Balance of Payments & Foreign Exchange Rate Class 12 Economics

| Table of contents |

|

| Introduction |

|

| The Balance of Payments |

|

| The Foreign Exchange Market |

|

| Determination of the Exchange Market |

|

| Determination of Equilibrium Income in Open Economy |

|

Introduction

An open economy interacts with other countries through various channels, unlike a closed economy with no external linkages. It trades goods, services, and financial assets internationally, fostering economic growth and global integration.

Three main ways in which these linkages are established in an open economy:

1. Output Market: Involves trade in goods and services between countries, providing consumers and producers with a wider range of choices.

2. Financial Market: Allows investors to buy financial assets from other countries, expanding investment opportunities beyond domestic borders.

3. Labour Market: Enables firms to choose production locations and workers to choose employment destinations, although immigration laws may restrict labour movement.

Foreign trade affects Indian aggregate demand in two ways: imports decrease it (leakage), while exports increase it (injection).

- Foreign economic agents require stable purchasing power in a national currency.

- Confidence instability is crucial for acceptance as an international medium of exchange.

- Lack of stability undermines trust, hindering usage as a unit of account in global transactions.

- Governments historically promised national currency convertibility into fixed assets.

- Typically, assets included gold or other currencies.

- Issuing authorities relinquish control over the asset's value.

- Credibility relied on unrestricted conversion and fixed conversion rates.

- The international monetary system regulated these aspects for stability in global transactions.

- Increased transaction volumes led to the decline of gold as the asset backing national currency convertibility.

- While some national currencies have international acceptance, the currency used in transactions between countries is crucial.

- The chosen currency for trade transactions holds significance, regardless of the international acceptability of individual currencies.

The Balance of Payments

Meaning: The balance of payments of a country is a systematic record of all economic transactions between residents of a country and residents of foreign countries during a given period of time.

There are two main accounts in BoP - the current account and the capital account

Current Account: The current account is a record of a country's trade in goods and services, along with transfer payments. It includes exports, imports, and various payments and receipts, such as remittances and grants, without expecting goods or services in return.

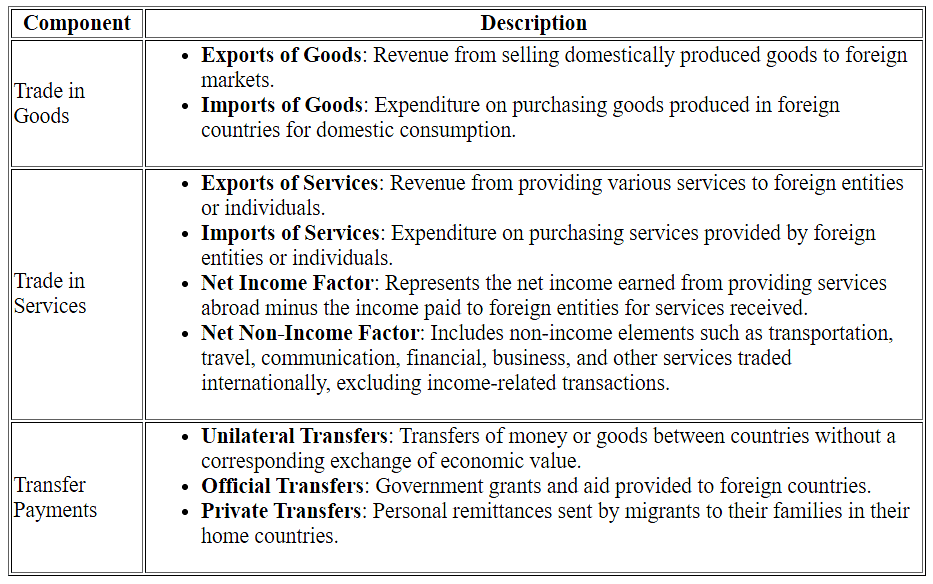

Components of Current Account

Components of Current Account

Balance on Current Account

When the receipts and payments on the current account are equal, the current account is balanced. A surplus indicates that the nation lends to other countries, while a deficit suggests that the nation borrows from them.

Balance on the Current Account has two components:

- Balance of Trade: A balanced Balance of Trade (BOT) occurs when a country's exports of goods equal its imports. A surplus BOT arises when exports exceed imports, while a deficit occurs when imports exceed exports. Net Invisibles represent the difference between a country's exports and imports of services, transfers, and income flows. These include factor income from production factors and non-factor income from service products like shipping, banking, and tourism. It is also known as Trade Balance.

- Balance of Payments: The balance on invisibles refers to the net difference between the value of exports and imports of services, transfers, and income flows between countries. It includes factor income earned from production factors (like labour and capital) and non-factor income from service products (such as shipping and tourism). A positive balance indicates that a country earns more from its invisible transactions than it spends, while a negative balance suggests the opposite.

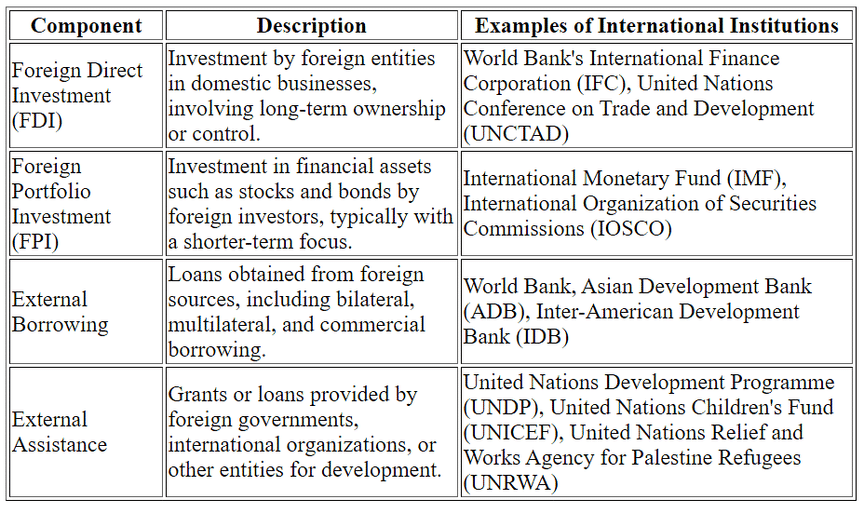

Capital Account: The Capital Account records all international transactions involving assets, which can include money, stocks, bonds, and government debt. Purchases of assets are debits on the capital account, such as when an Indian buys a UK car company, resulting in foreign exchange flowing out of India. Conversely, sales of assets, like selling shares of an Indian company to a Chinese customer, are credits on the capital account. Capital account transactions include Foreign Direct Investments (FDIs), Foreign Institutional Investments (FIIs), external borrowings, and assistance.

Balance on Capital Account

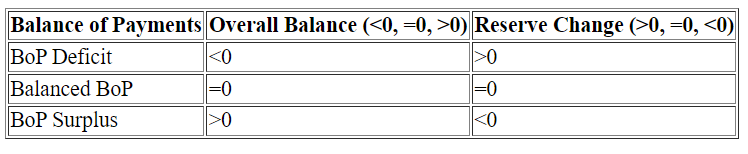

The Capital Account is balanced when capital inflows (e.g., loans, asset sales) equal outflows (e.g., loan repayments, asset purchases). A surplus occurs when inflows exceed outflows, while a deficit arises when outflows surpass inflows.Balance of Payments Surplus and Deficit

The essence of international payments resembles an individual's budgeting: if a country has a current account deficit (spending exceeds income), it must finance it by selling assets or borrowing abroad. Thus, a deficit is balanced by a capital account surplus, representing a net inflow of capital. In balance of payments equilibrium, the deficit is fully financed by international borrowing, without using reserves.

- Foreign exchange reserves: Assets held to stabilize currency and meet international obligations, safeguarding economic stability.

- Balance of payments deficits: Occur when expenditures exceed revenues, necessitating intervention to maintain stability.

- Official reserve sales: Central bank's selling of foreign exchange reserves to counterbalance deficits and stabilize the currency.

- Official reserve transactions: All transactions except those in this category may be termed autonomous transactions. They are so-called because they were entered into with some independent motive. Balance of payments always balance.

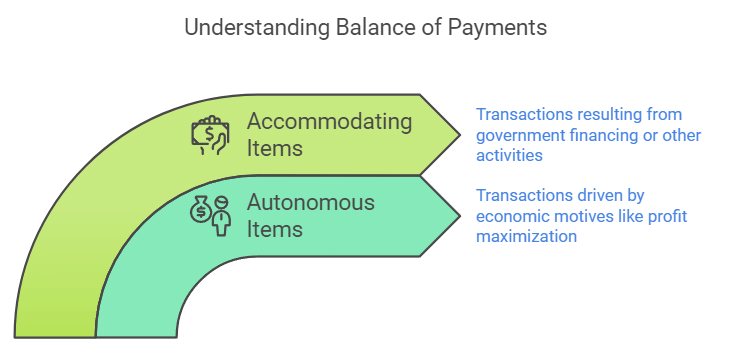

Autonomous and Accommodating Items

- Autonomous items: Autonomous items in the B.O.P refer to international economic transactions that take place due to some economic motive such as profit maximization. These items are often called above-the-line items in the B.O.P.

The balance of payments is in a deficit if the autonomous receipts are less than autonomous payments. The monetary authorities may finance a deficit by depleting their reserves of foreign currencies, or by borrowing from I.M.F. - Accommodating items: Accommodating items in the B.O.P. refer to transactions that occur because of other activity with the B.O.P such as government financing. Accommodating items are also referred to as below the line of items.

Errors and Omissions: In the Balance of Payments (BoP), alongside the current and capital accounts, there's a third component known as "errors and omissions." This element accounts for inaccuracies in recording international transactions. The following table illustrates a sample BoP for India, highlighting a trade deficit and current account deficit, yet a capital account surplus.

Sample of Balance of Payments for India

Sample of Balance of Payments for India

The Foreign Exchange Market

- Our exploration of international transactions now narrows to focus on a single transaction scenario.

- Understanding the exchange rate becomes crucial as it determines the price of currencies in the foreign exchange market.

- Major participants in this market include commercial banks, foreign exchange brokers, authorized dealers, and monetary authorities.

- Despite these entities potentially operating from their own trading centres, it's essential to recognize that the foreign exchange market operates globally.

- This global operation facilitates trading across multiple locations, with seamless communication between trading centres enabling participants to engage in transactions across various markets.

Foreign Exchange Rate

- Foreign Exchange refers to all currencies other than the domestic currency of a given country.

- Foreign exchange rate is the rate at which the currency of one country can be exchanged for the currency of another country.

- Foreign Exchange Market: The Foreign Exchange market is the market where the national currencies are traded for one another.

- Functions of Foreign Exchange Market:

- Transfer function: It transfers the purchasing power between countries.

- Credit function: It provides credit channels for foreign trade

- Hedging function: It protects against foreign exchange risks.

Demand For and Supply of Foreign Exchange

Demand for Foreign Exchange- To purchase goods and services from other countries

- To send gifts abroad

- To purchase financial assets (shares and bonds)

- To speculate on the value of foreign currencies

- To undertake foreign tours

- To invest directly in shops, factories, buildings

- To make payments of international trade.

Supply of foreign exchange:

Foreign currencies flow into the domestic economy due to the following reason.

- When foreigners purchase home countries goods and services through exports

- When foreigners invest in bonds and equity shares of the home country.

- Foreign currencies flow into the economy due to currency dealers and speculators.

- When foreign tourists come to India

- When Indian workers working abroad send their savings to families in India.

Determination of the Exchange Market

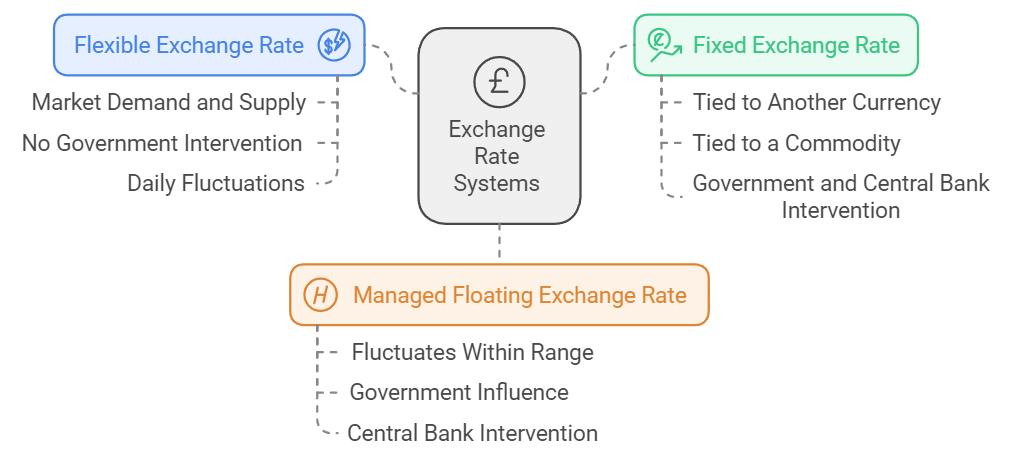

Different countries adopt different methods to determine their currency's exchange rate based on their economic policies and goals:

Flexible Exchange Rate: Determined by market demand, and supply. Value fluctuates freely, with no government, or central bank intervention. Market forces set currency value, leading to daily fluctuations.

Fixed Exchange Rate: Currency value tied to another currency, or commodity. The government, and central bank intervene to maintain fixed value, buying, and selling currency reserves.

Managed Floating Exchange Rate: Hybrid system, currency fluctuates within range. The government, and central bank intervene to influence the exchange rate if deviates too much.

Flexible Exchange Rate

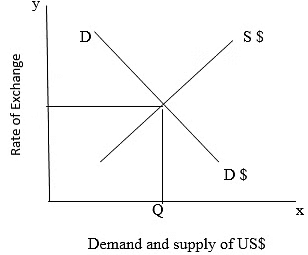

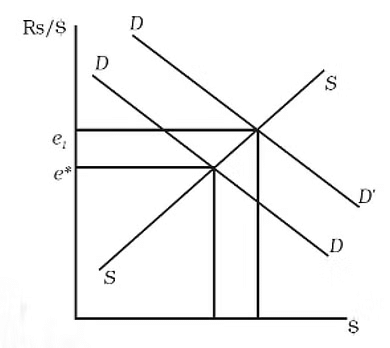

- Flexible exchange rates determined by market forces

- Demand and supply intersection sets rates

- Increased demand for foreign goods shifts the demand curve

- Higher demand leads to currency depreciation

- Depreciation means more domestic currency needed for one unit of foreign currency

- Appreciation occurs when domestic currency strengthens

- Appreciation means fewer units of domestic currency needed for one unit of foreign currency

When demand for foreign goods and services rises, like due to increased international travel among Indians, the exchange rate shifts. Initially at 50 Rupees per Dollar (e0), it rises to 70 Rupees per Dollar at the new equilibrium (e1). This means Rupees have depreciated against Dollars, costing more Rupees for each Dollar.

Below is the graph of Equilibrium Under a Flexible Exchange Rate

Effect of an Increase in Demand for Imports in the Foreign Exchange Market

Effect of an Increase in Demand for Imports in the Foreign Exchange Market

Interest Rates and the Exchange Rate

In the short term, interest rate differentials between countries impact exchange rates. Funds from banks, corporations, and individuals flow globally to seek higher interest rates. For instance, if Country A offers 8% interest on government bonds and Country B offers 10%, investors from A will buy B's currency, depreciating A's currency and appreciating B's. Domestic interest rate hikes often lead to currency appreciation, assuming no restrictions on foreign bond purchases.

Income and the Exchange Rate

- Increased income boosts consumer spending and imports.

- Higher imports shift demand curve for foreign exchange rightward, depreciating domestic currency.

- Increased foreign income raises domestic exports, shifting foreign exchange supply curve outward.

- Currency depreciation hinges on whether exports outpace imports; faster domestic demand growth typically leads to depreciation.

Exchange Rates in the Long Run

- Purchasing Power Parity (PPP) theory predicts long-run exchange rates in flexible systems.

- Assumes no trade barriers like tariffs or quotas.

- Exchange rates adjust so identical products cost the same regardless of currency (e.g., a product costs the same whether measured in rupees in India, dollars in the US, yen in Japan).

- Long-term rates reflect differences in price levels between countries.

Exchange Rate

Exchange Rate

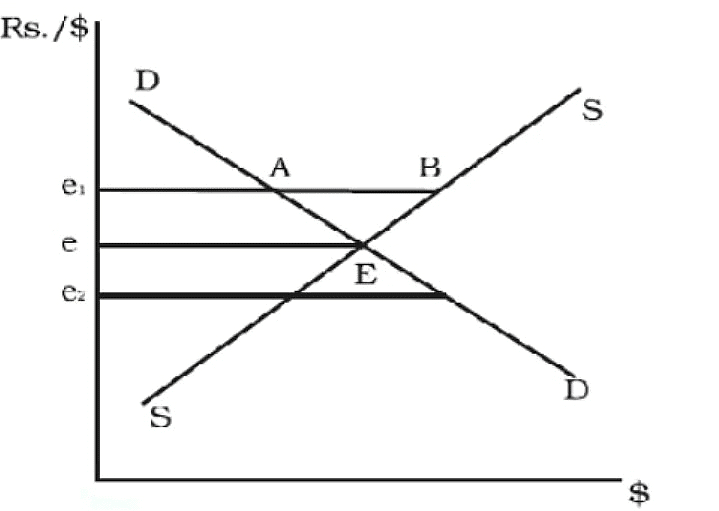

Fixed Exchange Rates

- In fixed exchange rate systems, the government fixes the exchange rate (e.g., Rs 70 per dollar instead of Rs 50).

- Higher rate leads to excess dollar supply, requiring RBI intervention to purchase them (e.g., intervention at rate e1).

- Conversely, lower rate like e2 leads to excess dollar demand, risking a black market for dollars.

- Increasing rate is Devaluation, decreasing is Revaluation (e.g., making domestic currency cheaper or costlier).

Foreign Exchange Market with Fixed Exchange Rates

Foreign Exchange Market with Fixed Exchange Rates

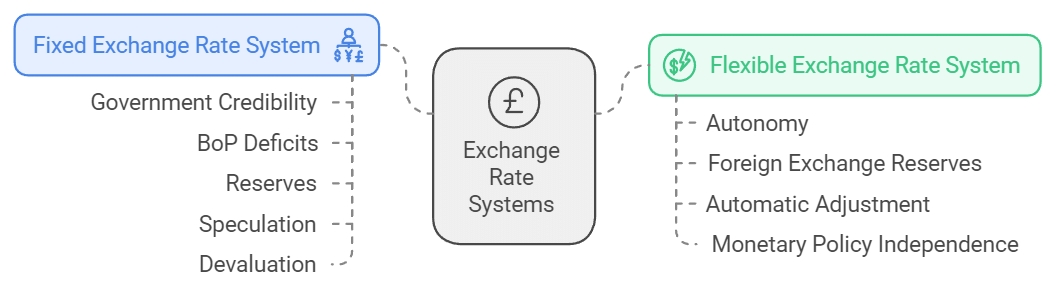

Merits and Demerits of Flexible and Fixed Exchange Rate Systems

- A fixed exchange rate system requires government credibility to maintain a specified rate.

- Deficits in BoP may prompt government intervention using reserves.

- Insufficient reserves may lead to doubts and speculation, potentially triggering devaluation.

- Speculative attacks on currency can occur if doubts lead to aggressive buying.

- A flexible exchange rate system offers the government more autonomy, requiring fewer foreign exchange reserves.

- Advantages include automatic adjustment of surpluses and deficits in BoP.

- Countries gain independence in conducting monetary policies due to minimal intervention needs.

Managed Floating: This is the combination of fixed and flexible exchange rates. Under this, the country manipulates the exchange rate to adjust the deficit in the B.O.P by following certain guidelines issued by I.M.F.

Dirty floating: If the countries manipulate the exchange rate without following the guidelines issued by the I.M.F is called as dirty floating.

Determination of Equilibrium Income in Open Economy

Given the choice to purchase goods from both local and international sources, it's crucial to differentiate between overall demand for goods and specifically for those produced domestically by consumers and firms.

National Income Identity for an Open Economy

In a closed economy, three sources drive demand for domestic goods: consumption (C), government spending (G), and domestic investment (I)

We can write

Y = C+ I+ G

In an open economy, exports (X) increase demand for domestic goods and services from abroad, while imports (M) add to the supply of foreign goods domestically. Thus, the national income identity must include both exports and imports.

Y + M = C + I + G + X

On rearranging we get

Y = C + I + G + X – M

or

Y = C + I + G + NX

Where NX represents net exports (exports - imports). A positive NX, indicating exports surpassing imports, signifies a trade surplus. Conversely, a negative NX, indicating imports exceeding exports, denotes a trade deficit.

To analyze how imports and exports influence equilibrium income in an open economy, we follow the same process as in a closed economy, treating investment and government spending as autonomous. Additionally, we must specify the factors influencing imports and exports. Import demand is influenced by domestic income (Y) and the real exchange rate (R). Increased income results in higher imports.

- Real exchange rate (R) compares foreign goods' price to domestic goods'.

- Higher R makes foreign goods relatively more expensive, decreasing imports.

- Imports increase with domestic income (Y) but decrease with R.

- Exports are essentially the imports of other countries.

- Our exports depend on foreign income (Yf) and R.

- Higher Yf boosts foreign demand for our goods, increasing exports.

- A higher R, making domestic goods cheaper, also boosts exports.

- Exports depend on foreign income and the real exchange rate.

- Assuming constant price levels and nominal exchange rates, R remains fixed.

- From our country's perspective, foreign income and exports are exogenous (X = Xmean ).

- Import demand depends on income and has an autonomous component.

The marginal propensity to import (MPI) represents the fraction of an additional rupee of income spent on imports, similar to the concept of the marginal propensity to consume (MPC).

|

64 videos|308 docs|51 tests

|

FAQs on Balance of Payments & Foreign Exchange Rate Class 12 Economics

| 1. What is the balance of payments? |  |

| 2. How does the foreign exchange market work? |  |

| 3. How is the exchange rate determined? |  |

| 4. What is meant by the equilibrium income in an open economy? |  |

| 5. How does an open economy affect the determination of equilibrium income? |  |