Unit 1: Basic Accounting Procedures- Journal Entries - 2 Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Modern Classification of Accounts |

|

| Journal |

|

| Advantages of Journal |

|

| Accounting For GST |

|

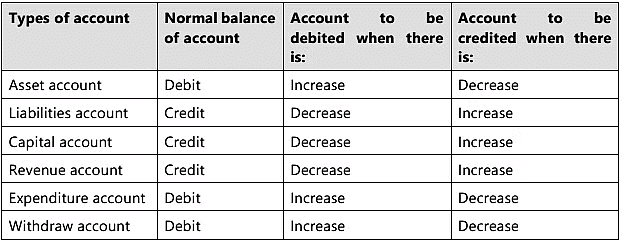

Modern Classification of Accounts

Real, nominal and personal accounts is the traditional classification of accounts. Now, let us see the modern and more acceptable classification of accounts:-

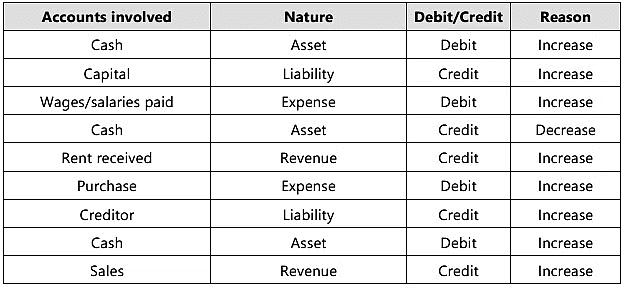

Let us solve the same example with the modern approach now:-

Journal

Transactions are initially recorded in this book to indicate which accounts will be debited and which will be credited. The journal is also referred to as a subsidiary book. The process of recording transactions in the journal is known as journalizing the entries. It serves as the book of original entry where transactions are documented daily in chronological order.Journalising Process

All transactions can be initially logged in the journal as they happen; this record is chronological to facilitate orderly maintenance of the records. Debits and credits are documented alongside the relevant explanations. There are primarily two categories of journals:- General journal

- Specialized journal

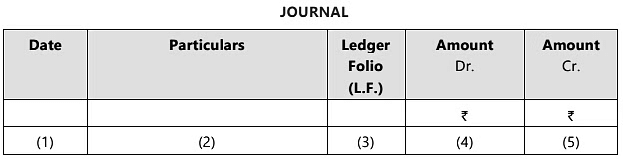

The latter is used when there are many repetitive transactions of the same nature. The form of the journal is given below:

The columns are numbered solely for clarity, but they are not to be numbered otherwise. The following points should be emphasized:

- In the first column, the transaction date is recorded—the year is listed at the top, followed by the month, and the specific date is entered in the narrower portion of the column.

- The second column contains the names of the accounts involved; first, the account to be debited is listed, with "Dr" written towards the end of the column. Below this, after a small space, the name of the account to be credited is written, preceded by the word "To" (modern practice often favors omitting "Dr." and "To"). Following this, the next line provides the explanation for the entry along with any necessary details, referred to as narration.

- The third column records the page number in the ledger where the account is documented.

- The fourth column lists the amounts to be debited to the relevant accounts.

- The fifth column indicates the amounts to be credited to various accounts.

Points to be taken into account while recording a transaction in the Journal

- Journal entries can be single entry (i.e. one debit and one credit) or compound entry (i.e. one debit and two or more credits or two or more debits and one credit or two or more debits and credits). In such cases, it is important to check that the total of both debits and credits are equal.

- If journal entries are recorded in several pages then both the amount column of each page should be totalled and the balance should be written at the end of that page and also that the same total should be carried forward at the beginning of the next page.

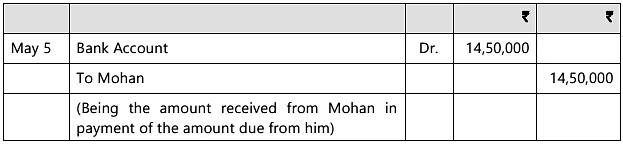

An entry in the journal may appear as follows:

We will now consider some individual transactions.

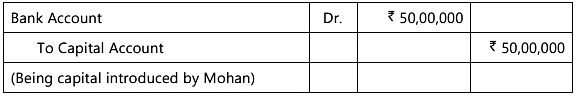

(i) Mohan commences business with ₹ 50,00,000 in his bank account. This means that the firm has ₹ 50,00,000 in bank. According to the rules given above, the increase in an asset has to be debited. The firm also now owes ₹ 50,00,000 to the proprietor, Mohan as capital. The rule given above also shows that the increase in capital should be credited. Therefore, the journal entry will be:

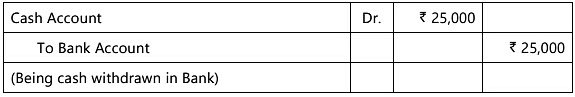

(ii) Out of the above, ₹ 25,000 is withdrawn from the bank. By this transaction the bank balance is reduced by ₹ 25,000 and another asset, cash account, comes into existence. Since increase in assets is debited and decrease is credited, the journal entry will be:

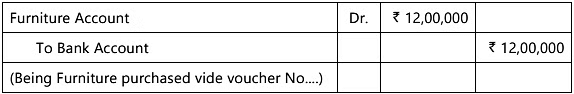

(iii) Furniture is purchased for ₹ 12,00,000. Applying the same reasoning as above the entry will be:

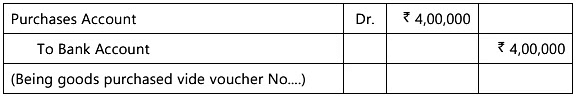

(iv) Purchased goods for ₹ 4,00,000. The student can see that the required entry is:

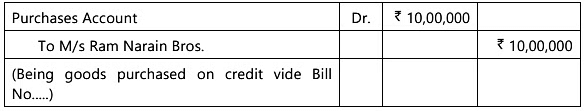

(v) Purchased goods for ₹ 10,00,000 on credit from M/s Ram Narain Bros. Purchase of merchandise is an expense item so it is to be debited. ₹ 10,00,000 is now owing to the supplier; his account should therefore be credited, since the amount of liabilities has increased. The entry will be:

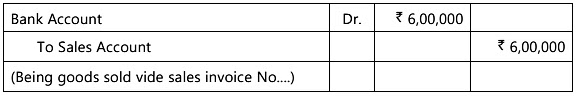

(vi) Sold goods to M/s Ram & Co. for ₹ 6,00,000. Amount is received in cheque. The amount of bank increases and therefore, the bank amount should be debited; sale of merchandise is revenue item so it is to be credited. The entry will be:

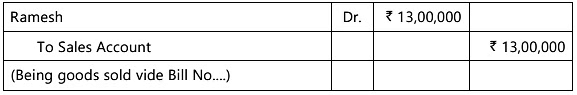

(vii) Sold goods to Ramesh on credit for ₹ 13,00,000. The Inventories of goods has decreased and therefore, the goods account has to be credited. Ramesh now owes ₹ 13,00,000; that is an asset and therefore, Ramesh should be debited. The entry is:

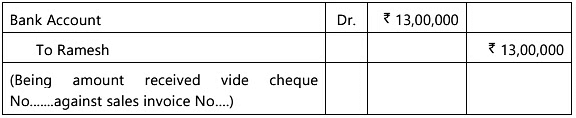

(viii) Received cheque from Ramesh ₹ 13,00,000. The amount of bank increased therefore the bank account has to be debited. Ramesh’s liability towards firm has decreased in fact in this case he no longer owes any amount to the firm now, i.e., this particular form of assets has disappeared; therefore, the account of Ramesh should be credited. The entry is:

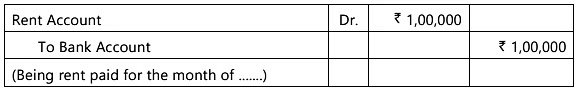

(x) Paid rent ₹ 1,00,000. The bank balance has decreased and therefore, the bank account should be credited. No asset has come into existence because the payment is for services enjoyed and is an expense. Expenses are debited. Therefore, the entry should be:

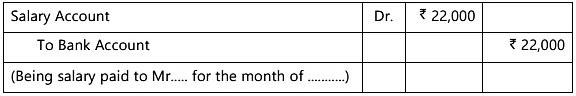

(xi) Paid ₹ 22,000 to the clerk as salary. Applying the reasons given in (x) above, the required entry is:

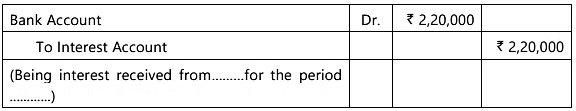

(xii) Received ₹ 2,20,000 interest. The bank account should be debited since there is an increase in the bank balance. There is no increase in any liability; since the amount is not returnable to any one, the amount is an income, incomes are credited. The entry is:

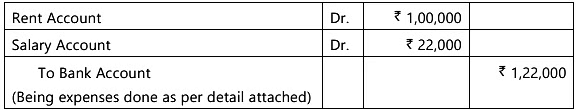

When transactions of similar nature take place on the same date, they may be combined while they are journalised. For example, entries (x) and (xi) may be combined as follows:

When journal entry for two or more transactions are combined, it is called composite journal entry. Usually, the transactions in a firm are so numerous that to record the transactions for a month will require many pages in the journal. At the bottom of one page the totals of the two columns are written together with the words “Carried forward” in the particulars column. The next page is started with the respective totals in the two columns with the words “Brought forward” in the particulars column.

Illustration 4: Analyse transactions of M/s Sahil & Co. for the month of March, 2022 on the basis of double entry system by adopting the following approaches:

(A) Accounting Equation Approach.

(B) Traditional Approach. Transactions for the month of March, 2022 were as follows (figures are in ‘000):

- Sahil introduced capital through bank of ₹ 4,000.

- Cash withdrawn from the City Bank ₹ 200.

- Loan of ₹ 500 taken from Mr. Y.

- Salaries paid for the month of March, 2022, ₹ 300 and ₹ 100 is still payable for the month of March, 2022.

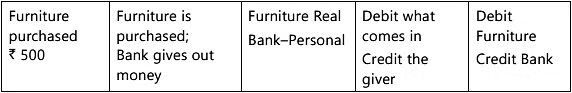

- Furniture purchased ₹ 500.

Required

What conclusions one can draw from the above analysis?

Sol:

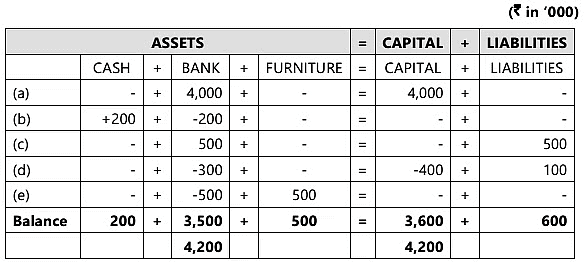

(A) Analysis of Business Transaction: Accounting Equation Approach

The accounting equation is

Assets = Liabilities + Capital

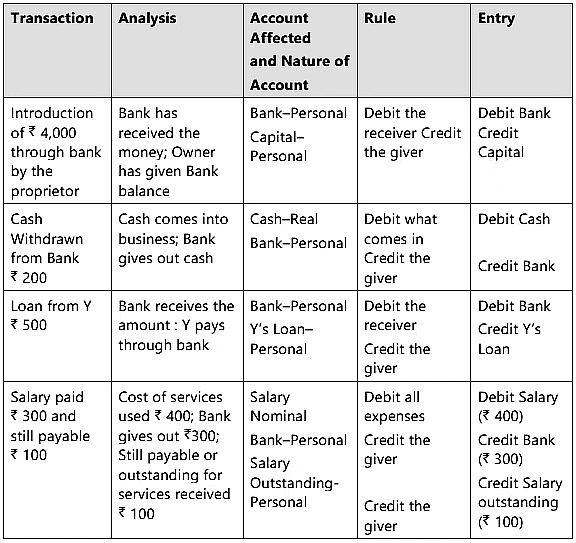

(B) Analysis of Business Transactions: Traditional Approach

Conclusion:

It is clear from the analysis that the methods for analyzing transactions, classifying accounts, and applying rules for recording business transactions differ between the accounting equation approach and the traditional approach. However, the accounts impacted and the entries made remain identical in both methods. Therefore, the recording of transactions in the corresponding accounts according to the double entry system is not reliant on the analysis method used by a business entity. In other words, the accounts that need to be debited and credited to document the dual aspect are consistent across both approaches.

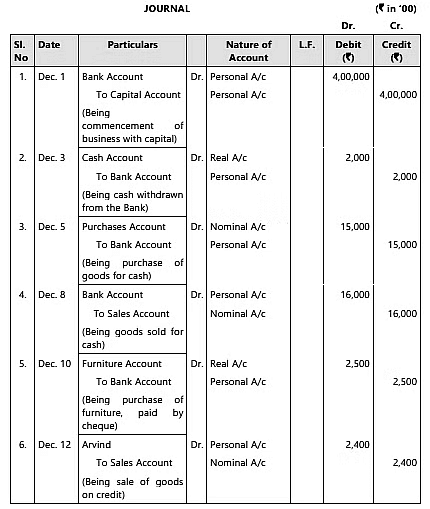

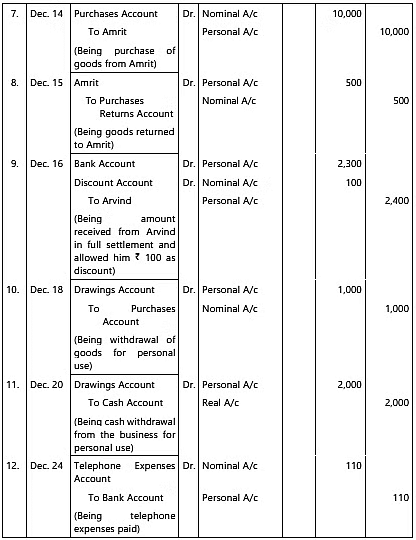

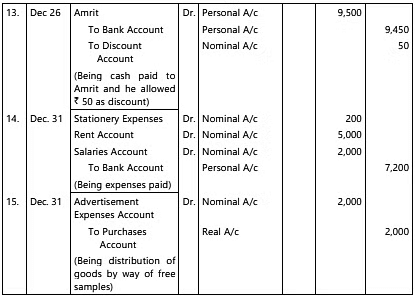

Illustration 5: Journalise the following transactions. Also state the nature of each account involved in the Journal entry.

Following figures are given in (‘00)

- December 1, 2022, Ajit started business with capital ₹ 4,00,000

- December 3, he withdrew cash for business from the Bank ₹ 2,000.

- December 5, he purchased goods by making payment through bank ₹ 15,000.

- December 8, he sold goods for ₹ 16,000 and received payment through bank.

- December 10, he purchased furniture and paid by cheque ₹ 2,500.

- December 12, he sold goods to Arvind ₹ 2,400.

- December 14, he purchased goods from Amrit ₹ 10,000.

- December 15, he returned goods to Amrit ₹ 500.

- December 16, he received from Arvind ₹ 2,300 in full settlement.

- December 18, he withdrew goods for personal use ₹ 1,000.

- December 20, he withdrew cash from business for personal use ₹ 2,000.

- December 24, he paid telephone charges ₹ 110.

- December 26, amount paid to Amrit in full settlement ₹ 9,450.

- December 31, paid for stationery ₹ 200, rent ₹5,000 and salaries to staff ₹ 2,000 from bank.

- December 31, goods distributed by way of free samples ₹ 2,000

Sol:

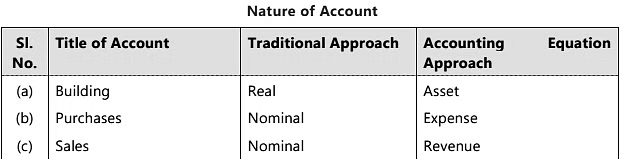

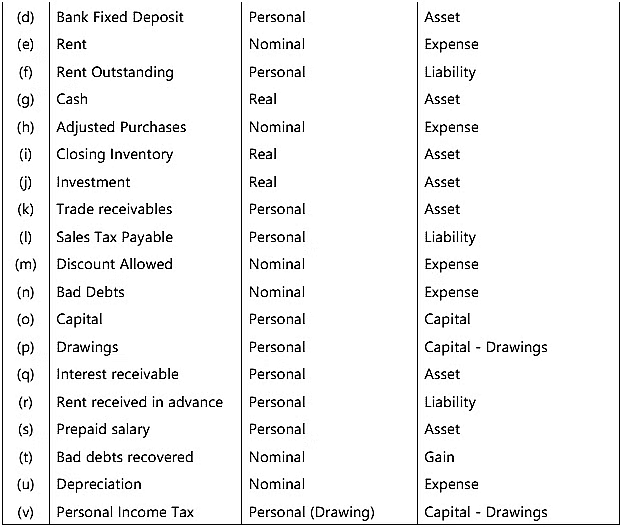

Illustration 6: Show the classification of the following Accounts under traditional and accounting equation approach:

(a) Building; (b) Purchases; (c) Sales; (d) Bank Fixed Deposit; (e) Rent; (f) Rent Outstanding; (g) Cash; (h) Adjusted Purchases; (i) Closing Inventory; (j) Investments; (k) Trade receivables; (l) Sales Tax Payable, (m) Discount Allowed; (n) Bad Debts; (o) Capital; (p) Drawings; (q) Interest Receivable account; (r) Rent received in advance account; (s) Prepaid salary account; (t) Bad debts recovered account; (u) Depreciation account, (v) Personal income-tax account.

Sol:

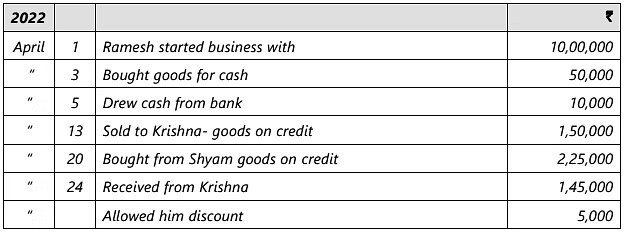

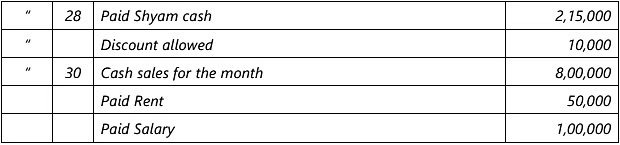

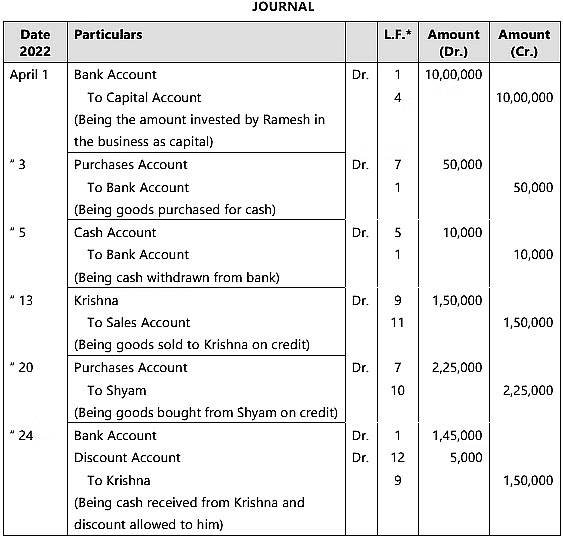

Illustration 7: Transactions of Ramesh for April are given below. Journalise them.

Sol:

Advantages of Journal

In a journal, transactions documented under the double entry system provide the following benefits:- Transactions are recorded in chronological order, allowing for comprehensive and timely insights into business activities.

- Each journal entry is accompanied by a narration, which serves as a succinct explanation of the transaction, facilitating a better understanding of the entry.

- The journal acts as a foundation for transferring entries to the ledger, minimizing the likelihood of errors.

Accounting For GST

Introduction to GST

Goods and Services Tax (GST) is a comprehensive Indirect Tax that has replaced multiple Indirect Taxes in India, such as State Value Added Tax (VAT) on goods sales, Excise Duty on the manufacture or production of goods, and Service Tax on services provided. GST is a unified tax on the supply of goods and services, applicable from the manufacturer to the consumer.Note: An indirect tax is one where the ultimate financial burden is borne by consumers, even though the immediate responsibility to pay the tax may rest on another party like a manufacturer or service provider. However, this tax is collected from the person purchasing the goods or services.

Pre-GST Scenario:

- On manufacture of goods: Excise Duty (levied by Central Government)

- On sale of goods within the State: State Value Added Tax (VAT)

- On sale of goods outside the State: Central Sales Tax (levied by Central Government)

- On provision of services: Service Tax (levied by Central Government)

Since different authorities (central and state) levied these taxes, it was impossible to benefit from tax credits across various stages. For example, if a trader received goods worth ₹ 1,00,000 from a manufacturer with an excise duty of 18% (₹ 18,000), the trader could not claim credit for this excise duty when charging VAT on selling the goods to a consumer. Thus, the trader's effective cost for the goods became ₹ 1,00,000 + ₹ 18,000 = ₹ 1,18,000, increasing the final price to the consumer and causing a cascading tax effect (tax-on-tax), which ultimately raised product prices and unjustly enriched sellers at the consumer's expense.

Post-GST Scenario:

With the implementation of GST, a single tax is levied at all stages of the supply chain, from manufacturing to final consumption, allowing for credit of taxes paid at previous stages. In the previous example, the GST (previously excise duty) of ₹ 18,000 paid by the trader can now be credited against the tax he charges to the consumer. Therefore, the cost of goods for the trader remains ₹ 1,00,000, as the ₹ 18,000 can be deducted from the GST charged to the consumer. The tax from the manufacturer to the trader is considered 'input tax,' while the tax charged by the trader to the consumer is 'output tax.' The 'input tax' is not added to the cost of goods or services, as it is offset against the 'output tax' liability. Consequently, only the value addition (i.e., the trader’s profit margin on the sale) is taxed, with the final tax burden resting on the ultimate consumer.

Salient features of GST

- GST is imposed on the supply of goods and services, meaning the manufacture or sale of goods and the provision of services constitute the taxable event, thereby creating the obligation to pay tax.

- Under GST, tax is applied solely to the value added at each step of the supply chain.

- GST functions as a destination-based consumption tax, which means the tax is charged at the location where the goods or services are consumed, not where they are produced.

- There is no tax on tax, eliminating the cascading effect of taxes under the GST framework.

- GST promotes the standardization of laws, procedures, and tax rates throughout the country.

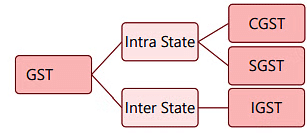

Types of Taxes under GST

- Before exploring the types of taxes under GST, it is essential to grasp the concepts of intra-State supply and inter-State supply, which determine the applicable tax charged by the supplier. The concepts of intra-State and inter-State supply depend on the location of the supplier and the place of supply (the place where goods/services are consumed).

- As a general rule, if the location of the supplier and the place of supply of goods or services are in the same State/Union Territory, it is classified as intra-State supply. Conversely, if the location of the supplier and the place of supply are in (i) two different States, (ii) two different Union Territories, or (iii) a State and a Union Territory, it is categorized as inter-State supply.

GST has a dual structure, with both the Centre and States levying taxes on a common base. The three main components of GST are:

- Central Goods and Services Tax (CGST): Levied and collected by the Centre on the intra-State supply of goods and services.

- State Goods and Services Tax (SGST): Levied and collected by State Governments (including Union Territories with legislatures, such as Delhi, Pondicherry, Jammu and Kashmir) on intra-State supply of goods and services.

- Union Territory Goods and Services Tax (UTGST): Levied and collected by Union Territories without Legislatures [i.e., Andaman and Nicobar Islands, Lakshadweep, Ladakh, Dadra and Nagar Haveli & Daman and Diu, and Chandigarh] on intra-State supply of goods and services.

- Integrated Goods and Services Tax (IGST): Levied on inter-State supply of goods and services and collected by the Centre. IGST is equivalent to the total of CGST and SGST.

GST is a “Consumption Based Tax“ i.e. the tax is received by the State in which the goods or services are consumed and not by the state in which the goods and services are manufactured.

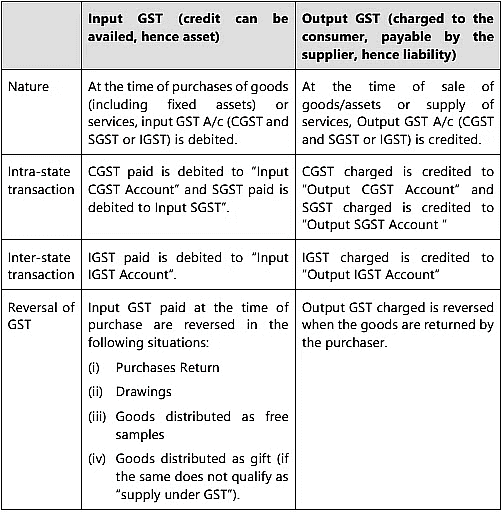

Input and Output GST

The tax paid by the buyer on the acquisition of goods/services is referred to as Input Tax. At every stage, an entity is allowed to claim credit for GST paid on the purchase of goods and/or services, which can be offset against the GST due on the goods and/or services it supplies. Consequently, the ultimate consumer pays the GST levied throughout the supply chain, benefiting from set-off at all earlier stages. Therefore, tax is only imposed on the value added, effectively eliminating double taxation. For instance, if the tax owed by a manufacturer on the final product is ₹750 and he has already paid tax of ₹500 on inputs, he can claim an 'Input Credit' of ₹500, thus only needing to pay ₹250 in cash.

Output tax means the GST charged on supply of goods or services made by a supplier.

Input tax means the credit of Input tax already paid.

Utilisation of Input Tax Credit under GST

Tax credit of CGST, SGST and IGST can be utilized in the following manner:

- Utilization of IGST Credit: IGST credit has to be first utilized against IGST liability and if any balance is still available, the same can be utilized against CGST or/and SGST in any order and in any proportion.

- Utilization of CGST Credit: CGST credit has to be first utilized against CGST liability and if any balance is available, same can be utilized against IGST. However, CGST credit cannot be utilized against SGST.

- Utilization of SGST Credit: SGST credit has to be first utilized against SGST liability and if any balance is available, same can be utilized against IGST. However, SGST credit cannot be utilized against CGST.

Double entry book-keeping with GST

The Double entry book-keeping records need to show the GST values separately so that the purchases, expenses and sales are posted net i.e. without the addition of GST.

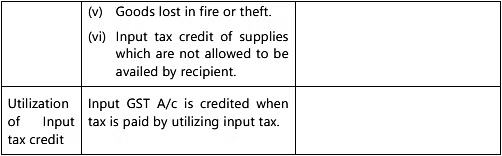

Journal entry in case of Sales of Goods or services

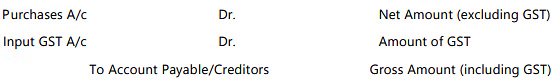

Journal entry in case of Purchase of Goods or services

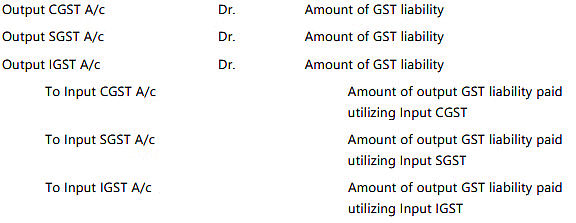

Journal entry in case of Utilization of Input Tax Credit towards payment of Output Tax

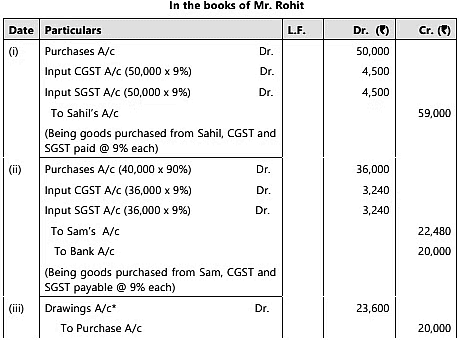

Illustration 8: Journalise the following transactions in the books of Mr. Rohit:

(i) Purchased goods from Sahil for ₹ 50,000 plus CGST and SGST @ 9% each.

(ii) Purchased goods from Sam for ₹ 40,000 at a trade discount of 10% plus CGST and SGST @ 9% each. ₹ 20,000 was paid immediately and balance payable after 3 months.

(iii) Goods costing ₹ 20,000 withdrawn for personal use. Such goods were purchased by paying CGST and SGST @ 9% each.

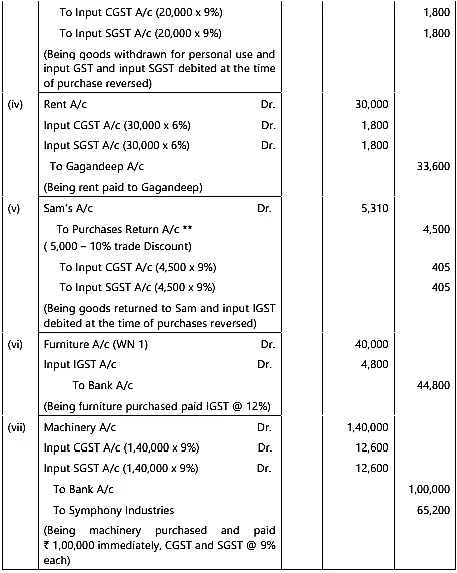

(iv) Paid rent to Gagandeep for ₹ 20,000 plus CGST and SGST @ 6% each.

(v) Goods costing ₹ 5,000 (before trade discount of 10% ) returned to Sam. Such goods were purchased by paying CGST and SGST @ 9% each.

(vi) Purchased furniture for ₹ 44,800 including IGST @ 12%.

(vii) Purchased machinery from M/s Symphony industries for ₹ 1,40,000 plus CGST and SGST @ 9% each. Paid ₹ 1,00,000 immediately and balance to be paid after two months.

Sol:

The input tax availed earlier is reversed, because these goods are ‘consumed’ by Mr. Rohit himself. Since he cannot ‘sell’ goods to himself and charged output tax, the input tax thereon is reversed, since in this case Mr. Rohit himself is the ultimate consumer of those goods.

Since goods are returned to the supplier, the input tax credit availed earlier on those goods is to be reversed, since these goods are no longer available to be sold. Working Note. 1. Furniture purchased is including IGST @ 12%. So, value of furniture excluding IGST = ₹ 44,800 × 100/112 = ₹ 40,000. IGST = ₹ 40,000 × 12% = ₹ 4,800.

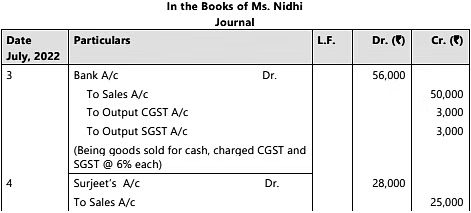

Illustration 9: Journalise the following transactions in the books of Ms. Nidhi traders

July, 2022

3 Sold Goods for ₹ 50,000, charged CGST and SGST @ 6% each.

4 Sold goods to Surjeet for ₹ 28,000 including CGST and SGST @ 6% each.

5 Received ₹ 25,200 from Surjeet in full settlement of his account of ₹ 28,000.

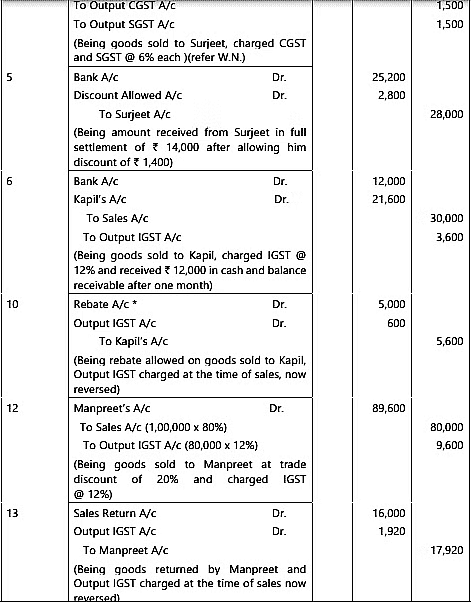

6 Sold goods to Kapil for ₹ 30,000 charged IGST @ 12%. Received ₹ 12,000 immediately and balance to be received after one month.

10 Kapil was allowed rebate of ₹ 5,000 as goods supplied to him were defective. These goods were sold by charging IGST @ 12%.

12 Sold goods to Manpreet for ₹ 1,00,000 at trade discount of 20% and charged IGST @ 12%

13 Goods of list price ₹ 20,000 returned by Manpreet.

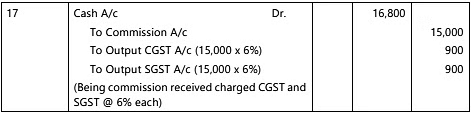

17 Received commission of ₹ 15,000, charged CGST and SGST @ 6% each.

Sol:

Since rebate is on account of defective goods which cannot be sold/utilized further by Kapil, the output GST charged thereon is also reversed. This treatment is like that of Sales Return. If rebate was on account of other reasons (such as prompt payment), Output IGST would not be reversed.

Working Note: Goods sold to Surjeet is including CGST and SGST @ 6% each. So, sales excluding CGST and SGST = ₹ 28,000 × 100/112 = ₹ 25,000. CGST and SGST = ₹ 25,000 × 6% = ₹ 1,500 each.

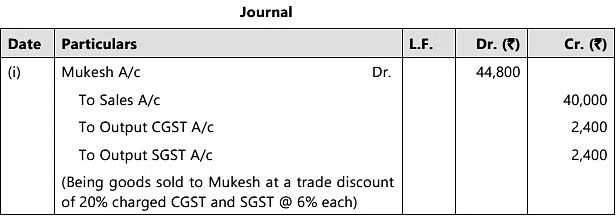

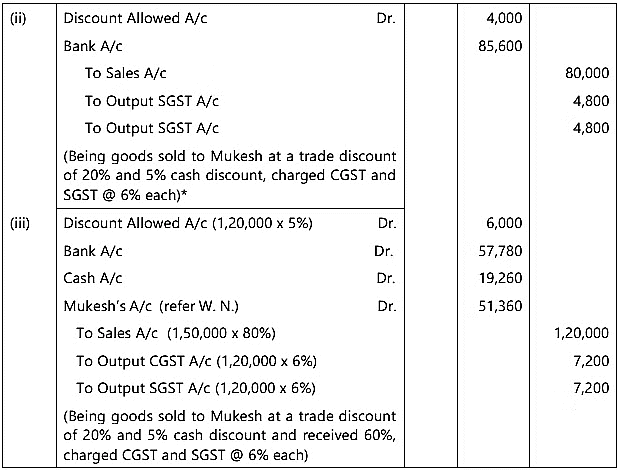

Illustration 10: Record the following transactions in a Journal, assuming CGST and SGST@ 6% each.

(i) Sold goods to Mukesh at the list price of ₹ 50,000 less 20% trade discount.

(ii) Sold goods to Mukesh at the list price of ₹ 1,00,000 less 20% trade discount and 5% cash discount.

(iii) Sold goods to Mukesh at the list price of ₹ 1,50,000 less 20% trade discount and 5% cash discount. Out of the amount due 60% is received out of which three-fourth is received by cheque.

Sol:

Note: After allowing cash discount of ₹ 4,000 (₹ 80,000 × 5%), the balance of ₹ 85,600 is received. Since discount is on account of prompt payment, output CGST and SGST is computed on value determine after deducting trade discount.

Working Note: After allowing cash discount of ₹ 6,000 on ₹ 1,20,000, 60% of the balance amount i.e. ₹ 1,28,400 (₹ 1,20,000 + 12% GST ₹ 14,400 – discount ₹ 6,000) is paid in cash and by cheque.

Hence, the amount paid in cash and cheque = ₹ 1,28,400 × 60% = 77,040.

Amount paid by cheque = ₹ 77,040 × 3/4 = ₹ 57,780

Amount paid in cash = ₹ 77,040 x ¼ = 19,260

Mukesh’s A/c = ( ₹ 1,20,000 + ₹ 14,400 – ₹ 6,000 – ₹ 57,780 – ₹ 19,260) = ₹ 51,360

Summary

The accounting process begins with the documentation of transactions as journal entries. This recording follows the double entry system. The journal, recognized as the book of first or original entry, serves this purpose. The subsequent step involves transferring these entries to the ledger, which will be addressed in the next unit.

|

68 videos|265 docs|83 tests

|

FAQs on Unit 1: Basic Accounting Procedures- Journal Entries - 2 Chapter Notes - Accounting for CA Foundation

| 1. What is a journal in accounting? |  |

| 2. What are the advantages of using a journal in accounting? |  |

| 3. How do you record a journal entry for GST transactions? |  |

| 4. What is the difference between a journal and a ledger? |  |

| 5. How can proper journal entries benefit a business? |  |