings and applications. While both concepts involve mitigating risks and providing financial protection, they differ in their scope, purpose, and the types of risks they cover.

Definition:

- Insurance: Insurance is a contract between an individual or entity (the insured) and an insurance company (the insurer). The insured pays regular premiums to the insurer, who, in turn, agrees to compensate the insured for specified losses or damages in the event of an unforeseen incident. Insurance primarily focuses on protecting against the financial consequences of uncertain events, such as accidents, natural disasters, or theft.

- Assurance: Assurance, on the other hand, is a long-term contract that guarantees the payment of a specified sum upon the occurrence of an event, typically death. It provides a form of financial security to the policyholder or their beneficiaries. Assurance is commonly associated with life insurance, where the policyholder pays regular premiums, and the insurer pledges to pay a predetermined amount upon the policyholder's death.

Scope and Purpose:

- Insurance: Insurance covers a wide range of risks and uncertainties, such as property damage, health issues, liability claims, and more. Its primary purpose is to provide financial protection against unforeseen events that may result in financial loss. Insurance policies are typically taken for a specific period and require regular premium payments.

- Assurance: Assurance primarily focuses on providing financial security in the event of a specified occurrence, usually the policyholder's death. It aims to ensure the well-being of the policyholder's dependents or beneficiaries. Assurance policies are typically long-term and require consistent premium payments throughout the policyholder's life.

Key Differences:

- Nature of Risk: Insurance covers uncertain events that may or may not happen, such as accidents or theft. Assurance, on the other hand, covers events that are certain to occur, such as death.

- Timeframe: Insurance policies are usually taken for a specific period, and the coverage ends once the policy expires. Assurance policies, however, are long-term and provide coverage until the specified event (usually the policyholder's death) occurs.

- Premiums: Insurance premiums are calculated based on the likelihood of an event occurring and the potential financial loss associated with it. Assurance premiums, on the other hand, are primarily based on the policyholder's age, health, and the amount of coverage desired.

- Payout: Insurance policies pay out when the insured suffers a loss covered by the policy. Assurance policies pay out upon the occurrence of the specified event, such as the policyholder's death.

Conclusion:

In summary, while insurance and assurance both provide financial protection, they differ in their scope, purpose, and the types of risks they cover. Insurance offers coverage against uncertain events, focusing on financial loss mitigation, while assurance guarantees a payout upon the occurrence of a specified event, mainly related to life insurance. Understanding these differences is crucial for individuals and businesses when considering the appropriate type of policy to meet their specific needs.

Introduction:

Insurance and assurance are two terms often used interchangeably, but they have distinct meanings and applications. While both concepts involve mitigating risks and providing financial protection, they differ in their scope, purpose, and the types of risks they cover.

Definition:

- Insurance: Insurance is a contract between an individual or entity (the insured) and an insurance company (the insurer). The insured pays regular premiums to the insurer, who, in turn, agrees to compensate the insured for specified losses or damages in the event of an unforeseen incident. Insurance primarily focuses on protecting against the financial consequences of uncertain events, such as accidents, natural disasters, or theft.

- Assurance: Assurance, on the other hand, is a long-term contract that guarantees the payment of a specified sum upon the occurrence of an event, typically death. It provides a form of financial security to the policyholder or their beneficiaries. Assurance is commonly associated with life insurance, where the policyholder pays regular premiums, and the insurer pledges to pay a predetermined amount upon the policyholder's death.

Scope and Purpose:

- Insurance: Insurance covers a wide range of risks and uncertainties, such as property damage, health issues, liability claims, and more. Its primary purpose is to provide financial protection against unforeseen events that may result in financial loss. Insurance policies are typically taken for a specific period and require regular premium payments.

- Assurance: Assurance primarily focuses on providing financial security in the event of a specified occurrence, usually the policyholder's death. It aims to ensure the well-being of the policyholder's dependents or beneficiaries. Assurance policies are typically long-term and require consistent premium payments throughout the policyholder's life.

Key Differences:

- Nature of Risk: Insurance covers uncertain events that may or may not happen, such as accidents or theft. Assurance, on the other hand, covers events that are certain to occur, such as death.

- Timeframe: Insurance policies are usually taken for a specific period, and the coverage ends once the policy expires. Assurance policies, however, are long-term and provide coverage until the specified event (usually the policyholder's death) occurs.

- Premiums: Insurance premiums are calculated based on the likelihood of an event occurring and the potential financial loss associated with it. Assurance premiums, on the other hand, are primarily based on the policyholder's age, health, and the amount of coverage desired.

- Payout: Insurance policies pay out when the insured suffers a loss covered by the policy. Assurance policies pay out upon the occurrence of the specified event, such as the policyholder's death.

Conclusion:

In summary, while insurance and assurance both provide financial protection, they differ in their scope, purpose, and the types of risks they cover. Insurance offers coverage against uncertain events, focusing on financial loss mitigation, while assurance guarantees a payout upon the occurrence of a specified event, mainly related to life insurance. Understanding these differences is crucial for individuals and businesses when considering the appropriate type of policy to meet their specific needs.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

What is difference between insurance and assurance?

Question Description

What is difference between insurance and assurance? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between insurance and assurance? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between insurance and assurance?.

What is difference between insurance and assurance? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between insurance and assurance? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between insurance and assurance?.

Solutions for What is difference between insurance and assurance? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of What is difference between insurance and assurance? defined & explained in the simplest way possible. Besides giving the explanation of

What is difference between insurance and assurance?, a detailed solution for What is difference between insurance and assurance? has been provided alongside types of What is difference between insurance and assurance? theory, EduRev gives you an

ample number of questions to practice What is difference between insurance and assurance? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.