B Com Exam > B Com Questions > proforma of trial balance Related: Journal, ...

Start Learning for Free

proforma of trial balance

Most Upvoted Answer

proforma of trial balance Related: Journal, Ledger and Trial Balance ...

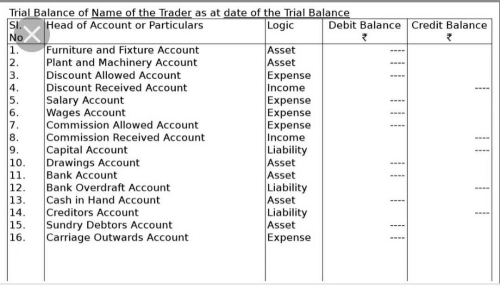

Proforma of Trial Balance

The proforma of a trial balance is a statement that summarizes the balances of all the accounts in the ledger at a particular point in time. It is a crucial step in the accounting cycle as it helps in verifying the accuracy and correctness of the recording and posting of transactions in the accounts.

Components of Trial Balance

A trial balance consists of the following components:

1. Account Names: The trial balance lists all the accounts in the ledger, including assets, liabilities, equity, revenue, and expense accounts.

2. Debit Column: The debit column represents the total debits for each account. Debits are transactions that increase assets and expenses or decrease liabilities and equity.

3. Credit Column: The credit column represents the total credits for each account. Credits are transactions that increase liabilities and equity or decrease assets and expenses.

4. Total Columns: The total columns at the end of the trial balance show the sum of debits and credits for each account.

5. Equality of Debits and Credits: The trial balance ensures that the total debits equal the total credits, indicating that the accounting equation (Assets = Liabilities + Equity) is in balance.

Journal, Ledger, and Trial Balance

1. Journal: The journal is the first step in the accounting process, where all transactions are recorded in chronological order. It includes the date, accounts affected, and the amounts debited or credited.

2. Ledger: The ledger is a collection of accounts that are created in response to the entries made in the journal. Each account in the ledger represents a specific asset, liability, equity, revenue, or expense. The ledger serves as a reference for the trial balance.

3. Trial Balance: The trial balance is prepared by taking the balances from the ledger accounts at a specific date. It ensures that the total debits equal the total credits in the ledger, providing a preliminary check on the accuracy of the recording and posting of transactions.

Importance of Trial Balance

The trial balance is essential for the following reasons:

1. Error Detection: It helps in identifying errors such as incorrect postings, transposition errors, or omitted entries. If the debits and credits do not match in the trial balance, it indicates an error in the ledger accounts.

2. Preparation of Financial Statements: The trial balance provides the necessary information to prepare financial statements such as the income statement and balance sheet. It serves as a basis for determining the final account balances and ensuring the accuracy of financial reports.

3. Audit and Review: The trial balance is a crucial document for auditors and accountants to review the financial records. It allows them to compare the account balances with the supporting documentation and investigate any discrepancies.

In conclusion, the proforma of a trial balance is a statement that summarizes the balances of all accounts in the ledger. It plays a vital role in error detection, preparation of financial statements, and auditing processes. By ensuring the equality of debits and credits, the trial balance provides a preliminary check on the accuracy and correctness of accounting records.

The proforma of a trial balance is a statement that summarizes the balances of all the accounts in the ledger at a particular point in time. It is a crucial step in the accounting cycle as it helps in verifying the accuracy and correctness of the recording and posting of transactions in the accounts.

Components of Trial Balance

A trial balance consists of the following components:

1. Account Names: The trial balance lists all the accounts in the ledger, including assets, liabilities, equity, revenue, and expense accounts.

2. Debit Column: The debit column represents the total debits for each account. Debits are transactions that increase assets and expenses or decrease liabilities and equity.

3. Credit Column: The credit column represents the total credits for each account. Credits are transactions that increase liabilities and equity or decrease assets and expenses.

4. Total Columns: The total columns at the end of the trial balance show the sum of debits and credits for each account.

5. Equality of Debits and Credits: The trial balance ensures that the total debits equal the total credits, indicating that the accounting equation (Assets = Liabilities + Equity) is in balance.

Journal, Ledger, and Trial Balance

1. Journal: The journal is the first step in the accounting process, where all transactions are recorded in chronological order. It includes the date, accounts affected, and the amounts debited or credited.

2. Ledger: The ledger is a collection of accounts that are created in response to the entries made in the journal. Each account in the ledger represents a specific asset, liability, equity, revenue, or expense. The ledger serves as a reference for the trial balance.

3. Trial Balance: The trial balance is prepared by taking the balances from the ledger accounts at a specific date. It ensures that the total debits equal the total credits in the ledger, providing a preliminary check on the accuracy of the recording and posting of transactions.

Importance of Trial Balance

The trial balance is essential for the following reasons:

1. Error Detection: It helps in identifying errors such as incorrect postings, transposition errors, or omitted entries. If the debits and credits do not match in the trial balance, it indicates an error in the ledger accounts.

2. Preparation of Financial Statements: The trial balance provides the necessary information to prepare financial statements such as the income statement and balance sheet. It serves as a basis for determining the final account balances and ensuring the accuracy of financial reports.

3. Audit and Review: The trial balance is a crucial document for auditors and accountants to review the financial records. It allows them to compare the account balances with the supporting documentation and investigate any discrepancies.

In conclusion, the proforma of a trial balance is a statement that summarizes the balances of all accounts in the ledger. It plays a vital role in error detection, preparation of financial statements, and auditing processes. By ensuring the equality of debits and credits, the trial balance provides a preliminary check on the accuracy and correctness of accounting records.

Community Answer

proforma of trial balance Related: Journal, Ledger and Trial Balance ...

|

Explore Courses for B Com exam

|

|

Question Description

proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management.

proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management for B Com 2025 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management covers all topics & solutions for B Com 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management.

Solutions for proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management defined & explained in the simplest way possible. Besides giving the explanation of

proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management, a detailed solution for proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management has been provided alongside types of proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management theory, EduRev gives you an

ample number of questions to practice proforma of trial balance Related: Journal, Ledger and Trial Balance - Accountancy and Financial Management tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.