Accounting Ratios (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Question:51

Total Debt 12,00,000; Current Liabilities 4,00,000; Capital Employed `12,00,000. Calculate Total Assets to Debt Ratio.

Solution:

Debt = Total Debt - Current Liabilities = 12, 00, 000 − 4, 00, 000 = Rs 8,00,000

Total Assets = Capital Employed + Current Liabilities

= 12,00,000 + 4,00,000 = Rs 16,00,000

Total Assets to Debt Ratio = Total Assets/Debt

= 16,00,000/8,00,000 = 2:1

Question:52

From the following information, calculate Total Assets to Debt Ratio:

Fixed Assets Gross - 6,00,000

Accumulated Depreciation - 1,00,000

Non-current Investments - 10,000

Long-term Loans and Advances - 40,000

Current Assets - 2,50,000

Current Liabilities - 2,00,000

Long-term Borrowings - 3,00,000

Long-term Provisions - 1,00,000

Solution:

Debts = Long-term Borrowings + Long Term Provisions = 3,00,000 + 1,00,000 = Rs 4,00,000

Total Assets = Non-Current Assets + Current Assets

= 6,00,000 -1,00,000 + 10,000 + 2,50,000 + 40,000 = Rs 8,00,000

Total Assets to Debt Ratio = Total Assets/Debt

= 8,00,000/4,00,000 = 2:1

Question:53

From the following information, calculate Proprietary Ratio:

Share Capital - 3,00,000

Reserves and Surplus - 1,80,000

Non-current Assets - 13,20,000

Current Assets - 6,00,000

Solution:

Proprietary Ratio = Shareholders' Funds/Total Assets

Proprietary Ratio = (Share Capital + Reserves and Surplus)/(Non-Current Assets + Current Assets)

Proprietary Ratio = (3,00,000 + 1,80,000)/(13,20,000 + 6,00,000) = 0.25:1 or 25%

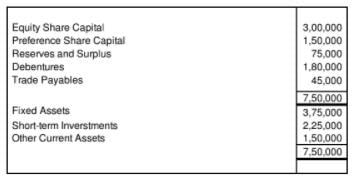

Question:54

From the following information, calculate Proprietary Ratio:

Solution:

Total Assets = Fixed Assets + Current Assets + Investments

= 3,75,000 + 1,50,000 + 2,25,000 = 7,50,000

Shareholders’ Funds = Equity Share Capital + Preference Share Capital + Reserves and Surplus

= 3,00,000 + 1,50,000 + 75,000 = 5,25,000

Proprietary Ratio = Shareholders' Funds/Total Assets = 5,25,000/7,50,000 = 0.70:1

Question:55

Calculate Proprietary Ratio from the following:

Equity Shares Capital - 4,50,000

9% Debentures - 3,00,000

10% Preference Share Capital - 3,20,000

Fixed Assets - 7,00,000

Reserves and Surplus - 65,000

Trade Investment - 2,45,000

Creditors - 1,10,000

Current Assets - 3,00,000

Solution:

Total Assets = Fixed Assets + Trade Investments + Current Assets

= 7,00,000 + 2,45,000 + 3,00,000 = 12,45,000

Shareholders’ Funds = Equity Share Capital + 10% Preference Share Capital + Reserves and Surplus

= 4,50,000 + 3,20,000 + 65,000 = 8,35,000

Proprietary Ratio = Shareholders' Funds/Total Assets = 8,35,000 /12,45,000 = 0.67:1

Question:56

From the following information, calculate Proprietary Ratio:

BALANCE SHEET OF FORTUNE LTD.

as at 31st March, 2019

| Particulars | Note No | Amount |

I. EQUITY AND LIABILITIES 1. Shareholders' Funds b. Reserves and Surplus 2. Current Liabilitiesa. Trade Payables b. Other Current Liabilities c. Short-term Provisions Provision for Tax Total | 6,00,000 1,50,000 1,00,000 50,000 1,00,000 10,00,000 | |

| II. Assets 1. Non-Current Assets Fixed Assets tangible Assets 2. Current Assets a. Current Investments b. Inventories c. Trade Receivables d. Cash and cash Equivalents Total | 5,00,000 1,50,000 1,00,000 1,50,000 1,00,000 10,00,000 |

Solution:

Total Assets = Fixed Assets + Short-term Investments + Inventories + Trade Receivables + Cash and Cash Equivalents

= 5,00,000 + 1,50,000 + 1,00,000 + 1,50,000 + 1,00,000 = 10,00,000

Shareholders’ Funds = Share Capital + Reserves and Surplus

= 6,00,000 + 1,50,000 = 7,50,000

Proprietary Ratio = Shareholders' Funds/Total Assets = 7,50,000 /10,00,000 = 0.75:1

Question:57

State with reason, whether the Proprietary Ratio will improve, decline or will not change because of the following transactions if Proprietary Ratio is 0.8 : 1:

i. Obtained a loan of 5,00,000 from State Bank of India payable after five years.

ii. Purchased machinery of 2,00,000 by cheque.

iii. Redeemed 7% Redeemable Preference Shares 3,00,000.

iv. Issued equity shares to the vendor of building purchased for 7,00,000.

v. Redeemed 10% redeemable debentures of 6,00,000.

Solution:

Transaction | Impact |

Obtained a loan of Rs 5,00,000 from State Bank of India payable after five years. | Total assets increase by 5,00,000.However, since shareholders' funds remain unchanged, therefore proprietary ratio will decrease. |

Purchased machinery ofRs 2,00,000 by cheque. | Total assets are increasing and decreasing by 2,00,000 simultaneously. Thus, both numerator and denominator remain unchanged and so proprietary ratio will not change. |

Redeemed 7% Redeemable Preference Shares Rs 3,00,000. | Both shareholders' funds and total assets decrease by 3,00,000 simultaneously and so proprietary ratio will decrease. |

Issued equity shares to the vendor of building purchased for Rs 7,00,000. | Both shareholders' funds and total assets increase by 7,00,000 simultaneously and so proprietary ratio will improve. |

Redeemed 10% redeemable debentures of Rs 6,00,000 | Total assets decrease by 6,00,000. However, since shareholders' funds remain unchanged, therefore proprietary ratio will improve. |

Question:58

If Profit before Interest and Tax is 5,00,000 and interest on Long-term Funds is 1,00,000, find Interest Coverage Ratio.

Solution:

Net Profit before Interest and Tax = 5,00,000

Interest = 1,00,000

Interest Coverage ratio = Net profit before Interest and Tax/Interest

= 5,00,000 /1,00,000

= 5 times

Question:59

From the following information, calculate Interest Coverage Ratio: Profit after Tax 1,70,000; Tax 30,000; Interest on Long-term Funds 50,000.

Solution:

Profit before Interest and Tax = Profit after Tax + Tax + Interest

= 1,70,000 + 30,000 + 50,000 = 2,50,000

Interest Coverage ratio = Net profit before Interest and Tax/Interest

= 2,50,000/50,000

= 5 times

Question:60

From the following information, calculate Interest Coverage Ratio:

10,000 Equity Shares of 10 each - 1,00,000

8% Preference Shares - 70,000

10% Debentures - 50,000

Long-term Loans from Bank - 50,000

Interest on Long-term Loans from Bank - 5,000

Profit after Tax - 75,000

Tax - 9,000

Solution:

Interest on 10% Debentures = 50,000 x 10/100 = 5000

Profit before Interest and Tax = Profit after Tax + Tax + Interest on Debentures + Interest on Long-term Loans from Bank

= 75,000 + 9,000 + 5,000 + 5,000 = 94,000

Total Interest Amount = Interest on Debentures + Interest on Long-term loans from Bank

= 5000 + 5000 = 10,000

Interest Coverage ratio = Net profit before Interest and Tax/Interest

= 94,000/10,000

= 9.4 times

Question:61

From the following details, calculate Inventory Turnover Ratio:

Cost of Revenue from Operations Cost of Goods Sold - 4,50,000

Inventory in the beginning of the year - 1,25,000

Inventory at the close of the year - 1,75,000

Solution:

Inventory Turnover ratio = Costs of Goods Sold/Average Stock

Cost of Goods Sold = 4,50,000

Average stock = (Opening + Closing Stock)/2

= (1,25,000 + 1,75,000)/2 = 1,50,000

Inventory Turnover Ratio = 4,50,000/1,50,000 = 3 times

Question:62

Cost of Revenue from Operations Cost of Goods Sold

5,00,000; Purchases 5,50,000; Opening Inventory 1,00,000.

Calculate Inventory Turnover Ratio.

Solution:

Cost of Goods Sold = Opening Inventory + Purchases − Closing Inventory

5,00,000 = 1,00,000 + 5,50,000 − Closing Inventory

Closing Inventory = 1,50,000

Average Inventory = (Opening Inventory + Closing Inventory)/2

= (1,00,000 + 1,50,000)/2 = 1,25,000

Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory = 5,00,000/1,25,000 = 4 times

Question:63

Calculate Inventory Turnover Ratio from the following information:

Opening Inventory is 50,000; Purchases 3,90,000; Revenue from Operations, i.e., Net Sales 6,00,000; Gross Profit Ratio 30%.

Solution:

Cost of Goods Sold = Net Sales – Gross Profit

= Rs 6,00,000 – 30% of Rs 6,00,000

= Rs 6,00,000 – Rs 1,80,000 = Rs 4,20,000

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

Rs 4,20,000 = Rs 50,000 + Rs 3,90,000 – Closing Inventory

Closing Inventory = Rs 50,000 + Rs 3,90,000 – Rs 4,20,000

= Rs 20,000

Average Stock = (Opening Stock + Closing Stock)/2 = (50,000 + 20,000)/2 = Rs 35,000

Stock Turnover Ratio = Costs of Goods sold/Average Stock = 4,20,000/35,000 = 12 times

Question:64

Calculate Inventory Turnover Ratio from the following:

Opening Inventory - 29,000

Closing Inventory - 31,000

Revenue from Operations, i.e., Sales - 3,20,000

Gross Profit Ratio 25%

Solution:

Sales = 3,20,000

Gross Profit = 25% on Sales

Therefore, Gross Profit = 3,20,000 x 25/100 = 80,000

Costs of good sold = Total sales - Gross Profit

= 3,20,000 - 80,000 = 2,40,000

Average Inventory = (Opening Inventory + Closing Inventory)/2 = (29,000 + 31,000)/2 = Rs 30,000

Inventory Turnover ratio = Costs of Goods sold/Average Inventory = 2,40,000/30,000 = 8 times

Question:65

From the following information, calculate Inventory Turnover Ratio:

Revenue from Operations - 16,00,000

Average Inventory - 2,20,000

Gross Loss Ratio 5%

Solution:

Cost of Revenue from Operations = Revenue from Operations + Gross Loss

=16,00,000+80,000 = Rs 16,80,000

Inventory Turnover ratio = Cost of revenue from operation/Average inventory = 16,80,000/2,20,000

= 7.64 times

Question:66

Revenue from Operations 4,00,000; Gross Profit 1,00,000; Closing Inventory 1,20,000; Excess of Closing Inventory over Opening Inventory 40,000. Calculate Inventory Turnover Ratio.

Solution:

Sales = 4,00,000

Gross Profit = 1,00,000

Cost of Goods Sold = Sales − Gross Profit

= 4,00,000 − 1,00,000 = 3,00,000

Let Opening Inventory = x

Closing Inventory = x + 40,000

1,20,000 = x + 40,000

x = 80,000

Opening Inventory = 80,000

Average Inventory = (Opening Inventory + Closing Inventory)/2 = (80,000 + 1.20,000)/2 = Rs 1,00,000

Inventory Turnover ratio = Costs of Goods sold/Average Inventory = 3,00,000/1,00,000 = 3 times

Question:67

From the following data, calculate Inventory Turnover Ratio:

Total Sales 5,00,000; Sales Return 50,000; Gross Profit 90,000; Closing Inventory 1,00,000; Excess of Closing Inventory over Opening Inventory 20,000.

Solution:

Cost of Goods Sold = Net Sales

Sales– Sales Return – Gross Profit

= Rs 5,00,000 – Rs 50,000 – Rs 90,000 = Rs 3,60,000

Closing Inventory = Rs 1,00,000

Closing Inventory is Rs 20,000 more than the Opening Inventory

Therefore, Opening Inventory = Rs 80,000

Rs1,00,000 – Rs20,000

Average Stock = (Opening Stock + Closing Stock)/2 = (80,000 + 1,00,000)/2 = Rs 90,000

Stock Turnover Ratio = Costs of Goods sold/Average Stock = 3,60,000/90,000 = 4 times

Question:68

2,00,000 is the Cost of Revenue from Operations Cost of Goods Sold, during the year. If Inventory Turnover Ratio is 8 times, calculate inventories at the end of the year. Inventories at the end are 1.5 times that of in the beginning.

Solution:

Inventory Turnover ratio = Costs of Goods sold/Average Inventory

8 = 2,00,000/Average Inventory

Average Inventory = Rs. 25,000

Let Opening Inventory = x

Closing Inventory = 1.5*x = 1.5x

Average Inventory = (Opening Inventory + Closing Inventory)/2

25,000 = (x + 1.5x)/2

2.5x = 50,000

x = 20,000

Opening Inventory = x = Rs 20,000

Closing Inventory = 1.5x = Rs 30,000

Question:69

Calculate Inventory Turnover Ratio from the following information:

Opening Inventory 40,000; Purchases 3,20,000; and Closing Inventory 1,20,000.

State, giving reason, which of the following transactions would

I. increase, ii. decrease, iii. neither increase nor decrease the Inventory Turnover Ratio:

Sale of goods for 40,000 Cost 32, 000

b. increase in the value of Closing Inventory by 40,000.

c. Goods purchased for 80,000.

d. Purchases Return 20,000.

e. goods costing 10,000 withdrawn for personal use.

f. Goods costing 20,000 distributed as free samples.

Solution:

Cost of Goods Sold = Opening Stock + Purchases + Closing Stock

= 40,000 + 3,20,000 − 1,20,000 = 2,40,000

Average Stock = (Opening Stock + Closing Stock)/2 = (40,000 + 1,20,000)/2 = Rs 80,000

Stock Turnover Ratio = Costs of Goods sold/Average Stock = 2,40,000/80,000 = 3 times

A. Sale of goods for Rs 40,000 Cost Rs 32,000 - Increase

Reason: This transaction will decrease stock at the end closing stock. Decrease in closing stock will result increase the proportion of Cost of Goods Sold and decrease in Average Stock

b. Increase in value of Closing Stock by 40,000 - Decrease

Reason: Increase in Closing Stock results decrease in Cost of Goods Sold and increase in Average Stock.

c. Goods purchased for Rs 80,000 - Decrease

Reason: This Transaction increases the amount of Closing Stock. Increase in Closing Stock reduces the proportion of Cost of Goods Sold and Increase in Average Stock.

d. Purchase Return Rs 20,000 - Increase

Reason: It will result in a decrease in Cost of Goods Sold and Average Stock with the same amount.

e. Goods costing Rs 10,000 withdrawn for personal use - Increase

Reason: Drawing of goods will decrease the amount of Closing Stock and increase in Cost of Goods Sold.

f. Goods costing Rs 20,000 distributed as free sample - Increase

Reason: Goods distributed as free samples reduces Closing Stock. Reduction in Closing Stock will result in an increase in Cost of Goods Sold and decrease in Average Stock.

Question:70

Calculate Inventory Turnover Ratio from the data given Below:

Inventory in the beginning of the year - 20,000

Carriage Inwards - 5,000

Inventory at the end of the year - 10,000

Revenue from Operations, i.e., Sales - 1,00,000

Purchases - 50,000

State the significance of this ratio.

Solution:

Cost of Goods Sold = Opening Stock + Purchases + Carriage Inwards − Closing Stock

= 20,000 + 50,000 + 5,000 − 10,000 = 65,000

Average Stock = (Opening Stock + Closing Stock)/2

= (20,000 + 10,000)/2 = Rs 15,000

Inventory Turnover ratio = Costs of Goods sold/Average Inventory = 65,000/15,000 = 4.33 times

Question:71

From the following information, calculate value of Opening Inventory:

Closing Inventory = 68,000

Total Sales = 4,80,000 including Cash Sales 1, 20, 000

Total Purchases = 3,60,000 including Credit Purchases 2, 39, 200

Goods are sold at a profit of 25% on cost.

Solution:

Let cost of goods sold be = x

Gross Profit = x*25/100 = 25x/100

Costs of good sold = Sales - Gross Profit

Or, x = 4,80,000 - 25x/100

or, x + 25/100 = 4,80,000

or, 125x/100 = 4,80,000

Or, x = (4,80,000*100)/125 = 3,84,000

Cost of Goods Sold = x = Rs 3,84,000

Cost of Goods Sold = Opening Inventory Stock + Purchases − Closing Inventory Stock

3,84,000 = Opening Inventory + 3,60,000 − 68,000

Opening Inventory = 3,84,000 − 2,92,000 = Rs 92,000

Question:72

From the following information, determine Opening and Closing inventories:

Inventory Turnover Ratio 5 Times, Total sales 2,00,000, Gross Profit Ratio 25%. Closing Inventory is more by 4,000 than the Opening Inventory.

Solution:

Sales = 2,00,000

Gross Profit = 25% on Sales

Gross Profit = 2,00,000 x 25/100 = 50,000

Cost of Goods Sold = Total Sales − Gross Profit

= 2,00,000 − 50,000 = 1,50,000

Inventory Turnover ratio = Costs of Goods sold/Average Inventory

5 = 1,50,000/Average Inventory

Average Inventory = 30,000

Let Opening Inventory = x

Closing Inventory = x + 4,000

Average Inventory = (Opening Inventory + Closing Inventory)/2

30,000 = (x + x + 4000)/2

60,000 = 2x + 4,000

x = 28,000

Opening Inventory = x = Rs 28,000

Closing Inventory = x + 4000 = 28,000 + 4000 = Rs 32,000

Question:73

Following figures have been extracted from Shivalika Mills Ltd.:

Inventory in the beginning of the year 60,000.

Inventory at the end of the year 1,00,000.

Inventory Turnover Ratio 8 times.

Selling price 25% above cost.

Compute amount of Gross Profit and Revenue from Operations Net Sales.

Solution:

Average Inventory = (Opening Inventory + Closing Inventory)/2

= (60,000 + 1,00,000)/2

= 80,000

Inventory Turnover ratio = Costs of Goods sold/Average Inventory

8 = Costs of Goods sold/80,000

Costs of Goods sold = Rs. 6,40,000

Gross profit = 25% on Cost

Therefore, Gross Profit = 6,40,000 x 25/100 = 1.60,000

Sales = Cost of Goods Sold + Gross Profit

= 6,40,000 + 1,60,000 = 8,00,000

Question:74

Inventory Turnover Ratio - 5 times; Cost of Revenue from Operations Cost of Goods Sold - 18,90,000. Calculate Opening Inventory and Closing Inventory if Inventory at the end is 2.5 times more than that in the beginning.

Solution:

Inventory Turnover ratio = Costs of Goods sold/Average Inventory

5 = 18,90,000/Average Inventory

Average Inventory = Rs. 3,78,000

Let Opening Inventory = x

Closing Inventory = 2.5x + x = 3.5x

Average Inventory = (Opening Inventory + Closing Inventory)/2

3,78,000 = (x + 3.5x)/2

x = 1,68,000

Opening Inventory = x = Rs 1,68,000

Closing Inventory = 3.5x = 3.5*1,68,00 = Rs 5,88,000

Question:75

3,00,000 is the Cost of Revenue from Operations Cost of Goods Sold

Inventory Turnover Ratio 8 times; Inventory in the beginning is 2 times more than the inventory at the end. Calculate value of Opening and Closing

Solution:

Inventory Turnover ratio = Costs of Goods sold/Average Inventory

8 = 3,00,000/Average Inventory

Average Inventory = Rs. 37,500

Let Closing Inventory = x

Opening Inventory = 2x + x = 3x

Average Inventory = (Opening Inventory + Closing Inventory)/2

37,500 = (3x + x)/2

x = 18,750

Closing Inventory = x = Rs 18,750

Opening Inventory = 3x = 3 ×18,750 = Rs 56,250

|

42 videos|199 docs|43 tests

|

FAQs on Accounting Ratios (Part - 3) - Accountancy Class 12 - Commerce

| 1. What are accounting ratios? |  |

| 2. How are accounting ratios calculated? |  |

| 3. What is the significance of accounting ratios in financial analysis? |  |

| 4. Can accounting ratios be used to compare companies in different industries? |  |

| 5. How often should accounting ratios be analyzed? |  |