CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Cheatsheet: Inventories

Cheatsheet: Inventories | Accounting for CA Foundation PDF Download

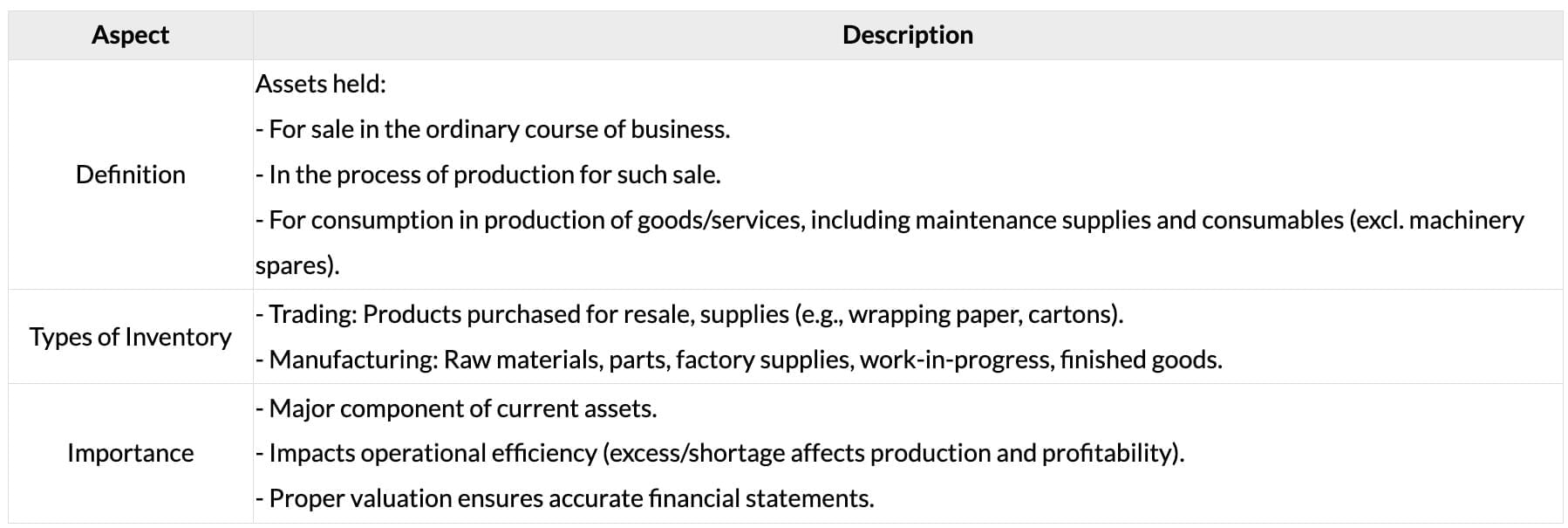

Meaning of Inventory

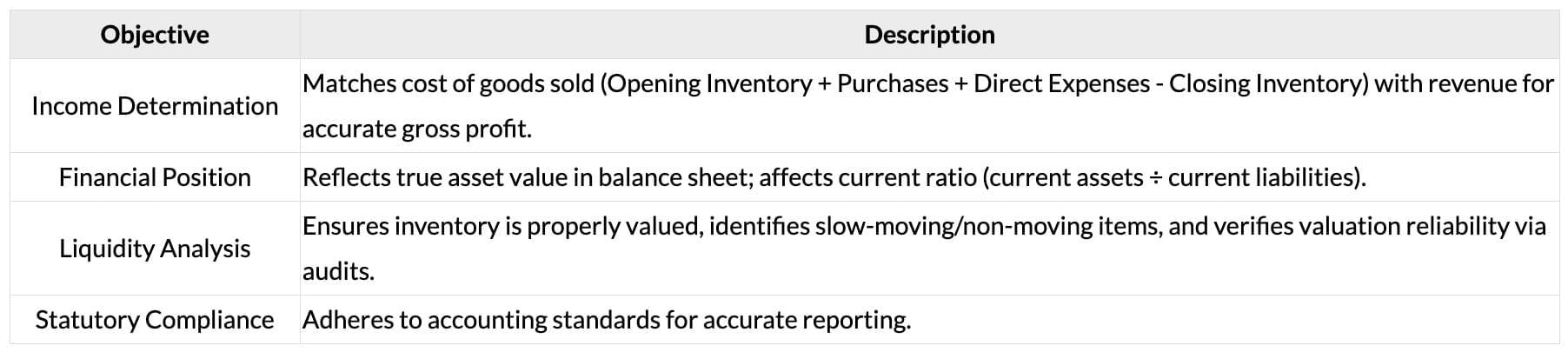

Objectives of Inventory Valuation

Basis of Inventory Valuation

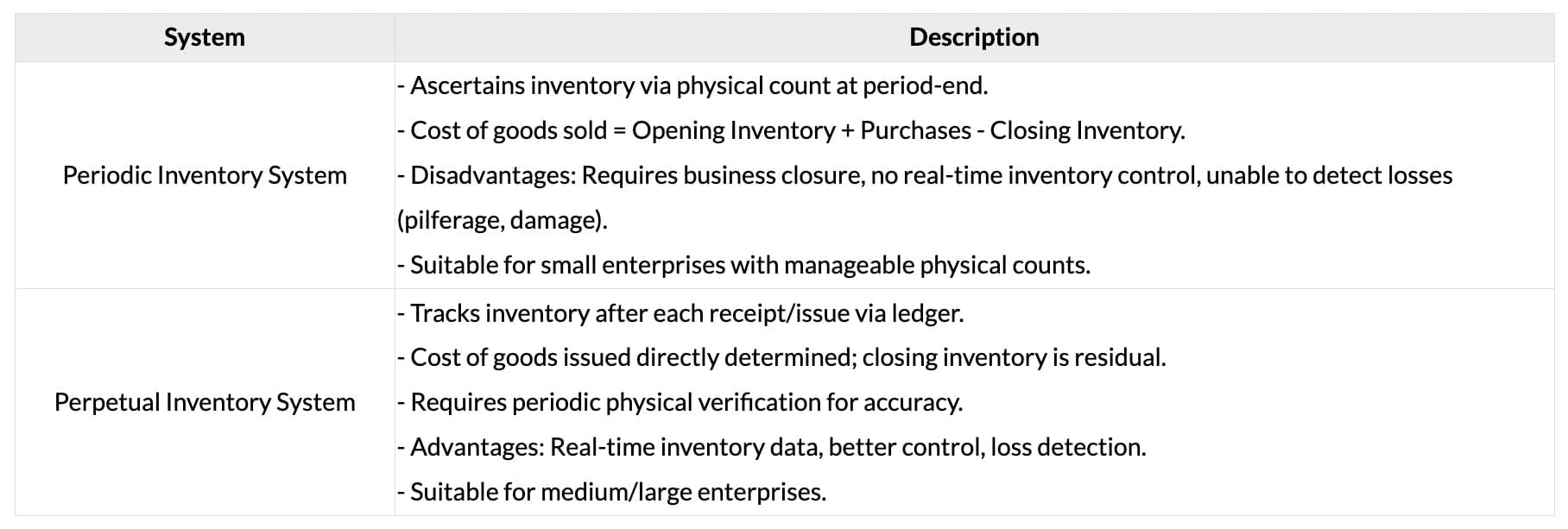

Inventory Record Systems

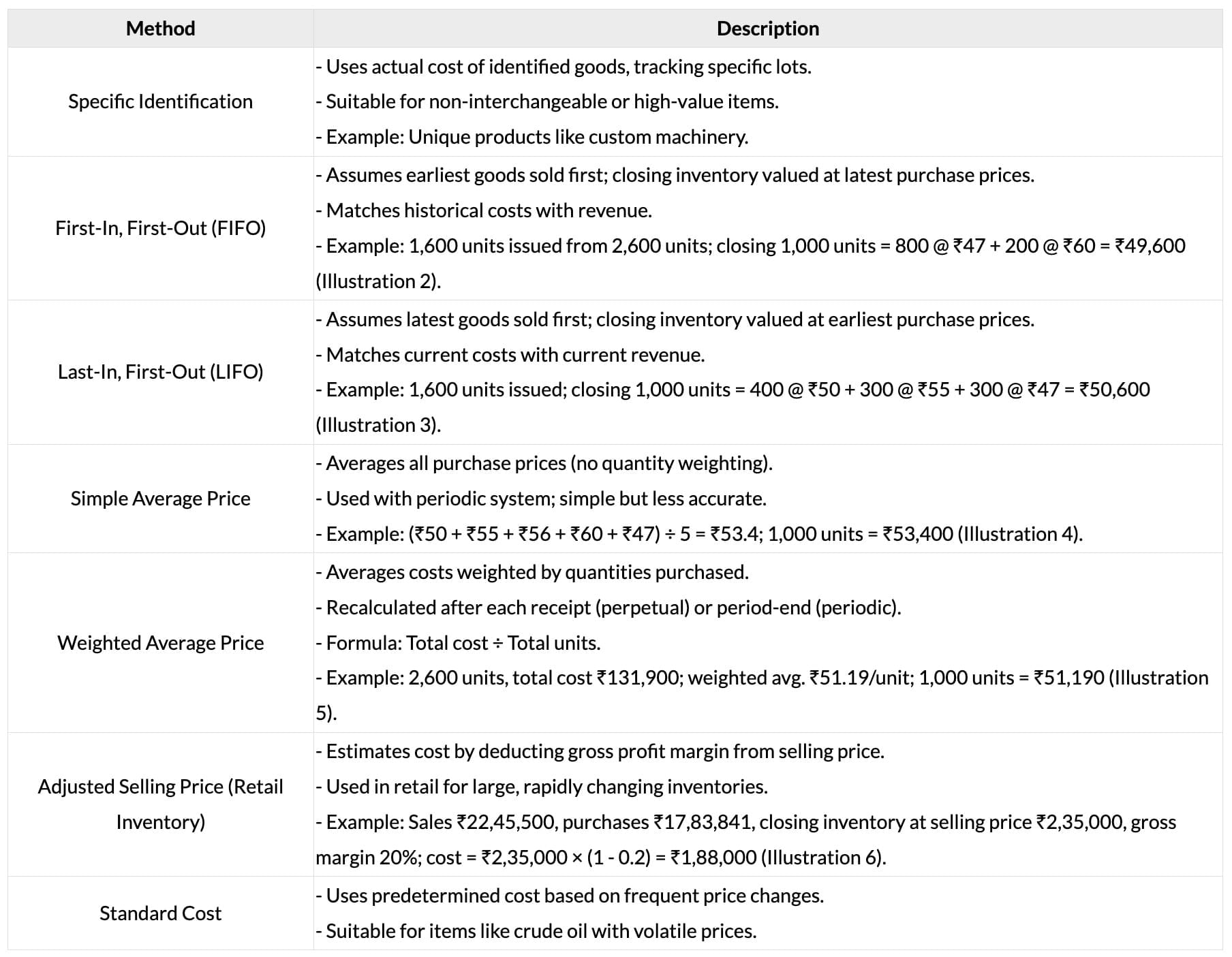

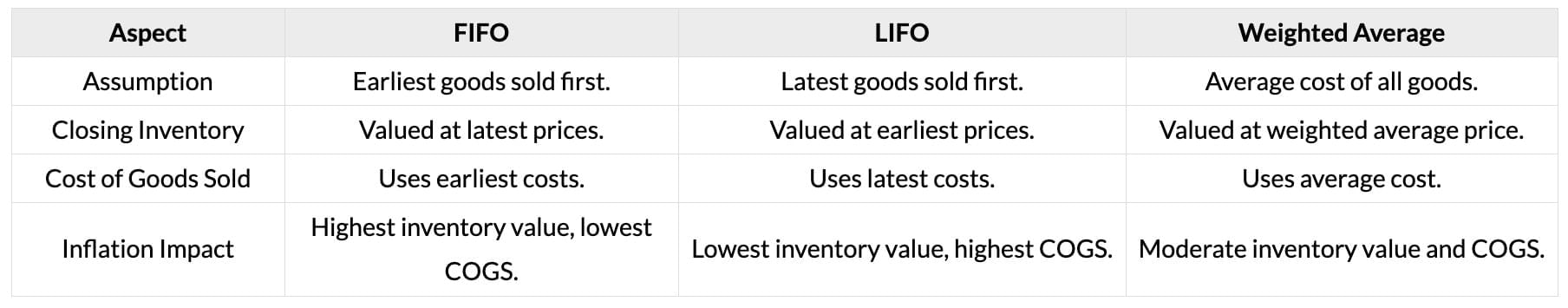

Inventory Valuation Methods

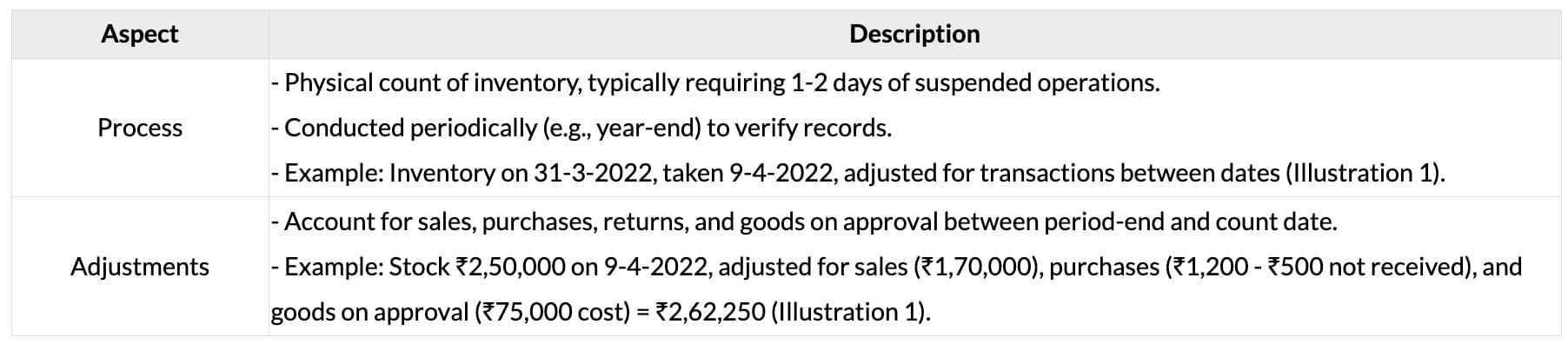

Inventory Taking

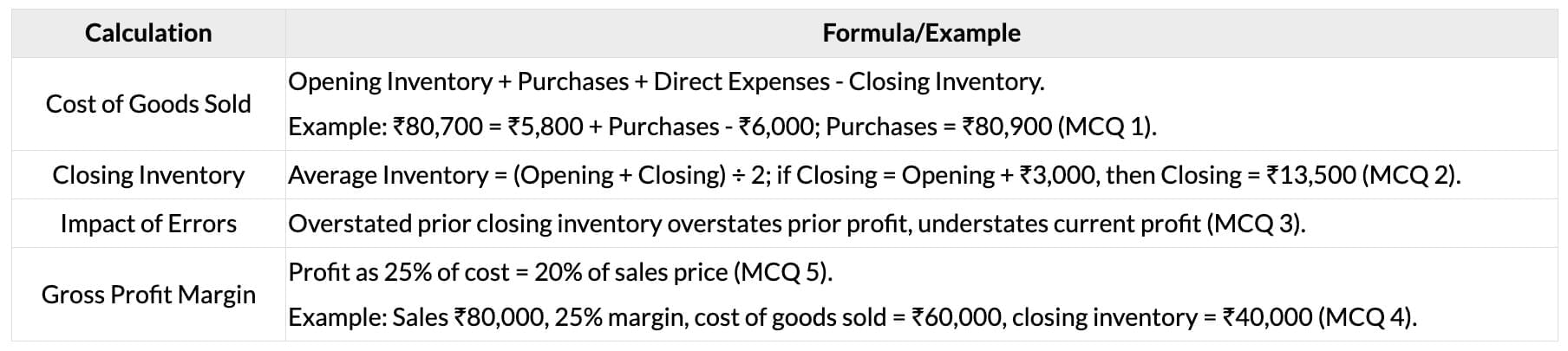

Key Calculations

Key Differences

The document Cheatsheet: Inventories | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Cheatsheet: Inventories - Accounting for CA Foundation

| 1. What is the meaning of inventory in accounting? |  |

Ans.Inventory refers to the goods and materials a business holds for the purpose of resale or production. It includes raw materials, work-in-progress, and finished goods, and is a crucial asset on a company's balance sheet.

| 2. What are the objectives of inventory valuation? |  |

Ans.The objectives of inventory valuation include determining the cost of goods sold, ensuring accurate financial reporting, aiding in tax calculations, and assisting in inventory management decisions. Proper valuation helps in assessing profitability and managing cash flow.

| 3. What are the different methods of inventory valuation? |  |

Ans.Common methods of inventory valuation include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted Average Cost. Each method affects the cost of goods sold and ending inventory differently, impacting financial statements and tax obligations.

| 4. What is the significance of taking inventory? |  |

Ans.Taking inventory is significant because it ensures accurate record-keeping, helps identify discrepancies between physical stock and recorded figures, and assists in assessing inventory levels for effective stock management. It is crucial for maintaining operational efficiency and financial accuracy.

| 5. How do inventory record systems impact business operations? |  |

Ans.Inventory record systems impact business operations by providing real-time data on stock levels, facilitating better inventory management, reducing the risk of stockouts or overstocking, and enhancing decision-making processes related to purchasing, sales, and production planning.

Related Searches