Class 10 Economics Chapter 3 Notes - Money and Credit

Introduction

Money is a central pillar in our lives, essential for both meeting daily needs and fulfilling our desires.

It often serves as a solution to many challenges we face. In the broader economic context, money performs three crucial functions:

- Medium of Exchange: Facilitates transactions.

- Unit of Account: Provides a common measure for valuing goods and services.

- Store of Value: Maintains purchasing power over time.

Credit, on the other hand, is equally vital. By enabling borrowing and lending, credit drives economic activity and fosters growth.

This chapter delves into the significant roles that money and credit play in shaping modern economies.

Money as a Medium of Exchange

Money

Money

- Everyone prefers to receive payments in money because it can be easily exchanged for any commodity or service they need.

- This flexibility allows individuals to use money to purchase exactly what they want.

Barter System:

- In the early periods when the use of money was not prominent, people had adopted a simple and convenient system where they exchanged goods with other types of goods. This was known as the Barter system.

- Suppose somebody has surplus vegetables and he needs wheat in lieu of that then he could find a person who has surplus wheat and needs vegetables.

Barter System

Barter System

Double Coincidence of wants:

Double Coincidence of Wants

Double Coincidence of Wants

Money

- Before the introduction of Modern day currency, grains, and cattle were used as money in India

- After them, coins of precious metals started getting used as a medium of exchange and this was the birth of money.

- As precious metals were difficult to procure, so slowly paper money or currency notes began to replace them.

- Now the government or government authorized body in a country issues currency notes for circulation.

- In India, the Reserve Bank of India issues currency notes. On the currency note, you can observe the statement promising a particular amount to be paid to the bearer of the currency note.

- Money removed the coincidence of wants factor and smoothens the exchange facilitating economic activity.

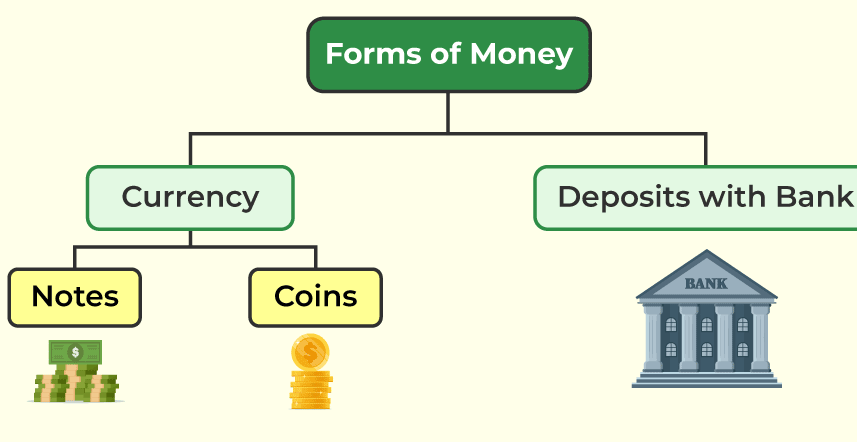

Modern forms of Money

Before the introduction of coins, a variety of objects was used as money. For example, since the very early ages, Indians used grains and cattle as money. Thereafter came the use of metallic coins — gold, silver, copper coins — a phase which continued well into the last century.

Currency

- Paper notes and coins are the modern form of currency.

- In India, the Reserve Bank of India issues currency notes on behalf of the central government.

- No other individual or organisation is allowed to issue currency.

- The rupee is widely accepted as a medium of exchange in India.

- So even though the materials used for making notes have no separate value, however, if the note is issued by the government, it becomes a medium of exchange.

Deposits with Banks

People often hold money in the form of bank deposits.

For example, workers who receive their salaries at the end of the month may have extra cash at the beginning of the month. To manage this surplus, they deposit it into their bank accounts.

- Interest on Deposits:

Banks accept these deposits and pay interest on them, ensuring that the money is both safe and earns a return.

Depositors can withdraw their money as needed, making these deposits known as demand deposits. - Cheque Payments: Demand deposits can also be used for payments via cheque.

A cheque is a written instruction from the account holder to the bank to pay a specific amount from their account to the recipient named on the cheque.

This system allows for convenient and secure transactions, making demand deposits a practical medium of exchange.

Modern Forms of Money

Modern Forms of Money

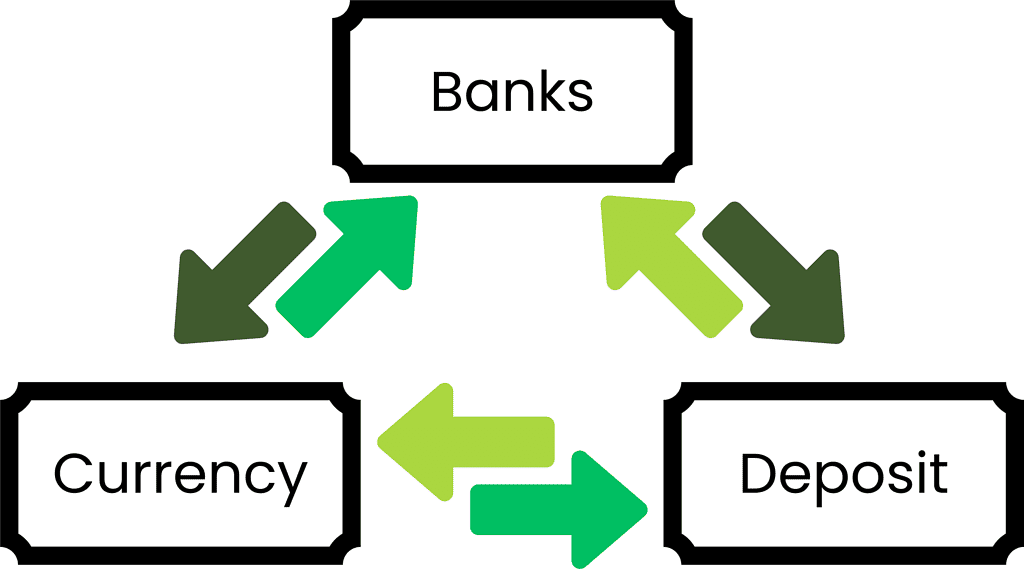

Loan Activities of Banks

1. Cash Reserves:

- Banks keep only a small fraction of their deposits as cash, about 15% in India.

- This cash is reserved to meet the withdrawal needs of depositors.

- Since only a portion of depositors withdraw money on any given day, banks can manage with this reserve.

2. Loan Extension:

- The majority of deposits are used by banks to extend loans.

- There is a high demand for loans for various economic activities, which banks address using these deposits.

3. Mediating Role:

- Banks act as intermediaries between depositors with surplus funds and borrowers in need of funds.

- They charge a higher interest rate on loans compared to the interest paid on deposits.

4. Income from Interest Rate Spread:

- The difference between the interest rates charged on loans and the rates paid on deposits constitutes the banks' main source of income.

Relationship Between Currency, Deposit and Bank

Relationship Between Currency, Deposit and Bank

Two Different Credit Situations

Two Different Credit Situations

Credit (Loan): A financial agreement where the lender provides the borrower with money, goods, or services with the understanding that the borrower will repay the amount in the future.

Here are 2 examples that helps you to understand how credit works :-

1) Festive Season

- Context: With the festival season approaching in two months, Salim, a shoe manufacturer, receives an order for 3,000 pairs of shoes to be delivered in a month.

- Production Needs: To fulfill the order on time, Salim needs to hire additional workers and purchase raw materials.

2. Sources of Credit:

- Supplier Credit: Salim arranges for leather from a supplier with the promise of future payment.

- Cash Loan: He also secures an advance payment for 1,000 pairs of shoes from the large trader, agreeing to deliver the entire order by the end of the month.

3. Outcome: With the credit, Salim completes production on time, delivers the order, earns a good profit, and repays the borrowed money.

4. Role of Credit: In this case, credit plays a crucial and positive role in meeting Salim's working capital needs, enabling him to manage production costs, meet deadlines, and ultimately increase his earnings.

2) Swapna’s Problem

1. Loan for Cultivation: Swapna, a small farmer, takes a loan from a moneylender to cover the expenses of cultivating groundnuts on her three acres of land, hoping to repay the loan with the harvest.

2. Crop Failure: Midway through the season, pests destroy her crop. Despite using expensive pesticides, the crop fails, leaving her unable to repay the loan. Her debt grows over the year.

3. Struggle with Debt: The following year, Swapna takes another loan for cultivation. Although the crop is normal, her earnings are not enough to repay the previous debt.

4. Consequences: Trapped in debt, Swapna is forced to sell part of her land to repay the loan. Instead of improving her situation, credit leaves her worse off, leading to what is commonly known as a debt trap.

Terms of Credit

Terms of Credit

- Interest Rate: Every loan agreement specifies an interest rate that the borrower must pay in addition to repaying the principal amount.

- Collateral: Lenders often require collateral, which is a valuable asset owned by the borrower, such as land, buildings, vehicles, livestock, or bank deposits. This collateral serves as a security for the loan.

- Guarantee: The borrower uses the collateral as a guarantee to the lender until the loan is fully repaid.

- Lender's Right: If the borrower cannot repay the loan, the lender has the right to sell the collateral to recover the money.

- Examples of Collateral: Common examples include land titles, bank deposits, and livestock.

Terms of Credit

Terms of Credit

- Terms of Credit:

The terms of credit include four main elements:1. Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount.

2. Collateral: Assets pledged by the borrower as security for the loan.

3. Documentation Requirements: The paperwork needed to process the loan.

4. Mode of Repayment: The agreed method and schedule for repaying the loan.These terms can vary widely depending on the specific credit arrangement and the relationship between the lender and borrower.

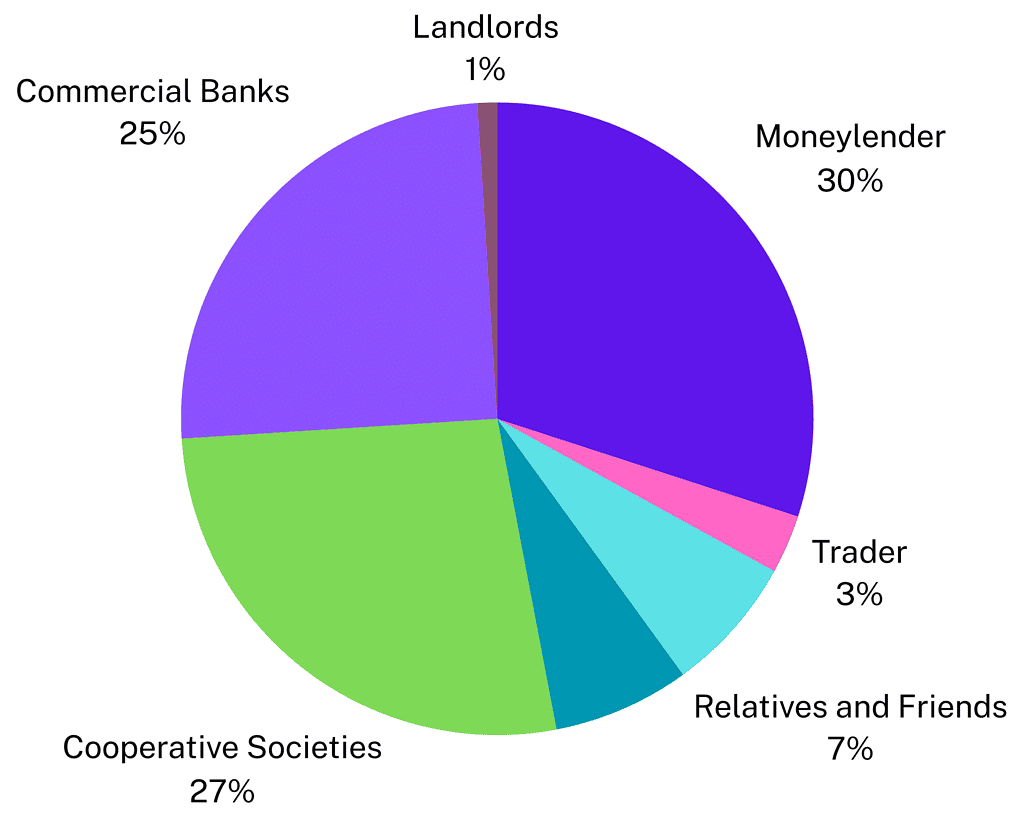

Formal Sector Credit in India

Formal Sector Credit in India

Cheap and affordable credit is crucial for the country’s development. The various types of loans can be grouped as:

(a) Formal sector loans:

- These are the loans from banks and cooperatives.

- The Reserve Bank of India oversees the operations of formal sources of loans.

- Banks are required to provide details to the RBI about their lending activities, including the amount lent, recipients, and interest rates.

(b) Informal sector loans:

- Loans come from various sources like moneylenders, traders, employers, relatives, and friends.

- No overseeingbody monitors these informal lenders.

- There are no restrictions preventing them from resorting to unfair tactics to retrieve their money.

Role of the Reserve Bank of India (RBI) and Credit Supervision:

Supervision of Formal Sources: The RBI oversees the functioning of formal loan sources like banks. It ensures banks maintain a minimum cash balance and provides loans not only to profitable businesses but also to small cultivators, small-scale industries, and other small borrowers.

Reporting Requirements: Banks are required to periodically report to the RBI on their lending practices, including the amount lent, the recipients, and the interest rates charged.

Lack of Supervision in Informal Sector: Unlike formal lenders, informal sector lenders are not regulated. They can charge any interest rate and use unfair practices to recover loans, leading to higher borrowing costs.

Impact of High Interest Rates: Informal lenders often charge significantly higher interest rates, resulting in a greater financial burden on borrowers. This reduces their income and, in some cases, leads to a debt trap where repayments exceed their income.

Need for More Formal Lending: To mitigate these issues, it is essential for banks and cooperative societies to increase their lending. Access to affordable credit would enable individuals to invest in agriculture, businesses, and small-scale industries, fostering economic growth and development.

Formal and Informal Credit: Who gets What?

- It is necessary that banks and cooperatives increase their lending, particularly in rural areas, so that the dependence on informal sources of credit reduces.

- While the formal sector loans need to expand, it is also necessary that everyone receives these loans.

Sources of Credit

Sources of Credit- The RBI sees that the banks give loans not just to profit-making businesses and traders but also to small cultivators, small scale industries, to small borrowers etc. Periodically, banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate, etc.

- There is no organisation that supervises the credit activities of lenders in the informal sector. Compared to the formal lenders, most of the informal lenders charge much higher interest on loans. Thus, the cost to the borrower of informal loans is much higher.

- A higher cost of borrowing means a larger part of the earnings of the borrowers is used to repay the loan. In certain cases, the high-interest rate of borrowing can mean that the amount to be repaid is greater than the income of the borrower.

- This could lead to increasing debt and a debt trap. Also, people who might wish to start an enterprise by borrowing may not do so because of the high cost of borrowing.

For these reasons, banks and cooperative societies need to lend more.

Self Help groups for the Poor

Self Help groups for the Poor

- A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save regularly. Saving per member varies from Rs 25 to Rs 100 or more, depending on the ability of the people to save.

- Members can take small loans from the group itself to meet their needs.

- The group charges interest on these loans but this is still less than what the moneylender charges. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

- The loan is sanctioned in the name of the group and is meant to create self-employment opportunities for the members.

- Most of the important decisions regarding the savings and loan activities are taken by the group members. The group decides as regards the loans to be granted — the purpose, amount, interest to be charged, repayment schedule etc.

- Also, it is the group that is responsible for the repayment of the loan. Any case of non-repayment of the loan by any one member is followed up seriously by other members in the group.

- Because of this feature, banks are willing to lend to the poor women when organised in SHGs, even though they have no collateral as such.

Overcoming Collateral Issues: SHGs assist borrowers by alleviating the need for collateral. Members can access timely loans for various purposes at reasonable interest rates.

Empowering Rural Poor: SHGs serve as foundational structures for organizing the rural poor, particularly empowering women to achieve financial self-reliance.

Social Impact: Regular group meetings offer a platform for discussing and addressing social issues, such as health, nutrition, and domestic violence, fostering community development beyond financial support.

- It helps borrowers to overcome the problem of lack of collateral.

- People can get timely loans for a variety of purposes and at a reasonable interest rate.

- SHGs are the building blocks of the organisation of the rural poor.

- It helps women to become financially self-reliant.

- The regular meetings of the group provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

DO YOU KNOW ? Grameen Bank of Bangladesh: Empowering the Poor Through Microcredit The Grameen Bank in Bangladesh is a remarkable example of successfully providing credit to the poor at reasonable rates. It began in the 1970s as a small initiative but has since grown significantly. By 2018, the bank had over 9 million members across approximately 81,600 villages in Bangladesh.

Most of the borrowers are women from the poorest segments of society. These women have demonstrated that they are not only reliable borrowers but also capable of starting and managing various small income-generating activities successfully. The Grameen Bank model highlights the potential of microcredit in empowering the poor and fostering economic development.

Summing Up

In this chapter, we explored modern forms of money and their connection to the banking system.

- Role of Banks: Depositors keep their money in banks, while borrowers take loans from these institutions. Economic activities often require credit, which can have both positive and negative impacts.

- Sources of Credit: Credit is available from both formal and informal sources, with significant variations in terms between them. Currently, richer households have better access to formal credit, while the poor rely on informal sources, which are often more expensive.

- Need for Reform: To reduce dependence on costly informal credit, it is crucial to increase the availability of formal sector credit. Ensuring that the poor receive a larger share of formal loans from banks and cooperative societies is essential for economic development.

|

64 videos|445 docs|87 tests

|

FAQs on Class 10 Economics Chapter 3 Notes - Money and Credit

| 1. What is the role of money as a medium of exchange? |  |

| 2. What are the modern forms of money mentioned in the chapter? |  |

| 3. How do banks engage in loan activities? |  |

| 4. What are the key differences between formal and informal credit mentioned in the chapter? |  |

| 5. How do self-help groups help the poor in accessing credit facilities? |  |

|

Explore Courses for Class 10 exam

|

|