Accounting Ratios (Part - 5) | Accountancy Class 12 - Commerce PDF Download

Question:101

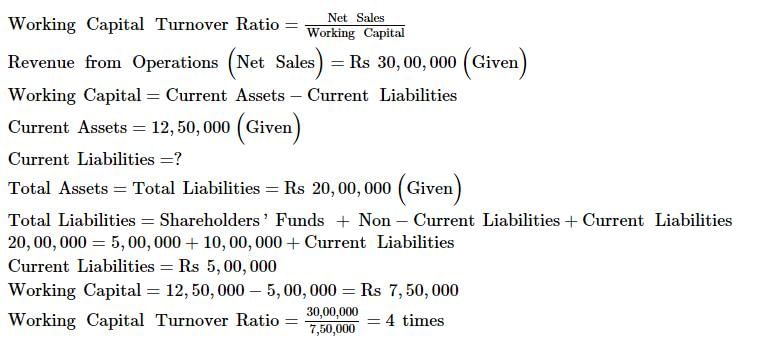

Calculate Working Capital Turnover Ratio from the following information:

Revenue from Operations 30,00,000; Current Assets 12,50,000; Total Assets 20,00,000; Non-current Liabilities 10,00,000, Shareholders' Funds 5,00,000.

Solution: Question:102

Question:102

A company earns Gross Profit of 25% on cost. For the year ended 31st March, 2017 its Gross Profit was 5,00,000; Equity Share Capital of the company was 10,00,000; Reserves and Surplus 2,00,000; Long-term Loan 3,00,000 and Non-current Assets were 10,00,000.

Compute the 'Working Capital Turnover Ratio' of the company.

Working Capital Turnover Ratio= Revenue from Operation/Working Capital

Solution:

Gross Profit = 25% on Cost

Let the Cost of Goods sold be 100.

Gross Profit = 25

Revenue from Operations = 100 + 25 = 125

When Gross profit is 25, revenue from operations is = 125

And, if Gross profit is 5,00,000 then revenue from operations will be = 5,00, 000 × 125/25 = 25,00,000

Capital Employed = Shareholder’s Funds + Non-Current Liabilities

= 10,00,000 + 2,00,000 + 3,00,000

= 15,00,000

Also, Capital Employed = Non Current Assets + Working Capital

Alternatively, Working Capital = Capital Employed – Non-current Assets = 15,00,000– 10,00,000

= 5,00,000

Hence, Working Capital Turnover Ratio= 25,00,000/5,00,000= 5 times

Question:103

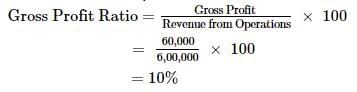

Compute Gross Profit Ratio from the following information:

Cost of Revenue from Operations Cost of Goods Sold

5,40,000; Revenue from Operations Net Sales

6,00,000.

Solution:

Gross Profit = Revenue from Operations – Cost of Revenue from Operations

= 6,00,000 – 5,40,000

= Rs 60,000

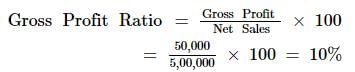

Question:104

From the following, calculate Gross Profit Ratio:

Gross Profit:50,000; Revenue from Operations 5,00,000; Sales Return: 50,000.

Solution:

Net Sales = Rs 5, 00, 000Gross Profit = Rs 50, 000

Note: Here we will not deduct the amount of sales return because the amount of net sales has already been provided in the question.

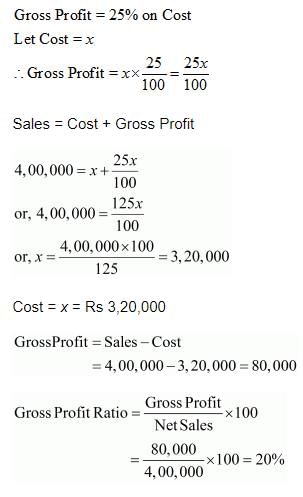

Question:105

Compute Gross Profit Ratio from the following information:

Revenue from Operations, i.e., Net Sales = 4,00,000; Gross Profit 25% on Cost.

Solution:

Question:106

Calculate Gross Profit Ratio from the following data:

Cash Sales are 20% of Total Sales; Credit Sales are 5,00,000; Purchases are 4,00,000; Excess of Closing Inventory over Opening Inventory 25,000.

Solution:

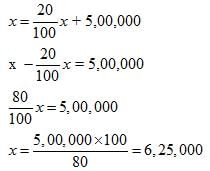

Credit Sales = 5,00,000

Cash sales = 20% of Total Sales

Let Total Sales be ‘x’

Therefore, Cash Sales = 20% of x

Total Sales = Cash Sales + Credit Sales

Cost of Goods Sold = Purchases – Excess of Closing Stock over Opening Stock

= Rs 4,00,000 – Rs 25,000 = Rs 3,75,000

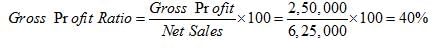

Gross Profit = Total Sales – Cost of Goods Sold

= Rs 6,25,000 – 3,75,000 = Rs 2,50,000

Question:107

From the following information, calculate Gross Profit Ratio:

Credit Sales 5,00,000

Decrease in Inventory 10,000

Purchases 3,00,000

Returns Outward 10,000

Carriage Inwards 10,000

Wages 50,000

Rate of Credit Sale to Cash Sale 4:1

Solution:

Credit Sale = Rs 5,00,000

Rate of Credit Sale to Cash Sale = 4:1

Total Sales = Cash Sales + Credit Sales = Rs 1,25,000 + Rs 5,00,000 = Rs 6,25,000

Cost of Goods Sold = Purchases – Return Outward + Carriage Inwards + Wages + Decrease in Inventory

= Rs 3,00,000 – Rs 10,000 + Rs 10,000 + Rs 50,000 + Rs 10,000

= Rs 3,60,000

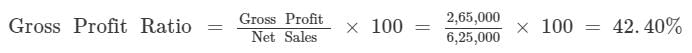

Gross Profit = Total Sales – Cost of Goods Sold

= Rs 6,25,000 – Rs 3,60,000 = Rs 2,65,000

Question: 108

Calculate Gross Profit Ratio from the following data:

Average Inventory 3,20,000; Inventory Turnover Ratio 8 Times; Average Trade Receivables 4,00,000; Trade Receivables Turnover Ratio 6 Times; Cash Sales 25% of Net Sales.

Solution:

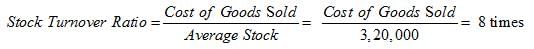

Inventory Turnover Ratio = 8 times

Average Inventory = Rs 3,20,000

Cost of Goods sold = 25,60,000

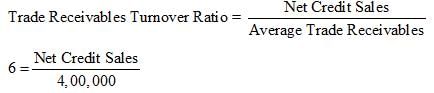

Trade Receivables Turnover Ratio = 6 times

Average Trade Receivables = Rs 4,00,000

Net Credit Sales = 24,00,000

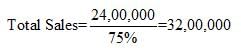

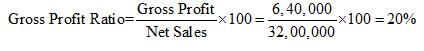

Total Sales = Cash Sales + Credit Sales

Total Sales = 25% of Total Sales + Credit Sales

75% of Total Sales = 24,00,000

Gross Profit = Total Sales – Cost of Goods Sold

= 32,00,000 – 25,60,000 = 6,40,000

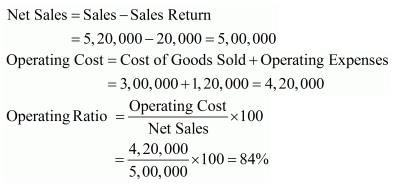

Question:109

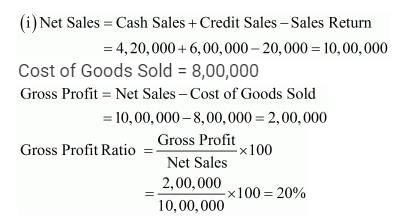

i. Revenue from Operations: Cash Sales 4,20,000; Credit Sales 6,00,000; Return 20,000. Cost of Revenue from Operations or Cost of Goods Sold 8,00,000. Calculate Gross Profit Ratio.

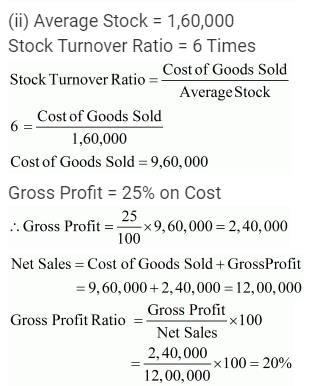

ii. Average Inventory 1,60,000; Inventory Turnover Ratio is 6 Times; Selling Price 25% above cost. Calculate Gross Profit Ratio.

iii. Opening Inventory 1,00,000; Closing Inventory 60,000; Inventory Turnover Ratio 8 Times; Selling Price 25% above cost. Calculate Gross Profit Ratio.

Solution:

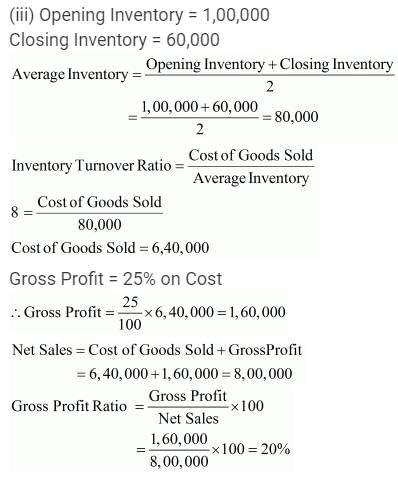

Question:110

Gross Profit Ratio of a company is 25%. State giving reason, which of the following transactions will

a. increase or b. decrease or c. not alter the Gross Profit Ratio.

i. Purchases of Stock-in-Trade 50,000.

ii. Purchases Return 15,000.

iii. Cash Sale of Stock-in-Trade 40,000.

iv. Stock-in-Trade costing 20,000 withdrawn for personal use.

v. Stock-in-Trade costing 15,000 distributed as a free sample.

Solution:  Question:111

Question:111

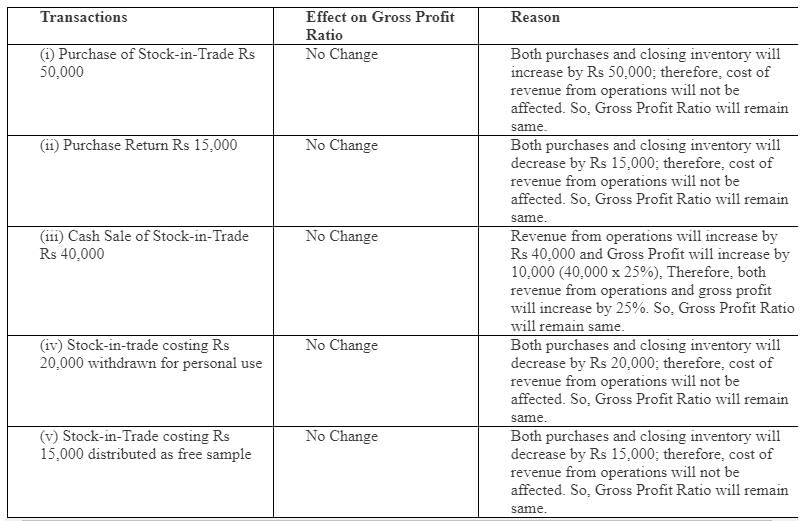

Cost of Revenue from Operations Cost of Goods Sold

3,00,000. Operating Expenses 1,20,000. Revenue from Operations: Cash Sales 5,20,000; Return 20,000. Calculate Operating Ratio.

Solution:

Question:112

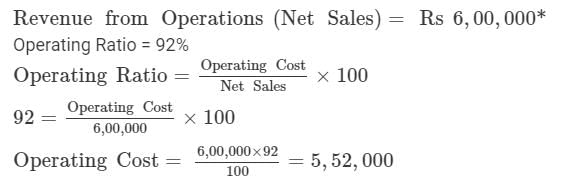

Operating Ratio 92%; Operating Expenses 94,000; Revenue from Operations 6,00,000; Sales Return 40,000. Calculate Cost of Revenue from Operations Cost of Goods Sold.

Solution:

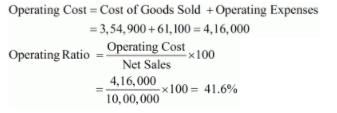

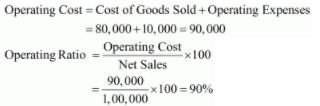

Operating Cost = Cost of Goods Sold + Operating Expenses

5,52,000 = Cost of Goods Sold + 94,000

Cost of Goods Sold = Rs 4,58,000

*Note: Sales Return will not be considered since net sales are given which means sales return have already been adjusted in the sales figure.

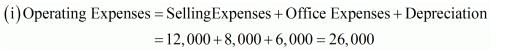

Question:113

i. Cost of Revenue from Operations Cost of Goods Sold Rs 2,20,000; Revenue from Operations Net Sales Rs 3,20,000; Selling Expenses 12,000; Office Expenses 8,000; Depreciation 6,000. Calculate Operating Ratio.

ii. Revenue from Operations, Cash Sales 4,00,000; Credit Sales 1,00,000; Gross Profit 1,00,000; Office and Selling Expenses 50,000. Calculate Operating Ratio.

Solution:

Cost of Goods Sold = 2,20,000

Operating Cost = Cost of Goods Sold + Operating Expenses

Operating Cost = 2,20,000 + 26,000 = 2,46,000

Sales = 3,20,000

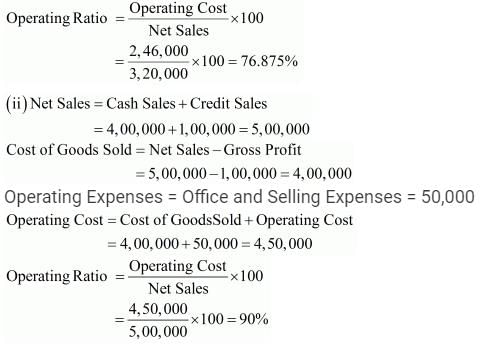

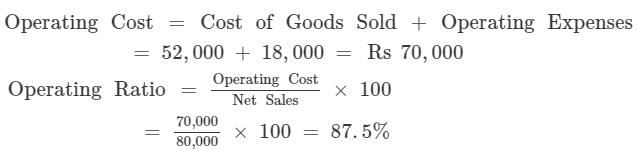

Question:114

From the following information, calculate Operating Ratio:

Cost of Revenue from Operations Cost of Goods Sold 52,000

Revenue from Operation Gross Sales 88,000

Operating Expenses 18,000

Sales Return 8,000

Solution:

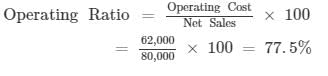

Net Sales = Gross Sales - Sales Return = 88, 000 - 8, 000 = Rs 80, 000

Question:115

Calculate Cost of Revenue from Operations from the following information:

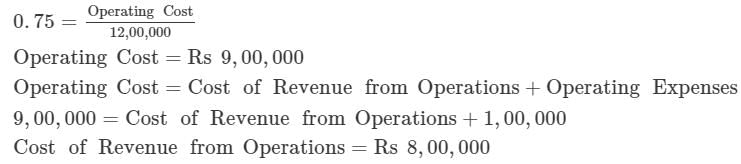

Revenue from Operations 12,00,000; Operating Ratio 75%; Operating Expenses 1,00,000.

Solution:

Revenue from Operations Net Sales = Rs 12, 00, 000

Operating Ratio = 75%

Operating Expenses = Rs 1, 00, 000

Find out: Cost of Revenue from Operations

Operating Ratio =

Question:116

Calculate Operating Ratio from the following information:

Operating Cost 6,80,000; Gross Profit 25%; Operating Expenses 80,000.

Solution:

Given: Operating Cost = Rs 6, 80, 000

Operating Expenses = Rs 80, 000

Gross Profit Ratio = 25 %

Find out: Operating Ratio

Operating Cost = Cost of Revenue from Operations + Operating Expenses

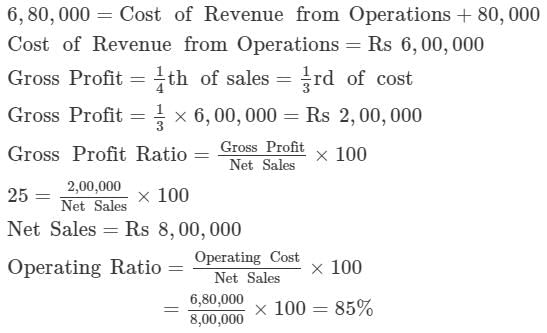

Question:117

Calculate Operating Profit Ratio from the following information:

Opening Inventory 1,00,000

Closing Inventory 1,50,000

Purchases 10,00,000

Loss by fire 20,000

Revenue from Operations, i.e., Net Sales 14,70,000

Dividend Received 30,000

Administrative and Selling Expenses 1,70,000

Solution:

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

= 1,00,000 + 10,00,000 – 1,50,000 = 9,50,000

Operating Expenses = Administrative and Selling Expenses = 1,70,000

Operating Cost = Cost of Goods Sold + Operating Expenses

= 9,50,000 + 1,70,000 = 11,20,000

Net Sales = 14,70,000

Operating Profit Ratio = 100 – Operating Ratio = 100 – 76.19 = 23.81%

Question:118

Calculate Operating Profit Ratio from the Following:

Revenue from Operations Net Sales 5,00,000

Cost of Revenue from Operations Cost of Goods Sold 2,00,000

Wages 1,00,000

Office and Administrative Expenses 50,000

Interest on Borrowings 5,000

Solution:

Cost of Goods Sold = 2,00,000

Operating Expenses = Office and Administrative Expenses = 50,000

Operating Cost = Cost of Goods Sold + Operating Expenses

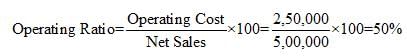

= 2,00,000 + 50,000 = 2,50,000

Net Sales = 5,00,000

Operating Profit Ratio = 100 – Operating Ratio = 100 – 50 = 50%

Question:119

What will be the Operating Profit Ratio, if the Operating Ratio is 82.59%?

Solution:

Operating Ratio = 82.59%

Operating Ratio + Operating Profit Ratio = 100%

Operating Profit Ratio = 100% − 82.59% = 17.41%

Question:120

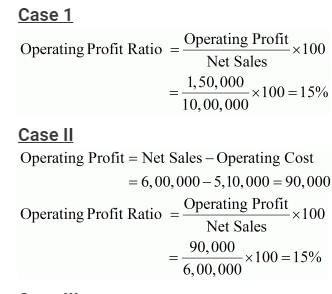

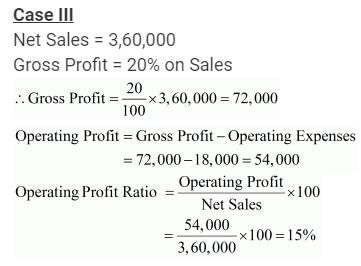

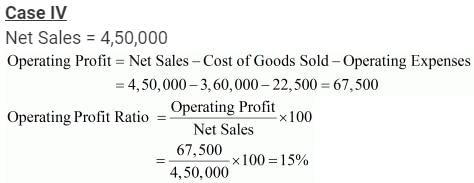

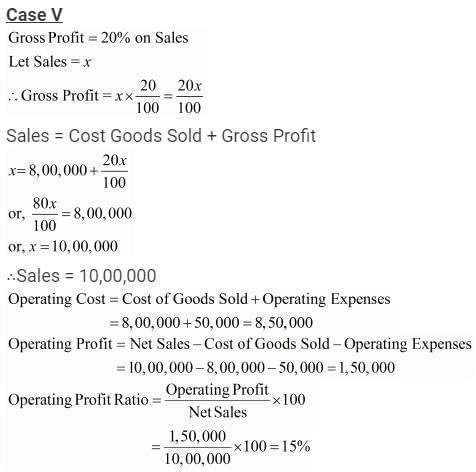

Calculate Operating Profit Ratio,in each of the following alternative cases:

Case 1: Revenue from Operations Net Sales 10,00,000; Operating Profit 1,50,000.

Case 2: Revenue from Operations Net Sales 6,00,000; Operating Cost 5,10,000.

Case 3: Revenue from Operations Net Sales 3,60,000; Gross Profit 20% on Sales; Operating Expenses 18,000

Case 4: Revenue from Operations Net Sales 4,50,000; Cost of Revenue from Operations 3,60,000; Operating Expenses 22,500.

Case 5: Cost of Goods Sold, i.e., Cost of Revenue from Operations 8,00,000; Gross Profit 20% on Sales; Operating Expenses 50,000.

Solution:

Question:121

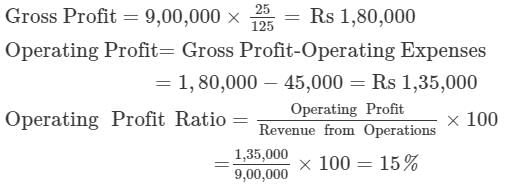

Revenue from Operations 9,00,000; Gross Profit 25% on Cost; Operating Expenses 45,000. Calculate Operating Profit Ratio.

Solution:

Question:122

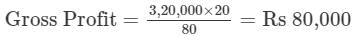

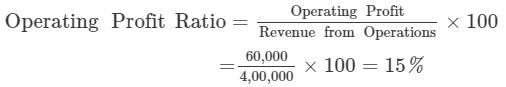

Operating Cost 3,40,000; Gross Profit Ratio 20%; Operating Expenses 20,000. Calculate Operating Profit Ratio.

Solution:

Cost of Revenue from Operations = Operating Cost - Operating Expenses = 3,40,000 - 20,000 = Rs 3,20,000 3,20,000 × 20

Revenue from Operations = Cost of Revenue from Operations + Gross Profit

=3,20,000+80,000 = Rs 4,00,000

Operating Profit = Revenue from Operations - Operating Cost

= 4, 00, 000 − 3, 40, 000 = Rs 60,000

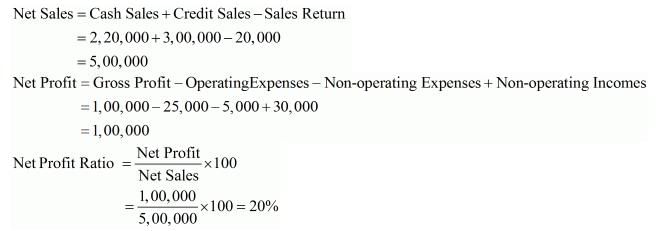

Question:123

Cash Sales 2,20,000; Credit Sales 3,00,000; Sales Return 20,000; Gross Profit 1,00,000; Operating Expenses 25,000; Non-operating incomes 30,000; Non-operating Expenses 5,000. Calculate Net Profit Ratio.

Solution:

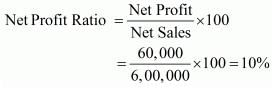

Question:124

Revenue from Operations, i.e., Net Sales 6,00,000. Calculate Net Profit Ratio.

Solution:

Net Sales = 6,00,000

Net profit = 60,000

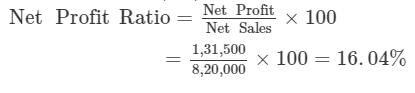

Question:125

Revenue from Operations, i.e., Net Sales 8,20,000; Return 10,000; Cost of Revenue from Operations Cost of Goods Sold 5,20,000; Operating Expenses 2,09,000; Interest on Debentures 40,500; Gain Profit on Sale of a Fixed Asset 81,000. Calculate Net Profit Ratio.

Solution:

Net Sales = Rs 8, 20, 000

Gross Profit = Net Sales - Cost of Goods Sold

= 8, 20, 000 - 5, 20, 000

= Rs 3, 00, 000

Net Profit = Gross Profit - Operating Expenses - Interest on Debentures + Profit on Sale of Fixed Asset

= 3, 00, 000 - 2, 09, 000 - 40, 500 + 81, 000

= Rs 1, 31, 500

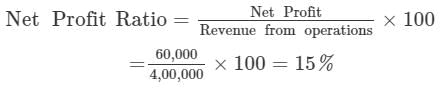

Question:126

Revenue from Operations 4,00,000; Gross Profit Ratio 25%; Operating Ratio 90%. Non-operating Expenses 2,000; Non-operating Income 22,000. Calculate Net Profit Ratio.

Solution:

Net Profit = Operating Profit + Non Operating Incomes - Non Operating Expenses

= 40,000+22,000- 2,000 = Rs 60,000

Operating Profit Ratio = 100 − Operating Ratio =100-90 =10%

Operating Profit = 4, 00, 000 × 10% = Rs 40,000

Question:127

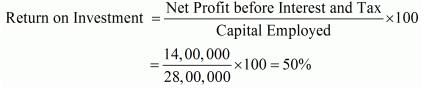

Calculate Return on Investment ROI

from the following details: Net Profit after Tax 6,50,000; Rate of Income Tax 50%; 10% Debentures of 100 each 10,00,000; Fixed Assets at cost 22,50,000; Accumulated Depreciation on Fixed Assets up to date 2,50,000; Current Assets 12,00,000; Current Liabilities 4,00,000.

Solution:

Net Fixed Assets = Fixed Assets at cost

− Accumulated Depreciation

= 22,50,000 − 2,50,000 = 20,00,000

Capital Employed = Net Fixed Assets + Current Assets − Current Liabilities

= 20,00,000 + 12,00,000 − 4,00,000

= 28,00,000

Interest on 10% Debentures = 10% of 10,00,000 = 1,00,000

Let Profit before Tax be = x

Profit after Tax = Profit Before Tax − Tax

Tax Rate = 50%

∴ Tax = 0.5 x

x − 0.5 x = 6,50,000

x = 13,00,000

Net Profit before Tax = x = 13,00,000

Profit before Interest and Tax = Profit before Tax + Interest on Long-term Debt

= 13,00,000 + 1,00,000

= 14,00,000

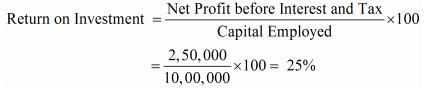

Question:128

Net Profit before Interest and Tax 2,50,000; Capital Employed 10,00,000. Calculate Return on Investment.

Solution:

Net Profit before Interest and Tax = 2,50,000

Capital Employed = 10,00,000

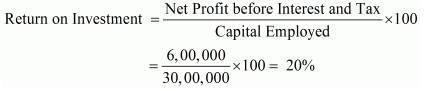

Question:129

Net Profit before Interest and Tax 6,00,000; Net Fixed Assets 20,00,000; Net Working Capital 10,00,000; Current Assets 11,00,000. Calculate Return on Investment.

Solution:

Net Profit before Interest and Tax = 6,00,000

Capital Employed = Net Fixed Assets + Net Working Capital

= 20,00,000 + 10,00,000 = 30,00,000

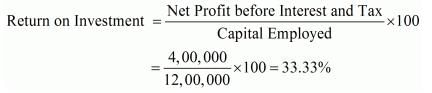

Question:130

Net Profit before Interest and Tax 4,00,000; 15% Long-term Debt 8,00,000; Shareholders' Funds 4,00,000. Calculate Return on Investment.

Solution:

Net Profit before Interest and Tax = 4,00,000

Capital Employed = 15% long-term Debt + Shareholders’ Funds

= 8,00,000 + 4,00,000 = 12,00,000

Question:131

y Ltd.'s profit after interest and tax was 1,00,000. Its Current Assets were 4,00,000; Current Liabilities 2,00,000; Fixed Assets 6,00,000 and 10% Long-term Debt 4,00,000. The rate of tax was 20%. Calculate 'Return on Investment' of Y Ltd.

Solution:

Return on Investment = Net Profit before Interest, Tax and Dividend/Capital Employed × 100

Let Profit before tax be Rs 100

Tax = Rs 20

Profit after tax = 100 – 20 = 80

If Profit after tax is Rs 80 then profit before tax is = Rs 100

If Profit after tax is Rs 1,00,000 then profit before tax is = Rs 1, 00, 000 × 100/80 = 1,25,000

Interest on long-term borrowings = Rs 4, 00, 000 × 10/100 = Rs 40,000

Profit after interest and Tax = Rs 1,25,000 + 40,000 = Rs 1,65,000

Capital Employed = Fixed Assets + Current Assets – Current Liabilities

= 6,00,000 + 4,00,000 – 2,00,000

= 8,00,000

Return on Investment = 1,65,000/8,00,000 × 100 = 20.625% or 20.63%

approx.

Question:132

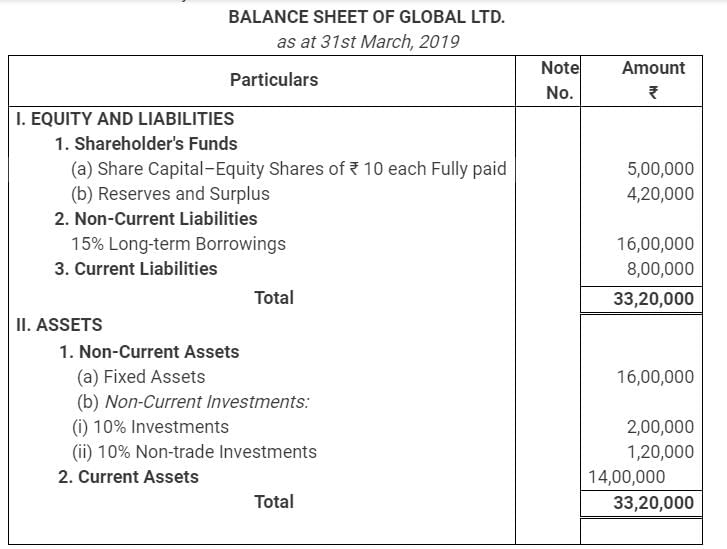

From the following Balance Sheet of Global Ltd., you are required to calculate Return on Investment for the year 2018-19:

Solution:

Return on Investment = (Net Profit before Interest, Tax and Dividend/ Capital Employed × 100)

Interest on borrowings = ₹ (16,00,000 × 15/100)= ₹ 2,40,000

Net Profit before Tax = ₹ 9,72,000

Net Profit before Interest and Tax = ₹ (9,72,000 + 2,40,000) = ₹ 12,12,000

Net Profit before Interest and Tax (excluding interest on Non-trade investments) = ₹ (12,12,000 – 12,000) = ₹ 12,00,000

Capital Employed = Shareholder’s Funds + Non-Current Liabilities – Non-Trade Investment

= ₹ (5,00,000 + 4,20,000 + 16,00,000 – 1,20,000) = ₹ 24,00,000

Return on Investment = (12,00,000/24,00,000 × 100) = 50%

Question:133

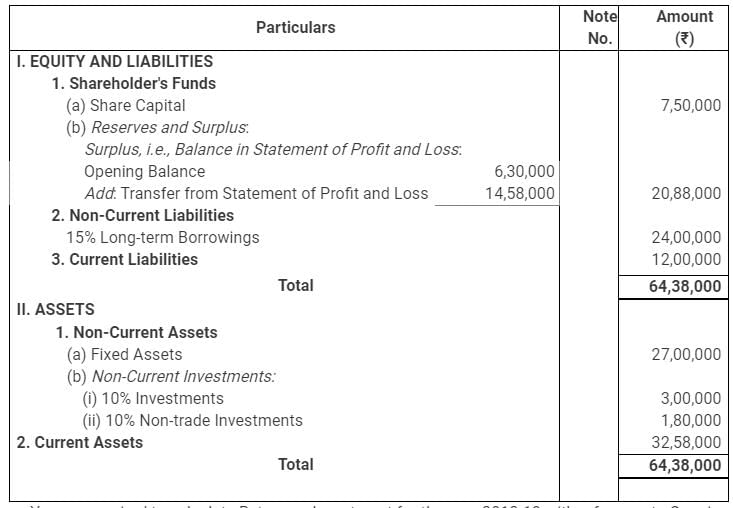

Following is the Balance Sheet of the Bharati Ltd. as at 31st March, 2019:

You are required to calculate Return on Investment for the year 2018-19 with reference to Opening Capital Employed.

Solution:

Return on Investment = (Net Profit before Interest, Tax and Dividend/ Capital Employed × 100)

Interest on borrowings = ₹ (24,00,000 × 15/100) = ₹3,60,000

Net Profit before Interest and Tax = Net Profit after tax + Interest on borrowings – Interest received on Non-trade Investments

= ₹ (14,58,000 + 3,60,000 – 18,000) = ₹ 18,00,000

Opening Capital Employed = Shareholder’s Funds (Opening) + Non-Current Liabilities (Opening) – Non-Trade Investment

= ₹(7,50,000 + 6,30,000 + 24,00,000 – 1,80,000) = ₹36,00,000

Return on Investment = (18,00,000/36,00,000 × 100) = 50%

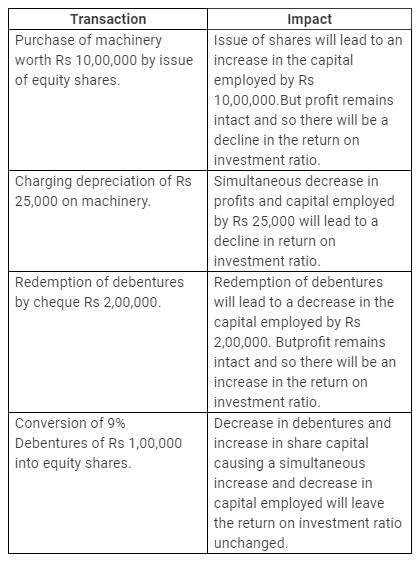

Question:134

State with reason whether the following transactions will increase, decrease or not change the 'Return on Investment' Ratio:

(i) Purchase of machinery worth ₹10,00,000 by issue of equity shares.

(ii) Charging depreciation of ₹25,000 on machinery.

(iii) Redemption of debentures by cheque ₹2,00,000.

(iv) Conversion of 9% Debentures of ₹1,00,000 into equity shares.

Solution:

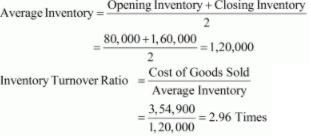

Question:135

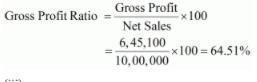

Opening Inventory ₹80,000; Purchases ₹4,30,900; Direct Expenses ₹4,000; Closing Inventory ₹1,60,000; Administrative Expenses ₹21,100; Selling and Distribution Expenses ₹40,000; Revenue from Operations, i.e., Net Sales ₹10,00,000. Calculate Inventory Turnover Ratio; Gross Profit Ratio; and Opening Ratio.

Solution:

(i) Opening Inventory = 80,000

Closing Inventory = 1,60,000

Cost of Goods Sold = Opening Inventory + Purchases + Direct Expenses − Closing Inventory

= 80,000 + 4,30,900 + 4,000 − 1,60,000

= 3,54,900

(ii) Sales = 10,00,000

Gross Profit = Net Sales − Cost of Goods Sold

= 10,00,000 − 3,54,900 = 6,45,100

(iii) Operating Expenses = Administration Expenses + Selling and Distribution Expenses

= 21,100 + 40,000 = 61,100

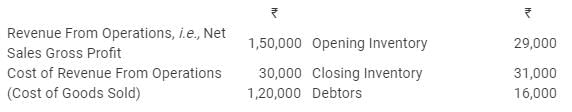

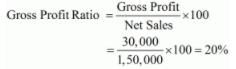

Question:136

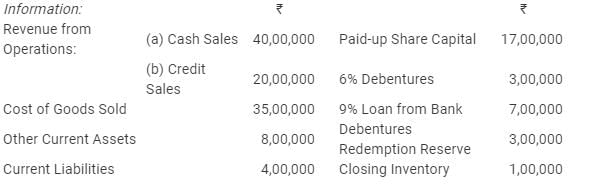

Following information is given about a company:

From the above information, calculate following ratios:

(i) Gross Profit Ratio,

(ii) Inventory Turnover Ratio, and

(iii) Trade Receivables Turnover Ratio.

Solution:

(i) Sales = 1,50,000

Gross Profit = 30,000

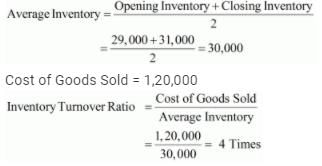

(ii) Opening Inventory = 29,000

Closing Inventory = 31,000

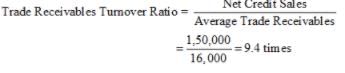

(iii)

Question:137

From the following information, calculate any two of the following ratios:

(i) Current Ratio;

(ii) Debt to Equity Ratio; and

(iii) Operating Ratio.

Revenue from Operations (Net Sales) ₹ 1,00,000; cost of Revenue from Operations (Cost of Goods Sold) was 80% of sales; Equity Share Capital ₹ 7,00,000; General Reserve ₹ 3,00,000; Operating Expenses ₹ 10,000; Quick Assets ₹ 6,00,000; 9% Debentures ₹ 5,00,000; Closing Inventory ₹ 50,000; Prepaid Expenses ₹ 10,000 and Current Liabilities ₹ 4,00,000.

Solution:

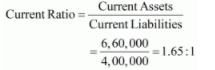

(i) Current Assets = Quick Assets + Closing Stock + Prepaid Expenses

= 6,00,000 + 50,000 + 10,000 = 6,60,000

Current Liabilities = 4,00,000

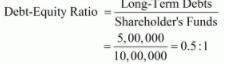

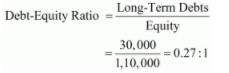

(ii) Long-term Debts = 9% Debentures = 5,00,000

Shareholder’s Funds = Equity Share Capital + General Reserve

= 7,00,000 + 3,00,000 = 10,00,000

(iii) Sales = 1,00,000

Cost of Goods Sold = 80% of Sales = 80,000

Operating Expenses = 10,000

Question:138

From the following information, calculate Inventory Turnover Ratio; Operating Ratio and Working Capital Turnover Ratio:

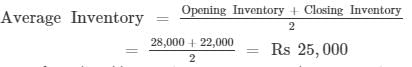

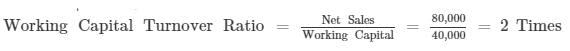

Opening Inventory ₹ 28,000; Closing Inventory ₹ 22,000; Purchases ₹ 46,000; Revenue from Operations, i.e., Net Sales ₹ 80,000; Return ₹10,000; Carriage Inwards ₹ 4,000; Office Expenses ₹ 4,000; Selling and Distribution Expenses ₹ 2,000; Working Capital ₹ 40,000.

Solution:

(i) Opening Inventory = 28,000

Closing Inventory = 22,000

Cost of Goods Sold = Opening Inventory + Purchases + Carriage Inwards − Closing Inventory

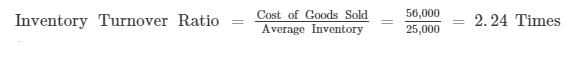

= 28,000 + 46,000 + 4,000 − 22,000 = 56,000

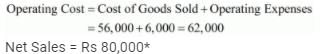

(ii) Operating Expenses = Office Expenses + Selling and Distribution Expenses

= 4,000 + 2,000 = 6,000

(iii) Working Capital = 40,000

*Note: Sales return will not be considered as the amount of net sales is provided in the question.

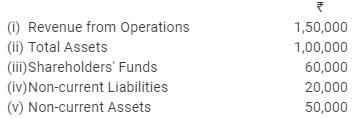

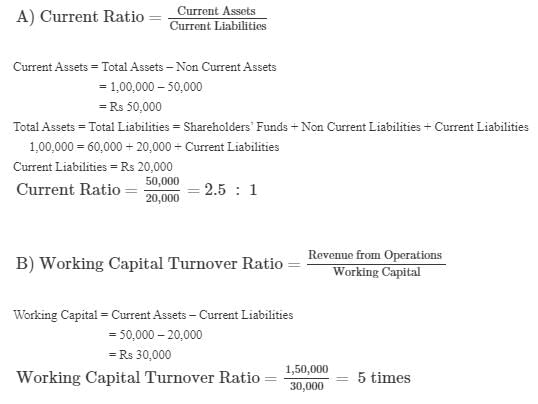

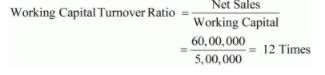

Question:139

From the following calculate:

(a) Current Ratio; and

(b) Working Capital Turnover Ratio.

Solution:

Question:140

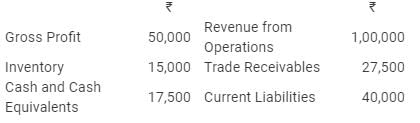

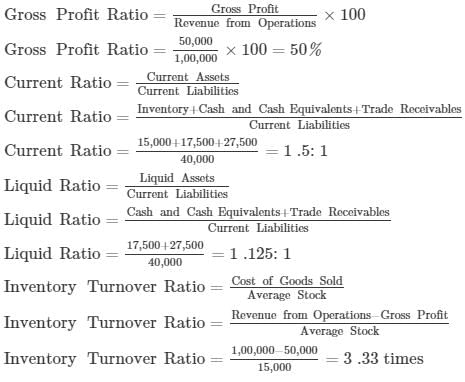

Calculate following ratios on the basis of the following information:

(i) Gross Profit Ratio;

(ii) Current Ratio;

(iii) Acid Test Ratio; and

(iv) Inventory Turnover Ratio.

Solution:

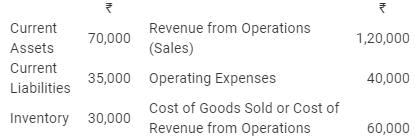

Question:141

Calculate following ratios on the basis of the given information:

(i) Current Ratio;

(ii) Acid Test Ratio;

(iii) Operating Ratio; and

(iv) Gross Profit Ratio.

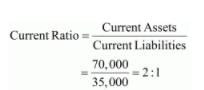

Solution:

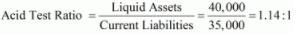

(i) Current Assets = 70,000

Current Liabilities = 35,000

(ii) Liquid Assets = Current Assets − Inventory

= 70,000 − 30,000 = 40,000

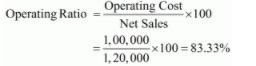

(iii) Net Sales = 1,20,000

Operating Cost = Cost of Goods Sold + Operating Expenses

= 60,000 + 40,000 = 1,00,000

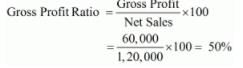

(iv) Gross Profit = Net Sales − Cost of Goods Sold

= 1,20,000 − 60,000 = 60,000

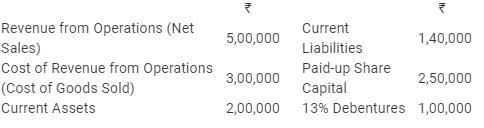

Question:142

From the information given below, calculate any three of the following ratio:

(i) Gross Profit Ratio;

(ii) Working Capital Turnover Ratio:

(iii) Debt to Equity Ratio; and

(iv) Proprietary Ratio.

Solution:

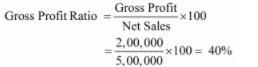

(i) Net Sales = 5,00,000

Cost of Goods Sold = 3,00,000

Gross Profit = Net Sales − Cost of Goods Sold

= 5,00,000 − 3,00,000 = 2,00,000

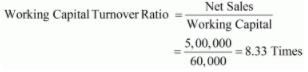

(ii) Current Assets = 2,00,000

Current Liabilities = 1,40,000

Working Capital = Current Assets − Current Liabilities

= 2,00,000 − 1,40,000 = 60,000

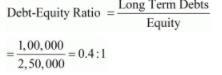

(iii) Long-term Debts = 13% Debentures = 1,00,000

Equity = Paid-up Share Capital = 2,50,000

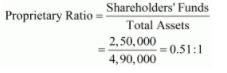

(iv) Total Assets = Total Liabilities

= Current Liabilities + Paid-up Share Capital + 13% Debentures

= 1,40,000 + 2,50,000 + 1,00,000

= 4,90,000

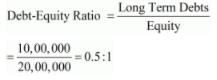

Question:143

On the basis of the following information calculate:

(i) Debt to Equity Ratio; and

(ii) Working Capital Turnover Ratio.

Solution:

(i) Long-term Debts = 6% Debentures + 9% Loan from Bank

= 3,00,000 + 7,00,000 = 10,00,000

Equity = Paid-up Share Capital + Debenture Redemption Reserve

= 17,00,000 + 3,00,000 = 20,00,000

(ii) Current Assets = Other Current Assets + Inventory

= 8,00,000 + 1,00,000

= 9,00,000

Working Capital = Current Assets − Current Liabilities

= 9,00,000 − 4,00,000

= 5,00,000

Net Sales = Cash Sales + Credit sales

= 40,00,000 + 20,00,000

= 60,00,000

Question:144

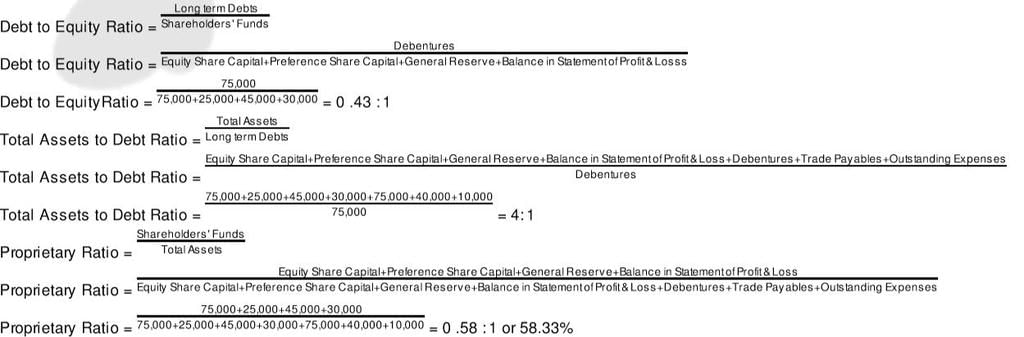

From the following, calculate (a) Debt to Equity Ratio; (b) Total Assets to Debt Ratio; and (c) Proprietary Ratio:

Solution:

Question:145

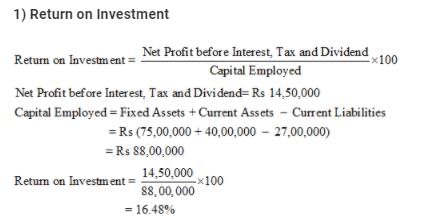

From the following information related to Naveen Ltd., calculate (a) Return on Investment and (b) Total Assets to Debt Ratio:

Information: Fixed Assets ₹ 75,00,000; Current Assets ₹ 40,00,000; Current Liabilities ₹ 27,00,000; 12% Debentures ₹ 80,00,000 and Net Profit before Interest, Tax and Dividend ₹ 14,50,000.

Solution:

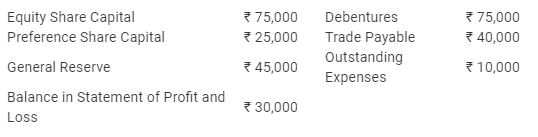

Question:146

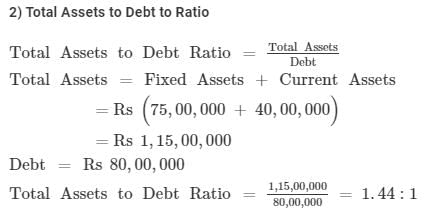

Calculate Current Ratio, Quick Ratio and Debt to Equity Ratio from the figures given below:

Solution:

(i) Current Assets = Inventory + Prepaid Expenses + Other Current Assets

= 30,000 + 2,000 + 50,000 = 82,000

Current Liabilities = 40,000

(ii) Liquid Assets = Current Assets − Inventory − Prepaid Expenses

= 82,000 − 30,000 − 2,000 = 50,000

(iii) Long-term Debts = 12% Debentures = 30,000

Equity = Accumulated Profits + Equity Share Capital

= 10,000 + 1,00,000 = 1,10,000

Question:147

From the following informations, calculate Return on Investment (or Return on Capital Employed):

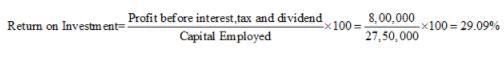

Solution:

Net Profit before tax = 6,00,000

Net Profit before interest, tax and dividend = Net Profit before tax + Interest on long-term borrowings

= 6,00,000 + 10% of 20,00,000 = 6,00,000 + 2,00,000 = 8,00,000

Capital Employed = Share Capital + Reserves and Surplus + Long-term borrowings

= 5,00,000 + 2,50,000 + 20,00,000 = 27,50,000

|

42 videos|199 docs|43 tests

|

FAQs on Accounting Ratios (Part - 5) - Accountancy Class 12 - Commerce

| 1. What are accounting ratios and why are they important in commerce? |  |

| 2. How are accounting ratios calculated? |  |

| 3. What is the significance of profitability ratios in accounting? |  |

| 4. How can liquidity ratios help assess a company's financial health? |  |

| 5. What are some common limitations of accounting ratios? |  |