CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Cheatsheet: Bank Reconciliation Statement

Cheatsheet: Bank Reconciliation Statement | Accounting for CA Foundation PDF Download

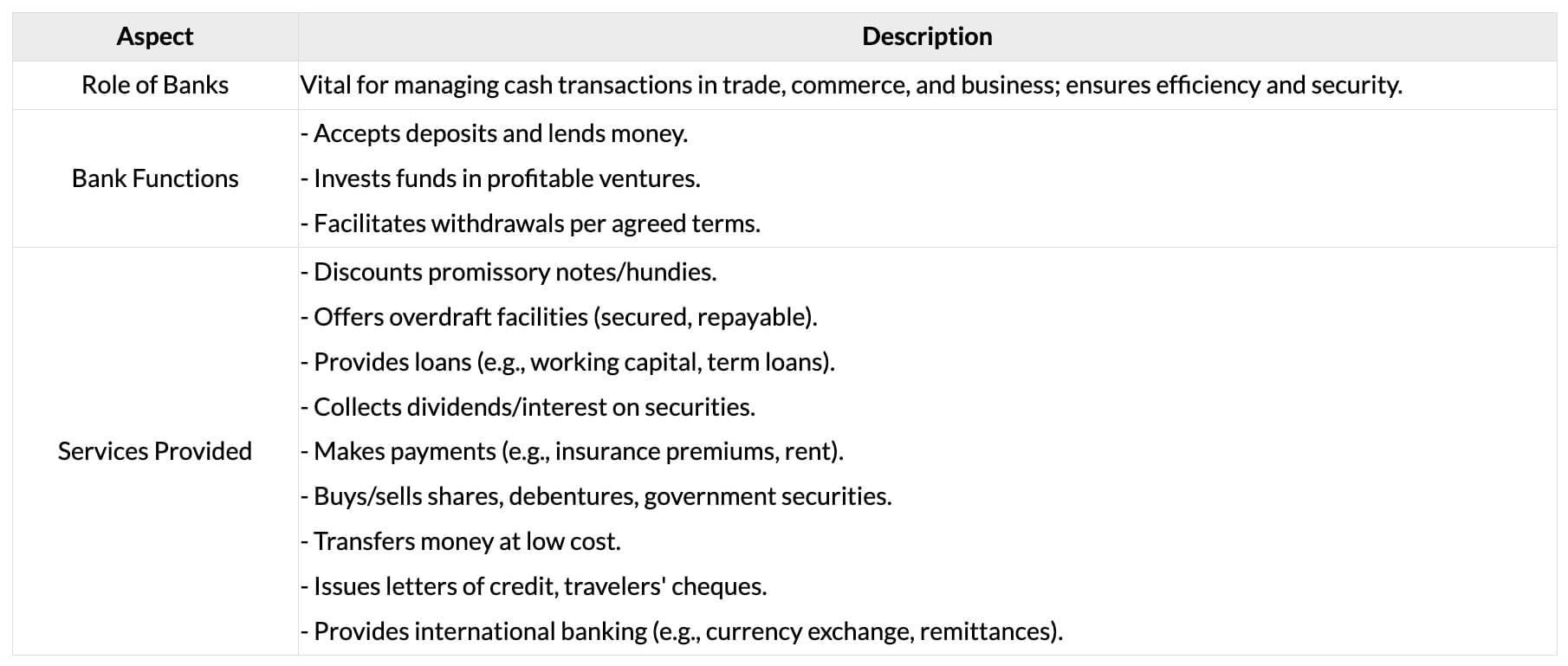

Introduction to Banking

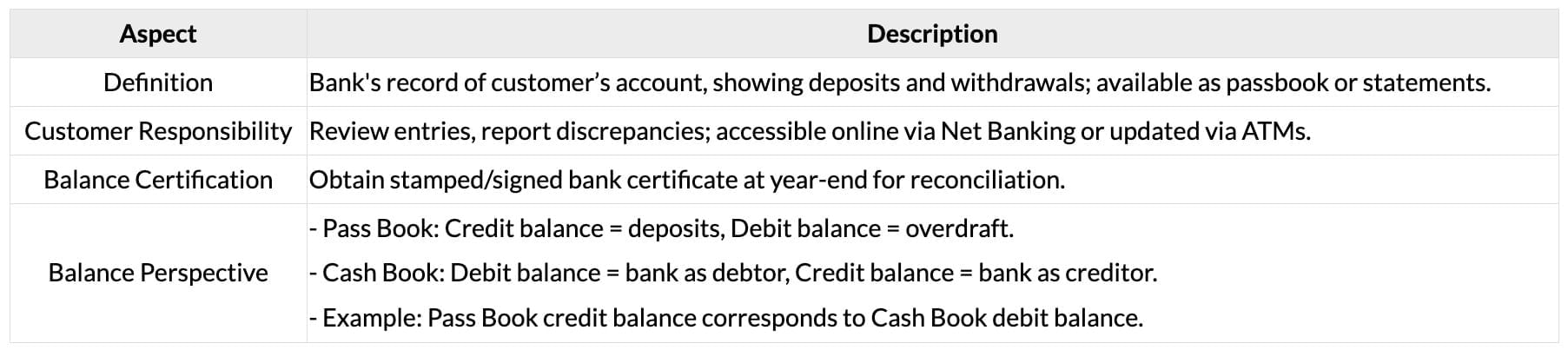

Bank Pass Book

Bank Reconciliation Statement

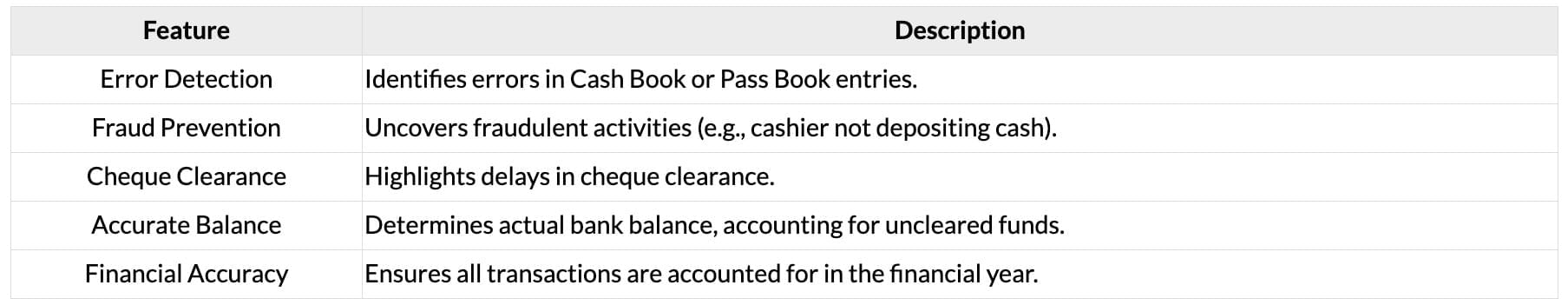

Importance of Bank Reconciliation

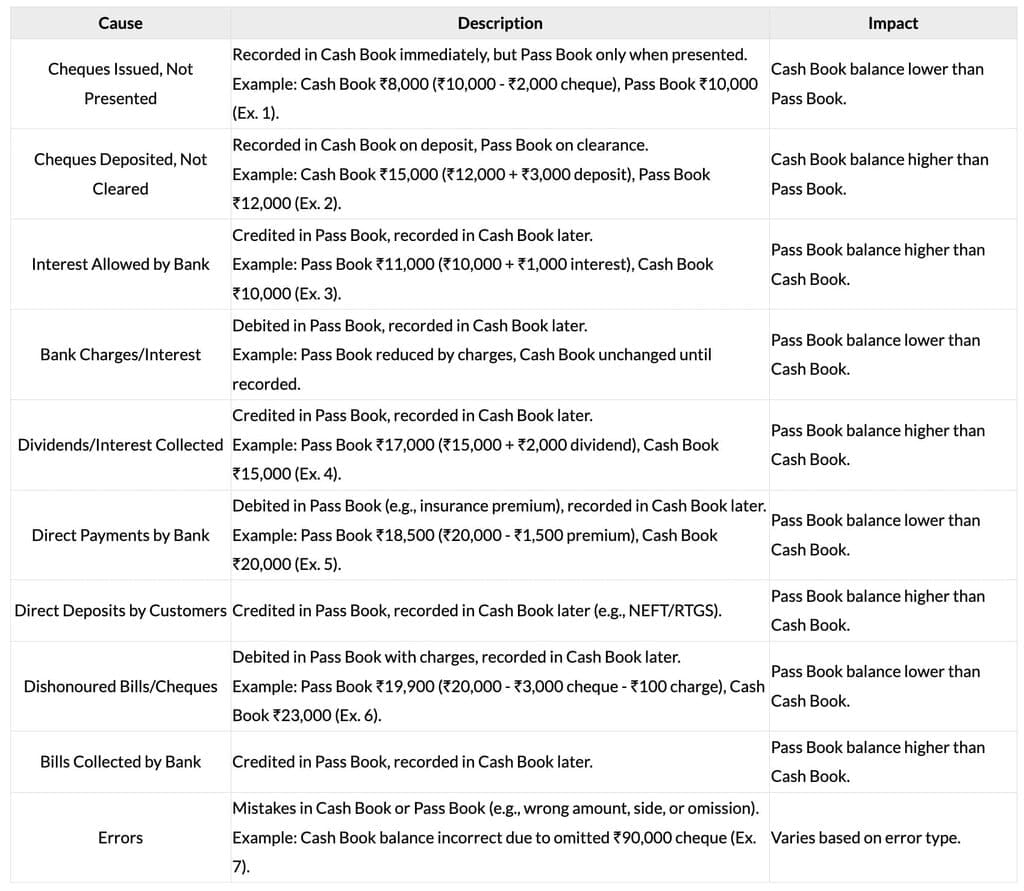

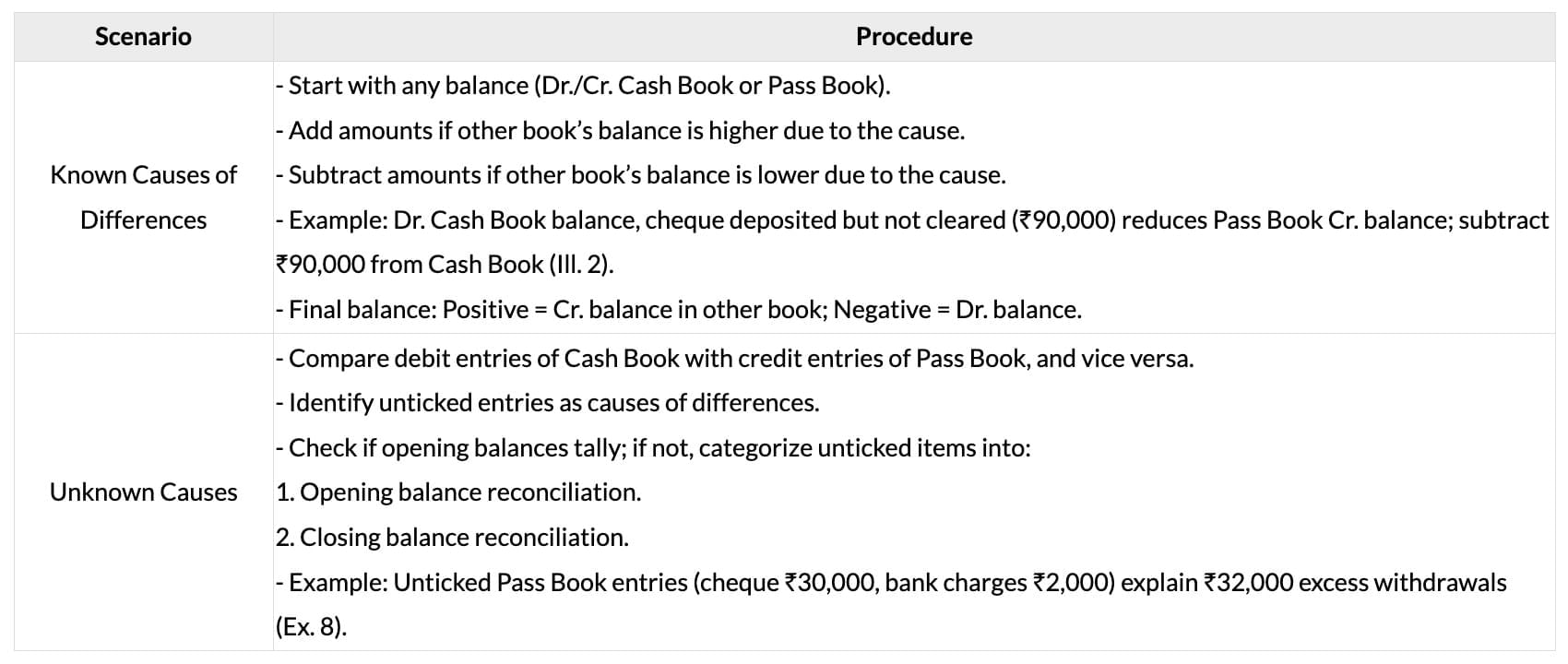

Causes of Differences

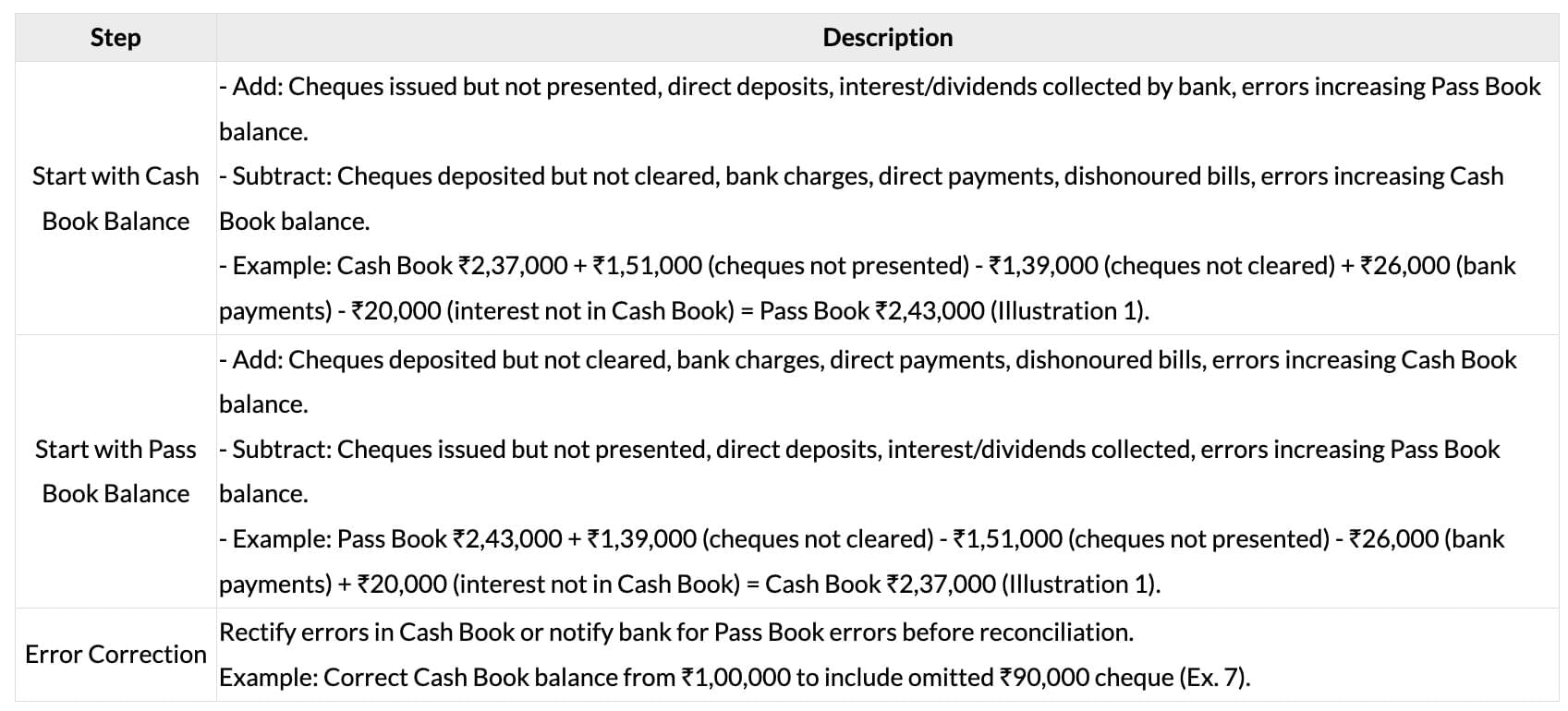

Reconciliation Process

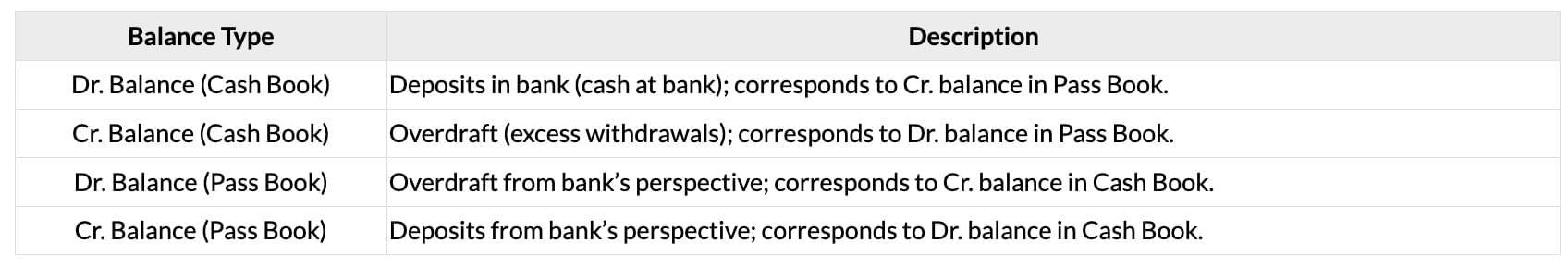

Understanding Balances

Reconciliation Procedure

Methods of Bank Reconciliation

The document Cheatsheet: Bank Reconciliation Statement | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Cheatsheet: Bank Reconciliation Statement - Accounting for CA Foundation

| 1. What is a bank reconciliation statement and why is it important? |  |

Ans. A bank reconciliation statement is a document that compares and reconciles the bank balance as per the bank statement with the balance in the company's cash book. It is important because it helps identify discrepancies between the two balances, ensuring that all transactions are accurately recorded and that potential errors or fraudulent activities are detected in a timely manner.

| 2. What are the common causes of differences in bank reconciliation? |  |

Ans. Common causes of differences in bank reconciliation include outstanding checks that have not yet cleared, deposits in transit that have not been recorded by the bank, bank fees or interest that have not been accounted for in the cash book, and errors in recording transactions in either the bank statement or the cash book.

| 3. What is the reconciliation process and how does it work? |  |

Ans. The reconciliation process involves comparing the bank statement with the cash book to identify discrepancies. This typically includes listing all transactions from both sources, identifying outstanding items and errors, and making necessary adjustments to ensure both records match. The end goal is to arrive at an accurate and consistent cash balance.

| 4. What methods can be used for bank reconciliation? |  |

Ans. There are several methods for bank reconciliation, including the adjusted cash balance method, where adjustments are made to the cash book to match the bank statement, and the reconciliation worksheet method, which involves creating a detailed worksheet that lists all deposits, withdrawals, and adjustments to pinpoint discrepancies.

| 5. Can you provide an example of a bank reconciliation scenario? |  |

Ans. For instance, if a company's cash book shows a balance of $5,000, but the bank statement shows $4,800, the reconciliation process would involve checking for outstanding checks and deposits in transit. If there are $200 in outstanding checks and a $400 deposit in transit, the adjusted bank balance would be $5,000, thus reconciling the two records.

Related Searches