Recording of Transactions-II Chapter Notes | Accountancy Class 11 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Purchases (Journal) Book |

|

| Purchases Return (Journal) Book |

|

| Sales (Journal) Book |

|

| Sales Return (Journal) Book |

|

| Balancing the Accounts |

|

Introduction

A journal is a book of original entries. It is a complete record of all the transactions of the business. However, the journal is used for recording all the transactions of the business. At times, the number of transactions is too large and it becomes cumbersome to record all of them in one book. The solution lies in dividing the Journal into different parts known as Special Journals.

Special Journals are meant to record all transactions of a similar nature.

- Cash Book is a special journal that records all cash receipts and cash payments.

- Purchases Book records all credit purchases of goods.

- Purchases Return Book records all goods returned to suppliers.

- Sales Book records all credit sales of goods.

- Sales Return Book records all goods returned by customers.

- Journal Proper is used for recording transactions that cannot be recorded in any special journal.

Special journals are cost-effective and facilitate the division of labour in accounting tasks. Many business transactions are repetitive and can be efficiently recorded in designated special journals, each tailored for similar types of transactions. For instance, all cash transactions may be documented in one journal, credit sales in another, and credit purchases in yet another. These special journals, also referred to as daybooks or subsidiary books, allow for streamlined recording.

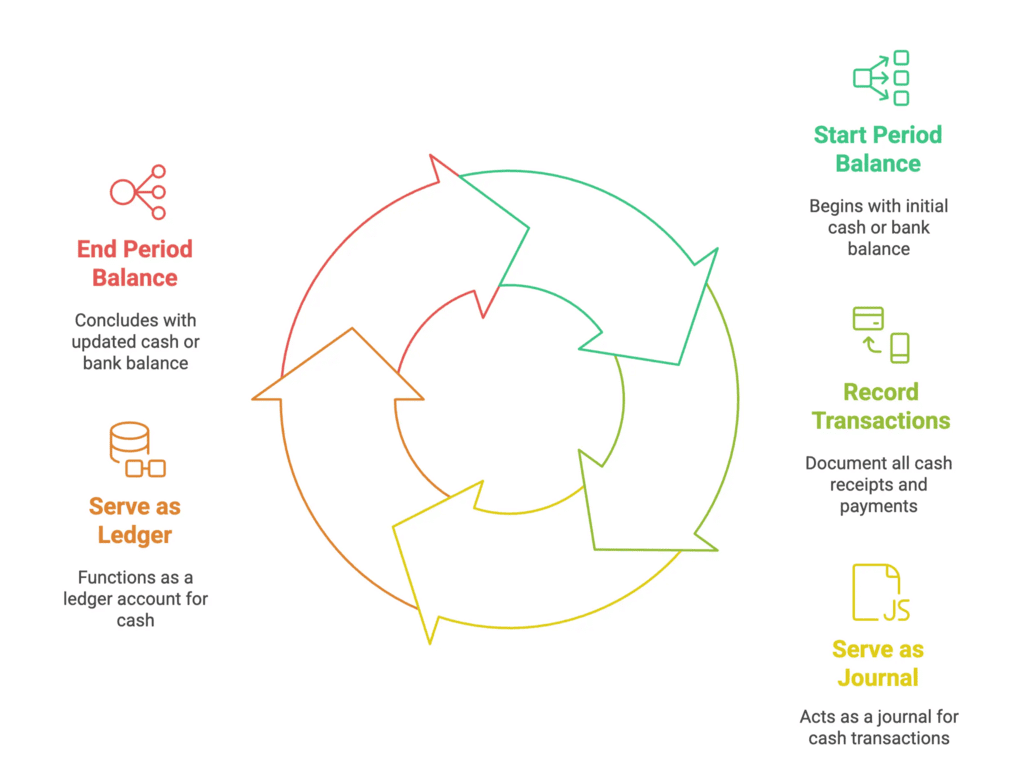

Cash Book

- A cash book is a financial record that keeps track of all transactions involving cash receipts and cash payments. It begins with the cash or bank balances at the start of the period and is typically prepared every month.

- Cash books are widely used by organizations of all sizes, whether for-profit or non-profit. They serve the dual purpose of a journal and a ledger (cash) account.

- This book is also known as the book of original entries. When a cash book is maintained, cash transactions are not recorded in the journal, and separate accounts for cash or bank are not needed in the ledger.

Single Column Cash Book

- The single-column cash book is used to record all cash transactions of a business in chronological order, capturing both cash receipts and cash payments.

- It is applicable when all receipts and payments are made exclusively in cash by the business organization. In this case, the cash book contains only one amount column on each side (debit and credit).

The recording of entries in the single-column cash book and its balancing is illustrated by an example. Consider the following transactions of M/s Roopa Traders and observe how they are recorded in a single-column cash book.

Posting of the Single Column Cash Book

- The left side of the cash book records cash receipts, while the right side records cash payments.

- Accounts appearing on the debit side of the cash book are credited to the respective ledger accounts because cash has been received.

- For example, an entry like "cash received from Gurmeet" on the debit side indicates that cash has been received from Gurmeet.

- As a result, Gurmeet's account in the ledger will be credited with "Cash" in the particulars column on the credit side.

- Similarly, accounts appearing on the credit side of the cash book are debited because cash or cheque has been paid in respect of them.

- This process ensures that all transactions are accurately reflected in the related ledger accounts.

Double Column Cash Book:

- Two Columns for Amounts: The double-column cash book features two columns for amounts on each side.

- Increased Bank Transactions: Nowadays, there are numerous bank transactions, and many organizations prefer to conduct all receipts and payments through the bank.

- Current Accounts: Businessmen typically open current accounts with banks. While banks do not pay interest on current account balances, they may charge incidental fees for the services provided.

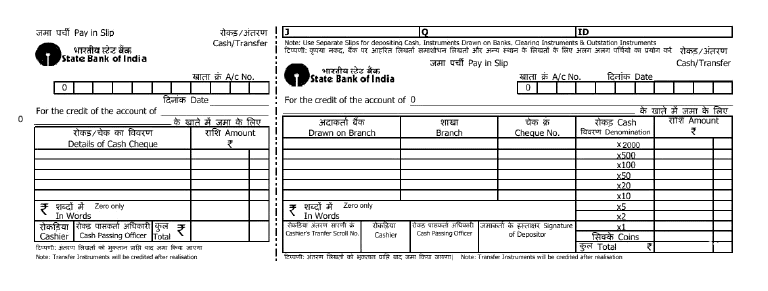

- Pay-in-Slips: To deposit cash or cheques into a bank account, a pay-in-slip form must be filled out. This form includes a counterfoil that is returned to the customer as a receipt, signed by the cashier.

- Cheque Forms: Banks issue blank cheque forms to account holders for withdrawing money. The account holder fills in the name of the payee after the word "Pay" on the cheque.

A pay-in-slip

A pay-in-slip

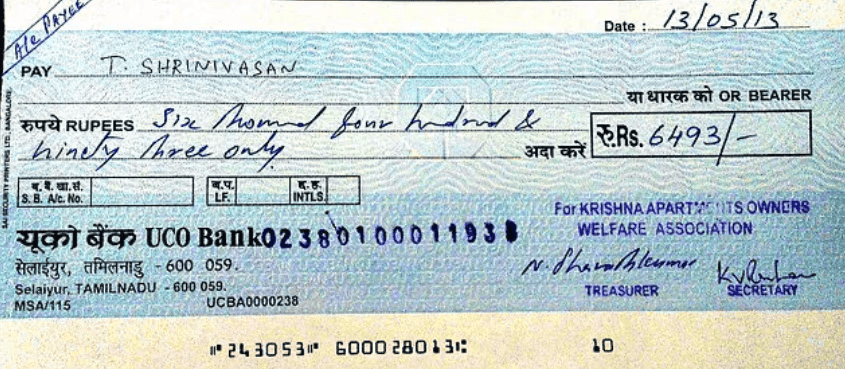

A cheque

A cheque

Cheque Forms:

- Bearer Cheque: When the word "bearer" is printed on a cheque, it means payment is to be made to the person whose name is written after "pay" or to the bearer of the cheque.

- Order Cheque: If "bearer" is crossed out, the cheque becomes an order cheque. This means payment is to be made to the person named on the cheque or to their order, after proper identification.

Crossing of Cheques:

- Cheques are often crossed in practice for security. A crossed cheque cannot be paid directly to the party at the counter; it must be paid through a bank.

Types of Crossing:

(a) A/c Payee Only Crossing: This type of crossing allows the cheque amount to be deposited only in the account of the person named on the cheque.

(b) Special Crossing: When the name of a bank is written between two parallel lines on the cheque, it becomes a special crossing. Payment can only be made to the bank whose name is written between the lines.

Transfer of Cheques:

- A cheque can be transferred by the payee (the person in whose favour the cheque has been drawn) to another person if it is not crossed "A/c payee only."

- Bearer Cheque Transfer: A bearer cheque can be passed on by mere delivery.

- Order Cheque Transfer: An order cheque can be transferred by endorsement and delivery. Endorsement involves writing instructions to pay the cheque to a particular person and signing it on the back of the cheque.

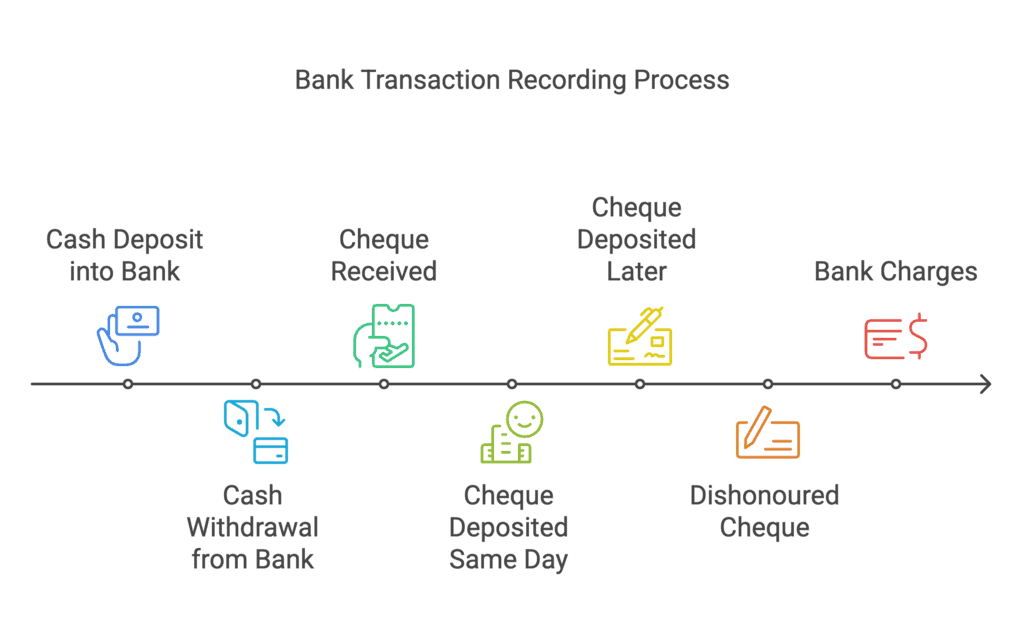

Bank Transactions in Cash Book:

- When there are many bank transactions, it's easier to have a separate amount column for these transactions in the cash book instead of recording them in the journal. This allows for quick updates on the bank account status.

- Similar to cash transactions, deposits into the bank are recorded on the left side, while withdrawals/payments through the bank are recorded on the right side.

- When cash is deposited in or withdrawn from the bank, both aspects of the transaction are recorded in the cash book.

- For cash deposits into the bank, the amount is written on the left side in the bank column and on the right side in the cash column. The reverse entries are made when cash is withdrawn from the bank for office use.

- The letter "C," indicating "contra," is written in the L.F. column for these entries, signifying that they are not to be posted to the ledger account.

- Balancing the Columns: The bank column is balanced similarly to the cash column. However, the bank column can also show a credit balance due to overdrafts, which occur when cash withdrawn from the bank exceeds the amount deposited.

- Cheques Received: When a cheque is received, it should be recorded in the bank column of the cash book. If the cheque is deposited on the same day, the amount is recorded in the bank column on the receipts side. If it is deposited on a later day, it is initially recorded in the cash column on the receipts side and then in the bank column on the day of deposit, with a contra entry in the cash column on the payment side.

- Dishonoured Cheques: If a cheque received from a customer is dishonoured, the bank will return it and debit the firm's account. Upon receiving the dishonoured cheque or notification from the bank, the firm will make a credit entry in the cash book by entering the dishonoured cheque amount in the bank column and the customer's name in the particulars column. This entry restores the position before the cheque is received and deposited. Dishonour of a cheque typically occurs due to insufficient funds in the customer's bank account.

- Bank Charges: If the bank debits the firm for interest, commission, or other charges, the entry will be made on the credit side in the bank column. Conversely, if the bank credits the firm's account, the entry will be made on the debit side of the cash book in the appropriate column.

Format of a Double Column Cash Book

- The format of the double-column cash book is illustrated in the figure below.

We will now learn how the transactions are recorded in the double-column cash book.

Consider the following example: The following transactions related to M/s Tools India:

The double-column cash book based on the above business transactions will prepared as follows:

Records and Posting

- When the bank column is kept in the cash book, there is no need to open a separate bank account in the ledger. The bank column itself serves the purpose of the bank account.

- Entries marked with "C", known as contra entries, are ignored when posting from the cash book to the ledger. These entries represent a debit or credit of the cash account against the bank account, or vice versa.

- Now, let's see how the transactions recorded in the double-column cash book are posted to individual accounts.

Petty Cash Book:

- Definition: A petty cash book is a record maintained by a petty cashier to track small, repetitive expenses in an organization.

- Purpose: It helps avoid overburdening the main cashier and prevents the cash book from becoming too bulky.

- System: The petty cashier operates on the imprest system, where a fixed amount (e.g., ₹ 2,000) is given at the beginning of a period.

- Reimbursement: When the petty cashier spends a substantial portion of the imprest amount (e.g., ₹ 1,780), they get reimbursed by the head cashier, restoring the full imprest amount for the next period.

- Frequency: Reimbursements can be made weekly, fortnightly, or monthly, depending on the frequency of small payments.

- Columns: The petty cash book has multiple columns for specific payment items, a miscellaneous column for unspecified payments, and a remarks column to describe the nature of each payment.

- Totalling: At the end of the period, all amount columns are totalled to show the total spent and to be reimbursed.

- Receipt Side: On the receipt side, there is only one amount column, while columns for date, voucher number, and particulars are common for both receipts and payments.

Advantages of Maintaining Petty Cash Book:

- Saving Time and Effort: The chief cashier doesn't have to handle petty disbursements, allowing them to focus on larger cash transactions. This division of labor saves time and helps the chief cashier perform their duties more effectively.

- Effective Cash Control: Dividing the work makes cash control easier. The head cashier can directly oversee big payments and monitor petty payments by keeping an eye on the petty cashier. This reduces the chances of fraud and embezzlement.

- Convenient Recording: Recording petty disbursements in the main cash book makes it bulky and unmanageable. The materiality principle suggests that insignificant details need not be included in the main cashbook. This way, the cash book only shows material and useful information.

- Cost Reduction: Preparing a petty cash book is a cost reduction control measure. Recording small payments in the petty cash book is easier, and it saves time and effort by posting totals of different types of expenses to the ledger instead of individual items.

For example, Mr. Mohit, the petty cashier of M/s Samaira Traders received Rupees 2,000 on May 01, 2017 from the Head Cashier. For the month, details of petty expenses are listed here under:

Posting from the Petty Cash Book

- The petty cash book is balanced regularly. Balance is the difference between total receipts and total payments.

- The balance is carried forward to the next period, and the petty cashier is reimbursed for the actual amount spent.

- A petty cash account is created in the ledger and debited with the amount given to the petty cashier.

- Each expense account is individually debited with the periodic total from the respective column, mentioning "petty cash account."

- The petty cash account is credited with the total expenditure incurred during the period, labelled as "sundries" according to the petty cash book.

- The petty cash account is then balanced, reflecting the actual cash held by the petty cashier.

The petty cash book for the month will be prepared as follows:

Balancing of Cash Book

- Left Side: All cash receipts (debits) are entered here, date-wise.

- Right Side: All cash payments (credits) are recorded here, also date-wise.

- When maintaining a cash book, a separate cash book in the ledger is not necessary.

- The cash book is balanced like any other account in the ledger. However, it will always show a debit balance because cash payments can never exceed cash receipts and the cash in hand at the beginning of the period.

- Source Documents: For cash receipts, the source document is usually a duplicate copy of the receipt issued by the cashier. For payments, any document such as an invoice, bill, or receipt serves as the source document for recording transactions in the cash book.

- After making a payment, these documents, known as vouchers, are given a serial number and filed in a separate folder for future reference and verification.

Example: From the following transactions made by M/s Kuntia Traders, prepare the single-column cashbook.

Ans:

Ans:

Purchases (Journal) Book

- Credit Purchases of Goods: Recorded in the purchases journal.

- Cash Purchases: Recorded in the cash book.

- Other Purchases (e.g., office equipment, furniture, buildings): Recorded in the journal proper if purchased on credit, or in the cash book if purchased for cash.

- Source Documents: Invoices or bills from suppliers are used for recording entries.

- Entry Amount: Entries are made with the net amount of the invoice.

- Trade Discount: Not recorded in this book.

- Purchases Journal Format: Refer to Figure 4.6 for the format.

The monthly total of the purchases book is posted to the debit of purchases account in the ledger. Individual supplier accounts may be posted daily.

Consider the following details obtained from M/s Kanika Traders and observe how the entries are recorded in the purchase journal.

Posting from the purchases journal:

- Frequency: Posting from the purchases journal is done daily to their respective accounts on the credit side.

- Total Posting: The total of the purchases journal is periodically posted to the debit of the purchases account, usually on a monthly basis.

- Flexible Posting: If the number of transactions is large, the total may be posted at different intervals such as daily, weekly, or fortnightly.

The posting from the purchases journal to the ledger is illustrated as follows:

Purchases Return (Journal) Book

- This book is used to record the return of goods that were previously purchased. Goods may be returned to the supplier for various reasons, such as:

1. Goods not meeting the required quality standards.

2. Defective products. - When goods are returned, a debit note is prepared in duplicate. The original debit note is sent to the supplier for their records.

- The supplier may respond with a credit note.

- The debit note serves as the source document for recording entries in the purchases return journal.

- A debit note includes the following information:

1. Name of the party to whom the goods are being returned

2. Details of the goods being returned

3, Reason for returning the goods

4. Each debit note is serially numbered and dated. - The format of the purchases return journal is illustrated in the figure below.

Debit and Credit Notes

Debit Note:

- This document is used to charge a party for reasons other than a credit sale.

- It is issued when goods received are not as per the order, and the defective items are returned to the supplier.

- Additionally, a debit note is used to claim extra amounts from a customer.

Credit Note:

- This document is prepared when a party is to be credited for reasons other than a credit purchase.

- It is often made in red ink as a common practice.

- When goods are returned by a customer, a credit note should be issued to them.

Refer to the purchases (journal) book of Kanika Traders you will notice that 20 mini size T.V.s and 15 tape- recorders were bought from Neema Electronics for ₹ 1,82,000 However, on delivery 2 mini T.V.s and tape recorders were found defective and were returned back vide debit note no. 03/2017. In this case, the purchases return books will be prepared as follows:

Posting from the purchases returns journal requires that the supplier’s individual accounts are debited with the amount of returns and the purchases returns account is credited with the periodical total.

|

Download the notes

Chapter Notes: Recording of Transactions-II

|

Download as PDF |

Sales (Journal) Book

- All credit sales of merchandise are recorded in the sales journal.

- Cash sales are recorded in the cash book.

- The format of the sales journal is similar to that of the purchases journal.

- Entries in the sales journal are based on sales invoices issued by the firm to customers.

- The sales journal includes details such as the date of sale, invoice number, customer name, and invoice amount.

- Additional details about the sales transaction are found in the invoice.

- Multiple copies of a sales invoice are prepared for each sale, and the bookkeeper uses one copy to make entries in the sales journal.

- An extra column for sales tax may be added to the sales journal to record tax recovered from customers.

- At the end of each month, the total amount in the sales journal is posted to the credit of the sales account in the ledger.

- Individual customer accounts may be updated daily.

For example, M/s Koina Supplies sold on credit:

(i) Two water purifiers @ ₹ 2,100 each and five buckets @ ₹ 130 each to M/s Raman Traders (Invoice no. 178 dated April 06, 2017).

(ii) Five roadside containers @ ₹ 4,200 each to M/s Nutan Enterprises (Invoice no 180 dated April 09, 2017) .

(iii) 100 big buckets @ ₹ 850 each to M/s Raman traders (Invoice no. 209, dated April 28, 2017).

The above-stated transactions will be entered into a sales journal as follows:

Posting from the sales journal is done to the debit of customer’s accounts kept in the ledger. Like the purchases journal, individual customer accounts are generally posted daily, with the amount involved. The sales journal is also totalled periodically (generally monthly), and this total is credited to the sales account in the ledger. The sales (journal) book illustrated above will be posted in the related ledger account in the following manner:

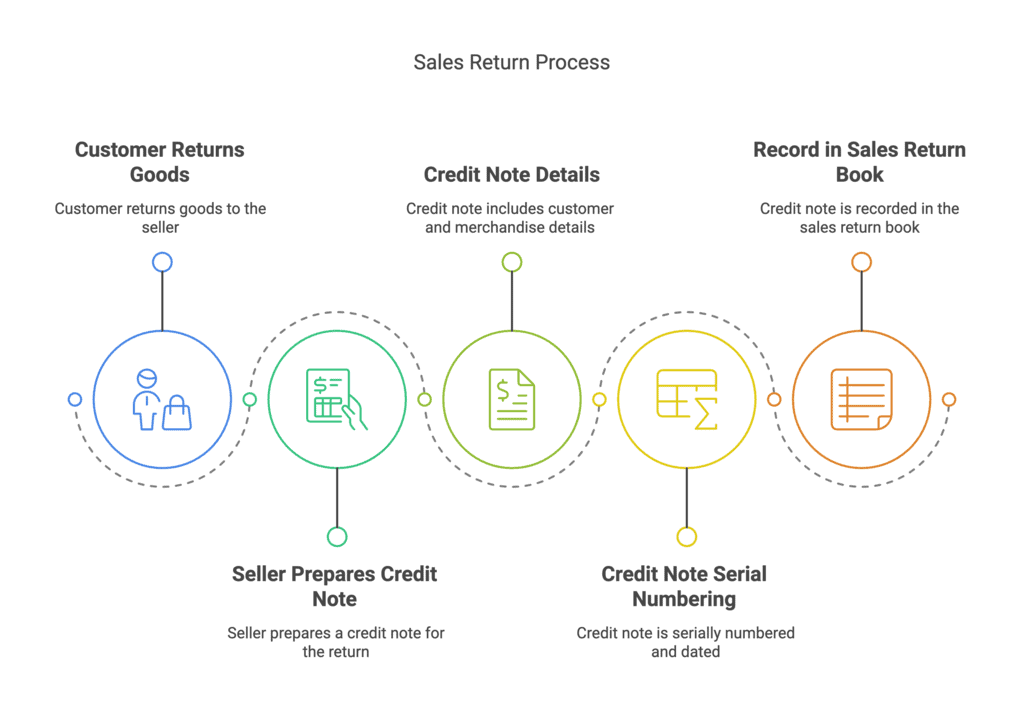

Sales Return (Journal) Book

- A Sales Return Journal Book is used to record the return of goods by customers to a seller on credit.

- When goods are received back from the customer, a credit note is prepared by the seller.

- The credit note is similar to a debit note, but it is prepared by the seller, while the debit note is prepared by the buyer.

- The credit note is also made in duplicate and includes details such as the name of the customer, merchandise details, and the amount.

- Each credit note is serially numbered and dated.

- The credit note serves as the source document for recording entries in the sales return book.

Format of Sales Return Book:

The format of the sales return book includes columns for date, particulars, and amount, as shown in the relevant figure.

Refer to the sales (journal) book of Koina Supplier you will find that two water purifiers were sold to Raman Traders for ₹ 2,100 each, out of which one purifier was returned due to the manufacturing defect (credit note no. 10/2017). In this case, the sales return (Journal) book will be prepared as follows:

Posting to the sales return journal involves the following steps:

- Credit the customer's account with the amount of returns.

- Debit the sales return account with the periodical total.

This process is similar to posting from the purchases journal.

Example: Enter the following transactions of M/s Hi-Life Fashions in purchases and purchases return book and post them to the ledger accounts for the month of September 2014:

Ans:

Ans:

(ii) Ledger Posting

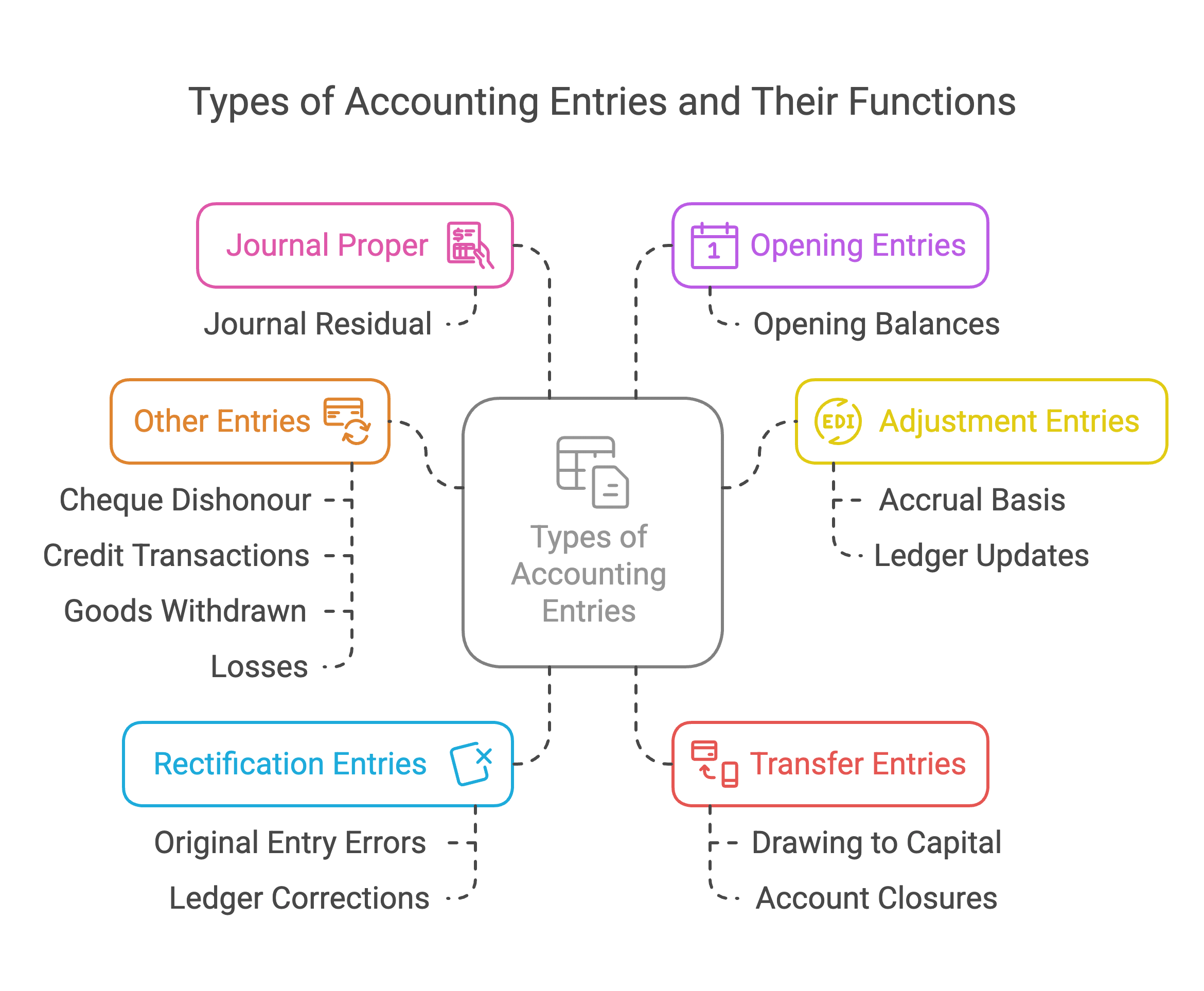

Journal Proper

- Journal Proper, also known as Journal Residual, is used to record transactions that do not fit into special journals.

- Opening Entries are made at the beginning of a new accounting year to record the opening balances of assets, liabilities, and capital.

- Adjustment Entries are made at the end of the accounting period to update ledger accounts on an accrual basis, such as rent outstanding, prepaid insurance, depreciation, and commission received in advance.

- Rectification Entries are used to correct errors in recording transactions in the books of original entry and their posting to ledger accounts.

- Transfer Entries include transferring the drawing account to the capital account at the end of the accounting year and closing accounts related to the operation of the business, such as sales, purchases, and income, and transferring their totals to the Trading and Profit and Loss account.

- Other Entries include recording transactions such as dishonour of a cheque, purchase/sale of items on credit other than goods, goods withdrawn by the owner for personal use, goods distributed as samples for sales promotion, endorsement and dishonour of bills of exchange, transactions in respect of consignment and joint venture, and loss of goods by fire, theft, or spoilage.

Balancing the Accounts

Accounts in the ledger are balanced periodically, usually at the end of the accounting period, to determine the net position of each amount. Balancing an account involves totalling both sides and showing the difference on the shorter side to make the totals equal. The term “balance c/d” is written against the difference.

- The balance is carried down (b/d) in the next accounting period to indicate that it is an ongoing account until finally settled or closed.

- If the debit side exceeds the credit side, the difference is written on the credit side, and vice versa. These differences are known as debit and credit balances, respectively.

- Accounts for expenses, losses, gains, and revenues are not balanced but closed by transferring their balances to the trading and profit and loss accounts.

- An example illustrating the process of recording transactions, posting to the ledger, and balancing accounts is provided below.

The recorded transactions will be posted in the ledger.

|

61 videos|158 docs|35 tests

|

FAQs on Recording of Transactions-II Chapter Notes - Accountancy Class 11 - Commerce

| 1. What is the purpose of a Purchases Journal Book? |  |

| 2. How do you record a purchase return in the Purchases Return Journal Book? |  |

| 3. What information is typically found in the Sales Journal Book? |  |

| 4. Why is it important to record Sales Returns? |  |

| 5. What does balancing the accounts involve? |  |