Admission of a Partner (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 5.85:

Question 1:

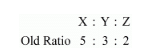

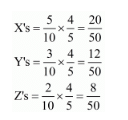

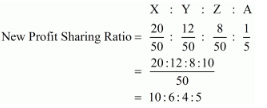

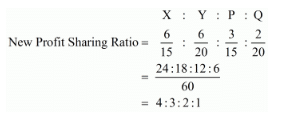

X,Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. They admit A into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio.

ANSWER:

A is admitted for 1/5 share of profit

Let the combined share of profit for all partners after A’s admission be = 1

Combined share of X, Y and Z after A’s admission =1 − A’s share

New Ratio = Old Ratio × Combined share of X, Y and Z

Page No 5.85:

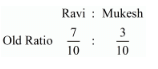

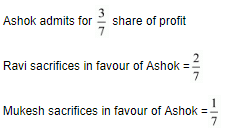

Question 2: Ravi and Mukesh are sharing profits in the ratio of 7 : 3. They admit Ashok for 3/7th share in the firm which he takes 2/7th from Ravi and 1/7th from Mukesh. Calculate new profit-sharing ratio.

ANSWER:

Page No 5.85:

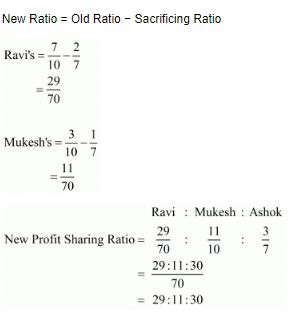

Question 3: A and B are partners sharing profits and losses in the proportion of 7 : 5. They agree to admit C, their manager, into partnership who is to get 1/6th share in the profits. He acquires this share as 1/24th from A and 1/8th from B. Calculate new profit-sharing ratio.

ANSWER:

Page No 5.85:

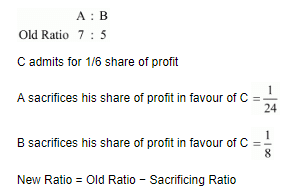

Question 4: A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. They admitted D as a new partner for 1/8th share in the profits, which he acquired 1/16th from B and 1/16th from C. Calculate the new profit-sharing ratio of A, B, C and D.

ANSWER:

Page No 5.85:

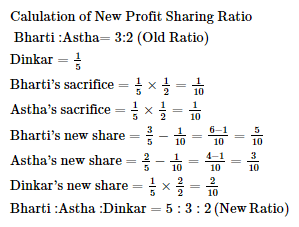

Question 5: Bharati and Astha were partners sharing profits in the ratio of 3 : 2. They admitted Dinkar as a new partner for 1/5th share in the future profits of the firm which he got equally from Bharati and Astha. Calculate the new profit-sharing ratio of Bharati, Astha and Dinkar.

ANSWER:

Page No 5.85:

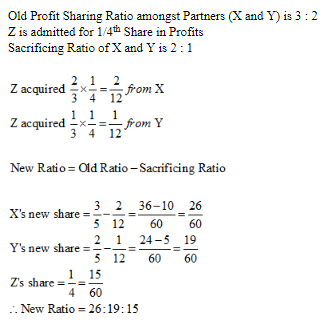

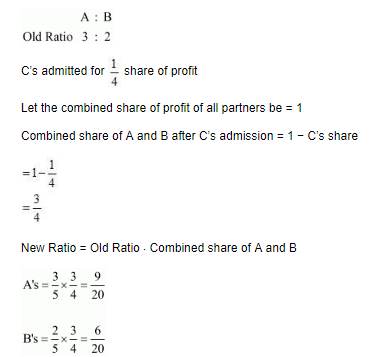

Question 6: X and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. Z is admitted as partner with 1/4 share in profit. Z acquires his share from X and Y in the ratio of 2 : 1. Calculate new profit-sharing ratio.

ANSWER:

Page No 5.86:

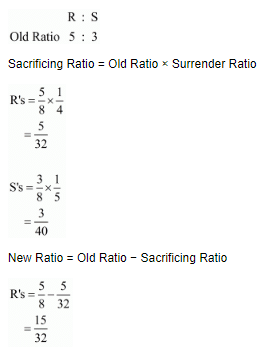

Question 7: R and S are partners sharing profits in the ratio of 5 : 3. T joins the firm as a new partner. R gives 1/4th of his share and S gives 1/5th of his share to the new partner. Find out new profit-sharing ratio.

ANSWER:

Page No 5.86:

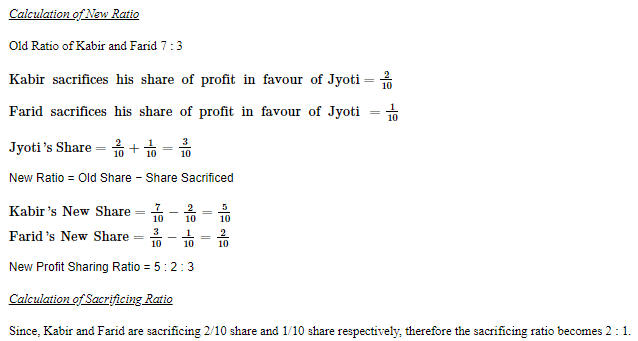

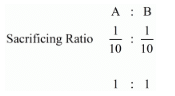

Question 8: Kabir and Farid are partners in a firm sharing profits and losses in the ratio of 7 : 3. Kabir surrenders 2/10th from his share and Farid surrenders 1/10th from his share in favour of Jyoti; the new partner. Calculate new profit-sharing ratio and sacrificing ratio.

ANSWER:

Page No 5.86:

Question 9: Find New Profit-sharing Ratio:

(i) R and T are partners in a firm sharing profits in the ratio of 3 : 2. S joins the firm. R surrenders 1/4th of his share and T 1/5th of his share in favour of S.

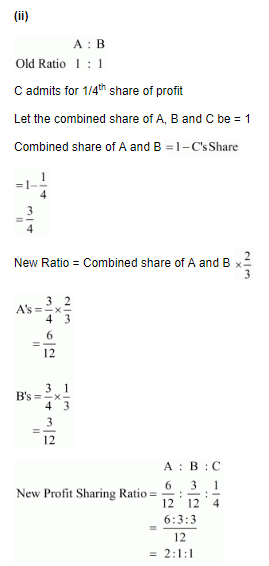

(ii) A and B are partners. They admit C for 1/4th share. In future, the ratio between A and B would be 2 : 1.

(iii) A and B are partners sharing profits and losses in the ratio of 3 : 2. They admit C for 1/5th share in the profit. C acquires 1/5th of his share from A and 4/5th share from B.

(iv) X, Y and Z are partners in the ratio of 3 : 2 : 1. W joins the firm as a new partner for 1/6th share in profits. Z would retain his original share.

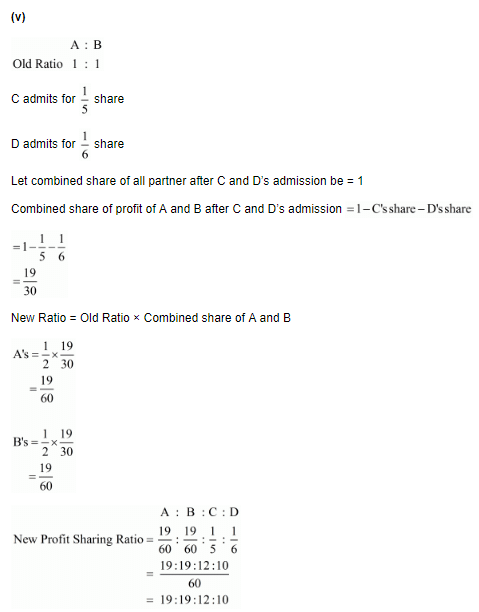

(v) A and B are equal partners. They admit C and D as partners with 1/5th and 1/6th share respectively.

(vi) A and B are partners sharing profits/losses in the ratio of 3 : 2 . C is admitted for 1/4th share. A and B decide to share equally in future.

ANSWER:

Page No 5.86:

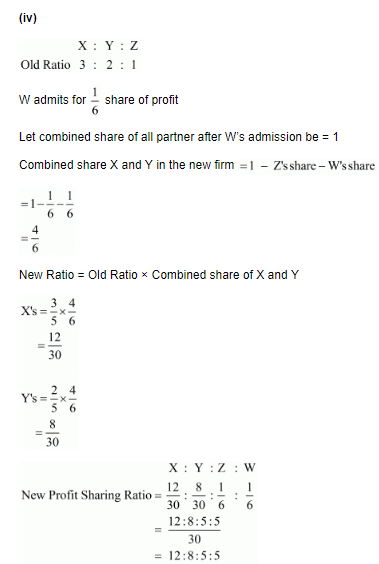

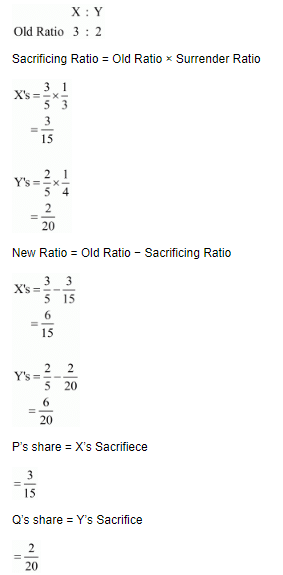

Question 10: X and Y were partners sharing profits in the ratio of 3 : 2. They admitted P and Q as new partners. X surrendered 1/3rd of his share in favour of P and Y surrendered 1/4th of his share in favour of Q. Calculate new profit-sharing ratio of X, Y, P and Q.

ANSWER:

Page No 5.86:

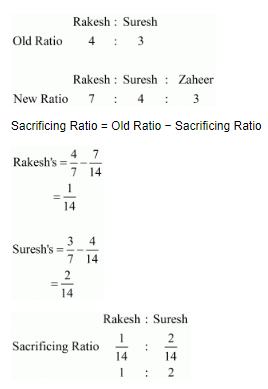

Question 11:Rakesh and Suresh are sharing profits in the ratio of 4 : 3. Zaheer joins and the new ratio among Rakesh, Suresh and Zaheer is 7 : 4 : 3. Find out the sacrificing ratio.

ANSWER:

Page No 5.86:

Question 12: A and B are partners sharing profits in the ratio of 3 : 2. C is admitted as a partner. The new profit-sharing ratio among A, B and C is 4 : 3 : 2. Find out the sacrificing ratio.

ANSWER:

Page No 5.86:

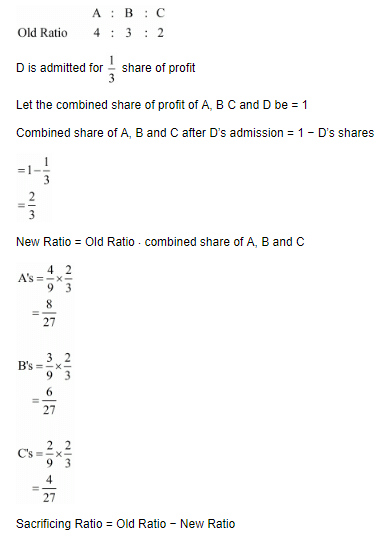

Question 13: A, B and C are partners sharing profits in the ratio of 4 : 3 : 2. D is admitted for 1/3rd share in future profits. What is the sacrificing ratio?

ANSWER:

Page No 5.86:

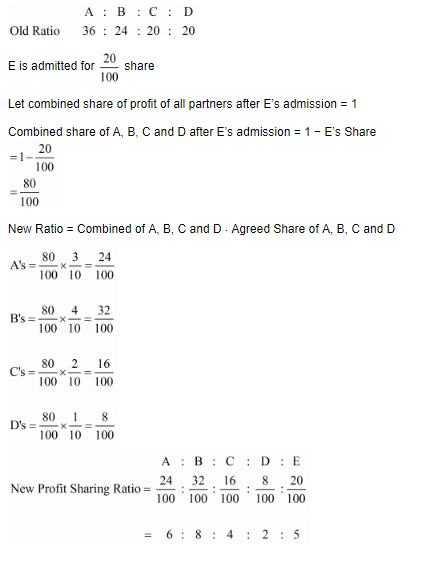

Question 14: A, B, C and D are in partnership sharing profits and losses in the ratio of 36 : 24 : 20 : 20 respectively. E joins the partnership for 20% share and A, B, C and D in future would share profits among themselves as 3/10 : 4/10 : 2/10 : 1/10. Calculate new profit-sharing ratio after E's admission .

ANSWER:

Page No 5.86:

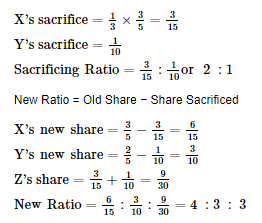

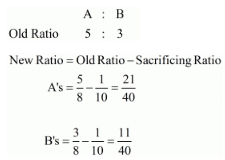

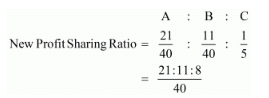

Question 15:X and Y are partners sharing profits and losses in the ratio of 3 : 2. They admit Z into partnership. X gives 1/3rd of his share while Y gives 1/10th from his share to Z. Calculate new profit-sharing ratio and sacrificing ratio.

ANSWER:

Old Ratio of X and Y is 3 : 2.

Page No 5.86:

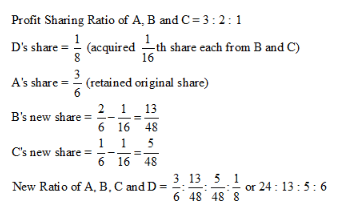

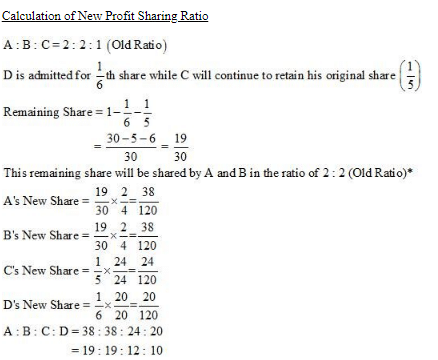

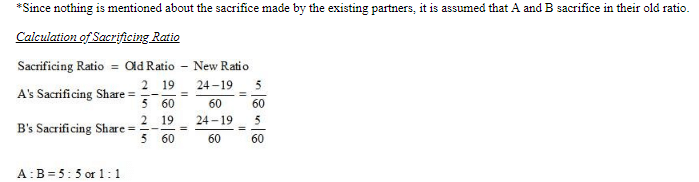

Question 16: A, B and C are partners sharing profits in the ratio of 2 : 2 : 1. D is admitted as a new partner for 1/6th share. C will retain his original share. Calculate the new profit-sharing ratio and sacrificing ratio.

ANSWER:

Page No 5.86:

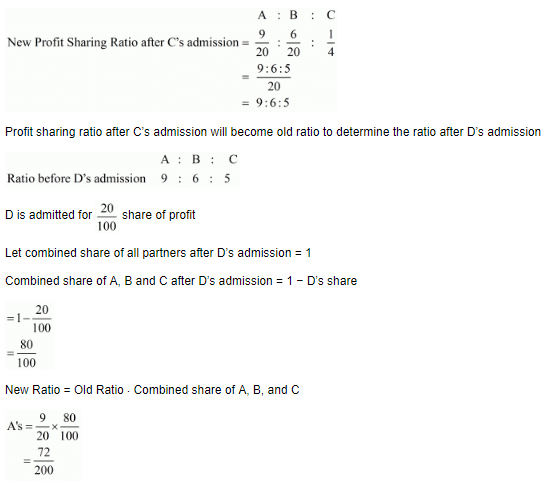

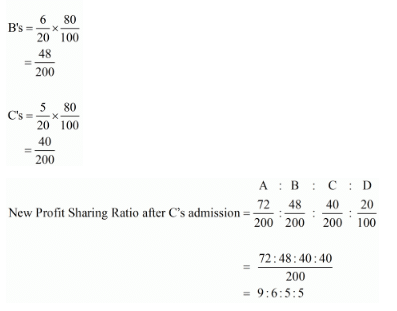

Question 17: A and B are in partnership sharing profits and losses as 3 : 2. C is admitted for 1/4th share. Afterwards D enters for 20 paise in the rupee. Compute profit-sharing ratio of A, B, C and D after D's admission.

ANSWER:

Page No 5.87:

Question 18: P and Q are partners sharing profits in the ratio of 3 : 2. They admit R into partnership who acquires 1/5th of his share from P and 4/25th share from Q. Calculate New Profit-sharing Ratio and Sacrificing Ratio.

ANSWER:

Page No 5.87:

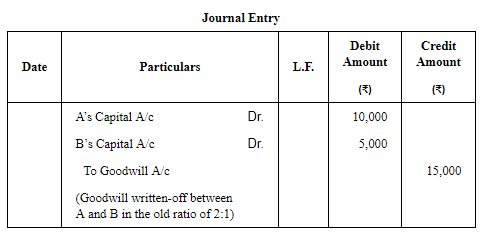

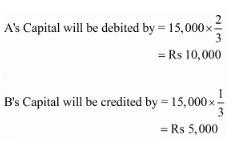

Question 19: A and B are partners sharing profits and losses in the ratio of 2 : 1. They take C as a partner for 1/5th share. Goodwill Account appears in the books at ₹ 15,000. For the purpose of C's admission, goodwill of the firm is valued at ₹ 15,000. C is to pay proportionate amount as premium for goodwill which he pays to A and B privately.

Pass necessary entries.

ANSWER:

Note- Goodwill brought in by C is not recorded in the books of the firm as the amount for goodwill is privately paid to A and B.

Working Note: Goodwill Written-off

Page No 5.87:

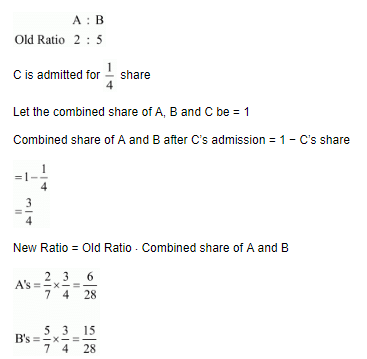

Question 20: A and B are partners sharing profits and losses in the ratio of 2 : 5. They admit C on the condition that he will bring ₹ 14,000 as his share of goodwill to be distributed between A and B. C's share in the future profits or losses will be 1/4th. What will be the new profit-sharing ratio and what amount of goodwill brought in by C will be received by A and B?

ANSWER:

Page No 5.87:

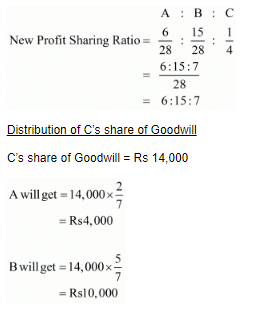

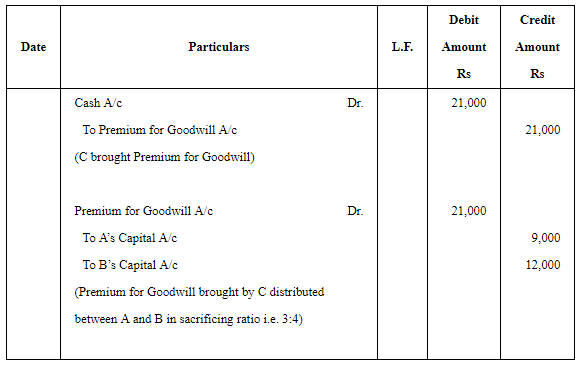

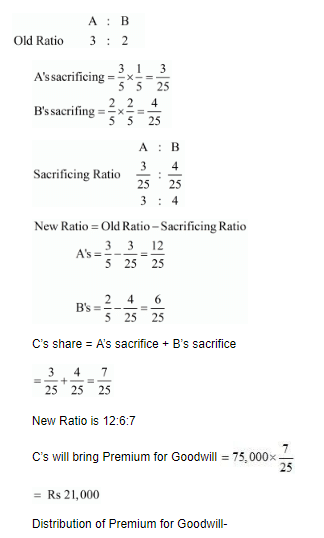

Question 21: A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. A new partner C is admitted. A surrenders 1/5th of his share and B surrenders 2/5th of his share and B surrenders 2/5th of his share in favour of C. For the purpose of C's admission, goodwill of the firm is valued at ₹ 75,000 and C brings in his share of goodwill in cash which is retained in the firm's books. Journalise the above transactions.

ANSWER:

Page No 5.87:

Question 22: Give Journal entries to record the following arrangements in the books of the firm:

(a) B and C are partners sharing profits in the ratio of 3 : 2. D is admitted paying a premium (goodwill) of ₹ 2,000 for 1/4th share of the profits, shares shares of B and C remain as before.

(b) B and C are partners sharing profits in the ratio of 3 : 2. D is admitted paying a premium of ₹ 2,100 for 1/4th share of profits which he acquires 1/6th from B and 1/12th from C.

ANSWER:

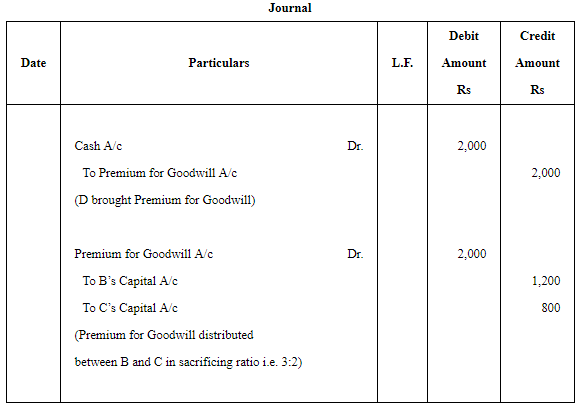

(a)

Working Note:

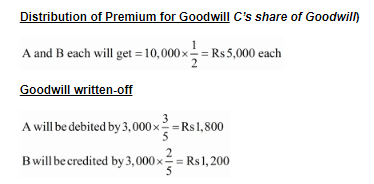

Distribution of premium for Goodwill-

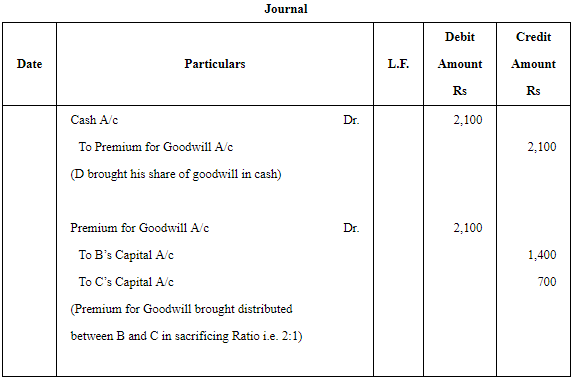

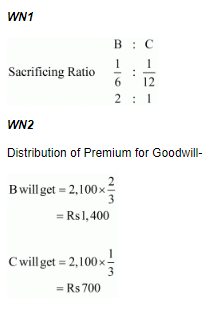

(b)

Working Note:

Page No 5.87:

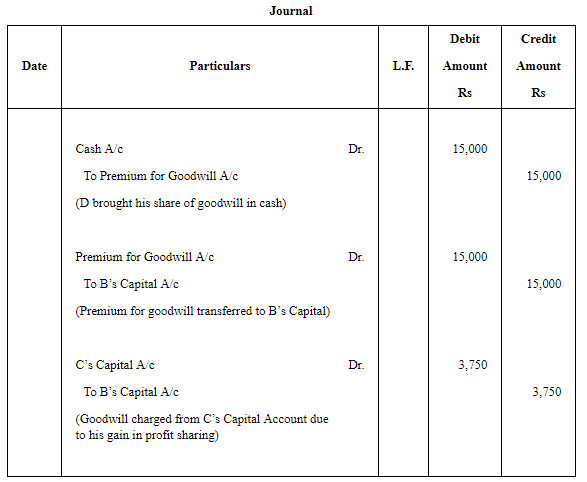

Question 23: B and C are in partnership sharing profits and losses as 3 : 1. They admit D into the firm, D pays premium of ₹ 15,000 for 1/3rd share of the profits. As between themselves, B and C agree to share future profits and losses equally. Draft Journal entries showing appropriations of the premium money.

ANSWER:

WN1

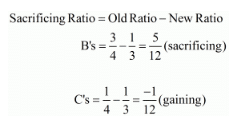

Calculation of Sacrificing Ratio:

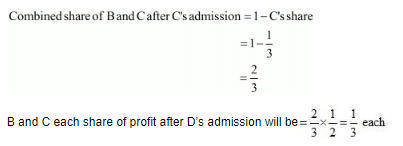

Let combined share of all partners after D’s admission be = 1

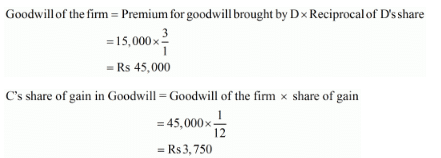

WN2

C is gaining in new the firm. Hence, C’s gain in goodwill will be debited to his capital and given to B (sacrificing partner).

Page No 5.87:

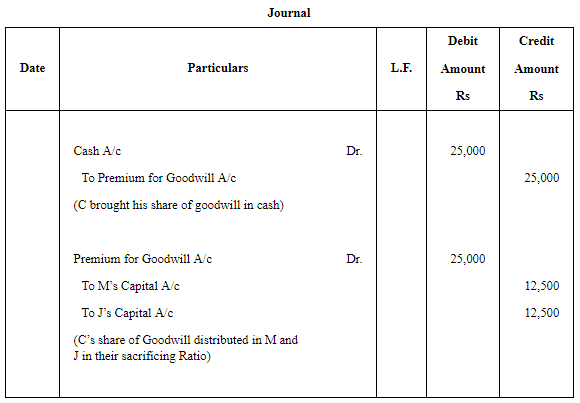

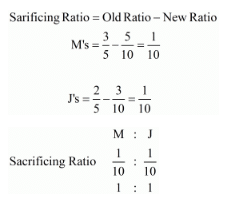

Question 24: M and J are partners in a firm sharing profits in the ratio of 3 : 2. They admit R as a new partner. The new profit-sharing ratio between M, J and R will be 5 : 3 : 2. R brought in ₹ 25,000 for his share of premium for goodwill. Pass necessary Journal entries for the treatment of goodwill.

ANSWER:

Working Notes:

WN1

Calculating of Sacrificing Ratio

WN2

Distribution of R’s share of Goodwill-

Page No 5.87:

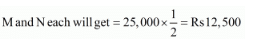

Question 25: A and B are in partnership sharing profits and losses in the ratio of 5 : 3. C is admitted as a partner who pays ₹ 40,000 as capital and the necessary amount of goodwill which is valued at ₹ 60,000 for the firm. His share of profits will be 1/5th which he takes 1/10th from A and 1/10th from B.

Give Journal entries and also calculate future profit-sharing ratio of the partners.

ANSWER:

Working Notes-

WN1

WN2

Calculation of new profit sharing Ratio

WN3

Distribution of C’s share of Goodwill (in Sacrificing Ratio)

Page No 5.88:

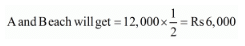

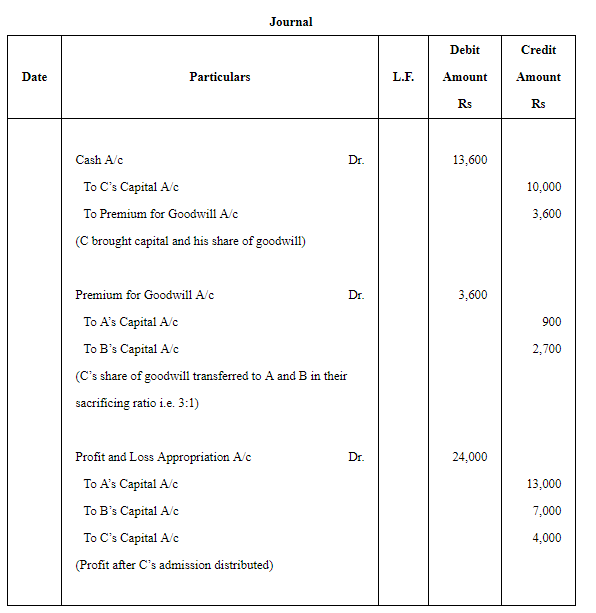

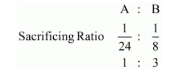

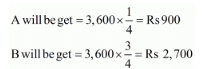

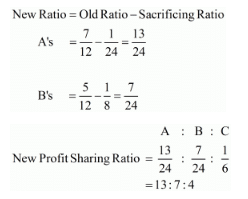

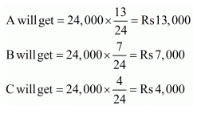

Question 26: A and B are partners sharing profits and losses in the ratio of 7 : 5. They admit C, their Manager, into partnership who is to get 1/6th share in the business. C brings in ₹ 10,000 for his capital and ₹ 3,600 for the 1/6th share of goodwill which he acquires 1/24th from A and 1/8th from B. Profits for the first year of the new partnership was ₹ 24,000. Pass necessary Journal entries for C's admission and apportion the profit between the partners.

ANSWER:

Working Note:

WN1

WN2

Distribution of C’s share of Goodwill (in sacrificing ratio)

WN3

Calculation of New Profit Sharing Ratio

WN4

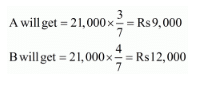

Distribution of Profit earned after C’s admission (in new ratio)

Page No 5.88:

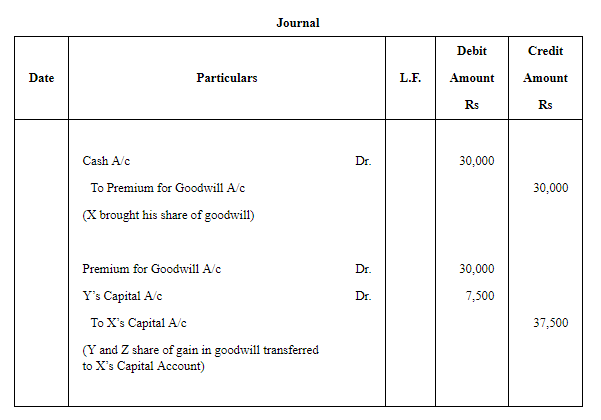

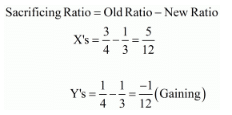

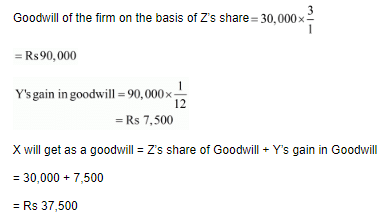

Question 27: X and Y are partners sharing profits in the ratio of 3 : 1. Z is admitted as a partner for which he pays ₹ 30,000 for goodwill in cash. X, Y and Z decide to share the future profits in equal proportion. You are required to pass a single Journal entry to give effect to the above arrangement.

ANSWER:

Working Notes:

WN1

Calculation of Sacrificing Ratio

WN2

Page No 5.88:

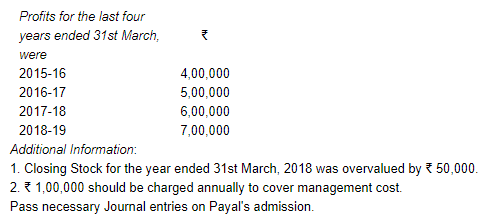

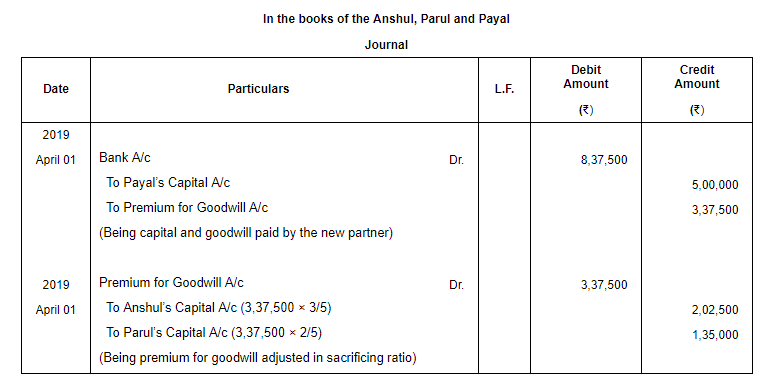

Question 28: Anshul and Parul are partners sharing profits in the ratio of 3 : 2. They admit Payal as partner for 1/4th share in profits on 1st April, 2019. Payal brings ₹ 5,00,000 as capital and her share of goodwill by cheque. It was agreed to value goodwill at three years' purchase of average profit of last four years.

ANSWER:

Working Notes:

Average Profits = ₹4,50,000 Goodwill = Average Profits × No. of years of Purchase = ₹ (4,50,000 ×3) = ₹ 13,50,000

Page No 5.88:

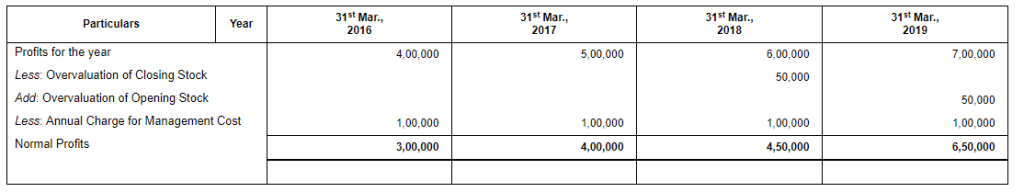

Question 29: A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. They admit C into partnership for 1/5th share. C brings ₹ 30,000 as capital and ₹ 10,000 as goodwill. At the time of admission of C, goodwill appeared in the Balance Sheet of A and B at ₹ 3,000. New profit-sharing ratio of the partners will be 5 : 3 : 2. Pass necessary Journal entries.

ANSWER:

Page No 5.88:

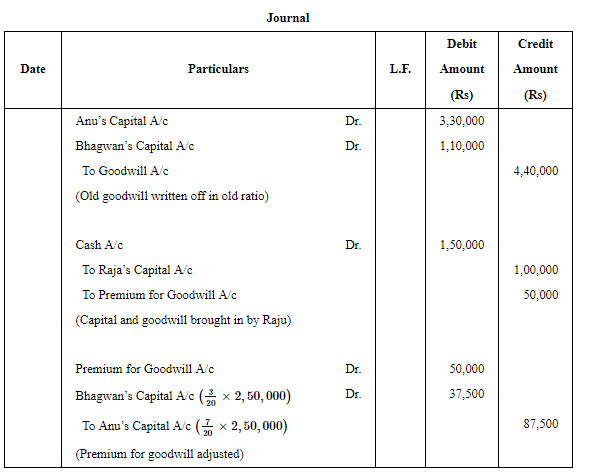

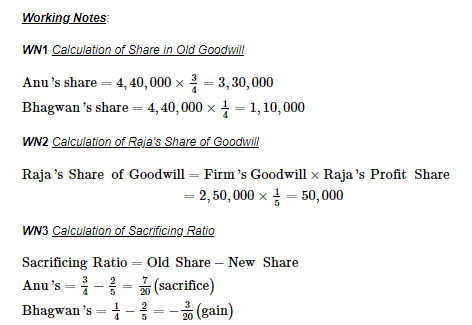

Question 30: Anu and Bhagwan were partners in a firm sharing profits in the ratio of 3 : 1. Goodwill appeared in the books at ₹ 4,40,000. Raja was admitted to the partnership. The new profit-sharing ratio among Anu, Bhagwan and Raja was 2 : 2 : 1.

Raja brought ₹ 1,00,000 for his capital and necessary cash for his goodwill premium. Goodwill of the firm was valued at ₹ 2,50,000.

Record necessary Journal entries in the books of the firm for the above transactions.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Admission of a Partner (Part - 1) - Accountancy Class 12 - Commerce

| 1. What is the meaning of admission of a partner in commerce? |  |

| 2. What are the reasons for admitting a new partner in a partnership firm? |  |

| 3. What is the procedure for admitting a new partner in a partnership firm? |  |

| 4. What are the implications of admitting a new partner in terms of profit sharing? |  |

| 5. What are the rights and obligations of a new partner upon admission? |  |