Class 10 Economics Chapter 3 Previous Year Questions - Money and Credit

Previous Year Questions 2024

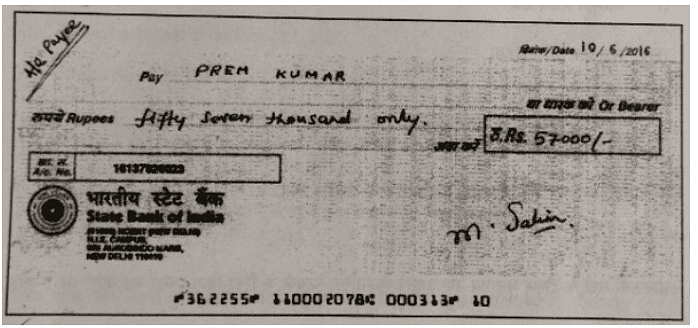

Q1: Read the image of the cheque. Identify the cheque number from the given options: (CBSE 2024) (a) 362255

(a) 362255(b) 110002078

(c) 000313

(d) 16137926023

View Answer

View AnswerAns: (a)

The cheque number is a unique identifier for a specific cheque, typically found at the top right corner of the cheque. In the given options, the correct cheque number is (a) 362255, as it matches the format and position usually found on a cheque. The other options either have too many digits or do not fit the typical cheque numbering format.

Q2: Which one of the following banks in India controls the issuance of currency and regulates the credit system in the country? (CBSE 2024)

(a) Punjab National Bank

(b) Indian Bank

(c) Reserve Bank of India

(d) State Bank of India

View Answer

View AnswerAns: (c)

The Reserve Bank of India (RBI) is the central bank of India, responsible for issuing currency and regulating the country's credit system. It manages monetary policy and ensures financial stability, making option (c) the correct answer. The other banks listed are commercial banks that operate under the regulations set by the RBI.

Q3: Explain the role of `Self Help Groups' in the rural society. (CBSE 2024)

View Answer

View AnswerAns: The role of self help groups in a rural society/ economyis as follows:

(1) They organise rural poor, in particular women, into small Self Help Groups to pool their savings.

(2) Self-help groups provide a platform for the rural poor to interchange thoughts, ideas and opinions about various domestic and regional issues.

(3) It inculcates the habit of saving and investing.

(4) It also becomes a medium to borrow cheap loans easily from local banks. Loan is sanctioned in the name of the group and is meant to create self-employment opportunities for the members.

(5) It develops the power of decision-making and develops political and social opinion among the members.

Previous Year Questions 2023

Q4: Explain the role of banks with regard to money which they accept from the public. (2023) View Answer

View AnswerAns: Banks play an important role regarding the money they accept from the public

- They keep the money of the public in their safe custody.

- They give interest on the deposited money to the public.

- Banks use the major portion of deposits to extend loans. These loans are then recovered with interest.

- It is easy for individuals to get credit who have savings and a current account in the banks.

Q5: Explain any three functions of the Reserve Bank of India. (2023, Al 2019)

View Answer

View AnswerAns: The Reserve Bank of India has many important roles that affect the common public:

- RBI monitors the balance kept by the bank for day to day transactions.

- RBI monitors the banking activity, particularly the loan-giving activity of the banks. It ensures that the banks give loans to the priority sector like agriculture and not just to profit-making sectors.

- The RBI undertakes the responsibility of controlling credit created by the commercial banks. RBI uses quantitative and qualitative techniques to control and regulate the credit flow. This includes interest rates and the percentage of loans to a sector.

- The RBI gives guidelines to the bank about setting up the terms of credit that the bank may decide upon for the borrowers.

Q6: "Cheap and affordable credit is crucial for the country’s development’.” Justify the statement. (CBSE 2023)

View Answer

View AnswerAns: Cheap and affordable credit is crucial for a country's development due to the following factors:

- Increased lending leads to higher incomes, encouraging people to invest in agriculture, business, and small-scale industries.

- Cheap credit leaves more income with borrowers for reinvestment, accelerating economic activity.

- Affordable credit allows weaker sections of society to access formal lending, reducing exploitation by informal moneylenders.

- It helps break the cycle of debt and promotes sustainable economic activity, enabling borrowers to invest in better technology and become more competitive.

Q7: Justify the role of 'Self Help Groups’ in the rural economy. (CBSE 2023)

View Answer

View AnswerAns: (i) SHGs have emerged as building blocks of the rural poor as it is the group as a whole which is responsible of the repayment of the loan. In case of non-repayment, it is taken up in a serious manner by the group members.

(ii) The SHGs are organisations of the rural poor people especially women. They provide small loans on reasonable rates.

(iii) The members of SHGs pool their savings and take loans at nominal rates of interests.

(iv) This creates self employment opportunities for the members particularly rural poor women.

(v) The SHGs help poor borrov/ers to overcome the problem of lack of collateral.

Previous Year Questions 2022

Q8: Why are transactions made in money? Explain. (Term-II,2021-22 C) View Answer

View AnswerAns: A person holding money can easily exchange it for any commodity or service that he or she might want. Thus, everyone prefers to receive payments in money and then exchange the money for things that they want.

Q9: How does a bank work as a key component of the financial system? Explain. (Term-II, 2021-22)

View Answer

View AnswerAns: Banks mediate between those v/ho have surplus funds (the depositors) and those who are in need of these funds (the borrowers). People need small amount of money for their day-to-day needs and deposit the surplus amount in the bank. Bank accepts the deposit and also pay an amount of interest on the deposits. In this way people’s money is safe and earns an amount as an interest.

Bank use the major portion of the deposits to meet the loan requirements of the people.

Q10: Analyse the situation in which credit pushes the borrower into a situation from which recovery is painful. (Term-II, 2021-22)

View Answer

View AnswerAns: Bank usually refered as a formal source of credit and in some situations the borrower would not able to repay loan. This pushes them in the situation of dept trap. Example:

(i) In case of rural areas if crop fails due to natural factors it will be difficult for the farmers to pay loan.

(ii) In case of failure of a business. It will be difficult for the businessman to repay the credit.

(iii) In case of informal sector, rate of interest is very high. If due to crop failure previous loan is not repaid interest rate further mounts.

(iv) In case of high risk activities failure without some support can push borrower in painful situation.

(v) In many cases people has to sell their land and fixed assets to repay loan.

Q11: Explain with an example the role of credit for development. (Term-ll, 2021-22)

View Answer

View AnswerAns: ‘Credit’ refers to an agreement in which the lender supplies the borrowers with money, goods or services in return for the promise of future payment. Credit plays vital role for development in different ways as:

(i) Credit helps people from all walks of life in setting up their business, increase their income and support their families.

(ii) To some people loan helps a lot in constructing their houses and get relief from monthly rent, to others it helps a lot in raising their standards of living.

(iii) Example of Salim: The credit helps him and he is able to meet the ongoing expenses of production, complete production on time and thereby increase his earning. 38. Banks play an important role in the economic development of the country.

(i) Capital formation : Banks offer very attractive schemes to attract the people to save their money with them and organised money market.

(ii) They mobilize the small savings of the people through their branches and make it available for productive purposes.

(iii) Credit creation leads to increased production, employment and caused faster economic development.

(iv) The banks help in the development of different type of industries by extending loans to concern persons.

(v) It ensures full utilisation of resources.

Q12: Read the following source and answer the questions that follow: (Term-II,2021-22)

A House Loan

Megha has taken a loan of Rs. 5 lakhs from the bank to purchase a house. The annual interest rate on the loan is 12 per cent and the loan is to be repaid in 10 years in monthly installments. Megha had to submit to the bank, documents showing her employment records and salary before the bank agreed to give her the loan. The bank retained as collateral the papers of the new house, which will be returned to Megha only when she repays the entire loan with interest.

(i) From which source of credit Megha has taken loan?

View Answer

View AnswerAns: Formal source

(ii) Explain the terms of credit given in the source.

View Answer

View AnswerAns: Terms of credit given in the source are

Document required - Salary slip and employment record.

Interest rate - 2% per annum

Mode of repayment - Monthly instalment

Collateral - New house papers

Q13: Dhananjay is a government employee and belongs to a rich household, whereas Raju is a construction worker and comes from a poor rural household. Both are in need and wish to take a loan. Create a list of argument explaining who between the two would successfully be able to arrange money from a formal source. Why? (Term-II,2021-22 C, 2016)

View Answer

View AnswerAns: Dhananjay will be able to get a loan from a formal source.

Arguments:

- Banks are not present everywhere in rural India. Even when they are present, getting a loan from a bank is much more difficult than taking a loan from informal sources.

- Bank loans require proper documents and collateral. Absence of collateral is one of the major reasons which prevent the poor from getting bank loans.

- Informal lenders such as moneylenders, on the other hand, know the borrowers personally and hence, are often willing to give a loan without collateral.

Previous Year Questions 2021

Q14: The exchange of goods with a commodity is known as: (2021 C)(a) Double coincidence of wants

(b) Local trade

(c) Domestic trade

(d) Foreign trade

View Answer

View AnswerAns: (a)

The exchange of goods with a commodity is known as "double coincidence of wants." This term means that for a trade to happen, each party must want what the other has to offer at the same time. Therefore, option (a) is the correct answer, as it specifically describes this type of barter system. The other options refer to different types of trade but do not capture this specific concept.

Q15: Which of the following authorities of India issues currency notes on behalf of the Central Government? (2021 C)

(a) The State Bank of India

(b) The Reserve Bank of India

(c) The Allahabad Bank

(d) The Punjab National Bank

View Answer

View AnswerAns: (b)

The Reserve Bank of India (RBI) is the authority responsible for issuing currency notes on behalf of the Central Government. It manages the country's monetary policy and ensures the supply of currency in the economy. Therefore, option (b) is the correct answer, while the other banks listed are commercial banks that do not have this authority.

Q16: "The use of money spans a very large part of our everyday life". Support the statement. (2021 C)

View Answer

View AnswerAns: In everyday lives, we use money to fulfill our requirement in different ways:

(i) To buy goods and services like in market, money can be used to buy clothes, vegetables etc.

(ii) To deposit in banks so that money can be saved and used for future use. For example : If a labourer deposits his monthly salary in his bank account, then, he can use it in installments during the entire month.

(iii) As a store value. For instance, we cannot store perishable goods like milk, grain etc. to exchange; but v/e can keep money for future use.

Previous Year Questions 2020

Q17: How do demand deposits have the essential features of money? Explain. (2020) View Answer

View AnswerAns: Demand deposits are considered as money because:

- The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash. Since demand deposits are accepted widely as a means of payment, along with currency, they constitute money in the modern economy.

- Banks accept the deposits and also pay an interest rate on the deposits.

- In this way, people’s money is safe with the banks and it earns an interest.

Q18: Read the information given below and select the correct option. (2020 C)

Rohan has taken a loan of Rs.5 lakhs from the bank to purchase a house on 12% rate of interest. He has to submit papers of new house and salary record to the bank. What is this process called as?

(a) Interest Rate

(b) Collateral

(c) Principal Amount

(d) Installments

View Answer

View AnswerAns: (b)

The process described is called "collateral," which refers to the assets (like the house Rohan is purchasing) that a borrower offers to the bank as security for a loan. If Rohan fails to repay the loan, the bank can take possession of the collateral. Therefore, option (b) is the correct answer, while the other options refer to different aspects of loans and interest.

Q19: Krishna is working in a neighbouring field with very less wages. Expenses on sudden illnesses or functions in the family are also met through loans. The landowner charges an interest rate of 5 per cent per month. At present she owes the landowner Rs. 5,000.

Analyse the credit arrangements given above. (CBSE 2020)

View Answer

View AnswerAns: Credit arrangement-informal sources of credit / No intervention of government in controlling the credit activities carried out by informal sources.

Q20: Why do lenders ask for collateral while lending? Explain. (CBSE 2020)

View Answer

View AnswerAns: Lenders ask for collateral while lending because:

- It works as a guarantee to a lender until the loan is repaid.

- If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

- It reduces exposure in order to do more business with each other when credit limits are under pressure.

Q21: "The Reserve Bank of India supervises the functioning of formal sources of loans." Support the statement with examples. (2020)

View Answer

View AnswerAns: The Reserve Bank of India (RBI) supervises the functioning of formal sources of loans in the following ways:

- It monitors the balance kept by banks for day-to-day transactions.

- It checks that the banks give loans not just to profit-making businesses and traders but also to small borrowers.

- Periodically, banks have to give details about lenders, borrowers, and interest rates to RBI. It is necessary for securing public welfare. It avoids the banks to run the business with a profit motive only. It also keeps a check on the interest rate of credit facilities provided by banks. RBI makes sure that the loans from the banks are affordable and cheap.

Q22: "Bank plays an important role in the economic development of the country”. Support the statement with an example. (2020)

View Answer

View AnswerAns: Banks play an important role in the economic development of the country.

(i) Capital formation : Banks offer very attractive schemes to attract the people to save their money with them and organised money market.

(ii) They mobilize the small savings of the people through their branches and make it available for productive purposes.

(iii) Credit creation leads to increased production, employment and caused faster economic development.

(iv) The banks help in the development of different type of industries by extending loans to concern persons.

(v) It ensures full utilisation of resources.

Q23: “Credit sometimes pushes the borrower into a situation from which recovery is very painful”. Support the statement with examples. (2020)

View Answer

View AnswerAns: (i) In rural areas, the main demand for credit is for crop production. Crop production involves considerable costs on seeds, fertilisers, pesticides, water, electricity, repair of equipment, etc.

(ii) There is a minimum stretch of three to four months between the time when the farmers buy these inputs and when they sell the crop.

(iii) Farmers usually take crop loans at the beginning of the season and repay the loan after harvest.

(iv) Repayment of the loan is crucially dependent on the income from farming.

(v) Example of credit which is painful for a borrower: A farmer picks up the loan from a money lender to meet the expenses of cultivation. But unfortunately crops hit by the pests and fails. So, he is unable to repay the loan and ; debt grows larger with interest. Next year, he picks up a fresh loan and is able to have a normal crop that year. But earnings are not enough to pay the earlier loan. He can repay the loan, only after selling a part of the land. So we can say that "Credit sometimes pushes the borrower into a situation from which recovery is very painful”.

Q24: Self-Help Groups are the building blocks of organisation of the rural poor. Suggest any three ways to make them popular for social issues. (2020 C)

View Answer

View AnswerAns: Ways to make SHGs popular for social issues:

- Government should make proper provisions to provide funding to SHGs for various social programs.

- SHG members can resolve family's internal issues like domestic violence faced by women and provide financial assistance for marriages.

- SHGs can be given a separate fund for pregnant women's health, which can provide proper diet and medical requirements.

Previous Year Questions 2019

Q25: Why are demand deposits considered as money? (AI2019) View Answer

View AnswerAns: Demand deposits are considered as money, because they can be withdrawn when required and the money withdrawn can be used for making payments. So, they are also considered as money in the modern economy.

Q26: How is 'double coincidence of wants' not appreciable in the contemporary scenario? (CBSE 2019)

View Answer

View AnswerAns: For double coincidence of wants to work out, an individual must require what the other person is willing to give away and vice-versa. If this situation is not reached exchange of goods does not happen. This problem is eliminated by the use of money.

Q27: Why is money called a medium of exchange? (AI2019)

OR

How does money act as medium of exchange? (2015)

View Answer

View AnswerAns: Money acts as an intermediate in the transaction and the exchange process . We can buy things with the help of money.

Q28: Describe the bad effects of informal sources of credit on borrowers. (Delhi 2019)

View Answer

View AnswerAns: The informal sector consists of money lenders, traders, employers, friends, relatives, merchants, and landlords. There is no organization that supervises the credit activities of lenders in the informal sector.

- The informal lenders usually charge a very high rate of interest. A higher cost of borrowing is often detrimental to the borrower. It usually results in a debt trap for the borrower. The borrower is seldom able to escape the never-ending cycle of loan repayment.

- Most loans from informal lenders carry a very high-interest rate and have other stringent conditions. They do little to increase the income of the borrowers.

- It has been observed that the loan recovery mechanics in the informal sector are particularly harsh in cases of loan repayment default. There have been cases of selling of properties at throwaway prices and total loss of belongings and even suicides.

Q29: Explain the three important terms of credit. (CBSE 2019)

View Answer

View AnswerAns: The three important terms of credit are:

- Interest Rate: It is the interest that the borrower pays to the bank. An interest component is added to the principal that the borrower pays to the bank as loan payment in installments.

- Collateral: An asset which is owned by the borrower and is used as a guarantee to a lender until the loan is repaid is called collateral. Land, house, vehicle, livestock, deposits with banks, insurance policy, gold, etc., are examples of assets that can be kept as collateral. If the borrower fails to repay the loan, the lender reserves the right to sell the collateral to obtain payment.

- Documentation: The transaction between the lender and the borrower is put on record by documenting it. It includes the rate of interest, tenure, collateral, and mode of repayment. The terms of credit vary from one loan agreement to another and also on the nature of the lender and the borrower.

Q30: Describe the vital and positive role of credit with examples. (2019, Delhi 2016)

View Answer

View AnswerAns: 'Credit' refers to an agreement in which the lender supplies the borrower with money to buy, goods or services in return for the promise of future payment. Credit plays a vital and positive role a s :

(i) Credit helps people from all walks of life in setting up their busiess, increases their income and support their families.

(ii) To some people loan helps in constructing their houses and get relief from monthly rent.

(iii) To other it helps in raising their living standards,

(iv) Example :Sheela has joined a job. She has taken a loan to buy a scooty that she can attend office conveniently and build a career. Without the loan she would have to travel in bus which takes more time. Thus she would not be able to attend evening classes.

Q31: Describe the importance of formal sources of credit in economic development. (Delhi 2019)

View Answer

View AnswerAns: The formal source of credit comprises of banks and cooperative societies. The Reserve Bank of India supervises the functioning of formal sources of loans.

The importance of formal sources of credit in economic development are:

- Even though collateral and paperwork are needed to secure a loan from banks, the interest rates here are lesser than informal sources.

- The formal sources of credit are part of the greater national economy. Hence even small borrowers should try to avail this facility and not go for informal sources of borrowing.

- The role of formal sources of credit has been very great, particularly for financing large developmental projects and various business projects in the private sector and the public sector.

Q32: Give one example each of modern currency and older currency. (CBSE 2019)

View Answer

View AnswerAns: Examples of modern currency are paper bills/notes, coins, credit cards etc., whereas examples of older currency are coins made of precious metals like gold or silver, terracotta coins, etc.

Q33: Examine any three situations in which credit helps in the development of agriculturists. (CBSE 2019)

View Answer

View AnswerAns: Credit helps in the development of agriculturists:

(1) The credit helps him to meet the ongoing expenses of production.

(2) It helps in purchasing raw material and equipment.

(3) It helps in irrigation.

Q34: Examine any three situations in which credit pushes the borrower into a debt-trap. (CBSE 2019)

View Answer

View AnswerAns: Credit leads borrowers into debt traps in these situations:

(1) Loans from informal sector could lead to debt trap.

(2) Lack of planning results in debt.

(3) Difficulty in repaying loans due to certain circumstances.

Q35: Why do banks and cooperative societies need to lend more? Explain. (CBSE 2019)

View Answer

View AnswerAns: Banks and cooperatives should increase their lending in rural areas because:

(1) India largely depends on agriculture for export revenues. Farmers and agricultural workers in rural areas deserve special attention as they lack capital and resources to invest in their work.

(2) Most of the people in rural areas are illiterate and informal money lenders exploit and cheat them for their benefit. People need a reliable source for credit.

(3) Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

(4) Banks and co-operative societies provide loans to the rural households at cheap rates and are backed by the government, which helps them boost their income. Incentives are also given to farmers for quick repayment.

(5) Most of the people in urban areas depend upon the rural people for their food and raw material requirements. For better production and to boost their income sources, easy credit is required.

Previous Year Questions 2018

Q36: Give any two examples of informal sector of credit. (2018) View Answer

View AnswerAns: Two examples of the informal sector of credit are moneylenders and relatives/friends who provide loans.

Previous Year Questions 2017

Q37: Explain any three loan activities of banks in India. (Al 2017) View Answer

View AnswerAns:

- Banks provide loans for various economic activities to people or organizations.

- Banks keep only a small proportion of the deposits with them as cash, to meet daily payment demands. The deposits are used to meet the loan requirements of the people.

- Banks intermediates between those who have surplus funds and those who are in need of these funds. Banks offer less interest on deposits than what they charge on loans.

Q38: "Banks are an efficient medium of exchange." Support the statement with arguments. (Delhi 2017)

View Answer

View AnswerAns:

- People deposit their money with banks by opening a bank account. Banks keep the money safe and provide interest on the deposited amount.

- The deposited money can be withdrawn from banks as and when required on demand.

- Banks also facilitate easy transfer of money through cheques, demand drafts, and internet banking from one account to another in the same or any other bank.

- Banks keep only 15% of their total cash deposits to meet the everyday withdrawal demands of their customers. The major portion of the remaining deposits is used to give loans to people at a specific rate of interest. Thus, we see that money is very efficiently exchanged between various people.

Q39: Illustrate with examples the role of 'loan' in 'business'. (Foreign 2017)

View Answer

View AnswerAns: Loan or credit plays a crucial role in business. By sanctioning loans to developing industries and trade, banks provide them with the necessary aid for functioning, developing, and expanding business. This leads to an increase in production, profits, and employment.

For this reason, it is important that the formal sector gives out more loans so that borrowers are not duped by money lenders and can ultimately contribute to national development.

Q40: Review any three merits and any two demerits of 'Formal sector of credit' in India. (Foreign 2017)

View Answer

View AnswerAns: Merits of the formal sector of credit in India:

- Regulation: The formal sector is regulated by the Reserve Bank of India, ensuring fair practices and protection for borrowers.

- Lower Interest Rates: Formal sources generally offer loans at lower interest rates compared to informal sources, reducing the burden on borrowers.

- Accessibility: The formal sector provides credit to a wide range of individuals, including both big businessmen and small borrowers.

Demerits of the formal sector of credit in India:

- Lengthy Process: Getting a loan from formal sources often involves a lengthy and bureaucratic process, leading to delays in loan disbursement.

- Collateral Requirement: Formal sources may require collateral for loans, which can be a barrier for individuals who do not possess valuable assets.

Q41: How is money beneficial in transactions? (Foreign 2017)

View Answer

View AnswerAns: Money is beneficial in transactions because it eliminates the inconvenience of the double coincidence of wants. In a barter system, individuals would have to find someone who has what they want and is willing to accept what they have to offer in exchange. This can be inefficient and time-consuming. However, with the introduction of money, people can simply exchange their goods or services for money and then use that money to purchase whatever they desire from anyone willing to accept it. Money provides a common medium of exchange that simplifies and accelerates transactions.

Q42: Explain the inherent problem of the ‘barter system’. (CBSE 2017, 15)

View Answer

View AnswerAns: The inherent problem of the barter system is that it is not necessary that when one person is willing to exchange his/her goods, the person he/she wants to exchange with is also willing to do the same.

Q43: Why is it necessary that banks and cooperatives increase their lending in rural areas? Explain. (CBSE 2017)

View Answer

View AnswerAns: Banks and cooperatives should increase their lending in rural areas because:

(1) India largely depends on agriculture for export revenues. Farmers and agricultural workers in rural areas deserve special attention as they lack capital and resources to invest in their work.

(2) Most of the people in rural areas are illiterate and informal money lenders exploit and cheat them for their benefit. People need a reliable source for credit.

(3) Most loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers.

(4) Banks and co-operative societies provide loans to the rural households at cheap rates and are backed by the government, which helps them boost their income. Incentives are also given to farmers for quick repayment.

(5) Most of the people in urban areas depend upon the rural people for their food and raw material requirements. For better production and to boost their income sources, easy credit is required

Previous Year Questions 2016

Q44: Why one cannot refuse a payment made in rupees in India? (2016) View Answer

View AnswerAns: One cannot refuse a payment made in rupees in India because the Indian rupee is the authorized and accepted medium of exchange in the country. The Government of India has established the Indian rupee as the official currency, and it is legally recognized as a valid form of payment. Therefore, individuals and businesses are required to accept payments made in rupees, and refusal to do so would be in violation of the accepted legal tender.

Q45: How does money eliminate the need for double coincidence? (2016)

View Answer

View AnswerAns: Money eliminates the need for double coincidence by providing a crucial intermediate step in transactions. In a barter system, individuals would have to find someone who not only wants what they have to offer but also has what they desire in return. This double coincidence can be challenging to achieve. However, with the introduction of money, individuals can simply sell their goods or services for money and then use that money to purchase any other desired commodity available in the market. Money acts as a universally accepted medium of exchange, allowing individuals to acquire what they need without the requirement of a direct match between their wants and the wants of others.

Q46: How do the deposits with banks become their source of income? (CBSE 2016)

View Answer

View AnswerAns: When we deposit our money in the bank we get an interest on it. However the bank uses that money to give loan to people. The bank charges an interest on its loan at a higher rate than what is paid to the depositors. Thus, the banks earn money from the deposits.

Q47: Why do banks maintain cash reserve? (2016)

View Answer

View AnswerAns: Banks maintain cash reserve to ensure smooth daily withdrawal by depositors.

Q48: Prove with an argument that there is a great need to expand formal sources of credit in rural India. (2016)

View Answer

View AnswerAns: The expansion of formal sources of credit in rural India is crucial because it ensures that the rural poor have access to credit at reasonable interest rates. This helps them meet their financial needs without falling into the trap of high-interest informal loans. Additionally, formal sources of credit provide better regulation and supervision, ensuring fair lending practices.

Q49: Why is the supervision of the functioning of formal sources of loans necessary? (2016)

View Answer

View AnswerAns: The supervision of formal sources of loans is necessary to ensure that these institutions provide loans not only to the rich but also to the poor. It helps in preventing exploitation and ensures that the banks follow the proper procedures and regulations set by the Reserve Bank of India (RBI).

Q50: Why do farmers require credit? (CBSE 2016)

View Answer

View AnswerAns: Farmers require credit to finance their agricultural activities. This credit is used to purchase agricultural inputs such as seeds, fertilizers, pesticides, and machinery. It helps farmers to manage their expenses and invest in their farming operations for better productivity.

Q51: How can money be used to easily exchange it for goods or services? Give examples to explain. (Delhi 2016)

View Answer

View AnswerAns: Money acts as a medium of exchange itself for goods and services. A person holding money can easily exchange it for any commodity or service that he or she might want. Everyone prefers to receive payments in money and exchange the money for things they want.

For example, a shoemaker wants to sell shoes in the market and buy wheat. The shoemaker will first exchange shoes for money and then exchange the money for wheat. If the shoemaker had to directly exchange shoes for wheat without the use of money, he would have to look for a wheat-growing farmer who not only wants to sell wheat but also wants to buy the shoe in exchange. Both the parties have to agree to sell and buy each other's commodities. This process is very difficult, time-consuming, and unhealthy.

Q52: How is money transferred from one bank account to another bank account? Explain with an example. (Foreign 2016)

View Answer

View AnswerAns: If a person has to make a payment to his or her friend and writes a cheque for a specific amount, this means that the person instructs his bank to pay this amount to his friend. His friend takes this cheque and deposits it in his account in the bank. This said amount is transferred from one bank account to another bank account.

Q53: Mention three points of difference between formal sector and informal sector loans. (2016)

View Answer

View AnswerAns: Formal sector loans:

- Loans from banks and cooperatives need collateral.

- Under the supervision of the Reserve Bank of India.

- Reasonable rates of interest.

Informal sector loans:

- Loans from moneylenders, relatives, friends, traders, etc., do not need collateral.

- No supervision of any institution.

- Very high rates of interest.

Q54: How is the concept of Self Help Groups important for poor people? Give your viewpoint. (Foreign 2016)

View Answer

View AnswerAns: Self Help Groups are known as SHGs:

- These are mainly created by the poor, often females of rural areas, for their own benefits.

- In this, all members deposit their monthly savings to the leader.

- This creates self-employment for the members.

- If any member needs money for domestic work such as renovation of a house, buying fertilizers, or agricultural equipment, he/she can borrow it from the group.

- Members can get timely loans at reasonable interest and without any collateral and documentation. It operates on mutual trust.

Q55: Poor households still depend on informal sources of credit". Support the statement with examples. (2016)

View Answer

View AnswerAns:

- Banks are not present everywhere in rural India, whereas informal sources are easily available everywhere.

- Getting a loan from a bank is difficult for poor people than taking a loan from informal resources because bank loans require proper documents and collateral.

- Moneylenders provide loans to poor people without any collateral.

- Formal sources provide loans only for productive purposes, whereas informal sources provide credit for productive and non-productive purposes.

- Other informal sources of credit are friends and relatives, or traders and landlords, who know the borrowers personally and therefore do not demand collateral.

Q56: "The credit activities of the informal sector should be discouraged." Support the statement with arguments. (CBSE 2016)

View Answer

View AnswerAns:

- 85% of loans taken by poor households in urban areas are from informal sources.

- Informal lenders charge very high interest on their loans.

- There are no boundaries and restrictions.

- The higher cost of borrowing means a larger part of the earnings of the borrowers is used to repay the loans.

- In certain cases, the high interest rate for borrowing can mean that the amount to be repaid is greater than the income of the borrower.

- This could lead to increasing debt and debt trap, therefore the credit activities of the informal sector should be discouraged.

Q57: What are demand deposits? Explain any three features of it. (2016)

View Answer

View AnswerAns: Demand deposits refer to the deposits made by individuals in banks that can be withdrawn on demand.

Three features of demand deposits are:

- Banks pay interest on these deposits, providing a safe place for people to keep their money.

- Cheques can be issued against demand deposits, allowing for easy and convenient transactions without the need for cash.

- Demand deposits, along with currency, constitute the money supply in the modern economy.

Q58: How can formal sector loans be made beneficial for poor farmers and workers? Suggest any five measures. (AI 2016)

View Answer

View AnswerAns: Formal sector loans can be made beneficial for poor farmers and workers through the following measures:

- Creating awareness: Educating farmers and workers about the availability and benefits of formal sector loans can encourage them to utilize these resources.

- Simplifying the loan process: Streamlining loan application procedures and reducing paperwork can make it easier for farmers and workers to access formal sector loans.

- Expanding banking services: Opening more branches of nationalized banks and cooperatives in rural areas can increase the accessibility of formal sector loans to farmers and workers.

- Increasing loan facilities: Banks and cooperatives should increase the availability of loans to cater to the demand of poor farmers and workers.

- Reducing interest rates: Lowering the interest rates for formal sector loans can make them more affordable for poor farmers and workers, reducing their financial burden.

Q59: Dhananjay is a Government employee and belongs to a rich household whereas Raju is a construction worker and comes from a poor rural household. Both are in need and wish to take loans. Create a list of arguments explaining who between the two will successfully be able to reach money from a formal source. Why? (CBSE 2016)

View Answer

View AnswerAns: Out of the two, Dhananjay is more likely to lend money from formal sources.

(1) Dhananjay is more educated and rich and hence, he can understand the nuances of credit.

(2) He must have the required documentation.

(3) He must have assets to be submitted as the collateral.

(4) Raju is a poor construction worker. He is not educated enough.

(5) He might not have the required documentation.

(6) He might not have the required asset to be used as a collateral.

|

64 videos|445 docs|87 tests

|

FAQs on Class 10 Economics Chapter 3 Previous Year Questions - Money and Credit

| 1. What is the importance of money in an economy? |  |

| 2. What are the different types of credit? |  |

| 3. How does inflation affect the value of money? |  |

| 4. What role do banks play in the money and credit system? |  |

| 5. What is the difference between secured and unsecured loans? |  |

|

Explore Courses for Class 10 exam

|

|