CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Mind Map: Bank Reconciliation Statement

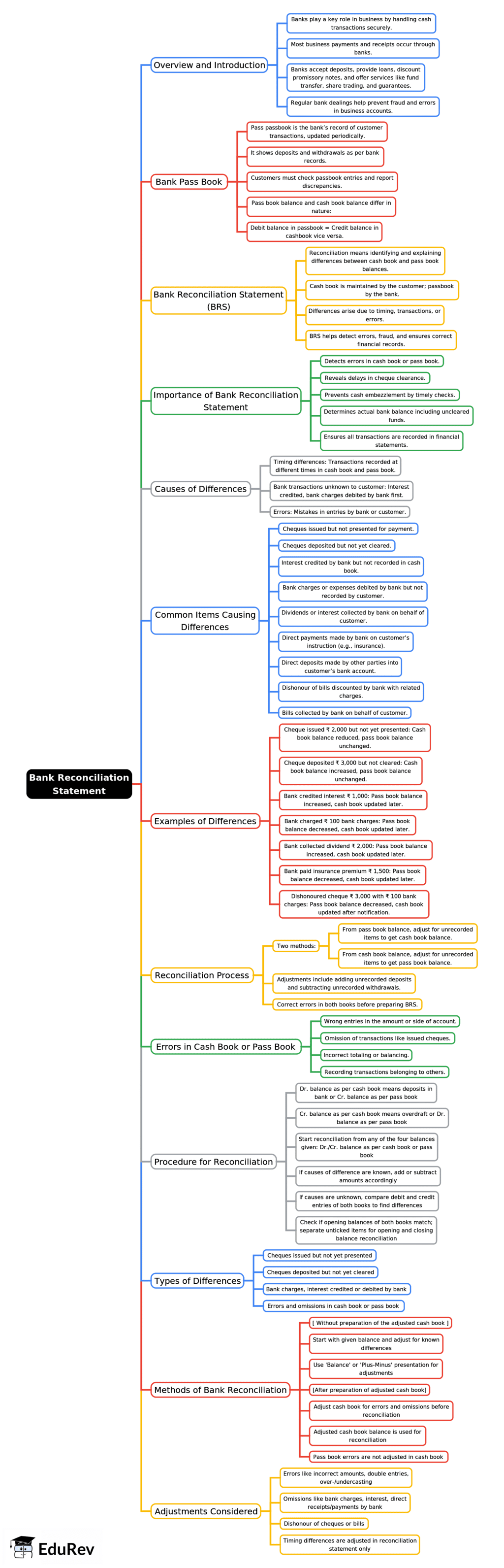

Mind Map: Bank Reconciliation Statement | Accounting for CA Foundation PDF Download

The document Mind Map: Bank Reconciliation Statement | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Mind Map: Bank Reconciliation Statement - Accounting for CA Foundation

| 1. What is a Bank Reconciliation Statement? |  |

Ans. A Bank Reconciliation Statement is a document that compares the cash balance on a company's books to the cash balance reported by its bank. The purpose of this statement is to identify any discrepancies between the two records, ensuring that the company's financial records are accurate and up-to-date.

| 2. Why is it important to perform bank reconciliation? |  |

Ans. Performing bank reconciliation is crucial for several reasons. It helps in detecting errors or fraudulent activities, ensures that all transactions are recorded accurately, and provides a clearer picture of the company’s cash position. Regular reconciliation helps maintain financial integrity and supports effective cash management.

| 3. What are the common reasons for discrepancies in bank reconciliation? |  |

Ans. Discrepancies in bank reconciliation can arise from various sources, including outstanding checks that have not yet cleared, deposits in transit that are not recorded by the bank, bank fees or interest not recorded in the company’s books, and errors made in either the bank’s or the company’s records.

| 4. How often should a company perform bank reconciliation? |  |

Ans. A company should perform bank reconciliation regularly, typically on a monthly basis. This frequency allows businesses to quickly identify and resolve discrepancies, maintain accurate financial records, and monitor cash flow effectively.

| 5. What steps are involved in preparing a Bank Reconciliation Statement? |  |

Ans. The steps involved in preparing a Bank Reconciliation Statement include gathering bank statements and the company's cash book, identifying outstanding checks and deposits in transit, adjusting the balances for any bank charges or errors, and finally reconciling the adjusted balances to ensure they match.

Related Searches