Commerce Exam > Commerce Notes > Accountancy Class 11 > Mind Map: Bank Reconciliation Statement

Mind Map: Bank Reconciliation Statement | Accountancy Class 11 - Commerce PDF Download

The document Mind Map: Bank Reconciliation Statement | Accountancy Class 11 - Commerce is a part of the Commerce Course Accountancy Class 11.

All you need of Commerce at this link: Commerce

|

61 videos|154 docs|35 tests

|

FAQs on Mind Map: Bank Reconciliation Statement - Accountancy Class 11 - Commerce

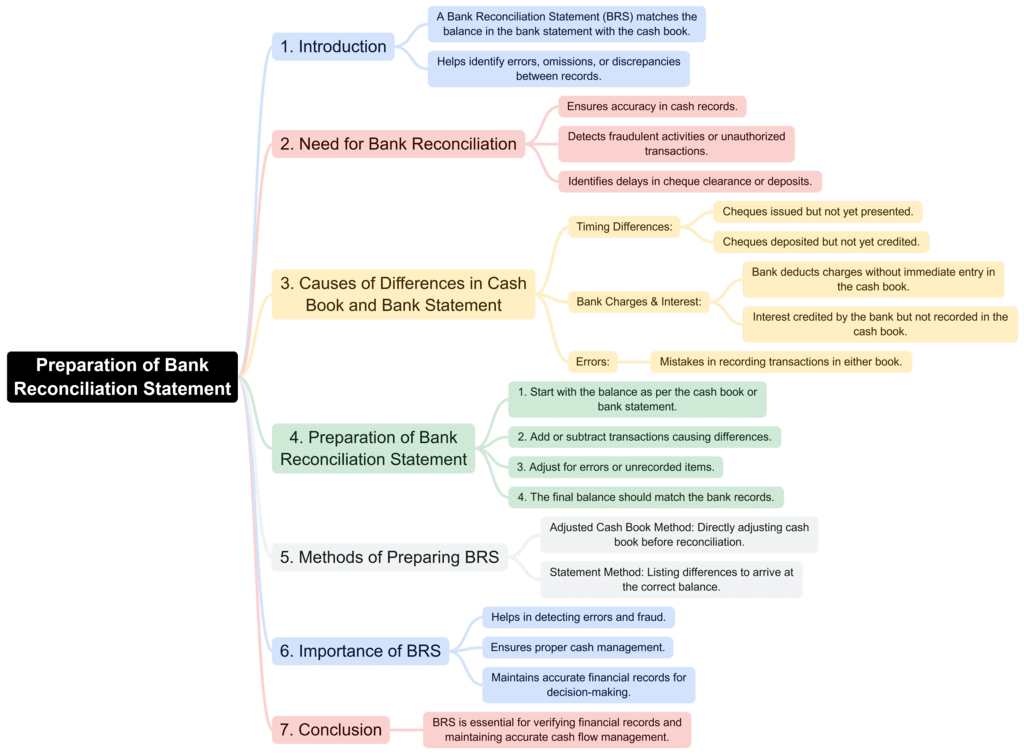

| 1. What is a bank reconciliation statement and why is it important? |  |

Ans. A bank reconciliation statement is a document that compares the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement. Its importance lies in ensuring that the records are accurate, identifying discrepancies, and preventing fraud or errors in financial reporting.

| 2. How often should a bank reconciliation statement be prepared? |  |

Ans. A bank reconciliation statement should ideally be prepared on a monthly basis. This frequency allows businesses to identify any discrepancies promptly and maintain accurate financial records, ensuring better cash flow management and financial control.

| 3. What are the common reasons for discrepancies in bank reconciliations? |  |

Ans. Common reasons for discrepancies in bank reconciliations include outstanding checks that have not yet cleared, deposits in transit, bank errors, and timing differences in recording transactions. Understanding these reasons can help in resolving discrepancies efficiently.

| 4. What steps are involved in preparing a bank reconciliation statement? |  |

Ans. The steps involved in preparing a bank reconciliation statement include gathering bank statements and cash account records, comparing deposits and withdrawals, identifying discrepancies, adjusting the cash account for any errors, and preparing the final reconciliation statement.

| 5. Can bank reconciliation statements help in fraud detection? |  |

Ans. Yes, bank reconciliation statements can significantly aid in fraud detection. By regularly comparing bank records with accounting entries, businesses can identify unauthorized transactions, errors, or omissions, thus enabling timely corrective measures to prevent further financial losses.

Related Searches