Analysis of Financial Statements -2 NCERT Solutions | Accountancy Class 12 - Commerce PDF Download

Numerical Questions

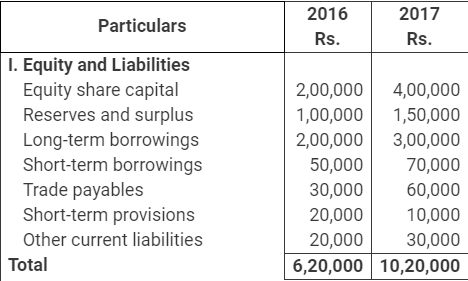

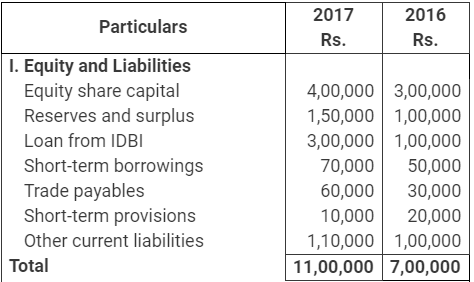

Q1: Following are the balance sheets of Alpha Ltd., as at March 31, 2016 and 2017.

You are required to prepare Comparative Balance Sheet.

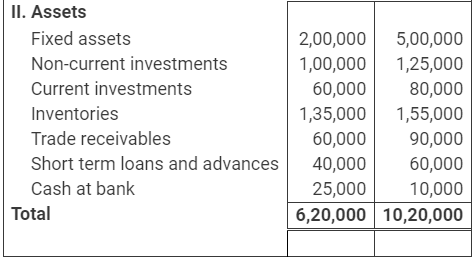

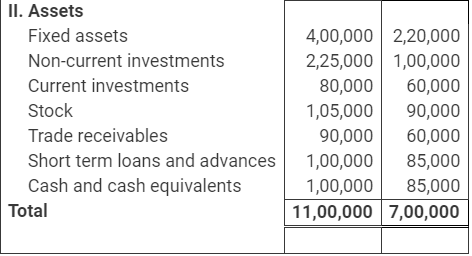

Ans:

Ans:

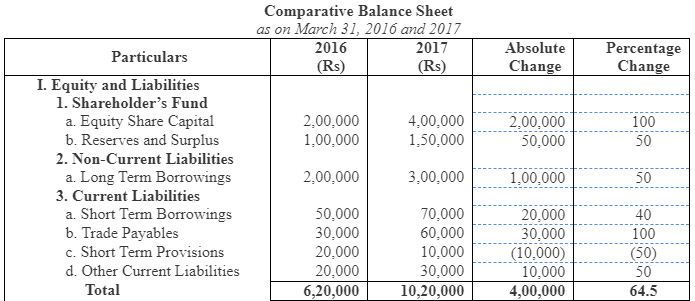

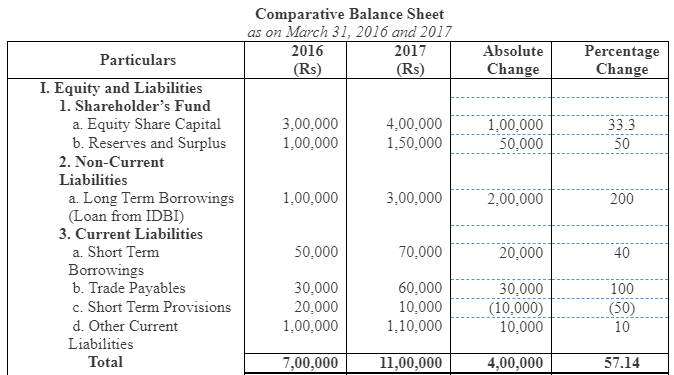

Q2: Following are the balance sheets of Beta Ltd. at March 31st, 2016 and 2017:

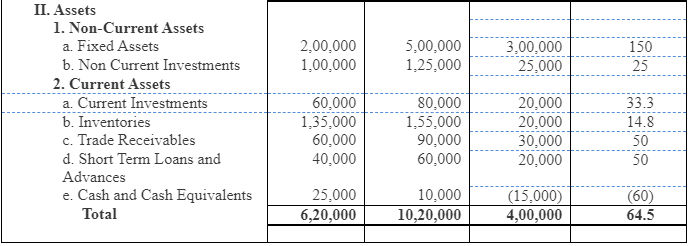

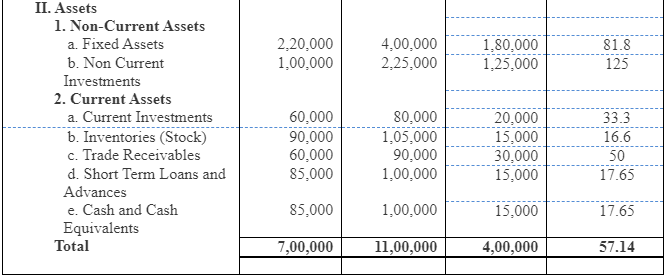

Ans:

Ans:

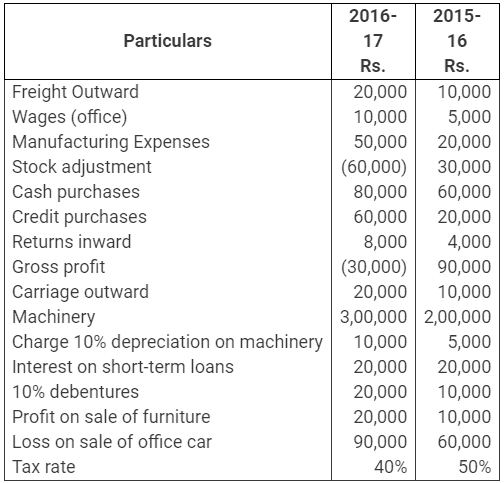

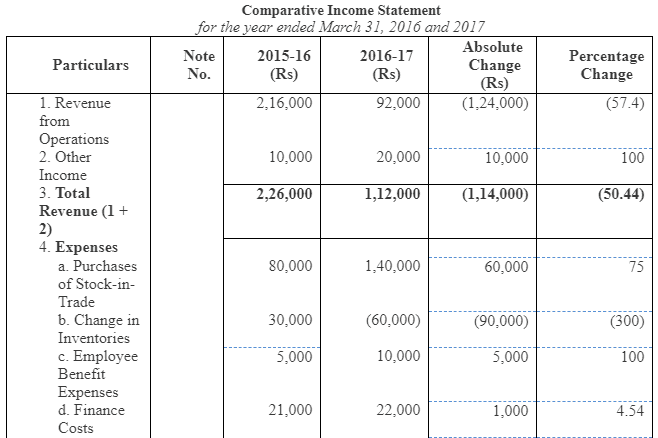

Q3: Prepare Comparative Statement of profit and loss from the following information. Ans:

Ans:

Working Notes:

1. Calculation of Net Sales

Net Sales = Cost of Goods Sold + Gross Profit - Sales Return

or, Net Sales = Purchases + Manufacturing Expenses + Change in Inventory + Gross Profit - Sales Return

Net Sales (2016) = 80,000 + 20,000 +30,000 + 90,000 - 4,000 = Rs 2,16,000

Net Sales (2017) = 1,40,000 + 50,000 - 60,000 - 30,000 - 80,000 = Rs 92,000

2. Calculation of Finance Cost

Finance Cost = Interest on short-term loans + Interest on 10% Debentures

Finance Cost (2016) = 20,000 + 1,000 = Rs 21,000

Finance Cost (2017) = 20,000 + 2,000 = Rs 22,000

3. Calculation of Other Expenses

Other Expenses = Freight Outward + Carriage Outward + Loss on sale of office car

Other Expenses (2016) = 10,000 + 10,000 + 60,000 = Rs. 80,000

Other Expenses (2017) = 20,000 + 20,000 + 90,000 = Rs. 1,30,000

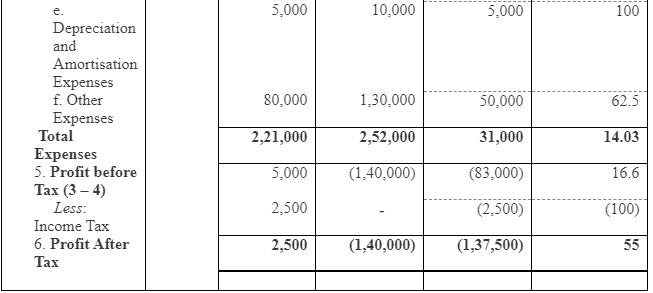

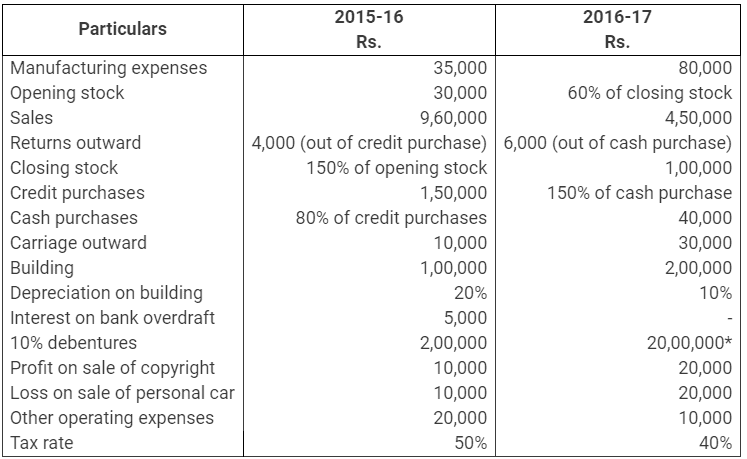

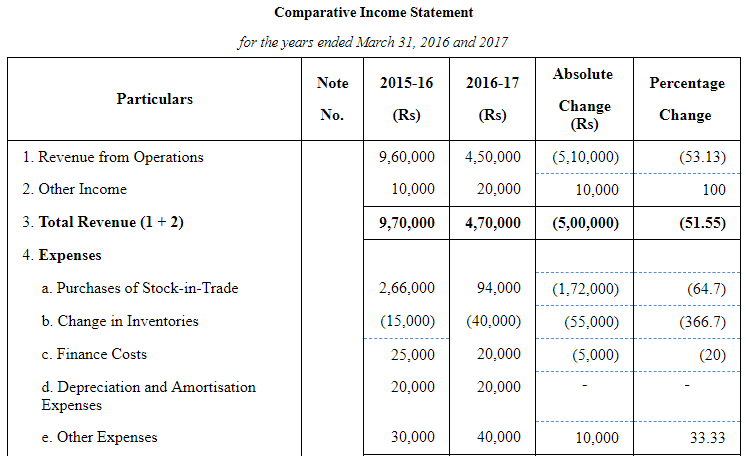

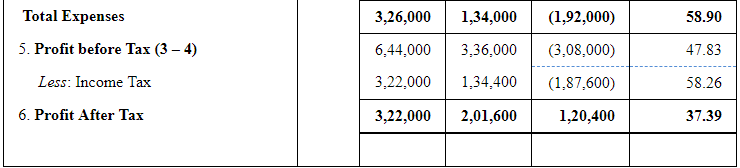

Q4: Prepare Comparative Statement of Profit and Loss from the following information: Ans:

Ans:

Working Notes:

1. Calculation of Net Purchases and Change in Inventory

2. Calculation of Finance Cost

Finance Cost = Interest on Bank Overdraft + Interest on Debentures

Finance Cost (2016) = 5,000 + 20,000 = Rs 25,000

Finance Cost (2017) = 0 + 20,000 = Rs 20,000

3. Calculation of Other Expenses

Other Expenses = Carriage outward + Other operating expenses

Other Expenses (2016) = 10,000 + 20,000 = Rs 30,000

Other Expenses (2017) = 30,000 + 10,000 = Rs 40,000

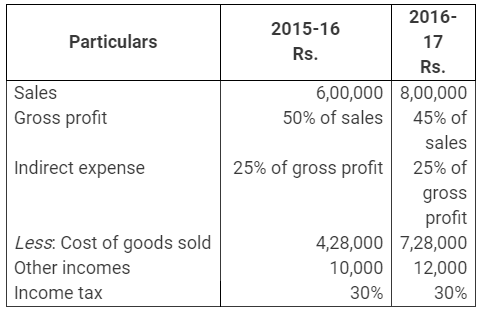

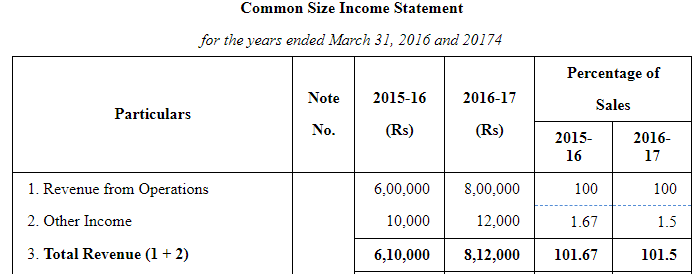

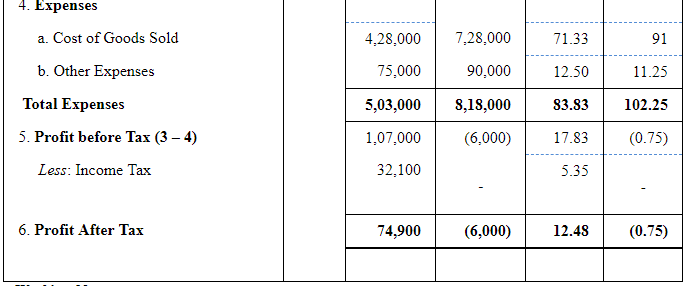

Q5: Prepare a Common size statement of profit and loss of Shefali Ltd. with the help of following information: Ans:

Ans:

Working Notes:

Working Notes:

1. Calculation of Other Expenses

Other Expenses = Indirect Expenses = % of Gross Profit

2016=6,00,000×50%×25%=Rs 75,000

2017=8,00,000×45%×25%=Rs 90,000

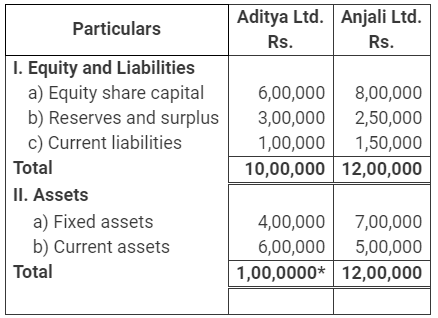

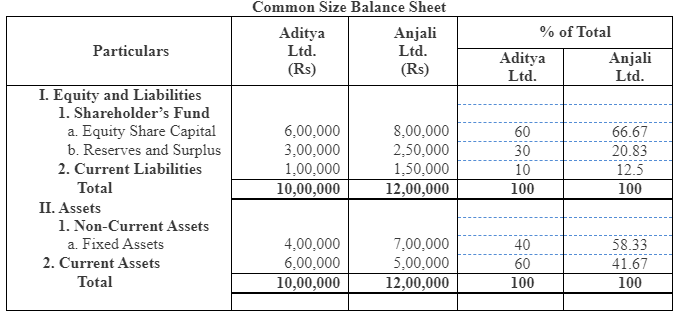

Q6: Prepare a Common Size balance sheet from the following balance sheet of Aditya Ltd., and Anjali Ltd.:

*The total of Liabilities side must be equal to the total of Assets side, therefore, it should be 10,00,000.

*The total of Liabilities side must be equal to the total of Assets side, therefore, it should be 10,00,000.

Ans:

|

42 videos|199 docs|43 tests

|

FAQs on Analysis of Financial Statements -2 NCERT Solutions - Accountancy Class 12 - Commerce

| 1. What are the key components of financial statements? |  |

| 2. How do financial ratios help in analyzing financial statements? |  |

| 3. What is the significance of the balance sheet in financial analysis? |  |

| 4. How can cash flow analysis improve financial decision-making? |  |

| 5. What are the limitations of financial statement analysis? |  |