Goodwill: Nature and Valuation (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 3.32:

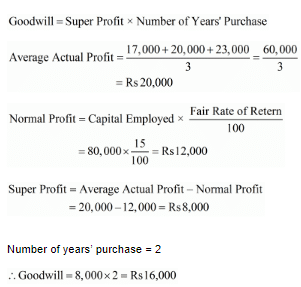

Question 26: A partnership firm earned net profits during the last three years ended 31st March, as follows: 2017 − ₹ 17,000; 2018 − ₹ 20,000; 2019 − ₹ 23,000.

The capital investment in the firm throughout the above-mentioned period has been ₹ 80,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. Calculate value of goodwill on the basis of two years' purchase of average super profit earned during the above-mentioned three years.

ANSWER:

Page No 3.32:

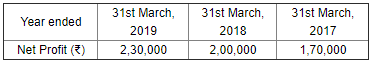

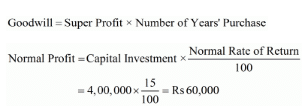

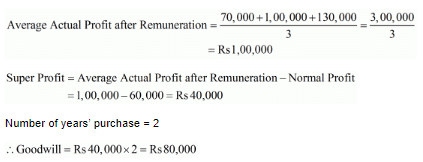

Question 27: A partnership firm earned net profits during the past three years as follows:

Capital investment in the firm throughout the above-mentioned period has been ₹ 4,00,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. The remuneration of the partners during this period is estimated to be ₹ 1,00,000 p.a.

Calculate value of goodwill on the basis of two years' purchase of average super profit earned during the above-mentioned three years.

ANSWER:

Page No 3.33:

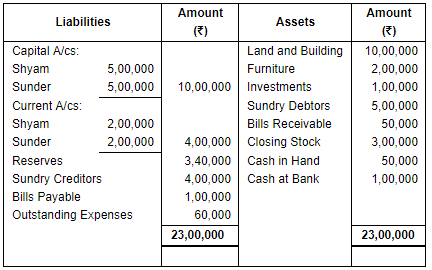

Question 28: Ideal Marketing earned an average profit of ₹ 4,00,000 during the last five years. Normal rate of return on capital employed is 10%. Balance Sheet of the firm as at 31st March, 2019 was as follows:

Calculate the value of goodwill, if it is valued at three years' purchase of Super Profits.

ANSWER:

Page No 3.33:

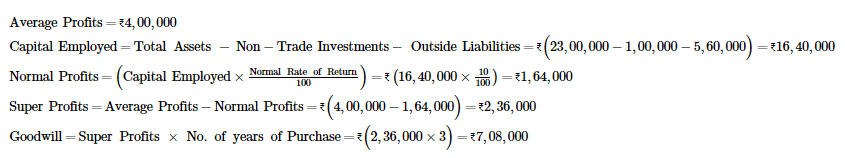

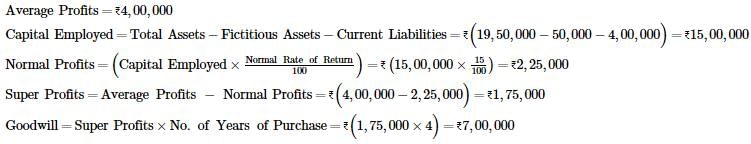

Question 29: Varuna and Karuna are partners for equal shares. They admit Lata into partnership for 1/4th share. It was agreed to value goodwill of the firm at 4 years' purchase of super profit. Normal rate of return is 15% of the capital employed. Average profit of the firm is ₹ 4,00,000. Balance Sheet of the firm as at 31st March, 2019 was as follows:

Calculate the value of goodwill.

ANSWER:

Average Profits=₹4,00,000Capital Employed=Total Assets-Fictitious Assets-Current Liabilities=₹(19,50,000-50,000-4,00,000)=₹15,00,000Normal Profits=Capital Employed×Normal Rate of Return100=₹15,00,000×15100=₹2,25,000Super Profits=Average Profits - Normal Profits=₹(4,00,000-2,25,000)=₹1,75,000Goodwill=Super Profits×No. of Years of Purchase=₹(1,75,000×4)=₹7,00,000

Page No 3.33:

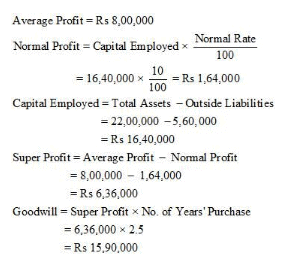

Question 30: A business earned an average profit of ₹ 8,00,000 during the last few years. The normal rate of profit in the similar type of business is 10%. The total value of assets and liabilities of the business were ₹ 22,00,000 and ₹ 5,60,000 respectively. Calculate the value of goodwill of the firm by super profit method if it is valued at 212/212 years' purchase of super profits.

ANSWER:

Page No 3.34:

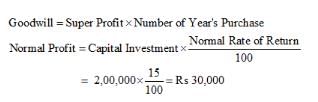

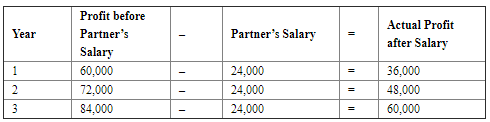

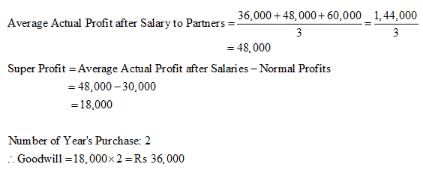

Question 31: Capital of the firm of Sharma and Verma is ₹ 2,00,000 and the market rate of interest is 15%. Annual salary to partners is ₹ 12,000 each. The profits for the last three years were ₹ 60,000; ₹ 72,000 and ₹ 84,000. Goodwill is to be valued at 2 years' purchase of last 3 years' average super profit.

Calculate goodwill of the firm.

ANSWER:

Page No 3.34:

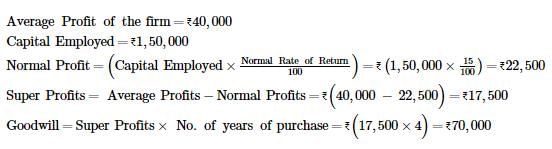

Question 32: Supreet and Shubham are equal partners. They decide to admit Akriti for 1/3rd share. For the purpose of admission of Akriti, goodwill of the firm is to be valued at four years' purchase of super profit. Average capital employed in the firm is ₹ 1,50,000. Normal rate of return may be taken as 15% p.a. Average profit of the firm is ₹ 40,000. Calculate value of goodwill.

ANSWER:

Page No 3.34:

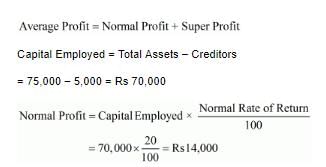

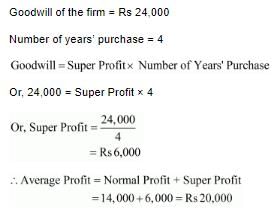

Question 33: On 1st April, 2019, an existing firm had assets of ₹ 75,000 including cash of ₹ 5,000. Its creditors amounted to ₹ 5,000 on that date. The firm had a Reserve of ₹ 10,000 while Partners' Capital Accounts showed a balance of ₹ 60,000. If Normal Rate of Return is 20% and goodwill of the firm is valued at ₹ 24,000 at four years' purchase of super profit, find average profit per year of the existing firm.

ANSWER:

Page No 3.34:

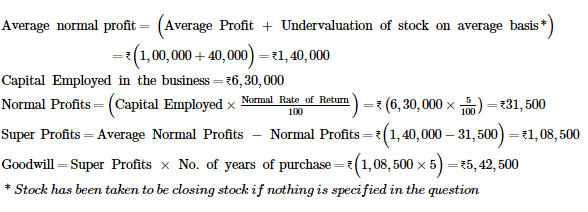

Question 34: Average profit earned by a firm is ₹ 1,00,000 which includes undervaluation of stock of ₹ 40,000 on an average basis. The capital invested in the business is ₹ 6,30,000 and the normal rate of return is 5%. Calculate goodwill of the firm on the basis of 5 times the super profit.

ANSWER:

Page No 3.34:

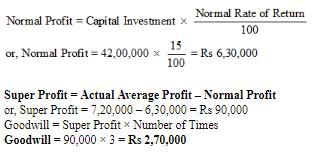

Question 35: Average profit earned by a firm is ₹ 7,50,000 which includes overvaluation of stock of ₹ 30,000 on an average basis. The capital invested in the business is ₹ 42,00,000 and the normal tare of return is 15%. Calculate goodwill of the firm on the basis of 3 time the super profit.

ANSWER:

Average Profit earned by a firm = Rs 7,50,000

Overvaluation of Stock = Rs 30,000

Average Actual Profit = Average Profit earned by a firm – Overvaluation of Stock

or, Average Actual Profit = 7,50,000 – 30,000 = Rs 7,20,000

Page No 3.34:

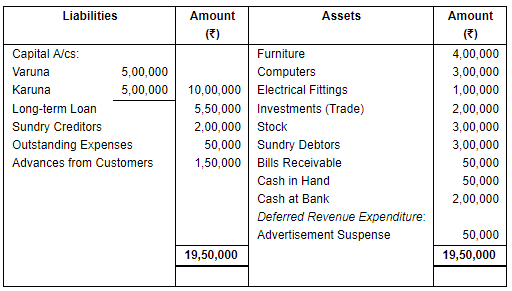

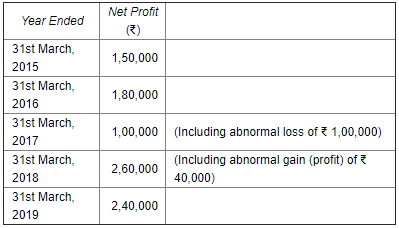

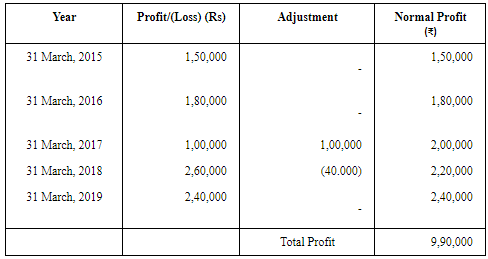

Question 36: Ayub and Amit are partners in a firm and they admit Jaspal into partnership w.e.f. 1st April, 2019. They agreed to value goodwill at 3 years' purchase of Super Profit Method for which they decided to average profit of last 5 years. The profits for the last 5 years were:

The firm has total assets of ₹ 20,00,000 and Outside Liabilities of ₹ 5,00,000 as on that date. Normal Rate of Return in similar business is 10%.

Calculate value of goodwill.

ANSWER:

Goodwill=Super Profit×No. of Years' Purchase

=48,000×3=Rs 1,44,000

Working Notes:

WN: 1 Calculation of Normal Profits:

WN2: Calculation of Super Profits

table attributes columnalign left end attributes row cell text Average Profit end text equals fraction numerator text Total Profit of past given years end text over denominator text Number of Years end text end fraction end cell row cell text end text equals fraction numerator 9 comma 90 comma 000 over denominator 5 end fraction equals text ₹ 1,98,000 end text end cell row cell text Normal Profit end text equals text Capital Employed end text cross times fraction numerator text Normal Rate of Return end text over denominator 100 end fraction end cell row cell text end text equals text 15,00,000 end text cross times 10 over 100 equals text ₹ 1,50,000 end text end cell row cell text Super Profit end text equals text Average Profit end text minus text Normal Profit end text end cell row cell text end text equals text 1,98,000 end text minus text 1,50,000 end text equals text ₹ 48,000 end text end cell end table

WN3: Calculation of Capital Employed

Capital Employed=Total Assets−Outside Liabilities =20,00,000−5,00,000=₹15,00,000

Page No 3.34:

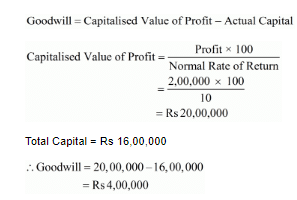

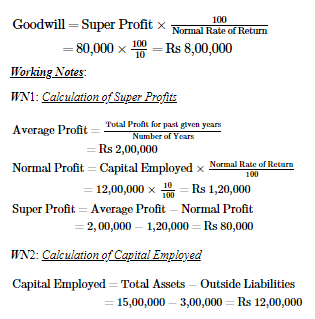

Question 37: From the following information, calculate value of goodwill of the firm by applying Capitalisation Method: Total Capital of the firm ₹ 16,00,000.

Normal rate of return 10%. Profit for the year ₹ 2,00,000.

ANSWER:

Page No 3.34:

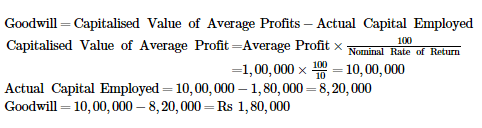

Question 38: A business has earned average profit of ₹ 1,00,000 during the last few years. Find out the value of goodwill by capitalisation method, given that the assets of the business are ₹ 10,00,000 and its external liabilities are ₹ 1,80,000. The normal rate of return is 10%.

ANSWER:

Page No 3.35:

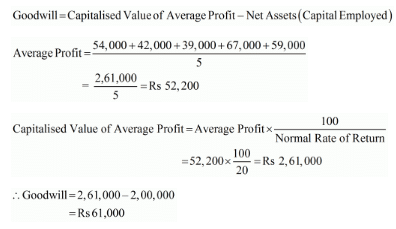

Question 39: Form the following particulars, calculate value of goodwill of a firm by applying Capitalisation of Average Profit Method:

(i) Profits of last five consecutive years ending 31st March are: 2019 − ₹ 54,000; 2018 − ₹ 42,000; 2017 − ₹ 39,000; 2016 − ₹ 67,000 and 2015 − ₹ 59,000.

(ii) Capitalisation rate 20%.

(iii) Net assets of the firm ₹ 2,00,000.

ANSWER:

Page No 3.35:

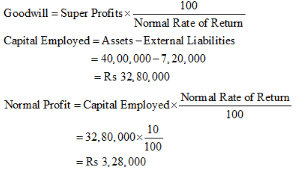

Question 40: A business has earned average profit of ₹ 4,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

(i) Capitalisation of Super Profit Method, and

(ii) Super Profit Method if the goodwill is valued at 3 years' purchase of super profits.

Assets of the business were ₹ 40,00,000 and its external liabilities ₹ 7,20,000.

ANSWER:

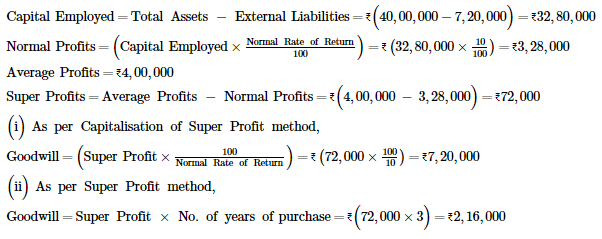

Average Profit – Rs 4,00,000

Normal Rate of Return – 10%

(i) Goodwill by Capitalisation of Super profit

Super Profit = Actual Profit – Normal Profit

= 4,00,000 – 3,28,000

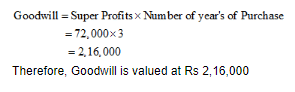

= Rs 72,000

(ii) Super Profit Method if the goodwill is valued at 3 years’ purchase of super profits

Page No 3.35:

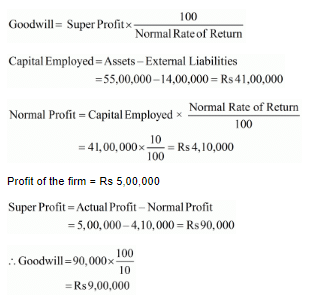

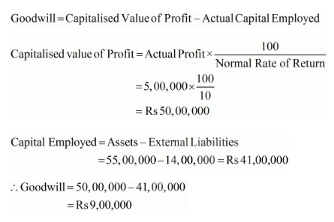

Question 41: A firm earns profit of ₹ 5,00,000. Normal Rate of Return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outsiders' liabilities as on the date of goodwill are ₹ 55,00,000 and ₹ 14,00,000 respectively. Calculate value of goodwill according to Capitalisation of Super Profit Method as well as Capitalisation of Average Profit Method.

ANSWER:

(i) Calculation of Goodwill by Capitalisation of Super Profit Method

(ii) Calculation of Goodwill by Capitalisation of Average Profit Method

Page No 3.35:

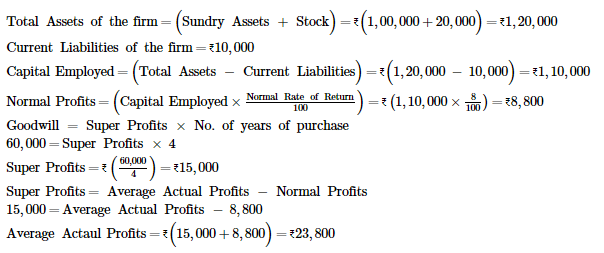

Question 42: On 1st April, 2018, a firm had assets of ₹ 1,00,000 excluding stock of ₹ 20,000. The current liabilities were ₹ 10,000 and the balance constituted Partners' Capital Accounts. If the normal rate of return is 8%, the Goodwill of the firm is valued of ₹ 60,000 at four years' purchase of super profit, find the actual profits of the firm.

ANSWER:

Page No 3.35:

Question 43: Average profit of the firm is ₹ 2,00,000. Total assets of the firm are ₹ 15,00,000 whereas Partners' Capital is ₹ 12,00,000. If normal rate of return in a similar business is 10% of the capital employed, what is the value of goodwill by Capitalisation of Super Profit?

ANSWER:

Page No 3.35:

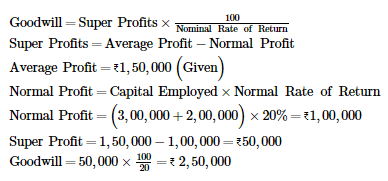

Question 44:Rajan and Rajani are partners in a firm. Their capitals were Rajan ₹ 3,00,000; Rajani ₹ 2,00,000. During the year 2018−19, the firm earned a profit of ₹ 1,50,000. Calculate the value of goodwill of the firm by capitalisation of super profit assuming that the normal rate of return is 20%.

ANSWER:

Page No 3.35:

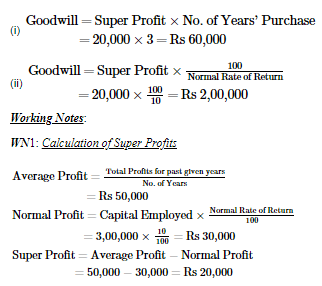

Question 45: Average profit of GS & Co. is ₹ 50,000 per year. Average capital employed in the business is ₹ 3,00,000. If the normal rate of return on capital employed is 10%, calculate goodwill of the firm by:

(i) Super Profit Method at three years' purchase; and

(ii) Capitalisation of Super Profit Method.

ANSWER:

Page No 3.35:

Question 46: A business has earned average profit of ₹ 4,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

(i) Capitalisation of Super Profit Method; and

(ii) Super Profit Method if the goodwill is valued at 3 years' purchase of super profit.

Assets of the business were ₹ 40,00,000 and its external liabilities ₹ 7,20,000.

ANSWER:

Page No 3.36:

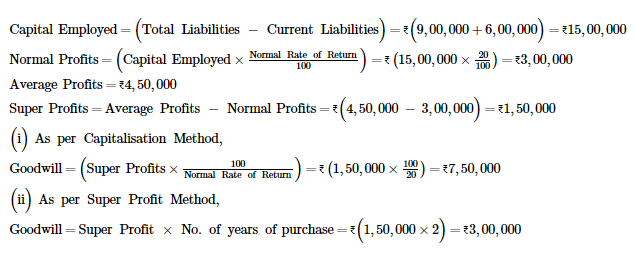

Question 47: Ajeet and Baljeet are partners in a firm. Their capitals are ₹ 9,00,000 and ₹ 6,00,000 respectively. During the year ended 31st March, 2019 the firm earned a profit of ₹ 4,50,000. Assuming that the normal rate of return is 20%, calculate value of goodwill of the firm:

(i) By Capitalisation Method; and

(ii) By Super Profit Method if the goodwill is valued at 2 years' purchase of super profit.

ANSWER:

Page No 3.36:

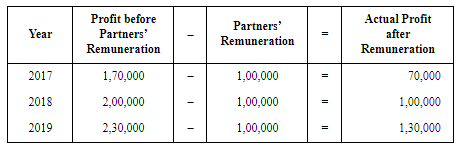

Question 48: From the following information, calculate value of goodwill of the firm:

(i) At three years' purchase of Average Profit.

(ii) At three years' purchase of Super Profit.

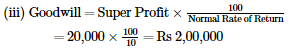

(iii) On the basis of Capitalisation of Super Profit.

(iv) On the basis of Capitalisation of Average profit.

Information:

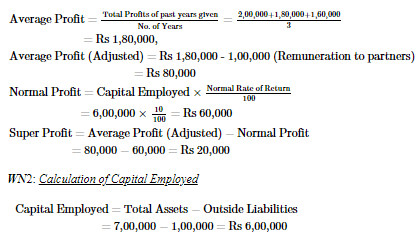

(a) Average Capital Employed is ₹ 6,00,000.

(b) Net Profit/(Loss) of the firm for the last three years ended are:

31st March, 2018 − ₹ 2,00,000, 31st March, 2017 − ₹ 1,80,000, and 31st March, 2016 − ₹ 1,60,000.

(c) Normal Rate of Return in similar business is 10%.

(d) Remuneration of ₹ 1,00,000 to partners is to be taken as charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets and non-trade investments) is ₹ 7,00,000 whereas Partners' Capital is ₹ 6,00,000 and Outside Liabilities ₹ 1,00,000.

ANSWER:

(i) Goodwill=Average Profit×No. of years' purchase

=80,000×3=Rs 2,40,000

(ii) Goodwill=Super Profit×No. of years' purchase

=20,000×3=Rs 60,000

(iv) Goodwill=Capitalised Value−Net Assets

=8,00,000−6,00,000=Rs 2,00,000

Working Notes:

WN1: Calculation of Average and Super Profits

|

42 videos|199 docs|43 tests

|

FAQs on Goodwill: Nature and Valuation (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is goodwill and why is it important in accounting? |  |

| 2. How is goodwill calculated and recorded in financial statements? |  |

| 3. What factors affect the valuation of goodwill? |  |

| 4. Can goodwill be negative? |  |

| 5. How does the impairment of goodwill impact a company's financial statements? |  |