ICAI Notes 5: Depreciation Accounting- 4 - CA Foundation PDF Download

5. CHANGE IN THE METHOD OF DEPRECIATION

The depreciation method selected should be applied consistently from period to period. A change from one method of providing depreciation to another should be made only if the adoption of the new method is required by the statute or for compliance with the accounting standard or if it is considered that the change would result in the more appropriate preparation and presentation of the financial statements of the enterprise. Whenever any change in depreciation method is made, depreciation should be recalculated in accordance with the new method from the date of asset coming into use. The deficiency or surplus arising from retrospective recomputation of depreciation should be debited or credited to Profit and Loss account in the year in which the method of depreciation is changed. Such change is treated as change in accounting policy. Its effect needs to be quantified and disclosed.

The company charges depreciation on straight line method for the first two years and thereafter decides to adopt written down value method.

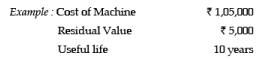

In this case: Rate of WDV depreciation (say `a’) would be;

After applying the log and antilog table, the rate of depreciation would be derived as follows:

a = 1-(5,000/1,05,000)1/10

a = 1-(1/21)1/10

Let (1/21)1/10 =a

Taking log both sides

Log a = 1/10(log1-log21)

= 1/10(0-1.3222)

= -0.13222

Adding and Subtracting 1 we get

bar 1.86778

Taking antilog both sides a= antilog(bar 1.86778) = 0.73753

Thus, 1 - 0.73753

= 0.26247 or 26.247%

Depreciation already charged for the first 2 years as per straight line method is 20,000.

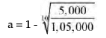

Retrospective computation of depreciation as per WDV method:

Therefore in the profit and loss account of the 3rd year, the short depreciation due to change in the method of depreciation of 27,885 should be debited. In addition, depreciation as per written down value method for 3rd year of

14,991, should also be debited.

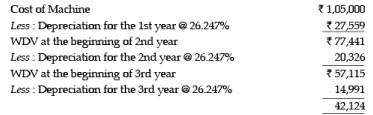

Illustration 14

A firm purchased on 1st January, 2009 certain machinery for 52,380 and spent

1,620 on its erection. On January 1, 2009 another machinery for

19,000 was acquired. On 1st July, 2010 the machinery purchased on 1st Januray, 2009 having become obsolete was auctioned for

28,600 and on the same date fresh machinery was purchased at a cost of

40,000.

Depreciation was provided annually on 31st December at the rate of 10 per cent on written down value. In 2011, however, the firm changed this method of providing depreciation and adopted the method of providing 5 per cent per annum depreciation on the original cost of the machinery with retrospective effect.

Solution

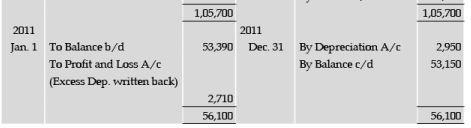

Machinery Account

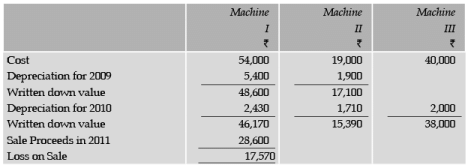

Working Notes :

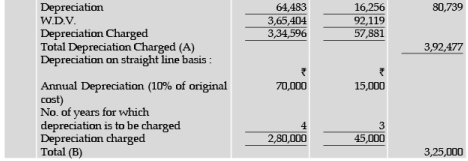

(1) Book Value of Machines:

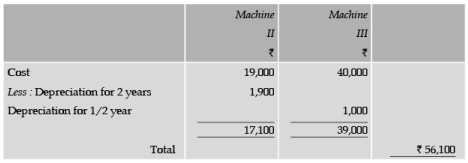

(2) Written down value on the basis of 5% depreciation on straight line basis as at 31st Dec., 2010.

(3) The book value appearing in the books is 53,390;

2,710 has to be written back to make this figure

56,100.

Note : The rate of 10% is assumed to be per annum.

Illustration 15

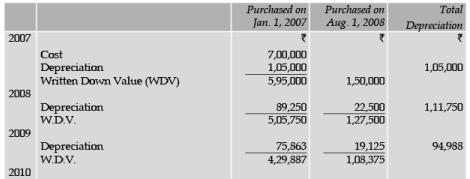

Messers Mill and Wright commenced business on 1st January 2007, when they purchased plant and equipment for 7,00,000. They adopted a policy of

(i) charging depreciation at 15% per annum on diminishing balance basis and

(ii) charging full year’s depreciation on additions.

Over the years, their purchases of plant have been:

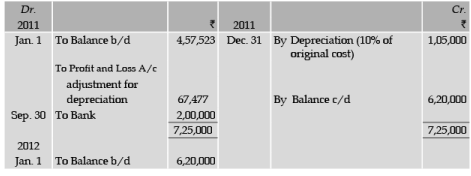

On 1-1-2011 it was decided to change the method and rate of depreciation to 10% on straight line basis with retrospective effect from 1-1-2007 the adjustment being made in the books of account.

Calculate the difference in depreciation to be adjusted in the Plant and Equipment being made in the accounts for the year ending 31st December, 2011.

Solution

Depreciation on written down value basis

Difference :

Excess depreciation charged to be adjusted in 2011 (A) – (B) = 67,477.

Plant and Equipment Account

6. REVISION OF THE ESTIMATED USE FUL LIFE OF THE DEPRECIABLE ASSET

There should be a periodical review of useful life of the depreciable assets. Whenever there is a revision in the estimated useful life of the asset, the unamortised depreciable amount should be charged to the asset over the revised remaining estimated useful life of the asset.

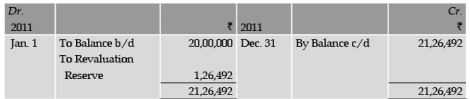

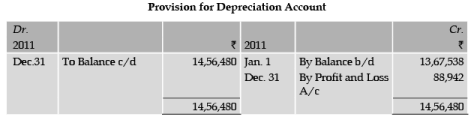

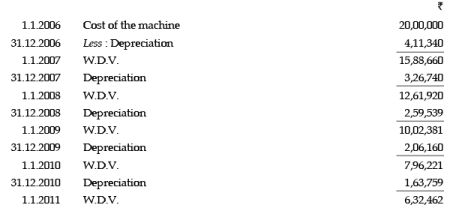

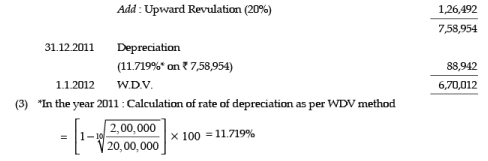

Illustration 16

M/s. Mayur & Co. purchased a machine on 1.1.2006 for ` 20,00,000. Estimated useful life was 10 years and scrap value at the end was expected to be ` 2,00,000. On 1.1.2011, the written down value of the machine was revalued to be up by 20%, useful life was re-estimated as 13 years and scrap value as ` 2,80,000. The company follows reducing balance method of charging depreciation. Show Machinery Account and Provision for Depreciation Account for the year ended 31.12.2011.

Solution

Machinery Account

Working Notes:

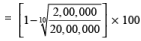

(1) In the year 2004 : Calculation of rate of depreciation as per WDV method

After applying the log and antilog table, the rate of depreciation would be derived as follows:

= [1 -(1/10 log 20 - 1/10 log 200)] x 100

= [1 -(1/10 x 1.3010 - 1/10 x 2.3010)] x 100

= [1 -(.1301 - .2301)] x 100

= [1 -(.10)] x 100

= [1 -(Antilog - .10 + 1 - 1)] x 100

= [1 -(Antilog bar 1.90)] x 100

= [1 -0.7943] x 100

= .2057 x 100

= 20.57%

(2) Statement of Depreciation

7. REVALUATION OF DEPRECIABLE ASSETS

Whenever the depreciable asset is revalued, the depreciation should be charged on the revalued amount on the basis of the remaining estimated useful life of the asset. If there is an upward revision in the value of asset for the first time, then the amount of appreciation is debited to Asset Account and credited to Revaluation Reserve Account. If an asset was earlier revalued downward and later on revalued upward then the appreciation to the extent of earlier downfall is credited to profit and loss account. If there is downward revision in the value of asset then Profit and Loss Account is debited and Asset Account is credited. If an asset was earlier revalued upward and then later on it was revalued downward then the downfall to the extent of earlier appreciation is debited to Revaluation Reserve Account. In case the revaluation has a material effect on the amount of depreciation, the same should be disclosed separately in the year in which revaluation is carried out.

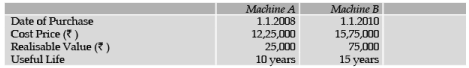

Illustration 17

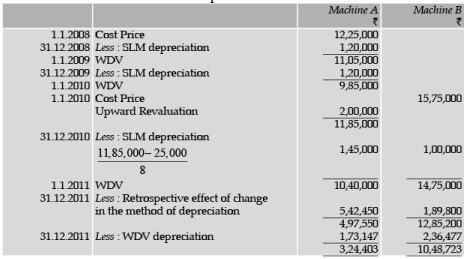

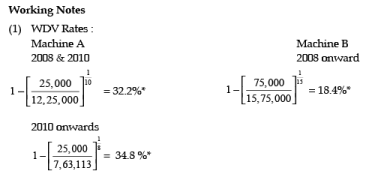

Consider the following details:

The machines were subject to depreciation under straight line basis. Calendar year is followed as the accounting year. In 2010, Machine A was revalued upward by ` 2 lacs. From 1.1.2011, it is decided to adopt written down value method of depreciation. You are asked to prepare a statement showing depreciation charged on each machine upto 31.12.2011.

Solution

Statement of Depreciation

8. PROVISION FOR REPAIRS AND RENEWALS

Expenditure incurred for repairs, renewals and maintenance on plant and machinery may vary over the years during the working life. Thus, for equalising the charge of repairs and renewals, sometimes a Provision for Repairs and Renewals Account is opened. Total of such expenses that may be incurred over the working life is estimated before hand. Average of this expenditure is debited to Profit and Loss Account and credited to Provision for Repairs and Renewals Account irrespective of actual expenses incurred. Every year Provision for Repairs and Renewals Account is debited and Repairs Account is credited for actual expenses incurred. The balance in provision for Repairs and Renewals Account is carried forward and in the end or on sale of the asset, the account is closed by transfer to the Asset Account for any balance left.

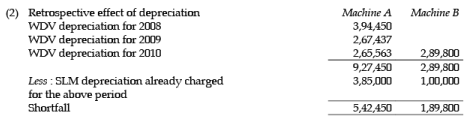

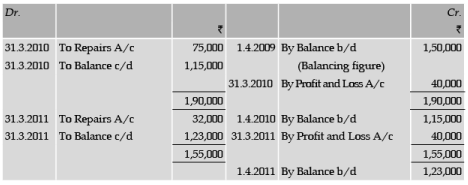

Illustration 18

The following particulars are available from the books of a public company having a large fleet of vehicles :

The company makes an annual provision of ` 40,000 on repairs and renewals.

Draw up the Provision for Repairs and Renewals Account for the years 2009-2010 and 2010-2011.

Solution

Provision for Repairs and Renewal Account

FAQs on ICAI Notes 5: Depreciation Accounting- 4 - CA Foundation

| 1. What is depreciation accounting? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the purpose of depreciation accounting? |  |

| 4. Can depreciation be reversed or adjusted? |  |

| 5. How does depreciation affect taxes? |  |