Past Year Questions: Inventories | Accounting for CA Foundation PDF Download

Q 1. State with reasons, whether the following statements are True or False: (2 Marks)

Under inflationary conditions, FIFO will not show the lowest value of cost of goods sold. (Jan 2025)

Answer: False. Under inflationary conditions, LIFO and weighted average will not show the lowest value of cost of goods sold.

Q 2. A trader prepared his final accounts on 31st March each year. Due to some unavoidable reasons, no inventory taking could be possible till 15th April, 2025 on which date the total cost of goods in his store came to ₹ 1,50,000.' (4 Marks, May 2025)

The following facts were established between 31st March and 15th April, 2025:

Sales (Credit): ₹ 70,000

Sales (Cash): ₹ 25,000

Purchases (Cash): ₹ 15,000

Purchases (Credit): ₹ 25,000

On 25th March, goods of the sale value of ₹ 30,000 were sent on sale or return basis to a customer, the period of approval being four weeks. He returned 25% of the goods on 12th April, approving the rest; the customer was billed on 25th April.

The trader had also received goods costing ₹ 10,000 in March, for sale on consignment basis. 50% of the goods had been sold by 31st March and another 25% by 15th April. These sales are not included in the above sales.

Goods are sold by the trader at a profit of 20% on sales.

You are required to ascertain the value of inventory as on 31st March, 2025.

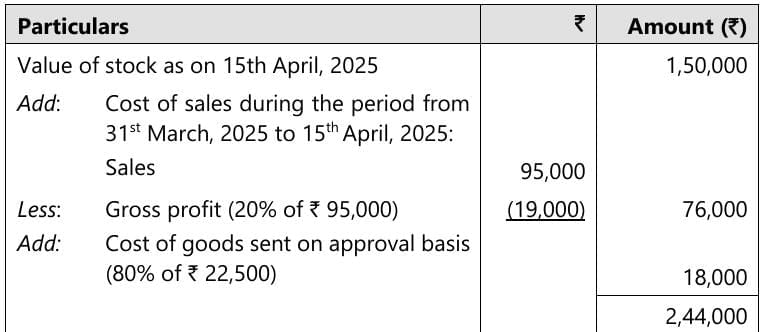

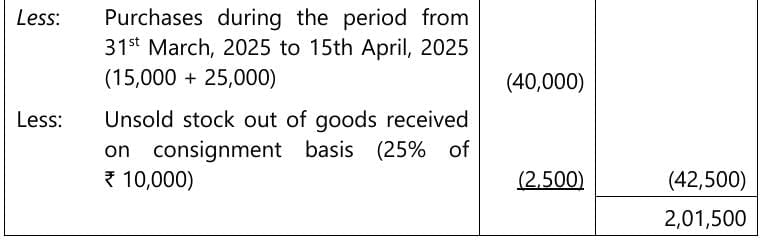

Answer:

Statement of Valuation of Inventory (Stock) on 31st March, 2025

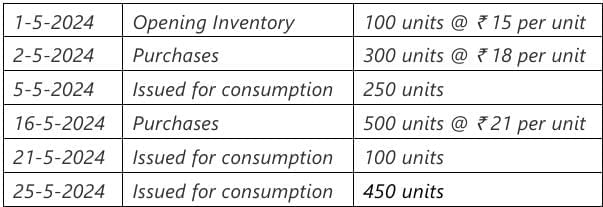

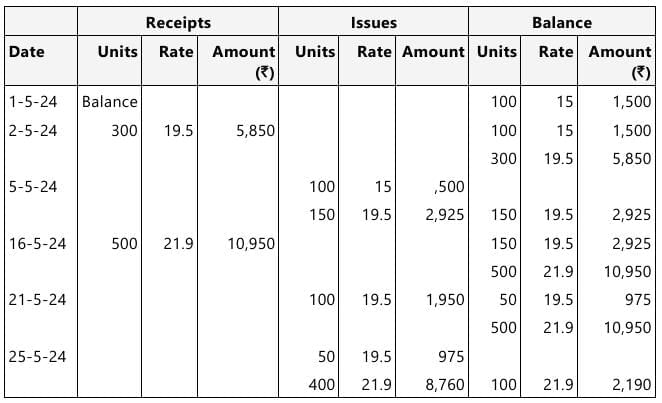

Q 3. The following details are available of raw material of a manufacturing unit: (5 Marks,Jan 2025)

The manufacturer also incurred the following expenses:

- Freight of ₹ 300 and unloading charges of ₹ 150 at the time of every purchase, respectively.

- Warehouse rent of ₹ 2,000 per month.

- Administrative Expenses of ₹ 1,500 per month.

You are required to find out the value of inventory as on May 31, 2024 if the company follows:

(a) Weighted Average method for inventory valuation.

(b) First in First Out method for inventory valuation.

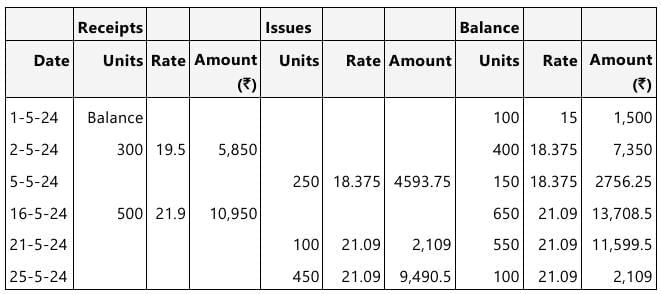

Answer: (a) Weighted Average basis

Calculation of the value of Inventory as on 31-5-2024

Therefore, the value of Inventory is as follows:

Value as per Weighted Method as on 31-5-2024: 100 units @ 21.09 = 2,109

(b) First-in-First-out basis

Calculation of the value of Inventory as on 31-5-2024

Therefore, the value of Inventory as on 31-5-2024 will be as follows:

Therefore, the value of Inventory as on 31-5-2024 will be as follows:

Value of Inventory as per FIFO Method: 100 units @ ₹ 21.9 = ₹ 2,190

Working Note: (i) Per unit cost of raw material purchased on May 2,2024

= (300 x 18 + 300 + 150)/ 300= ₹ 19.5

(ii) Per unit cost of raw material purchased on May 16,2024

= (500 x 21 + 300 + 150)/500 = ₹ 21.9

Note:

(a) Freight and unloading charges are directly attributable cost and are necessary to bring the inventory into present location and condition hence are included in the cost of inventory.

(b) Warehouse rent are indirectly attributable expenses and are not considered as cost of inventory.

(c) Administrative expenses are indirectly attributable expenses and do not usually add any specific value to inventories and hence excluded from the cost of inventory.

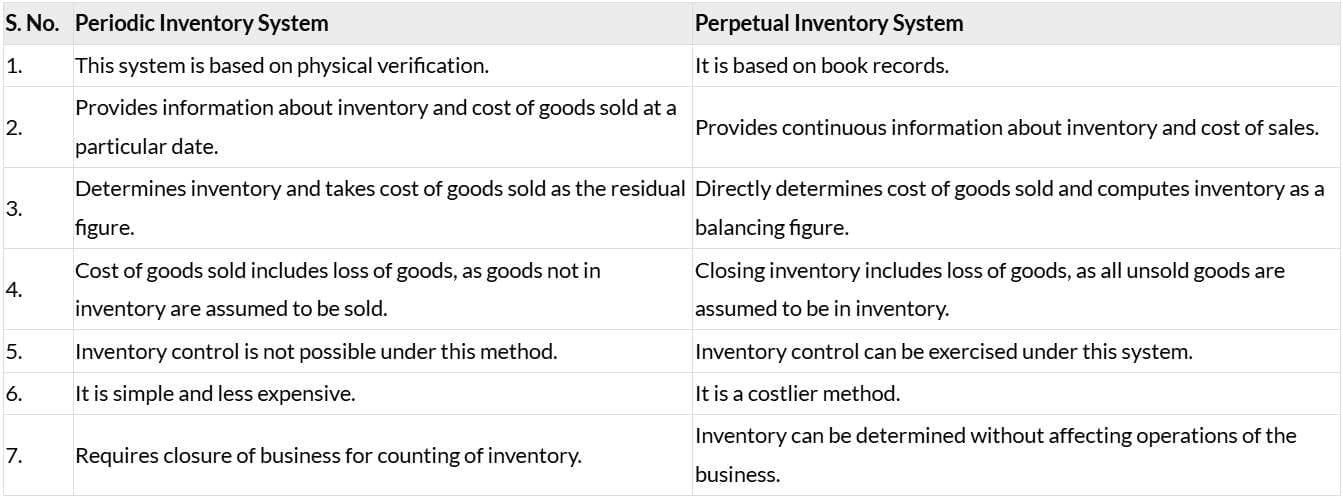

Q 4. Differentiate between Periodic Inventory System and Perpetual Inventory System. (5 Marks, Sep 2024)

Answer:

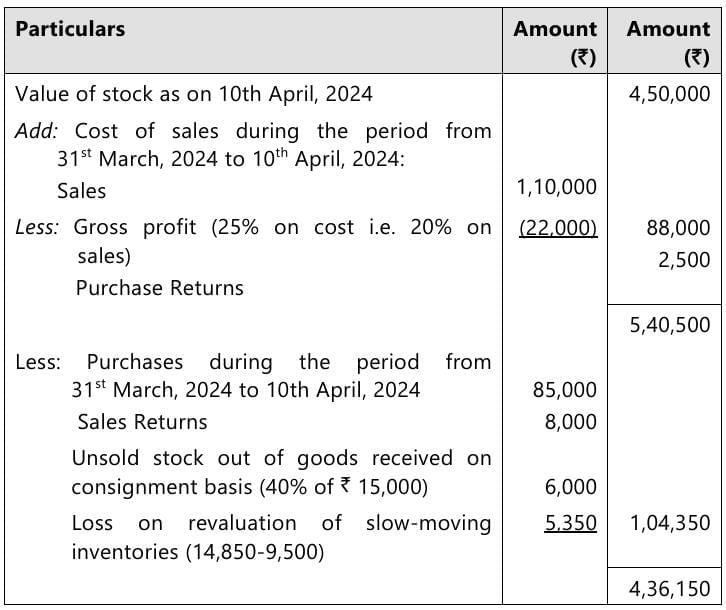

Q 5. Manish closed his books of account on 31st March, each year. Inventory taking for the year ended 31st March, 2024 was completed by 10th April, 2024, on which date value of the stock available in the godown was of ₹ 4,50,000 at cost. (5 Marks, Jun 2024)

Following are the details of transactions that took place between 31st March, 2024 and 10th April, 2024:

(i) Goods sold to customers ₹ 1,10,000.

(ii) Sales return ₹ 10,000.

(iii) Purchases ₹ 85,000 (Including Cash Purchases ₹ 10,000).

(iv) Purchases return amounted to ₹ 2,500.

(v) Goods costing ₹ 15,000 received in March, for sale on a consignment basis, out of which 60% of goods had been sold by 10th April. These sales are not included in above sales.

(vi) After the stock was taken, it was found that there was certain very old slow-moving items costing ₹ 14,850, which should be taken at ₹ 9,500 to ensure disposal to an interested customer.

Goods are sold at a profit margin of 25% on cost. Ascertain the value of inventory for inclusion in the final accounts for the year ended 31st March, 2024.

Answer:

Statement of Valuation of Inventory as on 31st March, 2024

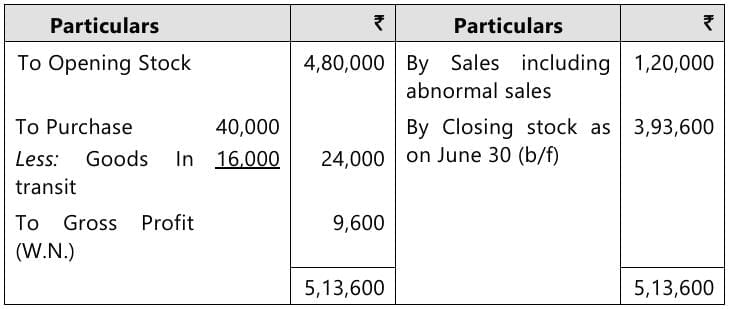

(i) Out of the Goods sent on consignment, Goods at cost worth ₹ 24,000 were unsold.

(ii) Purchase of ₹ 40,000 were made out of which Goods worth ₹ 16,000 were delivered on 5th July, 2023.

(iii) Sales were ₹ 1,36,000 which include Goods worth ₹ 32,000 sent on approval. Half of these Goods were returned before 30th June 2023, but no information is available regarding the remaining goods.

(iv) Goods are sold at cost plus 25%. However, Goods costing ₹ 24,000 had been sold for ₹ 12,000.

Determine the value of stock on 30th June, 2023.

Answer:

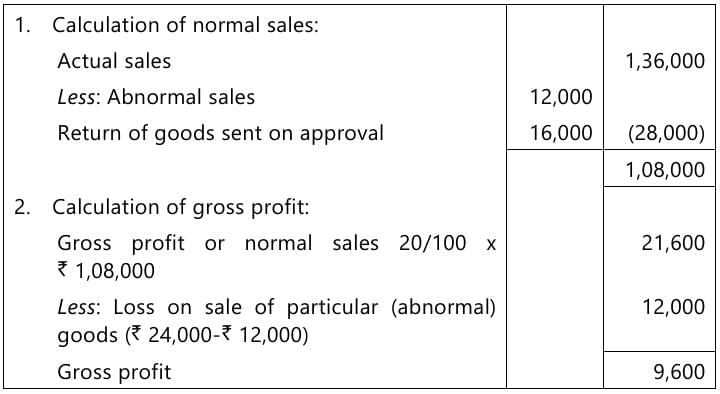

Trading Account for the period from 23rd June to 30th June  Statement of valuation of stock on 30th June 2023

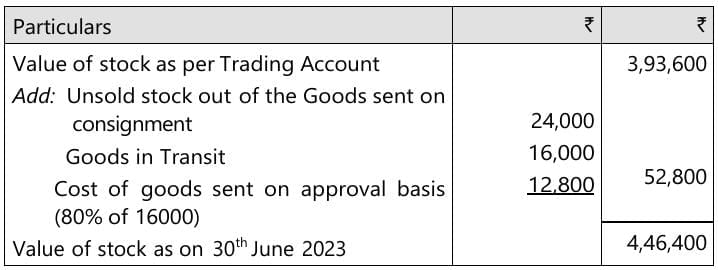

Statement of valuation of stock on 30th June 2023

Working Notes:

|

68 videos|265 docs|83 tests

|

FAQs on Past Year Questions: Inventories - Accounting for CA Foundation

| 1. What are the key components of inventory management? |  |

| 2. How does inventory valuation affect financial reporting? |  |

| 3. What are the different methods of inventory valuation? |  |

| 4. What is the significance of inventory turnover ratio? |  |

| 5. How can technology improve inventory management? |  |