Change in Profit-Sharing Ratio Among the Existing Partners (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 4.42:

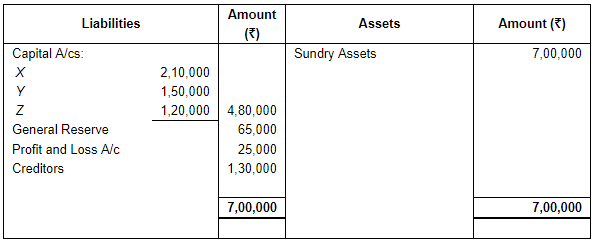

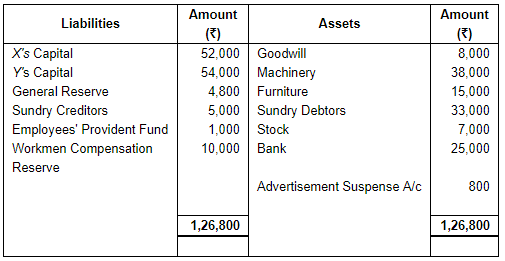

Question 25: X, Y and Z are partners sharing profits and losses in the ratio of 7 : 5 : 4. Their Balance Sheet as at 31st March, 2019 stood as:

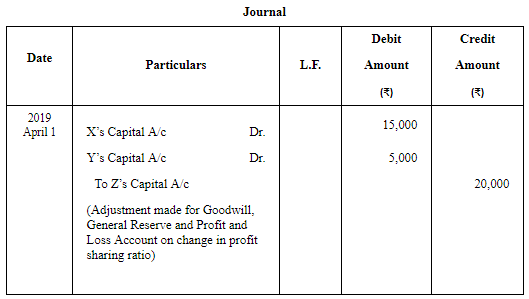

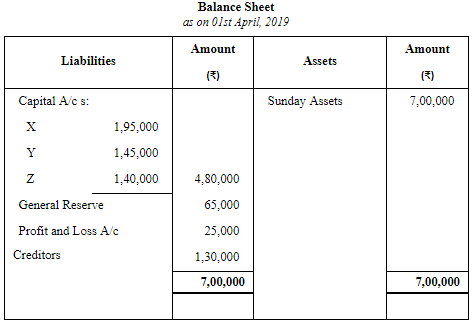

Partners decided that with effect from 1st April, 2019, they will share profits and losses in the ratio of 3 : 2 : 1. For this purpose, goodwill of the firm was valued at ₹ 1,50,000. The partners neither want to record the goodwill nor want to distribute the General Reserve and profits.

Pass a Journal entry to record the change and prepare Balance Sheet of the constituted firm.

ANSWER:

Working Notes:

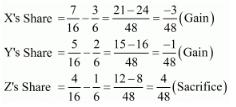

WN 1 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 7 : 5 : 4

New Ratio (X, Y and Z) = 3 : 2 : 1

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

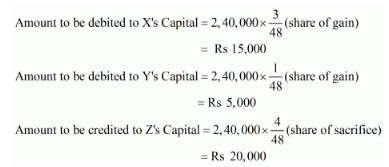

WN 2 Adjustment of General Reserve, Profit and Loss Account and Goodwill

Total Amount for Adjustment = General Reserve + Profit and Loss Account + Goodwill

= 65,000 + 25,000 + 1,50,000 = Rs 2,40,000

WN 3

Page No 4.42:

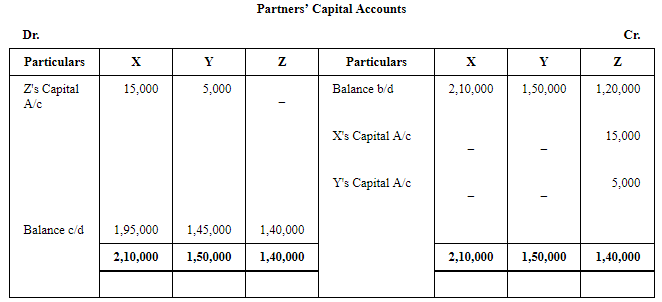

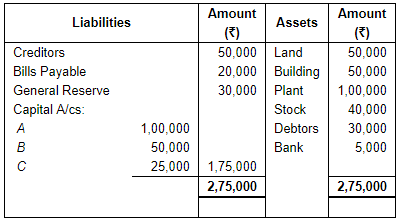

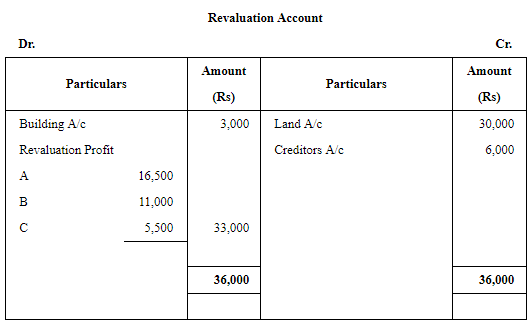

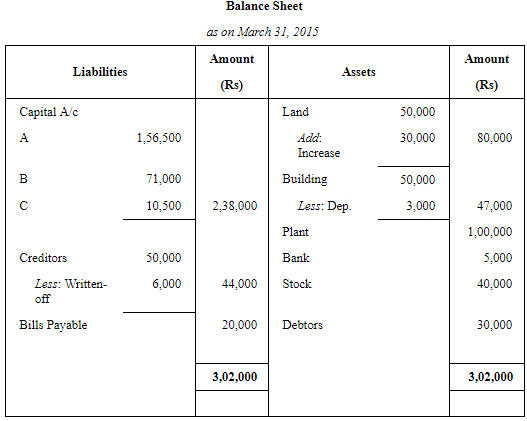

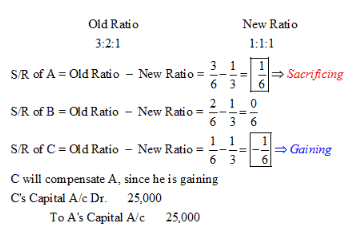

Question 26: A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2015 was as follows:

From 1st April, 2015, A, B and C decided to share profits equally. For this it was agreed that:

(i) Goodwill of the firm will be valued at ₹ 1,50,000.

(ii) Land will be revalued at ₹ 80,000 and building be depreciated by 6%.

(iii) Creditors of ₹ 6,000 were not likely to be claimed and hence should be written off.

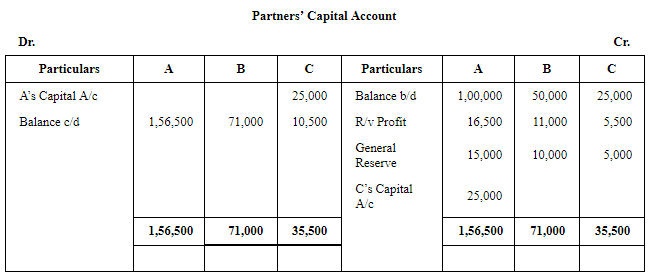

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the reconstituted firm.

ANSWER:

Working Notes

Page No 4.43:

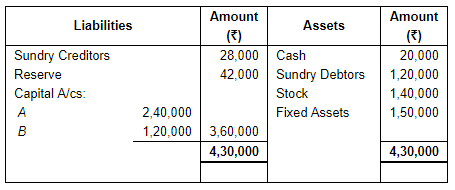

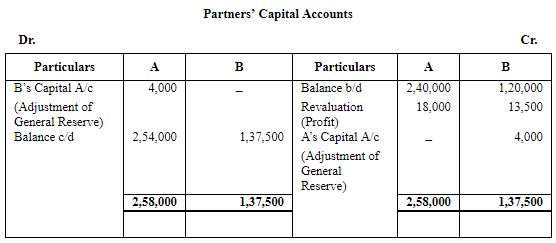

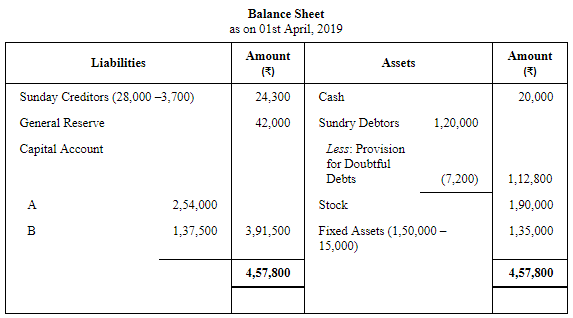

Question 27: A and B are partners sharing profits in the ratio of 4 : 3. Their Balance Sheet as at 31st March, 2019 stood as:

They decided that with effect from 1st April, 2019, they will share profits and losses in the ratio of 2 : 1. For this purpose they decided that:

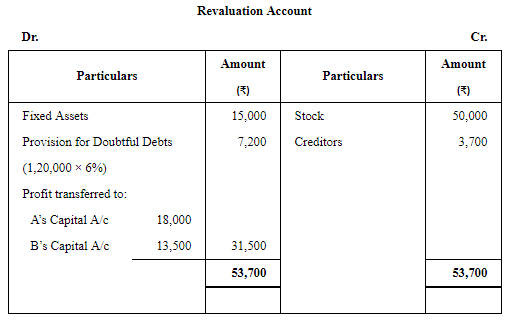

(i) Fixed Assets are to be reduced by 10%.

(ii) A Provision for Doubtful Debts of 6% be made on Sundry Debtors.

(iii) Stock be valued at ₹ 1,90,000.

(iv) An amount of ₹ 3,700 included in Creditors is not likely to be claimed .

Partners decided to record the revised values in the books. However, they do not want to disturb the Reserve. You are required to pass Journal entries, prepare Capital Accounts of Partners and the revised Balance Sheet.

ANSWER:

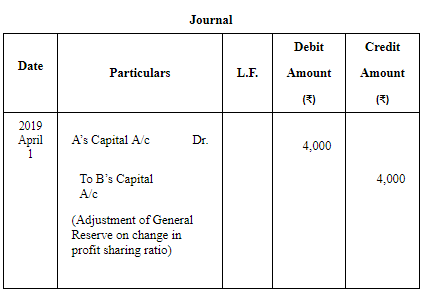

Working Notes:

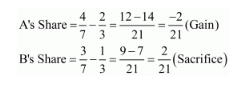

WN 1 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (A and B) = 4 : 3

New Ratio (A and B) = 2 : 1

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

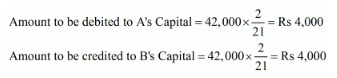

WN 2 Adjustment of General Reserve

WN 3

Page No 4.43:

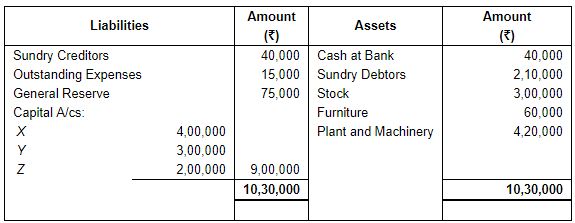

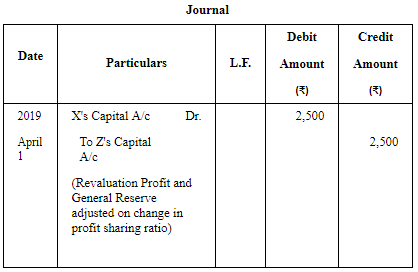

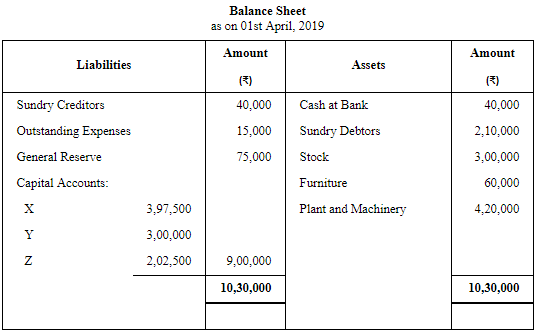

Question 28: X, Y and Z are partners in a firm sharing profits and losses as 5 : 4 : 3. Their Balance Sheet as at 31st March, 2019 was:

From 1st April, 2019, they agree to alter their profit-sharing ratio as 4 : 3 : 2. It is also decided that:

(a) Furniture be taken at 80% of its value.

(b) Stock be appreciated by 20%.

(c) Plant and Machinery be valued at ₹ 4,00,000.

(d) Outstanding Expenses be increased by ₹ 13,000.

Partners agreed that altered values are not to be recorded in the books and they also do not want to distribute the General Reserve.

You are required to pass a single Journal entry to give effect to the above. Also, prepare Balance Sheet of the new firm.

ANSWER:

Working Notes:

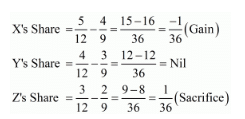

WN 1 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 5 : 4 : 3

New Ratio (X, Y and Z) = 4 : 3 : 2

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

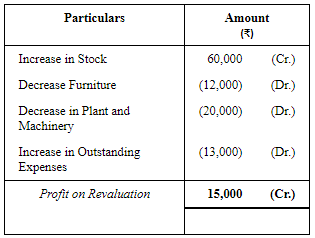

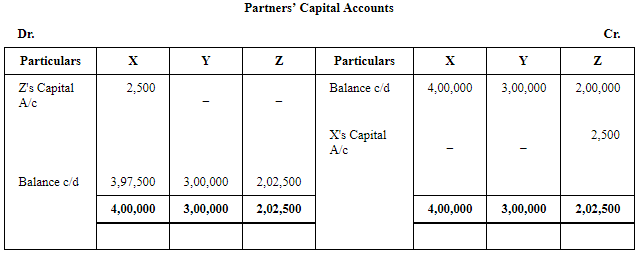

WN 2 Calculation of Profit or Loss on Revaluation

WN 3 Adjustment of Profit on Revaluation and General Reserve

Amount for Adjustment = Profit on Revaluation + General Reserve

= 15,000 + 75,000 = Rs 90,000

WN 4

Page No 4.44:

Question 29: Balance Sheet of X and Y, who share profits and losses as 5 : 3, as at 1st April, 2019 is:

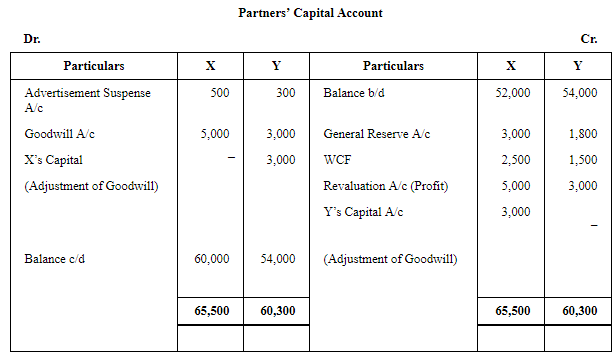

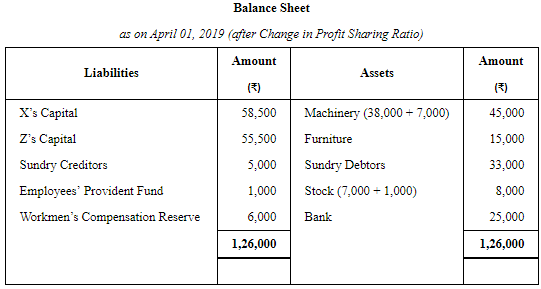

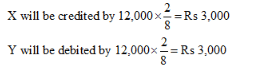

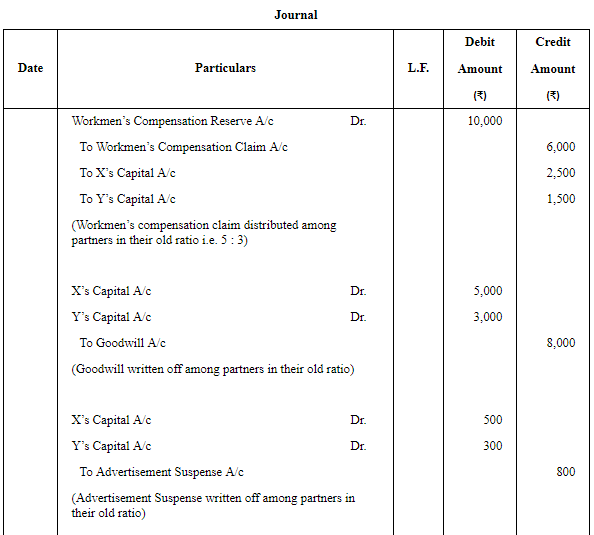

On the above date, they decided to change their profit-sharing ratio to 3 : 5 and agreed upon the following:

(a) Goodwill be valued on the basis of two years' purchase of the average profit of the last three years. Profits for the years ended 31st March, are: 2016-17 − ₹ 7,500; 2017-18 − ₹ 4,000; 2018-19 − ₹ 6,500.

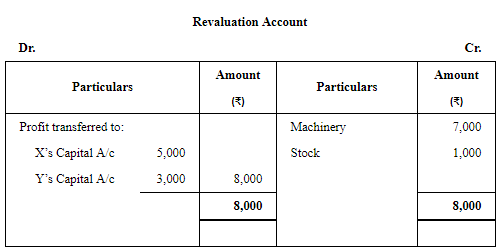

(b) Machinery and Stock be revalued at ₹ 45,000 and ₹ 8,000 respectively.

(c) Claim on account of workmen compensation is ₹ 6,000.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

ANSWER:

Working Notes:

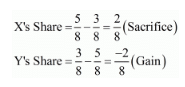

WN 1 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X and Y) = 5 : 3

New Ratio (X and Y) = 3 : 5

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

WN 2 Calculation of New Goodwill

Goodwill = Average Profit × Number of Year′s Purchase = 6,000 × 2 = Rs 12,000

WN 3 Adjustment of Goodwill

Page No 4.44:

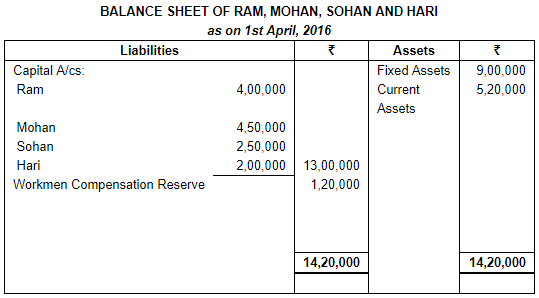

Question 30: Ram, Mohan, Sohan and Hari were partners in a firm sharing profits in the ratio of 4 : 3 : 2 : 1. On 1st April, 2016, their Balance Sheet was as follows:

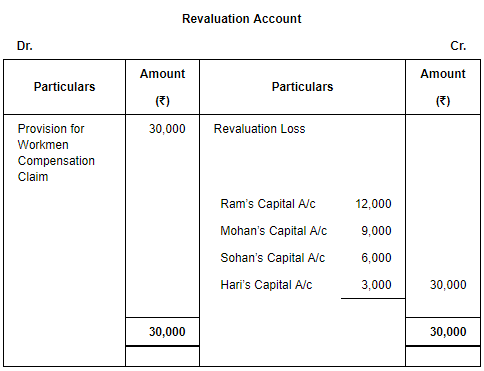

From the above date, the partners decided to share the future profits in the ratio of 1 : 2 : 3 : 4. For this purpose the goodwill of the firm was valued at ₹ 1,80,000. The partners also agreed for the following:(a) The Claim for workmen compensation has been estimated at ₹ 1,50,000.

(b) Adjust the capitals of the partners according to the new profit-sharing ratio by opening Partners' Current Accounts.

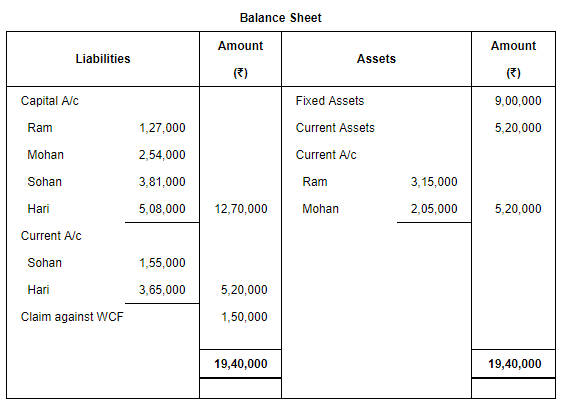

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted firm.

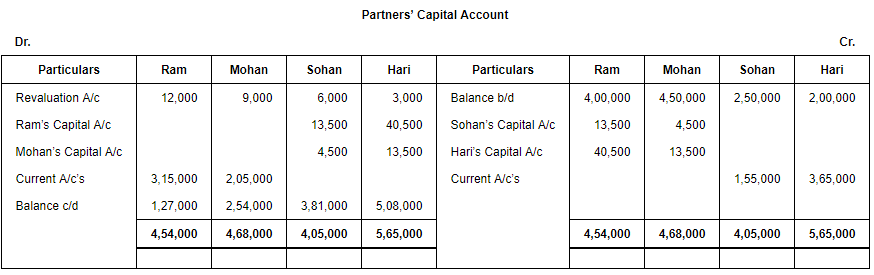

ANSWER:

Working Notes

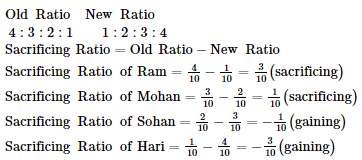

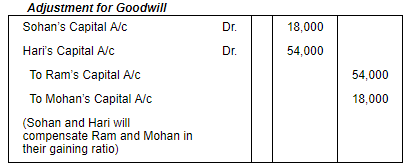

WN1: Calculation of Gaining/Sacrificing Ratio

(a) Sohan will compensate Ram and Mohan in the ratio 3 : 1

(b) Hari will compensate Ram and Mohan in the ratio of 3 : 1

WN2: Calculation of Adjusted Capital

Ram = 4,54,000 – 12,000 = Rs 4,42,000

Mohan = 4,68,000 – 9,000 = Rs 4,59,000

Sohan = 2,50,000 – 24,000 = Rs 2,26,000

Hari = 2,00,000 – 57,000 = Rs 1,43,000

Total Combined Capital = 12,70,000

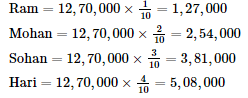

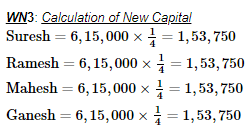

WN3: Calculation of New Capital

Page No 4.45:

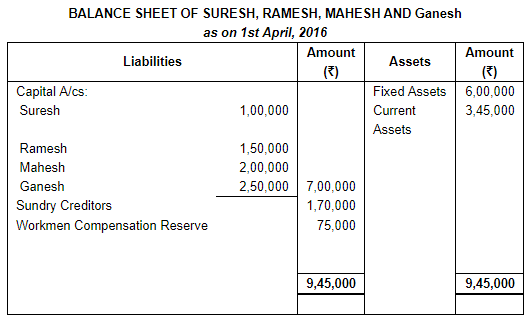

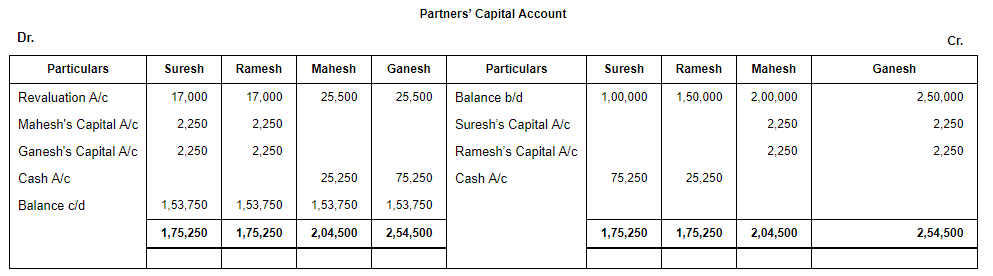

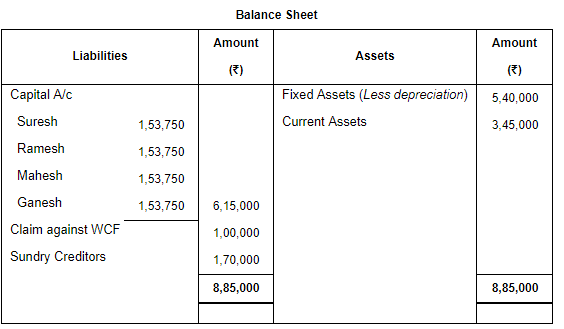

Question 31: Suresh, Ramesh, Mahesh and Ganesh were partners in a firm sharing profits in the ratio of 2 : 2 : 3 : 3. On 1st April, 2016, their Balance Sheet was as follows:

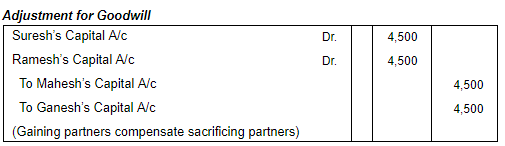

From the above date, the partners decided to share the future profits equally. For this purpose the goodwill of the firm was valued at ₹ 90,000. It was also agreed that:

(a) Claim against Workmen Compensation Reserve will be estimated at ₹ 1,00,000 and fixed assets will be depreciated by 10%.

(b) The Capitals of the partners will be adjusted according to the new profit-sharing ratio. For this, necessary cash will be brought or paid by the partners as the case may be.

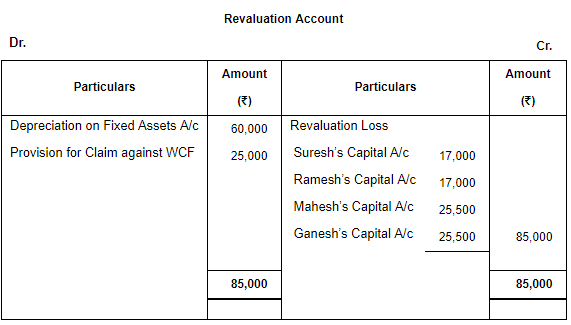

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

Working Notes

WN1:

Calculation of Gaining/Sacrificing Ratio

WN2: Calculation of Adjusted Capital

Suresh = 1,00,000 – 21,500 = Rs 78,500

Ramesh = 1,50,000 – 21,500 = Rs 1,28,500

Mahesh = 2,04,500 – 25,500 = Rs 1,79,000

Ganesh = 2,54,500 – 25,500 = Rs 2,29,000

Total Combined Capital = 6,15,000

Page No 4.45:

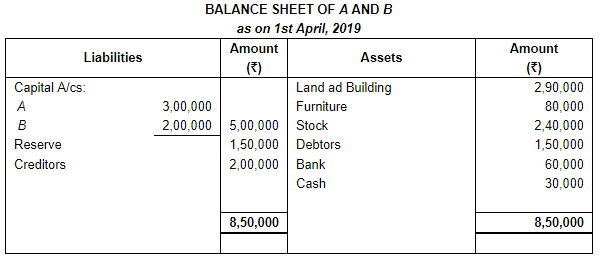

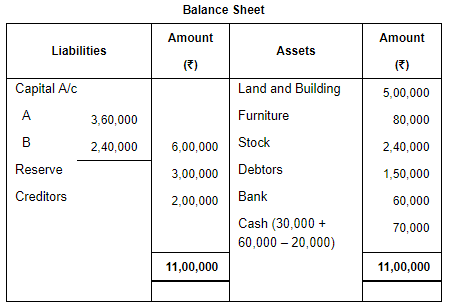

Question 32: Following is the Balance Sheet of A and B, who shared Profits and Losses in the ratio of 2 : 1, as at 1st April, 2019:

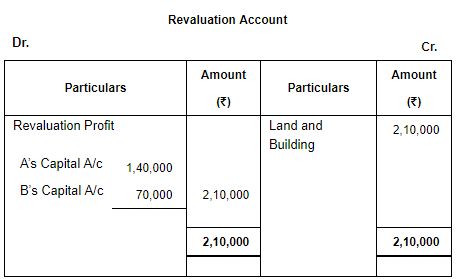

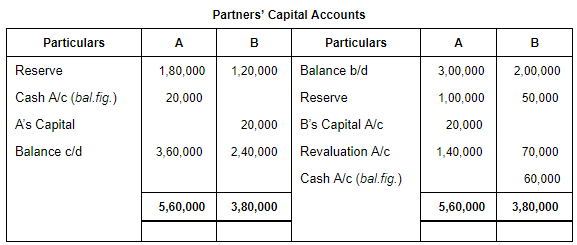

On the above date, the partners changed their profit-sharing ratio to 3 : 2. For this purpose, the goodwill of the firm was valued at ₹ 3,00,000. The partners also agreed for the following:

(a) The value of Land and Building will be ₹ 5,00,000;

(b) Reserve is to be maintained at ₹ 3,00,000.

(c) The total capital of the partners in the new firm will be ₹ 6,00,000, which will be shared by the partners in their new profit-sharing ratio.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the reconstituted firm.

ANSWER:

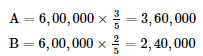

Working Notes

WN1: Calculation of New Capital

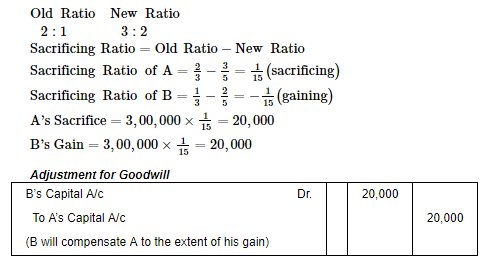

WN2: Calculation of Gaining/Sacrificing Ratio& Adjustment for Goodwill

|

42 videos|199 docs|43 tests

|

FAQs on Change in Profit-Sharing Ratio Among the Existing Partners (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is a profit-sharing ratio among partners? |  |

| 2. How is the profit-sharing ratio determined among partners? |  |

| 3. Can the profit-sharing ratio among partners be changed? |  |

| 4. What are the implications of changing the profit-sharing ratio among partners? |  |

| 5. Is it common for profit-sharing ratios to change among existing partners? |  |