Retirement/Death of a Partner (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 6.79:

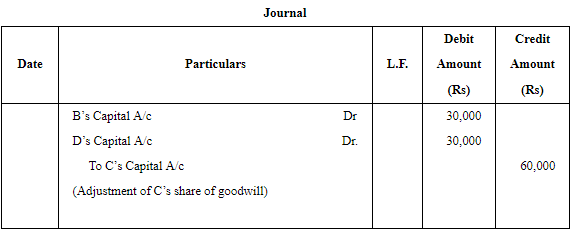

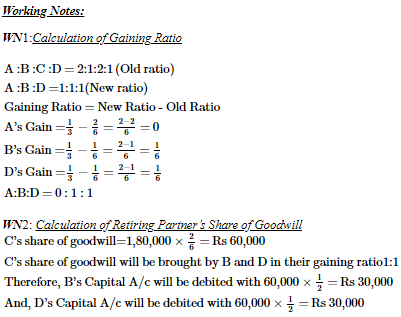

Question 21: A, B, C and D are partners in a firm sharing profits, in the ratio of 2 : 1 : 2 : 1. On the retirement of C, Goodwill was valued ₹ 1,80,000. A, B and D decide to share future profits equally. Pass the necessary Journal entry for the treatment of goodwill.

ANSWER:

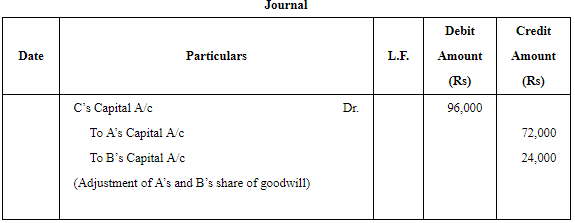

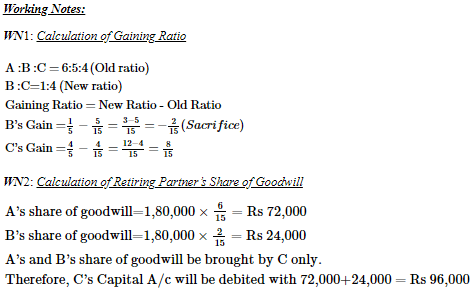

Question 22: A, B and C were partners in a firm sharing profits in the ratio of 6 : 5 : 4. Their capitals were A − ₹ 1,00,000; B − ₹ 80,000 and C − ₹ 60,000 respectively. On 1st April, 2009, A retired from the firm and the new profit sharing ratio between B and C was decided as 1 : 4. On A's retirement, the goodwill of the firm was valued at ₹ 1,80,000. Showing your calculations clearly, pass the necessary Journal entry for the treatment of goodwill on A's retirement.

ANSWER:

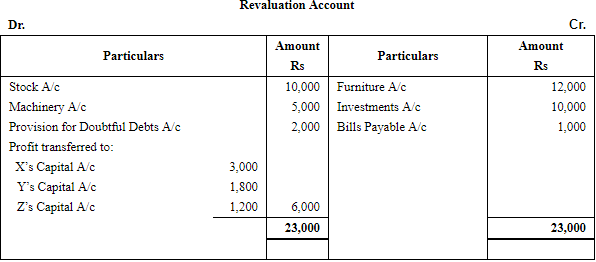

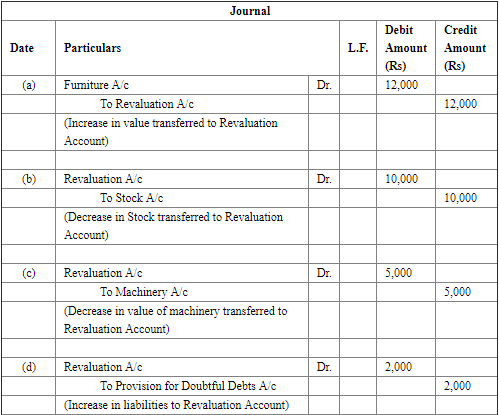

Question 23: X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2. Z retired and on the date of his retirement, following adjustments were agreed upon:

(a) The value of Furniture is to be increased by ₹ 12,000.

(b) The value of stock to be decreased by ₹ 10,000.

(c) Machinery of the book value of ₹ 50,000 is to be depreciated by 10%.

(d) A Provision for Doubtful Debts @ 5% is to be created on debtors of book value of ₹ 40,000.

(e) Unrecorded Investment worth ₹ 10,000.

(f) An item of ₹ 1,000 included in bills payable is not likely to be claimed, hence should be written back. Pass necessary Journal entries.

ANSWER:

Page No 6.80:

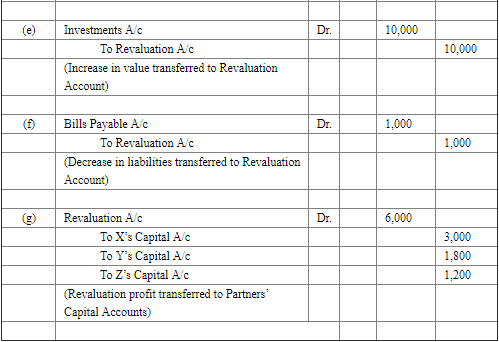

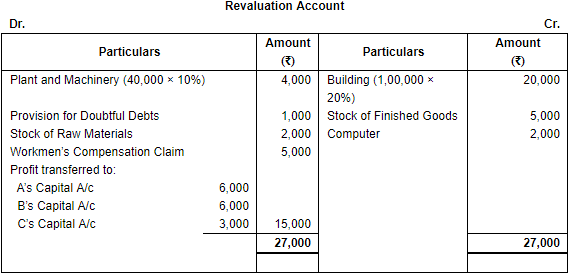

Question 24: A, B and C were partners, sharing profits and losses in the ratio of 2 : 2 : 1. B decides to retire on 31st March, 2019. On the date of his retirement, some of the assets and liabilities appeared in the books as follows: Creditors ₹ 70,000; Building ₹ 1,00,000; Plant and Machinery ₹ 40,000; Stock of Raw Materials ₹ 20,000; Stock of Finished Goods ₹ 30,000 and Debtors ₹ 20,000. Following was agreed among the partners on B's retirement:

(a) Building to be appreciated by 20%.

(b) Plant and Machinery to be reduced by 10%.

(c) A Provision of 5% on Debtors to be created for Doubtful Debts.

(d) Stock of Raw Materials to be valued at ₹ 18,000 and Finished Goods at ₹ 35,000.

(e) An Old Computer previously written off was sold for ₹ 2,000 as scrap.

(f) Firm had to pay ₹ 5,000 to an injured employee.

Pass necessary Journal entries to record the above adjustments and prepare the Revaluation Account.

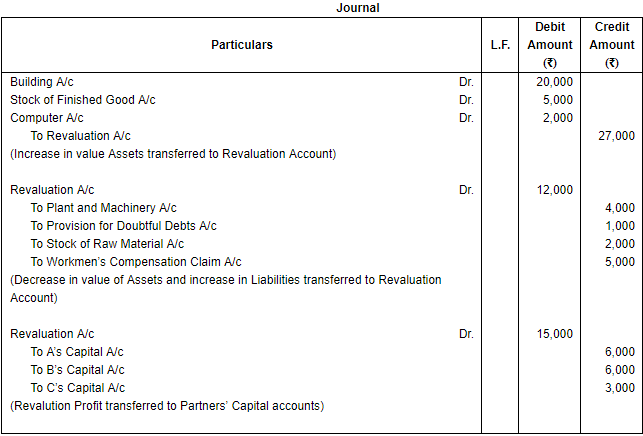

ANSWER:

Question 25: Ramesh wants to retire from the firm. The gain (profit) on revaluation on that date was ₹ 12,000. Mohan and Rahul want to share this in their new profit-sharing ratio of 3 : 2. Ramesh wants this to be shared equally. How is the profit to be shared? Give reasons.

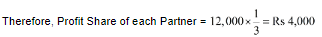

ANSWER: Revaluation of assets and liabilities is made at the time of Ramesh’s retirement and not after his retirement. Therefore, profits on revaluation will be distributed among all the partners in their old profit sharing ratio. In the absence of partnership deed, profits are distributed equally among all the partners.

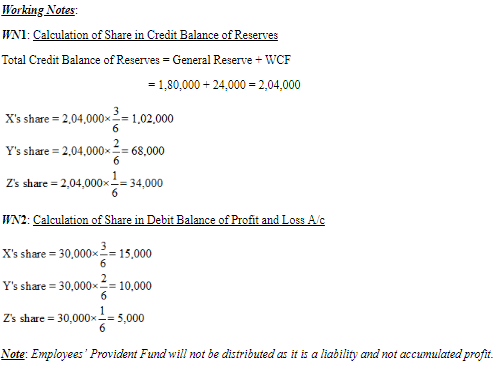

Question 26: X, Y and Z are partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Z retires from the firm on 31st March, 2019. On the date of Z's retirement, the following balances appeared in the books of the firm:

General Reserve ₹ 1,80,000

Profit and Loss Account (Dr.) ₹ 30,000

Workmen Compensation Reserve ₹ 24,000 which was no more required

Employees' Provident Fund ₹ 20,000.

Pass necessary Journal entries for the adjustment of these items on Z's retirement.

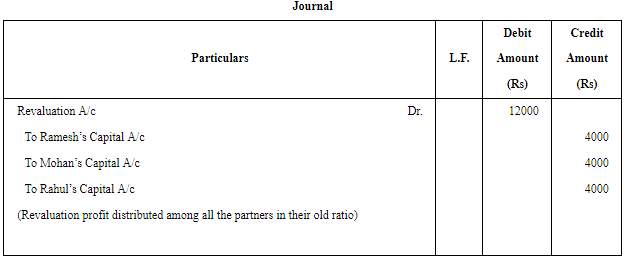

ANSWER:

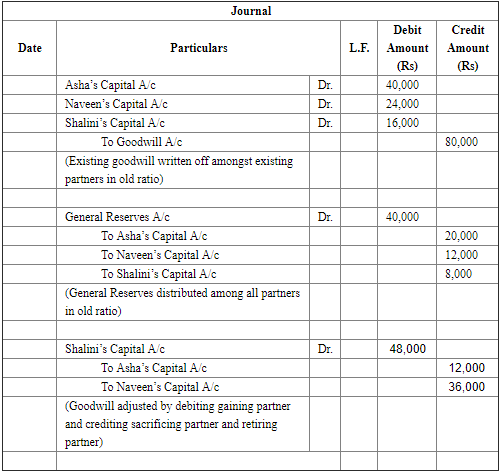

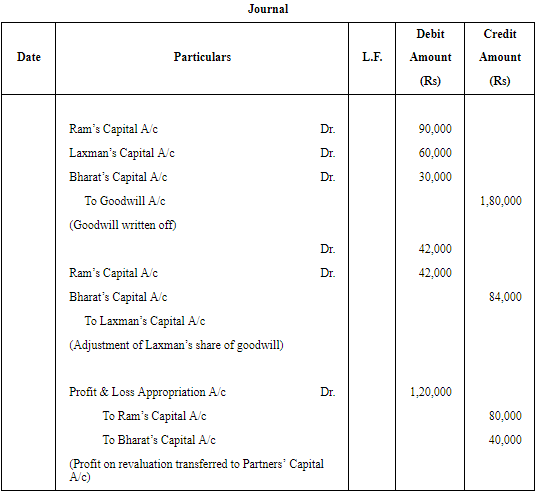

Question 27: Asha, Naveen and Shalini were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Goodwill appeared in their books at a value of ₹ 80,000 and General Reserve at ₹ 40,000. Naveen decided to retire from the firm. On the date of his retirement, goodwill of the firm was valued at ₹ 1,20,000. The new profit-sharing ratio decided among Asha and Shalini is 2 : 3.

Record necessary Journal entries on Naveen's retirement.

ANSWER:

Page No 6.81:

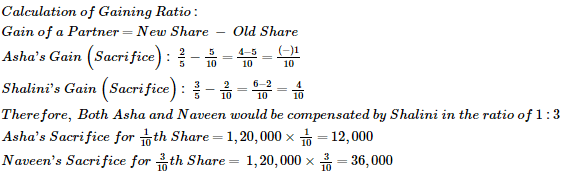

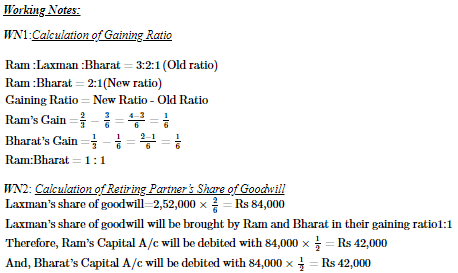

Question 28: Ram, Laxman and Bharat are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill is appearing in the books at a value of ₹ 1,80,000. Laxman retires and at the time of his retirement, goodwill is valued at ₹ 2,52,000. Ram and Bharat decided to share future profits in the ratio of 2 : 1. The Profit for the first year after Laxman's retirement amount to ₹ 1,20,000. Give the necessary Journal entries to record goodwill and to distribute the profit. Show your calculations clearly.

ANSWER:

Note: The entry for distributing profit as given in the book is wrong. The profit will be distributed between Ram & Bharat and not Ram and Laxman (since Laxman has retired)

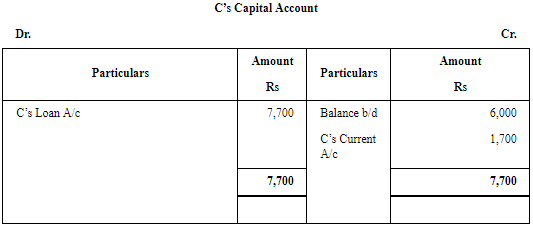

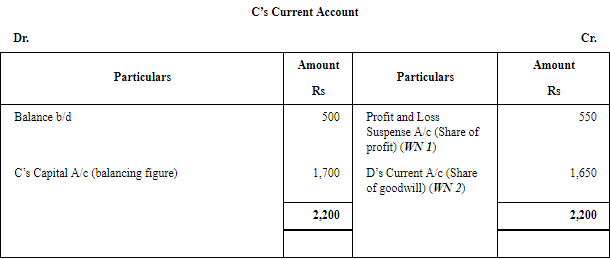

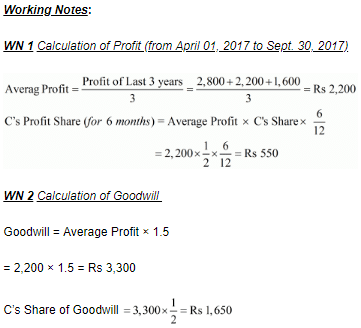

Question 29: Partnership Deed of C and D, who are equal partners, has a clause that any partner may retire from the firm on the following terms by giving a six-month notice in writing:

The retiring partner shall be paid−

(a) the amount standing to the credit of his Capital Account and Current Account.

(b) his share of profit to the date of retirement, calculated on the basis of the average profit of the three preceding completed years.

(c) half the amount of the goodwill of the firm calculated at 11/2 times the average profit of the three preceding completed years.

C gave a notice on 31st March, 2017 to retire on 30th September, 2017, when the balance of his Capital Account was ₹ 6,000 and his Current Account (Dr.) ₹ 500. Profits for the three preceding completed years ended 31st March, were: 2015 − ₹ 2,800; 2016 − ₹ 2,200 and 2017 − ₹ 1,600. What amount is due to C as per the partnership agreement?

ANSWER:

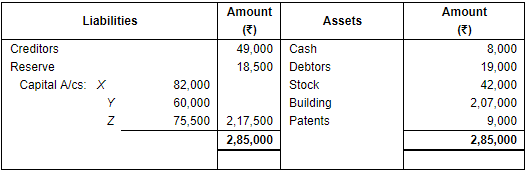

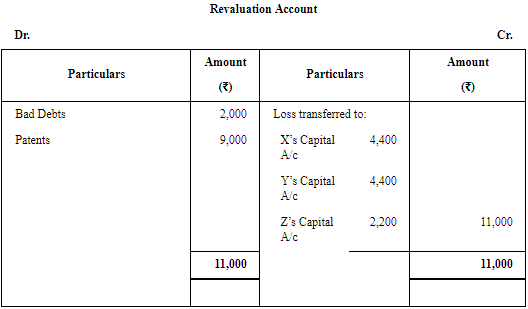

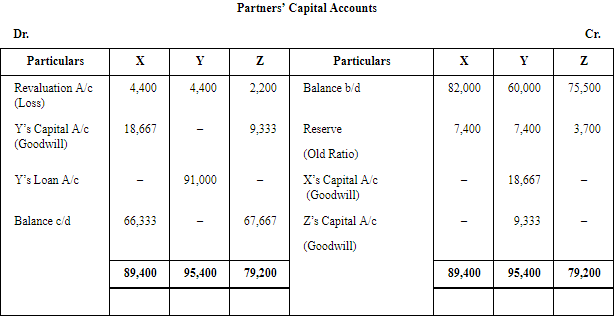

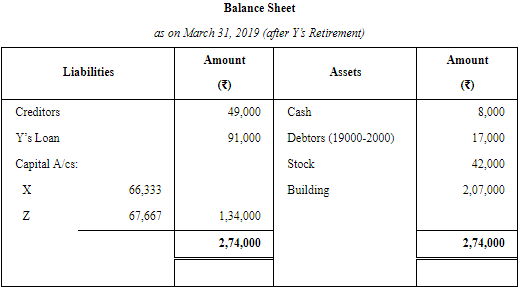

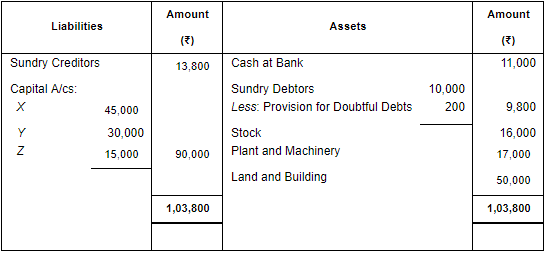

Question 30: X, Y and Z were partners in a firm sharing profits in the ratio of 2 : 2 : 1. Their Balance Sheet as at 31st March, 2019 was:

Y retired on 1st April, 2019 on the following terms:

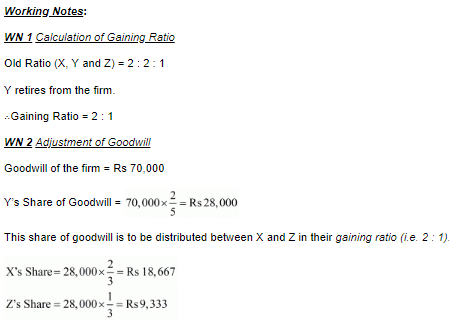

(a) Goodwill of the firm was valued at ₹ 70,000 and was not to appear in the books.

(b) Bad Debts amounted to ₹ 2,000 were to be written off.

(c) Patents were considered as valueless.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of X and Z after Y's retirement.

ANSWER:

Page No 6.82:

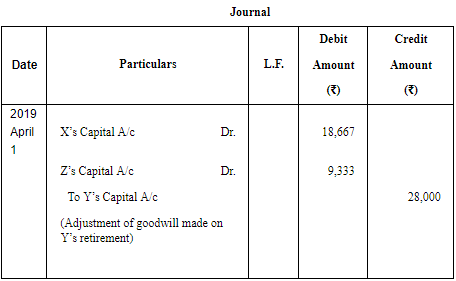

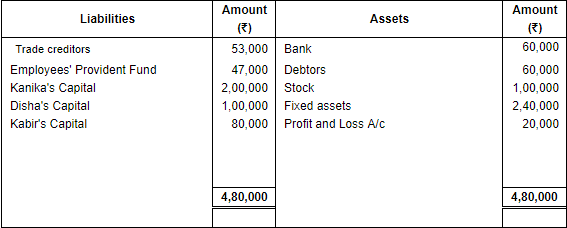

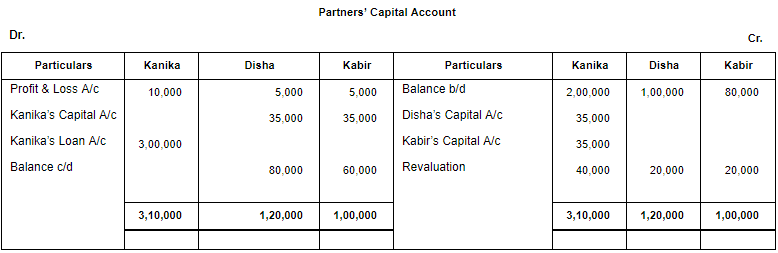

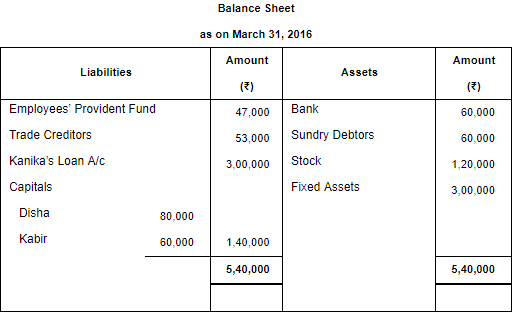

Question 31: Kanika, Disha and Kabir were partners sharing profits in the ratio of 2 : 1 : 1. On 31st March, 2016, their Balance Sheet was as under:

Kanika retired on 1st April, 2016. For this purpose, the following adjustments were agreed upon:

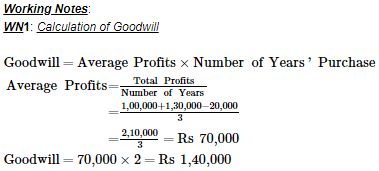

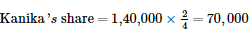

(a) Goodwill of the firm was valued at 2 years' purchase of average profits of three completed years preceding the date of retirement. The profits for the year:

2013-14 were ₹ 1,00,000 and for 2014-15 were ₹ 1,30,000.

(b) Fixed Assets were to be increased to ₹ 3,00,000.

(c) Stock was to be valued at 120%.

(d) The amount payable to Kanika was transferred to her Loan Account.

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of the reconstituted firm.

ANSWER:

(to be borne by gaining partners in gaining ratio)

Note: Since no information is given about the share of gain, it is assumed that the old partners are gaining in their old profit sharing ratio.

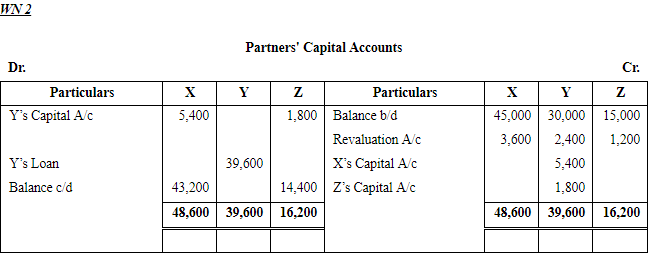

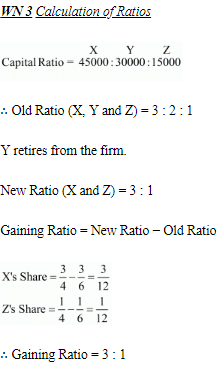

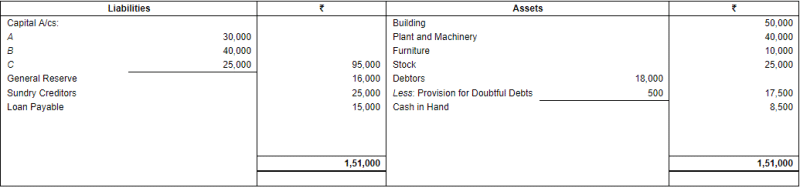

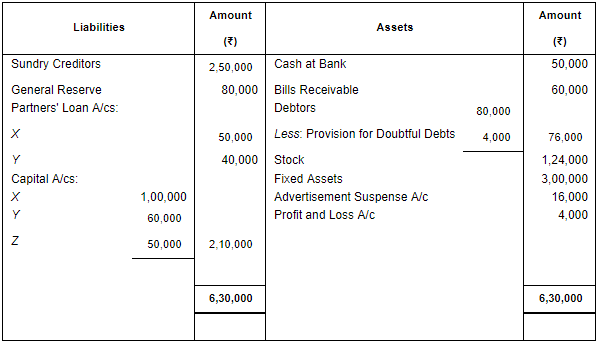

Question 32: The Balance Sheet of X, Y and Z who were sharing profits in ratio of their capitals stood as follows at 31st March, 2019:

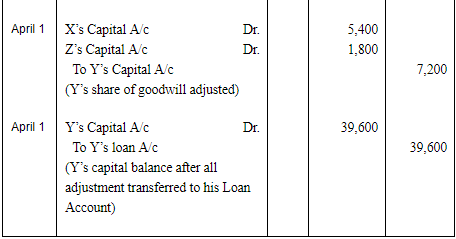

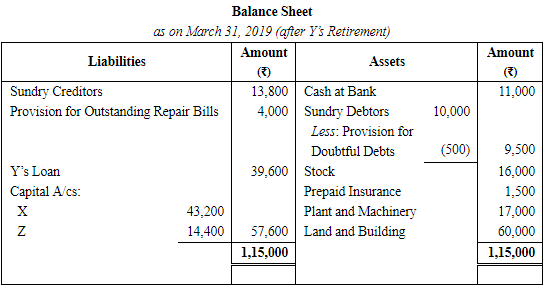

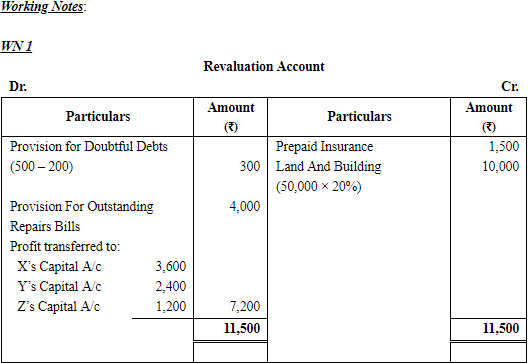

Y retired on 1st April, 2019 and the following terms:

(a) Out of the insurance premium debited to Profit and Loss Account, ₹ 1,500 to be carried forward as Prepaid Insurance.

(b) Provision for Doubtful Debts to be brought up to 5% of Sundry Debtors.

(c) Land and Building to be appreciated by 20%.

(d) A provision of ₹ 4,000 be made in respect of outstanding bills for repairs.

(e) Goodwill of the firm was determined at ₹ 21,600.

Y's share of goodwill be adjusted to that of X and Z who will share profits in future in the ratio of 3 : 1.

Pass necessary Journal entries and give the Balance Sheet after Y's retirement.

ANSWER:

Page No 6.83:

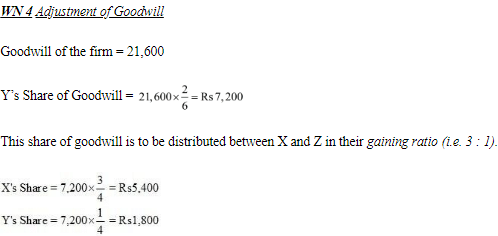

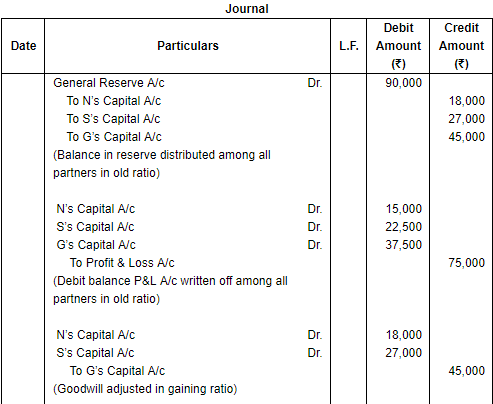

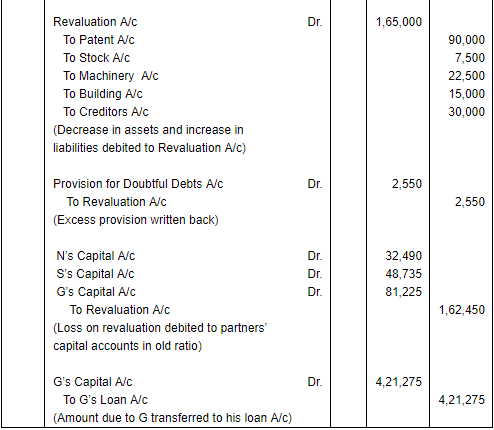

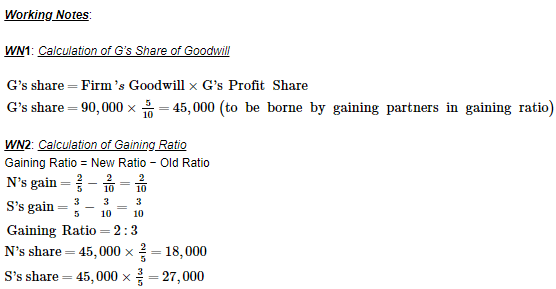

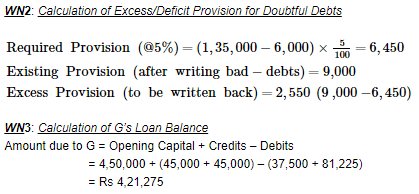

Question 33: N, S and G were partners in a firm sharing profits and losses in the ratio of 2 : 3 : 5. On 31st March, 2016 their Balance Sheet was as under:

G retired on the above date and it was agreed that:

(a) Debtors of ₹ 6,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(b) Patents will be completely written off and stock, machinery and building will be depreciated by 5%.

(c) An unrecorded creditor of ₹ 30,000 will be taken into account.

(d) N and S will share the future profits in 2 : 3 ratio.

(e) Goodwill of the firm on G's retirement was valued at ₹ 90,000.

Pass necessary Journal entries for the above transactions in the books of the firm on G's retirement.

ANSWER:

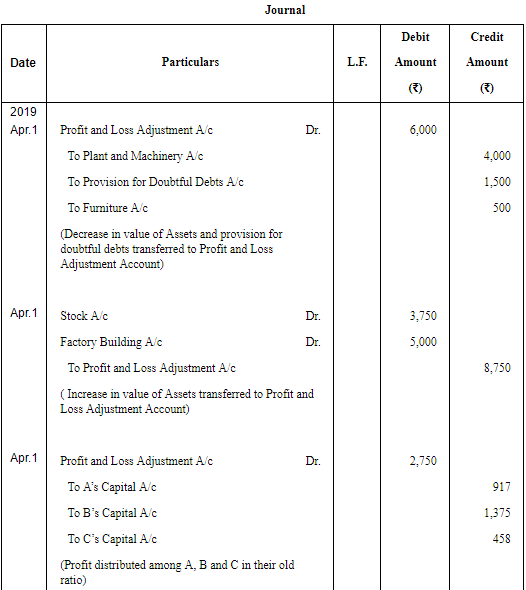

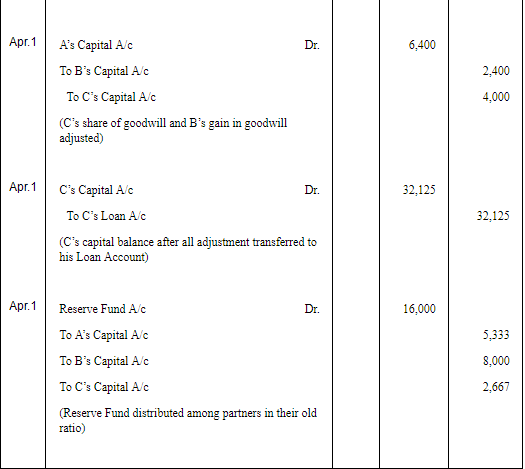

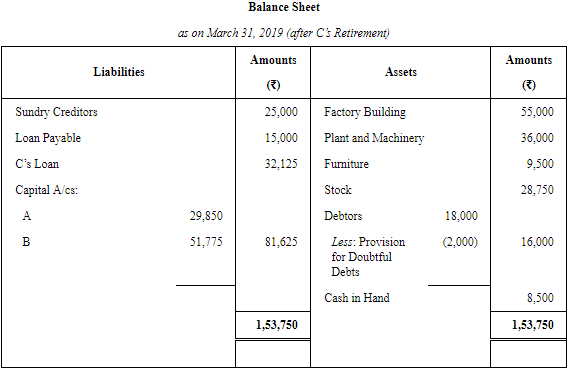

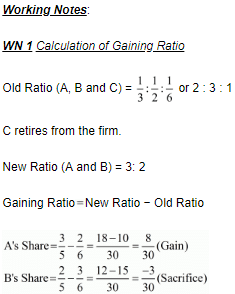

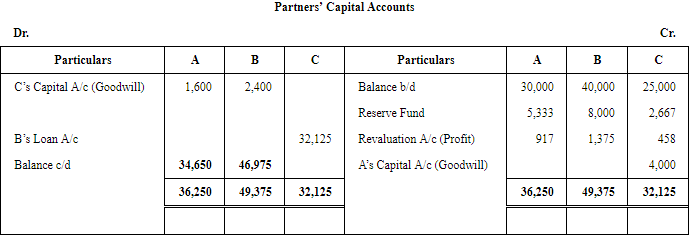

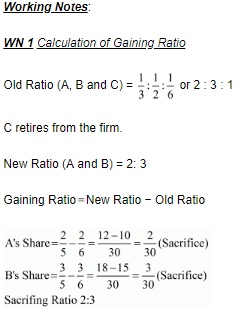

Question 34: A, B and C are partners in a firm, sharing profits and losses as A 1/3, B 1/2 and C 1/6 respectively. The Balance Sheet of the firm as at 31st March, 2019 was: C retires on 1st April, 2019 subject to the following adjustments:

C retires on 1st April, 2019 subject to the following adjustments:

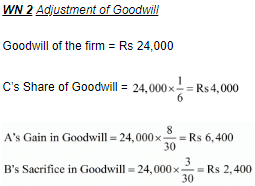

(a) Goodwill of the firm be valued at ₹ 24,000. C's share of goodwill be adjusted into the accounts of A and B who are going to share in future in the ratio of 3 : 2.

(b) Plant and Machinery to be reduced by 10% and Furniture by 5%.

(c) Stock to be appreciated by 15% and Building by 10%.

(d) Provision for Doubtful Debts to be raised to ₹ 2,000.

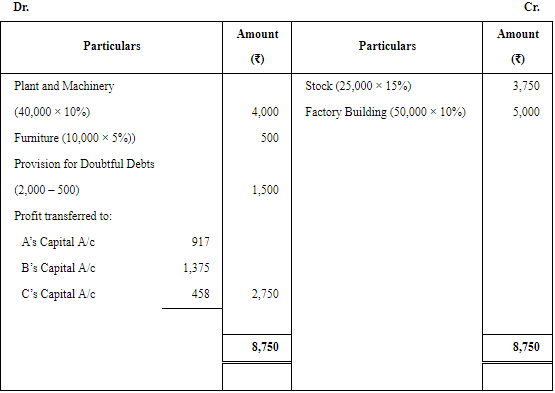

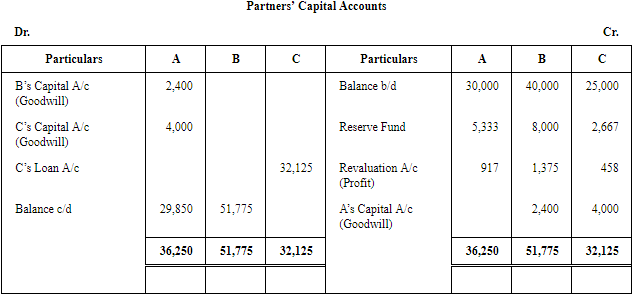

Pass Journal entries to record the above transactions in the books of the firm and show the Profit and Loss Adjustment Account, Capital Account of C and the Balance Sheet of the firm after C's retirement.

ANSWER:

Profit and Loss Adjustment Account

Page No 6.84:

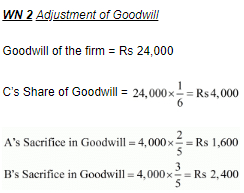

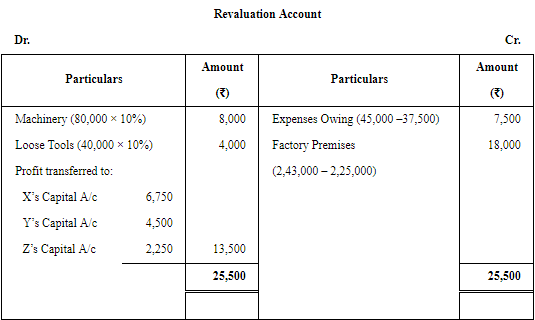

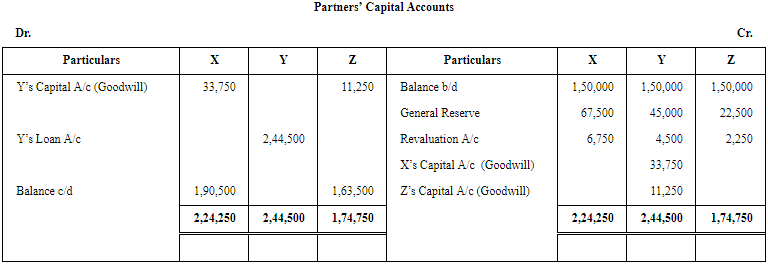

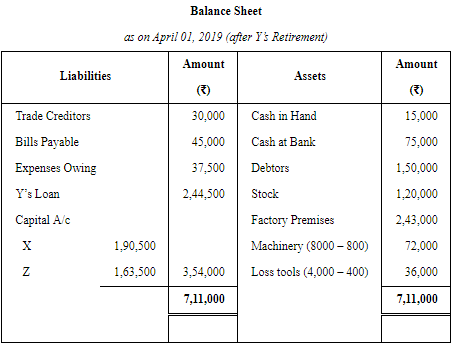

Question 35: X, Y and Z were in partnership sharing profits and losses in the proportions of 3 : 2 : 1. On 1st April, 2019, Y retired from the firm. On that date, their Balance Sheet was:

The terms were:

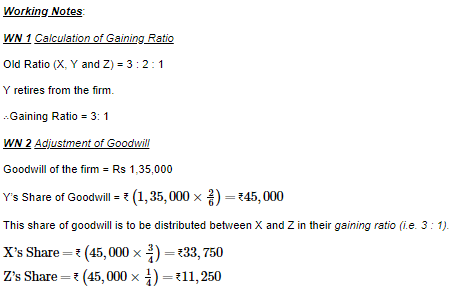

(a) Goodwill of the firm was valued at ₹ 1,35,000 and adjustment in this respect was to be made in the continuing Partners' Capital Accounts without raising Goodwill Account.

(b) Expenses Owing to be brought down to ₹ 37,500.

(c) Machinery and Loose Tools are to be valued @ 10% less than their book value.

(d) Factory Premises are to be revalued at ₹ 2,43,000.

Show Revaluation Account, Partners' Capital Accounts and prepare the Balance Sheet of the firm after the retirement of Y.

ANSWER:

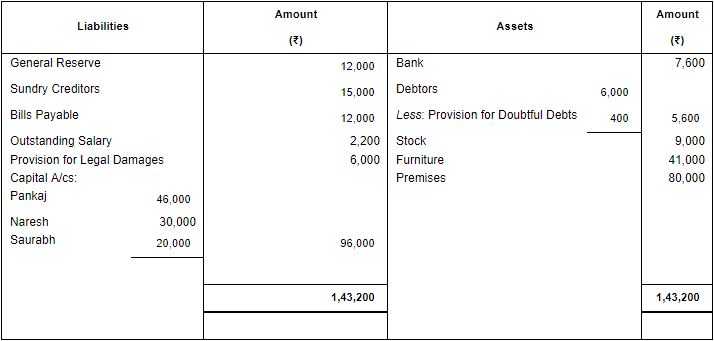

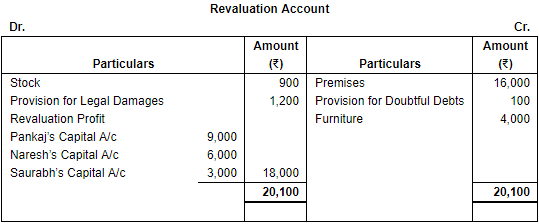

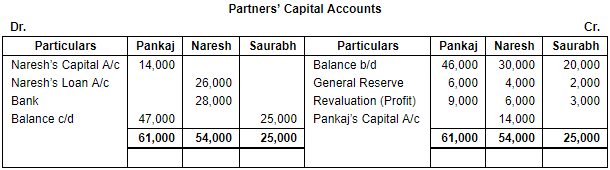

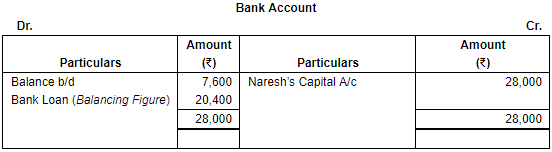

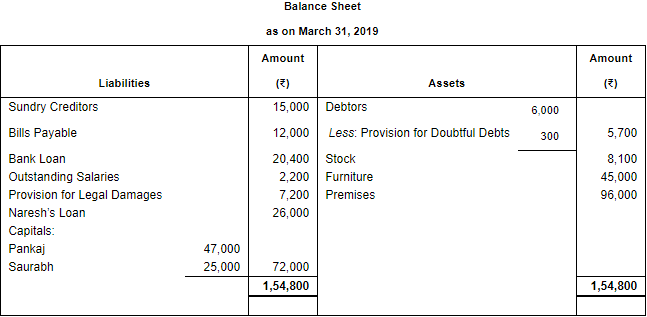

Question 36: Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2019, Naresh retired on that date, Balance Sheet of the firm was as follows:

Additional Information:

(a) Premises have appreciated by 20%, stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors. Further, provision for legal damages is to be made for ₹ 1,200 and furniture to be brought up to ₹ 45,000.

(b) Goodwill of the firm be valued at ₹ 42,000.

(c) ₹ 26,000 from Naresh's Capital Account be transferred to his Loan Account and balance be paid through bank: if required, necessary loan may be obtained from bank.

(d) New profit-sharing ratio of Pankaj and Saurabh is decided to be 5 : 1.

Give the necessary Ledger Accounts and Balance Sheet of the firm after Naresh's retirement.

ANSWER:

Page No 6.85:

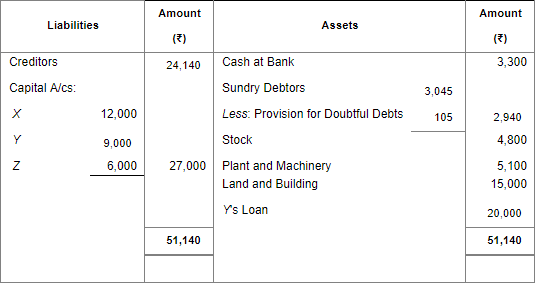

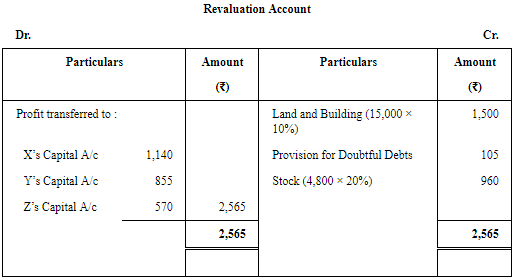

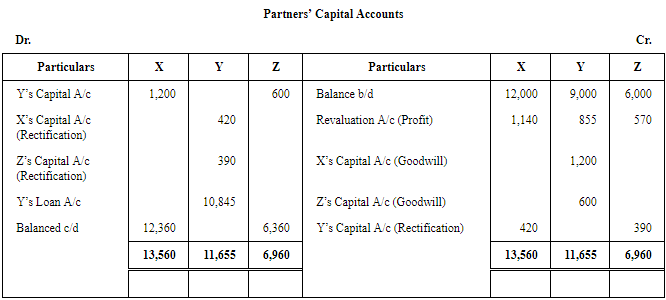

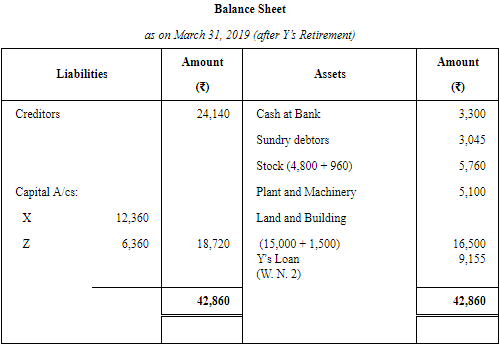

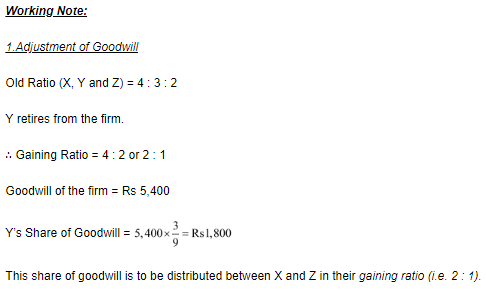

Question 37: X, Y and Z are partners sharing profits in the ratio of 4 : 3 : 2. Their Balance Sheet as at 31st March, 2019 stood as follows:

Y retired on 1st April, 2019 after giving due notice. Following adjustments in the books of the firm were agreed:

(a) Land and Building be appreciated by 10%.

(b) Provision for Doubtful Debts is no longer necessary since all the debtors are good.

(c) Stock be appreciated by 20%.

(d) Adjustment be made in the accounts to rectify a mistake previously committed whereby Y was credited in excess by ₹ 810, while X and Z were debited in excess of ₹ 420 and ₹ 390 respectively.

(e) Goodwill of the firm be valued at ₹ 5,400 and Y's share of the same be adjusted to that of X and Z who were going to share in the ratio of 2 : 1.

(f) It was decide by X and Y to settle Y's account immediately on his retirement.

Prepare: (i) Revaluation Account; (ii) Partner's Capital Accounts and (iii) Balance Sheet of the firm after Y's retirement.

ANSWER:

Page No 6.86:

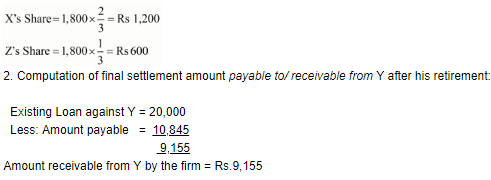

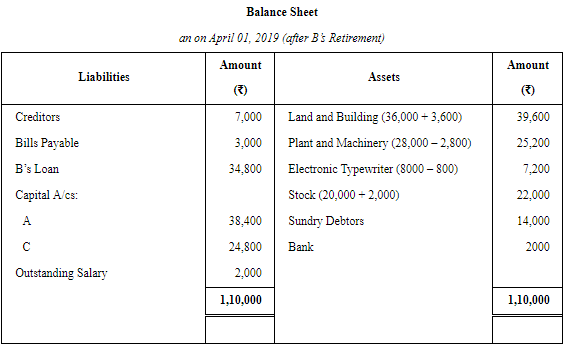

Question 38: A, B and C are partners sharing profits and losses in the ratio of 4 : 3 : 3. Their Balance Sheet as at 31st March, 2019 is:

On 1st April, 2019, B retired from the firm on the following terms:

On 1st April, 2019, B retired from the firm on the following terms:

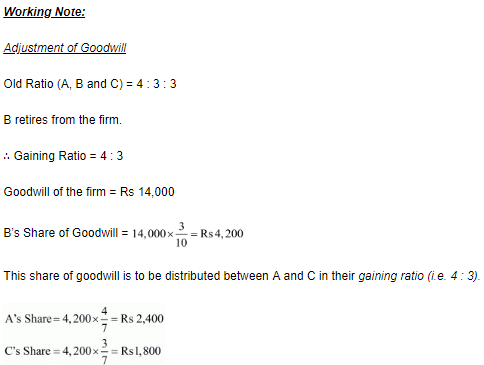

(a) Goodwill of the firm is to be valued at ₹ 14,000.

(b) Stock, Land and Building are to be appreciated by 10%.

(c) Plant and Machinery and Computer Printer are to be reduced by 10%.

(d) Sundry Debtors are considered to be good.

(e) There is a liability of ₹ 2,000 for the payment of outstanding salary to the employees of the firm. This liability was not provided in the Balance Sheet but the same is to be recorded now.

(f) Amount payable to B is to be transferred to his Loan Account.

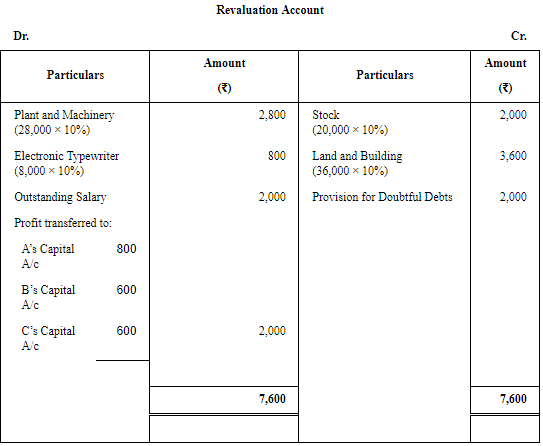

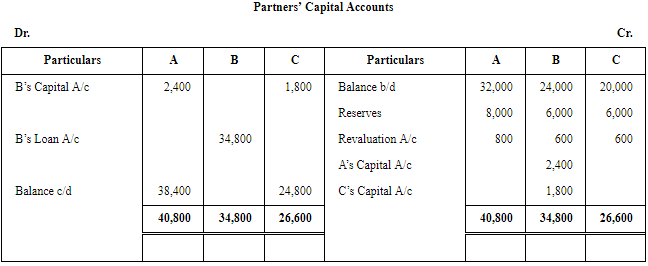

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of A and C after B's retirement.

ANSWER:

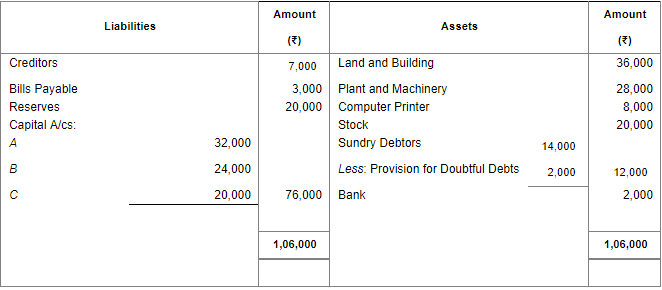

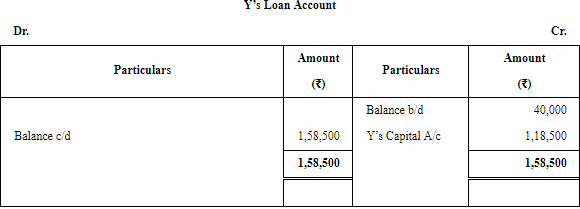

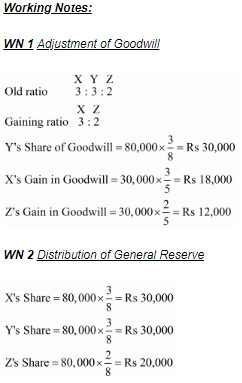

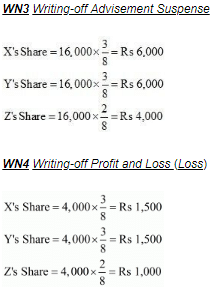

Question 39: Following is the Balance Sheet of X, Y and Z as at 31st March, 2019. They shared profits in the ratio of 3 : 3 : 2:

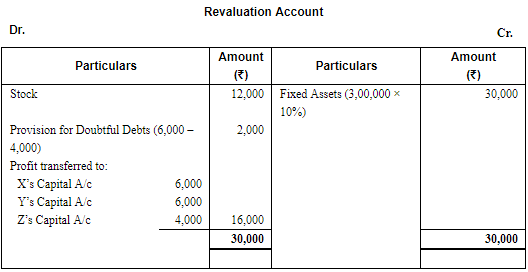

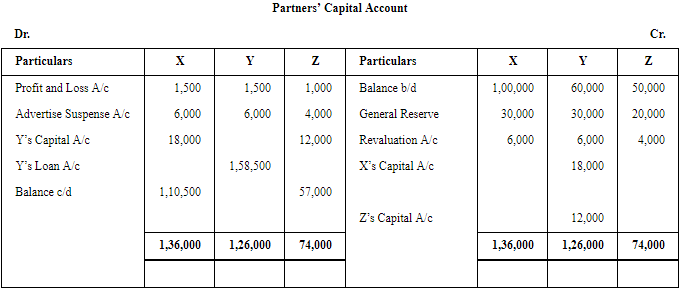

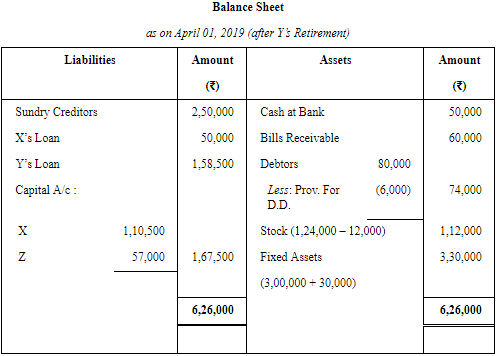

On 1st April, 2019, Y decided to retire from the firm on the following terms:

(a) Stock to be reduced by ₹ 12,000.

(b) Advertisement Suspense Account to be written off.

(c) Provision for Doubtful Debts to be increased to ₹ 6,000.

(d) Fixed Assets be appreciated by 10%.

(e) Goodwill of the firm, valued at ₹ 80,000 and the amount due to the retiring partners be adjusted in X's and Z's Capital Accounts.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet to give effect to the above.

ANSWER:

Page No 6.87:

Question 40: X, Y and Z are partners sharing profits and losses in the ratio of 3 : 2 : 1. Balance Sheet of the firm as at 31st March, 2019 was as follows:

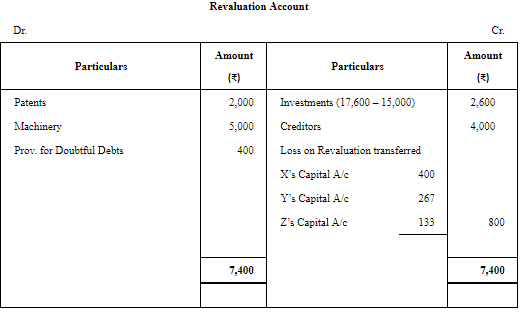

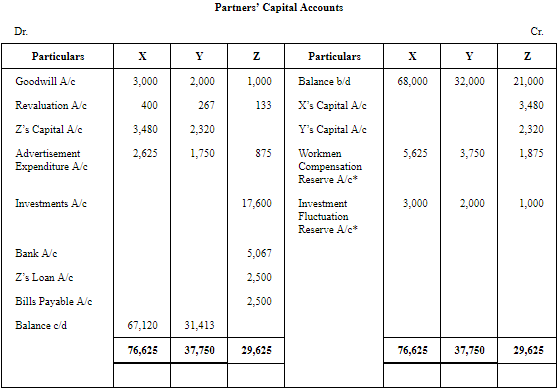

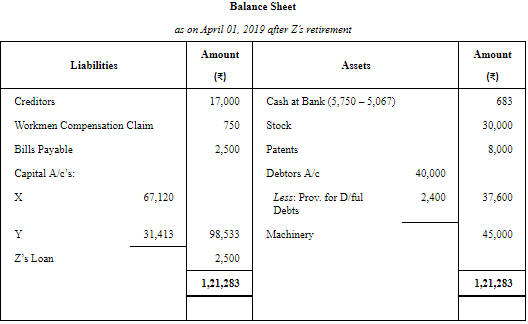

Z retired on 1st April, 2019 on the following terms:

(a) Goodwill of the firm is to be valued at ₹ 34,800.

(b) Value of Patents is to be reduced by 20% and that of machinery to 90%.

(c) Provision for doubtful debts is to be created @ 6% on debtors.

(d) Z took over the investment at market value.

(e) Liability for Workmen Compensation to the extent of ₹ 750 is to be created.

(f) A liability of ₹ 4,000 included in creditors is not to be paid.

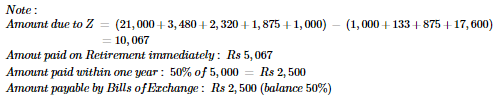

(g) Amount due to Z to be paid as follows: ₹ 5,067 immediately, 50% of the balance within one year and the balance by a draft for 3 Months.

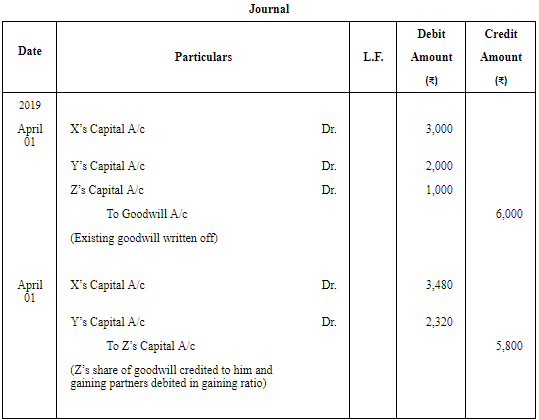

Give necessary Journal entries for the treatment of goodwill, prepare Revaluation Account, Capital Accounts and the Balance Sheet of the new firm.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Retirement/Death of a Partner (Part - 2) - Accountancy Class 12 - Commerce

| 1. What are the options for retirement planning? |  |

| 2. How much money should I save for retirement? |  |

| 3. What happens to my retirement savings if my partner passes away? |  |

| 4. What is a pension plan and how does it work? |  |

| 5. How can I financially prepare for the death of my partner? |  |