Financial Statements of a Company (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 1.64

Question:1

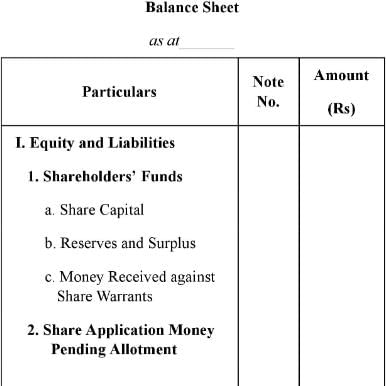

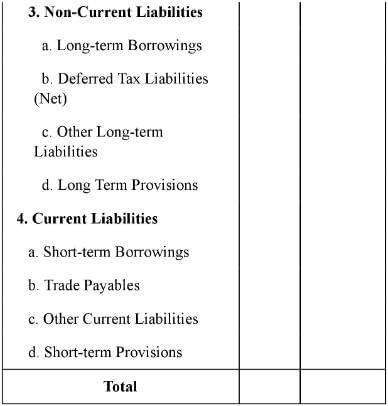

What are the major heads in the Equity and Liabilities part of the Balance Sheet as per Schedule III?

Solution:

The major heads in the Equities and Liabilities part of the Balance sheet are:

i. Shareholder’s Funds,

ii. Share Application Money Pending Allotment,

iii. Non- Current Liabilities and

iv. Current Liabilities

Question:2

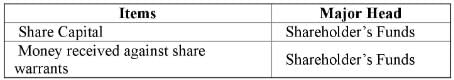

Under which major head will the following be shown:

(i) Share Capital; and (ii) Money Received Against Share Warrants?

Solution:

Page No 1.65

Question:3

List any five items that are shown under Reserves and Surplus.

Solution:

Items shown under Reserves and Surplus are:

i. Capital Reserve,

ii. Capital Redemption Reserve,

iii. Securities Premium Reserve,

iv. Debenture Redemption Reserve,

v. Revaluation Reserve etc.

Question:4

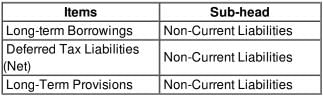

Under which sub-head will the following be classified or shown:

(i) Long-term Borrowings; (ii) Deferred Tax Liabilities (Net); and (iii) Long-term Provision?

Solution:

Question:5

Name the itmes that are shown under Long-term Borrowings.

Solution:

Items shown under Long-term Borrowings are:

a. Debentures,

b. Bonds,

c. Terms Loans (both from Banks and from others),

d. Public Deposits,

e. Other Loans and Advances.

Question:6

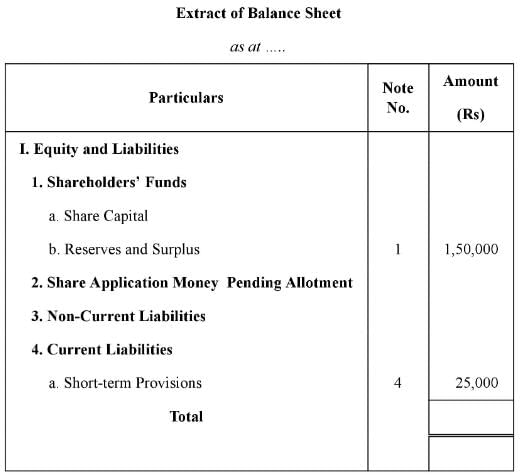

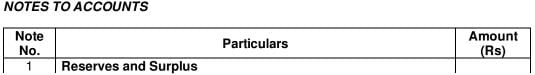

A company has an opening credit balance in Surplus, i.e., Balance in Statement of Profit and Loss of 1,00,000. During the year, it earned a profit of 75,000. It decided to transfer 15,000 to Debentures Redemption Reserve (DRR) and also proposed to pay dividend of 25,000.

How will be the appropriations shown in the financial statements?

Solution:

Question:7

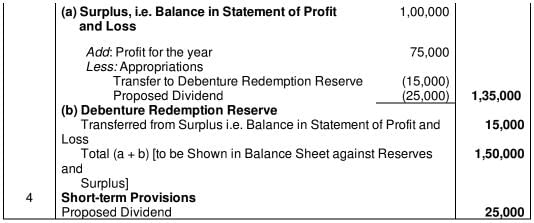

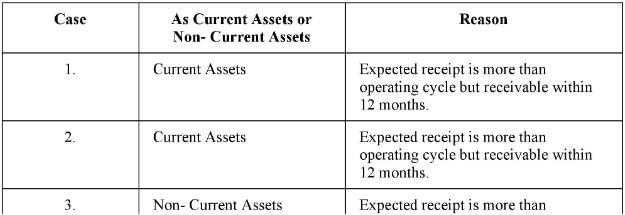

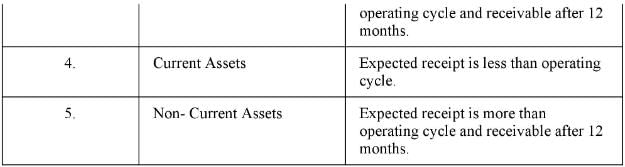

State giving reason whether Trade Receivables are classified as Current Assets or Non-current Assets in the Balance Sheet of a Company as per Schedule III of the companies Act, 2013 in the following cases.

Ans.

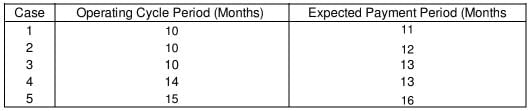

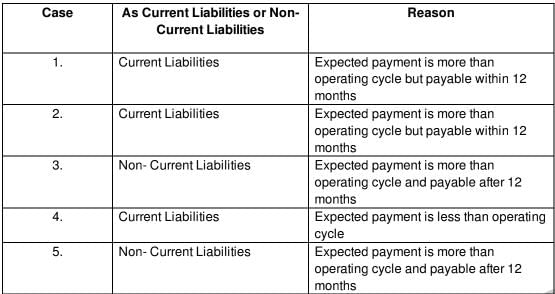

Question:8

State giving reason whether Trade Payables are classified as Current Liabilities or Non-current Liabilities in the Calance Sheet of a Company as per Schedule III of the Companies Act, 2013 in the following Cases:

Solution:

Page No 1.66

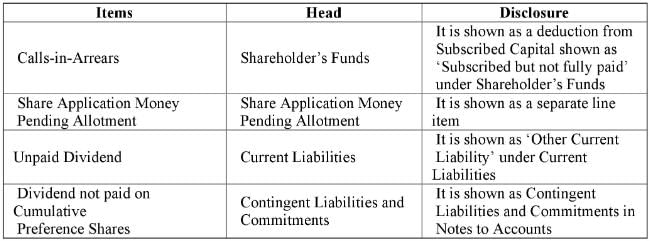

Question:9

Under which head and how are the following items shown in the Balance Sheet of a company under Schedule III:

(i) Calls-in-Arrears; (ii) Share Application Money Pending Allotment; (iii) Unpaid Dividend; and (iv) Dividend not paid on Cumulative preference shares ?

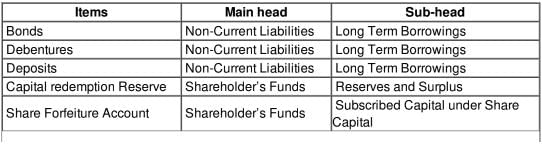

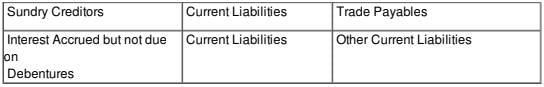

Question:10

Under which main head and sub-head of Equity and Liabilities part of the Balance Sheet are the following items classified or

shown:

(i) Bonds;

(ii) Debentures

(iii) Public Deposits;

(iv) Capital Redemption Reserve;

(v) Forfeited Shares Account:

(vi) Sundry Creditors; and

(vii) Interest Accrued but Not Due on Debentures?

Solution:

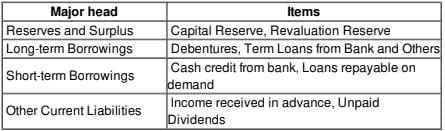

Question:11

State any two items that are included in the following major heads under which liabilities of a company are shown: (i) Reserves and Surplus; (ii) Long-term Borrowings; (iii) Short-term Borrowings; (iv) Other Current Liabilities.

Solution:

Question:12

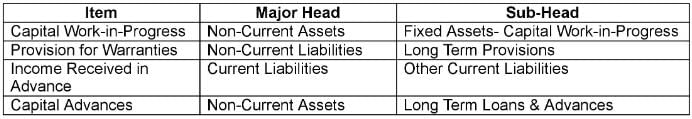

Classify the following items under major head and sub-head (if any) in the Balance Sheet of a company as per Schedule III of the Compaines Act, 2013: (i) Capital Work-in-Progress (ii) Provision for Warranties; (iii) Income received in Advance; and (iv) Capital Advances

Solution:

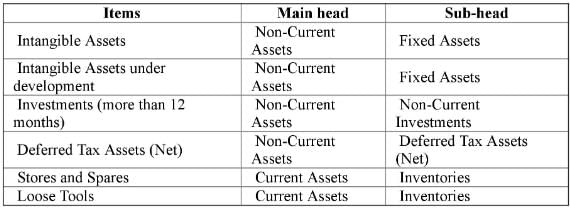

Question:13

Under which major head and sub-head of the Assets part of the Balance Sheet will the following be shown:

(i) Intangible Assets; (ii) Intangible Assets under Development; (iii) Investments (more than 12 months); (iv) Deferred Tax Assets (Net); (v) stores and Spares; and (vi) Loose Tools ?

Solution:

Page No 1.67

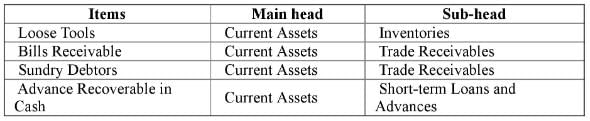

Question:14

Under which heads the following items are classified or shown on the Assets part of the Balance Sheet of a copany: (i) Loose Tools; (ii) Bills Receivable; (iii) Sundry Debtors: and (iv) Advances Recoverable in Cash?

Solution:

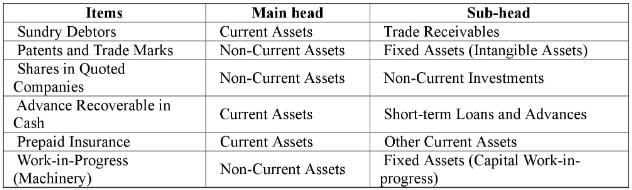

Question:15

Under which heads the following items on the Assets part of the Balance Sheet of a company will be presented?

(i) Sundry Debtors;

(ii) Patents and Trademarks;

(iii) Shares in Quoted Companies:

(iv) Advances recoverable in cash;

(v) Prepaid Insurance; and

(vi) Work-in-Progress (Machinery)?

Question:16

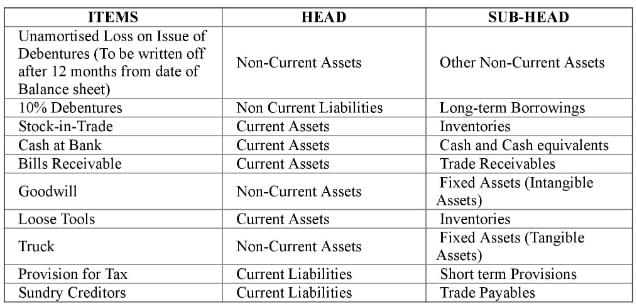

Under which of the major heads will the following items be shown while preparing Balance Sheet of a company, as per

Schedule III of the Companies Act, 2013:

(i) Unamortised Loss on Issue of Debentures (To be written off after 12 months from the date of Balance Sheet);

(ii) 10% Debentures;

(iii) Stock-in-Trade;

(iv) Cash at Bank;

(v) Bills Receivable;

(vi) Goodwill;

(vii) Loose Tools;

(viii) Truck;

(ix) Provision for Tax; and

(x) Sundry Creditors?

Solution:

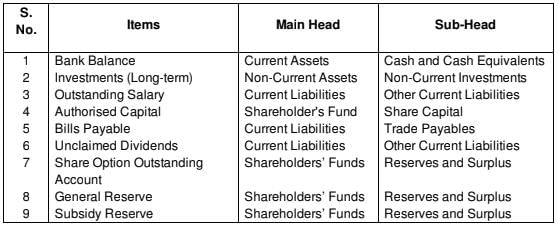

Question:17

Under which heads will the following items be shown in the Balance Sheet of a Company

(i) Bank Balance;

(ii) Investments (Long-term);

(iii) Outstanding Salary;

(iv) Authorised Capital;

(v) Bills Payable;

(vi) Unclaimed Dividents;

(vii) Shares Option Outstanding Account;

(viii) General Reserve; and

(ix) Subsidy Reserve?

Solution:

Ans.

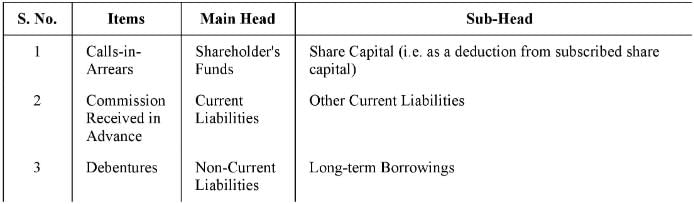

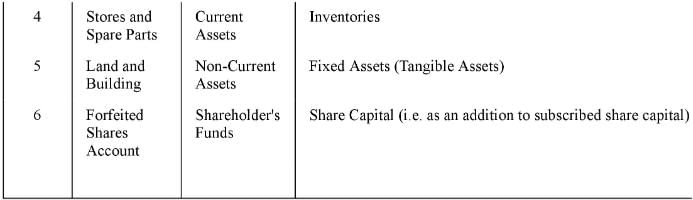

Question:18

Under which heads the following items are shown in the Balance Sheet of a company:

(i) Calls-in-Arrears;

(ii) Commission Received in Advance;

(iii) Debentures;

(iv) Stores and Spare Parts;

(v) Land and Building;

(vi) Forfeited Shares Account?

Solution:

Page No 1.68

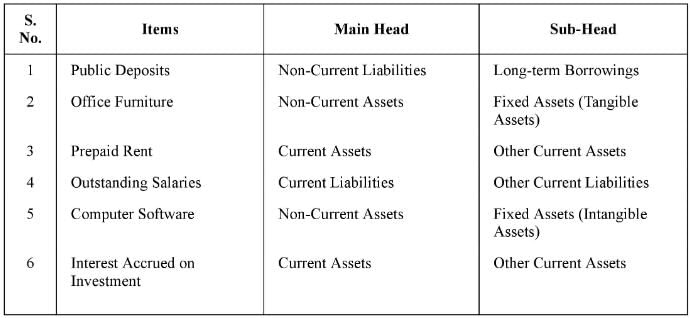

Question:19 Under which heads the following are shown in a company's Balance Sheet:

(i) Public Deposits;

(ii) Office Furniture;

(iii) Prepaid Rent;

(iv) Outstanding Salaries;

(v) Computer Software;

(vi) Interest Accrued on Investment?

Solution:

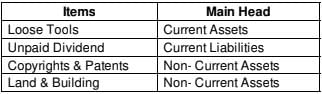

Question:20

Name the major heads under which the following items will be presented in the Balance Sheet of a company as per Schedule III of the Companies Act, 2013:

(i) Loose Tool.

(ii) Unpaid Dividend.

(iii) Copyrights and Patents.

(iv) Land and Building.

Solution:

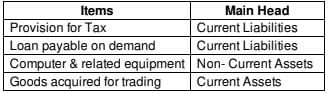

Question:21

Identify the major heads under which the following items will be shown in the Balance Sheet of a company as per Schedule III of Companies Act, 2013:

(i) Provision for Tax.

(ii) Loan payable on demand.

(iii) Computer and related equipment.

(iv) Goods acquired for trading

Solution:

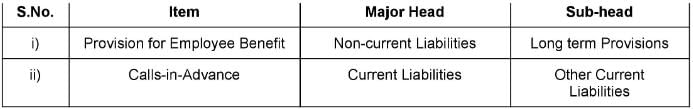

Question:22

Under which major headings and sub-headings the following items will be shown in the Balance Sheet of a company as per schedule III of Companies Act, 2013?

(i) Provision for Employee Benefits.

(ii) Calls-in-Advance.

Solution:

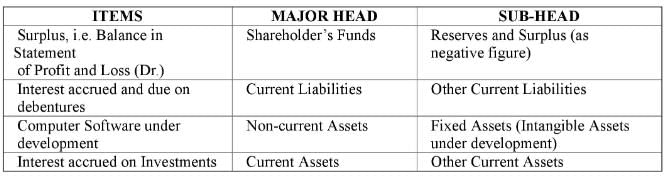

Question:23

How are the following items shown while preparing Balance Sheet of a company:

(i) Surplus, i.e., Balance in Statement of Profit and Loss (Dr.);

(ii) Interest accrued and due on Debentures;

(iii) Computer Software under development;

(iv) Interest accrued on Investment?

Solution:

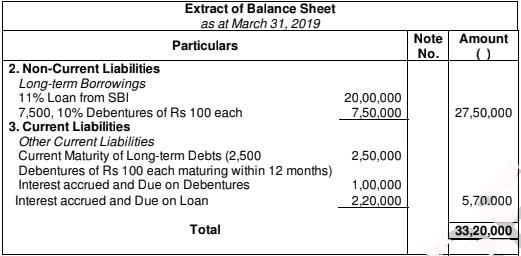

Question:24

Hero Ltd. has raised following long-term loans on 1st April, 2018:

10,000; 10% Debentures of 100 each redeemable in four equal yearly

installments beginning 1st July, 2019 10,00,000

11% Bank Loan from SBI repayable after 5 years 20,00,000

Interest on Debentures and Bank Loan has not yet been paid.

How will be the above items shown in the Balance Sheet of the company as at 31st March, 2019?

Solution:

Page No 1.69

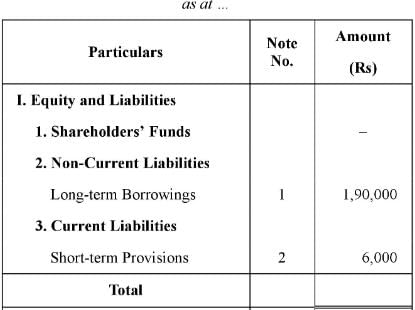

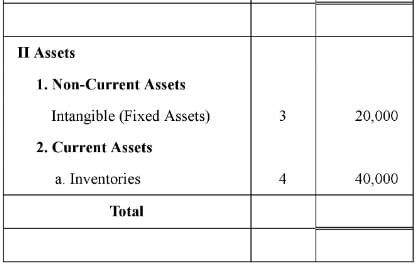

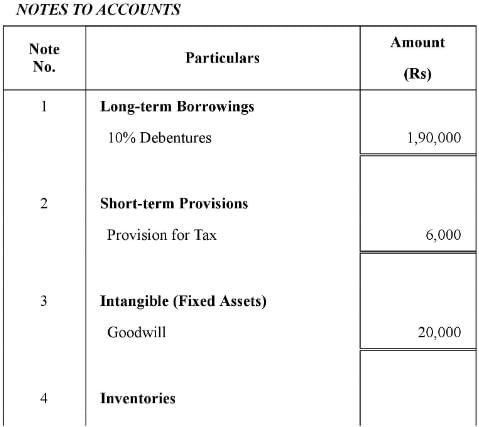

Question:25

Prepare Balance Sheet of the Company as per Schedule III

of the Companies Act, 2013:

10% Debentures of 100 each 1,90,000

Stock-in-Trade (inventories) 40,000

Goodwill 20,000

Provision for Tax 60,000

Totalling of Balance Sheet is not required

Solution:

Balance Sheet

|

42 videos|199 docs|43 tests

|

FAQs on Financial Statements of a Company (Part - 1) - Accountancy Class 12 - Commerce

| 1. What are financial statements of a company? |  |

| 2. Why are financial statements important for a company? |  |

| 3. How often are financial statements prepared and published by a company? |  |

| 4. What is the purpose of the balance sheet in financial statements? |  |

| 5. How does the income statement contribute to financial statements? |  |