Admission of a Partner (Part - 4) | Accountancy Class 12 - Commerce PDF Download

Page No 5.104:

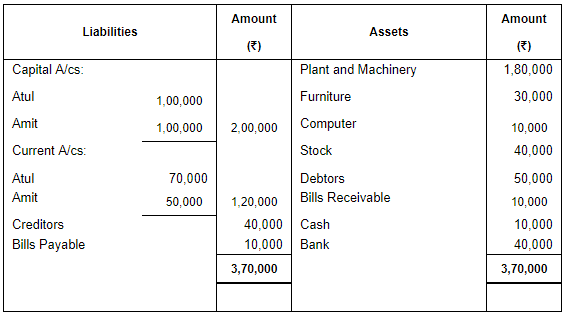

Question 81: Atul and Amit are partners sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2019 is as follows:

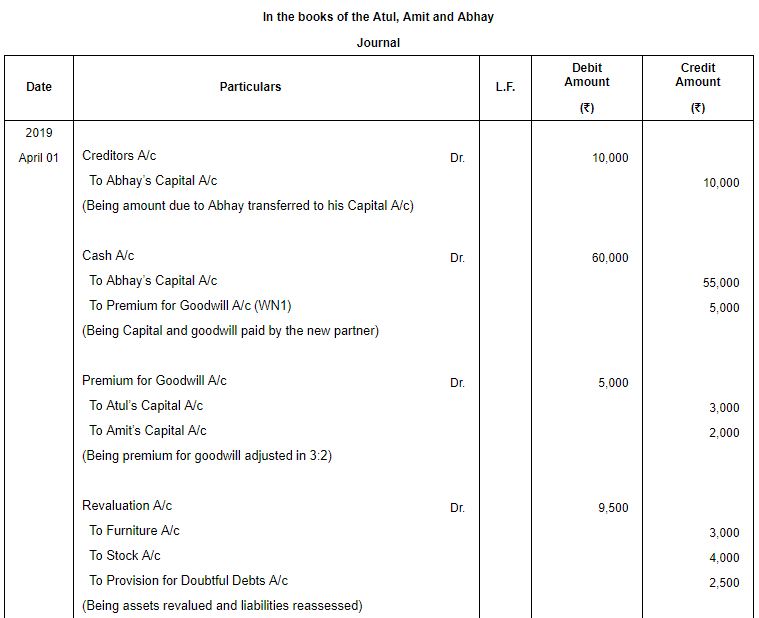

Abhay is admitted as a partner for 1/4th share on 1st April, 2019 on the following terms:

(a) Abhay is to bring ₹ 65,000 as capital after adjusting amount due to him included in creditors and his share of Goodwill.

(b) ₹ 10,000 included in creditors is payable to Abhay which is to be transferred to his Capital Account.

(c) Furniture is to reduced by ₹ 3,000 and Plant and Machinery is to be increased to ₹ 1,98,000.

(d) Stock is overvalued by ₹ 4,000.

(e) A Provision for Doubtful Debts is to be created @ 5%.

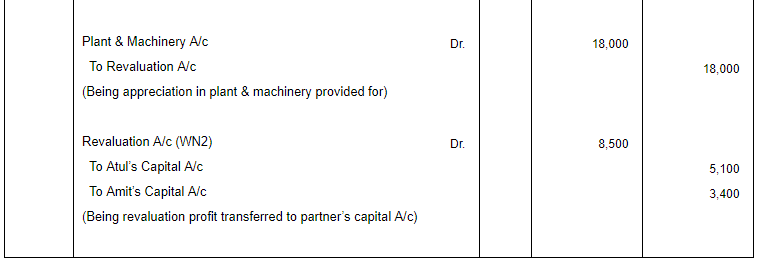

(f) Goodwill is to be valued at 2 years' purchase of average profit for four years. Profits of four years ended 31st March were as follows: 2018-19 − ₹ 25,000, 2017-18 − ₹ 10,000, 2016-17 − ₹ 2,500, and 2015-16 − ₹ 2,500.

Pass the Journal entries for the above arrangement.

ANSWER:

Page No 5.104:

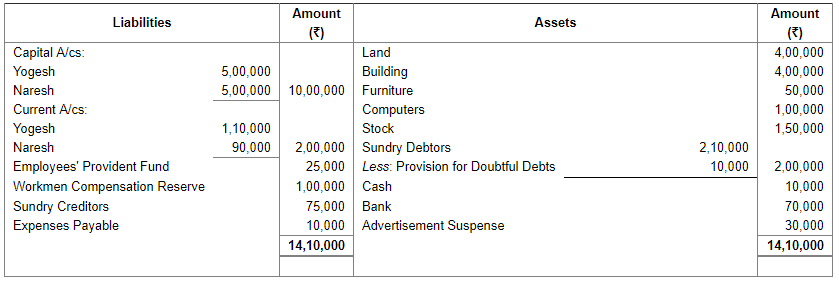

Question 82: Yogesh and Naresh are partners sharing profits in the ratio of 3 : 2. They admit Ramesh for 1/3rd share on 1st April, 2019 and also decide to share future profits equally. Balance Sheet of the firm as at 31st March, 2019 was as follows:

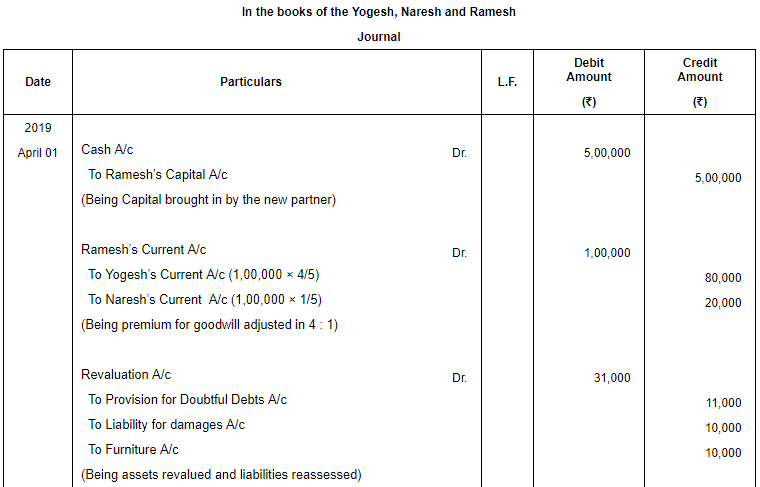

They admitted Ramesh on the following terms:

(a) He will bring ₹ 5,00,000 as his capital.

(b) His share of goodwill is valued at ₹ 1,00,000 but he is unable to bring cash for his share of goodwill. It is agreed to debit the amount to his Current Account.

(c) Value of Land and Building is to be appreciated by ₹ 40,000 each.

(d) Value of Furniture to be reduced to ₹ 40,000.

(e) Provision for Doubtful Debts to be increased to 10%.

(f) A liability for damages of ₹ 10,000 is to be created.

Pass the Journal entries on admission of Ramesh and prepare Revaluation Account.

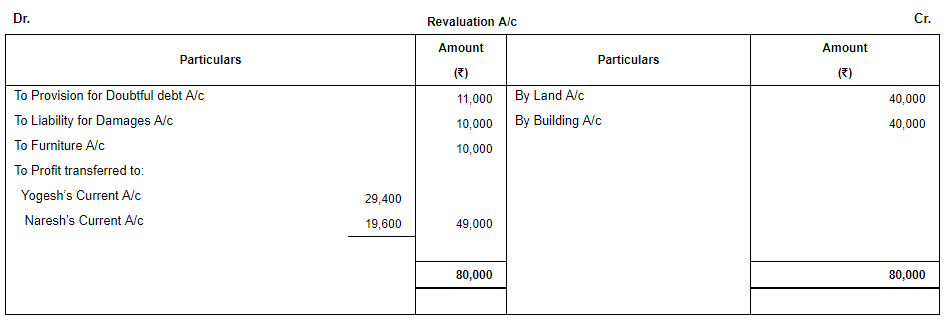

ANSWER:

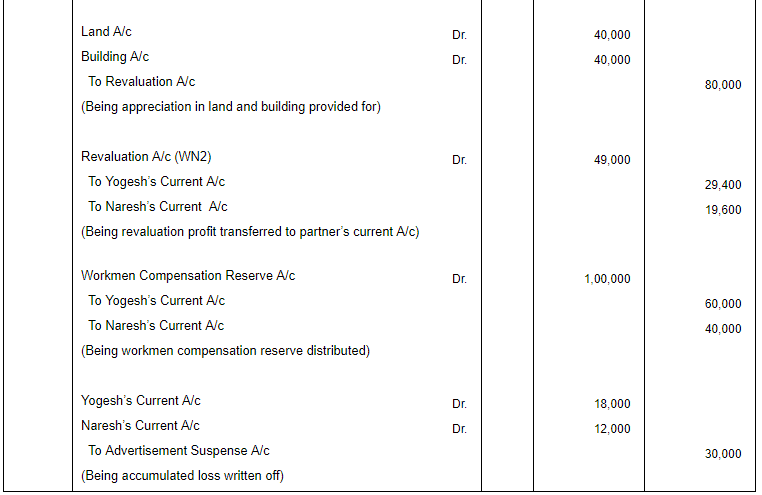

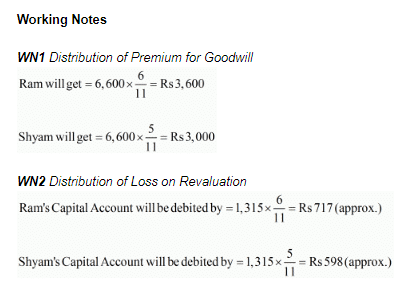

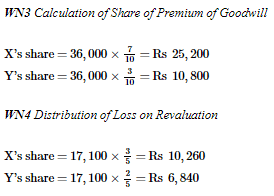

Working Notes:

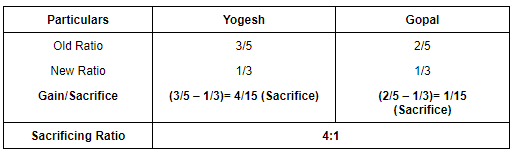

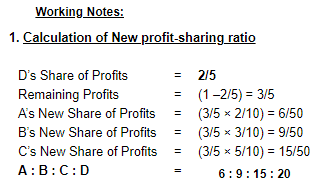

1. Calculation of new profit-sharing ratio:

2. Calculation of Revaluation Profit/Loss:

Debit side total= ₹ (11,000 + 10,000 + 10,000) = ₹ 31,000

Credit side total = ₹ 80,000

Gain on Revaluation= ₹ (80,000 – 31,000) = ₹ 49,000

Page No 5.105:

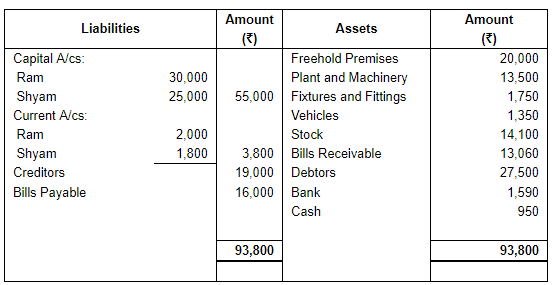

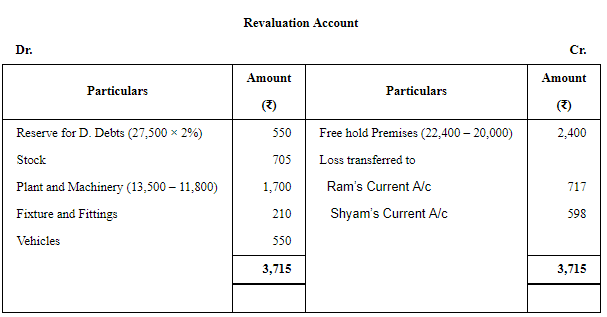

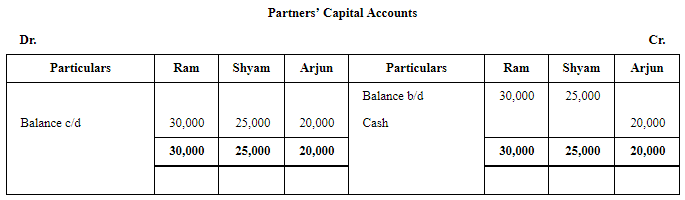

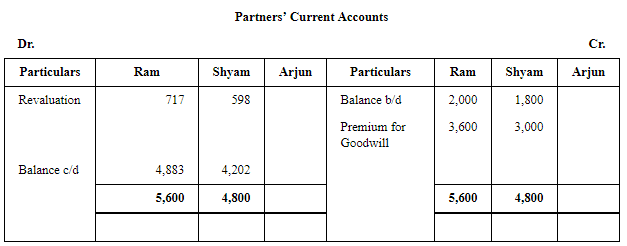

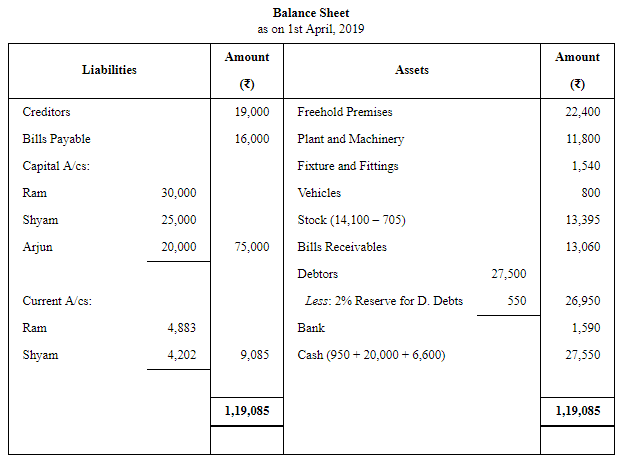

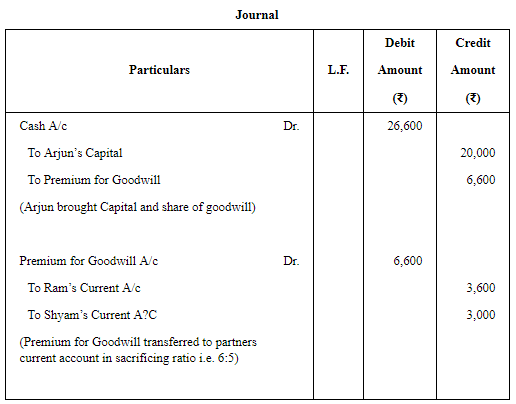

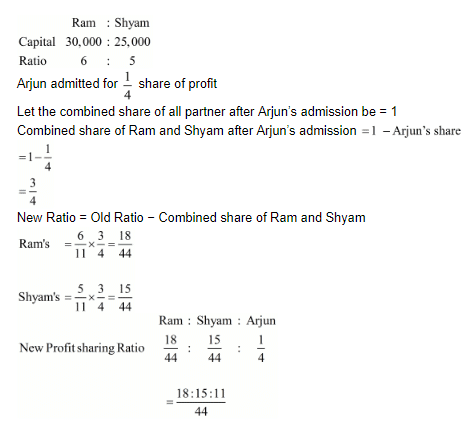

Question 83: Balance Sheet of Ram and Shyam who shares profits in the ratio of their capitals as at 31st March, 2019 is:

On 1st April, 2019, they admitted Arjun into partnership on the following terms:

(a) Arjun to bring ₹ 20,000 as capital and ₹ 6,600 for goodwill, which is to be left in the business and he is to receive 1/4th share of the profits.

(b) Provision for Doubtful Debts is to be 2% on Debtors.

(c) Value of Stock to be written down by 5% .

(d) Freehold Premises are to be taken at a value of ₹ 22,400; Plant and Machinery ₹ 11,800; Fixtures and Fittings ₹ 1,540 and Vehicles ₹ 800.

You are required to make necessary adjustments entries in the firm, give Balance Sheet of the new firm as at 1st April, 2019 and also determine the ratio in which the partners will share profits, there being no change in the ratio of Ram and Shyam.

ANSWER:

Page No 5.105:

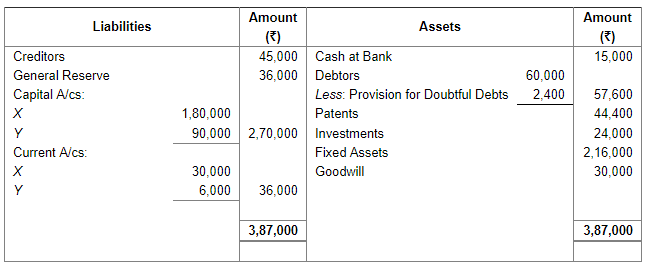

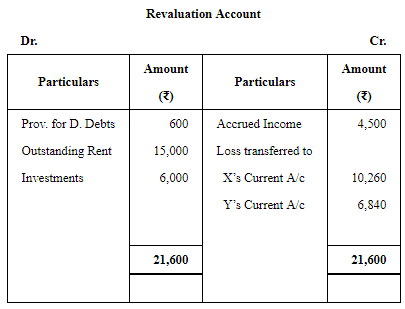

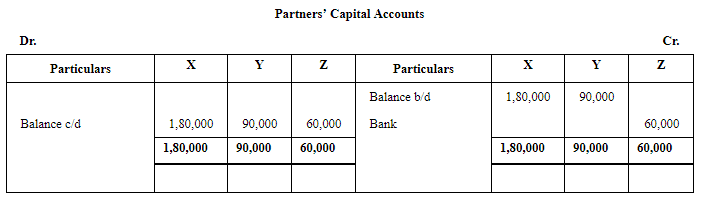

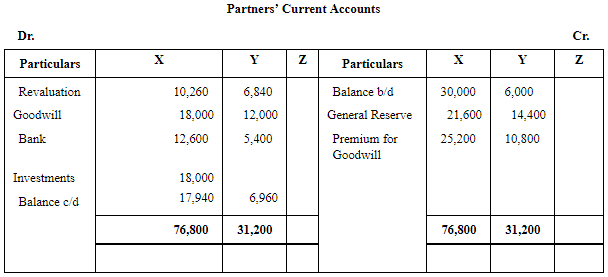

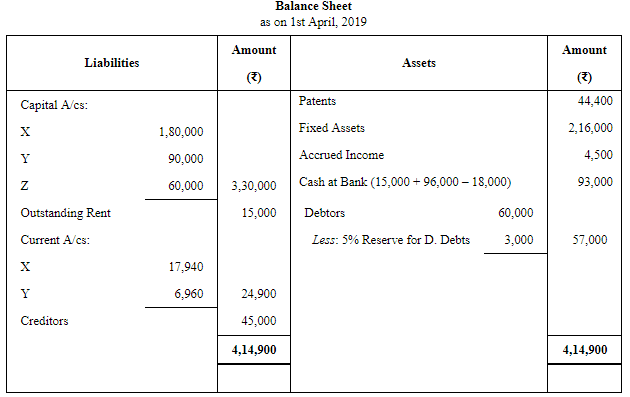

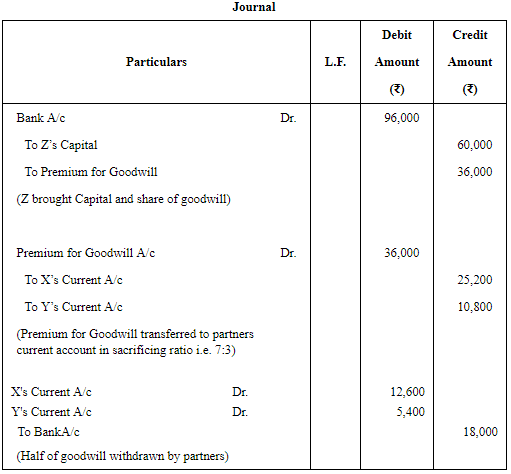

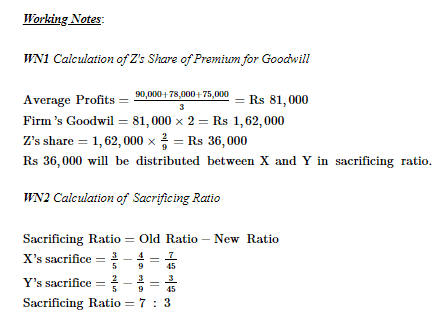

Question 84: Following is the Balance Sheet of X and Y as at 31st March, 2019 who are partners in a firm sharing profits and losses in the ratio of 3 : 2 respectively:

Z is admitted as a new partner on 1st April, 2019 on the following terms:

(a) Provision for doubtful debts is to be maintained at 5% on Debtors.

(b) Outstanding rent amounted to ₹ 15,000.

(c) An accrued income of ₹ 4,500 does not appear in the books of the firm. It is now to be recorded.

(d) X takes over the Investments at an agreed value of ₹ 18,000.

(e) New Profit-sharing Ratio of partners will be 4 : 3 : 2.

(f) Z will bring in ₹ 60,000 as his capital by cheque.

(g) Z is to pay an amount equal to his share in firm's goodwill valued at twice the average profit of the last three years which were ₹ 90,000; ₹ 78,000 and ₹ 75,000 respectively.

(h) Half of the amount of goodwill is to be withdrawn by X and Y.

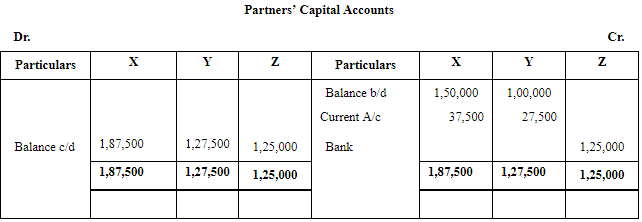

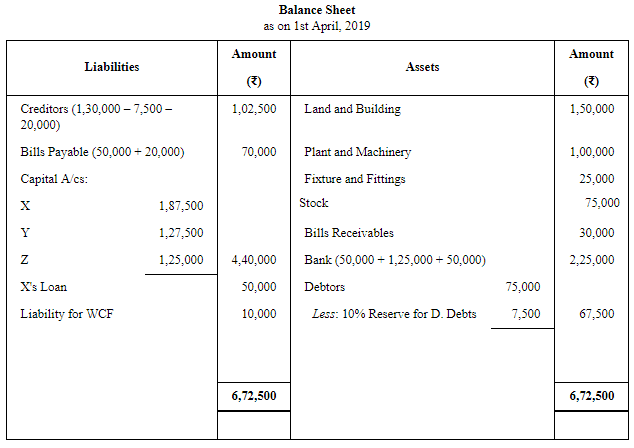

You are required to pass Journal entries, prepare Revaluation Account, Partners' Capital and Current Accounts and the Balance Sheet of the new firm.

ANSWER:

Page No 5.106:

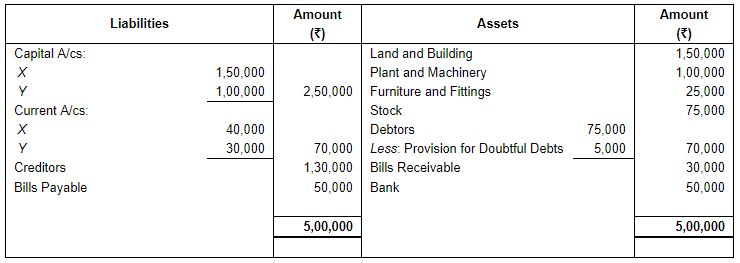

Question 85: X and Y are partners sharing profits equally. Their Balance Sheet as on 31st March, 2019 is given below:

Z is admitted as a new partner for 1/4th share under the following terms:

(a) Z is to introduce ₹ 1,25,000 as capital.

(b) Goodwill of the firm was valued at nil.

(c) It is found that the creditors included a sum of ₹ 7,500 which was not to be paid. But it was also found that there was a liability for Compensation to Workmen amounting to ₹ 10,000.

(d) Provision for doubtful debts is to be created @ 10% on debtors.

(e) In regard to the Partners' Capital Accounts, present Fixed Capital Account Method is to be converted into Fluctuating Capital Account Method.

(f) Bills of ₹ 20,000 accepted from creditors were not recorded in the books.

(g) X provides ₹ 50,000 loan to the business carrying interest @ 10% p.a.

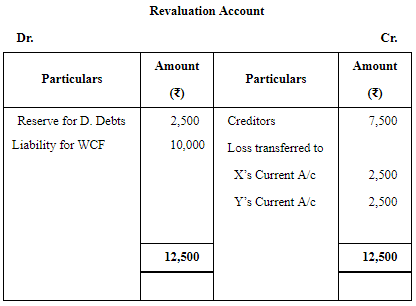

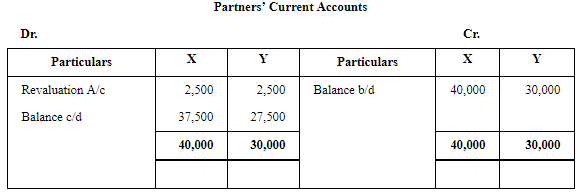

You are required to prepare Revaluation Account, Partners' Capital Accounts, Bank Account and the Balance Sheet of the new firm.

ANSWER:

Page No 5.106:

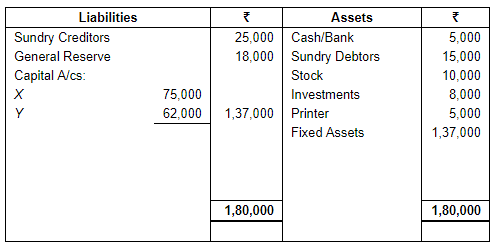

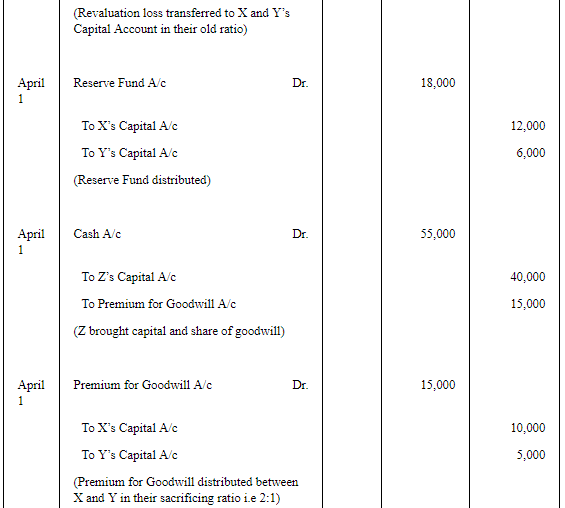

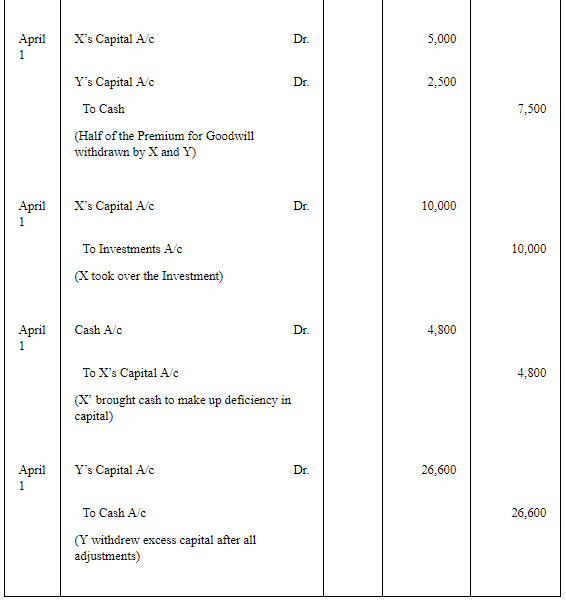

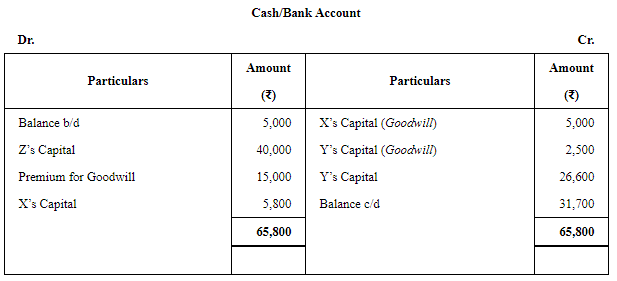

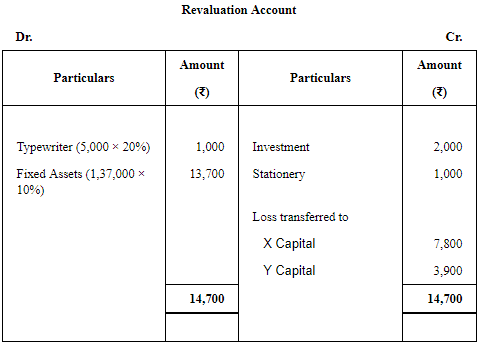

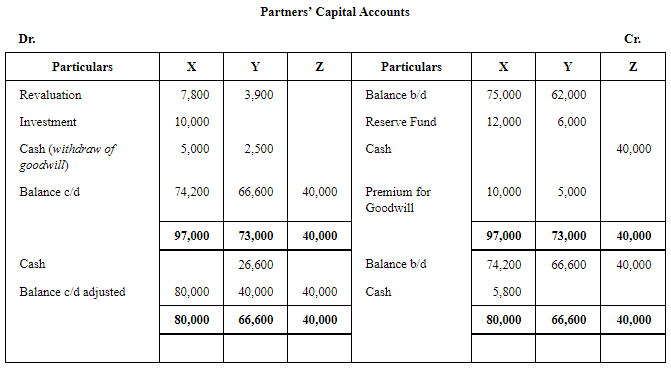

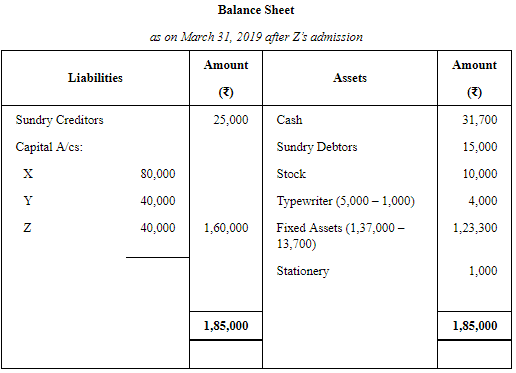

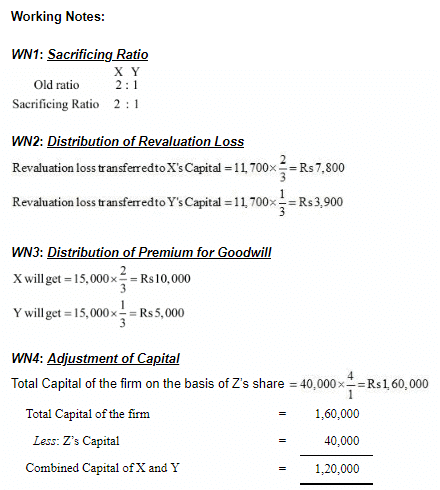

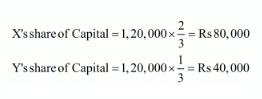

Question 86: X and Y are partners sharing profits in the ratio of 2 : 1. Their Balance Sheet as at 31st March, 2019 was:

They admit Z into partnership on the same date on the following terms:

(a) Z brings in ₹ 40,000 as his capital and he is given 1/4th share in profits.

(b) Z brings in ₹ 15,000 for goodwill, half of which is withdrawn by old partners.

(c) Investments are valued at ₹ 10,000. X takes over Investments at this value.

(d) Printer is to be reduced (depreciated) by 20% and Fixed Assets by 10%.

(e) An unrecorded stock of Stationery on 31st March, 2019 is ₹ 1,000.

(f) By bringing in or withdrawing cash, the Capitals of X and Y are to be made proportionate to that of Z on their profit-sharing basis.

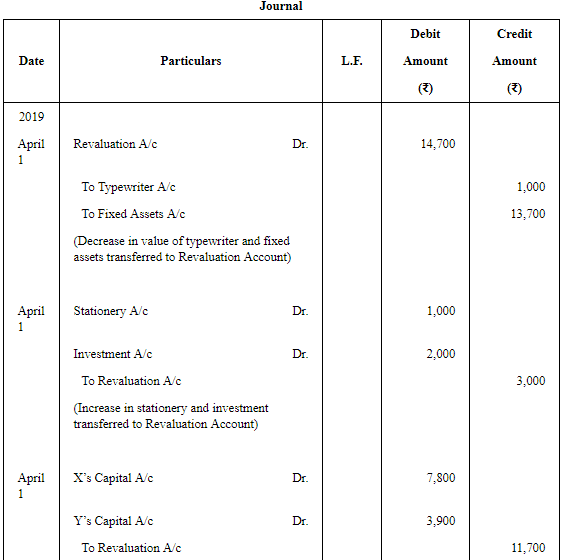

Pass Journal entries, prepare Revaluation Account, Capital Accounts and new Balance Sheet of the firm.

ANSWER:

Page No 5.106:

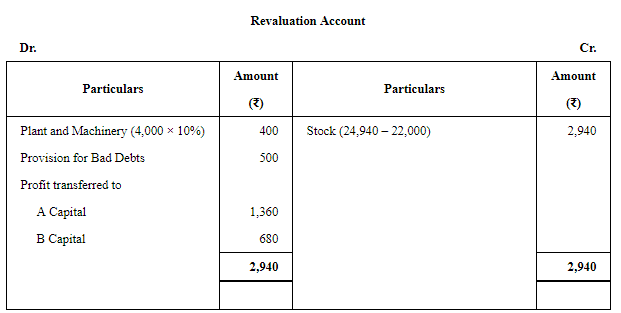

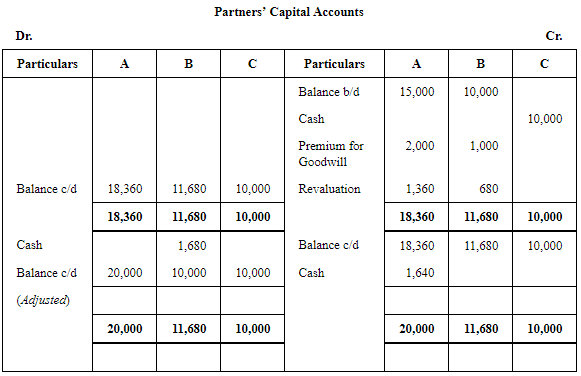

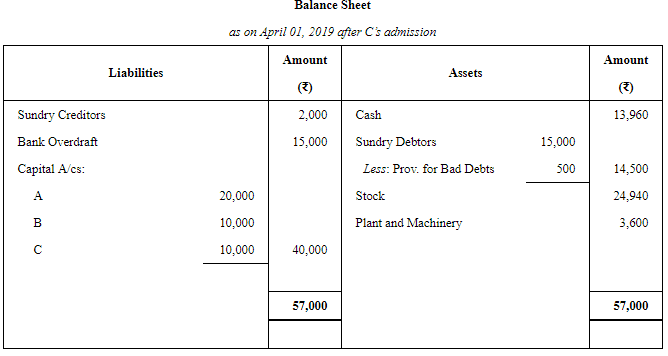

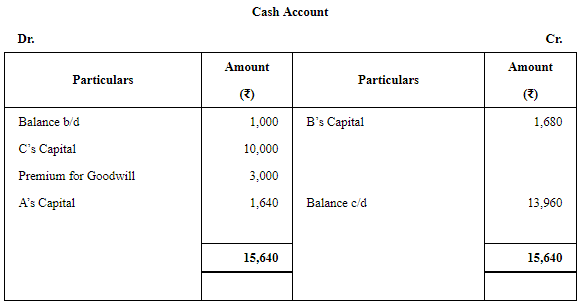

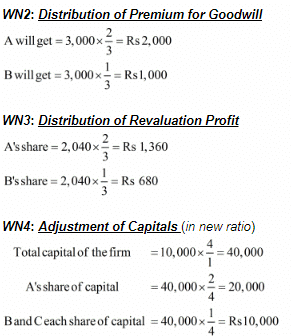

Question 87: A and B are in partnership sharing profits and losses in the proportion of 2/3rd and 1/3rd respectively. Their Balance Sheet as at 31st March, 2019 was: Cash ₹ 1,000; Sundry Debtors ₹ 15,000; Stock ₹ 22,000; Plant and Machinery ₹ 4,000; Sundry Creditors ₹ 2,000; Bank Overdraft ₹ 15,000; A's Capital ₹ 15,000; B's Capital ₹ 10,000.

On 1st April, 2019 they admitted C into partnership on the following terms:

(a) C to purchase one-quarter of the goodwill for ₹ 3,000 and provide ₹ 10,000 as capital. C brings in necessary cash for goodwill and capital.

(b) Profits and losses are to be shared in the proportion of one-half to A, one-quarter to B and one quarter to C.

(c) Plant and Machinery is to be reduced by 10% and ₹ 500 are to be provided for estimated Bad Debts. Stock is to be taken at a valuation of ₹ 24,940.

(d) By bringing in or withdrawing cash the capitals of A and B are to be made proportionate to that of C on their profit-sharing basis.

Prepare necessary Ledger Accounts in the books of the firm relating to the above arrangement and submit the opening Balance Sheet of the new firm.

ANSWER:

Page No 5.107:

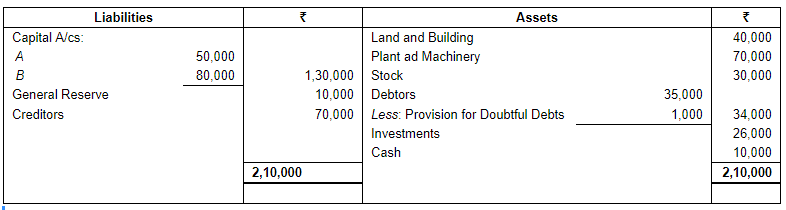

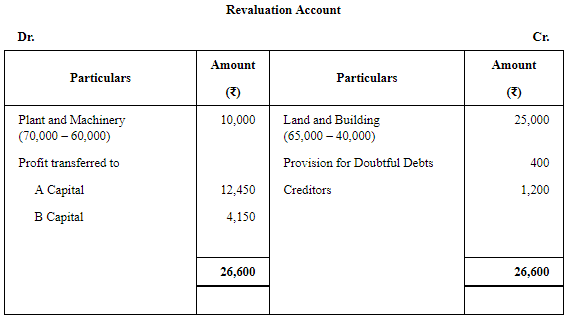

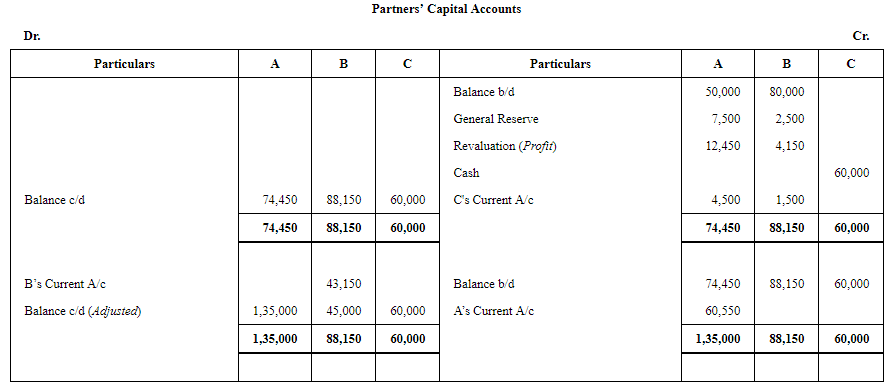

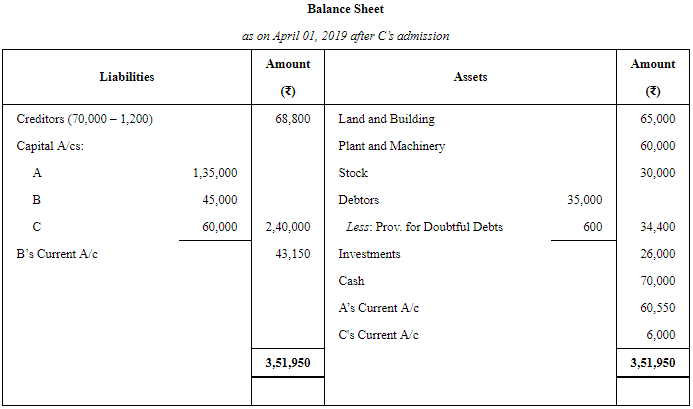

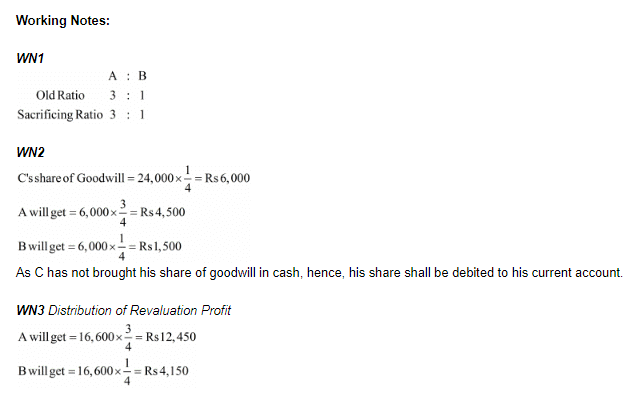

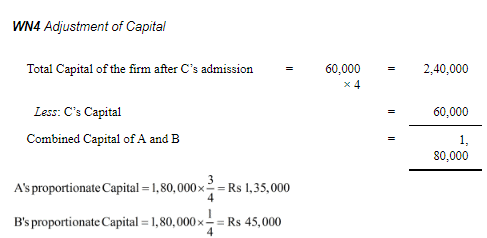

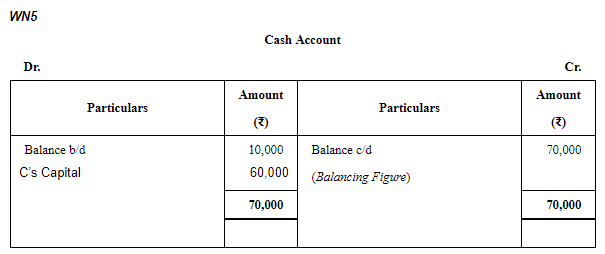

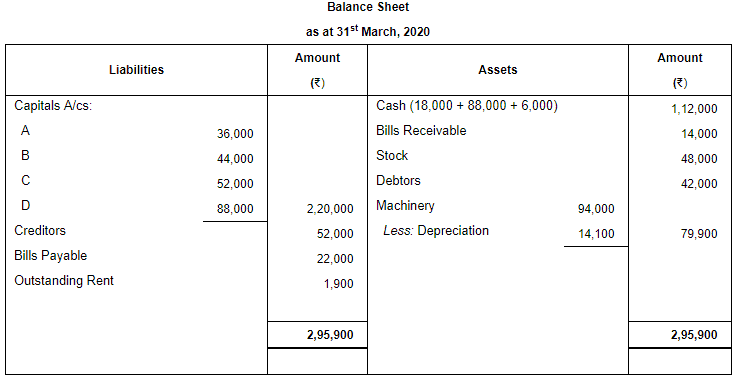

Question 88: A and B were partners in a firm sharing profits in 3 : 1 ratio. They admitted C as a partner for 1/4th share in the future profits. C was to bring ₹ 60,000 for his capital. The Balance Sheet of A and B as at 1st April, 2019, the date on which C was admitted, was:

The other terms agreed upon were:

(a) Goodwill of the firm was valued at ₹ 24,000.

(b) Land and Building were valued at ₹ 65,000 and Plant and Machinery at ₹ 60,000.

(c) Provision for Doubtful Debts was found in excess by ₹ 400.

(d) A liability of ₹ 1,200 included in Sundry Creditors was not likely to arise.

(e) The capitals of the partners be adjusted on the basis of C's contribution of capital to the firm.

(f) Excess of shortfall, if any, be transferred to Current Accounts.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.107:

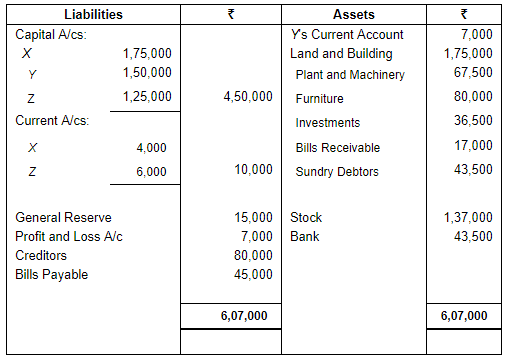

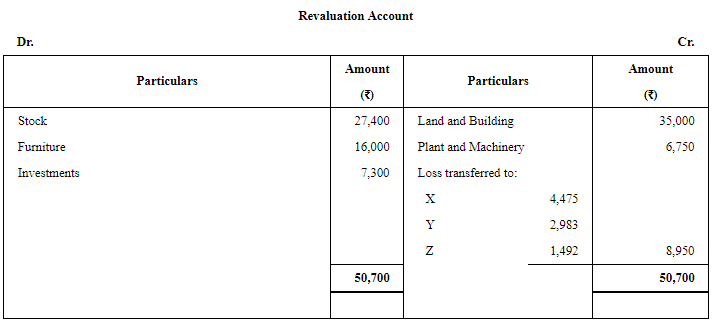

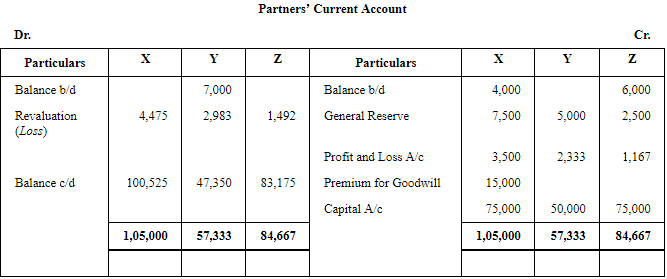

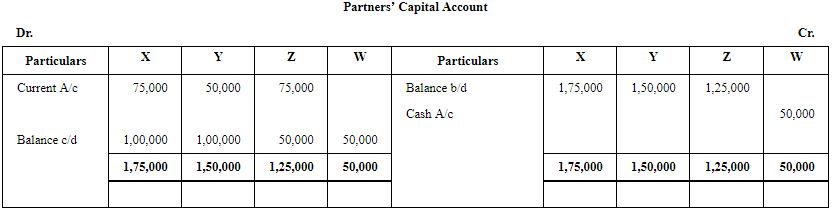

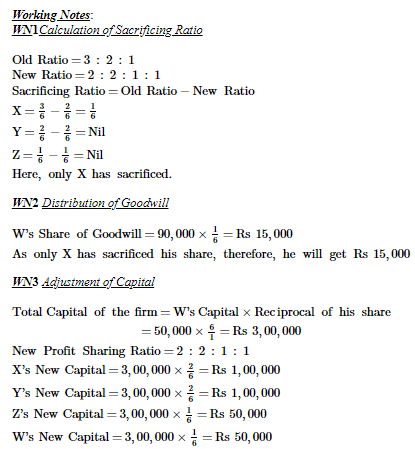

Question 89: The Balance Sheet of X, Y and Z who share profits and losses in the ratio of 3 : 2 : 1, as on 1st April, 2019 is as follows:

On the above date, W is admitted as a partner on the following terms:

(a) W will bring ₹ 50,000 as his capital and get 1/6th share in the profits.

(b) He will bring necessary amount for his share of goodwill premium. Goodwill of the firm is valued at ₹ 90,000.

(c) New profit-sharing ratio will be 2 : 2 : 1 : 1.

(d) A liability of ₹ 7,004 will be created against bills receivable discounted earlier but now dishonoured.

(e) The value of stock, furniture and investments is reduced by 20%, whereas the value of Land and Building and Plant and Machinery will be appreciated by 20% and 10% respectively.

(f) Capital Accounts of the partners will be adjusted on the basis of W's Capital through their Current Accounts.

Prepare Revaluation Account, Partners' Current Accounts and Capital Accounts.

ANSWER:

Page No 5.108:

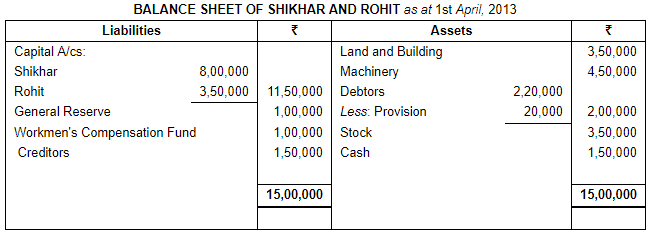

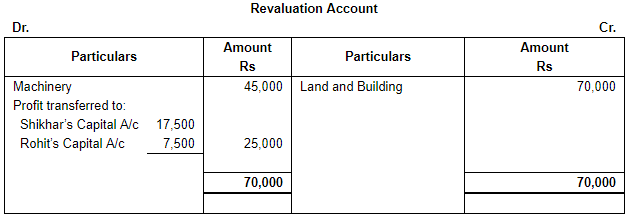

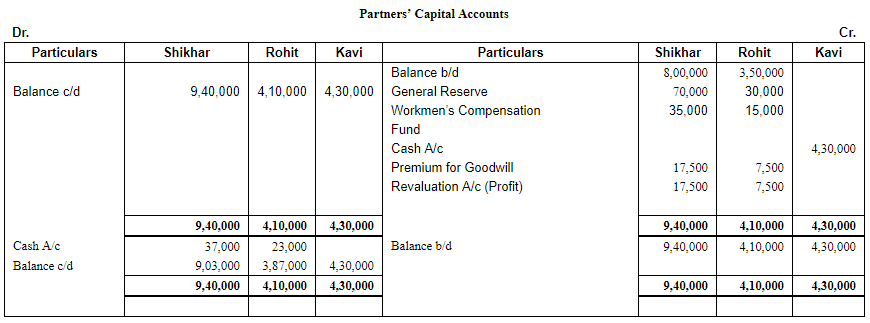

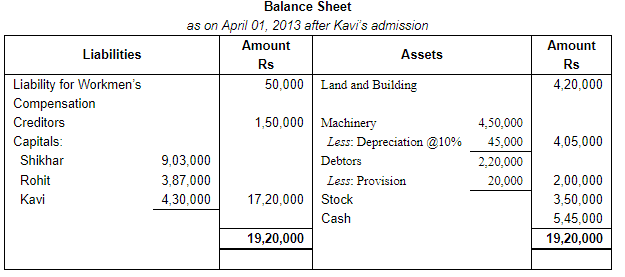

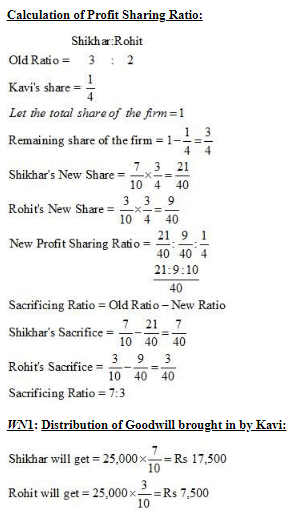

Question 90: Shikhar and Rohit were partners in a firm sharing profits in the ratio of 7 : 3. On 1st April, 2013, they admitted Kavi as a new partner for 1/4th share in profits of the firm. Kavi brought ₹ 4,30,000 as his capital and ₹ 25,000 for his share of goodwill premium. The Balance Sheet of Shikhar and Rohit as on 1st April, 2013 was as follows:

It was agreed that:

(a) the value of Land and Building will be appreciated by 20%.

(b) the value of Machinery will be depreciated by 10%.

(c) the liabilities of Workmen's Compensation Fund were determined at ₹ 50,000.

(d) capitals of Shikhar and Rohit will be adjusted on the basis of Kavi's capital and actual cash to be brought in or to be paid off as the case may be.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.108:

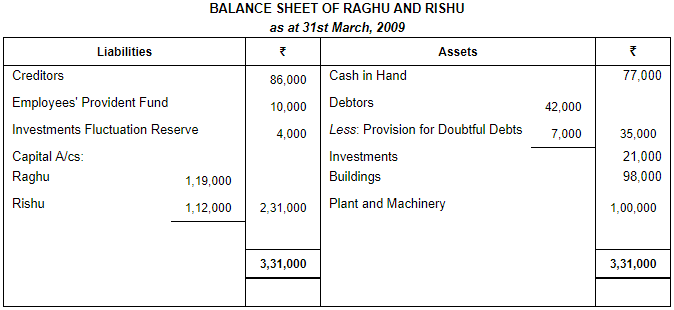

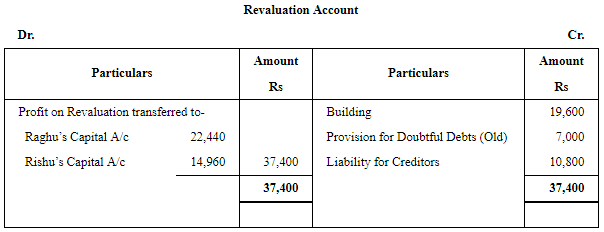

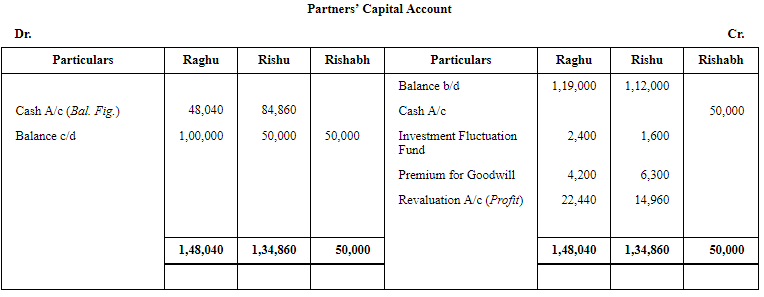

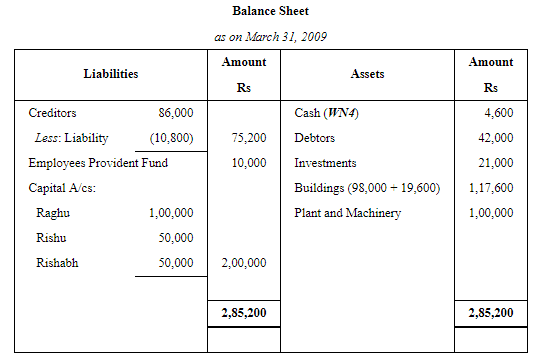

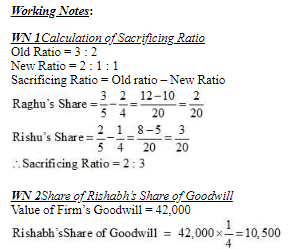

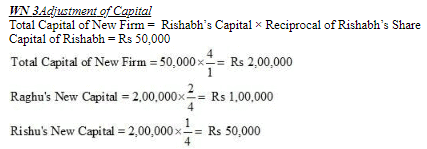

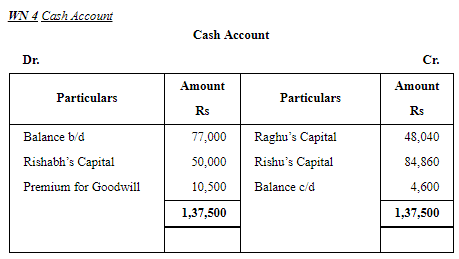

Question 91:Raghu and Rishu are partners sharing profits in the ratio 3 : 2. Their Balance Sheet as at 31st March, 2009 was as follows:

Rishabh was admitted on that date for 1/4th share of profit on the following terms:

(a) Rishabh will bring ₹ 50,000 as his share of capital.

(b) Goodwill of the firm is valued at ₹ 42,000 and Rishabh will bring his share of goodwill in cash.

(c) Buildings were appreciated by 20%.

(d) All Debtors were good.

(e) There was a liability of ₹ 10,800 included in Creditors which was not likely to arise.

(f) New profit-sharing ratio will be 2 : 1 : 1.

(g) Capital of Raghu and Rishu will be adjusted on the basis of Rishabh's share of capital and any excess or deficiency will be made by withdrawing or bringing in cash by the concerned partners as the case may be.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.109:

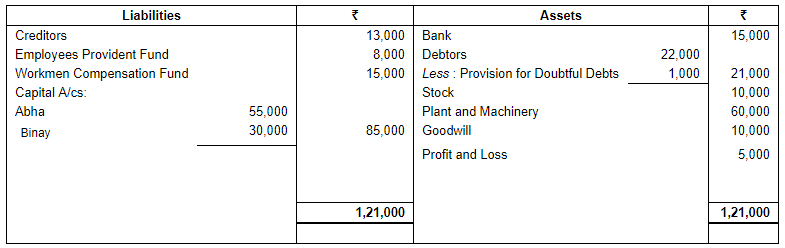

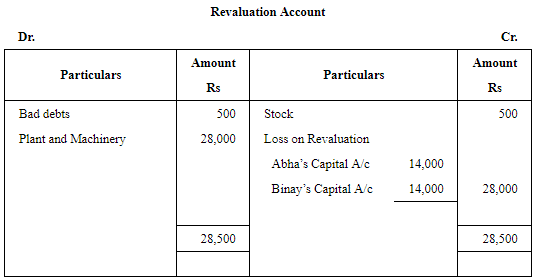

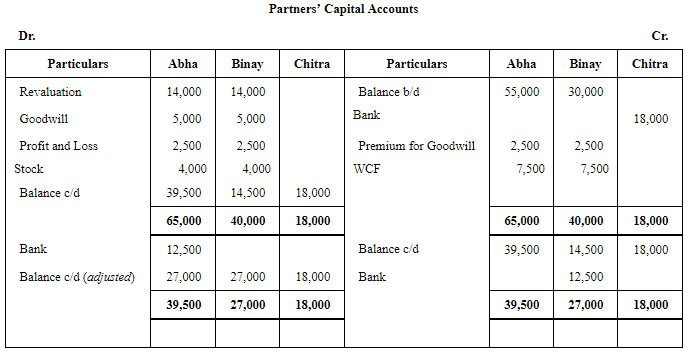

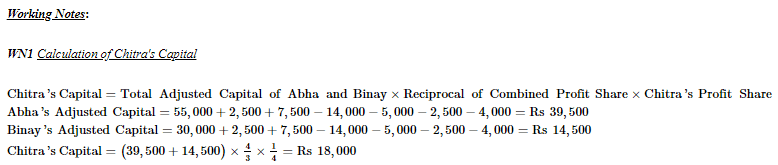

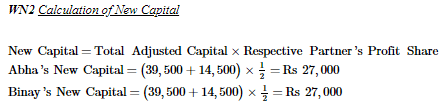

Question 92: Following is the Balance Sheet of Abha and Binay as at 31st March, 2014:

Chitra was admitted as a partner for 1/4th share in the profits of the firm. It was decided that:

(a) Bad Debts amounted to ₹ 1,500 will be written off.

(b) Stock worth ₹ 8,000 was taken over by Abha and Binay at Book Value in their profit-sharing ratio. The remaining stock was valued at ₹ 2,500.

(c) Plant and Machinery and Goodwill were valued at ₹ 32,000 and ₹ 20,000 respectively.

(d) Chitra brought her share of goodwill in cash.

(e) Chitra will bring proportionate capital and the capitals of Abha and Binay will be adjusted in their profit-sharing ratio by bringing in or paying off cash as the case may be.

Prepare Revaluation Account and Partners' Capital Accounts.

ANSWER:

Page No 5.109:

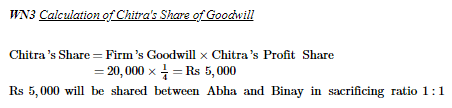

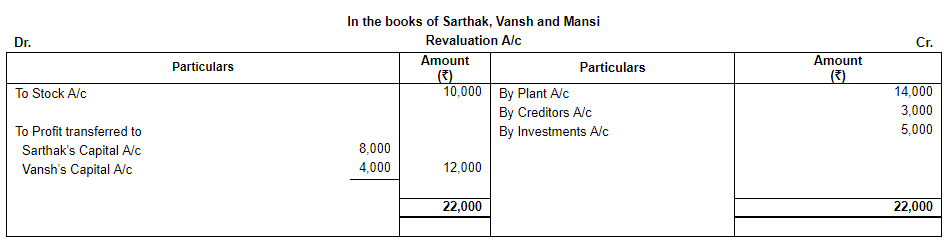

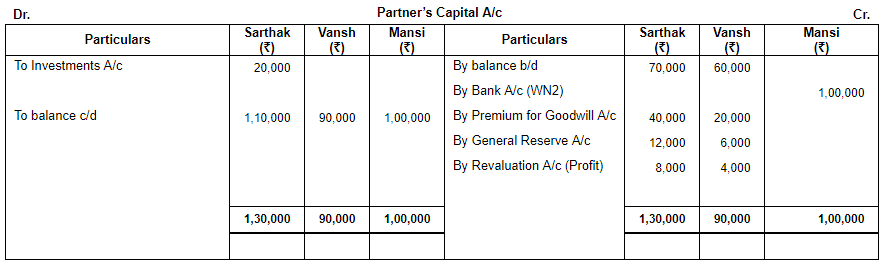

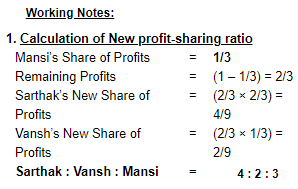

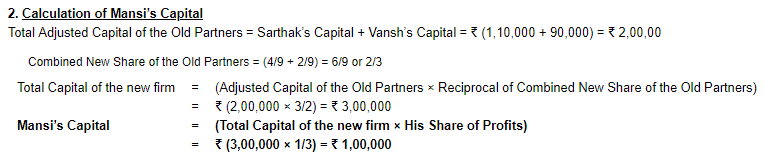

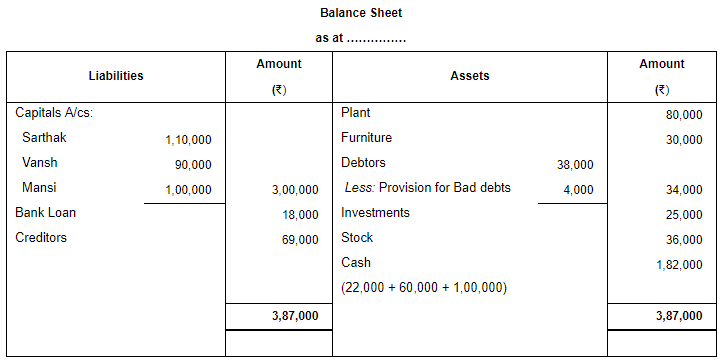

Question 93: Sarthak and Vansh are partners sharing profits in the ratio of 2 : 1. Since both of them are specially abled sometimes they find it difficult to run the business on their own. Mansi, a common friend, decides to help them. Therefore, they admit her into partnership for 1/3rd share in profits. She brings ₹ 60,000 for goodwill and proportionate capital. At the time of admission of Mansi, the Balance Sheet of Sarthak and Vansh was as under:

It was decided to:

(a) Reduce the value of Stock by ₹ 10,000.

(b) Plant is to be valued at ₹ 80,000.

(c) An amount of ₹ 3,000 included in Creditors was not payable.

(d) Half of the investments were taken over by Sarthak and remaining were valued at ₹ 25,000.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of reconstituted firm.

ANSWER:

Page No 5.110:

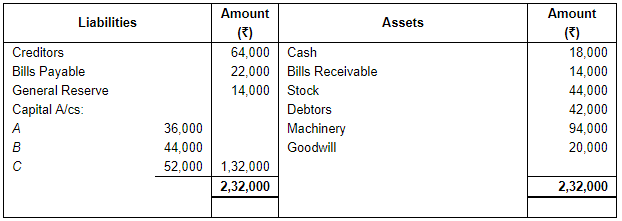

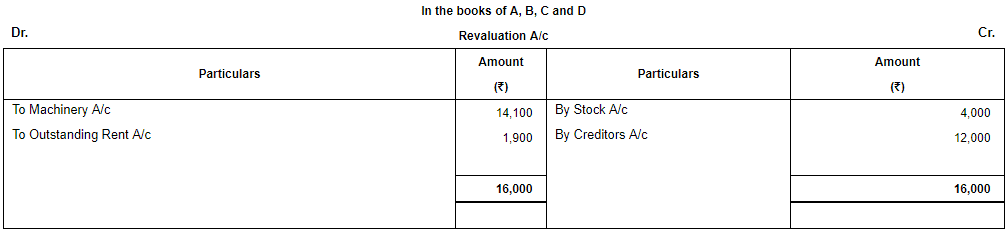

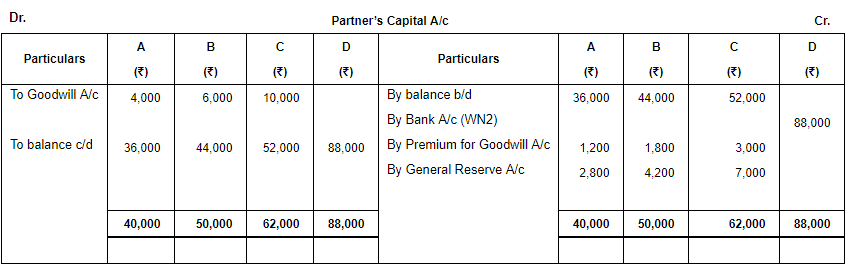

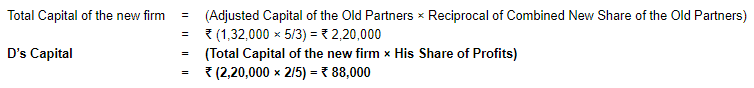

Question 94: A, B and C are partners sharing profits and losses in the ratio of 2 : 3 : 5. On 31st March, 2019, their Balance Sheet was:

They admit D into partnership on the following terms:

(a) Machinery is to be depreciated by 15%.

(b) Stock is to be revalued at ₹ 48,000.

(c) It is found that the Creditors included a sum of ₹ 12,000 which was not to be paid.

(d) Outstanding Rent is ₹ 1,900.

(e) D is to bring in ₹ 6,000 as goodwill and sufficient capital for 2/5th share.

(f) The partners decided to use 10% of the profits every year in providing drinking water in schools, where required.

Prepare Revaluation Account, Partners' Capital Accounts, Cash Account and Balance Sheet of the new firm.

ANSWER:

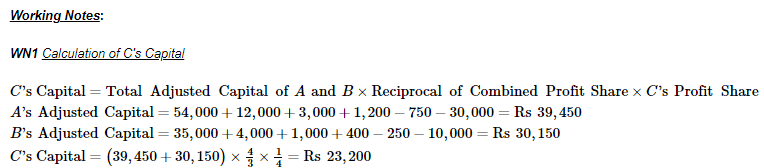

2. Calculation of D’s Capital

Total Adjusted Capital of the Old Partners = A’s Capital + B’s Capital + C’s Capital = ₹ (36,000 + 44,000 + 52,000) = ₹ 1,32,000 Combined New Share of the Old Partners = (6/50 + 9/50 + 15/50) = 30/50 or 3/5

Page No 5.110:

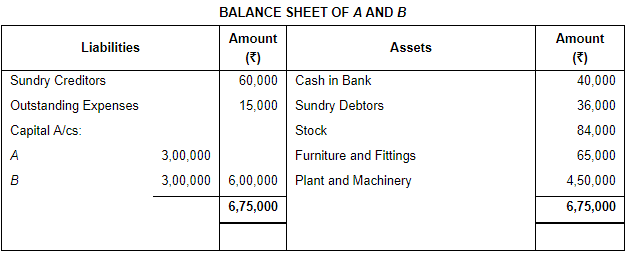

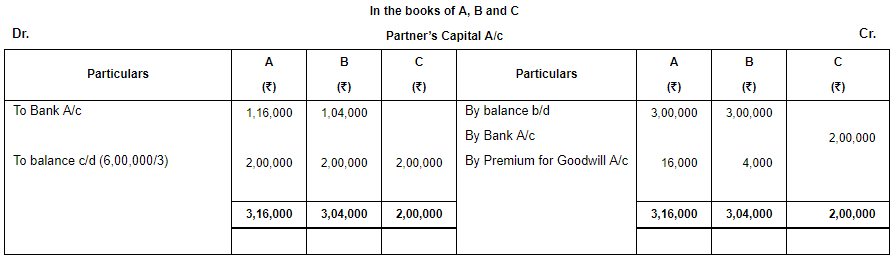

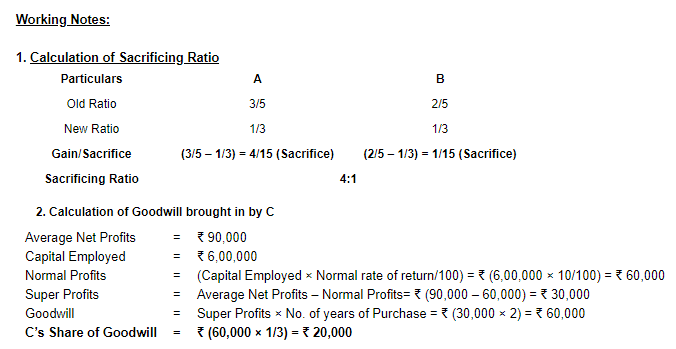

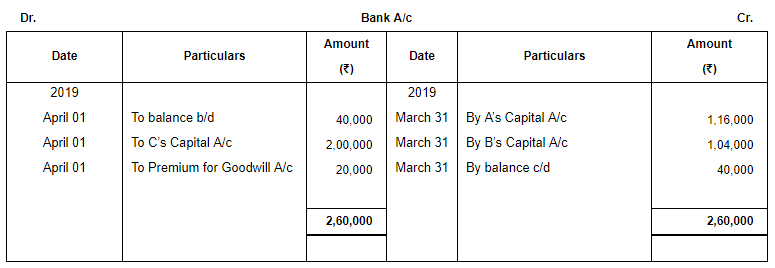

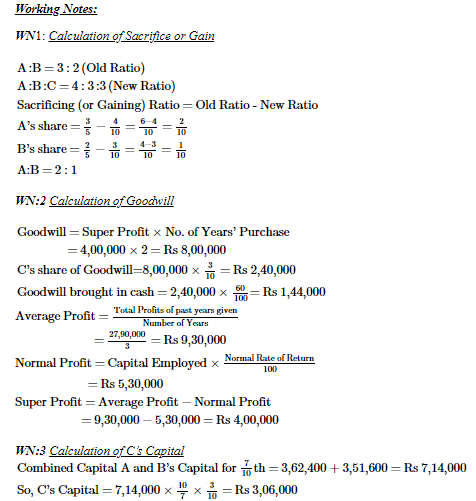

Question 95: A and B are partners in a firm sharing profits in the ratio of 3 : 2. They decide to admit C as a new partner w.e.f. 1st April, 2019. In future, profits will be shared equally. The Balance Sheet of A and B as at 1st April, 2019 and the terms of admission are:

(a) Capital of the firm is fixed at ₹ 6,00,000 to be contributed by partners in the profit-sharing ratio. The difference will be adjusted in cash.

(b) C to bring in his share of capital and goodwill in cash. Goodwill of the firm is to be valued on the basis of two years' purchases of super profit. The average net profits expected in the future by the firm ₹ 90,000 per year. The normal rate of return on capital in similar business is 10%.

(c) The partners agreed to help maintain the plants and keep the area clean.

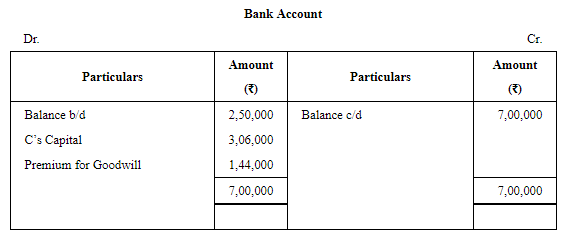

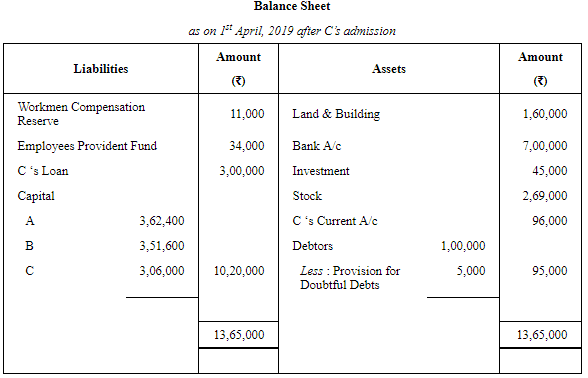

Calculate goodwill and prepare Partners' Capital Accounts and Bank Account.

ANSWER:

Page No 5.111:

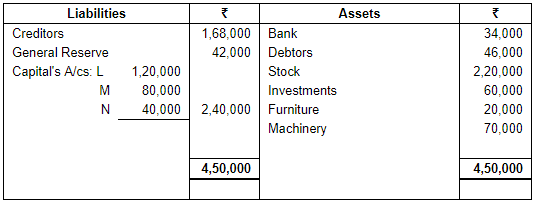

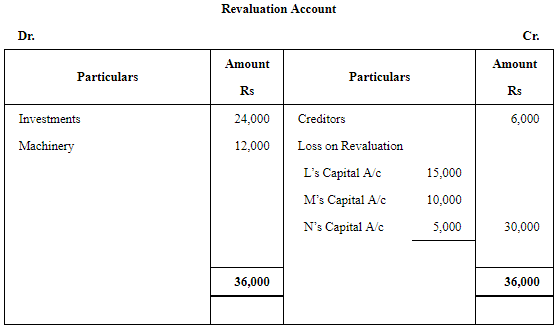

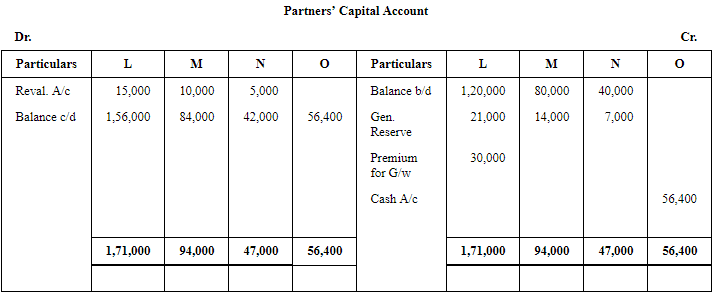

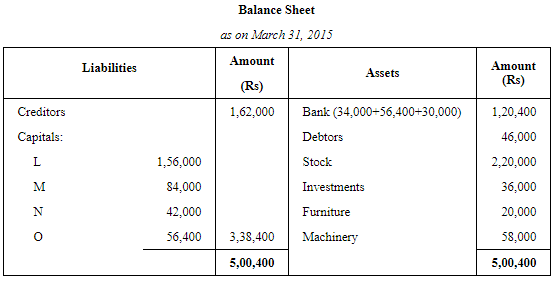

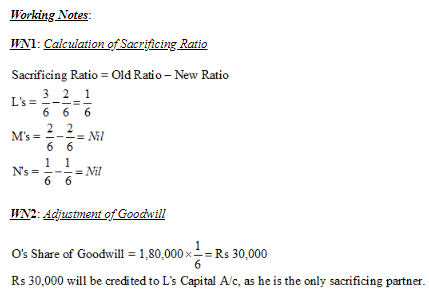

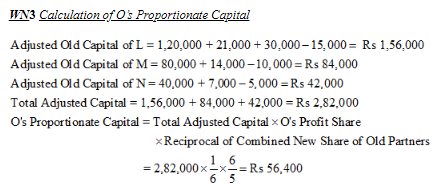

Question 96: L, M and N were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet on 31st March, 2015 was as follows:

On the above date, O was admitted as a new partner and it was decided that:

(i) The new profit-sharing ratio between L, M, N and O will be 2 : 2 : 1 : 1.

(ii) Goodwill of the firm was valued at ₹ 1,80,000 and O brought his share of goodwill premium in cash.

(iii) The market value of investments was ₹ 36,000.

(iv) Machinery will be reduced to ₹ 58,000.

(v) A creditor of ₹ 6,000 was not likely to claim the amount and hence was to be written off.

(vi) O will bring proportionate capital so as to give him 1/6th share in the profits of the firm.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

ANSWER:

Page No 5.111:

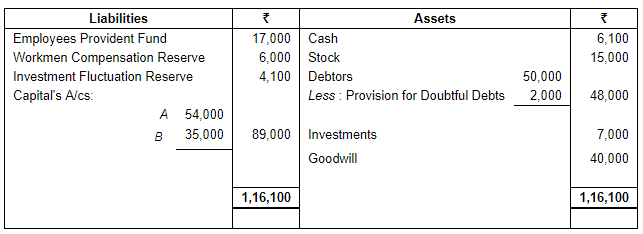

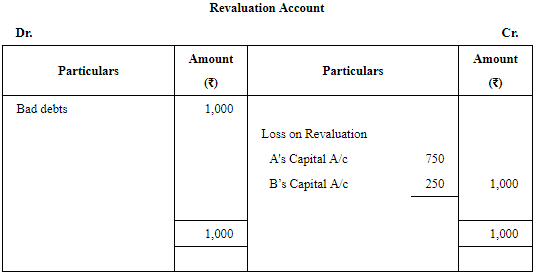

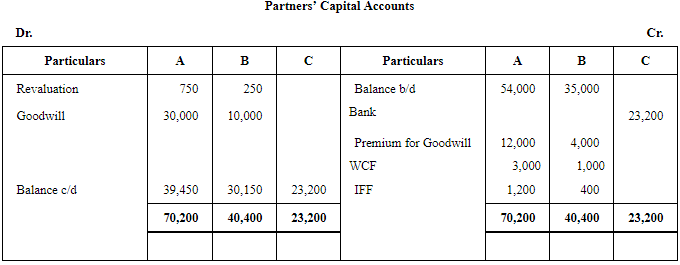

Question 97: A and B are partners in a firm sharing profits and losses in the ratio 3 : 1. They admit C for 1/4th share on 31st March, 2014 when their Balance Sheet was as follows:

The following adjustments were agreed upon:

(a) C brings in ₹ 16,000 as goodwill and proportionate capital.

(b) Bad debts amounted to ₹ 3,000.

(c) Market value of investment is ₹ 4,500.

(d) Liability on account of Workmen Compensation Reserve amounted to ₹ 2,000.

Prepare Revaluation Account and Partners' Capital Accounts.

ANSWER:

Notes:

1. Premium for Goodwill Rs 16,000 will be distributed between A and B in sacrificing ratio i.e. 3 : 1.

2. Excess WCF of Rs 4,000 will be shared in old ratio among old partners.

3. Excess IFF of Rs 1,600 will be shared in old ratio among old partners.

Page No 5.112:

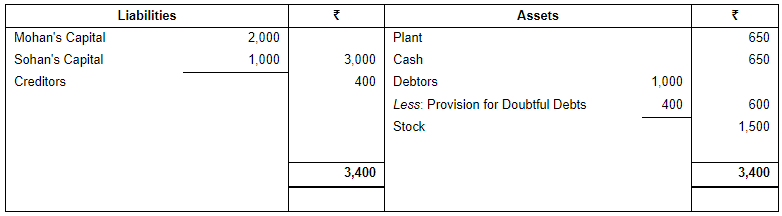

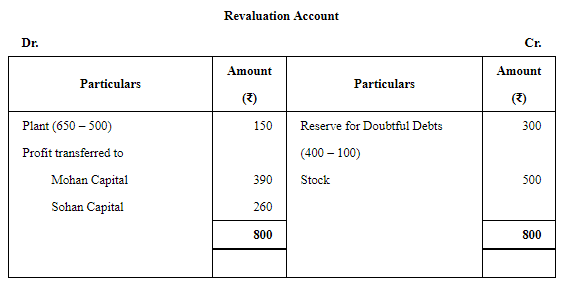

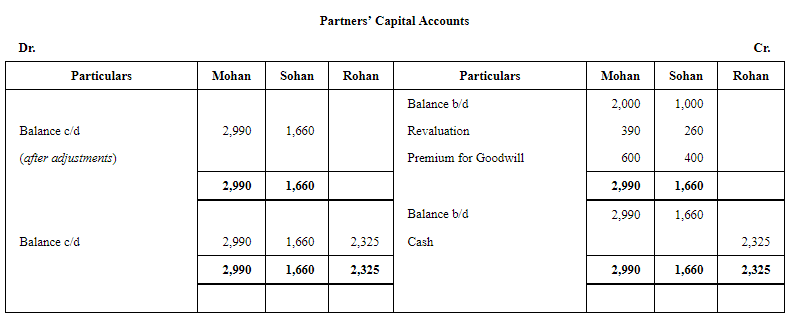

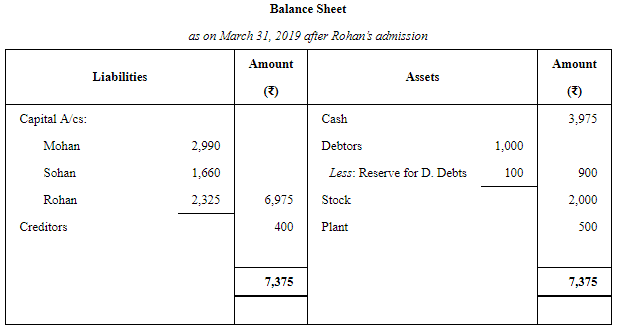

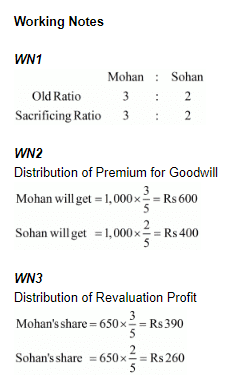

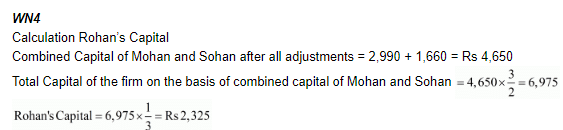

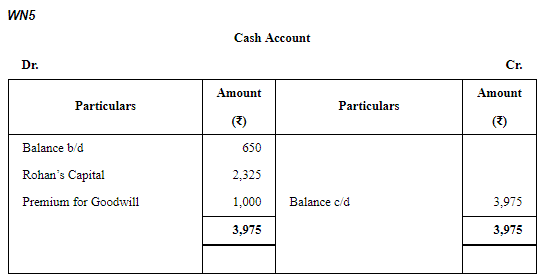

Question 98: Mohan and Sohan are in partnership sharing profits in the proportion of 3/5th and 2/5th respectively. Their Balance Sheet as at 31st March, 2019 was:

They admit Rohan to a 1/3rd share upon the terms that he is to pay into the business ₹ 1,000 as Goodwill and sufficient Capital to give him a 1/3rd share of the total capital of the new firm. It was agreed that the Provision for Doubtful Debts be reduced to ₹ 100 and the Stock be revalued at ₹ 2,000 and that the Plant be reduced to ₹ 500.

You are required to record the above in the Ledger of the firm and show Balance Sheet of the new partnership.

ANSWER:

Page No 5.112:

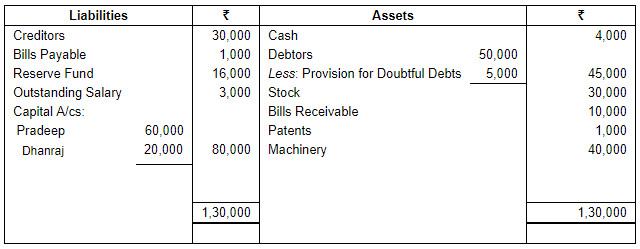

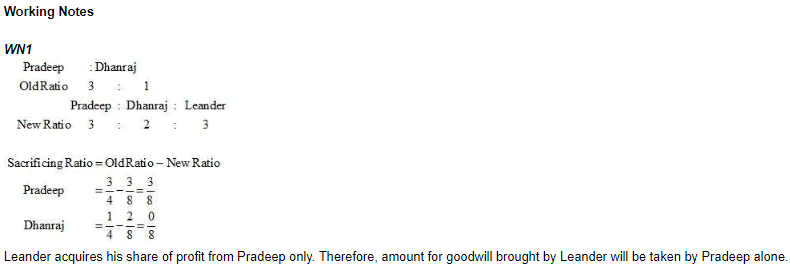

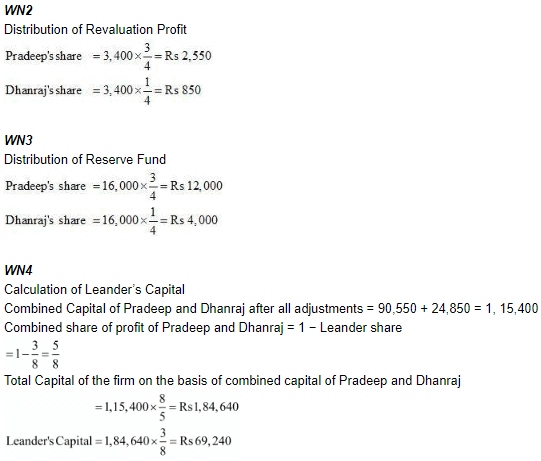

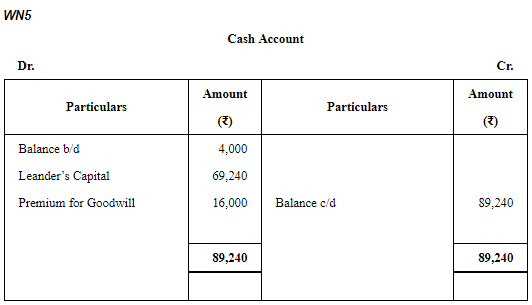

Question 99: Pradeep and Dhanraj were partners in a firm sharing profits in the ratio of 3 : 1. Their Balance Sheet on 31st March, 2019 was:

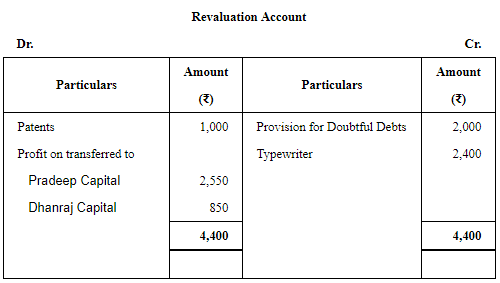

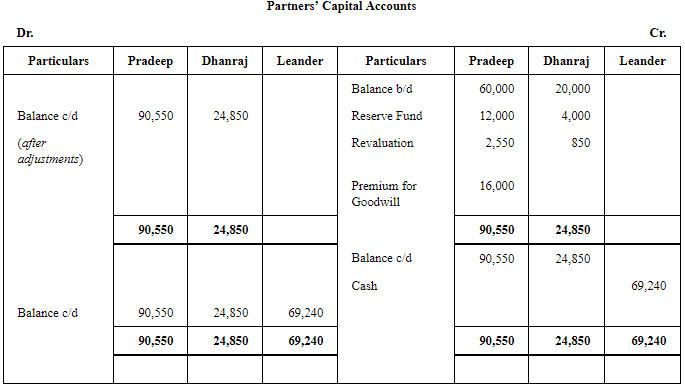

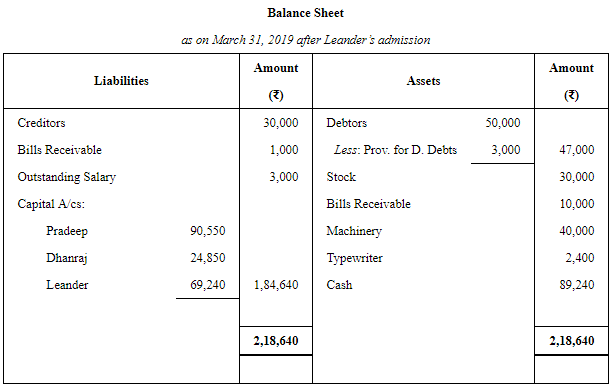

They admitted Leander as a new partner on this date. New profit-sharing ratio is agreed as 3 : 2 : 3. Leander brings in proportionate capital after the following adjustments:

(a) Leander brings ₹ 16,000 as his share of goodwill.

(b) Provisions for Doubtful Debts is to be reduced by ₹ 2,000.

(c) There is an old Printer valued at ₹ 2,400. It does not appear in the books of the firm. It is now to be recorded.

(d) Patents are valueless.

Prepare Revaluation Account, Capital Accounts and opening Balance Sheet of Pradeep, Dhanraj and Leander.

ANSWER:

Page No 5.112:

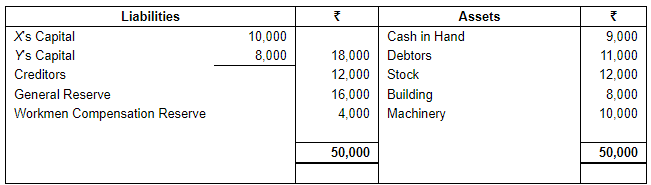

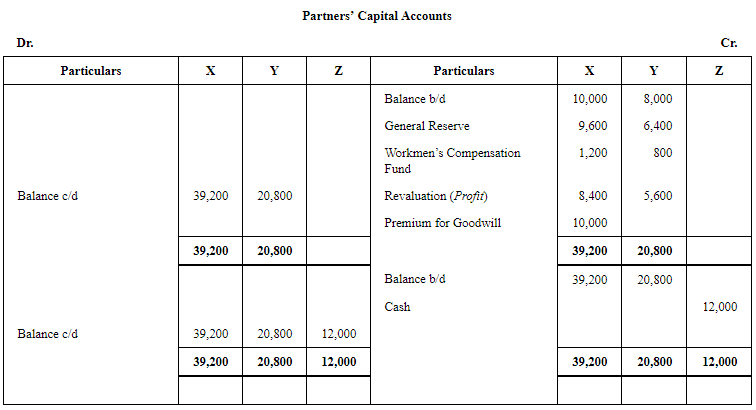

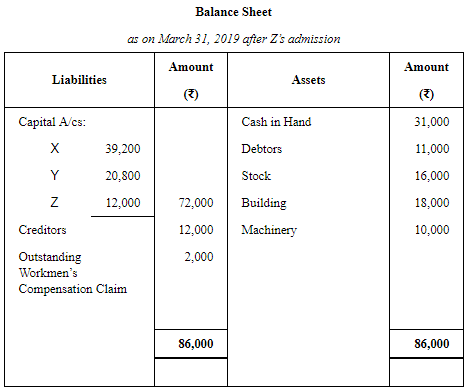

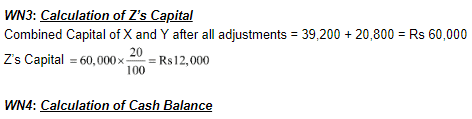

Question 100: Following is the Balance Sheet of X and Y as at 31st March, 2019. Z is admitted as a partner on that date when the position of X and Y was:

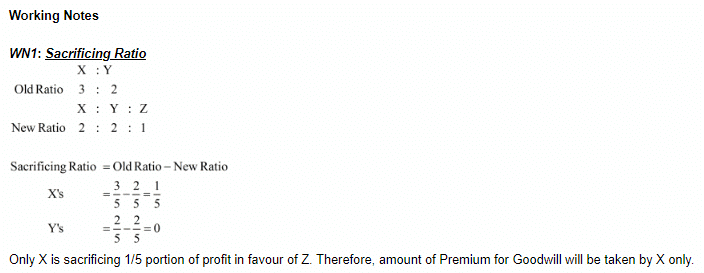

X and Y share profits in the proportion of 3 : 2. The following terms of admission are agreed upon:

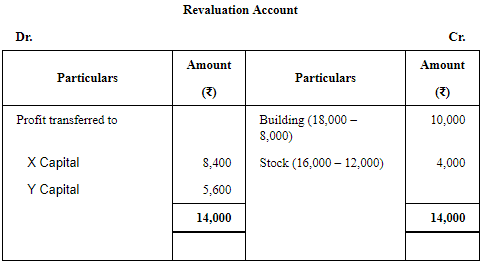

(a) Revaluation of assets: Building ₹ 18,000; Stock ₹ 16,000.

(b) The liability on Workmen Compensation Reserve is determined at ₹ 2,000.

(c) Z brought in as his share of goodwill ₹ 10,000 in cash.

(d) Z was to bring in further cash as would make his capital equal to 20% of the combined capital of X and Y after above revaluation and adjustments are carried out.

(e) The further profit-sharing proportions were: X−2/5th, Y−2/5th and Z−1/5th.

Prepare new Balance Sheet of the firm and Capital Accounts of the Partners.

ANSWER:

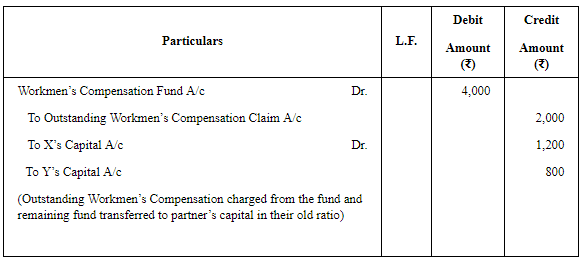

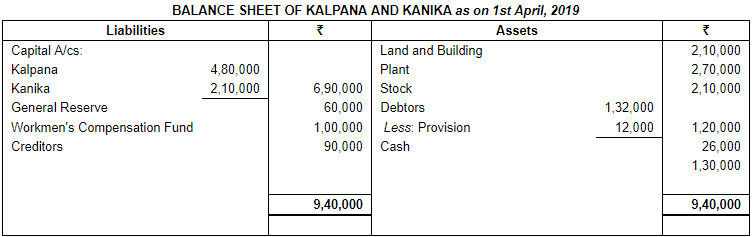

WN2: Treatment of Workmen Compensation Fund

Page No 5.113:

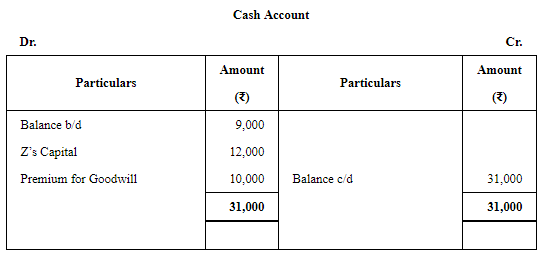

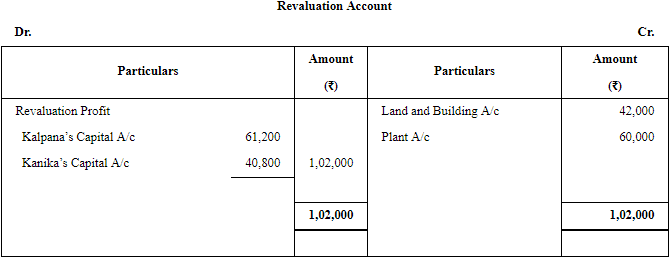

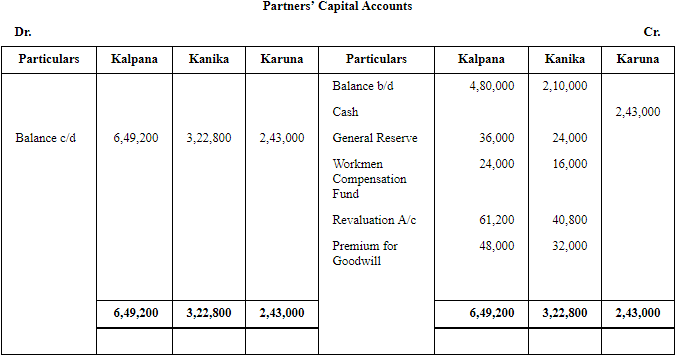

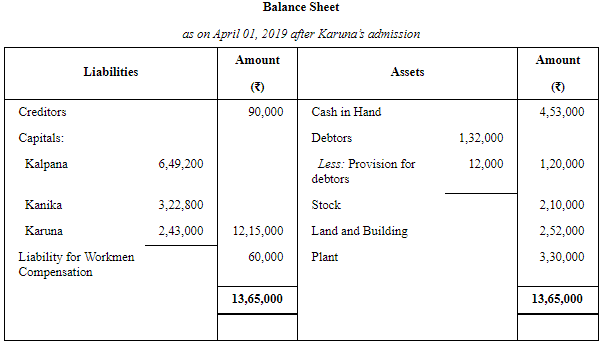

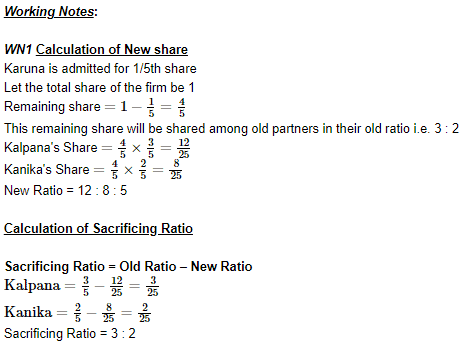

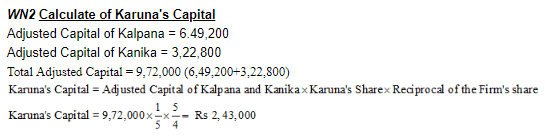

Question 101: Kalpana and Kanika were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2019, they admitted Karuna as a new partner for 1/5th share in the profits of the firm. The Balance Sheet of Kalpana and Kanika as on 1st April, 2019 was as follows:

It was agreed that:

(a) the value of Land and Building will be appreciated by 20%.

(b) the value of plant be increased by ₹ 60,000.

(c) Karuna will bring ₹ 80,000 for her share of goodwill premium.

(d) the liabilities of Workmen's Compensation Fund were determined at ₹ 60,000.

(e) Karuna will bring in cash as capital to the extent of 1/5th share of the total capital of the new firm.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Page No 5.113:

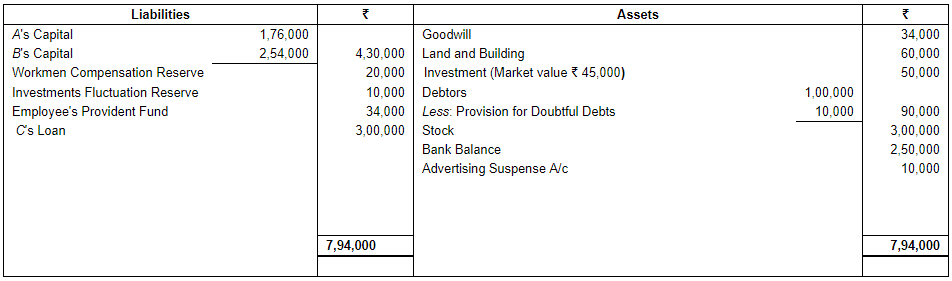

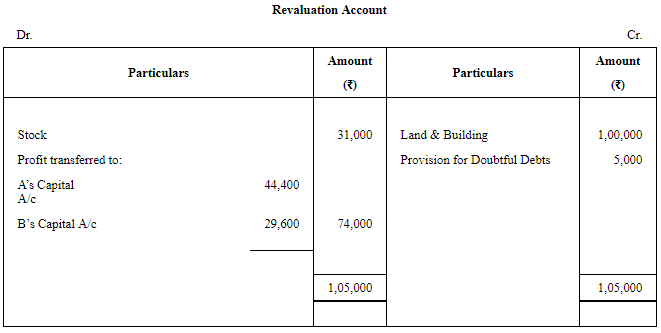

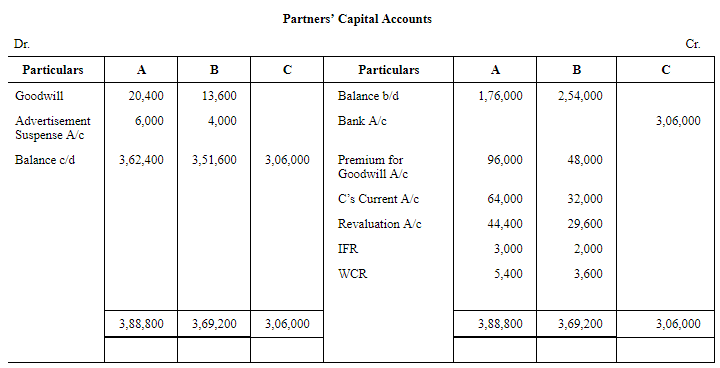

Question 102: A and B are partners sharing profits in the ratio of 3 : 2. They admit C as a new partner from 1st April, 2019. They have decided to share future profits in the ratio of 4 : 3 : 3. The Balance Sheet as at 31st March, 2019 is given below:

Terms of C's admission are as follows:

(i) C contributes proportionate capital and 60% of his share of goodwill in cash.

(ii) Goodwill is to be valued at 2 years' purchase of super profit of last three completed years. Profits for the years ended 31st March were:

2017 − ₹ 4,80,000; 2018 − ₹ 9,30,000; 2019 − ₹ 13,80,000.

The normal profit is ₹ 5,30,000 with same amount of capital invested in similar industry.

(iii) Land and Building was found undervalued by ₹ 1,00,000.

(iv) Stock was found overvalued by ₹ 31,000.

(v) Provision for Doubtful Debts is to be made equal to 5% of the debtors.

(vi) Claim on account of Workmen Compensation is ₹ 11,000.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Admission of a Partner (Part - 4) - Accountancy Class 12 - Commerce

| 1. What is the meaning of admission of a partner? |  |

| 2. What are the benefits of admitting a new partner? |  |

| 3. What are the legal formalities required for admitting a new partner? |  |

| 4. What is the process of valuing the new partner's contribution to the firm? |  |

| 5. What are the potential risks of admitting a new partner? |  |