Accounting for Partnerships: Basic Concepts Chapter Notes | Accountancy Class 12 - Commerce PDF Download

| Table of contents |

|

| Nature of Partnership |

|

| What is a Partnership Deed? |

|

| Distribution of Profit among Partners |

|

| Guarantee of Profit to a Partner |

|

| Past Adjustments |

|

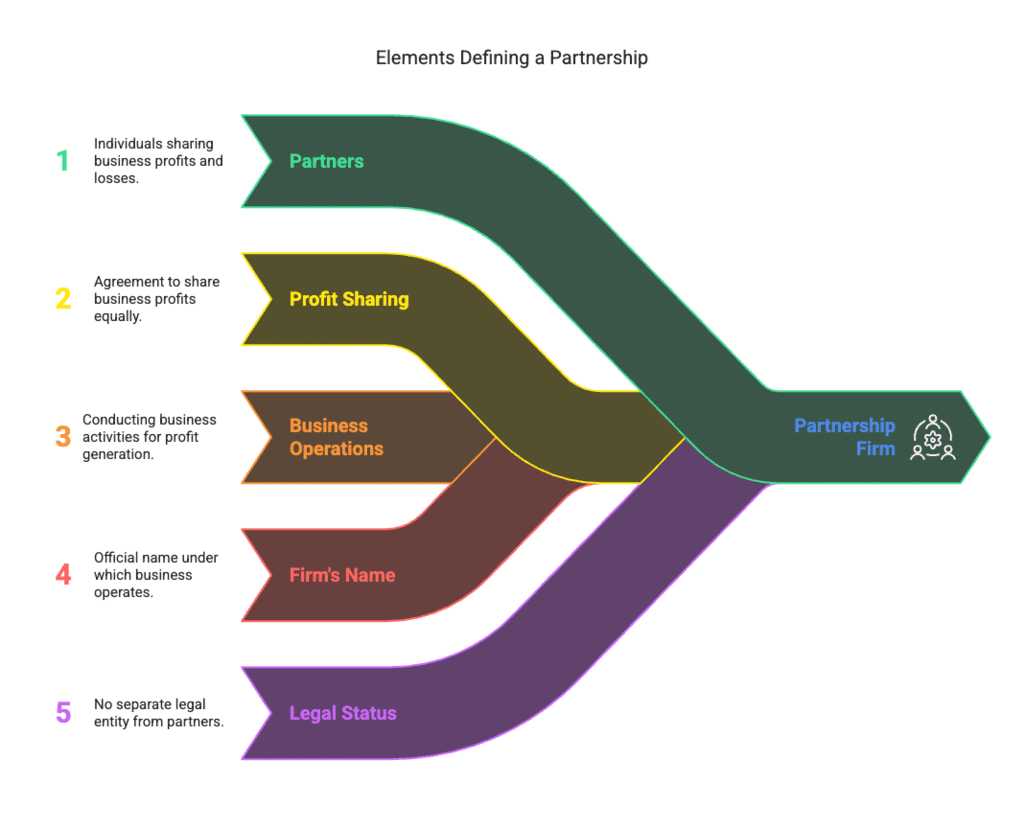

Nature of Partnership

- When two or more individuals come together to establish a business and agree to share its profits and losses, they are said to be in a partnership.

- According to Section 4 of the Indian Partnership Act 1932, partnership is defined as the relationship between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

The people in the partnership are called “partners,” and together they form a “firm.”

The business name is the “firm’s name.”

Unlike a company, a partnership firm isn’t a separate legal entity—it’s just the partners working together.

The key features of a partnership include:

- Two or More Persons: A partnership requires at least two individuals coming together for a common purpose. The minimum number of partners in a firm is two. However, there is a limit on the maximum number of partners. According to Section 464 of the Companies Act 2013, the Central Government can prescribe the maximum number of partners in a firm, which cannot exceed 100. Currently, the maximum number of partners in a firm is set at 50.

- Agreement: A partnership arises from an agreement between two or more individuals to conduct business and share its profits and losses. This agreement forms the basis of the relationship between the partners. While a written agreement is preferred to avoid disputes, an oral agreement is also valid.

- Business: For an agreement to be called a partnership, there must be some business activity. Just owning something together, like land, doesn’t make people partners. For example, if two people buy a piece of land together, they are co-owners, not partners. But if they buy and sell land regularly to earn money, then they are partners in a business.

- Mutual Agency: In a partnership, the business can be run by all the partners together or by any one partner representing the others. This means every partner has the right to help manage the business. It also means that each partner can make decisions that affect everyone, and everyone is responsible for each other’s actions. This mutual trust and shared responsibility are very important. Without it, there is no real partnership.

- Sharing of Profit: An essential aspect of partnership is the agreement to share the profits and losses of the business. While the Partnership Act emphasises profit-sharing, loss-sharing is also implied. If individuals come together for a charitable purpose, it would not be considered a partnership.

- Liability of Partners: Each partner is jointly and severally liable to third parties for the acts of the firm committed during their partnership. This liability is unlimited, meaning that a partner's personal assets can be used to satisfy the firm's debts.

What is a Partnership Deed?

- A partnership is formed through an agreement among the partners, which can be either oral or written.

- While the Partnership Act does not mandate a written agreement, when it is in writing, the document outlining the terms is referred to as a 'Partnership Deed.'

- This deed typically includes details about the business objectives, capital contributions by each partner, profit and loss sharing ratios, and entitlements such as interest on capital or loans.

- The clauses within the partnership deed can be modified with the consent of all partners.

- It is essential for the deed to be well-drafted, adhering to the provisions of the 'Stamp Act,' and it is advisable to register it with the Registrar of Firms.

Contents of the Partnership Deed

The Partnership Deed typically includes the following details:

- Names and Addresses of the firm and its main business;

- Names and Addresses of all partners;

- Amount of capital to be contributed by each partner;

- The accounting period of the firm;

- The date of commencement of partnership;

- Rules regarding operation of Bank Accounts;

- Profit and loss sharing ratio;

- Rate of interest on capital, loan, drawings, etc.;

- Mode of auditor’s appointment, if any;

- Salaries, commission, etc., if payable to any partner;

- The rights, duties and liabilities of each partner;

- Treatment of loss arising out of insolvency of one or more partners;

- Settlement of accounts on dissolution of the firm;

- Method of settlement of disputes among the partners;

- Rules to be followed in case of admission, retirement, death of a partner; and

- Any other matter relating to the conduct of business.

While the partnership deed aims to cover all aspects of the partners' relationships, any matters not explicitly agreed upon will be governed by the provisions of the Indian Partnership Act of 1932.

Provisions of the Partnership Act Relevant to Accounting

- Profit Sharing Ratio: If the partnership agreement doesn't mention how to share profits, all partners will share profits and losses equally, no matter how much money each has invested.

- Interest on Capital: Partners don’t automatically get interest on the money they put into the business. It is only given if the agreement clearly says so.

- Interest on Drawings: If the agreement doesn’t say anything about charging interest on money taken out by partners (drawings), then no interest will be charged.

- Interest on Loan: If a partner gives a loan to the firm for business use, they will get 6% interest per year on that loan.

- Remuneration for Work: Partners won’t get any salary or payment for working in the business unless the agreement clearly allows it.

Apart from the above, the Indian Partnership Act specifies that, subject to a contract between the partners:

- If a partner makes any profit for themselves from a transaction of the firm or from using the firm's property, business connections, or the firm's name, they must account for that profit and pay it to the firm.

- If a partner engages in any business that is similar to and competes with the firm, they are obligated to account for and pay to the firm all profits earned from that competing business.

Special Aspects of Partnership Accounts

When doing accounting for partnership firms, there are some key differences from sole proprietorships. Here are the main points:

- Partners’ Capital Accounts: Each partner has their own capital account that keeps a record of how much money they have invested or withdrawn from the business.

- Profit and Loss Sharing: Profits and losses are shared among partners as per the partnership agreement. This can be equal or based on a set ratio.

- Fixing Wrong Profit Distribution: If profits were shared wrongly in the past, corrections must be made to ensure fairness for all partners.

- Changes in the Partnership (Reconstitution): If a new partner joins or an old one leaves, the partnership is reformed. This requires updating capital accounts and the profit-sharing arrangement.

- Closing the Partnership (Dissolution): When the partnership ends, proper steps must be taken to settle all accounts and divide the remaining assets among the partners.

The first three aspects mentioned above are explained in detail in the following sections of this chapter. The remaining aspects, such as reconstitution and dissolution, will be covered in subsequent chapters.

Maintenance of Capital Accounts of Partners

All transactions related to the partners of a firm are recorded in the firm's books through their capital accounts. This includes the following:

- Amount of money brought in as capital

- Withdrawal of Capital

- Share of profit

- Interest on capital

- Interest on drawings

- Partner’s salary

- Commission to partners

There are two methods for maintaining the capital accounts of partners:

1. Fixed Capital Method

Under this method, the capital of each partner remains fixed unless there is an agreement to introduce additional capital or withdraw a portion of the capital. Here’s how it works:

- Fixed Capital: The capital accounts of partners show a fixed balance year after year, unless there are changes due to additional capital or withdrawals.

- Current Account: Items like share of profit or loss, interest on capital, drawings, and interest on drawings are recorded in a separate account called the Partner’s Current Account.

- Credit Balance: The partners’ capital accounts always show a credit balance.

- Debit/Credit Balance: The partners’ current account may show either a debit or credit balance.

- Balance Sheet: The partners’ capital accounts appear on the liabilities side of the balance sheet, while the current account’s balance is shown on the liabilities side if it’s a credit balance and on the assets side if it’s a debit balance.

The partner’s capital account and the current account under the fixed capital method would appear as shown below.

2. Fluctuating Capital Method

- One Account System: Each partner has only one capital account.

- Direct Adjustments: All changes like profit or loss share, interest on capital, drawings, interest on drawings, salary, or commission are recorded directly in this account.

- Changing Balances: The balance in the capital account keeps changing, so it’s called the fluctuating capital method.

- Default Method: If no method is mentioned, this is the method that should be used to prepare the capital account.

The proforma of capital accounts prepared under the fluctuating capital method is given below:

Distinction between Fixed and Fluctuating Capital Accounts:

The main points of difference between the fixed and fluctuating capital methods can be summed up as follows:

Distribution of Profit among Partners

- In a partnership firm, profits and losses are shared by the partners based on the ratio they agreed upon.

If there is no agreement, profits and losses are divided equally. - In a sole proprietorship, the profit or loss from the Profit and Loss Account is directly added to or deducted from the owner’s capital account.

- In a partnership, extra adjustments like interest on drawings, interest on capital, partner’s salary, and commission need to be considered.

- To handle these, a Profit and Loss Appropriation Account is prepared. It helps find the final amount of profit or loss to be shared among the partners as per their profit-sharing ratio.

Profit and Loss Appropriation Account

- The Profit and Loss Appropriation Account is an extension of the firm’s Profit and Loss Account.

- It shows how profits are distributed among the partners.

- All adjustments like partner’s salary, partner’s commission, interest on capital, interest on drawings, etc., are made through this account.

- The account starts with the net profit or net loss from the Profit and Loss Account.

The journal entries for the preparation of the Profit and Loss Appropriation Account and making various adjustments through it are given as follows:

Journal Entries

1. Transfer of the balance of the Profit and Loss Account to the Profit and Loss Appropriation Account:

2. Interest on Capital:

3. Interest on Drawings:

4. Partner’s Salary:

5. Partner’s Commission:

6. Share of Profit or Loss after appropriations:

The Proforma of Profit and Loss Appropriation Account is given as follows

Example: Sameer and Yasmin are partners with capitals of Rs.15,00,000 and Rs. 10,00,000 respectively. They agreed to share profits in the ratio of 3:2. Show how the following transactions will be recorded in the capital accounts of the partners in case:

(i) the capitals are fixed, and

(ii) the capitals are fluctuating.

The books are closed on March 31, every year.

Ans:

Fixed Capital Method

Fluctuating Capital Method

Interest on Capital

- Interest on partners' capital is not allowed unless explicitly agreed upon in the partnership deed.

- When specified in the deed, interest on capital is credited to partners at an agreed rate based on the duration the capital was in the business during the financial year.

- Interest on capital istypically provided in two scenarios:

- When partners contribute unequal amounts of capital but share profits equally.

- When capital contributions are the same, but profit sharing is unequal.

- Interest on capital is calculated considering any additions or withdrawals of capital during the accounting period.

- For example, in a partnership where Mohini, Rashmi, and Navin contribute Rs. 3,00,000, Rs. 2,00,000, and Rs. 1,00,000 respectively with no additions or withdrawals during the year, and an agreed interest rate of10% per annum:

- Interest on capital for Mohini: Rs. 30,000 (10% of Rs. 3,00,000)

- Interest on capital for Rashmi: Rs. 20,000 (10% of Rs. 2,00,000)

- Interest on capital for Navin: Rs. 10,000 (10% of Rs. 1,00,000)

- In another example with partners Mansoor and Reshma, where their capital accounts showed Rs. 2,00,000 and Rs. 1,50,000 respectively on April 1, 2019, and with additional capital introduced later:

- Mansoor introduced Rs. 1,00,000 on August 1, 2019.

- Reshma introduced Rs. 1,50,000 on October 1, 2019.

- Interest is allowed at 6% per annum on the capital.

It shall be worked as follows:

Calculating Interest on Capital with Additions and Withdrawals:

- Opening Balance: Interest is calculated for the whole year on the opening balance of the capital accounts of partners.

- Additional Capital: For any additional capital brought in by a partner during the year, interest is calculated from the date of introduction of the additional capital to the end of the financial year.

- Withdrawal of Capital: In the case of withdrawal of capital:

- Interest is calculated on the opening capital from the beginning of the year until the date of capital withdrawal.

- After the withdrawal, interest is calculated on the reduced capital for the remaining period of the year.

Example: Saloni and Srishti are partners in a firm. Their capital accounts as on April 01. 2019 showed a balance of Rs. 2,00,000 and Rs. 3,00,000 respectively. On July 01, 2019, Saloni introduced additional capital of Rs. 50,000 and Srishti, Rs. 60,000. On October 01 Saloni withdrew Rs. 30,000, and on January 01, 2020 Srishti withdraw, Rs. 15,000 from their capitals. Interest is allowed @ 8% p.a. Calculate interest payable on capital to both the partners during the financial year 2019–2020.

Ans: Statement Showing Calculation of Interest on Capital:

For Saloni

For Srishti

At times, the opening capitals of the partners might not be provided. In such cases, to calculate interest on capital, the opening capitals will first need to be determined by using the partners’ closing capitals. This is done by making necessary adjustments for any capital additions, withdrawals, drawings, or share of profit or loss if these have already been recorded in the partners' capital accounts.

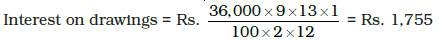

Interest on Drawings

- If the partnership agreement allows, interest can be charged on money withdrawn by partners for personal use.

- Interest on drawings is not applied unless there is a specific agreement among partners.

- When mentioned in the partnership deed, interest is charged at an agreed rate for the time the drawings are made.

- Charging interest on drawings helps to prevent excessive withdrawals by partners.

- The way to calculate interest on drawings can vary depending on different situations.

When Fixed Amounts are Withdrawn Monthly

- Partners may withdraw a fixed sum at regular intervals, such as monthly or quarterly.

- Consider the timing of withdrawals—whether at the beginning, middle, or end of the period.

- For example, withdrawing at the beginning of each month incurs interest for 6½ months.

- Withdrawing at the end of each month incurs interest for 5½ months.

- Withdrawing in the middle of the month incurs interest for 6 months.

- For instance, if Aashish withdrew Rs. 10,000 each month from the firm for personal use during the year ending March 31, 2017, the interest calculation would vary based on when he made the withdrawals.

The calculation of the average period and the interest on drawings, in different situations, would be as follows:

(a) When the amount is withdrawn at the beginning of each month:

(b) When the amount is withdrawn at the end of each month:

(c) When money is withdrawn in the middle of the month:

When money is withdrawn in the middle of the month, nothing is added or deduced from the total period.

When Fixed Amount is withdrawn Quarterly:

- When a fixed amount of money is withdrawn quarterly by partners, in such a situation, for the purpose of calculating interest, the total period of time is ascertained depending on whether the money was withdrawn at the beginning or at the end of each quarter.

- If the amount is withdrawn at the beginning of each quarter, the interest is calculated on the total money withdrawn during the year, for a period of seven and a half months, i.e., (12 3)/2.

- If withdrawn at the end of each quarter, it will be calculated for a period of 4½ months, i.e., (9 0)/2.

Suppose Satish and Tilak are partners in a firm, sharing profits and losses equally. During the financial year 2016–2017, Satish withdrew Rs. 30,000 quarterly. If interest is to be charged on drawings @ 8% per annum, the calculation of the average period and interest on drawings will be as follows:

(a) If the amount is withdrawn at the beginning of each quarter

Alternatively, the interest can be calculated on the total amount withdrawn during the accounting year, i.e. Rs. 1,20,000 for a period of 7½ months (12+9+6+3)/4. as follows:

(b) If the amount is withdrawn at the end of each quarter

Alternatively, the interest can be calculated on the total amount withdrawn during the accounting year, i.e., Rs. 1,20,000 for a period of 4½ months (9 + 6 + 3 + 0)/4 months as follows:

When Varying Amounts are Withdrawn at Different Intervals:

- When the partners withdraw different amounts of money at different time intervals, the interest is calculated using the product method.

- Under the product method, for each withdrawal, the money withdrawn is multiplied by the period (usually expressed in months) for which it remained withdrawn during the financial year.

- The period is calculated from the date of the withdrawal to the last day of the accounting year.

- The products so calculated are totalled on the total of the products.

- Interest at the specified rate is calculated as under:

Total of products x Rate x 1/12.

Example: John Ibrahm, a partner in Modern Tours and Travels withdrew money during the year ending March 31, 2020 from his capital account, for his personal use. Calculate interest in drawings in each of the following alternative situations, if rate of interest is 9 per cent per annum.

(a) If he withdrew Rs. 3,000 per month at the beginning of the month.

(b) If an amount of Rs. 3,000 per month was withdrawn by him at the end of each month.

(c) If the amounts withdrawn were : Rs. 12,000 on June 01, 2019, Rs. 8,000; on August 31, 2019, Rs. 3,000; on September 30, 2019, Rs. 7,000, on November 30, 2019, and Rs. 6,000 on January 31, 2020.

Ans:

(a) As a fixed amount of Rs. 3,000 per month is withdrawn at the beginning of the month, interest on drawings will be calculated for an average period of  months.

months. (b) As the fixed amount of Rs. 3,000 per month is withdrawn at the end of each month, interest on drawings will be calculated for an average period of

(b) As the fixed amount of Rs. 3,000 per month is withdrawn at the end of each month, interest on drawings will be calculated for an average period of  months.

months.

(C) Statements showing Calculation of Interest on Drawings

When Dates of Withdrawal are Not Specified:

- When the total amount withdrawn is known but the specific dates of withdrawals are not provided, it is assumed that the withdrawals were made evenly throughout the year.

- For instance, if Shakila withdrew Rs. 60,000 from a partnership firm during the year ending March 31, 2020, and the interest on drawings is set at 8 per cent per annum, the calculation of interest would consider a period of six months.

- This six-month period is based on the assumption that the amount was withdrawn evenly in the middle of the year.

The amount of interest on drawings works out to be Rs. 2,400 as follows:

Guarantee of Profit to a Partner

- When a new partner joins a firm, they might be promised a minimum share of the profits, regardless of the actual earnings. This guarantee can be provided by the existing partners, either collectively or individually.

- If the new partner's calculated share falls short of this guaranteed amount, the difference is covered by the guaranteeing partners.

- For instance, if a firm earns Rs.1,20,000 in profit and the partners decide on a profit-sharing ratio of 2:3:1 for Madhulika, Rakshita, and Kanishka, respectively:

- Madhulika's share: Rs.40,000 (2/6 of Rs.1,20,000)

- Rakshita's share: Rs.60,000 (3/6 of Rs.1,20,000)

- Kanishka's share: Rs.20,000 (1/6 of Rs.1,20,000)

- If Kanishka is guaranteed a minimum of Rs.25,000, the partners must cover the shortfall of Rs.5,000. This deficiency is split between the guaranteeing partners, Madhulika and Rakshita, in their profit-sharing ratio (2:3).

- This means:

- Madhulika covers Rs.2,000 (2/5 of Rs.5,000).

- Rakshita covers Rs.3,000.

- The final profit distribution would be:

- Madhulika: Rs.38,000 (Rs.40,000 - Rs.2,000)

- Rakshita: Rs.57,000 (Rs.60,000 - Rs.3,000)

- Kanishka: Rs.25,000 (Rs.20,000 + Rs.2,000 + Rs.3,000)

- If only one partner, like Rakshita, provides the guarantee, she would cover the entire deficiency of Rs.5,000. In that scenario, the profit distribution would be:

- Madhulika: Rs.40,000

- Rakshita: Rs.55,000 (Rs.60,000 - Rs.5,000)

- Kanishka: Rs.25,000 (Rs.20,000 + Rs.5,000)

Example: Mohit and Rohan share profits and losses in the ratio of 2:1. They admit Rahul as partner with 1/4 share in profits with a guarantee that his share of profit shall be at least Rs. 50,000. The net profit of the firm for the year ending March 31, 2015 was Rs. 1,60,000. Prepare Profit and Loss Appropriation Account.

Ans:

Working Notes:

The new profit-sharing ratio after the admission of Rahul comes to 2:1:1. As per this ratio the share of partners in the profit comes to:

Mohit = Rs. 1,60,000 × 2/4= Rs. 80,000

Rohan = Rs. 1,60,000 × 1/4= Rs. 40,000

Rahul = Rs. 1,60,000 × 1/4= Rs. 40,000

But, since Rahul has been given a guarantee of a minimum of Rs. 50,000 as his share of profit. The deficiency of Rs. 10,000 (Rs. 50,000 – Rs. 40,000) shall be borne by Mohit and Rohan in the ratio in which they share profits and losses between themselves, viz. 2:1 as follows:

Mohit’s share in deficiency comes to 2/3 × Rs. 10,000 = Rs. 6,667

Rohan’s share in deficiency comes to 1/3 × Rs. 10,000 = Rs. 3,333

Thus Mohit will get Rs. 80,000 – Rs. 6,667 = Rs. 73,333, Rohan will get

Rs. 40,000–Rs. 3,333 = Rs. 36,667 and Rahul will get Rs. 40,000 + Rs. 6,667 + Rs. 3,333 =

Rs. 50,000 in the profit of the firm.

Calculation of new profit sharing ratio

The new partner Rahul’s share is 1/4. The remaining profit is 1-1/4 = 3/4, to be shared between Mohit and Rohan in the ratio of 2:1.

Thus, the new profit-sharing ratio comes to be

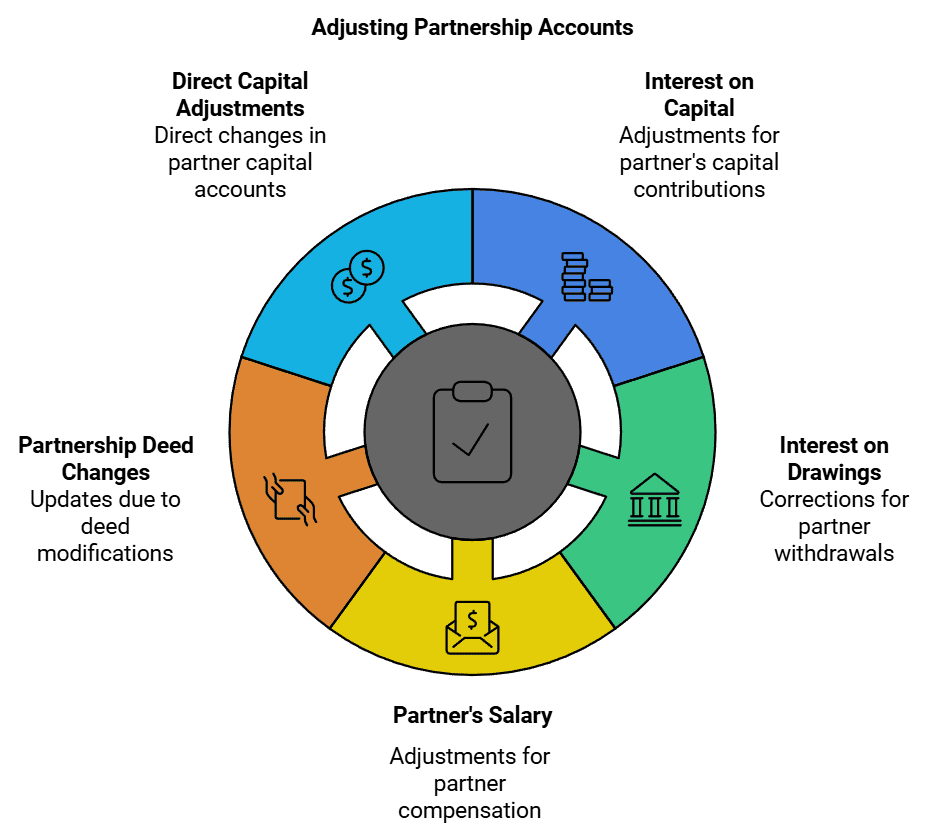

Past Adjustments

- Sometimes, after the final accounts are prepared and profits are distributed, mistakes or missing entries are found.

- These may include items like interest on capital, interest on drawings, interest on partners’ loans, partner’s salary, partner’s commission, or outstanding expenses.

- There may also be changes in the partnership deed or accounting system that affect past records.

- These omissions and errors need to be corrected.

- Instead of changing the old accounts, the necessary changes can be made using a Profit and Loss Adjustment Account or directly in the capital accounts of the concerned partners.

For example: Rameez and Zaheer are equal partners. Their capital as of April 01, 2015, was Rs. 50,000 and Rs. 1,00,000 respectively. After the accounts for the financial year ending March 31, 2016, had been prepared, it was discovered that interest at the rate of 6 per cent per annum, as provided in the partnership deed had not been credited to the partners’ capital accounts before the distribution of profit. In this case, the interest on capital not credited to the partners’ capital accounts works out to be Rs. 3000 (6/100 × Rs. 50,000) for Rameez and Rs. 6,000 (6/100 × Rs. 1,00,000) for Zaheer. Had the interest on capital been duly provided, the firm’s profit would have been reduced by Rs. 9,000. By this omission, the whole amount of profit as per the Profit and Loss Account (without adjustment of Rs. 9,000) has been distributed among the partners in their profit-sharing ratio, and the amounts of interest on capital have not been credited to their capital accounts.

This error can be rectified in any of the following ways:

(a) Through Profit and Loss Adjustment Account

(b) Directly in Partners’ Capital Accounts

For direct adjustment in partners’ capital accounts first, a statement to ascertain the net effect of omission on partners’ capital accounts will be worked out as follows and then the adjustment entries can be recorded.

The statement shows that Rameez has got excess credit of Rs. 1,500 while Zaheer’s account has been credited less by Rs. 1,500. In order to rectify the error Rameez’s capital account should be debited and of Zaheer, credited with Rs. 1,500 by passing the following journal entry;

Journal entry.

Example: Nusrat, Sonu and Himesh are partners sharing profits and losses in the ratio of 5 : 3 : 2. The partnership deed provides for charging interest on drawing’s @ 10% p.a. The drawings of Nusrat, Sonu and Himesh during the year ending March 31, 2015 amounted to Rs. 20,000, Rs. 15,000 and Rs. 10,000 respectively. After the final accounts have been prepared, it was discovered that interest on drawings has not been taken into consideration. Give necessary adjusting journal entry.

Ans: Journal Entry for adjustment of interest on drawings would be:

The people in the partnership are called “partners,” and together they form a “firm.”

The business name is the “firm’s name.”

Unlike a company, a partnership firm isn’t a separate legal entity—it’s just the partners working together.

|

42 videos|199 docs|43 tests

|

FAQs on Accounting for Partnerships: Basic Concepts Chapter Notes - Accountancy Class 12 - Commerce

| 1. What is a Profit and Loss Appropriation Account and how is it prepared? |  |

| 2. What are the important provisions of the Partnership Act that affect profit sharing? |  |

| 3. How are Partner's Capital Accounts maintained in a partnership? |  |

| 4. What is the significance of charging Interest on Capital in a partnership? |  |

| 5. How is Interest on Drawings calculated and why is it important? |  |