CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Cheatsheet: Accounting Concepts, Principles and Conventions

Cheatsheet: Accounting Concepts, Principles and Conventions | Accounting for CA Foundation PDF Download

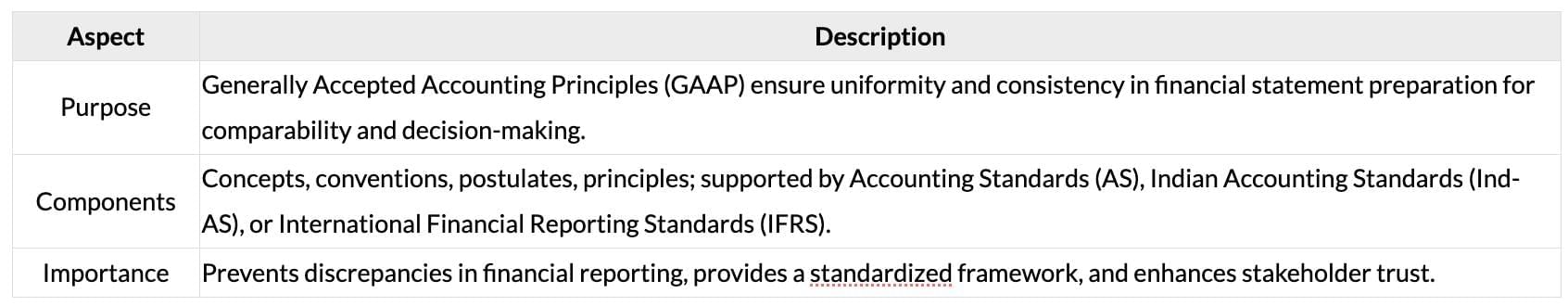

Introduction to GAAP

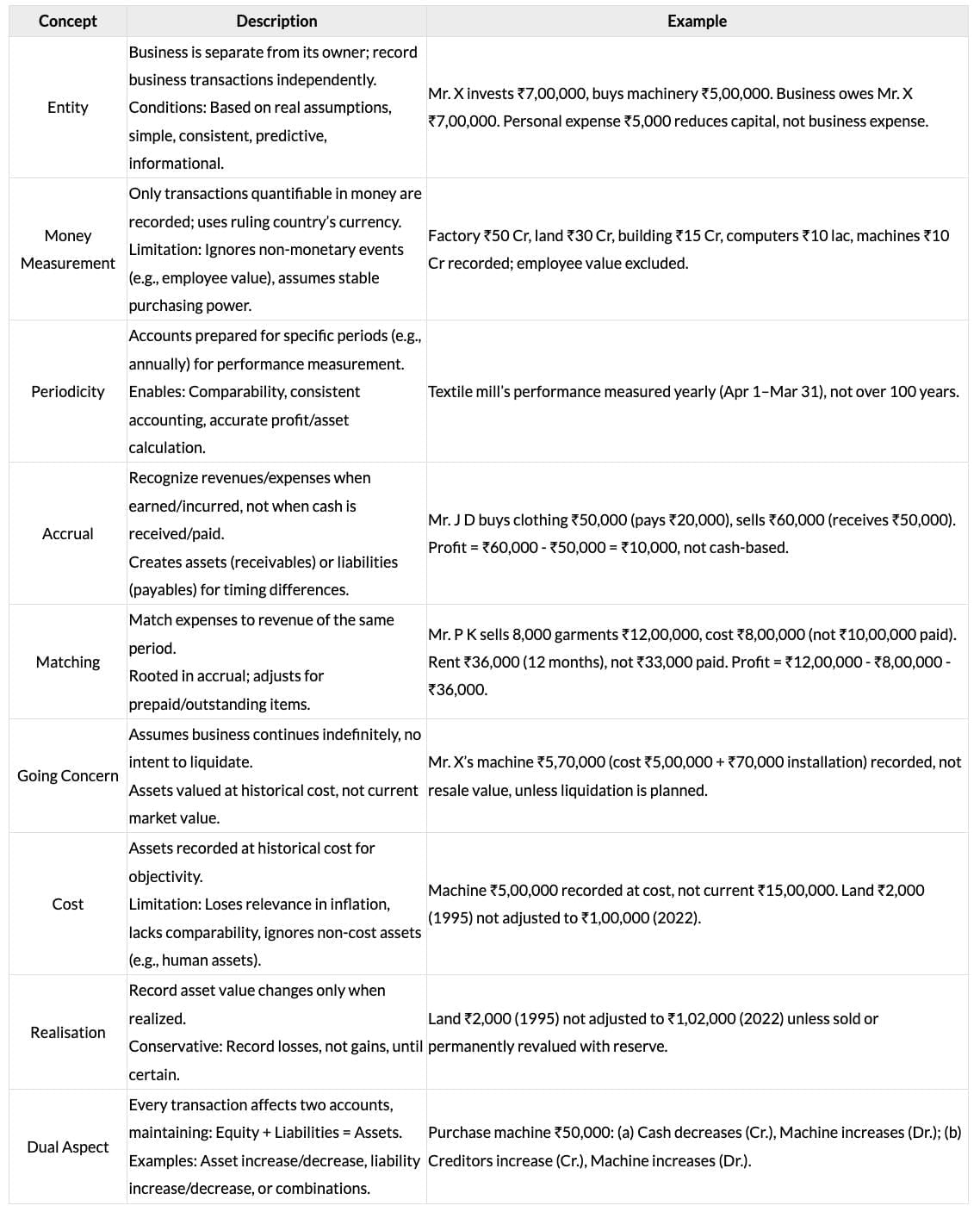

Accounting Concepts

Accounting Principles and Conventions

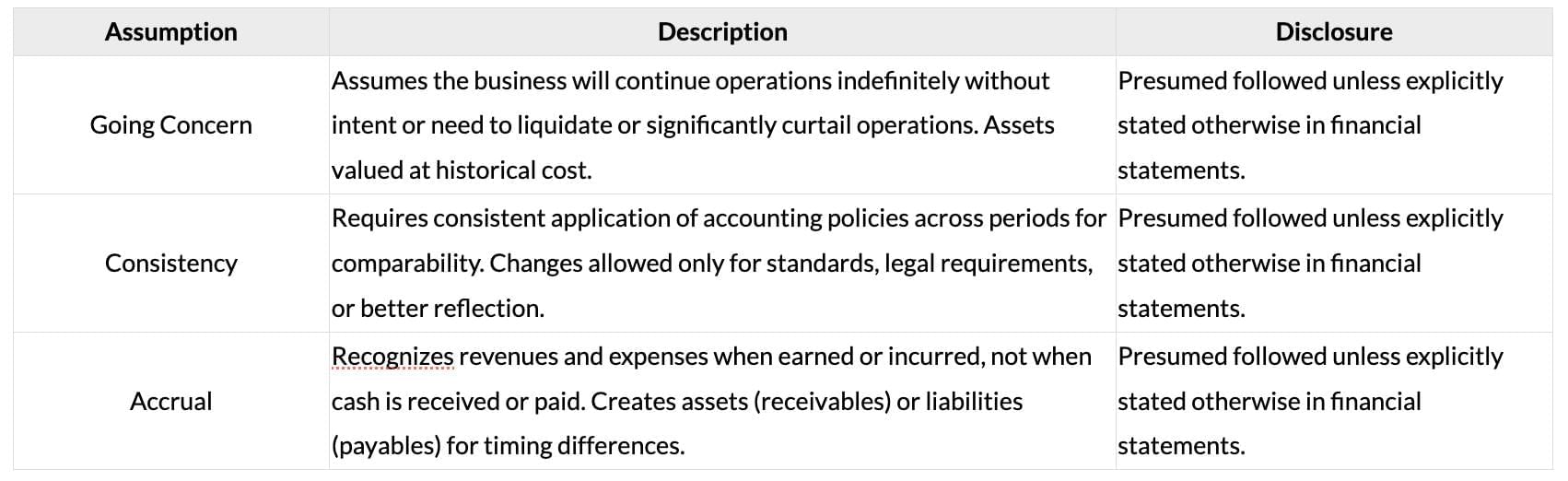

Fundamental Accounting Assumptions

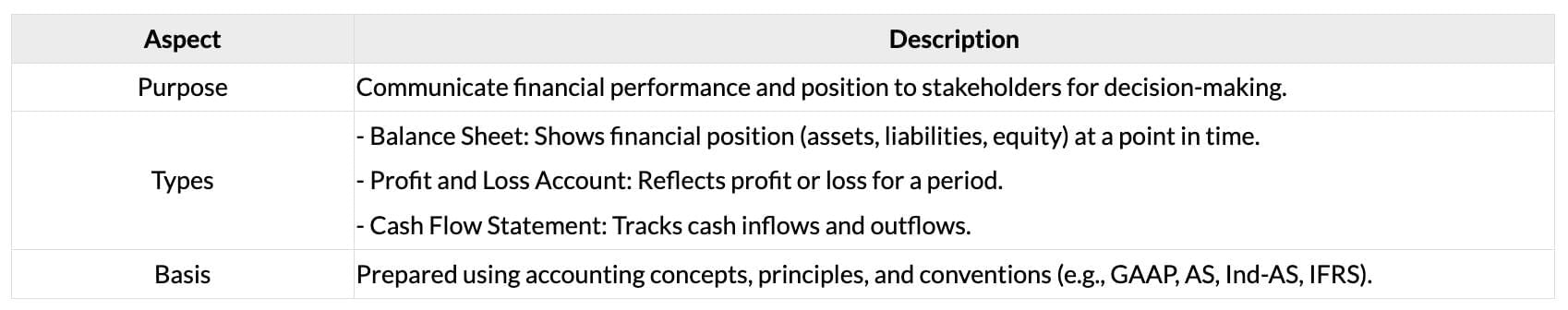

Financial Statements

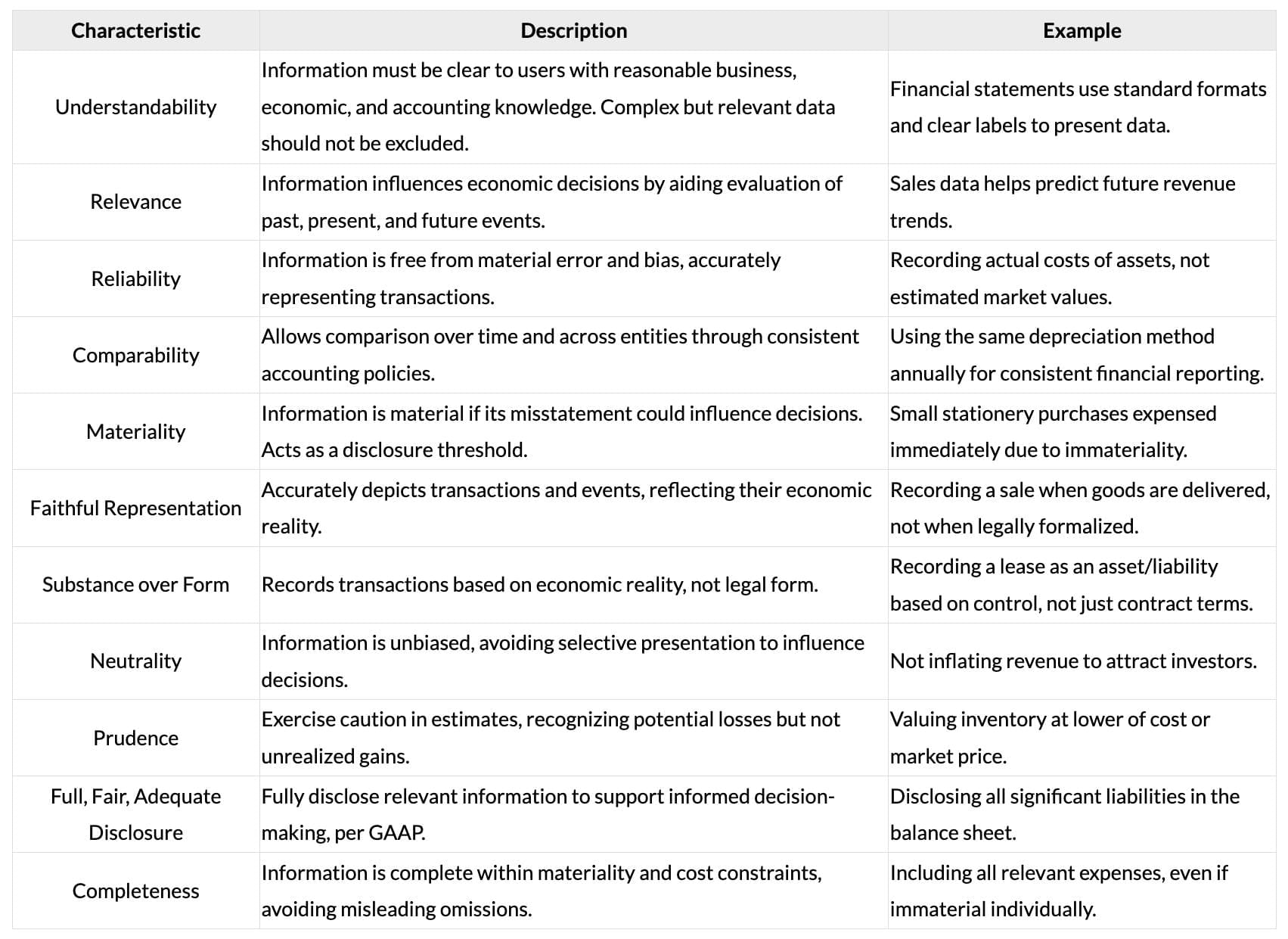

Qualitative Characteristics of Financial Statements

The document Cheatsheet: Accounting Concepts, Principles and Conventions | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Cheatsheet: Accounting Concepts, Principles and Conventions - Accounting for CA Foundation

| 1. What is GAAP and why is it important in accounting? |  |

Ans.GAAP, or Generally Accepted Accounting Principles, refers to a set of rules and standards for financial reporting in the United States. It is important because it ensures consistency, transparency, and comparability of financial statements, which helps investors, regulators, and other stakeholders make informed decisions.

| 2. What are the fundamental accounting assumptions in GAAP? |  |

Ans.The fundamental accounting assumptions in GAAP include the Economic Entity Assumption, which separates the business's financial activities from its owners or other businesses; the Going Concern Assumption, which assumes that a business will continue to operate indefinitely; the Monetary Unit Assumption, which states that transactions should be recorded in a stable currency; and the Time Period Assumption, which allows for the reporting of financial information over specific time intervals.

| 3. What are the qualitative characteristics of financial statements according to GAAP? |  |

Ans.The qualitative characteristics of financial statements include relevance, which ensures that the information is useful for decision-making; faithful representation, which means the information accurately reflects the financial status; comparability, which allows users to compare financial statements over time or across entities; verifiability, which means that information can be substantiated through evidence; timeliness, ensuring that information is available in a timely manner; and understandability, making sure that information is presented clearly and concisely.

| 4. Can you explain the difference between accounting principles and conventions? |  |

Ans.Accounting principles are the fundamental guidelines that dictate how financial transactions should be recorded and reported, such as the revenue recognition principle and the matching principle. On the other hand, accounting conventions are the generally accepted practices that guide the application of these principles, providing flexibility in areas where strict adherence to principles may not be practical, such as materiality and conservatism.

| 5. What financial statements are required under GAAP, and what do they represent? |  |

Ans.Under GAAP, the primary financial statements required include the Balance Sheet, which provides a snapshot of a company's assets, liabilities, and equity at a specific date; the Income Statement, which shows the company's revenues, expenses, and profit or loss over a period; the Statement of Cash Flows, which details the cash inflows and outflows from operating, investing, and financing activities; and the Statement of Stockholders' Equity, which outlines changes in equity accounts over time. Together, these statements provide a comprehensive view of a company's financial health.

Related Searches