|

The primary methods of calculating depreciation are straight-line, declining balance, and units of production methods. |

Card: 2 / 30 |

|

Fill in the blank: Amortization is primarily used for ___ and is similar to depreciation. |

Card: 3 / 30 |

|

True or False: Depreciation can be applied to land as it has a finite useful life. |

Card: 5 / 30 |

|

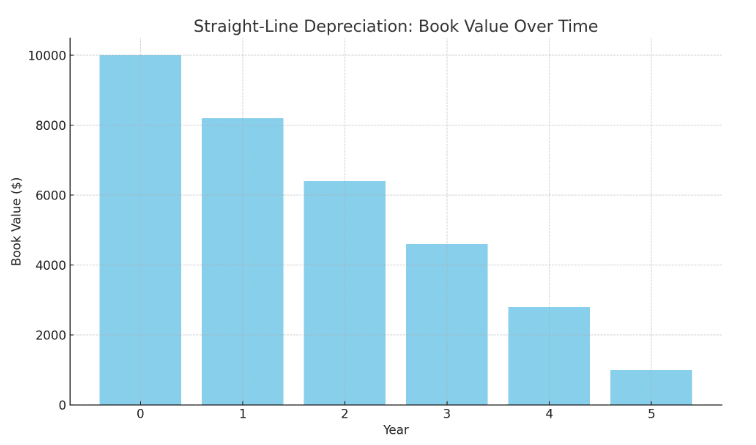

In the straight-line method of depreciation, how is the annual depreciation expense calculated? |

Card: 7 / 30 |

|

Annual depreciation expense is calculated by subtracting the asset's salvage value from its cost and then dividing by its useful life. |

Card: 8 / 30 |

|

The primary difference is that depreciation applies to tangible assets, while amortization applies to intangible assets. |

Card: 10 / 30 |

|

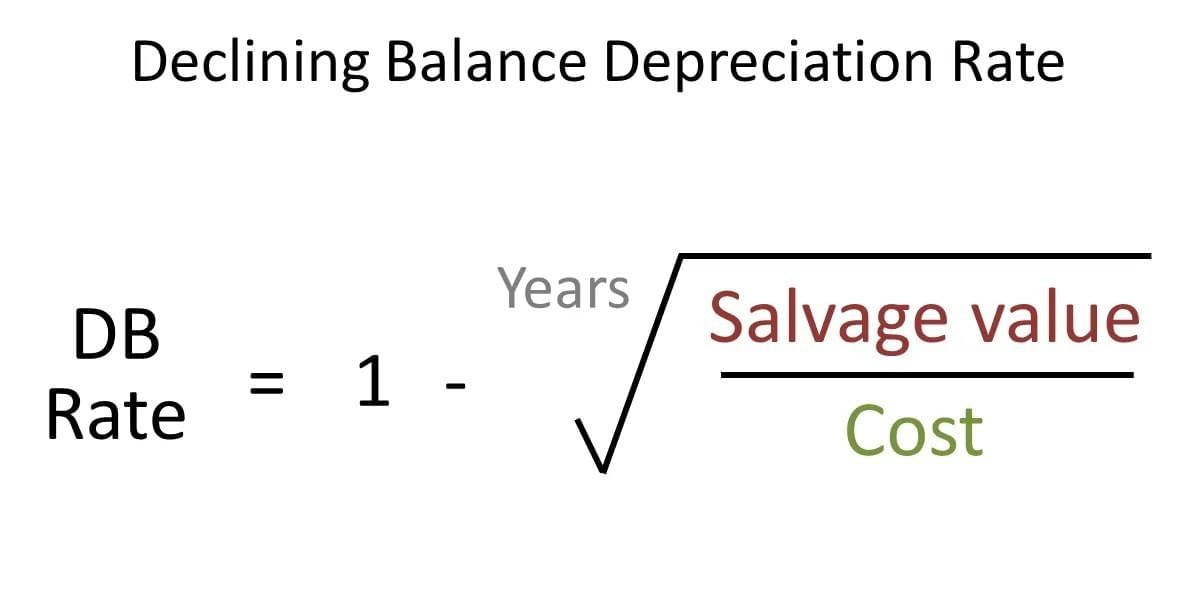

Fill in the blank: The declining balance method applies a fixed percentage to the ___ of the asset each year. |

Card: 11 / 30 |

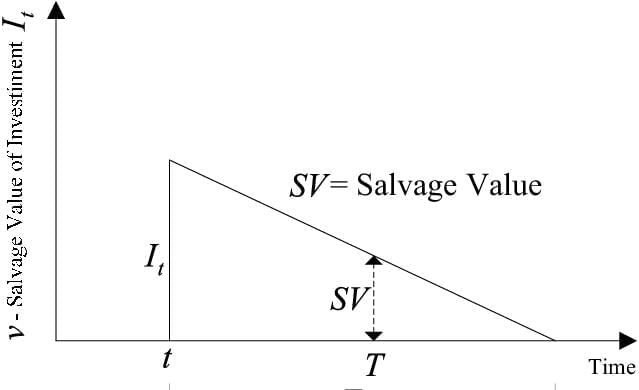

Salvage value refers to the estimated residual value of an asset at the end of its useful life. |

Card: 14 / 30 |

|

True or False: The units of production method of depreciation is best suited for assets whose wear and tear are based on usage rather than time. |

Card: 15 / 30 |

Unlock all Flashcards with EduRev Infinity Plan Starting from @ ₹99 only

|

|

Useful life refers to the estimated time period over which an asset is expected to be used in business operations. |

Card: 18 / 30 |

|

Explain how the declining balance method can lead to a higher depreciation expense in the earlier years of an asset's life. |

Card: 19 / 30 |

|

Declining balance method increases early depreciation.

|

Card: 20 / 30 |

|

Fill in the blank: Under the straight-line method, if an asset costs $10,000, has a salvage value of $1,000, and a useful life of 5 years, the annual depreciation expense is ___ per year. |

Card: 21 / 30 |

|

Depreciation reduces taxable income and reflects the wear and tear of assets, impacting both the income statement and the balance sheet. |

Card: 24 / 30 |

|

True or False: Amortization schedules are only relevant for loans and not for intangible assets. |

Card: 25 / 30 |

|

False. Amortization schedules are relevant for both loans and the amortization of intangible assets. |

Card: 26 / 30 |

|

In what scenarios might a company choose to use the units of production method for depreciation? |

Card: 27 / 30 |

|

Units of production method is usage-based.

|

Card: 28 / 30 |

|

What is the significance of estimating the salvage value accurately in the depreciation calculation? |

Card: 29 / 30 |

|

Estimating salvage value is crucial.

|

Card: 30 / 30 |