CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Cheatsheet: Basic Accounting Procedures - Journal Entries

Cheatsheet: Basic Accounting Procedures - Journal Entries | Accounting for CA Foundation PDF Download

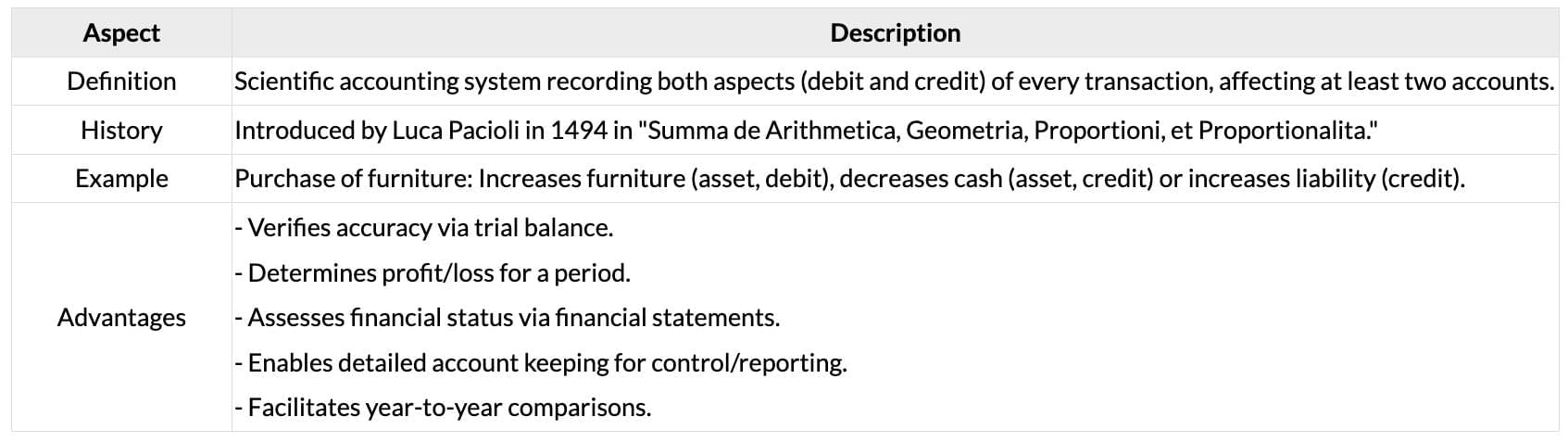

Double Entry System

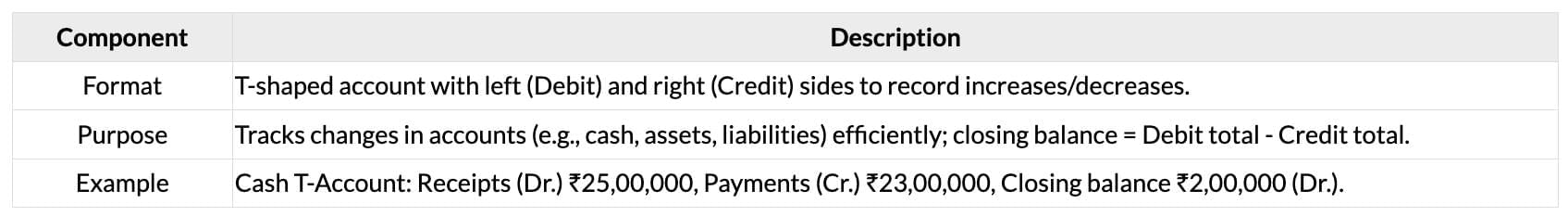

T-Account Structure

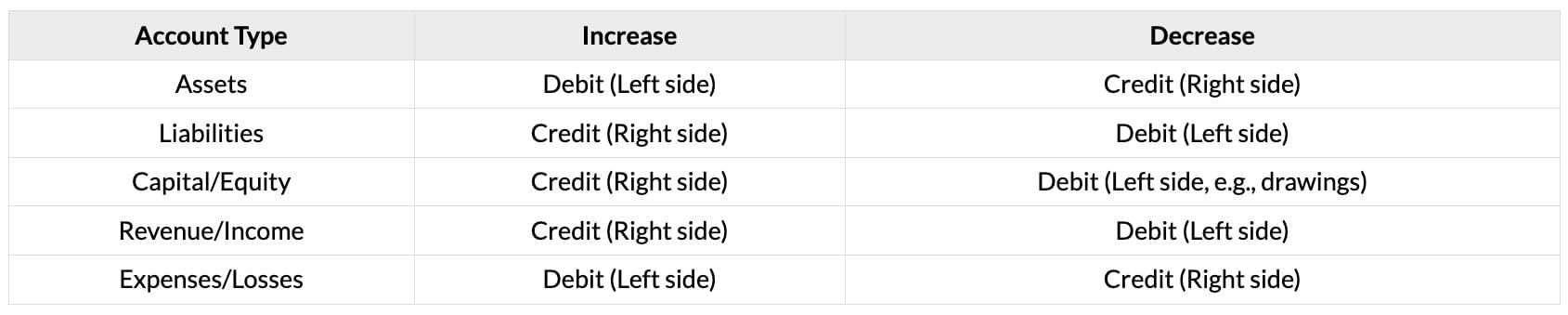

Debit and Credit Rules

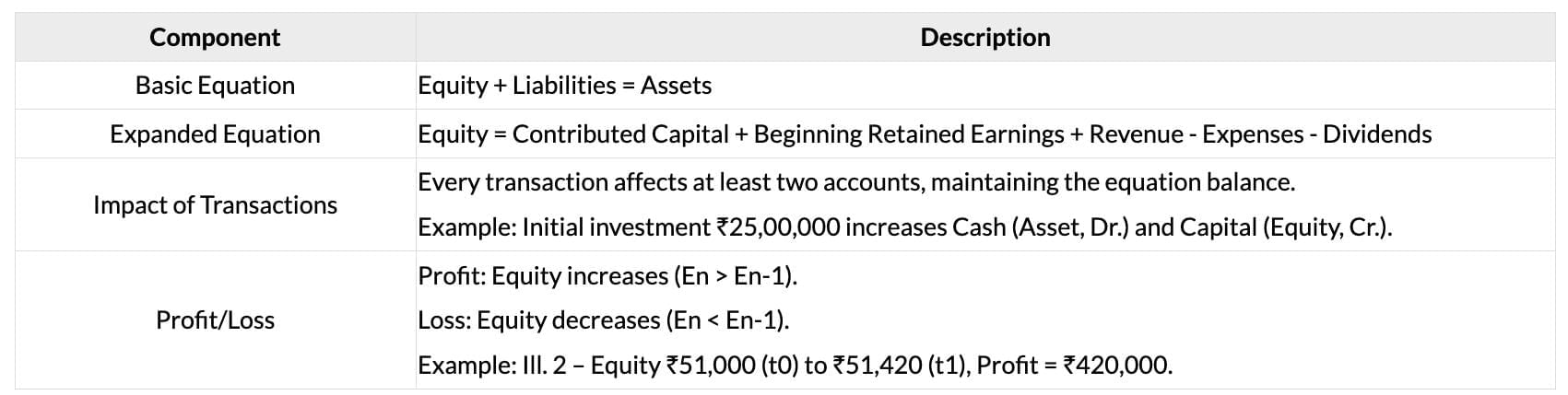

Accounting Equation

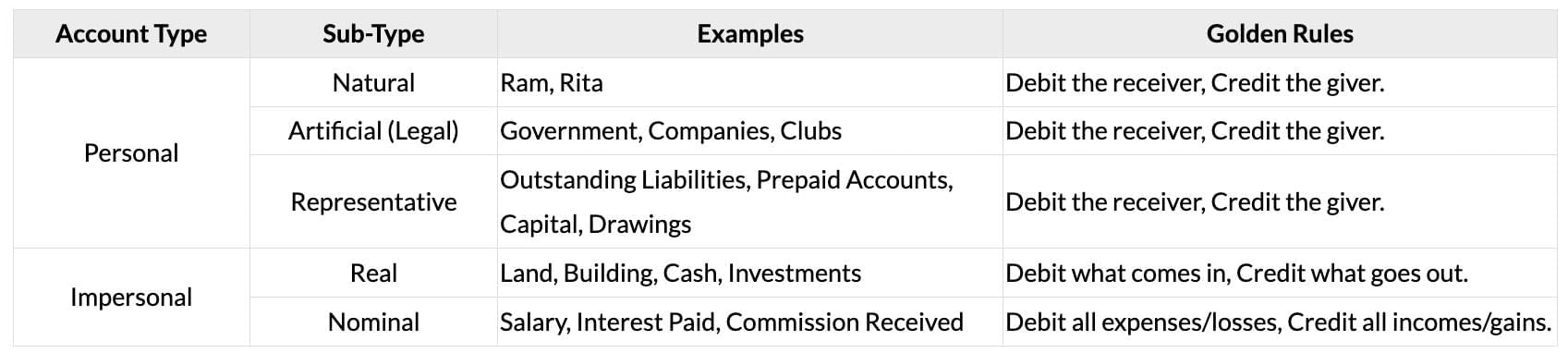

Classification of Accounts

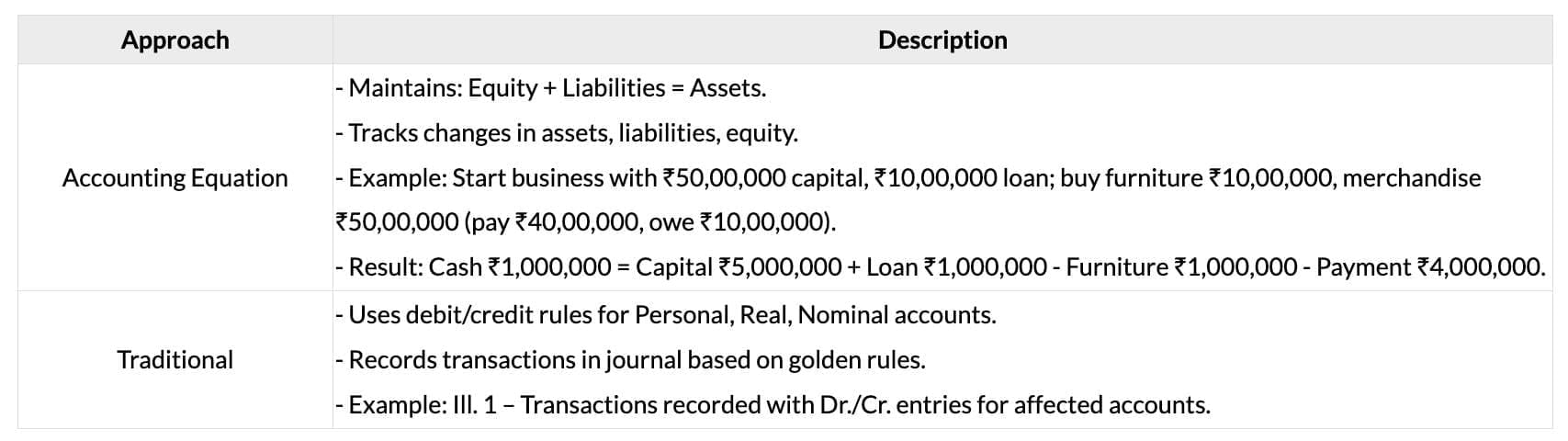

Transaction Recording Approaches

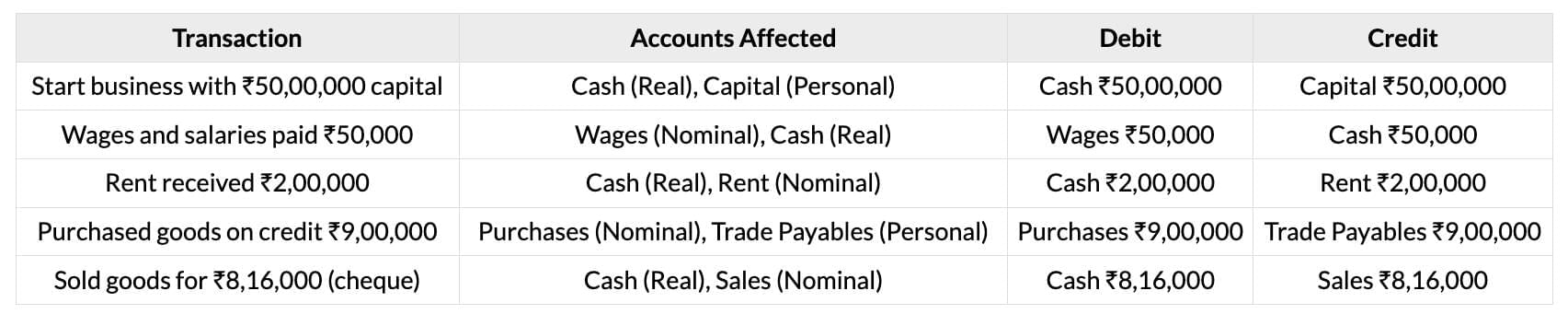

Transaction Examples

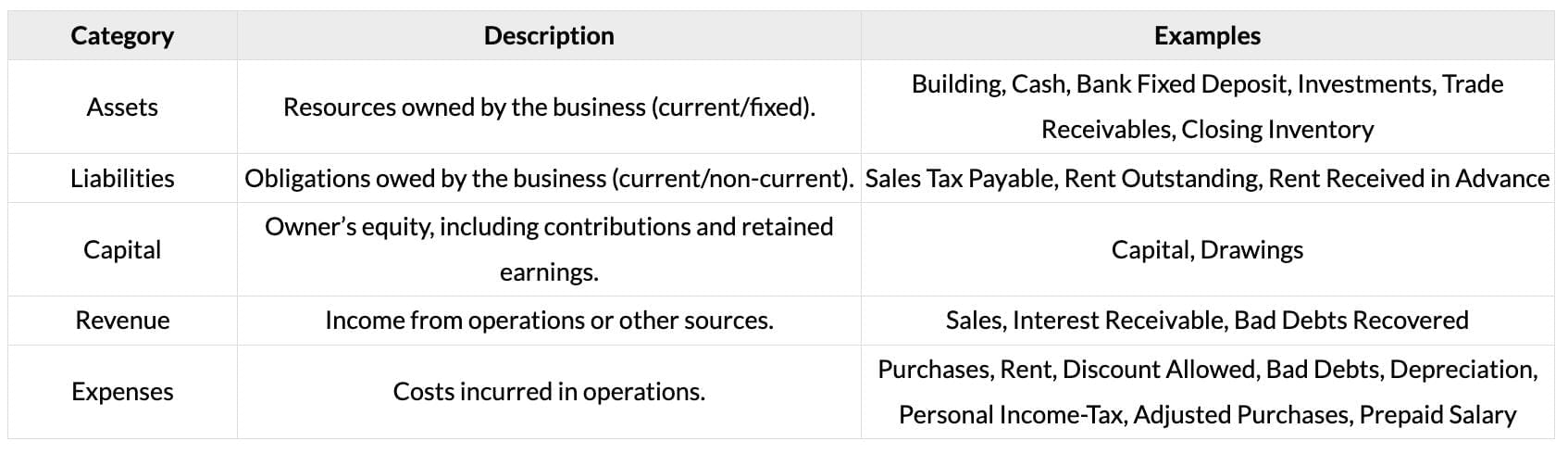

Modern Classification of Accounts

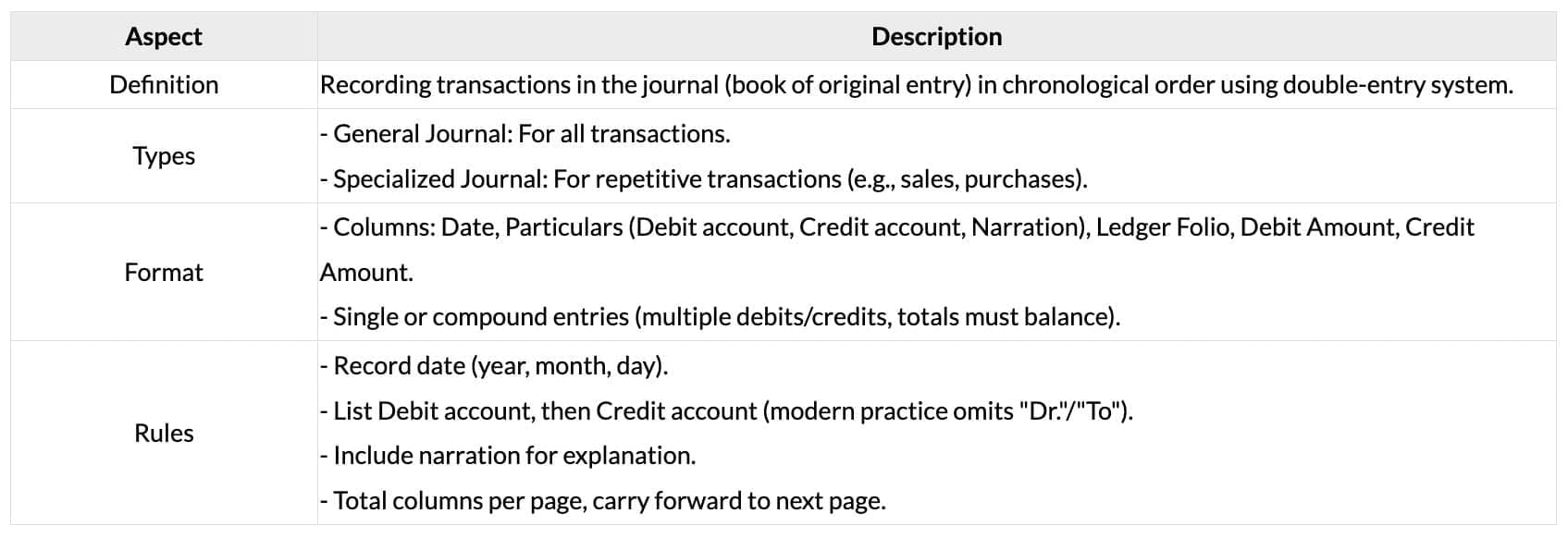

Journalising Process

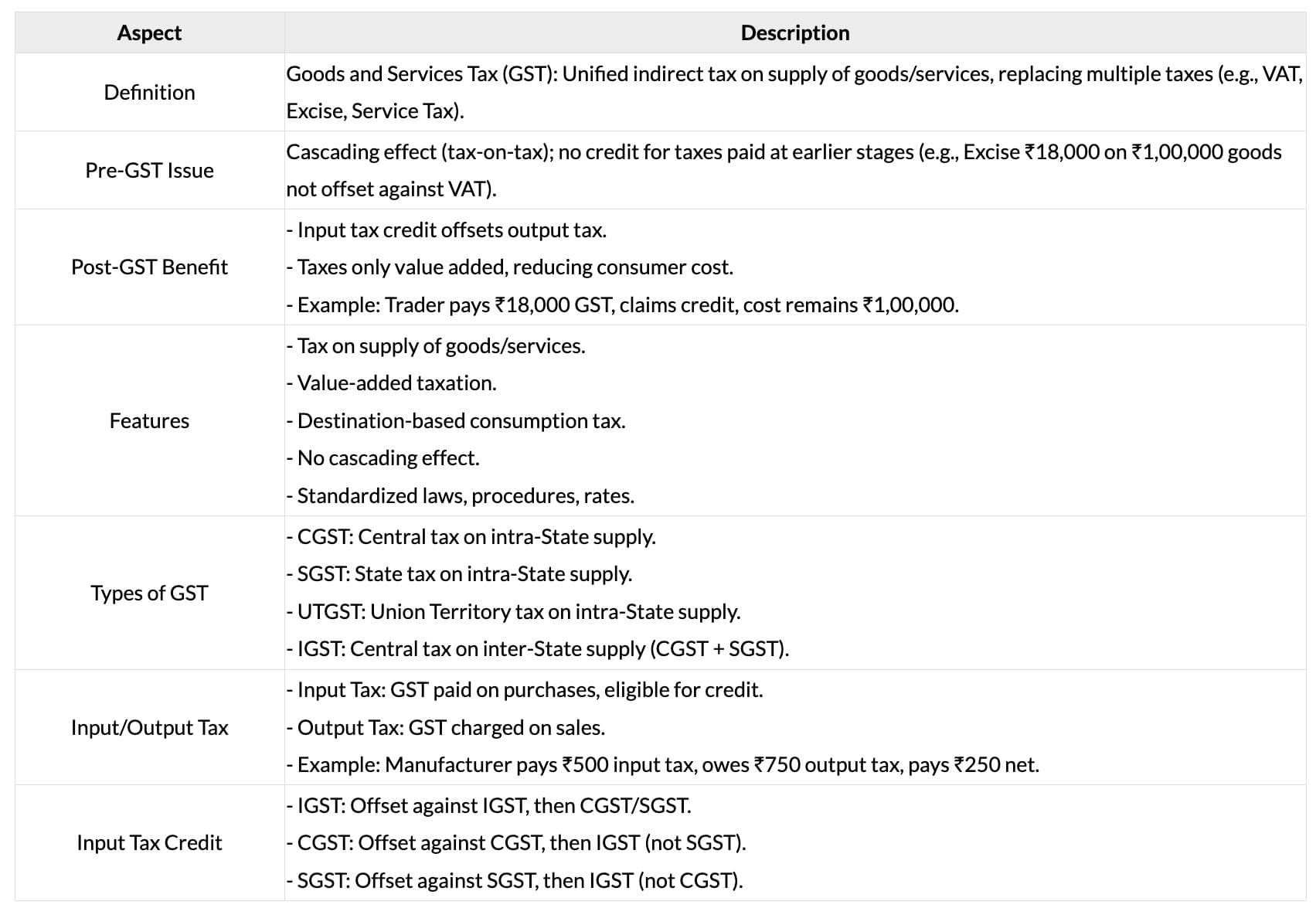

GST Overview

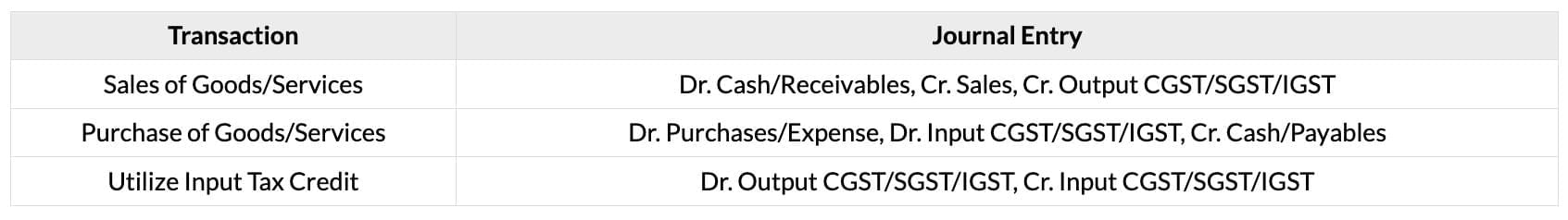

GST Journal Entries

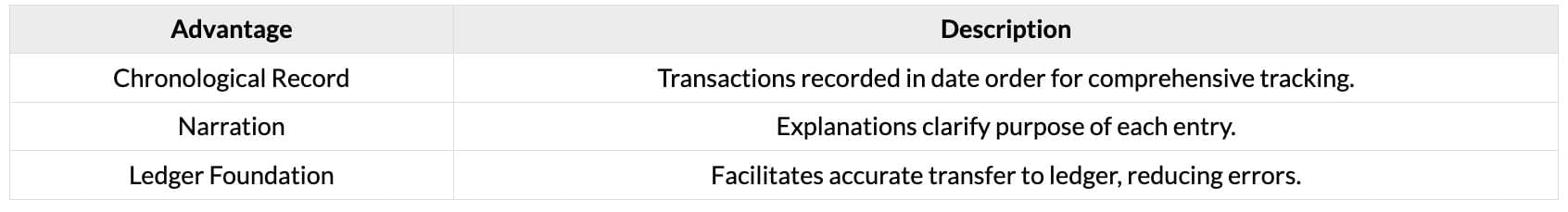

Advantages of Journal

The document Cheatsheet: Basic Accounting Procedures - Journal Entries | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Cheatsheet: Basic Accounting Procedures - Journal Entries - Accounting for CA Foundation

| 1. What is the double entry system in accounting? |  |

Ans. The double entry system is an accounting method that records each transaction in two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. Each transaction affects both a debit and a credit entry, which helps maintain accurate financial records and provides a complete picture of a business's financial position.

| 2. How do I structure a T-account? |  |

Ans. A T-account is structured in a "T" shape, where the left side represents debits and the right side represents credits. The account title is placed at the top. When recording transactions, debits are entered on the left side and credits on the right, allowing for easy tracking of balances and changes in each account.

| 3. What are the basic rules for debit and credit in accounting? |  |

Ans. The basic rules for debit and credit are:

1. Assets increase with debits and decrease with credits.

2. Liabilities increase with credits and decrease with debits.

3. Equity increases with credits and decreases with debits.

4. Revenues increase with credits and decrease with debits.

5. Expenses increase with debits and decrease with credits.

| 4. Can you explain the journalising process in accounting? |  |

Ans. The journalising process involves recording financial transactions in a journal, which is the first step in the accounting cycle. Each entry includes the date of the transaction, the accounts affected, the amounts debited and credited, and a brief description. This systematic approach helps ensure that all transactions are documented accurately before they are posted to the respective accounts in the ledger.

| 5. What is GST and how does it affect accounting practices? |  |

Ans. GST, or Goods and Services Tax, is a value-added tax levied on the supply of goods and services. It affects accounting practices by requiring businesses to track GST collected on sales and GST paid on purchases separately. Companies must ensure proper accounting for GST to comply with tax regulations, maintain accurate records, and prepare necessary tax returns accurately.

Related Searches