Fiscal Policy: Economics | Indian Economy for UPSC CSE PDF Download

Introduction

Fiscal policy is the guiding force that helps the government decide how much money it should spend to support the economic activity, and how much revenue it must earn from the system, to keep the wheels of the economy running smoothly.

For example: During an economic downturn, the government may decide to open up its coffers to spend more on building projects, welfare schemes, providing business incentives, etc. The aim is to help make more productive money available to the people, free up some cash with the people so that they can spend it elsewhere, and encourage businesses to make investments. At the same time, the government may also decide to tax businesses and people a little less, thereby earning less revenue itself.

Objectives of Fiscal Policy

- Economic growth: Fiscal policy helps maintain the economy’s growth rate so that certain economic goals can be achieved.

- Price stability: It controls the price level of the country so that when inflation is too high, prices can be regulated.

- Full employment: It aims to achieve full employment, or near full employment, as a tool to recover from low economic activity.

Importance of Fiscal Policy

- In a country like India, fiscal policy plays a key role in elevating the rate of capital formation both in the public and private sectors.

- Through taxation, the fiscal policy helps mobilise a considerable amount of resources to finance its numerous projects.

- Fiscal policy also helps provide a stimulus to elevate the savings rate.

- The fiscal policy gives adequate incentives to the private sector to expand its activities.

- Fiscal policy aims to minimise the imbalance in the dispersal of income and wealth.

Components of Fiscal Policy

1. Capital Account: A capital account is an account that includes capital receipts and payments. It basically includes assets as well as liabilities of the government.

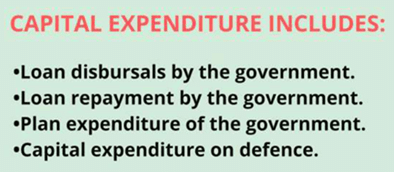

(a) Capital Expenditure: Capital expenditure is the expenditures made by the government to create physical or financial assets.

Capital expenditure either creates an asset or causes a reduction in liabilities of the government.

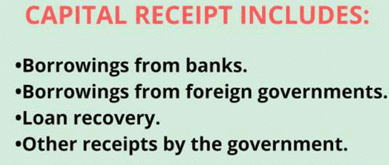

(b) Capital Receipts: Capital receipts are those which create a liability on the government or reduce the assets.

2. Revenue Account: A revenue account is an account with a credit balance. It includes all the revenue receipts and the revenue expenditure of the government.

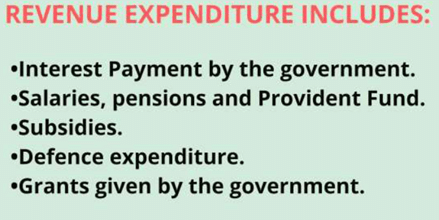

(a) Revenue Expenditure: Revenue expenditure is the expenditure made by the government which creates neither an asset nor a liability. These expenditures are simply interest payments on debts by the government, grants to state governments and general expenses.

Revenue Expenditure is divided into:

- Plan Expenditure which is made for central government plans (Five-year plans), and other State and Union Territory plans.

- Non-Plan Expenditure which are general expenditures such as salaries, pensions, and interest payments.

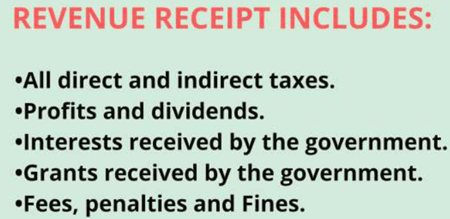

(b) Revenue Receipts: Revenue receipts are the current income to the government and they cannot be taken back from the government.

The Revenue receipts are divided into Tax and Non-Tax Revenue:

- Tax Revenue is the main component of revenue receipts. It includes taxes and duties made by the government.

Tax Revenue mainly includes:

- Direct taxes (personal income tax, corporation tax) fall directly on a person.

- Indirect taxes include (excise duties and customs duties) which are on goods produced in the country or goods that are exported and imported.

- Non-Tax Revenue includes interest on loans of the government, dividends and profits on investment and foreign aid.

Deficits and their Types

What Is a Deficit?

A deficit is an amount by which a resource, especially money, falls short of what is required. A deficit occurs when expenses exceed revenues, imports exceed exports, or liabilities exceed assets.

In a deficit, the total of negative amounts is greater than the total of positive amounts. In other words, the outflow of money exceeds the inflow of funds. A deficit can occur when a government, company, or individual spends more than is received in a given period, usually a year.

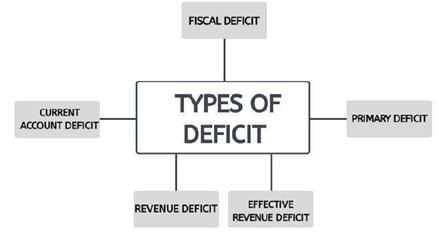

(i) Current account deficit is when a country imports more goods and services than it exports.

Current Account = Trade gap + Net current transfers + Net income abroad Trade gap = Exports – Imports

(ii) A fiscal deficit occurs when a government's total expenditures exceed the revenue that it generates, excluding money from borrowings.

Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts)

(iii) Primary deficit is the fiscal deficit of the current year minus interest payments on previous borrowings.

Primary Deficit = Fiscal Deficit (Total expenditure – Total income of the government) – Interest payments (of previous borrowings)

(iv) Revenue deficit relates only to the government: It describes the shortfall of total revenue receipts compared to total revenue expenditures.

Revenue Deficit: Total revenue receipts – Total revenue expenditure.

(v) Effective Revenue Deficit is the difference between revenue deficit and grants for the creation of capital assets.

Effective Revenue Deficit: Revenue deficit - Grant for creation of capital assets.

Fiscal Responsibility and Budget Management Act (FRBMA), 2003

The objective of this FRBM Act is to impose fiscal discipline on the government.

It means fiscal policy should be conducted in a disciplined manner or in a responsible manner i.e. government deficits or borrowings should be kept within reasonable limits and the government should plan its expenditure in accordance with its revenues so that the borrowing should be within limits.

Targets under this FRBM Act

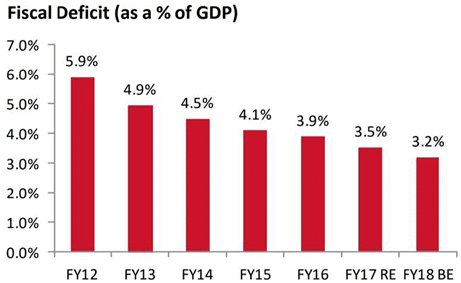

- The FRBM Act's original target of reducing the fiscal deficit to 3% of GDP by 2008-09 was not met due to multiple economic disruptions, including the COVID-19 pandemic. The government revised its fiscal roadmap, now targeting a fiscal deficit below 4.5% of GDP by 2025-2026.

- The fiscal deficit for 2024-2025 is estimated at 5.1% of GDP.

- Similarly, the revenue deficit has to be reduced by 0.5% of the GDP per year with complete elimination to be achieved by 2008-09.

Methods to Control Fiscal Deficit

- Printing Fresh Currency by RBI (May Cause Inflation)

- Market Borrowing (May Cause Crowding Out of Private Investment)

Better Approach Is That Resources Should Be Raised from Taxes, User Charges, Disinvestment Etc.

Expenditure Control Should Not Involve Tage; padding: 0px 1px; user-select: none;">

NK Singh Committee Recommendations (From Review Committee).

The FRBM Review Committee headed by former Revenue Secretary, NK Singh was appointed by the government to review the implementation of FRBM.

Major Recommendations of the N.K. Singh Committee

The key recommendations of the committee are summarised below:

Debt to GDP ratio

- The NK Singh Committee suggested making debt the main focus of fiscal policy.

- They proposed targeting a Debt to GDP ratio of 60%, with a 40% limit for the central government and a 20% limit for state governments.

- Many countries with fiscal rules in place also aim for a debt-to-GDP ratio of 60%.

- As of 2025, the combined debt-to-GDP ratio remains above the recommended levels, primarily due to increased borrowings during the pandemic and economic recovery programs

- Debt signifies the total government liabilities, while fiscal deficit represents new borrowings for the year and revenue deficit indicates the portion used to cover expenses.

Fiscal Council

- The NK Singh Committee recommended establishing an independent fiscal Council with a chairperson and two members chosen by the central government.

- To ensure autonomy, it suggested a fixed 4-year term for both the chairperson and members.

- Individuals in these roles must not hold positions in the Central or State Government during their appointment.

Role of the Fiscal Council

- The Council's task would involve creating financial forecasts for multiple years.

- It would suggest alterations to the financial plan.

- Enhancing the quality of fiscal information is another goal.

- If necessary, the Council would advise the government on straying from the fiscal target.

- If there is non-compliance with the bill, the Council would recommend corrective actions to the government.

Debt Trajectory for the Individual States

- The committee suggested that the 15th Finance Commission should be tasked with proposing the financial path for each State.

- This decision should be based on how well each State has managed its finances and public well-being.

Deviations

- The NK Singh Committee emphasized that the government must adhere to targets under the FRBM act, except in specific circumstances like national calamities, national security concerns, or other exceptional situations as designated by the government.

- It was recommended by the committee that the reasons permitting the government to deviate from the set targets should be explicitly outlined, and the government should not have the authority to specify additional circumstances.

Fiscal Deficit as the operating target

- The group supported using the fiscal deficit as the main target to decrease the government debt.

- To consolidate finances, the fiscal deficit stands at 5.1% of GDP in 2024-25, with a goal of reducing it below 4.5% by 2025-26.

- An analysis conducted for the central government indicates that aiming for this deficit will aid in achieving the 40% public debt-to-GDP ratio target by 2025-26.

Revenue Deficit Target

- The committee suggested that the national government should gradually reduce the revenue shortfall by 0.25% of the Gross Domestic Product (GDP) each year.

- The goal is to reduce the revenue deficit to 1.5% of GDP by 2025-26, from the revised estimate of 1.9% in 2024-25.

Escape clause

- The NK Singh Committee proposed more flexibility in financial matters beyond the set fiscal deficit goals through special provisions known as Escape clauses.

- These Escape clauses allow adjustments for temporary and moderate deviations from the regular financial plan in response to cyclical changes.

- To avoid misuse, the committee suggests specific regulations to control these deviations, limiting them to 0.5% of the Gross Domestic Product (GDP) within a single year.

- Under exceptional circumstances, the government can diverge from these set targets based on advice from the Fiscal Council, such as during instances of national security concerns, war, national disasters, agricultural crises affecting output and incomes, economic structural reforms with financial implications, or a significant drop in real output growth compared to the previous four quarters.

Borrowings from RBI

- The draft bill restricts the government from borrowing from the Reserve Bank of India except during the temporary shortfall in receipts of the centre.

- When RBI subscribes to the government securities to finance any deviation from the specified targets.

- RBI purchases Government Securities from the secondary market.

- Monetary and fiscal policy should complement each other and help accomplish economic stability and growth.

- The committee also advised the government not to finance the government's day-to-day expenditures through borrowings.

Recent Developments

As of May 2025, India’s fiscal policy has adapted to address post-COVID economic recovery, global uncertainties, and domestic priorities such as sustainable development and digital transformation. These updates are essential for UPSC aspirants to grasp the evolving fiscal landscape and its implications for India’s economy.

Fiscal Deficit and FRBM Framework

- The 2024–25 Union Budget sets the fiscal deficit at 4.9% of GDP, reduced from 5.1% in 2023–24, signaling robust fiscal consolidation. The revised FRBM roadmap targets a deficit below 4.5% by 2025–26.

- The debt-to-GDP ratio, which surged to 89% in 2020–21 due to pandemic borrowing, has declined to approximately 81% in 2024. The government aims to reduce it below 70% by 2030, aligning with NK Singh Committee recommendations.

- The revenue deficit for 2024–25 is projected at 1.8% of GDP, with a target of 1.5% by 2025–26, reflecting a shift away from borrowing for revenue expenditure.

Taxation Reforms

- The Goods and Services Tax (GST) has matured, with monthly collections rising from ₹1.24 lakh crore in 2020 to ₹2.1 lakh crore in April 2024. Proposals for GST 2.0 in 2024–25 aim to simplify rate structures and include petroleum products.

- The 2024–25 Budget raised long-term capital gains tax to 12.5% and short-term capital gains tax to 20%, enhancing revenue while encouraging investment. Digital tax administration, including faceless assessments and blockchain systems, has improved compliance.

- The optional direct tax regime (introduced in 2020), offering lower rates without exemptions, is now used by over 50% of individual taxpayers as of 2024.

Expenditure Priorities

- The 2024–25 Budget allocates ₹11.11 lakh crore for capital expenditure (3.4% of GDP), focusing on infrastructure, renewable energy, and digital public infrastructure like UPI and DigiLocker.

- Post-COVID schemes like PM Garib Kalyan Anna Yojana (2020–23, ₹2 lakh crore) ensured food security, while MNREGA funding remains strong at ₹86,000 crore in 2024–25.

- The Production-Linked Incentive (PLI) scheme, with ₹1.97 lakh crore allocated by 2024, drives manufacturing growth in sectors like electronics, creating jobs.

Post-COVID Fiscal Reforms

- The Atmanirbhar Bharat package (2020–21, ₹20.97 lakh crore) provided liquidity, credit guarantees, and direct spending to support MSMEs, agriculture, and healthcare during the pandemic.

- The 2023–24 fiscal strategy introduced the GYAN framework (Gareeb, Yuva, Annadata, Nari), targeting inclusive growth for marginalized groups, youth, farmers, and women.

- These reforms have propelled GDP growth to 6.7% in 2024–25, with projections of 7% by 2026, driven by fiscal stimulus and rising private investment.

Climate and Green Fiscal Policy

- The 2023–24 Green Credit Programme promotes eco-friendly projects, while ₹1 lakh crore in 2024–25 funds renewable energy initiatives, including green hydrogen and PM Suryaghar Yojana for solar power.

- India has raised ₹16,000 crore through green bonds by 2024 to finance sustainable infrastructure, supporting the net-zero by 2070 goal.

- Fiscal measures include ₹10,000 crore for disaster mitigation in 2024–25, enhancing climate resilience.

Fiscal Federalism

- The 15th Finance Commission (2021–26) increased states’ share of the divisible pool to 41%, strengthening fiscal autonomy. GST compensation issues were resolved in 2022, with ₹1.18 lakh crore disbursed to states.

- States advocate for a 50:50 Centre-State tax-sharing model, with discussions ongoing in 2024–25.

- Cooperative federalism is supported by ₹2.55 lakh crore in grants-in-aid to states in 2024–25.

Global Economic Influences

- The Russia-Ukraine war (2022–24) led to fuel subsidies of ₹1.05 lakh crore in 2022–23. The 2024–25 Budget reduces fuel subsidies to ₹2 lakh crore, balancing fiscal resources.

- The Critical Minerals Mission (2024) allocates ₹10,000 crore to secure lithium and rare earths, enhancing supply chain resilience.

- Global inflation (6.2% CPI in 2021–22) was managed through fiscal-monetary coordination, stabilizing CPI at around 5% in 2024.

Digital and Technology-Driven Fiscal Measures

- Fiscal support for the digital economy includes ₹1.52 lakh crore for IT and telecom in 2024–25, strengthening UPI, which handles 50% of global digital transactions by value.

- Blockchain-based tax systems and DigiLocker have boosted revenue collection to ₹32 lakh crore in 2024–25.

- The Digital India initiative has formalized 60% of GDP transactions by 2024, enhancing tax buoyancy and economic transparency.

|

121 videos|490 docs|159 tests

|

FAQs on Fiscal Policy: Economics - Indian Economy for UPSC CSE

| 1. What are the main objectives of fiscal policy? |  |

| 2. Why is fiscal policy considered important for an economy? |  |

| 3. What are the key components of fiscal policy? |  |

| 4. What are the different types of fiscal deficits? |  |

| 5. What were the recommendations of the NK Singh Committee regarding fiscal policy? |  |