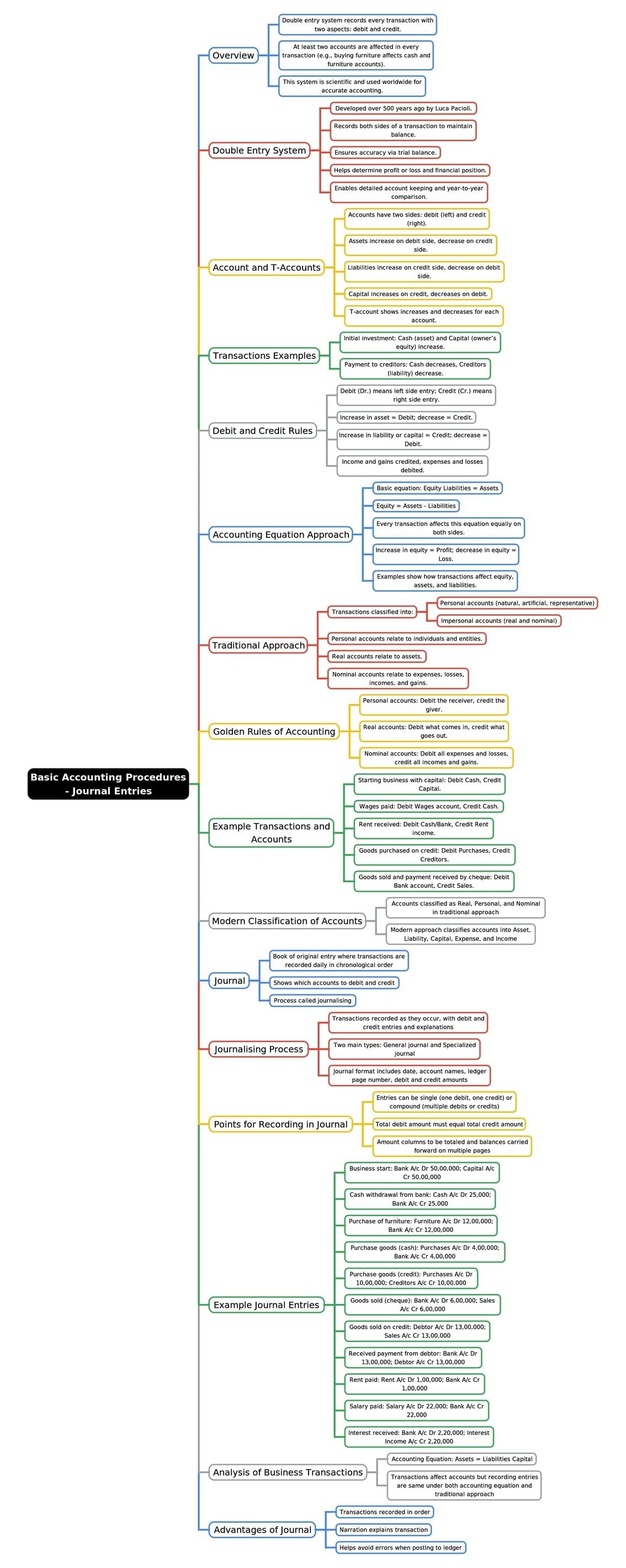

CA Foundation Exam > CA Foundation Notes > Accounting for CA Foundation > Mind Map: Basic Accounting Procedures - Journal Entries

Mind Map: Basic Accounting Procedures - Journal Entries | Accounting for CA Foundation PDF Download

The document Mind Map: Basic Accounting Procedures - Journal Entries | Accounting for CA Foundation is a part of the CA Foundation Course Accounting for CA Foundation.

All you need of CA Foundation at this link: CA Foundation

|

68 videos|265 docs|83 tests

|

FAQs on Mind Map: Basic Accounting Procedures - Journal Entries - Accounting for CA Foundation

| 1. What are journal entries in accounting? |  |

Ans. Journal entries are the foundational components of the accounting process. They record all financial transactions in a systematic manner, detailing the accounts involved, the amounts, and the dates of the transactions. Each entry includes a debit and a credit, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

| 2. How do I determine which accounts to debit and credit in a journal entry? |  |

Ans. To determine which accounts to debit and credit, one must understand the nature of the transaction. Generally, assets are increased with debits and decreased with credits, while liabilities and equity are increased with credits and decreased with debits. A useful approach is to follow the rules of double-entry bookkeeping, ensuring that each transaction affects at least two accounts.

| 3. What is the purpose of a journal in accounting? |  |

Ans. The purpose of a journal in accounting is to provide a detailed record of all transactions before they are posted to the general ledger. It serves as a chronological log that helps in tracking the financial activities of a business, ensuring accuracy, and facilitating audits. Journals help accountants identify errors and discrepancies in financial reporting.

| 4. What are the common types of journal entries? |  |

Ans. Common types of journal entries include regular entries, adjusting entries, and closing entries. Regular entries record everyday transactions, adjusting entries account for accrued and deferred items at the end of an accounting period, and closing entries transfer temporary account balances to permanent accounts at the end of the fiscal year.

| 5. What is the significance of the date in a journal entry? |  |

Ans. The date in a journal entry is significant as it indicates when the transaction occurred. Accurate dating helps maintain the chronological order of transactions, which is essential for preparing financial statements and for audit trails. It ensures that the financial records reflect the actual timing of the financial activities.

Related Searches