Admission of a Partner (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 5.94:

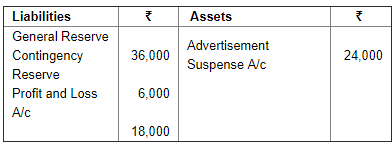

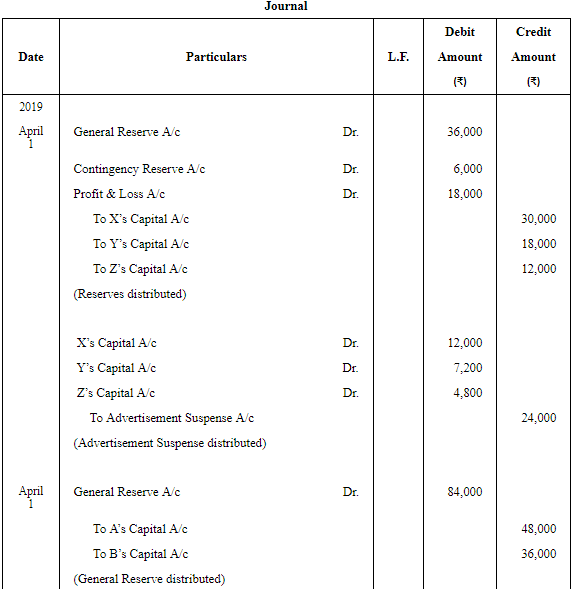

Question 61: (a) X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. They admit W as partner for 1/6th share. Following is the extract of the Balance Sheet on the date of admission:

Pass necessary Journal entries.

(b) A and B were partners in a firm sharing profit in 4 : 3 ratio. On 1st April, 2019, they admitted C as a new partner. On the date of C's admission, the Balance Sheet of A and B showed a General Reserve of ₹ 84,000 and a debit balance of ₹ 8,400 in the 'Profit and Loss Account'. Pass necessary Journal entries for the treatment of these items on C's admission.

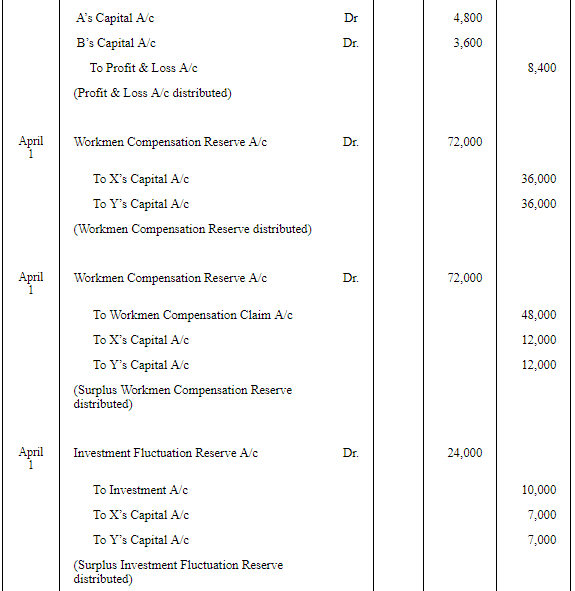

(c) Give the Journal entry to distribute 'Workmen Compensation Reserve' of ₹ 72,000 at the time of admission of Z, when there is no claim against it. The firm has two partners X and Y.

(d) Give the Journal entry to distribute 'Workmen Compensation Reserve' of ₹ 72,000 at the time of admission of Z, when there is claim of ₹ 48,000 against it. The firm has two partners X and Y .

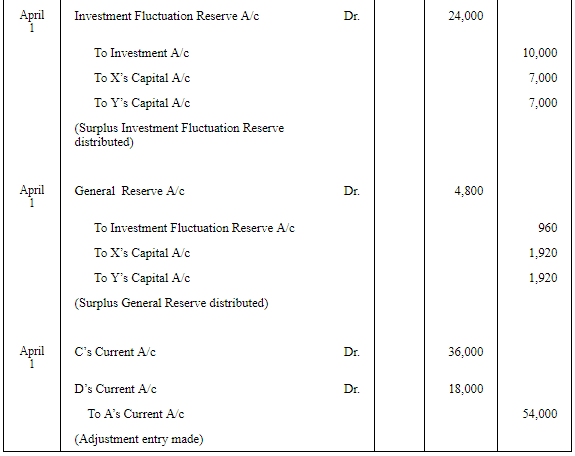

(e) Give the Journal entry to distribute 'Investment Fluctuation Reserve' of ₹ 24,000 at the time of admission of Z, when Investment (Market Value ₹ 1,10,000) appears at ₹ 1,20,000. The firm has two partners X and Y.

(f) Give the Journal entry to distribute 'General Reserve' of ₹ 4,800 at the time of admission of Z, when 20% of General Reserve is to be transferred to Investment Fluctuation Reserve. The firm has two partners X and Y .

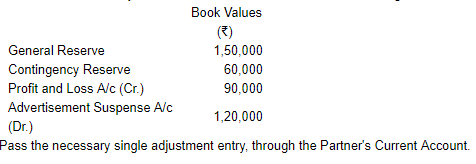

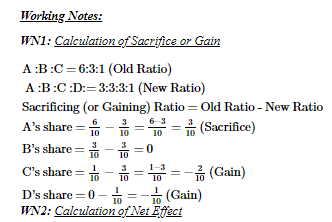

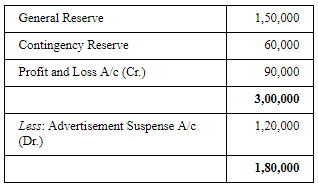

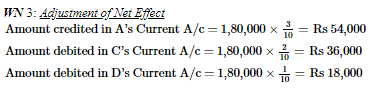

(g) A, B and C were partners sharing profits and losses in the ratio of 6 : 3 : 1. They decide to take D into partnership with effect from 1st April, 2019. The new profit-sharing ratio between A, B, C and D will be 3 : 3 : 3 : 1. They also decide to record the effect of the following without affecting their book values, by passing a single adjustment entry:

ANSWER:

Page No 5.95:

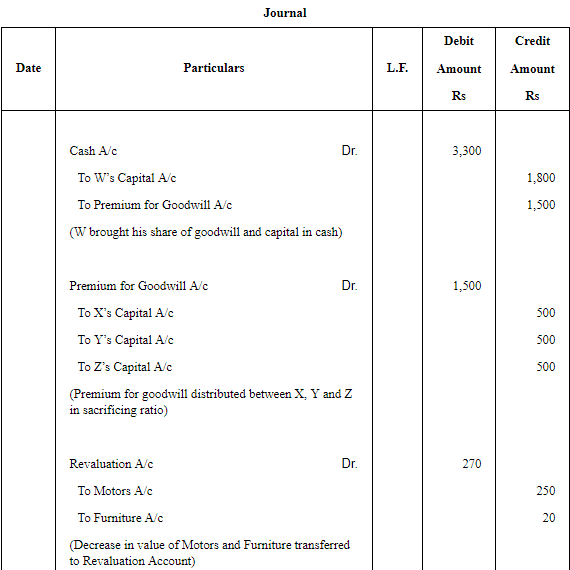

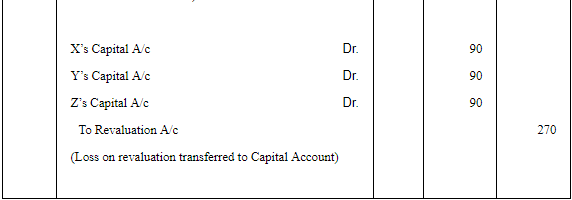

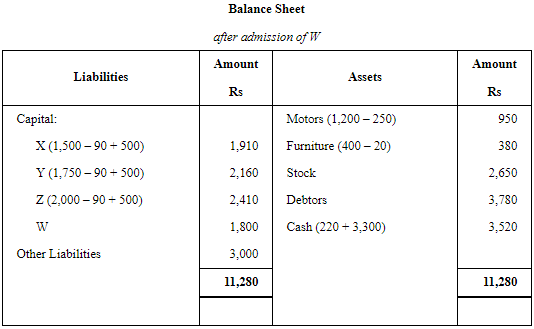

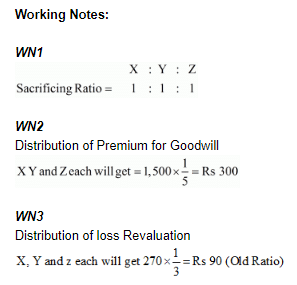

Question 62: X, Y and Z are equal partners with capitals of ₹ 1,500; ₹ 1,750 and ₹ 2,000 respectively. They agree to admit W into equal partnership upon payment in cash ₹ 1,500 for 1/4th share of the goodwill and ₹ 1,800 as his capital, both sums to remain in the business. The liabilities of the old firm amounted to ₹ 3,000 and the assets, apart from cash, consist of Motors ₹ 1,200, Furniture ₹ 400, Stock ₹ 2,650 and Debtors ₹ 3,780. The Motors and

Furniture were revalued at ₹ 950 and ₹ 380 respectively.

Pass Journal entries to give effect to the above arrangement and also show

Balance Sheet of the new firm.

ANSWER:

Page No 5.95:

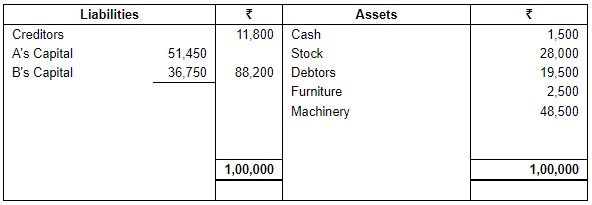

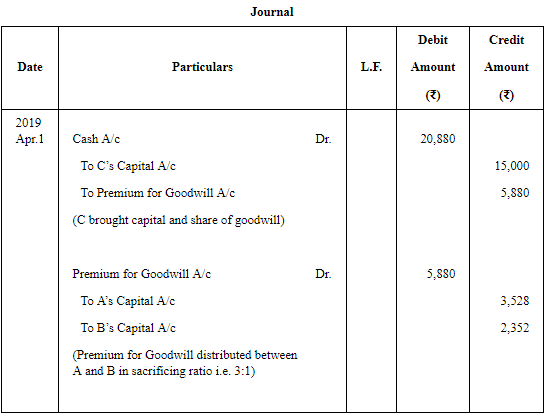

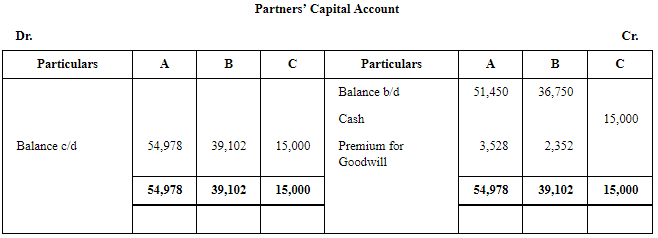

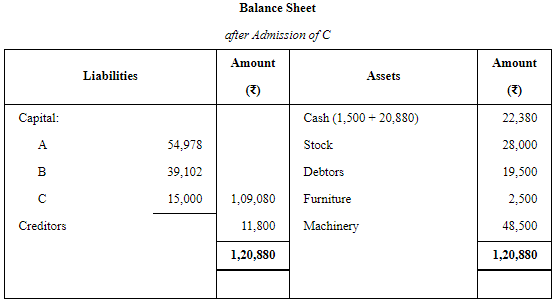

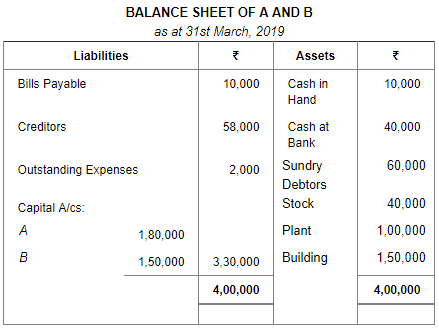

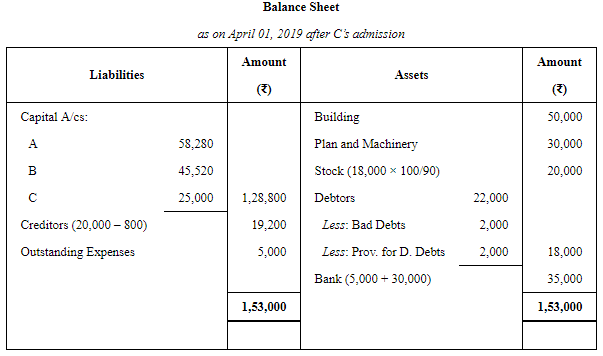

Question 63: A and B are carrying on business in partnership and sharing profits and losses in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 stood as:

They admit C into partnership on 1st April, 2019 and give him 1/8th share in future profits on the following terms:

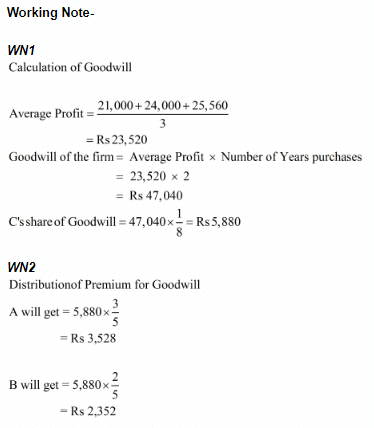

(a) Goodwill of the firm be valued at twice the average of the last three years' profits which amounted to ₹ 21,000; ₹ 24,000 and ₹ 25,560.

(b) C is to bring cash for the amount of his share of goodwill.

(c) C is to bring cash ₹ 15,000 as his capital.

Pass Journal entries recording these transactions, draw out the Balance Sheet of the new firm and determine new profit-sharing ratio.

ANSWER:

Page No 5.95:

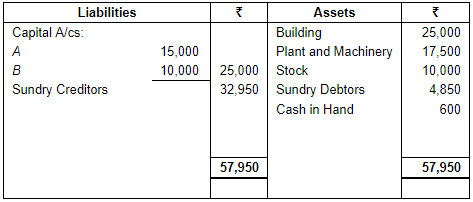

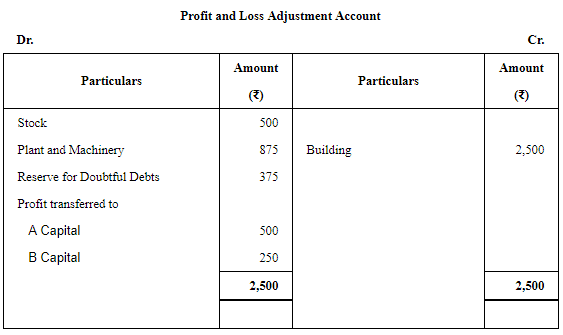

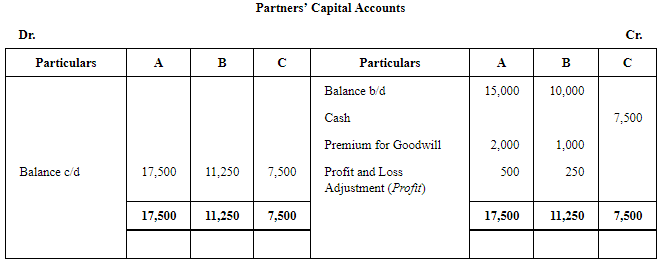

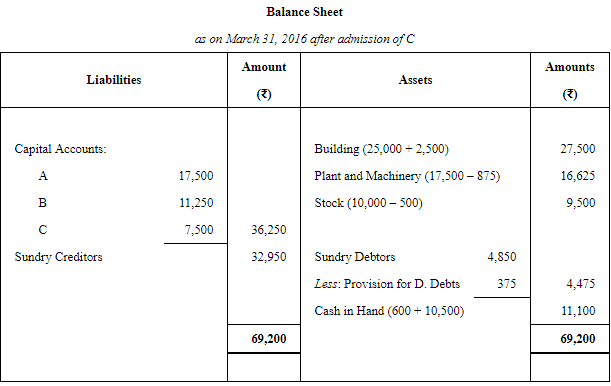

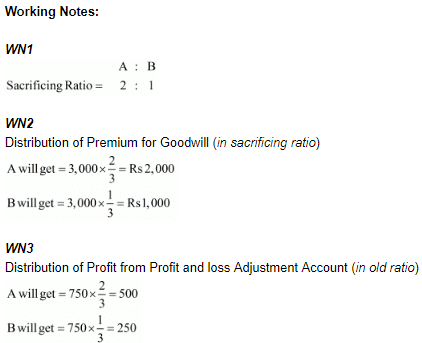

Question 64: Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March, 2019:

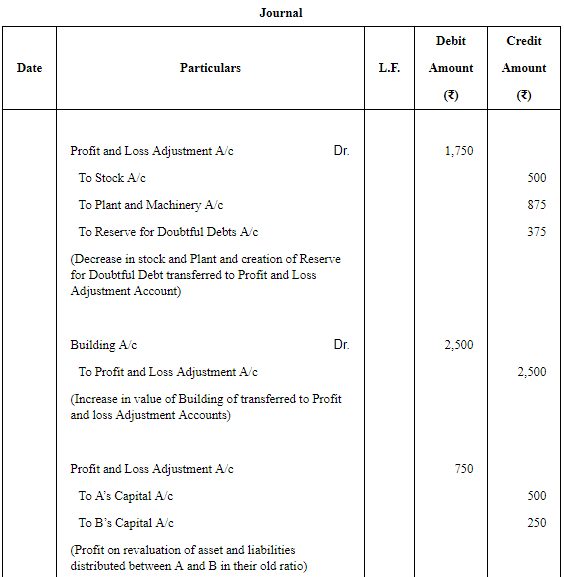

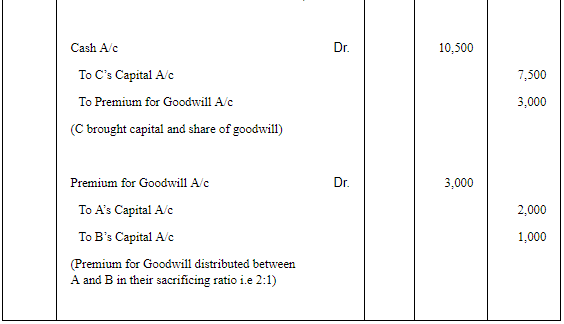

They admit C into partnership on the following terms:

(a) C was to bring ₹ 7,500 as his capital and ₹ 3,000 as goodwill for 1/4th share in the firm.

(b) Values of the Stock and Plant and Machinery were to be reduced by 5%.

(c) A Provision for Doubtful Debts was to be created in respect of Sundry Debtor ₹ 375.

(d) Building was to be appreciated by 10%.

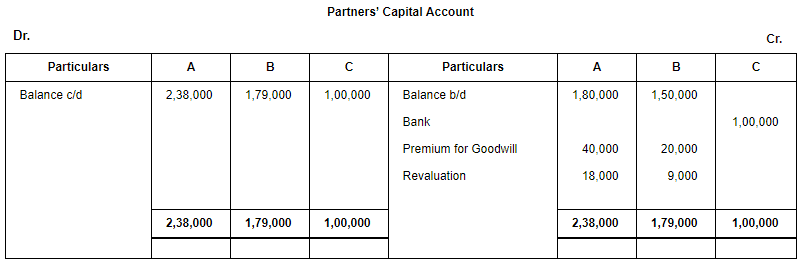

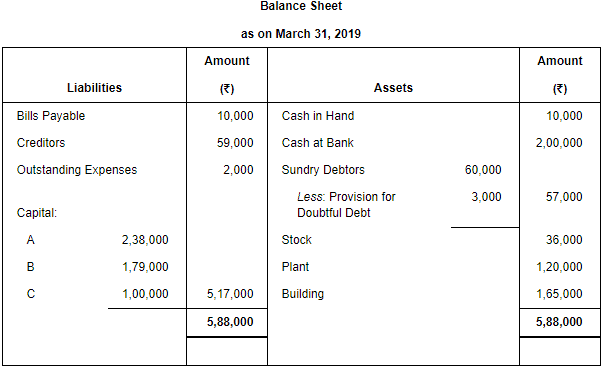

Pass necessary Journal entries to give effect to the arrangements. Prepare Profit and Loss Adjustment Account (or Revaluation Account), Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.96:

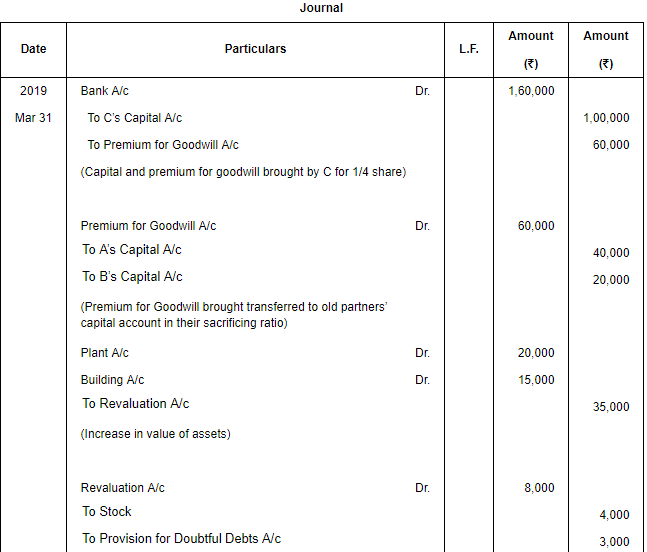

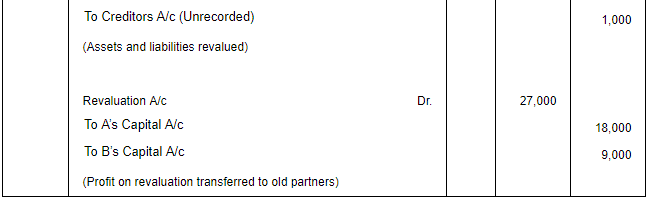

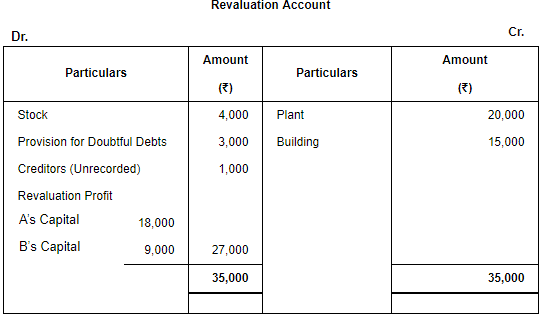

Question 65: Given below is the Balance Sheet of A and B, who are carrying on partnership business on 31st March, 2019. A and B share profits and losses in the ratio of 2 : 1.

C is admitted as a partner on 1st April, 2019 on the following terms:

(a) C will bring ₹ 1,00,000 as his capital and ₹ 60,000 as his share of goodwill for 1/4th share in the profits.

(b) Plant is to be appreciated to ₹ 1,20,000 and the value of building is to be appreciated by 10%.

(c) Stock is found overvalued by ₹ 4,000.

(d) A provision for doubtful debts is to be created at 5% of sundry debtors.

(e) Creditors were unrecorded to the extent of ₹ 1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partners' Capital Accounts, and show the Balance Sheet after the admission of C.

ANSWER:

Note: Since no information is given about the share of sacrifice, it is assumed that the old partners are sacrificing in their old profit sharing ratio.

Page No 5.96:

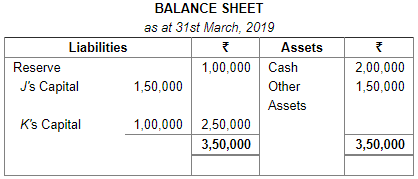

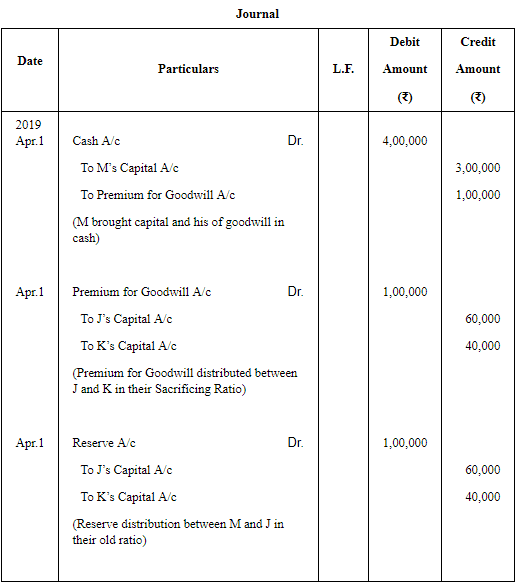

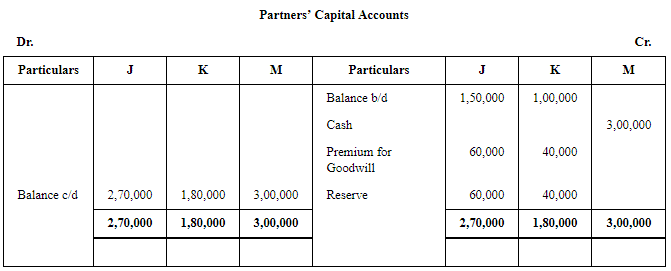

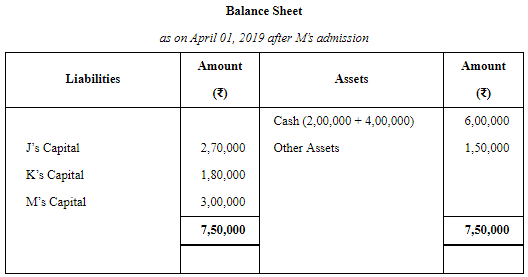

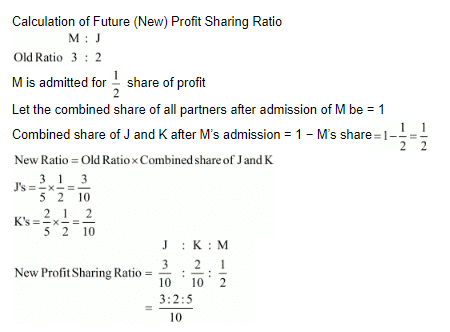

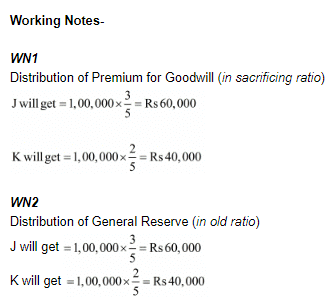

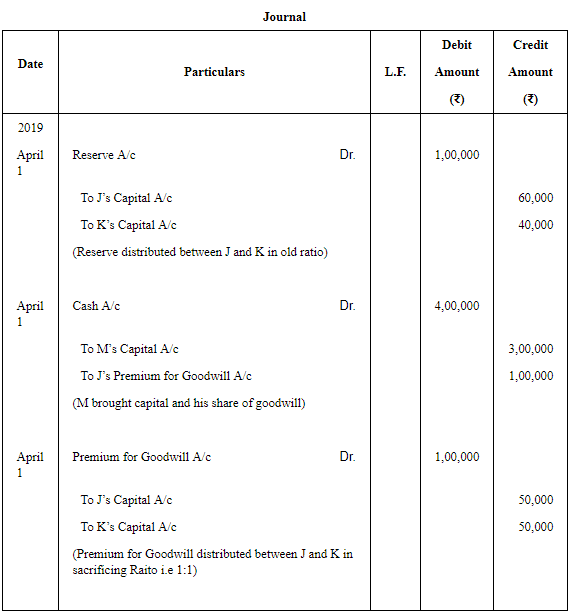

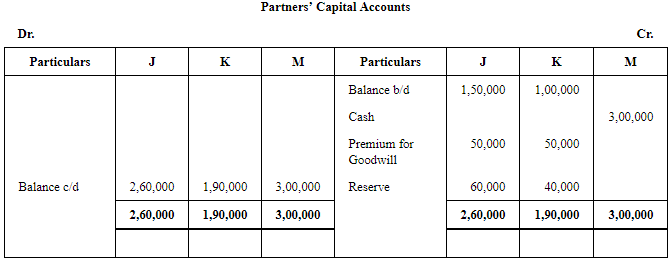

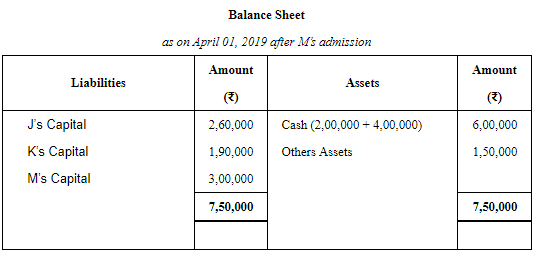

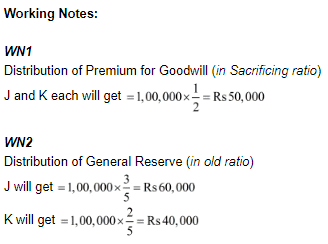

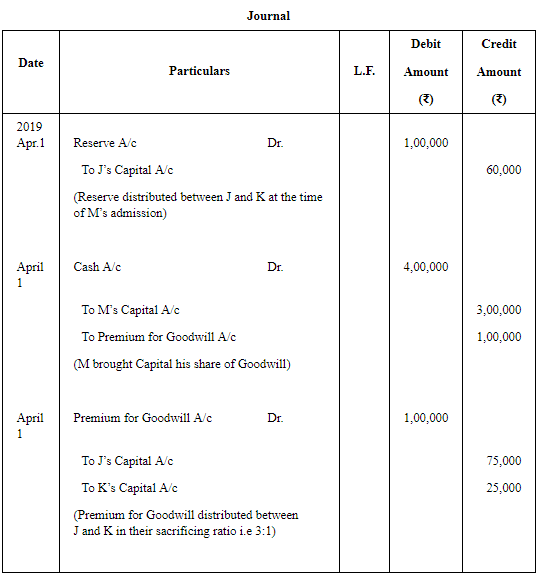

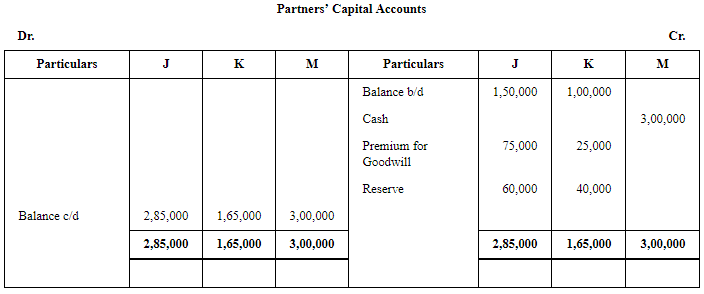

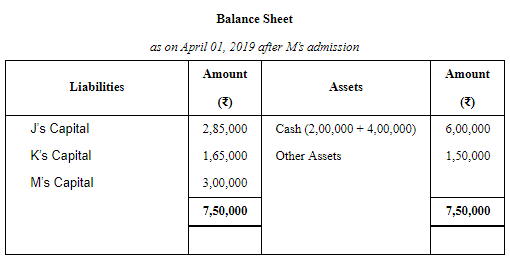

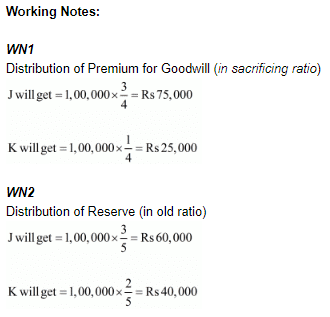

Question 66: Balance Sheet of J and K who share profits in the ratio of 3 : 2 is as follows:

M joins the firm from 1st April, 2019 for a half share in the future profits. He is to pay ₹ 1,00,000 for goodwill and ₹ 3,00,000 for capital. Draft the Journal entries and prepare Balance Sheet in each of the following cases:

(a) If M acquires his share of profit from the firm in the profit-sharing ratios of the partners.

(b) If M acquires his share of profits from the firm in equal proportions from the original partners.

(c) If M acquires his share of profit in the ratio of 3 : 1 from the original partners, ascertain the future profit-sharing ratio of the partners in each case.

ANSWER:

(a) If M acquires his share of profit from the firm in the original ratios of the partners

(b) If M acquires his share of profit from the firm in equal proportions from the original partners.

(c) If M acquires his share of profit in the ratio of 3:1 from the original partners

Page No 5.96:

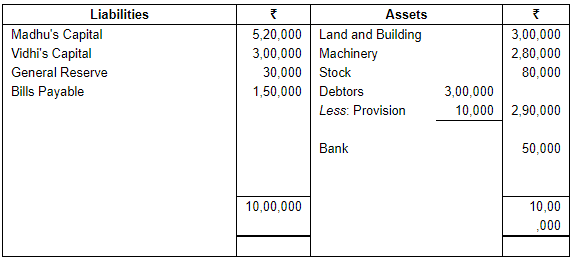

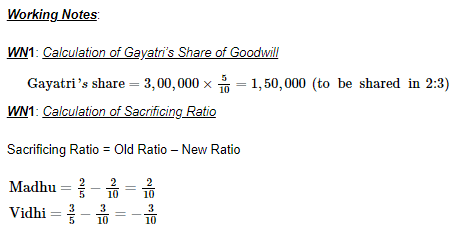

Question 67: The Balance Sheet of Madhu and Vidhi who are sharing profits in the ratio of 2 : 3 as at 31st March, 2016 is given below:

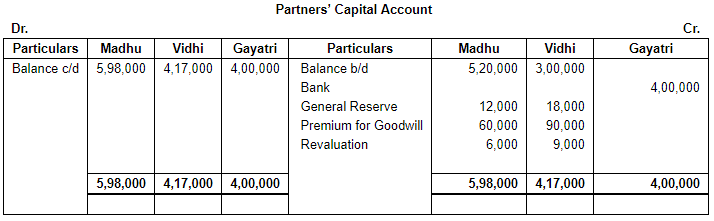

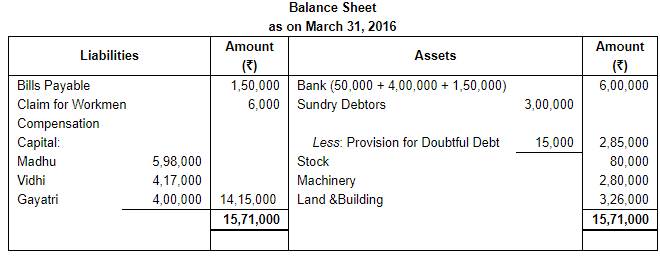

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April, 2016 and their new profit-sharing ratio will be 2 : 3 : 5. Gayatri brought ₹ 4,00,000 as her capital and her share of goodwill premium in cash.

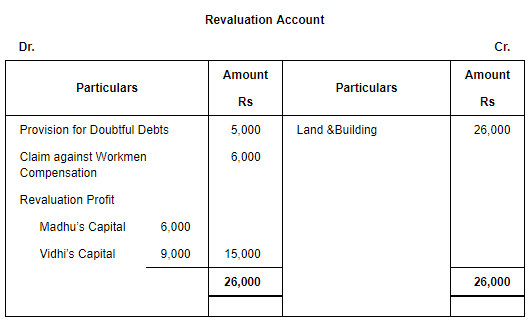

(a) Goodwill of the firm was valued at ₹ 3,00,000.

(b) Land and Building was found undervalued by ₹ 26,000.

(c) Provision for doubtful debts was to be made equal to 5% of the debtors.

(d) There was a claim of ₹ 6,000 on account of workmen compensation.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

Page No 5.97:

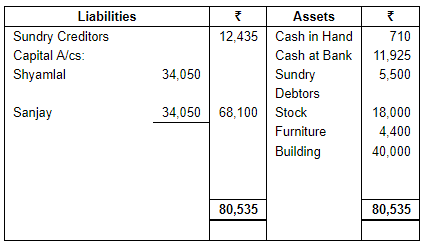

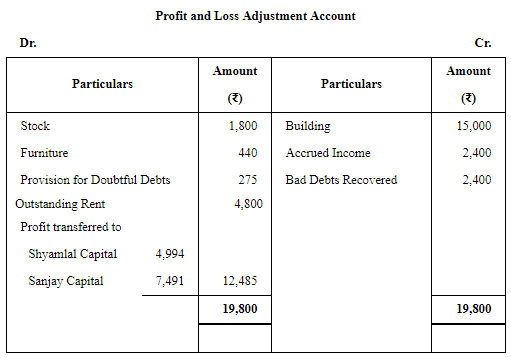

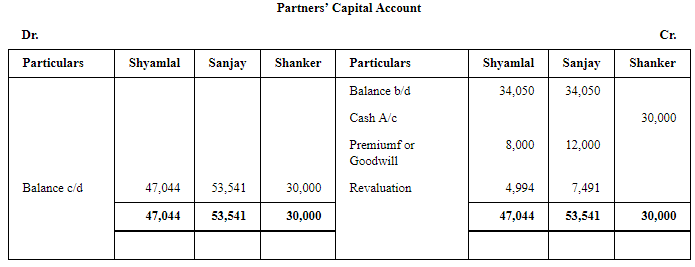

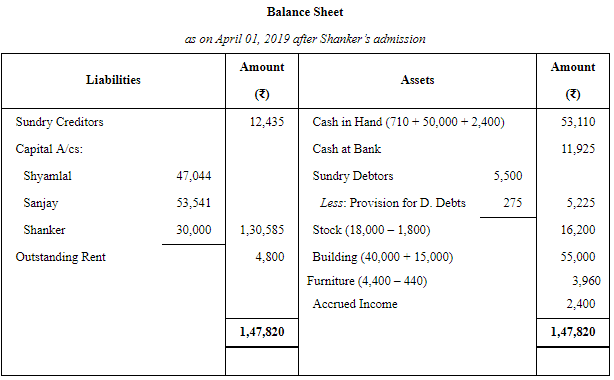

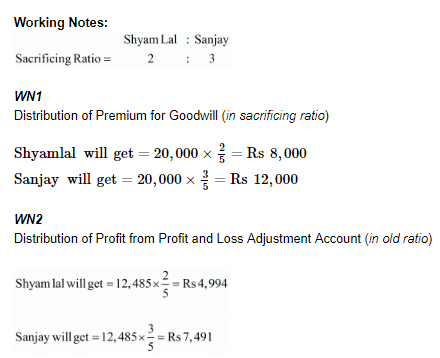

Question 68: Shyamlal and Sanjay were in partnership business sharing profits and losses in the ratio of 2 : 3 respectively. Their Balance Sheet as at 31st March, 2019 was:

On 1st April, 2019, they admitted Shanker into partnership for 1/3rd share in future profits on the following terms:

(a) Shanker is to bring in ₹ 30,000 as his capital and ₹ 20,000 as goodwill which is to remain in the business.

(b) Stock and Furniture are to be reduced in value by 10%.

(c) Building is to be appreciated by ₹ 15,000.

(d) Provision of 5% is to be made on Sundry Debtors for Doubtful Debts.

(e) Unaccounted Accrued Income of ₹ 2,400 to be provided for. A debtor, whose dues of ₹ 4,800 were written off as bad debts, paid 50% in full settlement.

(f) Outstanding Rent amounted to ₹ 4,800.

Show Profit and Loss Adjustment Account (Revaluation Account), Capital Accounts of Partners and opening Balance Sheet of the new firm.

ANSWER:

Page No 5.97:

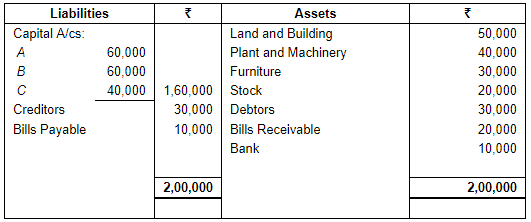

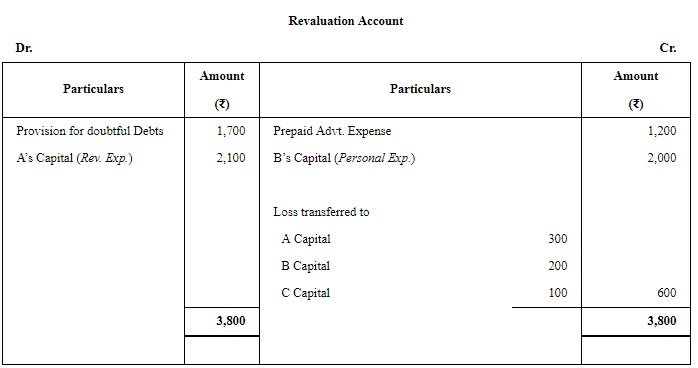

Question 69: A, B and C are partners sharing profits and losses in the ratio of 3 : 2 : 1 respectively. Their Balance Sheet as at 31st March, 2019 is as follows:

D is admitted as a partner on 1st April, 2019 for equal share. His capital is to be ₹ 50,000.

Following adjustments are agreed on D's admission:

(a) Out of the Creditors, a sum of ₹ 10,000 is due to D, it will be adjusted against his capital.

(b) Advertisement Expenses of ₹ 1,200 are to be carried forward as Prepaid Expenses.

(c) Expenses debited in the Profit and Loss Account includes a sum of ₹ 2,000 paid for B's personal expenses.

(d) A Bill of Exchange of ₹ 4,000, which was previously discounted with the bank, was dishonoured on 31st March, 2019 but entry was not passed for dishonour.

(e) A Provision for Doubtful Debts @ 5% is to be created against Debtors.

(f) Expenses on Revaluation amounted to ₹ 2,100 is paid by A.

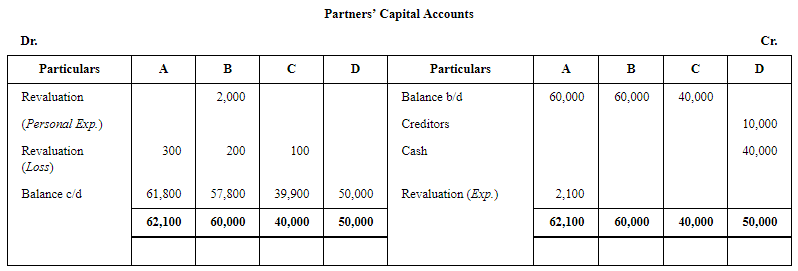

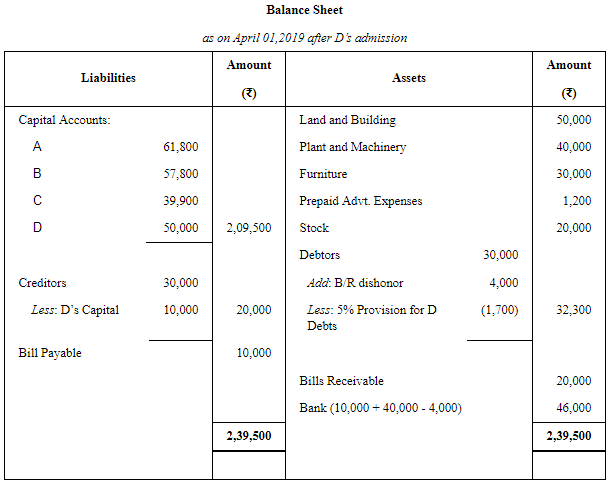

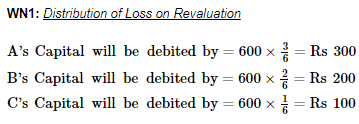

Prepare necessary Ledger Accounts and Balance Sheet after D's admission.

ANSWER:

Page No 5.98:

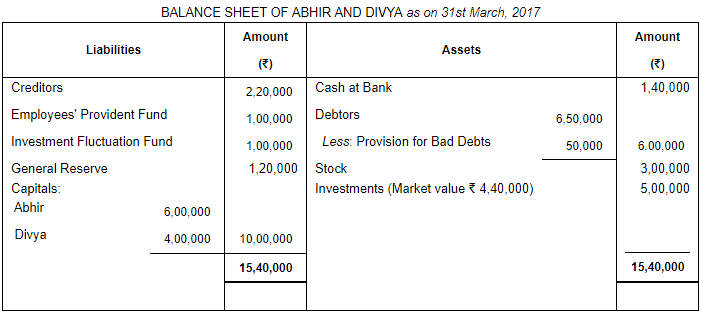

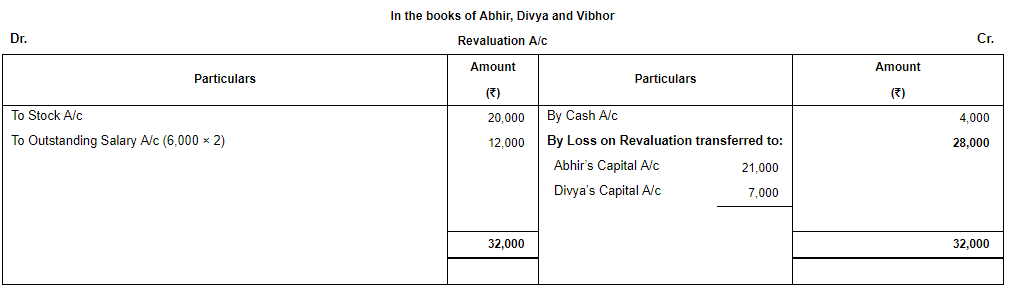

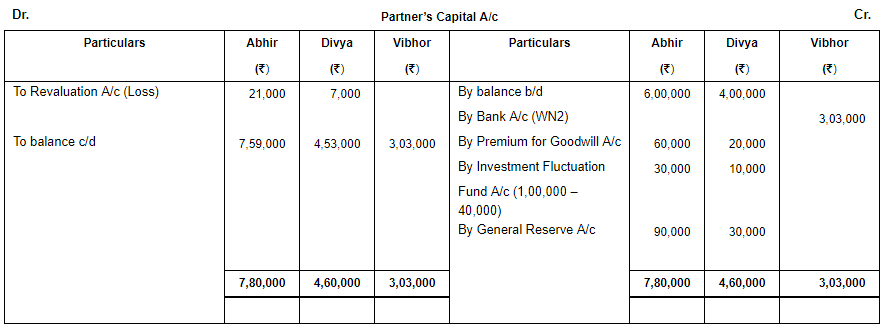

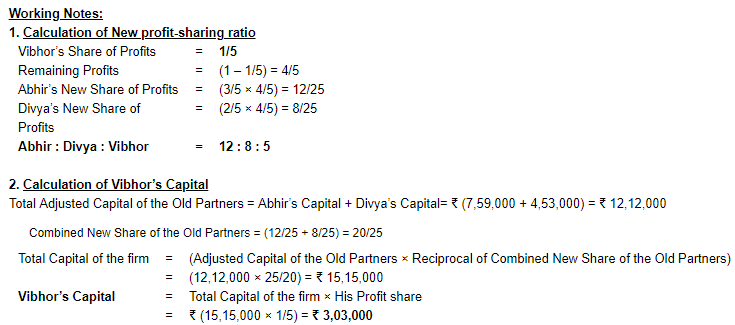

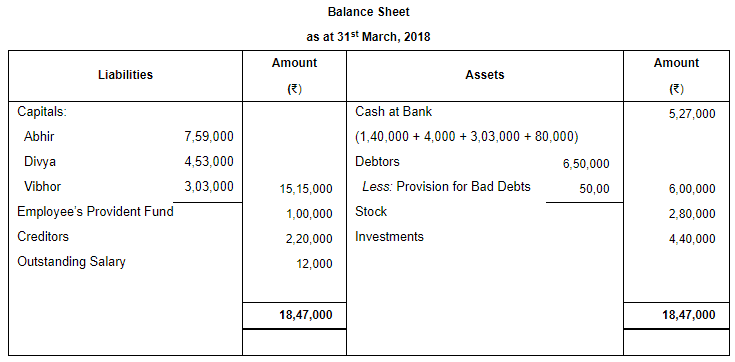

Question 70: On 31st March, 2017, the Balance Sheet of Abhir and Divya, who were sharing profits in the ratio of 3 : 1 was as follows: They decided to admit Vibhor on 1st April, 2017 for 1/5th share.

They decided to admit Vibhor on 1st April, 2017 for 1/5th share.

(a) Vibhor shall bring ₹ 80,000 as his share of goodwill premium.

(b) Stock was overvalued by ₹ 20,000.

(c) A debtor whose dues of ₹ 5,000 were written off as bad debts, paid ₹ 4,000 in full settlement.

(d) Two months' salary @ ₹ 6,000 per month was outstanding.

(e) Vibhor was to bring in Capital to the extent of 1/5th of the total capital of the new firm.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

Page No 5.98:

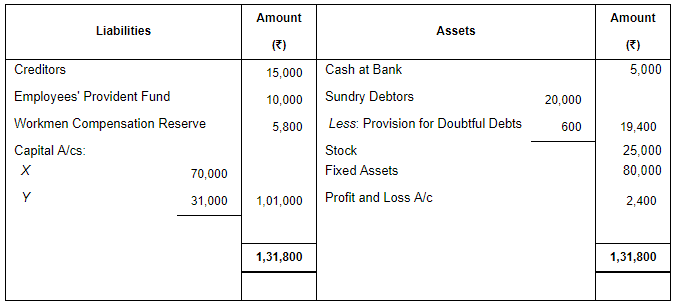

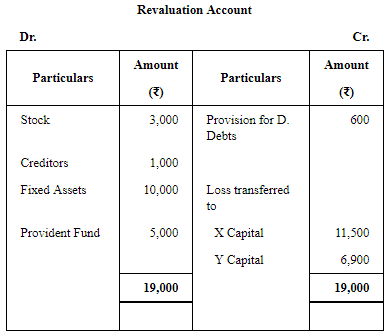

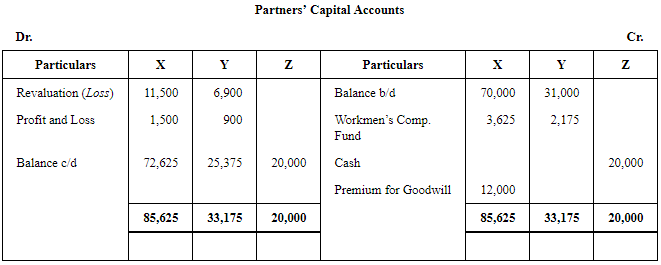

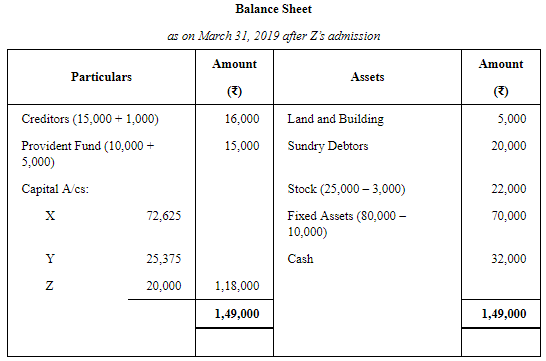

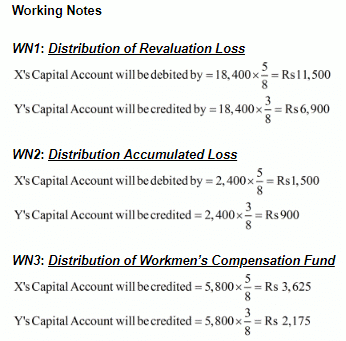

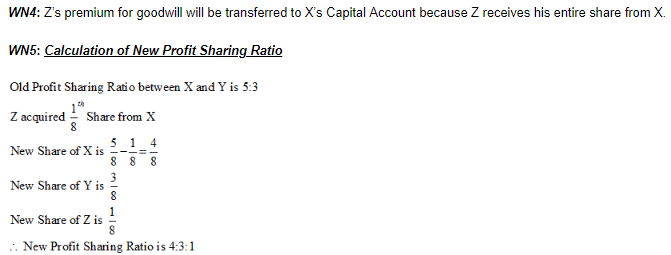

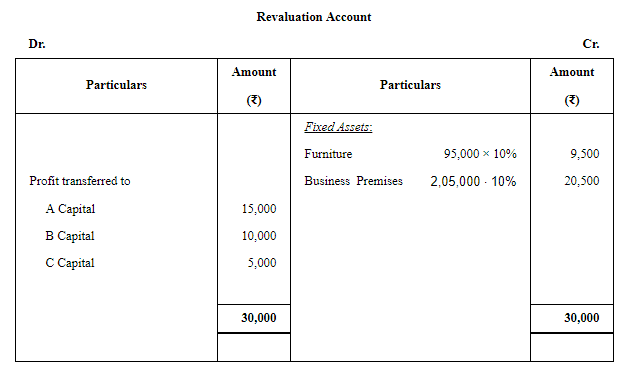

Question 71: X and Y share profits in the ratio of 5 : 3. Their Balance Sheet as at 31st March, 2019 was:

They admit Z into partnership with 1/8th share in profits on 1st April, 2019. Z brings ₹ 20,000 as his capital and ₹ 12,000 for goodwill in cash. Z acquires his share from X. Following revaluations are also made:

(a) Employees' Provident Fund liability is to be increased by ₹ 5,000.

(b) All Debtors are good.

(c) Stock includes ₹ 3,000 for obsolete items.

(d) Creditors are to be paid ₹ 1,000 more.

(e) Fixed Assets are to be revalued at ₹ 70,000.

Prepare Journal entries, necessary accounts and new Balance Sheet. Also, calculate new profit-sharing ratio.

ANSWER:

Page No 5.99:

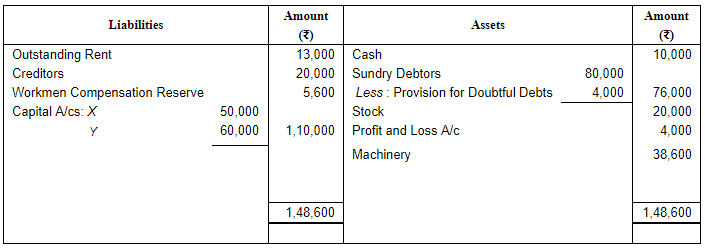

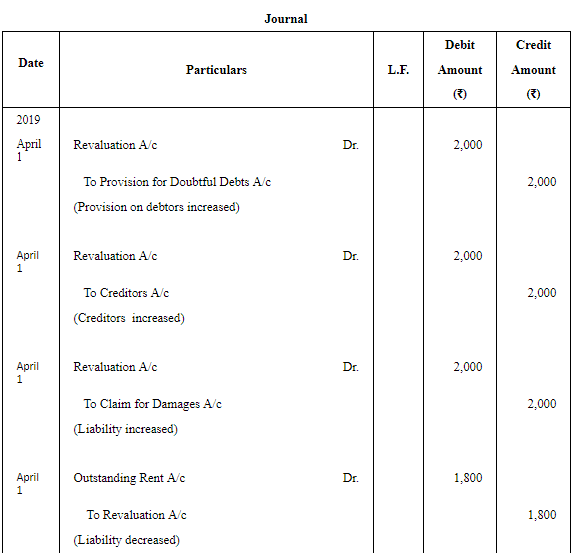

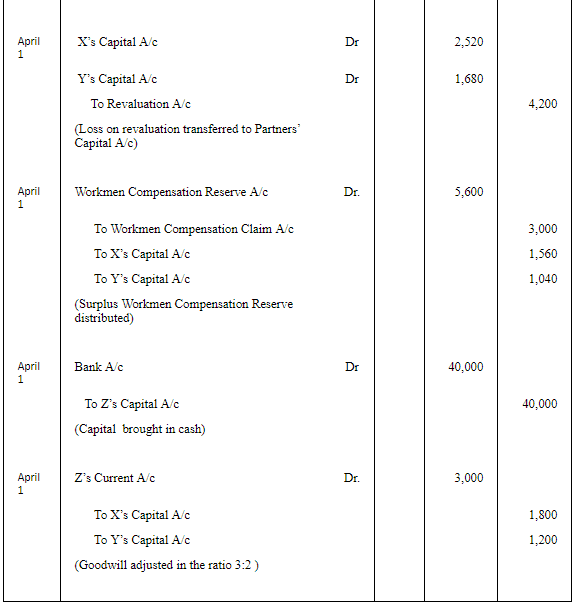

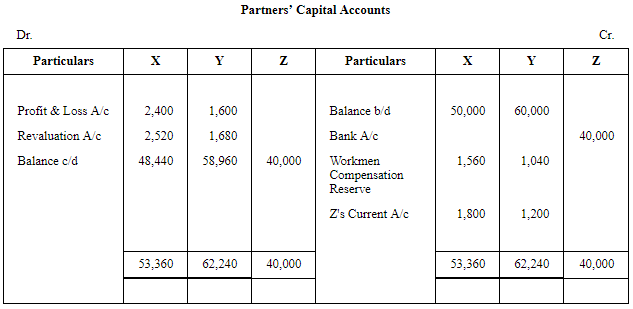

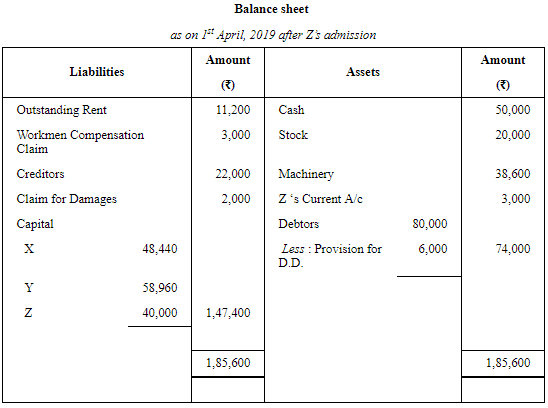

Question 72: X and Y are partners in a firm sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 was as follows:

On 1st April, 2019, they admitted Z as a partner for 1/6th share on the following terms:

(i) Z brings in ₹ 40,000 as his share of Capital but he is unable to bring any amount for Goodwill.

(ii) Claim on account of Workmen Compensation is ₹ 3,000.

(iii) To write off Bad Debts amounted to ₹ 6,000.

(iv) Creditors are to be paid ₹ 2,000 more.

(v) There being a claim against the firm for damages, liabilities to the extent of ₹ 2,000 should be created.

(vi) Outstanding rent be brought down to ₹ 11,200.

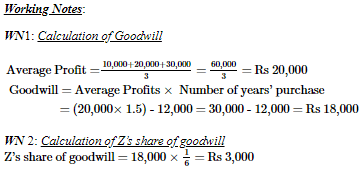

(vii) Goodwill is valued at  years' purchase of the average profits of last 3 years, less ₹ 12,000. Profits for the last 3 years amounted to ₹ 10,000; ₹ 20,000 and ₹ 30,000.

years' purchase of the average profits of last 3 years, less ₹ 12,000. Profits for the last 3 years amounted to ₹ 10,000; ₹ 20,000 and ₹ 30,000.

Pass Journal entries, prepare Partners' Capital Accounts and opening Balance Sheet.

ANSWER:

Page No 5.99:

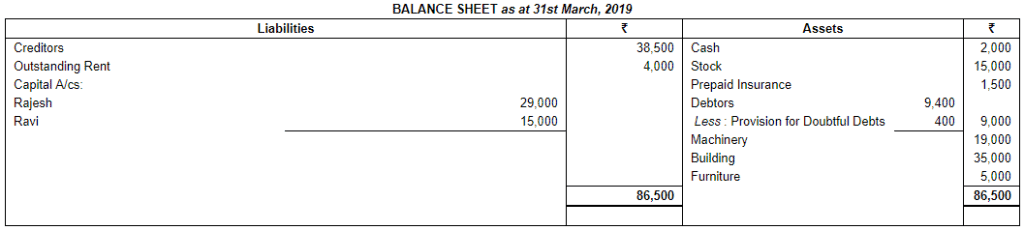

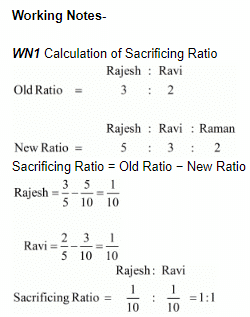

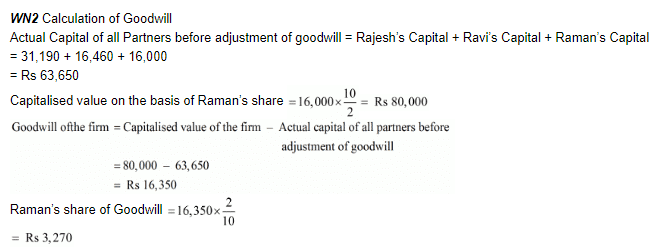

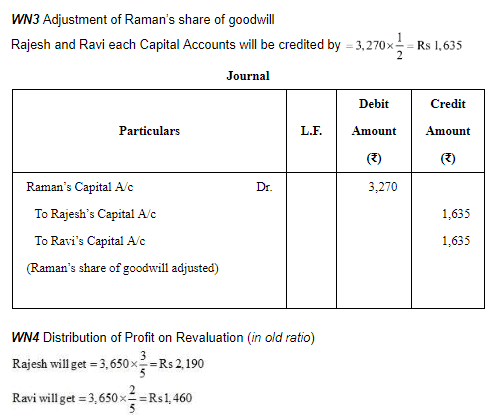

Question 73: Rajesh and Ravi are partners sharing profits in the ratio of 3 : 2. Their Balance Sheet at 31st March, 2019 stood as:

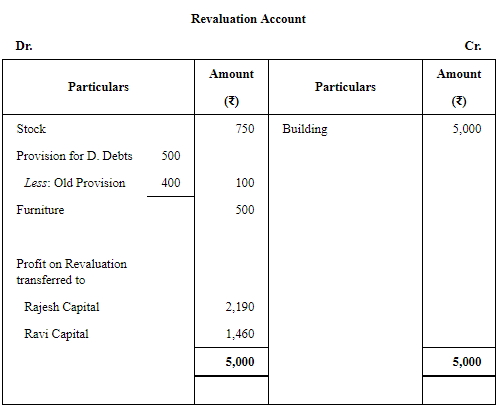

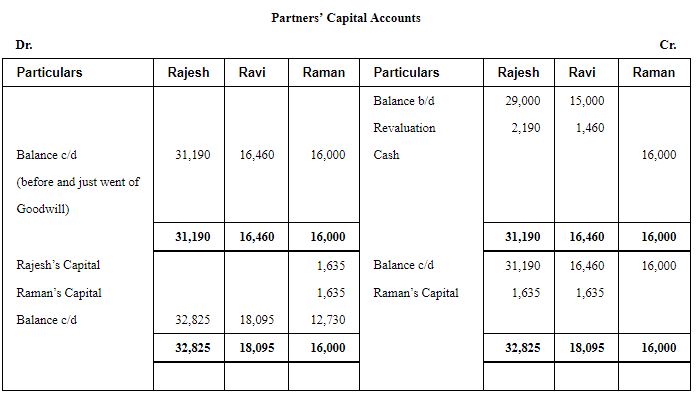

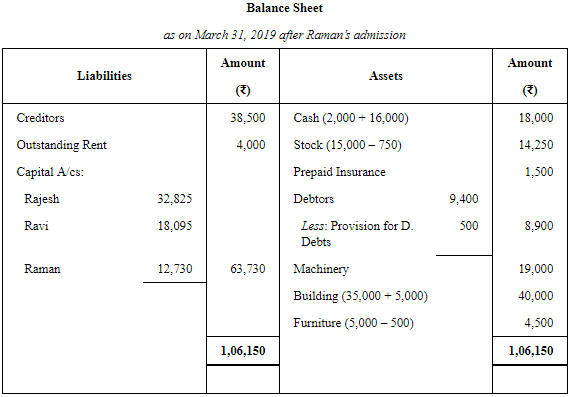

Raman is admitted as a new partner introducing a capital of ₹ 16,000. The new profit-sharing ratio is decided as 5 : 3 : 2. Raman is unable to bring in any cash for goodwill. So, it is decided to value the goodwill on the basis of Raman's share in the profits and the capital contributed by him. Following revaluations are made:

(a) Stock to decrease by 5%;

(b) Provision for Doubtful Debts is to be ₹ 500;

(c) Furniture to decrease by 10%;

(d) Building is valued at ₹ 40,000.

Show necessary Ledger Accounts and Balance Sheet of new firm.

ANSWER:

Page No 5.100:

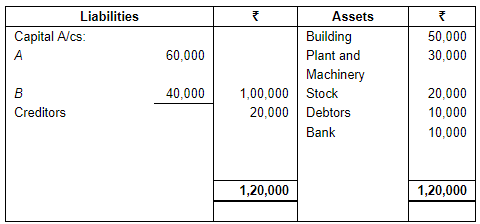

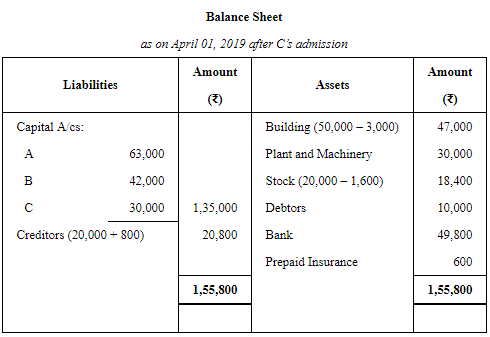

Question 74: A and B are partners in a firm sharing profits in the ratio of 3 : 2. They admit C as a partner on 1st April, 2019 on which date the Balance Sheet of the firm was:

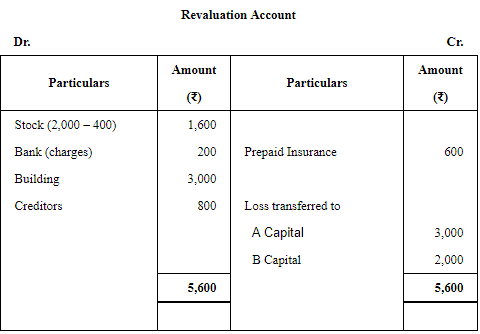

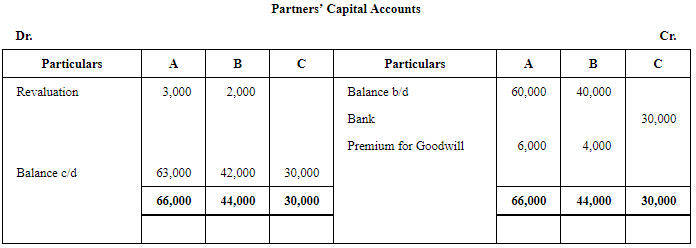

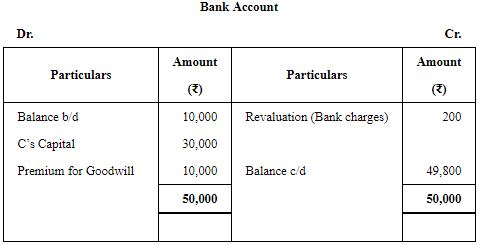

You are required to prepare the Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm after considering the following:

(a) C brings ₹ 30,000 as capital for 1/4th share. He also brings ₹ 10,000 for his share of goodwill.

(b) Part of the Stock which had been included at cost of ₹ 2,000 had been badly damaged in storage and could only expect to realise ₹ 400.

(c) Bank charges had been overlooked and amounted to ₹ 200 for the year 2018-19.

(d) Depreciation on Building of ₹ 3,000 had been omitted for the year 2018-19.

(e) A credit for goods for ₹ 800 had been omitted from both purchases and creditors although the goods had been correctly included in Stock.

(f) An expense of ₹ 1,200 for insurance premium was debited in the Profit and Loss Account of 2018-19 but ₹ 600 of this are related to the period after 31st March, 2019.

ANSWER:

Page No 5.100:

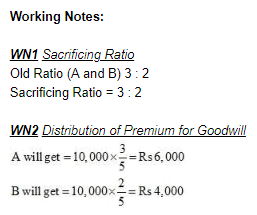

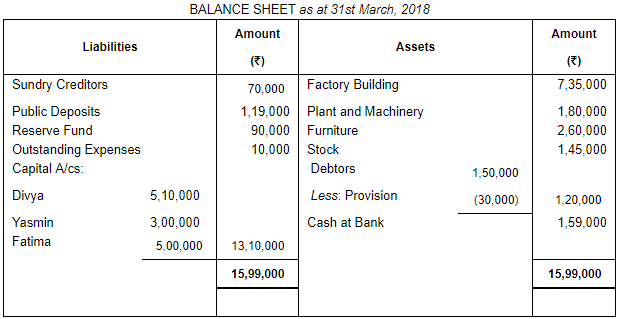

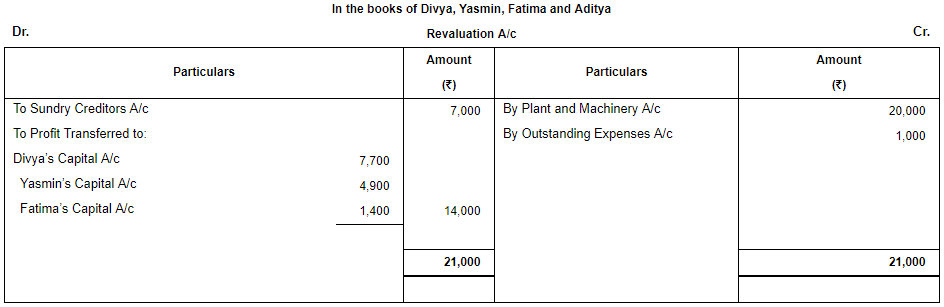

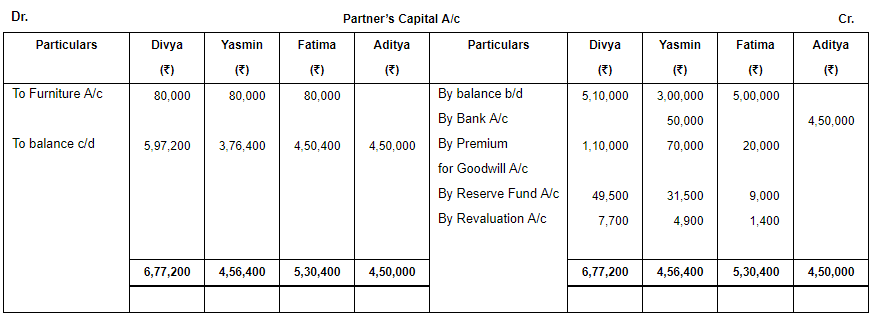

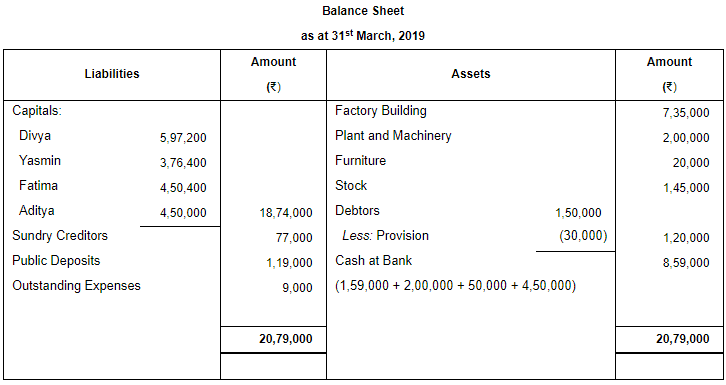

Question 75: Divya, Yasmin and Fatima are partners in a firm, sharing profits and losses in 11 : 7 : 2 respectively. The Balance Sheet of the firm on 31st March, 2018 was as follows:

On 1st April, 2018, Aditya is admitted as a partner for one-fifth share in the profits with a capital of ₹ 4,50,000 and necessary amount for his share of goodwill on the following terms:

(a) Furniture of ₹ 2,40,000 were to be taken over Divya, Yasmin and Fatima equally.

(b) A creditor of ₹ 7,000 not recorded in books to be taken into account.

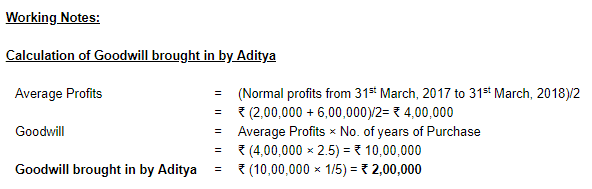

(c) Goodwill of the firm is to be valued at 2.5 years' purchase of average profits of last two years. The profit of the last three years were:

2015-16 − ₹ 6,00,000; 2016-17 − ₹ 2,00,000; 2017-18 − ₹ 6,00,000.

(d) At time of Aditya's admission. Yasmin also brought in ₹ 50,000 as fresh capital.

(e) Plant and Machinery is re-valued to ₹ 2,00,000 and expenses outstanding were brought down to ₹ 9,000.

Prepare Revaluation Account, Partners Capital Account and the Balance Sheet of the reconstituted firm.

ANSWER:

Page No 5.101:

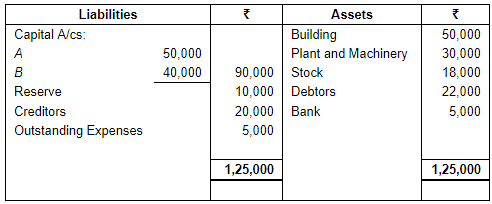

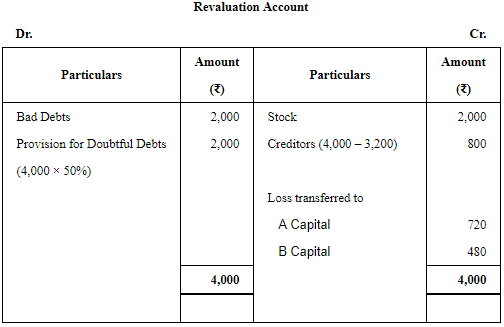

Question 76: A and B are partners in a firm. The net profit of the firm is divided as follows: 1/2 to A, 1/3 to B and 1/6 carried to a Reserve. They admit C as a partner on 1st April, 2019 on which date, the Balance Sheet of the firm was:

Following are the required adjustments on admission of C:

(a) C brings in ₹ 25,000 towards his capital.

(b) C also brings in ₹ 5,000 for 1/5th share of goodwill.

(c) Stock is undervalued by 10%.

(d) Creditors include a liability of ₹ 4,000, which has been decided by the court at ₹ 3,200.

(e) In regard to the Debtors, the following Debts proved Bad or Doubtful−

₹ 2,000 due from X−bad to the full extent;

₹ 4,000 due from Y−insolvent, estate expected to pay only 50%.

You are required to prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.101:

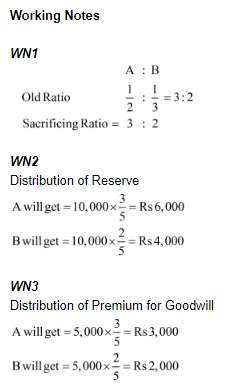

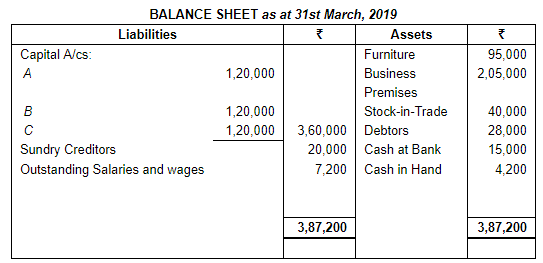

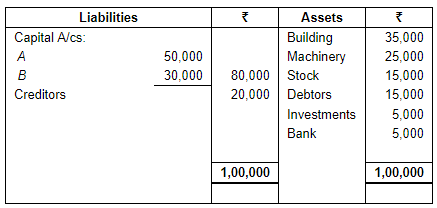

Question 77: Following is the Balance Sheet of the firm, Ashirvad, owned by A, B and C who share profits and losses of the business in the ratio of 3 : 2 : 1.

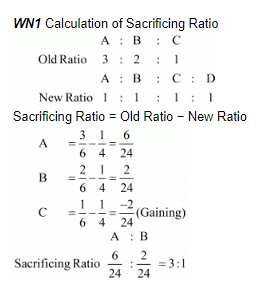

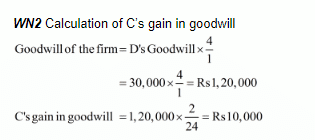

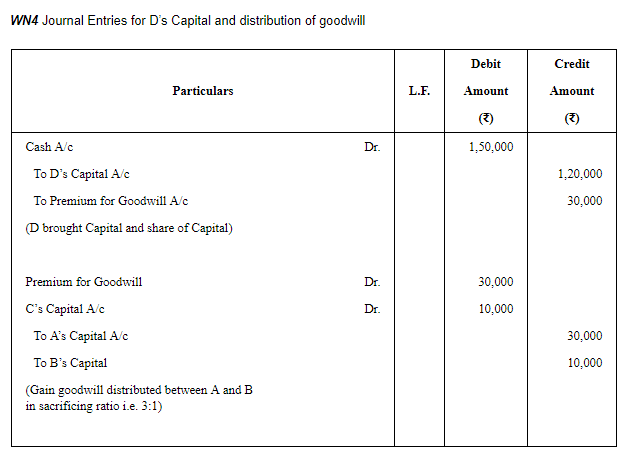

On 1st April, 2019, they admit D as a partner on the following conditions:

(a) D will bring in ₹ 1,20,000 as his capital and also ₹ 30,000 as goodwill premium for a quarter of the share in the future profits/losses of the firm.

(b) Values of the fixed assets of the firm will be increased by 10% before the admission of D.

(c) Mohan, an old customer whose account was written off as bad debts, has promised to pay ₹ 3,000 in full settlement of his dues.

(d) Future profits and losses of the firm will be shared equally by all the partners.

Pass the necessary Journal entries and prepare Revaluation Account, Partners' Capital Accounts and opening Balance Sheet of the new firm.

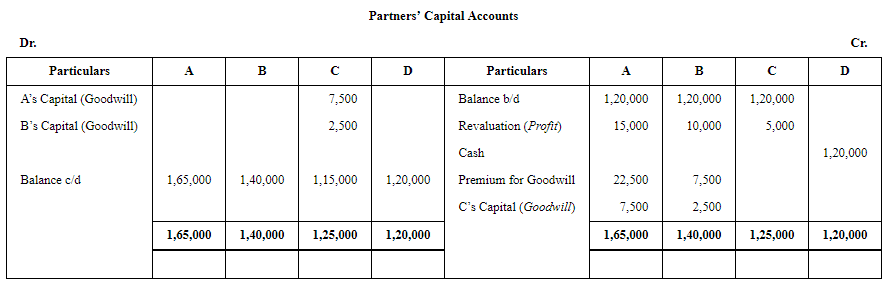

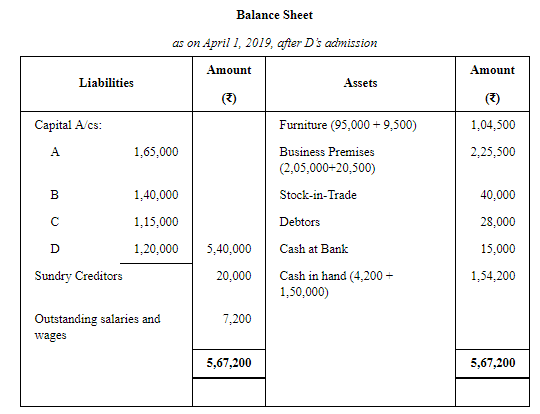

ANSWER:

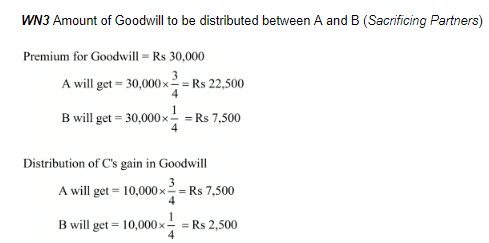

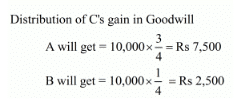

Working Note:

Page No 5.102:

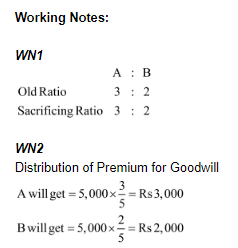

Question 78: A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. Following is their Balance Sheet as at 31st March, 2019:

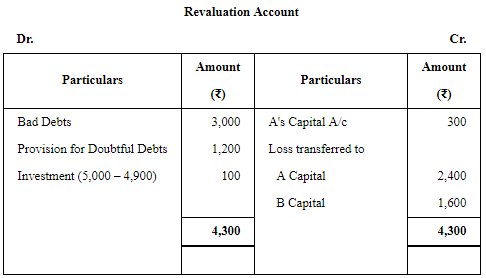

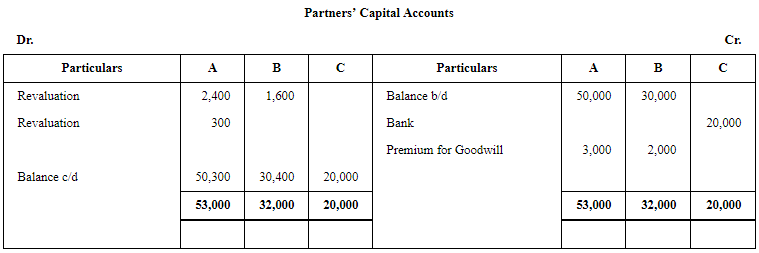

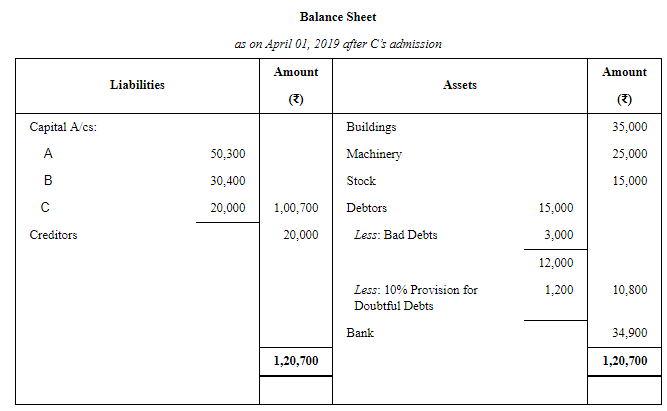

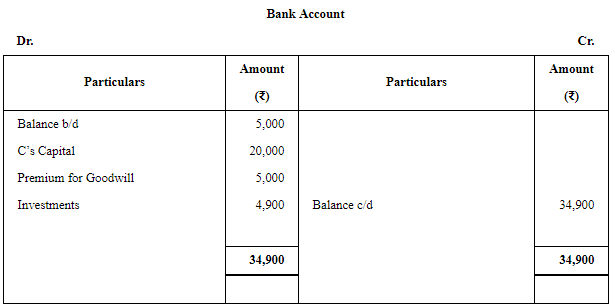

C is admitted as a partner on 1st April, 2019 on the following terms:

(a) C is to pay ₹ 20,000 as capital for 1/4th share. He also pays ₹ 5,000 as premium for goodwill.

(b) Debtors amounted to ₹ 3,000 is to be written off as bad and a Provision of 10% is created against Doubtful Debts on the remaining amount.

(c) No entry has been passed in respect of a debt of ₹ 300 recovered by A from a customer, which was previously written off as bad in previous year. The amount is to be paid by A.

(d) Investments are taken over by B at their market value of ₹ 4,900 against cash payment.

You are required to prepare Revaluation Account, Partner's Capital Accounts and new Balance Sheet.

ANSWER:

Page No 5.102:

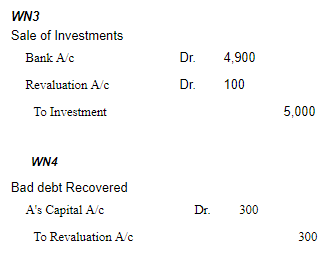

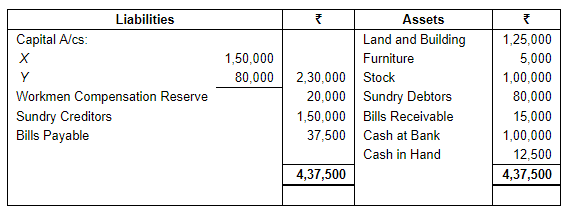

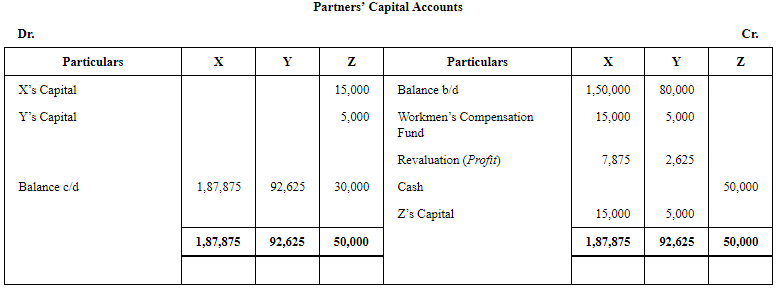

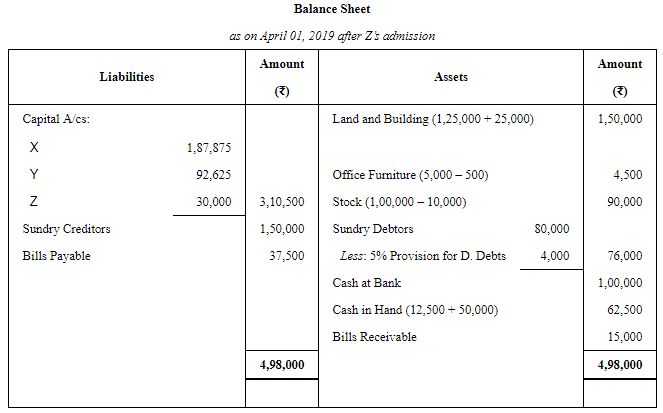

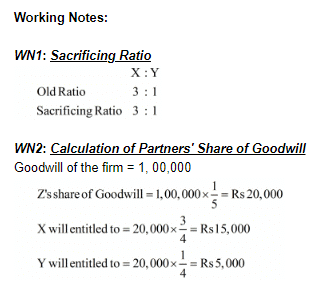

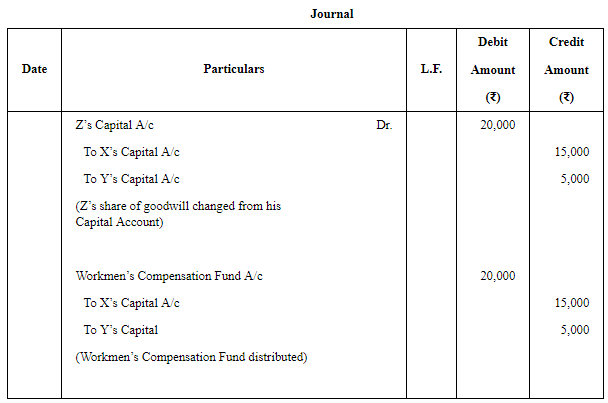

Question 79: X and Y are partners sharing profits and losses in the ratio of 3/4 and 1/4. Their Balance Sheet as at 31st March, 2019 is:

They admit Z into partnership on 1st April, 2019 on the following terms:

(a) Goodwill is to be valued at ₹ 1,00,000.

(b) Stock and Furniture to be reduced by 10%.

(c) A Provision for Doubtful Debts is to be created @ 5% on Sundry Debtors.

(d) The value of Land and Building is to be appreciated by 20%.

(e) Z pays ₹ 50,000 as his capital for 1/5th share in the future profits.

You are required to show Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.103:

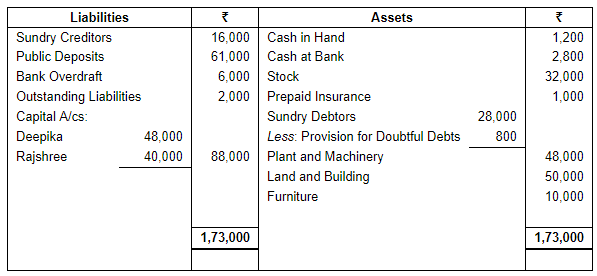

Question 80: Deepika and Rajshree are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2019 their Balance Sheet was:

On 1st April, 2019 the partners admit Anshu as a partner on the following terms:

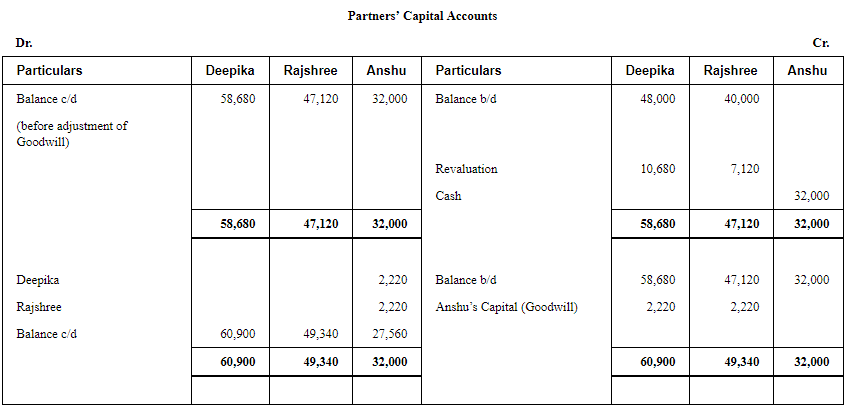

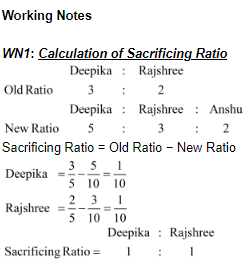

(a) The new profit-sharing ratio of Deepika, Rajshree and Anshu will be 5 : 3 : 2 respectively.

(b) Anshu shall bring in ₹ 32,000 as his capital.

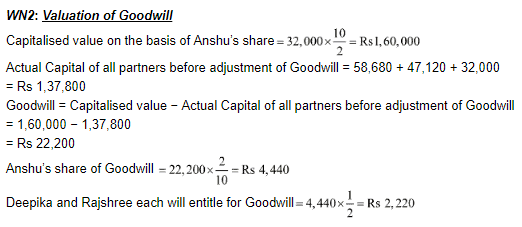

(c) Anshu is unable to bring in any cash for his share of goodwill. Partners, therefore, decide to calculate the goodwill on the basis of Anshu's share in the profits and the capital contribution made by her to the firm.

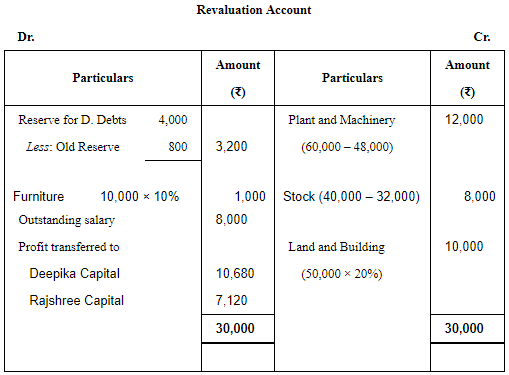

(d) Plant and Machinery is to be valued at ₹ 60,000, Stock at ₹ 40,000 and the Provision for Doubtful Debts is to be maintained at ₹ 4,000. Value of Land and Building has appreciated by 20%. Furniture has been depreciated by 10%.

(e) There is an additional liability of ₹ 8,000 being outstanding salary payable to employees of the firm. This liability is not included in the outstanding liabilities, stated in the above Balance Sheet. Partners decide to show this liability in the books of account of the reconstituted firm.

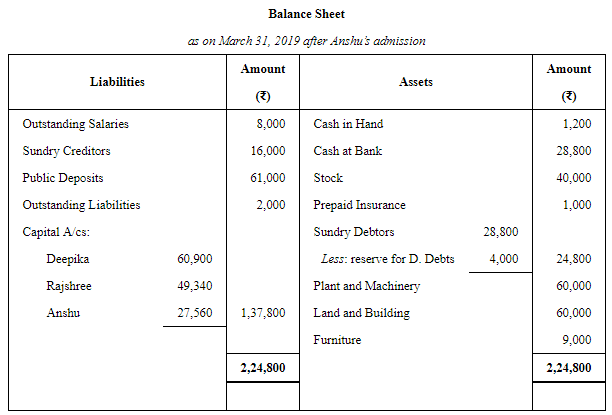

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of Deepika, Rajshree and Anshu.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Admission of a Partner (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is the meaning of admission of a partner in commerce? |  |

| 2. What are the reasons for admitting a partner in a partnership firm? |  |

| 3. How is the admission of a partner recorded in the books of accounts? |  |

| 4. What are the legal formalities involved in the admission of a partner? |  |

| 5. Can a partner be admitted without the consent of existing partners? |  |