Ramesh Singh Summary: Banking in India- 1 | Indian Economy for UPSC CSE PDF Download

Introduction

The banking sector holds a central position in shaping the economic landscape of a country, and India is no exception. Understanding the historical evolution, regulatory frameworks, and the role of banks in economic development is crucial for comprehending the broader financial dynamics of the nation. From its historical roots to contemporary initiatives, this brief overview aims to provide insights into the pivotal role of banking institutions in India's economic journey.

NBFCs

- NBFCs (Non-Banking Financial Companies) are fast emerging as an important segment of Indian financial system. It is an heterogeneous group of institutions (other than commercial and co-operative banks) performing financial intermediation in a variety of ways, like accepting deposits, making loans and advances, leasing, hire purchase, etc.

- They cannot have certain activities as their principal business— agricultural, industrial and sale-purchase or construction of immovable property.

- They raise funds from the public, directly or indirectly, and lend them to ultimate spenders.

- They advance loans to the various whole sale and retail traders, small-scale industries and self-employed persons. Thus, they have broadened and diversified the range of products and services offered by a financial sector.

- To promote financial inclusion through direct interaction between small lenders and small borrowers together with addressing consumer protection, during 2017-18 , RBI introduced two new categories of the NBFC— Peer to Peer [P2P] and Account Aggregators [AA].

Reserve Bank of India

- The Reserve Bank of India, was set up on April 1,1935 in accordance with the provisions of the RBI Act, 1934, in Calcutta [got shifted to Bombay in 1937].

- Set up under private ownership like a bank it was given two extra functions— regulating banking industry and being the banker of the Government. To better serve the purpose, during mid-1940s, a view emerged across the world in favour of a government-owned central bank— and governments started taking them over.

- As per the changing needs of time, the RBI Nationalisation Act of 1949 has been amended several times by the Government and its functions broadened. Its current functions may be summarised objectively in the following way—

(i) Monetary Authority : It includes formulation, implementation and monitoring of the monetary policy. The broad objective is — maintaining price stability keeping in mind the objective of growth.

(ii) Currency Authority : It includes issuing of new currency notes and coins (except the currency and coins of rupee one or its denominations, which are issued by Ministry of Finance itself) as well as exchanging or destroying those ones which are not fit for circulation This function includes the distribution responsibility of the currencies and coins also (of those ones also which are issued by the Ministry of Finance). The broad objective is — keeping adequate supplies of quality currencies and coins.

(iii) Regulator and Supervisor of the Financial System : It includes prescribing broad parameters of banking operations with in which the banking and financial system operates.

(iv) Manager of Foreign Exchange : In includes broad functions like — managing the FEMA (Foreign Exchange Management Act, 1999 ]; keeping the Forex (foreign exchange) reserves of the country ; stabilising the exchange rate of rupee; and representing the Government of India in the IMF and World Bank.

(v) Regulator and Supervisor of Payment and Settlement Systems : It includes functions like introducing and upgrading safe and efficient modes of payment systems in the country to meet the requirements of the public at large. The objective is maintaining public confidence in payment and settlement system.

(vi) Banker of the Governments and Banks : It includes three category of functions— firstly, performing the Merchant Banking functions for the central and state governments; secondly, acting as their Bankers; and thirdly, maintaining banking accounts of the SCBs.

(vii) Developmental Functions : Unlike most of the central banks in the world, the RBI was given some developmental functions also. Playing this role, it did set up developmental banks like— IDBI, SIDBI, NABARD, NEDB (North Eastern Development Bank), Exim Bank, NHB.

Monetary Policy

The primary objective of monetary policy is to maintain price stability while keeping in mind the objective of growth. Price stability is a necessary precondition for sustainable growth. To maintain price stability, inflation needs to be controlled. The government of India sets an inflation target for every five years. RBI has an important role in the consultation process regarding inflation targeting. The current inflation-targeting framework in India is flexible in nature.

Cash Reserve Ratio

- Banks operating in the country are under regulatory obligation to maintain 'reserve ratios' of two kinds, one of it being the cash reserve ratio (the other being 'statutory liquidity ratio').

- Under it, all scheduled commercial banks operating in the country are supposed to maintain a part of their total deposits with the RBI in cash form as the cash reserve ratio (CRR).

- The RBI could fix it between 3 to 15 per cent of the 'net demand and time liabilities' (NDTL) of the banks.

- In the wake of the ongoing process of banking reforms, certain changes were affected by the RBI in relation to the ratio since late 1990s—

(i) Aimed at enabling banks to lend more and cut interest rates on loans they offer, in 1999-2000, the RBI started paying banks an interest income on their CRR. The payment of interest was discontinued by late 2007 in the wake of rising prices.

(ii) The ratio which used to be generally on the higher side, was drastically cut down to 4.5 per cent in 2003.

(iii) A major development came in 2007 when by an amendment (in the RBI Act, 1949), the Government abolished the lower ceiling (called 'floor') on the CRR and gave the RBI greater flexibility in fixing this ratio.

Statutory Liquidity

- Ratio Banks operating in the country are under regulatory obligation to maintain 'reserve ratios' of two kinds, one of it being the statutory liquidity ratio (the other being the 'cash reserve ratio').

- Under it, all scheduled commercial banks operating in the country are supposed to maintain a part of their total deposits (i.e., their NDTL) with themselves in non-cash form (i.e., in 'liquid assets')— the ratio could be fixed by the RBI between 25 to 40 per cent.

Bank Rate

- The interest rate which the RBI charges on its long-term lendings is known as the Bank Rate.

- The clients who borrow through this route are the Government of India, state governments, banks, financial institutions, co-operative banks, NBFCs, etc.

- The rate has direct impact on long term lending activities of the concerned lending bodies operating in the Indian financial system.

Repo Rate

- The rate of interest the RBI charges from its clients on their short-term borrowing is the repo rate in India. Basically, this is an abbreviated form of the 'rate of repurchase' and in western economies it is known as the 'rate of discount'.

- In practice it is not called an interest rate but considered a discount on the dated government securities, which are deposited by institution to borrow for the short term.

- When they get their securities released from the RBI, the value of the securities is lost by the amount of the current repo rate.

Long Term

- Repo Aimed at promoting enhanced lending and cutting the cost of short-term funds for the banks, in a first of its kind move, in February 2020 (6th Bi-monthly Monetary Policy of 2019-20), the RBI announced to offer long term repo operation (LTRO) of Rs. 1.50 lakh crores at a fixed rate (i.e., at the Repo rate).

- The tenure of the LTRO will be from one to three years.

- This was aimed at ensuring permanent and deeper liquidity in the financial system together with enhancing lending by cutting cost of funds for the banks (enabling them to lend cheaper loans).

Reverse Repo Rate

- It is the rate of interest the RBI pays to its clients who offer short-term loan to it.

- In 2022-23, it was converted into fixed reverse repo rate and by March 2023, it was at 3.35 percent.

- In April 2022, this window of the LAF was replaced by the Standing Deposit Facility (SDF) by the RBI.

- In practice, financial institutions operating in India park their surplus funds with the RBI for short-term period and earn money.

- It has a direct bearing on the interest rates charged by the banks and the financial institutions on their different forms of loans.

Marginal Standing Facility (MSF)

- MSF is a new scheme announced by the RBI in its Monetary Policy, 2011-12 which came into effect from May, 2011.

- Under this scheme, banks can borrow overnight upto 1 per cent of their net demand and time liabilities (NDTL) from the RBI, at the interest rate 1 per cent (100 basis points) higher than the current repo rate.

- In an attempt to strengthen rupee and checking its falling exchange rate, the RBI increased the gap between 'repo' and MSF to 3 per cent (late July 2013).

- By March 2023 it was at 6.25 percent.

Other Tools

Other than the above-given instruments, RBI uses some other important, too to activate the right kind of the credit and monetary policy—

- Call Money Market : The call money market is an important segment of the money market where borrowing and lending of funds take place on over night basis. Participants in the call money market in India currently include scheduled commercial banks (SCBs) —excluding regional rural banks), cooperative banks (other than land development banks), insurance. Prudential limits, in respect of both outstanding borrowing and lending transactions in the call money market for each of these entities, are specified by the RBI.

- Open Market Operations (OMOs) : OMOs are conducted by the RBI via the sale/purchase of government securities (G-Sec) to/from the market with the primary aim of modulating rupee liquidity conditions in the market. OMOs are an effective quantitative policy tool in the armoury of the RBI, but are constrained by the stock of government securities available with it at a point in time.

- Liquidity Adjustment Facility (LAF) : The LAF is the key element in the monetary policy operating framework of the RBI (introduced in June 2000). On daily basis, the RBI stands ready to lend to or borrow money from the banking system, as per the need of the time, at fixed interest rates (repo and reverse repo rates). Together with moderating the fund-mismatches of the banks, LAF operations help the RBI to effectively transmit interest rate signals to the market.

- Market Stabilisation Scheme (MSS) : This instrument for monetary management was introduced in 2004 . Surplus liquidity of a more enduring nature a rising from large capital inflows is absorbed through sale of short-dated government securities and treasury bills. The mobilised cash is held in a separate government account with the Reserve Bank. The instrument thus has features of both, SLR and CRR.

- Standing Deposit Facility Scheme (SDFS) : The new scheme has been proposed by the Union Budget 2018-19 . Such a tool was proposed by the RBI in November 2015 itself. The scheme is aimed at helping RBI to manage liquidity in a better way, especially when the economy is flush with excess fund.

Base Rate

- Base Rate is the interest rate below which Scheduled Commercial Banks (SCBs) will lend no loans to its customers— its means it is like prime lending rate (PLR) and the bench mark prime lending Rate (BPLR) of the past and is basically a floor rate of interest.

- It replaced the existing idea of BPLR on 1 July, 2010.

- The BPLR system (while the existing system was of PLR), introduced in 2003, fell short of its original objective of bringing transparency to lending rates.

- This was mainly because under this system, banks could lend below BPLR.

- This made a bargaining by the borrower with bank ultimately one borrower getting cheaper loan than the other, and blurred the attempts of bringing in transparency in the lending business.

- For the same reason , it was also difficult to assess the transmission of policy rates (i.e., repo rate, reverse repo rate, bank rate) of the Reserve Bank to lending rates of banks. The Base Rate system is aimed at enhancing transparency in lending rates of banks and enabling better assessment of transmission of monetary policy.

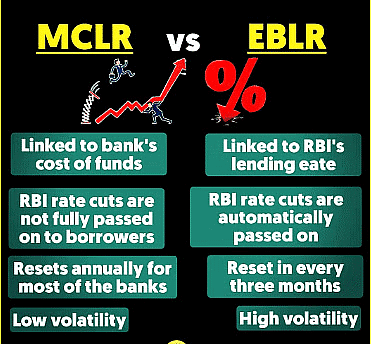

MCLR

From the financial year 2016 - 17 (i.e., from 1st April, 2016), banks in the country have shifted to a new methodology to compute their lending rate. The new methodology— MCLR (Marginal Cost of funds based Lending Rate)— which was articulated by the RBI in December 2015. The main features of the MCLR are—

(i) It will be a tenor linked internal benchmark , to be reset on annual basis.

(ii) Actual lending rates will be fixed by adding a spread to the MCLR.

(iii) To be reviewed every month on a pre-announced date.

(iv) Existing borrowers will have the option to move to it.

(v) Banks will continue to review and publish 'Base Rate' as hitherto.

EBLR

Following the initiation of the Marginal Cost of Fund-Based Lending Rates (MCLR), which did not significantly enhance monetary transmission, the Reserve Bank of India (RBI) introduced the External Benchmarks-Based Lending Rate (EBLR) for banks in December 2018. Under this system, banks were given the choice to link their lending rates to one of the specified external benchmarks:

- Repo rate

- 91-day Treasury Bill yield

- 182-day Treasury Bill yield

- Any other benchmark produced by Financial Benchmarks India Private Ltd (FIBIL)

Monetary Tranmission

- Monetary policy plays a very vital role in the allocation of funds from the financial system. For this, lending rates decided by the banks must be sensitive to the policy rates (i.e., repo, reverse repo, MSF and bank rate) announced by the central bank — known as 'monetary transmission '.

- Till April 2020, steps like enforcing the MCLR and extern al benchmarks on banks for deciding their lending rates, have been taken by the RBI. But monetary transmission has been weak in 2019 also— on all three accounts, namely — Rate Structure, Quantity of Credit, and Term Structure.

Liquidity Management Framework

- A liquidity management framework (LMF) was provisioned by the RBI in 2014 to check volatility in the inter-bank call money market (CMM) and allow banks manage their needs of short-term capital.

- In a push to bring in more 'stability' and better 'interest rate signalling' in the loan market, the RBI has been trying to inspire banks to think in longer term in their operations. Aimed at making banks follow prudential norms, the Basel III norms also has put a clear check on short-termism followed by banking industry.

Global Monetary Tightening & India

In 2022, high inflation made a comeback, affecting both advanced and emerging economies, marking a significant shift after nearly four decades. The repercussions led to an unprecedented, simultaneous, and rapid series of monetary tightening measures across various countries. According to the Economic Survey 2022-23, central banks globally implemented substantial increases in policy rates, with the US Federal Reserve leading the way with the steepest rate hikes since the 1970s. By March 2023, the Federal Reserve had raised policy rates by 4.25%, while the European Central Bank (ECB) and the Bank of England (BoE) implemented increases of 3.00% and 2.50%, respectively.

Meanwhile, the Monetary Policy Committee (MPC) of India maintained a status quo on the repo rate, having reduced it by 1.15% between March 2020 and May 2020. In January 2022, when the headline/retail inflation (CPI-C) surpassed the upper limit (6%) of RBI's tolerance band, signaling a serious risk to price stability, the RBI initiated a monetary tightening cycle in April 2022. The central bank shifted its monetary policy stance from 'accommodative' to 'accommodative and focused on the withdrawal of accommodation while supporting growth.'

Since then, up to December 2022, the RBI increased the policy repo rate by 2.25% (further raised by 1% in the bi-monthly monetary policy in February 2023).

Nationalisation and Development of Banking India

Emergence of the SBI

- The Government of India, with the enactment of the SBI Act, 1955 partially nationalised the three Imperial Banks and named them the State Bank of India — the first public sector bank emerged in India.

- The RBI had purchased 92 per cent of the shares in this partial nationalisation. Satisfied with the experiment, the government in are lated move partially nationalised eight more private banks (with good regional presence) via the SBI (Associates) Act, 1959 and named them as the Associates of the SBI— the RBI had acquired 92 per cent stake in the mas well.

Emergence of Nationalised Banks

- After successful experimentation in the partial nationalisations the government decided to go for complete nationalisation. With the help of the Banking Nationalisation Act, 1969.

- The nationalisation of banks the government stopped opening of banks in the private sector though some foreign private banks were allowed to operate in the country to provide the external currency loans.

- After India ushered in the era of the economic reforms, the government started a comprehensive banking system reform in the fiscal 1992-93.

- As a general principle, the public sector and the nationalised banks are to be converted into private sector entities.

- The policy of bank consolidation is still being followed by the government, so that these banks could broaden their capital base and emerge as significant players in the global banking competition.

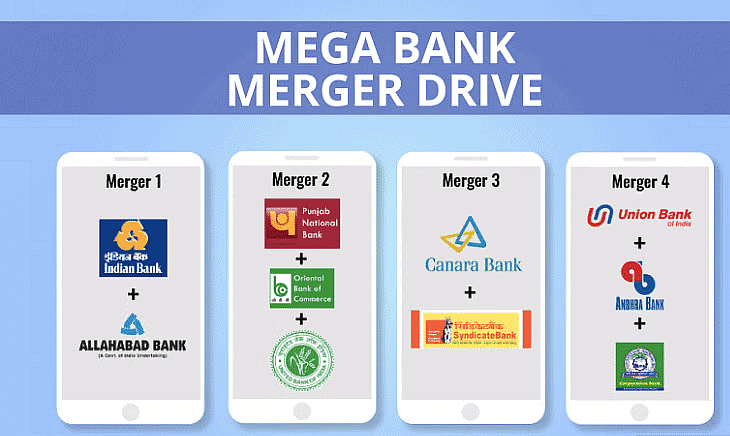

Consolidation of Banks

In line with the financial reform recommendations (M. Narasimham, 1991, and 1998), a broader banking consolidation process for Public Sector Banks (PSBs) began in 1993-94 in India. The objective was to enhance PSBs' global significance by broadening their capital base. To achieve this, the government took the following actions:

- Merger: The focus was on creating larger and stronger banks, reducing operational costs, and expanding the capital base. Starting with the merger of the Associates of SBI, a major consolidation occurred in August 2019 when 10 PSBs were merged into four, bringing the total number down to 12. As of the Union Budget 2021-22, two to three more banks were planned for merger in 2021-22.

- Disinvestment: The government adopted two routes for disinvestment: 'minority' stake sale and 'strategic,' which could lead to privatization. This move aimed to inject fresh capital and enhance managerial professionalism. In the Union Budget 2021-22, the government announced its intention to privatize all 'non-strategic' public sector enterprises, including some PSBs, while retaining control in 'strategic' ones, limited to only four (including a few PSBs and other financial institutions).

- Strategic Partners: The government had earlier decided to sell majority stakes to a 'strategic partner' during privatization, ensuring the banks benefit from world-class experience. Although a specific announcement on strategic disinvestment was not made until April 2021, it was anticipated.

Recent Developments in Indian Banking

The Indian banking sector has undergone transformative changes in 2024 and early 2025, driven by technological innovation, regulatory advancements, and a focus on financial inclusion and sustainability. Below is a detailed overview of the key recent developments:

- Digital Banking Revolution:

- Unified Payments Interface (UPI) 2.0: UPI continues to dominate digital payments, with transaction volumes exceeding 130 billion annually by March 2025, a 30% increase from 2024. Enhancements in UPI 2.0 include features like UPI AutoPay for recurring payments, UPI Lite for small-value offline transactions, and UPI for feature phones, expanding access to rural users. The RBI’s introduction of UPI Circle allows primary account holders to delegate payment capabilities to secondary users, boosting household financial inclusion.

- Central Bank Digital Currency (CBDC): The RBI’s Digital Rupee (e₹) pilot, launched in 2022, has scaled significantly. By April 2025, over 5 million users and 1.5 million merchants participate in retail and wholesale CBDC pilots across 20 cities. The RBI is integrating CBDC with UPI for seamless interoperability, with plans to test cross-border transactions with countries like Singapore and the UAE.

- Open Banking Framework: The RBI’s Account Aggregator (AA) ecosystem has matured, with 180 million consents processed by March 2025, connecting 200 Financial Information Providers and 600 Financial Information Users. This has streamlined credit access for MSMEs and individuals by enabling secure financial data sharing. The RBI’s Open Banking APIs are fostering fintech-bank collaborations, driving innovation in personalized financial products.

- AI and Machine Learning: Banks like SBI, HDFC, and ICICI are leveraging AI for credit scoring, fraud detection, and customer service. Chatbots and robo-advisors handle over 40% of customer queries in leading banks, improving efficiency. The RBI’s Regulatory Sandbox has greenlit AI-based credit assessment tools for rural borrowers, enhancing financial inclusion.

- Financial Inclusion Initiatives:

- Pradhan Mantri Jan Dhan Yojana (PMJDY): By March 2025, PMJDY has facilitated over 55 crore bank accounts, with deposits surpassing ₹2.5 lakh crore. The scheme now integrates Aadhaar-enabled payment systems (AePS) and micro-insurance, ensuring comprehensive financial services for the unbanked. Women account for 56% of account holders, reflecting gender-inclusive growth.

- India Stack Expansion: The Digital India Stack, comprising Aadhaar, UPI, and DigiLocker, has enabled paperless banking. The Open Credit Enablement Network (OCEN) has disbursed over ₹50,000 crore in micro-loans to small businesses by April 2025, leveraging digital KYC and credit scoring.

- Regional Rural Banks (RRBs): RRBs, recapitalized with ₹15,000 crore in 2024, have expanded digital offerings, with 80% of RRBs adopting core banking solutions. The RBI’s RRB 2.0 Strategy emphasizes technology-driven rural credit, with RRBs disbursing ₹3 lakh crore in agricultural loans in 2024-25.

- Asset Quality and NPA Management:

- Declining NPAs: The gross non-performing asset (NPA) ratio of scheduled commercial banks dropped to 2.5% by March 2025, the lowest in 12 years, driven by robust recovery mechanisms. The Insolvency and Bankruptcy Code (IBC), 2016, resolved cases worth ₹3.5 lakh crore in 2024, with 60% recovery rates in large corporate accounts.

- NARCL’s Impact: The National Asset Reconstruction Company Ltd (NARCL), operational since 2022, acquired stressed assets worth ₹2 lakh crore by April 2025, cleaning up PSB balance sheets. The Bad Bank model has accelerated NPA resolution, boosting investor confidence.

- Proactive Monitoring: The RBI’s Central Repository of Information on Large Credits (CRILC) and Early Warning Systems have reduced fresh slippages. Banks’ provision coverage ratios (PCR) averaged 75% in 2024, ensuring resilience against potential shocks.

- Sustainable and Green Banking:

- Green Financing: Indian banks issued ₹1 lakh crore in green bonds in 2024, funding renewable energy and sustainable infrastructure projects. The RBI’s Green Deposit Framework, introduced in 2023, has mobilized ₹10,000 crore in retail green deposits by March 2025.

- ESG Integration: Over 70% of PSBs and major private banks have adopted ESG (Environmental, Social, Governance) frameworks, aligning with India’s net-zero by 2070 goal. SBI and ICICI launched ESG-focused mutual funds, attracting ₹25,000 crore in investments.

- Climate Risk Assessment: The RBI mandated banks to integrate climate risk into their risk management frameworks by 2025. Pilot projects on Transition Finance are supporting industries shifting to low-carbon operations.

- Regulatory and Structural Reforms:

- Scale-Based Regulation (SBR): The RBI’s SBR framework, updated in January 2025, categorizes NBFCs and banks based on size and risk, enforcing stricter governance and capital norms. Upper-layer NBFCs now face Basel III-like regulations, enhancing sector stability.

- Bank Consolidation: Post-2020 mergers, the number of PSBs stabilized at 12, with merged entities like Punjab National Bank and Bank of Baroda reporting 15% higher profitability in 2024 due to operational synergies. The RBI is exploring cooperative bank mergers to strengthen the sector.

- Cybersecurity Enhancements: The RBI’s Cybersecurity Framework 2.0, rolled out in 2024, mandates real-time threat monitoring and Zero Trust Architecture for banks. Incidents of cyber fraud dropped by 20% in 2024, with banks investing ₹5,000 crore in cybersecurity infrastructure.

- Global Integration and Innovation:

- Cross-Border Payments: The RBI’s collaboration with global central banks has integrated UPI with systems like Singapore’s PayNow and UAE’s Aani, facilitating instant remittances for NRIs. By April 2025, cross-border UPI transactions reached $10 billion monthly.

- Fintech Ecosystem: Fintech lending grew to ₹4 lakh crore in 2024, with platforms like PhonePe and Razorpay partnering with banks for embedded finance. The RBI’s Fintech Regulatory Sandbox approved 50 innovative products, including blockchain-based trade finance solutions.

- Global Presence: SBI and ICICI expanded overseas operations, with SBI opening 10 new branches in the Middle East and Europe in 2024. Indian banks’ exposure to international trade finance grew by 25%, supporting India’s export-led growth.

- Monetary Policy and Economic Support:

- Repo Rate Adjustment: In February 2025, the RBI reduced the repo rate by 25 basis points to 6.00% to stimulate growth amid global slowdown concerns, maintaining the CRR at 4.00% and SLR at 18.00%. The Standing Deposit Facility (SDF) rate is at 5.75%, ensuring liquidity balance.

- Support for MSMEs: The Emergency Credit Line Guarantee Scheme (ECLGS) was extended to 2025, disbursing ₹4 lakh crore to MSMEs. The RBI’s Priority Sector Lending (PSL) norms now include green projects, with banks meeting 42% of PSL targets in 2024.

- Inflation Management: With retail inflation hovering around 5% in early 2025, within the RBI’s 2-6% target, the Monetary Policy Committee adopted a neutral stance, balancing growth and price stability.

Impact and Future Implications

These developments have positioned the Indian banking sector as a global leader in digital innovation and financial inclusion. The focus on digital infrastructure, sustainable finance, and robust regulation ensures resilience against global economic uncertainties. By April 2025, bank credit growth is projected at 13-15% annually, driven by retail, MSME, and infrastructure lending. The RBI’s Vision 2025 roadmap emphasizes inclusive growth, climate resilience, and global competitiveness, paving the way for Indian banks to support India’s $5 trillion economy goal.

|

108 videos|431 docs|128 tests

|

FAQs on Ramesh Singh Summary: Banking in India- 1 - Indian Economy for UPSC CSE

| 1. What are NBFCs and how do they differ from traditional banks? |  |

| 2. What role does the Reserve Bank of India (RBI) play in the country's monetary policy? |  |

| 3. What is the difference between Base Rate, MCLR, and EBLR? |  |

| 4. How does monetary transmission affect the economy? |  |

| 5. What is the impact of global monetary tightening on India's economy? |  |