Ramesh Singh Summary: GDP, GNP, NDP, NNP & Revised Methods | Indian Economy for UPSC CSE PDF Download

| Table of contents |

|

| Gross Domestic Product –GDP |

|

| Net Domestic Product (NDP) |

|

| Net National Product (NNP) |

|

| Cost and Price of National Income |

|

| Revised Method |

|

| Recent Developments |

|

In This Chapter

Definition and features of GDP, NDP, GNP, NNP etc.

Methods of GDP calculation.

Costs and Prices of GDP.

Revised Methods

Gross Domestic Product –GDP

- GDP stands for Gross Domestic Product. It represents the total value of all goods and services produced within a country's borders over a specific period.

- For example, in India, GDP is calculated for a calendar year from April 1st to March 31st.

- GDP is calculated by summing up national private consumption, investments, government spending, and net exports (exports minus imports). It measures the total economic output of a country.

- Understanding Key Terms:

- Gross: This term refers to the total amount before deductions or expenses.

- Domestic: It signifies activities within the borders of a nation.

- Product: Refers to goods and services produced for consumption.

- Goods and Services: These are tangible and intangible outputs of economic activities, respectively.

- Growth Rate of GDP:

- The growth rate of GDP indicates how much the economy has expanded or contracted compared to the previous period.

- For instance, if a country's GDP grows by 7% compared to the previous year, it means the economy has increased its output by 7%.

- A growing economy implies an increase in income and economic activity.

- Quantitative Nature of GDP:

- GDP is a quantitative concept, meaning it measures the volume or size of economic activity.

- A higher GDP indicates a stronger economy in terms of production and consumption.

- However, GDP alone doesn't provide information about the quality of life or distribution of wealth within a country.

- International Comparison and Exchange Rates:

- GDP allows for the comparison of economic sizes between countries.

- Exchange rates are used to convert GDP into a common currency, usually the US dollar.

- Purchasing Power Parity (PPP) adjusts GDP for differences in price levels between countries, providing a more accurate comparison of living standards.

- For example, China may have a lower GDP than the USA when measured in US dollars, but in terms of PPP, it might be higher, reflecting the purchasing power of its currency within its own borders.

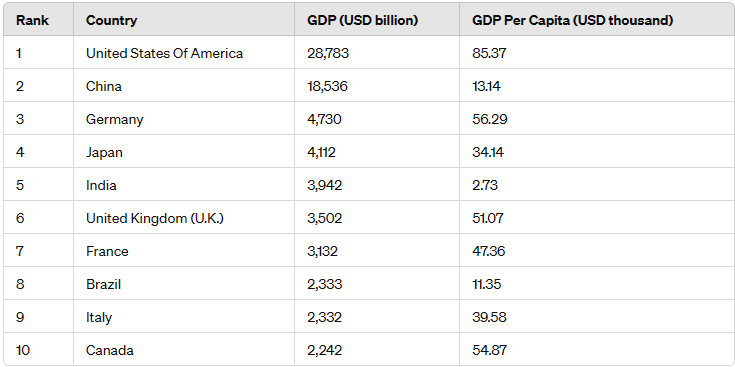

Top 10 Countries in 2024

Top 10 Countries in 2024

Net Domestic Product (NDP)

- Net domestic product (NDP) is an annual measure of the economic output of a nation that is calculated by subtracting depreciation from the Gross Domestic Product (GDP).

NDP = GDP – Depreciation

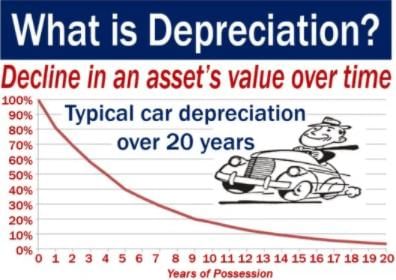

- Depreciation = Capital assets (e.g. Machinery, building etc) used to produce goods and services, undergo ‘wear’ and ‘tear’ in the process of production. The monetary value of the assets decreases over time due to use, wear and tear or obsolescence. This decrease in the value of capital assets is known as depreciation.

- Every asset (except human beings) undergoes depreciation. Government (Ministry of commerce and industry) announces the rates by which assets depreciate For example, a residential house in India has 1 % depreciation rate per annum, an electric fan has depreciation rate of 10 % per annum etc.

- While calculating GDP, the impact of depreciation is not taken in to account, which is done in NDP.

- NDP of an economy has to be always lower than its GDP for the same year, since there is no way to cut the depreciation to zero.

- NDP is not used to compare the economies of the world because different rate of depreciation is set by different countries.

Gross National Product (GNP)

- Gross National Product (GNP) is the total value of goods and services produced by the people of a country in a given year. It is not territory specific.

- Gross National Product (GNP) of a country is measured by adding its GDP with its ‘factor income from abroad’.( Factor income is the income that is derived from the factors of production like land, labour , capital and organization)

- Factor income from abroad = Residents of a country earn income not only within the domestic territory of a country but outside it also. Income from outside can be earned mainly in following ways:

(i) Income from work: Income is earned by working in other countries earning thereby wages and salaries.

(ii) Income from property and entrepreneur ship: Income from abroad is also earned by owning property (Like buildings, shops, factories, financial assets like bonds and shares) in foreign countries. Also, profit is earned for undertaking entrepreneurial activities of producing goods and services.

(iii) Retained earnings of resident companies abroad.

GNP = GDP + Net Factor Income from Abroad (NFIA)

Net Factor Income from Abroad of India = Factor income earned from abroad by Indians – Factor income earned by foreigners in India.

- The GNP of India is lower than its GDP because India’s net factor income from abroad has always been negative (due to more outflow of money than incoming). That means the factor income earned by foreigners in India is more than factor income earned by Indians from abroad.

- While calculating GNP, ‘Who’ produces goods and services becomes more important than ‘where’ it was produced.

Example: Many Indian citizen works in USA. They produce goods and services. Those goods and services are included in USA’s GDP but the salary/wages earned by those Indian’s will be included in India’s GNP.

Similarly, USA car company, Ford produces cars in India. The value of the cars produced by Ford in India will be added in India’s GDP but the profits earned by Ford Company in India will be included in in USA’s GNP.

Net National Product (NNP)

Net National Product = GNP – Depreciation

Net National Product (NNP) at factor cost is considered as ‘National Income’ of India.

Per Capita Income

- Per capita means per person. It is a Latin term that translates to "by the head."

- Per capita income or average income measures the average income earned per person in a country in a specified year. It is calculated by dividing the country’s total income by its total population.

- Per Capital Income = National Income divided by the population.

OR

Net National Product at factor cost divided by the population. - Let’s say, The National Income of a country is 1000 and there are 10 people in that country. The per capita income of that country will be, 1000 / 10 = 100.

Net National Product (NNP)

NNP, or Net National Product, is the Gross National Product (GNP) after deducting the loss due to depreciation.

Mathematically, NNP can be expressed as:

NNP = GNP - Depreciation

or

NNP = GDP + Income from Abroad - Depreciation

Uses of NNP:

National Income Indicator:

- NNP serves as a measure of the total income earned by all residents of a country from their productive activities, whether domestically or abroad.

- While GDP, NDP, and GNP also represent national incomes, NNP specifically indicates the income remaining after accounting for depreciation.

Purity of National Income:

- NNP represents the purest form of a nation's income as it considers the net income generated after deducting depreciation.

Per Capita Income Calculation:

- By dividing NNP by the total population of a nation, we obtain the Per Capita Income (PCI), also known as income per head per year.

- It provides an average measure of the income earned by individuals in the country.

Impact of Depreciation Rates:

- The rates of depreciation followed by different nations influence their NNP and subsequently, their PCI.

- Higher depreciation rates lead to lower PCIs, reflecting a greater portion of income being used to replace depreciated assets rather than contributing to personal income.

- Differences in depreciation rates can affect international comparisons of national incomes, especially when using metrics like PCI.

Policy Implications:

- Economies have the flexibility to set their own depreciation rates for various assets.

- However, the chosen rates can impact the comparative analysis of national incomes by international financial institutions.

- Policymakers may adjust depreciation rates as a tool to influence economic outcomes, such as encouraging investment or managing inflation.

In summary, NNP is a crucial economic indicator that provides insights into a nation's income, accounting for depreciation and influencing metrics like Per Capita Income. Understanding the implications of depreciation rates on NNP is essential for analyzing and comparing the economic performance of different countries.

Cost and Price of National Income

When measuring the economic health of a nation, one essential metric is its national income. However, determining national income involves various considerations, including the costs and prices used in the calculation. Two critical factors in this calculation are the choice between factor cost and market cost, as well as between constant price and current price.

Factor Cost vs. Market Cost:

- Factor Cost: This represents the input costs incurred by producers in the production process. It includes expenses such as capital costs (interest on loans), raw materials, labor wages, rent, etc.

- Market Cost: Market cost is derived by adding indirect taxes to the factor cost. It reflects the price at which goods reach the market, including taxes. It is also referred to as the selling price or production cost.

- Difference: The main distinction lies in the treatment of taxes. Factor cost excludes taxes, while market cost includes them. India historically calculated its national income at factor cost but switched to market price calculation in January 2015 to align with international practices. This change became more streamlined with the implementation of the Goods and Services Tax (GST), which made it easier to calculate national income at market price.

Constant Price vs. Current Price:

- Constant Price: Income calculated at constant prices assumes inflation remains constant at a base year. Inflation is held steady to analyze changes in real income over time, without the influence of price changes.

- Current Price: Income calculated at current prices includes present-day inflation. It reflects the actual prices prevailing in the market, including any changes due to inflation.

- Difference: Constant price calculations provide a measure of real income, adjusting for changes in purchasing power due to inflation. Current price calculations, on the other hand, reflect the nominal income including the impact of inflation.

- Inflation Impact: Constant price calculations freeze inflation at a specific year (the base year), while current price calculations account for ongoing inflation rates, reflecting the maximum retail prices seen in the market.

In summary, while calculating national income, decisions regarding whether to use factor cost or market cost and constant price or current price depend on the desired economic analysis. Understanding these concepts helps in interpreting national income data accurately and assessing economic trends effectively.

Revised Method

In 2015, the Central Statistics Office (CSO) released revised data for the National Accounts, which involved significant changes in methodology and coverage. These changes aimed to enhance the accuracy and comprehensiveness of economic data, aligning with international standards and reflecting the evolving nature of the Indian economy. Let's explore the key modifications made by the CSO:

- Base Year Revision: The CSO updated the base year for calculating economic indices from 2004-05 to 2011-12. This adjustment was in accordance with the recommendation of the National Statistical Commission (NSC), which advised revising the base year every five years to ensure the data accurately represents the current economic landscape.

- Methodology Revision:

- The methodology for calculating National Accounts underwent a revision to align with the System of National Accounts (SNA), an internationally accepted standard.

- One major change was the adoption of GDP at constant market prices as the measure for headline growth rate, aligning with international practices. Previously, growth rate was measured based on GDP at factor cost and constant prices.

- Gross Value Added (GVA) Calculation:

- The method for calculating Gross Value Added (GVA) underwent a significant change. GVA estimates are now provided at basic prices instead of factor cost.

- GVA at basic prices includes various components such as compensation of employees, operating surplus, mixed income, and consumption of fixed capital.

- Additionally, production taxes and subsidies are factored into GVA calculations to provide a more comprehensive picture of economic activity.

- Enhanced Sector Coverage:

- The revised methodology led to improved coverage of the corporate and financial sectors. Annual accounts of companies filed with the Ministry of Corporate Affairs (MCA) were incorporated, providing a more detailed insight into their activities beyond manufacturing.

- Inclusion of information from accounts of stock brokers, stock exchanges, asset management companies, mutual funds, pension funds, and regulatory bodies further enhanced coverage of the financial sector.

- Coverage of Local Bodies and Autonomous Institutions: Efforts were made to comprehensively cover the activities of local bodies and autonomous institutions. Approximately 60% of grants/transfers provided to these institutions are now accounted for, ensuring a more accurate representation of their economic contributions.

The revisions made by the CSO in 2015 aimed to modernize and improve the accuracy of National Accounts data. By updating the base year, aligning methodology with international standards, and enhancing sector coverage, the CSO ensured that economic data reflects the dynamic nature of the Indian economy, providing policymakers and analysts with reliable insights for informed decision-making.

Recent Developments

- Base Year Revision to 2022-23:

- In early 2025, the Ministry of Statistics and Programme Implementation (MOSPI) announced a revision of the GDP base year from 2011-12 to 2022-23, as recommended by the 26-member Advisory Committee on National Accounts Statistics, chaired by Biswanath Goldar.

- This revision, expected to be implemented by early 2026, updates economic indices like the Index of Industrial Production (IIP), Wholesale Price Index (WPI), and Consumer Price Index (CPI), ensuring they reflect current economic realities.

- The new base year affects real GDP growth calculations by adjusting for inflation, making historical GDP comparisons using the 2011-12 base year outdated.

- Methodological Enhancements:

- The Advisory Committee is exploring new data sources, such as digital economy transactions and informal sector contributions, to enhance the accuracy of GDP, GNP, NDP, and NNP calculations.

- Methodological refinements align with the System of National Accounts (SNA) 2008, improving global comparability and supporting policymaking. Chain-based GDP calculations were considered but deemed unsuitable due to India’s volatile agricultural and fuel prices.

- These updates ensure that national accounts capture post-pandemic economic dynamics and digital advancements, which were not fully accounted for in the 2015 methodology.

- Recent Economic Data (2024-2025):

- According to the Economic Survey 2024-25 (tabled on January 31, 2025), India’s GDP growth for 2024-25 is projected at 6.4% to 6.5%, with inflation at 4.2% (IMF, February 27, 2025).

- Sectoral data shows a 6.12% increase in domestic air passenger traffic in 2024, reaching 161.3 million passengers, indicating robust service sector growth (IBEF, March 27, 2025).

- These figures are critical for analyzing current economic trends and are not covered in earlier methodologies using the 2011-12 base year.

- Policy and Economic Events Impacting National Accounts:

- The Economic Survey 2024-25 highlighted fiscal challenges and potential tax policy shifts, which could influence net factor income from abroad, affecting GNP and NNP calculations.

- Global events, such as potential U.S. tariff hikes under new policies (Deloitte, January 16, 2025), may impact India’s trade balance, altering GDP and GNP figures.

- A favorable monsoon in 2024, with 8% above-average rainfall (The Hindu, October 1, 2024), boosted agricultural output, contributing to higher NDP and NNP values.

|

173 videos|487 docs|159 tests

|

FAQs on Ramesh Singh Summary: GDP, GNP, NDP, NNP & Revised Methods - Indian Economy for UPSC CSE

| 1. What is the difference between Gross Domestic Product (GDP) and Net Domestic Product (NDP)? |  |

| 2. How is Net National Product (NNP) calculated and why is it important? |  |

| 3. What is the Cost and Price of National Income in the context of GDP and NNP? |  |

| 4. What are the key differences between the traditional and revised methods of calculating national income? |  |

| 5. How do revisions in national income calculation methods impact economic policies and decision-making? |  |