Financial Statements of Not for Profit Organisations (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 1.61:

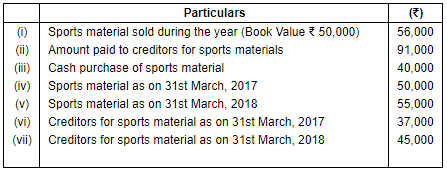

Question 26: Calculate the amount of sports material to be transferred to income and Expenditure Account of Raman Bhalla Sports Club, Ludhiana, for the year ended 31st March, 2018:

ANSWER:

Page No 1.61:

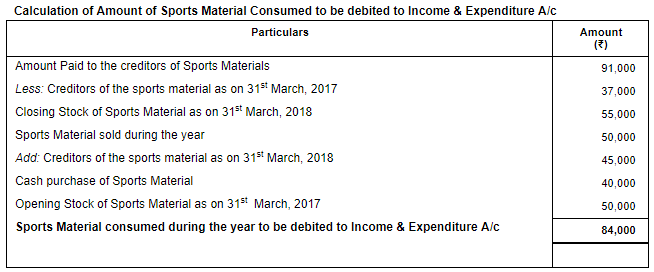

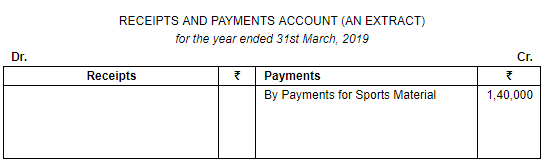

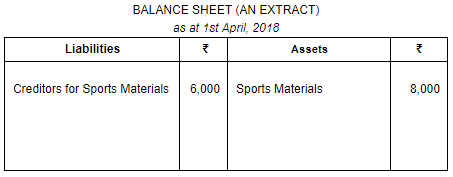

Question 27: How are the following dealt with while preparing the final accounts for the year ended 31st , 2019?

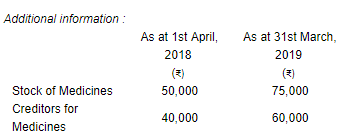

Additional information :

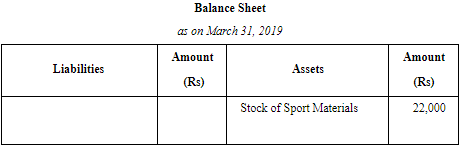

Sports Materials in Hand on 31st March, 2019 – ₹ 22,000.

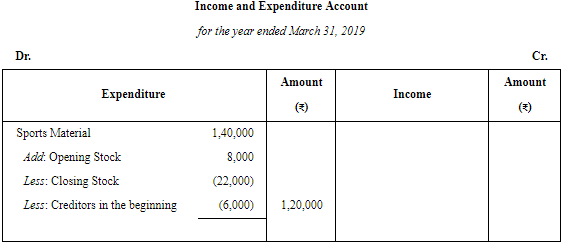

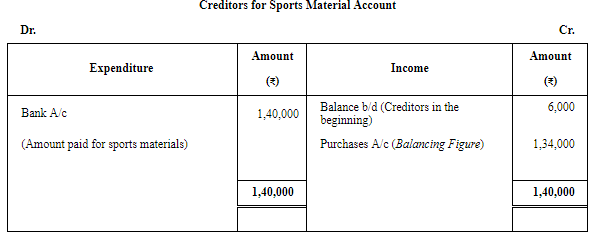

ANSWER:

Alternatively, Sports Material consumed can also be calculated as.

Sports Material Consumed = Opening Stock + Purchases – Closing Stock = 8,000 + 1,34,000 – 22,000 = Rs 1,20,000

Page No 1.61:

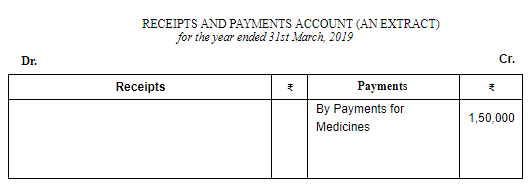

Question 28: How are the following dealt with while preparing the final accounts for the year ended 31st March, 2019?

ANSWER:

Page No 1.62:

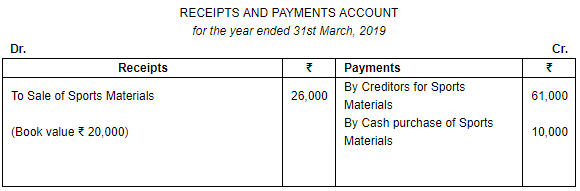

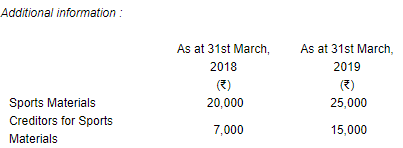

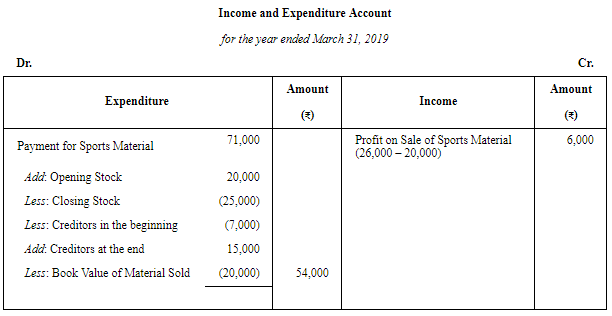

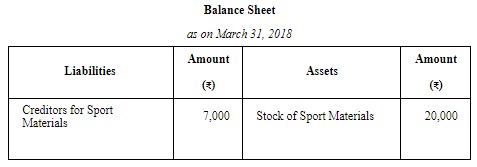

Question 29: How are the following dealt with while preparing the final accounts of a sports club for the year ended 31st March, 2019?

ANSWER:

Page No 1.62:

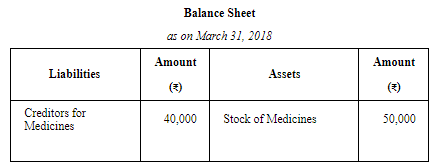

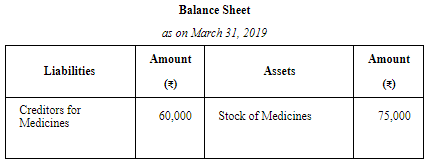

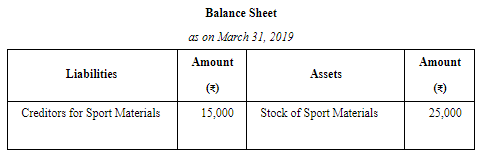

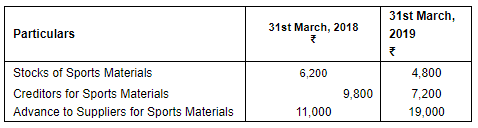

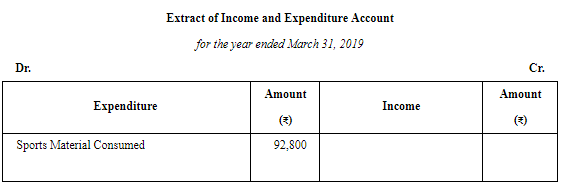

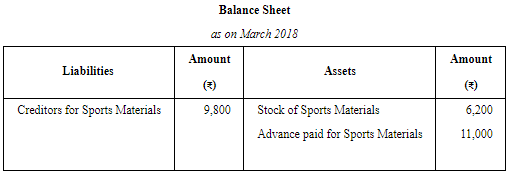

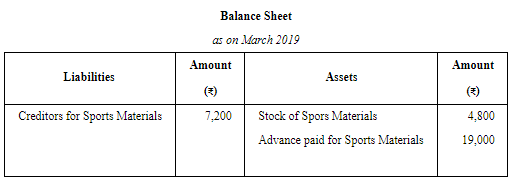

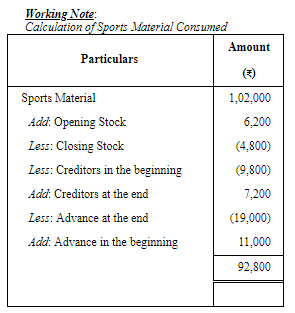

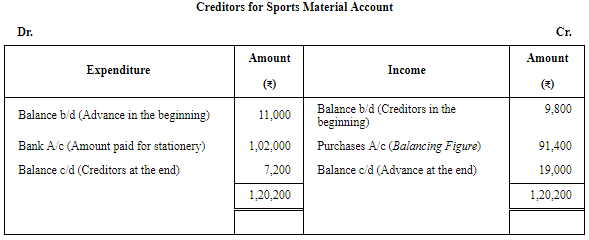

Question 30: From the following information of a Not-for-Profit Organisation, show the 'Sports Materials' item in the Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheets as at 31st March, 2018 and 31st March, 2019:

Payment to suppliers for Sports Materials during the year was ₹ 1,02,000. There were no cash purchases made.

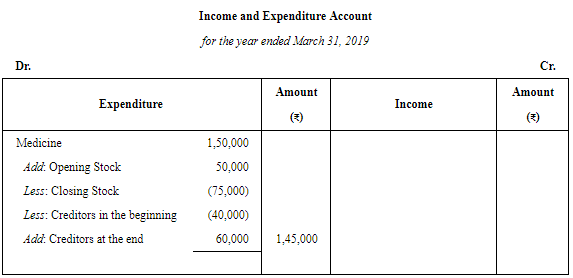

ANSWER:

Alternatively, Sports Material consumed can also be calculated as.

Sports Material Consumed = Opening Stock + Purchases – Closing Stock = 6,200 + 91,400 – 4,800 = Rs 92,800

Page No 1.62:

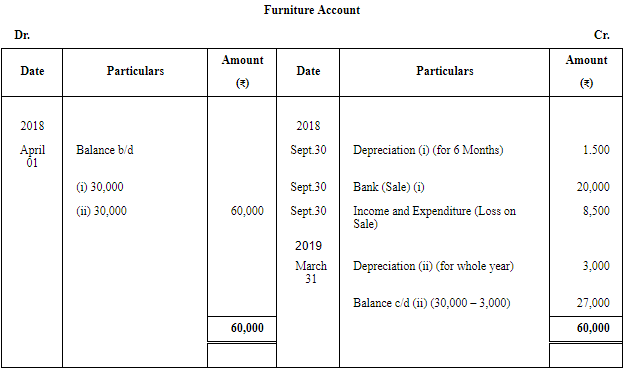

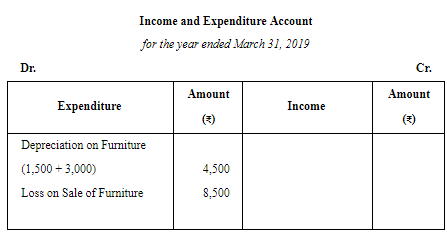

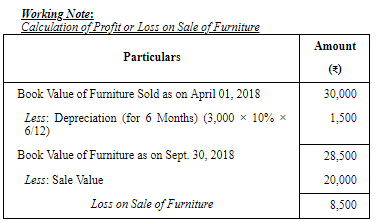

Question 31: The book value of furniture on 1st April, 2018 is ₹ 60,000. Half of this furniture is sold for ₹ 20,000 on 30th September, 2018. Depreciation is to be charged on furniture @ 10% p.a.

Calculate loss on sale of furniture. Show how the loss on sale and depreciation on furniture will be shown in the Income and Expenditure Account for the year ended 31st March, 2019.

ANSWER:

Page No 1.63:

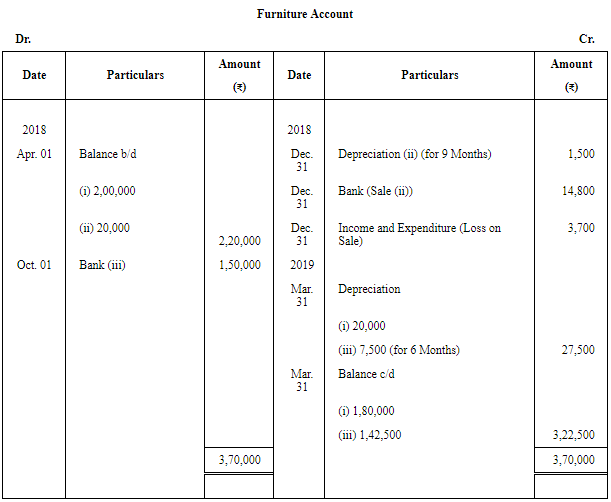

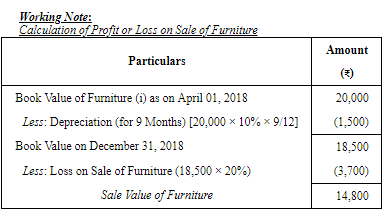

Question 32: Delhi Youth Club has furniture at a value of ₹ 2,20,000 in its book on 31st March, 2018. It sold old furniture, having book value of ₹ 20,000 as at 1st April , 2018 at a loss of 20% on 31st December, 2018. Furniture is to be depreciated @ 10% p.a. Furniture costing ₹ 1,50,000 was also purchased on 1st October, 2018.

Prepare Furniture Account for the year ended 31st March, 2019.

ANSWER:

Page No 1.63:

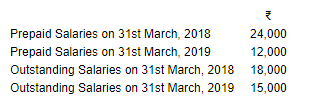

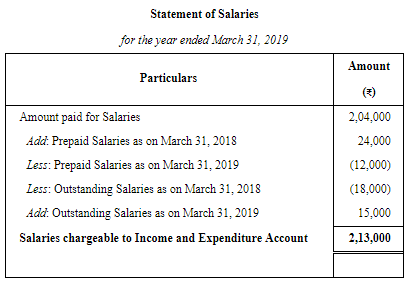

Question 33: In the year ended 31st March, 2019, salaries paid amounted to ₹ 2,04,000. Ascertain the amount chargeable to the Income and Expenditure Account for the year ended 31st March, 2019 from the following additional information:

ANSWER:

Page No 1.63:

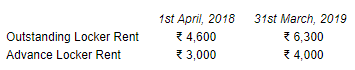

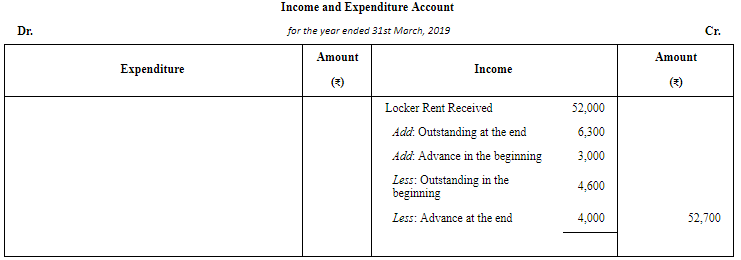

Question 34: How are the following items dealt with while preparing Income and Expenditure Account of a club for the year ended 31st March, 2019?

Locker Rent received during the year ended 31st March, 2019 – ₹ 52,000.

ANSWER:

Page No 1.63:

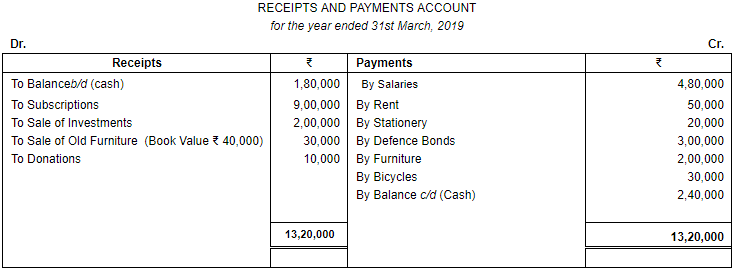

Question 35: Prepare Income and Expenditure Account for the year ended 31st March, 2019 from the following:

ANSWER:

Page No 1.63:

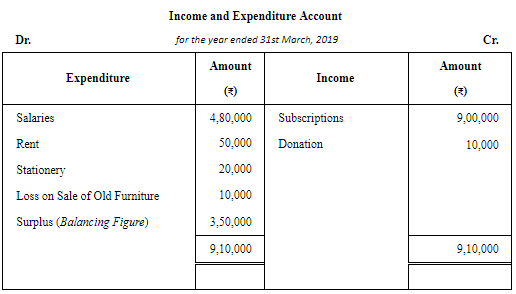

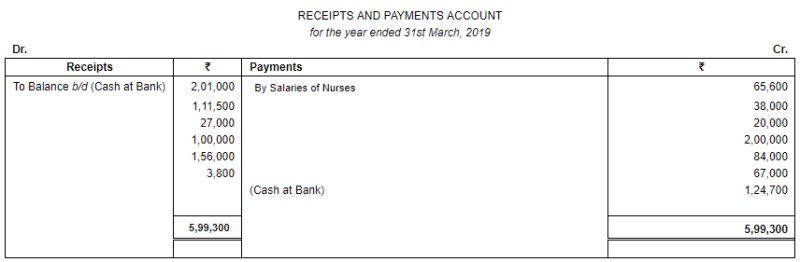

Question 36: Prepare Income and Expenditure Account from the following Receipts and Payments Account of Delhi Nursing Society for the year ended 31st March, 2019:

Donation of ₹ 10,000 received for Building Fund was wrongly included in the Subscriptions Account. A bill of medicines purchased during the year amounted to ₹12,800 was outstanding. Government Grant is not for a specific purpose.

ANSWER:

Page No 1.64:

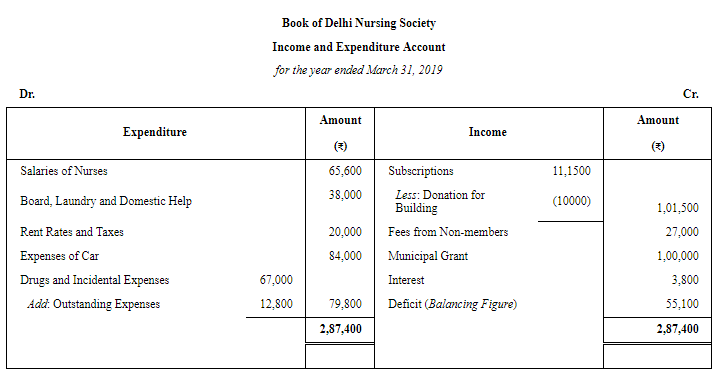

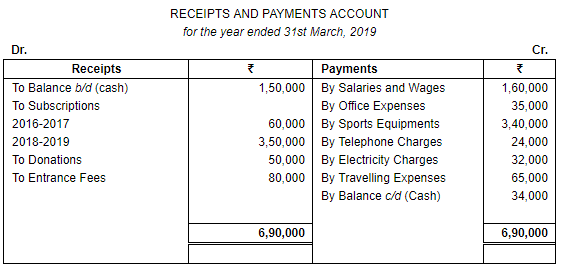

Question 37: Following is the Receipts and Payments Account of You Bee Forty Club for the year ended 31st March, 2019:

Additional information :

(a) Outstanding Subscriptions for the year ended 31st March, 2019 – ₹ 55,000

(b) Outstanding Salaries and Wages – ₹ 40,000.

(c) Depreciate Sports Equipments by 25%.

Prepare Income and Expenditure Account of the Club from the above particulars.

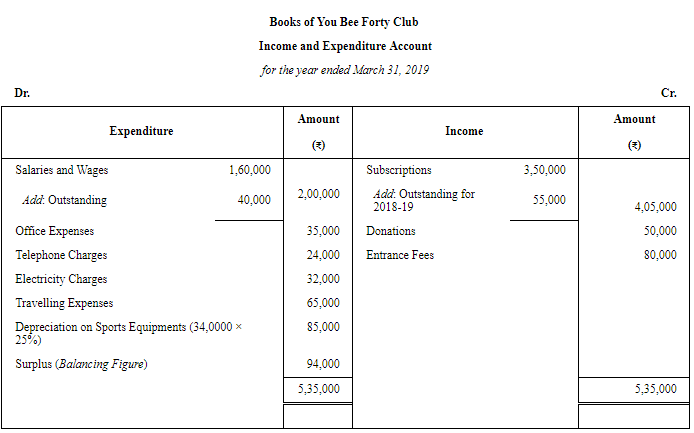

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Financial Statements of Not for Profit Organisations (Part - 3) - Accountancy Class 12 - Commerce

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. How are financial statements of not-for-profit organizations different from those of for-profit organizations? |  |

| 3. What information can be derived from the statement of activities in a financial statement of a not-for-profit organization? |  |

| 4. How can the statement of functional expenses be useful in analyzing the financial performance of a not-for-profit organization? |  |

| 5. What is the importance of the statement of cash flows in the financial statements of not-for-profit organizations? |  |