Cash Flow Statement (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No. 5.100

Question:26

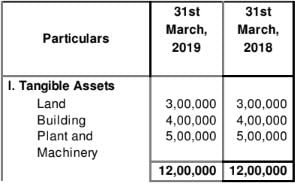

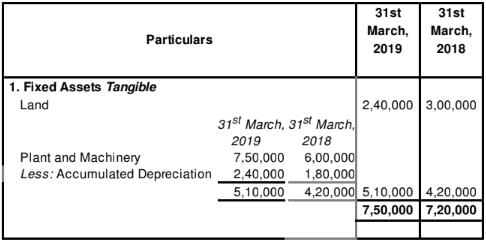

From the following Balance Sheet of Combiplast Ltd. for the year ended 31st March, 2019 and additional information, calculate Cash Flow from Investing Activities:

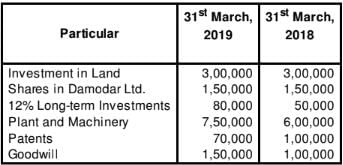

Notes to Accounts

Additional Information: During the year the company sold machinery at Book Value of 1,50,000.

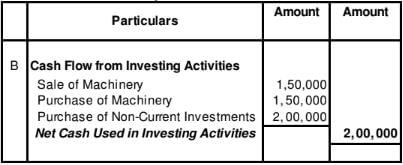

Solution:

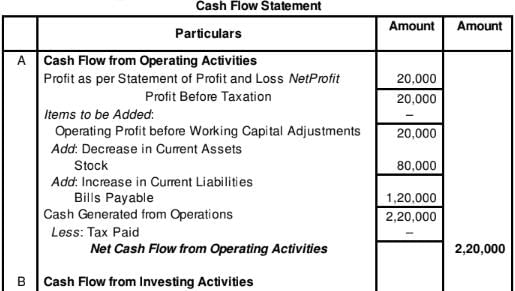

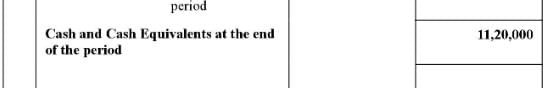

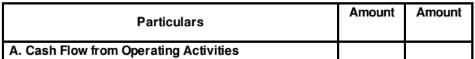

Cash Flow Statement

for the year ended March 31, 2019

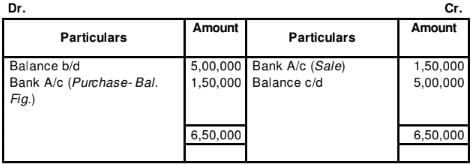

Working Notes:

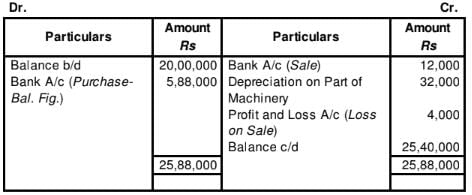

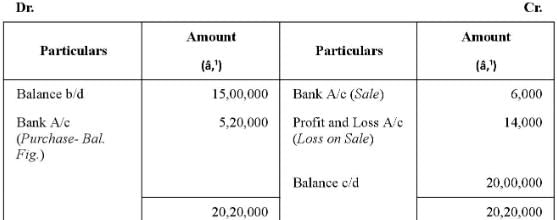

Plant & Machinery Account

Question:27

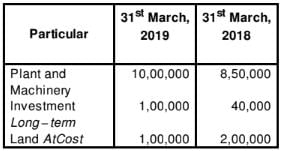

From the following information, calculate Cash Flow from Investing Activities

Additional Information:

1. Depreciation charged on Plant and Machinery 50,000.

2. Plant and Machinery with a Book Value of 60,000 was sold for 40,000.

3. Land was sold at a profit of 60,000.

4. No investment was sold during the year.

Solution:

Cash Flow from Investing Activities

Working Notes:

WN1

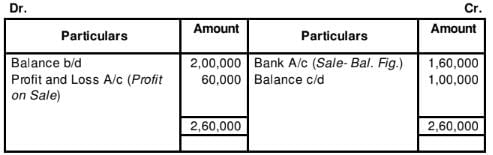

Plant and Machinery Account

WN2

Land Account

Question:28

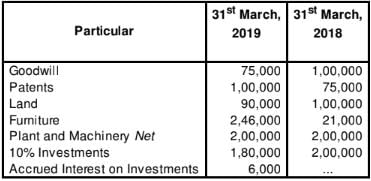

From the following extracts of a company, calculate Cash Flow from Investing Activities:

Solution:

Cash Flow from Investing Activities

Note: It has been assumed that Investments have been sold at their Book Value at the end of the accounting period.

Working Notes:

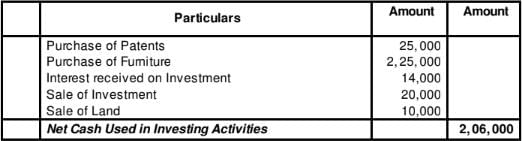

Computation of Interest on Investments

Question:29

Calculate Cash Flow from Investing Activities from the following information:

Additional Information:

1. A piece of land was purchased as an investment out of surplus. It was let out for commercial purpose and the rent received was 20,000.

2. Dividend received from Damodar Ltd. @ 12%.

3. Patents written off to the extent of 20,000. Some patents were sold at a profit of 10,000.

4. A machine costing 80,000 depreciation provided the reon 30, 000 was sold for 35,000. Depreciation charged during the year was 70,000.

5. During the year 12% investments were purchased for 1,00,000 and some investments were sold at a profit of 10,000. Interest on investments for the year was duly received.

Solution:

Cash Flow from Investing Activities

Working Notes:

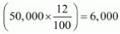

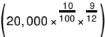

WN1 Computation of Interest on Investments

Interest on 12% Long-term Investments =

WN2

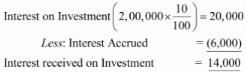

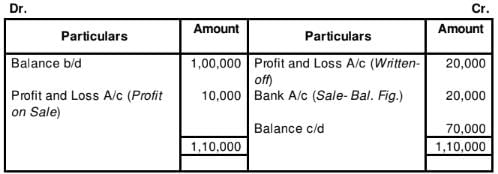

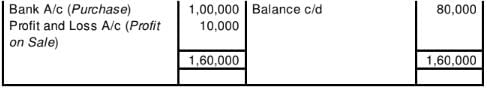

Patents Account

WN3

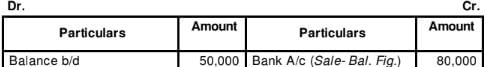

12% Long-Term Investments Account

WN3

Plant and Machinery Account

Question:30

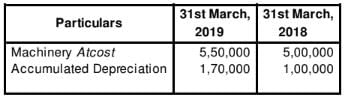

From the following information, calculate Cash Flow from Investing Activities:

During the year, a machinery costing 50,000 accumulated depreciation provided the reon 20, 000 was sold for 26,000.

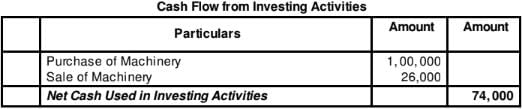

Solution:

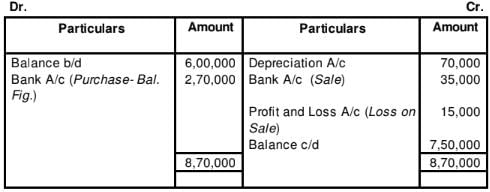

Working Notes:

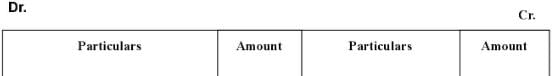

Machinery Account

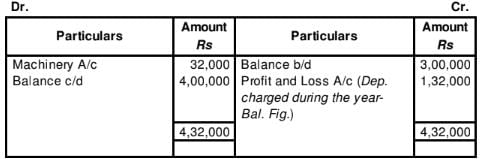

Accumulated Depreciation Account

Question:31

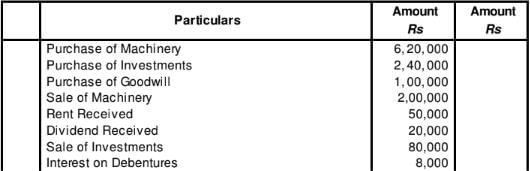

From the following particulars, calculate Cash Flow from Investing Activities.

Additional Information:

1. Interest received on debentures held as investment 8,000.

2. Interest paid on debentures issued 20,000.

3. Dividend received on shares held as investment 20,000.

4. Dividend paid on Equity Share Capital 30,000.

5. A plot of land was purchased out of the surplus funds for investment purposes and was let out for commercial use. Rent received 50,000 during the year.

Solution:

Cash Flow from Investing Activities

Note: Dividend paid and interest paid is a part of Financing Activities.

Question:32

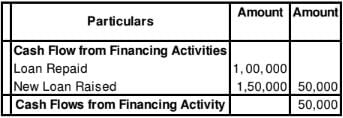

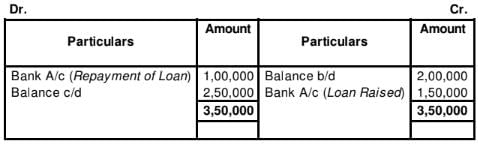

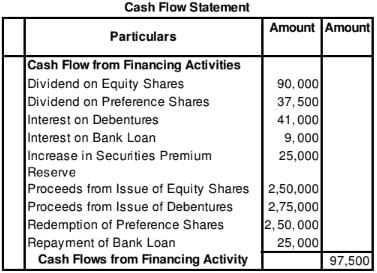

From the following information, calculate Cash Flow from Financing Activities:

During the year, the company repaid a loan of 1,00,000.

Solution:

Cash Flow Statement

Working Notes:

Long Term Loan Account

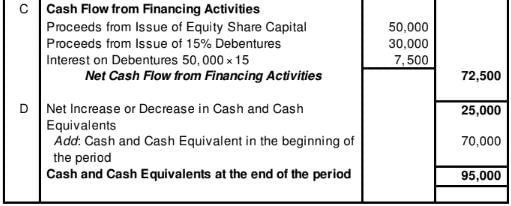

Question:33

From the following information, calculate Cash Flow from Financing Activities:

Additional Information: Interest paid on debentures 18,000.

Solution:

Cash Flow from Financing Activities

Page No. 5.101

Question:34

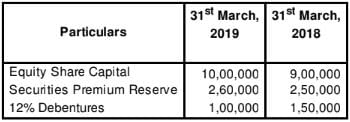

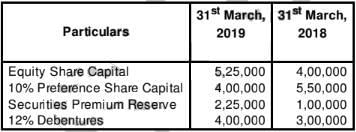

From the following extracts of Balance Sheet of Exe Ltd., calculate Cash Flow from Financing Activities:

Additional Information:

1. Equity Shares were issued on 31st March, 2019.

2. Interim dividend on Equity Shares was paid @ 15%.

3. Preference Shares were redeemed on 31st March, 2019 at a premium of 5%. Premium paid was debited to Statement of Profit and Loss.

4. 12% Debentures of face value 1,00,000 were issued on 31st March, 2019.

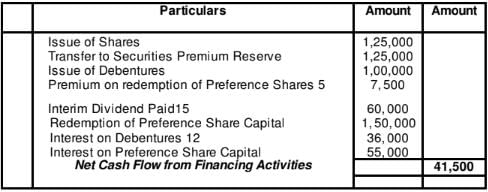

Solution:

Cash Flow from Financing Activities

for the year ended March 31, 2019

Question:35

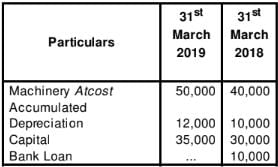

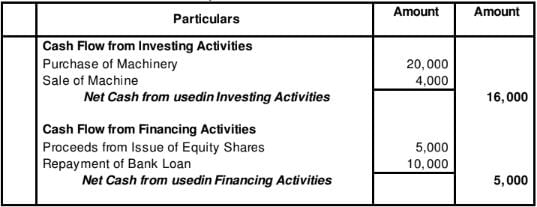

From the following information, calculate Cash Flow from Investing and Financing Activities:

During the year, a machine costing 10,000 was sold at a loss of 2,000. Depreciation on machinery charged during the year amounted to 6,000.

Solution:

Cash Flow Statement

for the year ended March 31, 2019

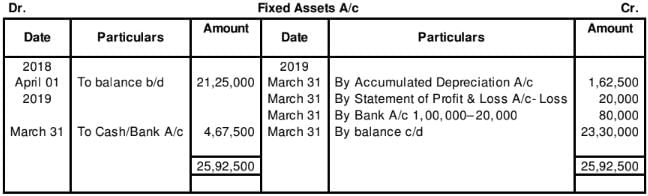

Working Notes:

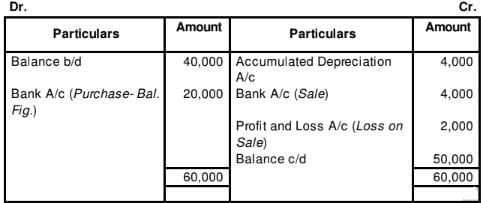

Machinery Account

Working Notes:

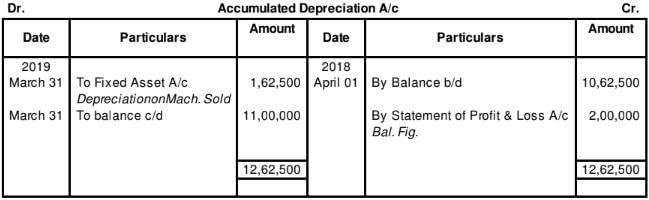

Accumulated Depreciation Account

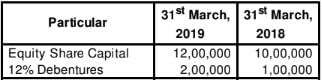

Question:36

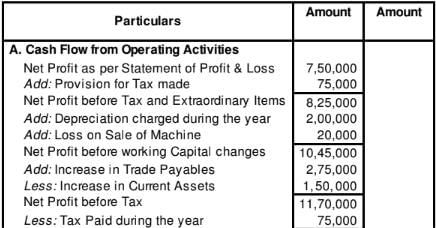

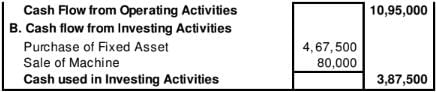

From the following information, calculation Cash Flow from Operating Activities and Investing Activities:

Additional Information:

1. A machine having book value of 1,00,000 Depreciation provided there on 1, 62, 500 was sold at a loss of 20,000.

2. Tax paid during the year 75,000.

Solution:

Cash flow Statement

for the year ended 31st March, 2019

Page No. 5.102

Question:37

XYZ. Ltd. provided the following information, calculate Net Cash Flow from Financing Activities:

Additional Information:

1.Interest paid on debentures 19,000.

2. Dividend paid in the year 50,000.

3. During the year, XYZ Ltd. issued bonus shares in the ratio of 5 : 1 by captialising reserve.

Solution:

Note: Amount of Equity Share Capital has been increased due to the issue of Bonus Shares which does not involve any flow of cash. Therefore, it is not considered in the Financing Activities.

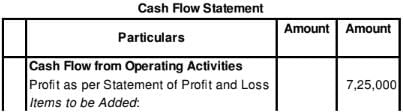

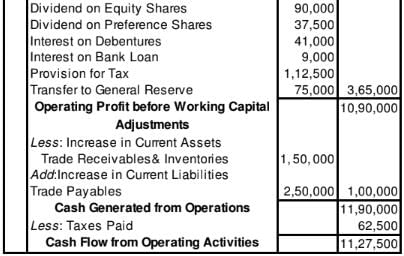

Question:38

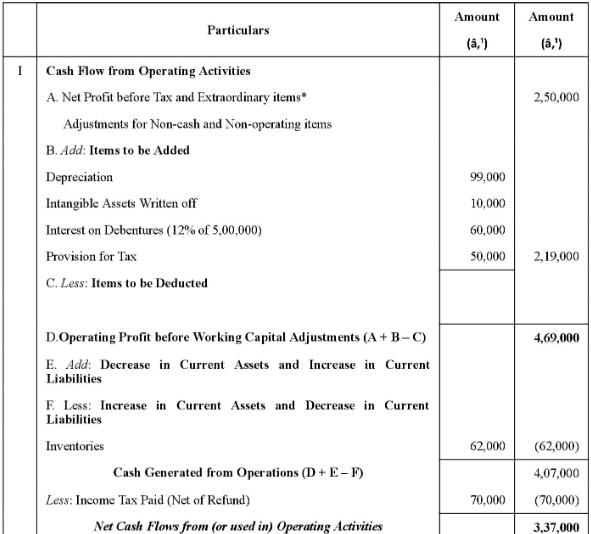

From the following information, calculate Net Cash Flow from Operating Activities and Financing Activities:

Additional Information:

i During the year additional debentures were issued at par on 1st October and Bank Loan was repaid on the same date.

ii Dividend on Equity Shares @ 8% was paid on Opening Balance.

iii Income tax 1,12,500 has been provided during the year.

iv Preference shares were redeemed at par at the end of the year.

Solution:

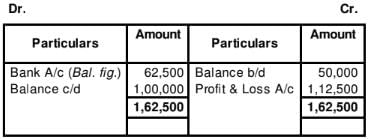

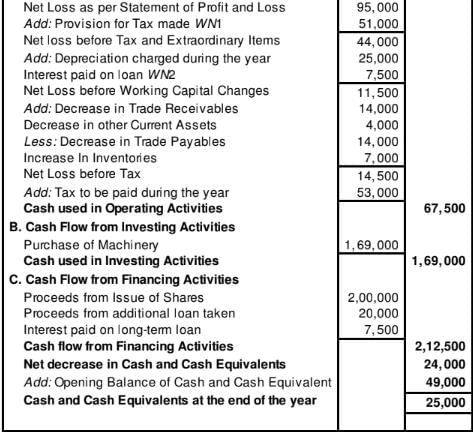

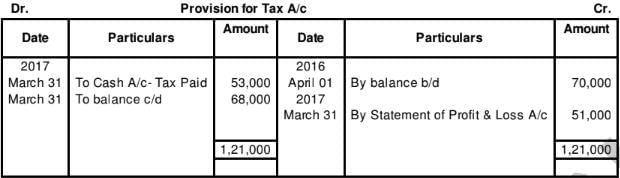

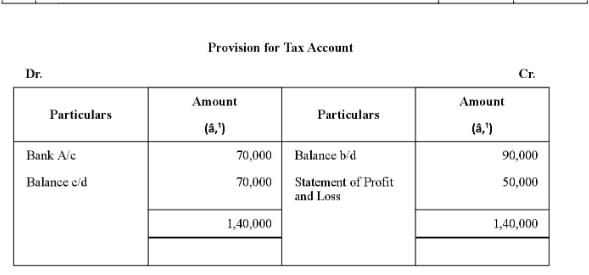

Working Notes:

Provision for Tax Account

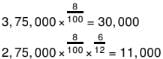

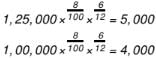

Calculation of Interest on Debentures

Total Interest = 41,000 (30 ,000+11,000 )

Calculation of Interest on Bank Loan

Total Interest = 9 ,000 (5 ,000+4,000 )

Page No. 5.103

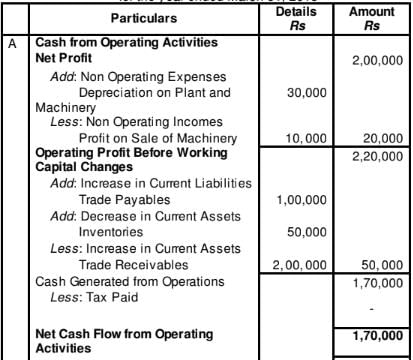

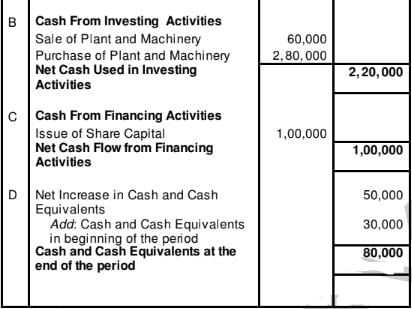

Question:39

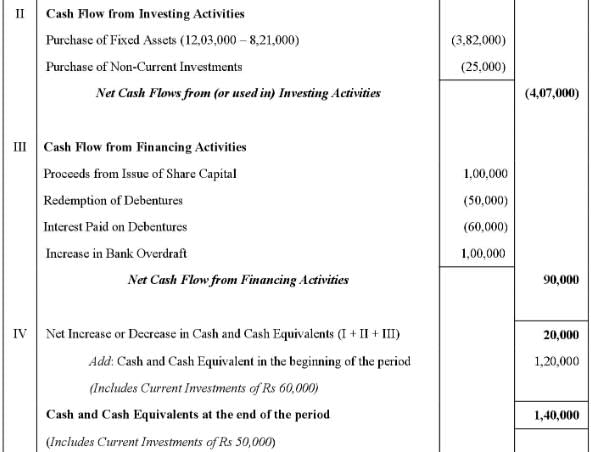

From the following information, prepare Cash Flow Statement:

Solution:

Question:40

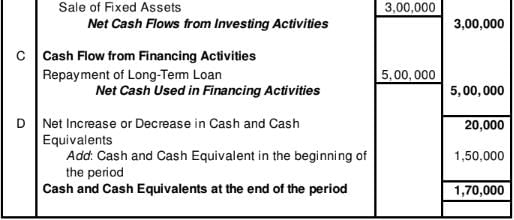

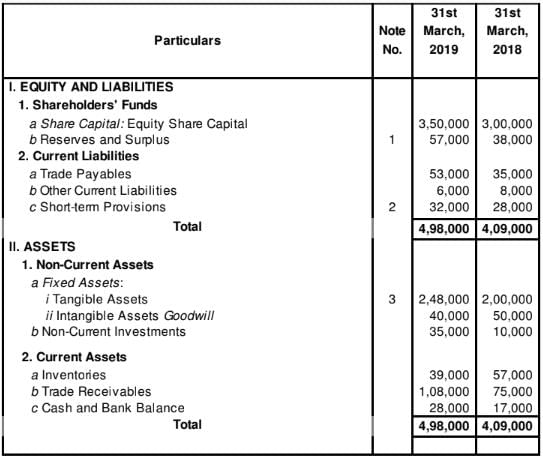

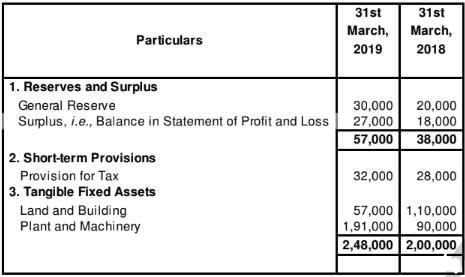

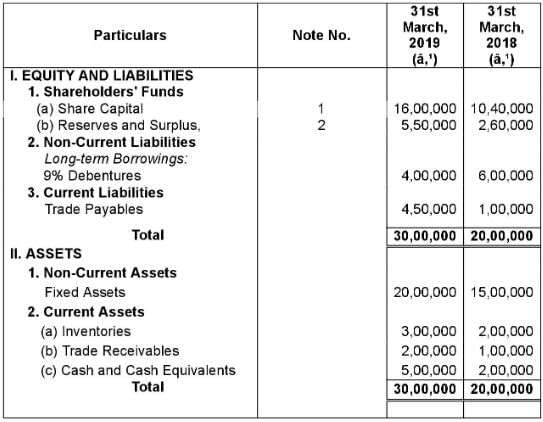

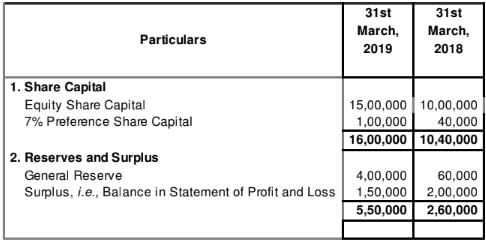

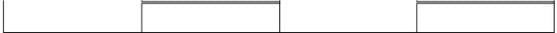

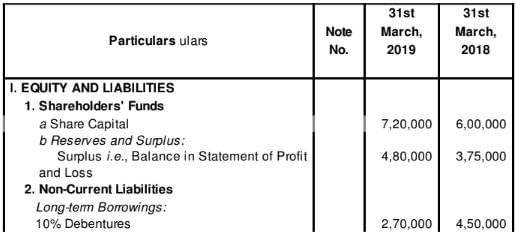

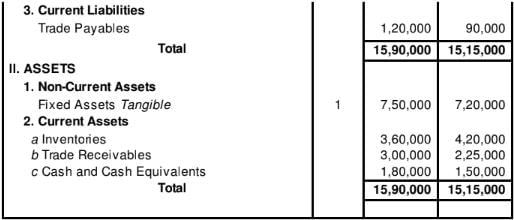

From the following Balance Sheet of Young India Ltd., prepare Cash Flow Statement:

BALANCE SHEET OF YOUNG INDIA LTD.

as at 31st March, 2019

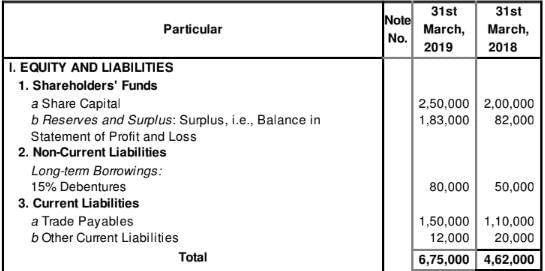

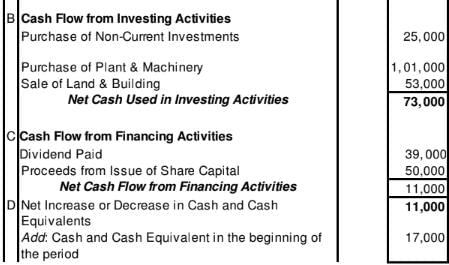

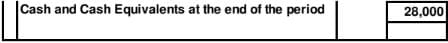

Solution:

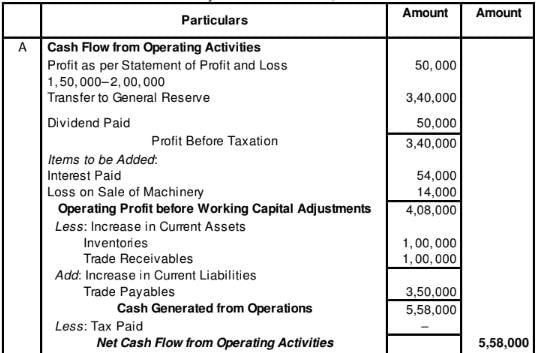

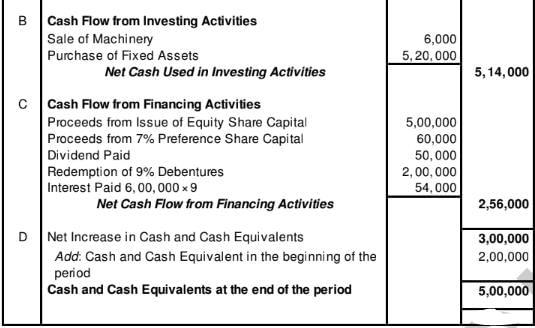

Cash Flow Statement

for the year ended March 31, 2019

Note: It has been assumed that Debentures were issued at the end of the accounting period. Therefore, interest on Debentures is computed on the opening balance of the Debenture.

Page No. 5.104

Question:41

Following is the Balance Sheet of Fine Products Ltd. as at 31st March, 2019:

Notes to Accounts

Note: Proposed dividends on equity for the years ended 31st March, 2018 and 2019 are 39,000 and 45,000 respectively. You are required to prepare Cash Flow Statement for the year ended 31st March, 2019.

Solution:

Cash Flow Statement

for the year ended March 31, 2019

Note: Proposed Dividend treatment is as per AS-4 Revised.

Page No. 5.105

Question:42

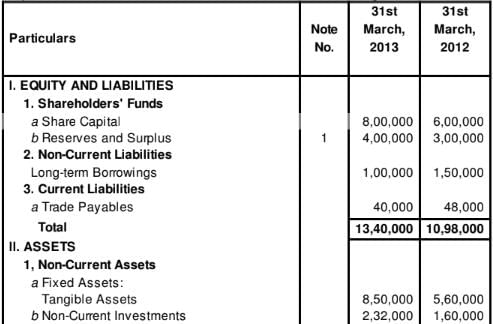

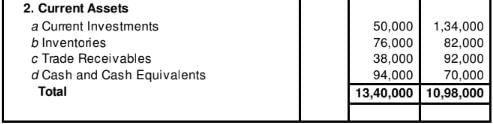

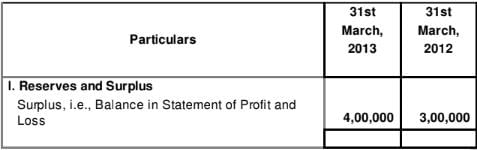

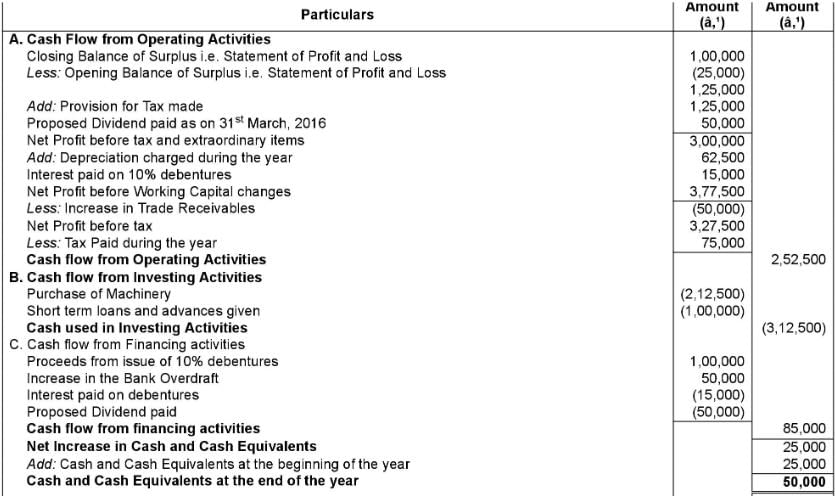

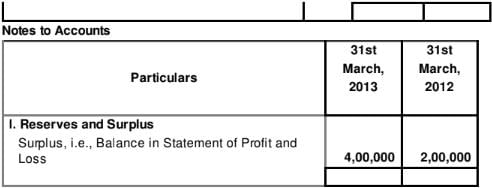

Prepare a Cash Flow Statement on the basis of the information given in the Balance Sheet of Libra Ltd. as at 31st March, 2013 and 31st March 2012:

Notes to Accounts

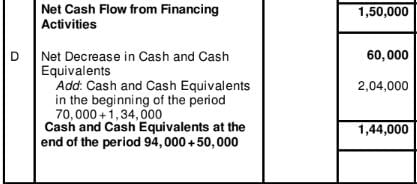

Solution:

Cash Flow Statement

for the year ended March 31, 2013

Page No. 5.106

Question:43

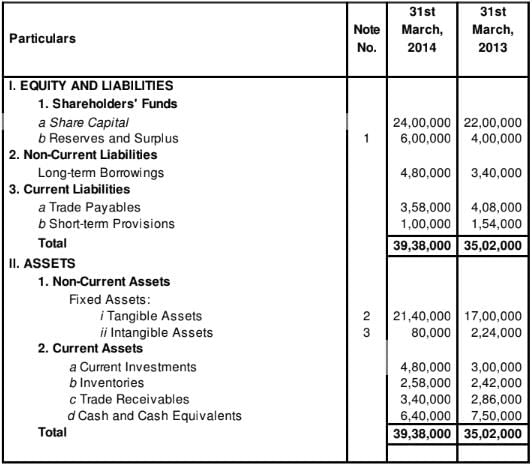

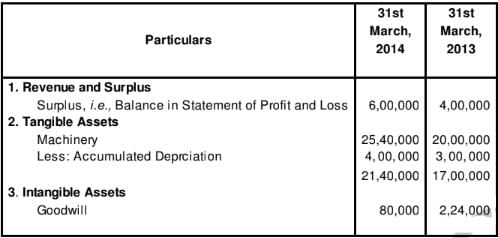

Following are the Balance Sheets of Solar Power Ltd. as at 31st March, 2014 and 2013:

Solar Power Ltd.

BALANCE SHEET

Notes to Accounts

Additional Information:

During the year, a piece of machinery costing 48,000 on which accumulated deprciation was 32,000. was sold for 12,000. Prepare Cash Flow Statement.

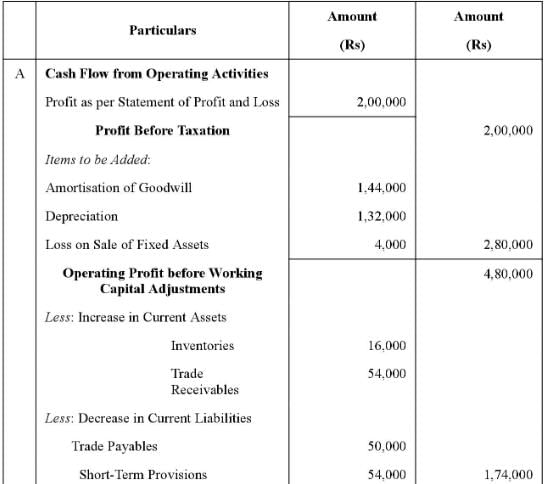

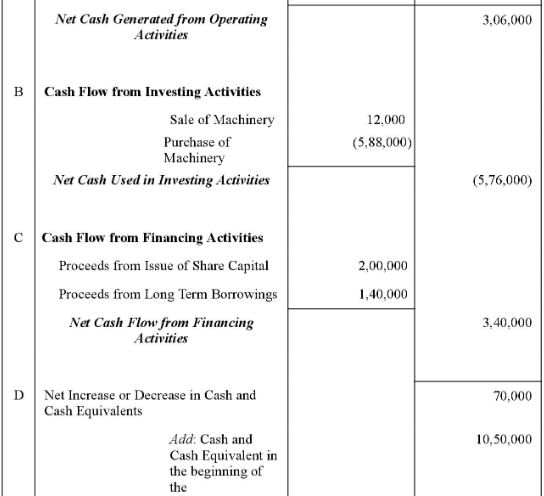

Solution:

Cash Flow Statement

for the year ended March 31, 2014

Working Notes:

Machinery Account

Accumulated Depreciation Account

Page No. 5.107

Question:44

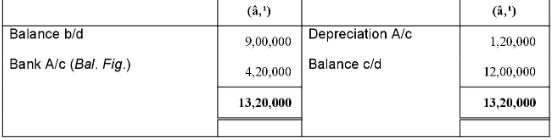

Following is the Balance Sheet of Mevanca Limited as at 31st March, 2017:

Mevanca Limited BALANCE SHEET

as at 31st March, 2017:

Notes to Accounts

Additional Information:

i Additional loan was taken on 1st July, 2016.

ii Tax of 53,000 was paid during the year.

Prepare Cash Flow Statement.

Solution:

Cash flow Statement

for the year ended 31st March, 2017

Working Notes:

1.

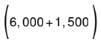

2. Interest on Loan

Interest on Loan taken on 1st July, 2016 =  1, 500 Interest on Loan as on 31st March, 2016 =

1, 500 Interest on Loan as on 31st March, 2016 =  = 6, 000 Total Interest Paid on Loan =

= 6, 000 Total Interest Paid on Loan =

Page No. 5.108

Question:45

From the following Balance Sheet of Kumar Ltd. as at 31st March, 2019, prepare Cash Flow Statement:

Notes to Accounts

Additional Information:

1. During a year, a machinery costing 20,000 was sold for 6,000.

2. Dividend paid during the year 50,000.

Solution:

Working Notes:

Fixed Assets Account

Page No. 5.109

Question:46

Following was the Balance Sheet of M.M. Ltd. as at 31st March, 2015:

Notes to Accounts

Additional Information:

1. 12% Debentures were redeemed on 31st March, 2015.

2. Tax

70,000 was paid during the year.

Prepare Cash Flow Statement.

Solution:

Cash Flow Statement

for the year ended 31st March, 2015

Page No. 5.110.

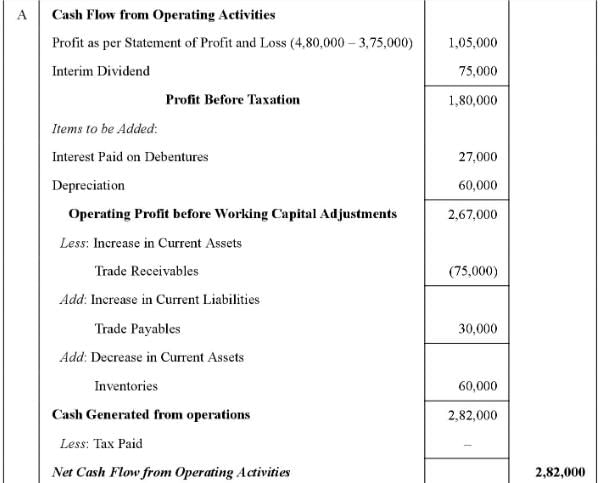

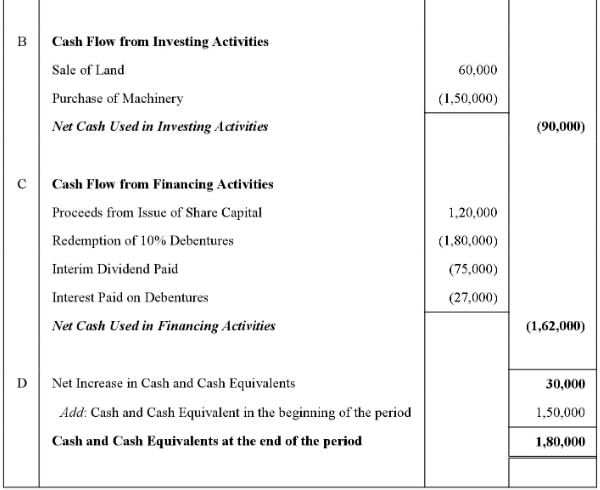

Question:47

The Balance Sheet of Virendra Paper Ltd. as at 31st March, 2019 is given below:

Notes to Accounts

Additional Information:

1. Interim Dividend of 75,000 has been paid during the year.

2. Debenture Interest paid during the year 27,000.

You are required to prepare Cash Flow Statement.

Solution:

Page No. 5.111

Question:48

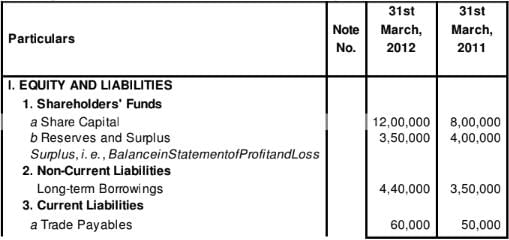

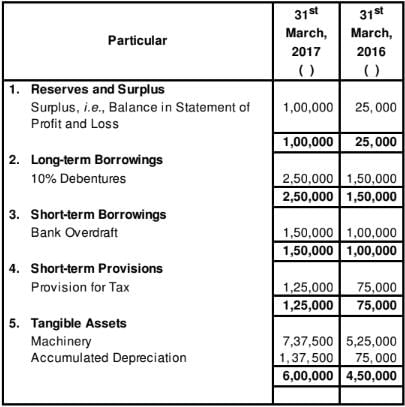

Following are the Balance Sheets of Krishtec Ltd. for the years ended 31st March 2012 and 2011:

Prepare a Cash Flow Statement after taking into account the following adjustments:

a. The company paid Interest 36,000 on its long-term borrowings.

b. Depreciation charged on tangible fixed assets was 1,20,000

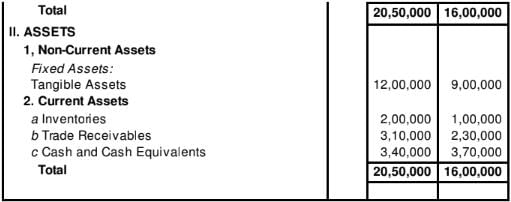

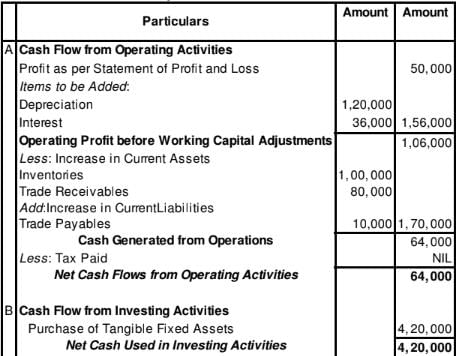

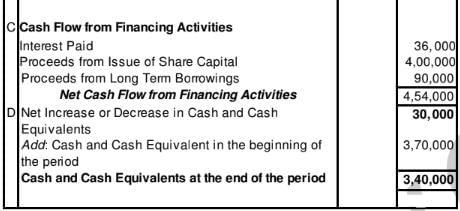

Solution:

Cash Flow Statement

for the year ended March 31, 2012

Tangible Fixed Assets Account

Question:49

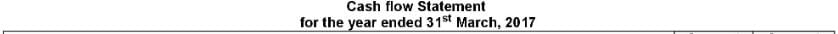

From the following Balance Sheet of JY Ltd. as at 31st March 2017, prepare a Cash Flow Statement:

BALANCE SHEET

as at 31st March, 2017

Notes to Accounts

Note: Proposed Dividend for the years ended 31st March, 2016 and 2017 are 50,000 and 75,000 respectively.

Additional Information: 1,00,000, 10% Debentures were issued on 31st March, 2017.

Solution:

Note: Proposed Dividend Treatment is as per AS-4.

Page No. 5.112.

Question:50

Prepare Cash Flow Statement from the following Balance Sheet:

Additional Information:

i. An old machinery having book value of 50,000 was sold for 60,000.

ii. Depreciation provided on Machinery during the year was 30,000.

Solution:

Cash Flow Statement

for the year ended March 31, 2013

Working Notes:

Plant and Machinery Account

|

42 videos|199 docs|43 tests

|

FAQs on Cash Flow Statement (Part - 2) - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement? |  |

| 2. Why is a cash flow statement important? |  |

| 3. How is a cash flow statement different from an income statement? |  |

| 4. What are the three main sections of a cash flow statement? |  |

| 5. How can a positive or negative cash flow affect a business? |  |