Goodwill: Nature And Valuation (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 3.28:

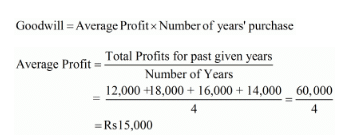

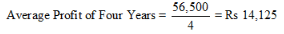

Question 1: Goodwill is to be valued at three years' purchase of four years' average profit. Profits for last four years ending on 31st March of the firm were: 2016 − ₹ 12,000; 2017 − ₹ 18,000; 2018 − ₹ 16,000; 2019 − ₹ 14,000.

Calculate amount of Goodwill.

ANSWER:

Number of years’ purchase = 3

Page No 3.28:

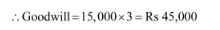

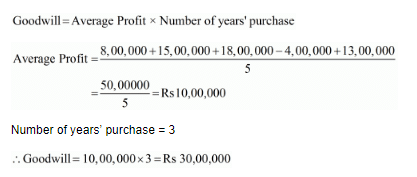

Question 2: Profits for the five years ending on 31st March, are as follows:

Year 2015 − ₹ 4,00,000; Year 2016 − ₹ 3,98,000; Year 2017 − ₹ 4,50,000; Year 2018 − ₹ 4,45,000 and Year 2019 − ₹ 5,00,000.

Calculate goodwill of the firm on the basis of 4 years' purchase of 5 years' average profit.

ANSWER:

Page No 3.28:

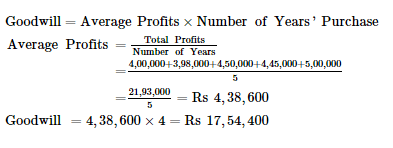

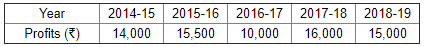

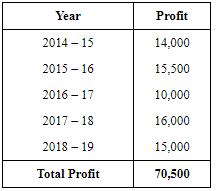

Question 3: Calculate value of goodwill on the basis of three years' purchase of average profit of the preceding five years which were as follows:

ANSWER:

Page No 3.28:

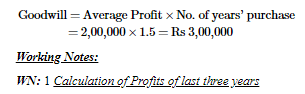

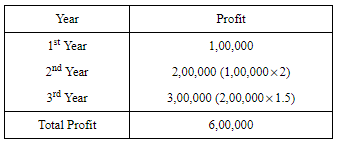

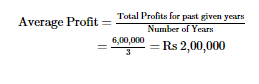

Question 4:Calculate the value of firm's goodwill on the basis of one and half years' purchase of the average profit of the last three years. The profit for first year was ₹ 1,00,000, profit for the second year was twice the profit of the first year and for the third year profit was one and half times of the profit of the second year.

ANSWER:

WN: 2 Calculation of Average Profit

Page No 3.28:

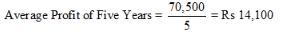

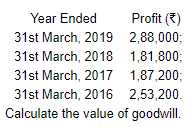

Question 5: Purav and Purvi are partners in a firm sharing profits and losses in the ratio of 2 : 1. They decide to take Parv into partnership for 1/4th share on 1st April, 2019. For this purpose, goodwill is to be valued at four times the average annual profit of the previous four or five years, whichever is higher. The agreed profits for goodwill purpose of the past five years are:

Calculate the value of goodwill.

ANSWER:

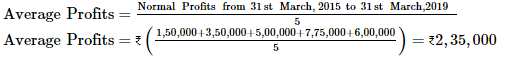

Calculation of Average Profit for Five Years

Calculation of Average Profit for Four Years

Average Profit of four years is taken to compute the value of goodwill of the firm. This is because Average Profit of four years is more than the Average Profit of five years.

Page No 3.29:

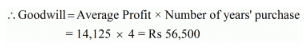

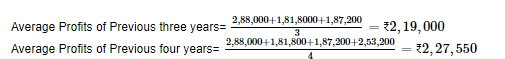

Question 6: Annu, Baby and Chetan are partners in a firm sharing profits and losses equally. They decide to take Deep into partnership from 1st April, 2019 for 1/5th share in the future profits. For this purpose, goodwill is to be valued at 100% of the average annual profits of the previous three or four years, whichever is higher. The annual profits for the purpose of goodwill for the past four years were:

ANSWER:

Since, the average profits of previous four years is greater than the average profits of previous three years.

Hence, Goodwill = 100% of Average Profits of Previous four years = ₹2,27,550

Page No 3.29:

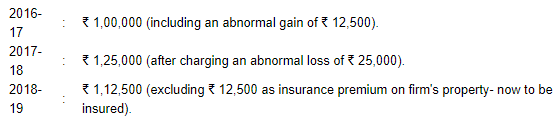

Question 7: Divya purchased Jyoti's business with effect from 1st April, 2019. Profits shown by Jyoti's business for the last three financial years were:

Calculate the value of firm's goodwill on the basis of two year's purchase of the average profit of the last three years.

ANSWER:

Page No 3.29:

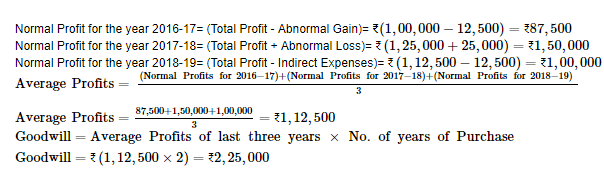

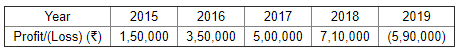

Question 8: Abhay, Babu and Charu are partners sharing profits and losses equally. They agree to admit Daman for equal share of profit. For this purpose, the value of goodwill is to be calculated on the basis of four years' purchase of average profit of last five years. These profits for the year ended 31st March, were:

On 1st April, 2018, a car costing ₹ 1,00,000 was purchased and debited to Travelling Expenses Account, on which depreciation is to be charged @ 25%. Interest of ₹ 10,000 on Non-trade Investments is credit to income for the year ended 31st March, 2018 and 2019.

Calculate the value of goodwill after adjusting the above.

ANSWER:

Normal Profits for the year ended 31st March, 2018:

=(Total Profits+Purchase of car wrongly debited − Depreciation on Car − Income from Non−trade Investments)=₹(7,10,000 + 1,00,000 − 25,000 − 10,000)=₹7,75,000

Normal Profits for the year ended 31st March, 2019:

Goodwill=Average Profits for last 5 years×No. of years of purchaseGoodwill=Average Profits for last 5 years×No. of years of purchase =₹(2,35,000×4)=₹9,40,000

Page No 3.29:

Question 9: Bharat and Bhushan are partners sharing profits in the ratio of 3 : 2. They decided to admit Manu as a partner from 1st April, 2019 on the following terms:

(i) Manu will be given 2/5th share of the profit.

(ii) Goodwill of the firm will be valued at two years' purchase of three years' normal average profit of the firm.

Profits of the previous three years ended 31st March, were:

2019 - Profit ₹ 30,000 (after debiting loss of stock by fire ₹ 40,000).

2018 - Loss ₹ 80,000 (includes voluntary retirement compensation paid ₹ 1,10,000).

2017 - Profit ₹ 1,10,000 (including a gain (profit) of ₹ 30,000 on the sale of fixed assets).

Calculate the value of goodwill.

ANSWER:

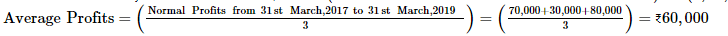

Normal Profits for the year ended 31st March,2019=(Total Profits+Loss by fire)=₹(30,000+40,000)=₹70,000

Normal Profits for the year ended 31st March,2018=(Total loss − Voluntary retirement Compensation paid)=₹(80,000 −1,10,000)Total loss - Voluntary retirement Compensation paid=₹(80,000 -1,10,000) = ₹30,000

Normal Profits for the year ended 31st March,2017=₹(Total Profit−Gain on sale of Fixed Assets)=₹(1,10,000−30,000)₹Total Profit-Gain on sale of Fixed Assets=₹(1,10,000-30,000) = ₹80,000

Goodwill=Average Profits for last 3 years × No. of years of purchase=₹(60,000×2)=₹1,20,000

Page No 3.29:

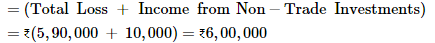

Question 10: Bhaskar and Pillai are partners sharing profits and losses in the ratio of 3 : 2. They admit Kanika into partnership for 1/4th share in profit. Kanika brings in her share of goodwill in cash. Goodwill for this purpose is to be calculated at two years' purchase of the average normal profit of past three years. Profits of the last three years ended 31st March, were:

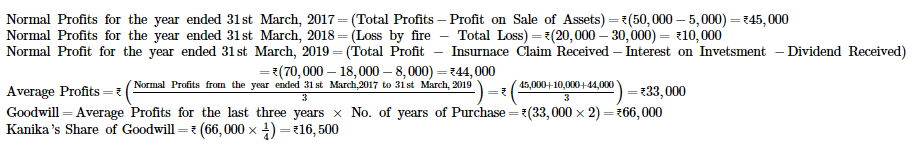

2017 - Profit ₹ 50,000 (including profit on sale of assets ₹ 5,000).

2018 - Loss ₹ 20,000 (including loss by fire ₹ 30,000).

2019 - Profit ₹ 70,000 (including insurance claim received ₹ 18,000 and interest on investments and Dividend received ₹ 8,000).

Calculate the value of goodwill. Also, calculate goodwill brought in by Kanika.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Goodwill: Nature And Valuation (Part - 1) - Accountancy Class 12 - Commerce

| 1. What is goodwill and why is it important in commerce? |  |

| 2. How is goodwill calculated and valued in commerce? |  |

| 3. Can goodwill be bought or sold separately from a business? |  |

| 4. What are some examples of factors that contribute to the creation of goodwill? |  |

| 5. How does goodwill impact financial statements and business valuation? |  |