Ramesh Singh Summary: Banking in India- 2 | Indian Economy for UPSC CSE PDF Download

Regional Rural Banks (RRBs)

- The Regional Rural Banks (RRBs) were first set up on 2 October, 1975 (only 5 in numbers) with the aim to take banking services to the doorsteps of the rural masses specially in the remote are as with no access to banking services with twin duties to fulfill.

- To provide credit to the weaker sections of the society at concessional rate of interest who previously depended on private money lending.

- To mobilise rural savings and channelise them for supporting productive activities in the rural areas.

(i) The Gol, the concerned state government and the sponsoring nationalised bank contribute the share capital of the RRBs in the proportion of 50 per cent, 15 per cent and 35 per cent, respectively.

(ii) By April 2020, as per the RBI, there were 53 RRBs operating in the country (over 13 of them were under the process of amalgamation with their parent PSBs)— incoming times to be fully replaced by the Small Banks.

Co-Operative Banks

Set up to supplant in digenous sources of rural credit, particularly money lenders, today they mostly serve the needs of agriculture and allied activities, rural-based industries and to a lesser extent, trade and industry in urban centres.

Co-operative banks have a two tier structure—

Co-operative banks have a two tier structure—

(i) UCBs : Primary credit societies (PCSs) in urban areas that meet certains pecified criteria can apply to RBI for a banking license to operate as urban co-operative banks (UCBs). They are registered and governed under the cooperative societies acts of the respective states and are covered by the Banking Regulation Act, 1949— thus are under dual regulatory control. The managerial aspects of these banks— registration, management, administration, recruitment, amalgamation, liquidation, etc. are controlled by the state governments, while the matters related to banking are regulated by RBI.

(ii) DCCBs & SCBs : As their names suggest, they operate at the district and state levels. One district can have no more than one DCCB with a number of DCCBs reporting to the SCB. They were under supervision of the RBI— later on this function was delegated to the NABARD.

Financial Sector Reforms

- The process of economic reforms initiated in 1991 had redefined the role of government in the economy— incoming times the economy will be dependent on the greater private participation for its development.

- Such a changed view to development required an over hauling in the investment structure of the economy. Now the private sector was going to demand high investible capital out of the financial system . Thus, an emergent need was felt to restructure the whole financial system of India.

- A high level committee on Financial System (CFS) was set up on 14 August, 1991 to examine all aspects relating to structure, organisation, function and procedures of the financial system — based on its recommendations, a comprehensive reform of the banking system was introduced in the fiscal 1992-93.

- The CFS based its recommendations on certain assumptions which are basic to the banking industry. And the suggestions of the committee became logical in light of this assumption, there is no second opinion about it.

Banking Sector Reforms

The government commenced a comprehensive reform process in the financial system in 1992-93 after the recommendations of the CFS in 1991. In December

1997 the government did set up another committee on the banking sector reform under the chairmanship of M. Narasimham.

The Narasimham Committee -II (popularly called by the Government of India) handed over its reports in April 1998.

- DRI : The differential rate of interest (DRI) is a lending programme launched by the government in April 1972 which makes it obligatory upon all the public sector banks in India to lend 1 per cent of the total lending of the preceding year to 'the poorest among the poor' at an interest rate of 4 per cent per annum.

- Priority Sector Lending : All Indian banks have to follow the compulsory target of priority sector lending (PSL). The priority sector in India are at present the sectors — agriculture, small and medium enterprises (SMEs), road and water transport, retail trade, small business, small housing loans (not more than ₹ 10 lakhs), software industries, self help groups (SHGs), agro-processing, small and marginal farmers, artisans , distressed urban poor and in debted non-institutional debtors besides the SCs, STs and other weaker sections of society.

NPAs and Stressed Assets

- Non-Performing Assets (NPAs) are the bad loans of the banks. The criteria to identify such assets have been changing over the time.

- To follow international best practices and to ensure greater transparency, the RBI shifted to the current policy in 2004.

- Under it, a loan is considered NPA if it has not been serviced for one term (i.e., 90 days). This is known as '90 day' overdue norm.

Current Situation

- During 2019-20, the performance of the banking sector, Public Sector Banks (PSBs) in particular, continued to be subdued.

- As per the Economic Survey 2019 -20 , the Gross NPA ratio of SCBs remained unchanged at 9.1 per cent between March and September 2019.

- The size of the net NPAs has remained sticky at around 12.2 percent for the SCBs.

- The public sector banks have been hit with the NPAs crisis at the maximum which has hit the general credit expansion in the economy.

Resolution of the NPAs

- 5 / 25 Refinancing : This scheme offered a larger window for revival of stressed assets in the infrastructure sectors and 8 core industries. Under this scheme lenders were allowed to extend the tenure of loans to 2 5 years with interest rates adjusted every 5 years, so tenure of the loans matches the long gestation period in the sectors.

- ARCs (Asset Reconstruction Companies) : ARCs were introduced to India under the SARFAESI Act (2002), as specialists to resolve the burden of NPAs. But the ARCs (most are privately-owned ) finding it difficult to resolve the NPAs they purchased, are today only willing to purchase such loans at low prices.

- SDR (Strategic Debt Restructuring) : In June 2015, RBI came up with the SDR scheme provide an opportunity to banks to convert debt of companies (whose stressed assets were restructured but which could not finally fulfil the conditions attached to such restructuring) to 51 percent equity and sell them to the highest bidders— ownership change takes place in it.

- AQR (Asset Quality Review) : Resolution of the problem of bad assets requires sound recognition of such assets. Therefore, the RBI emphasized AQR, to verify that banks were assessing loans in line with RBI loan classification rules. Any deviations from such rules were to be rectified by March 2016.

- S4A (Scheme for Sustain able Structuring of Stressed Assets) : Introduced in June 2016, in it, an independent agency is hired by the banks which decides as how much of the stressed debt of a company is 'sustain able'. The rest ('unsustainable') is converted into equity and preference shares. Unlike the SDR arrangement, this involves no change in the ownership of the company.

PUBLIC SECTOR ASSET REHABILITATION AGENCY (PARA)

- To resolve the twin problems of 'balance sheet syndrome', the Economic Survey 2016-17 has suggested the Government to set up a public sector asset rehabilitation agency (PARA)— charged with the largest and most complex cases of the 'syndrome'. Such initiatives were successfully able to handle the 'twin balance sheet' (TBS)

- Problems in the countries hit by the South East Currency Crises of mid-1990s.

- The Survey has outlined seven reasons in support of its suggestion for setting up the PARA— which are as given below :

(i) It's not just about banks, it's a lot about companies.

(ii) It is an economic problem, not a morality play.

(iii) The stressed debt is heavily concentrated in large companies.

(iv) Many of these companies are unviable at current levels of debt requiring debt write downs in many case.

(v) Banks are finding it difficult to resolve these cases, despite a proliferation of schemes to help them.

(vi) Delay is costly.

(vii) Progress may require a PARA.

Insolvency and Bankruptcy

- The lenders (banks) and borrowers (private corporate sector) both have been paying a high financial cost of country's complex and time-taking process of insolvency and bankruptcy process.

- The new Insolvency and Bankruptcy Code, 2016 (IBC) was amended and enforced by the Government in November 2017.

- There has been a significant amount of progress in this regard — the entire mechanism for the Corporate Insolvency Resolution Process (CIRP) has been put in place. A number of rules and regulations have been notified to create the institutions and professionals necessary for the process to work. A large number of cases have entered the insolvency process.

- A major factor behind the effectiveness of the new Code has been the adjudication by the Judiciary — it prescribes strict time limits for various procedures under it. Inspite of the large inflow of cases to NCLT benches across India, these benches have been able to admit or reject applications for CIRP admissions with few delays.

- In addition, appellate courts, including the NCLAT, High Courts and the Supreme Court have also disposed appeals quickly and decisively. In this process, a rich case-law has evolved, reducing future legal uncertainty.

- In the CIRP, the Committee of Creditors (CoC) invites resolution plans from resolution applicants, and may select one of these plans.

Wilful Defaulter

- There are many people and entities who borrow money from lending institutions but fail to repay. However, not all of them are called wilful defaulters. As is embedded in the name, a wilful defaulter is one who does not repay a loan or liability, but apart from this there are other things that define a wilful defaulter.

- According to the RBI, a wilful defaulter is one who

(i) Is financially capable to repay and yet does not do so;

(ii) One who diverts the funds for purposes other than what the fund was availed for;

(iii) With whom funds are not available in the form of assets as funds have been siphoned off;

(iv) Who has sold or disposed the property that was used as a security to obtain the loan.

Sarfaesi Act, 2002

- Gol finally cracked down on the wilful defaulters by passing the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

- The Act gives far reaching powers to the banks/FIs concerning NPAs :

1. Banks/FIs having 75 per cent of the dues owed by the borrower can collectively proceed on the following in the event of the account becoming NPA :

(i) Issue notice of default to borrowers asking to clear dues within 60 days.

(ii) On the borrower's failure to repay :

(a) Take possession of security.

(b) Take over the management of the borrowing concern.

(c) Appoint a person to manage the concern.

(iii) If the case is already before the BIFR, the proceedings can be stalled if banks/FIs having 75 per cent share in the dues have taken any steps to recover the dues under the provisions of the ordinance.

2. The banks/FIs can also sell the security to a securitisation or Asset Reconstruction Company (ARC), established under the provisions of the Ordinance.

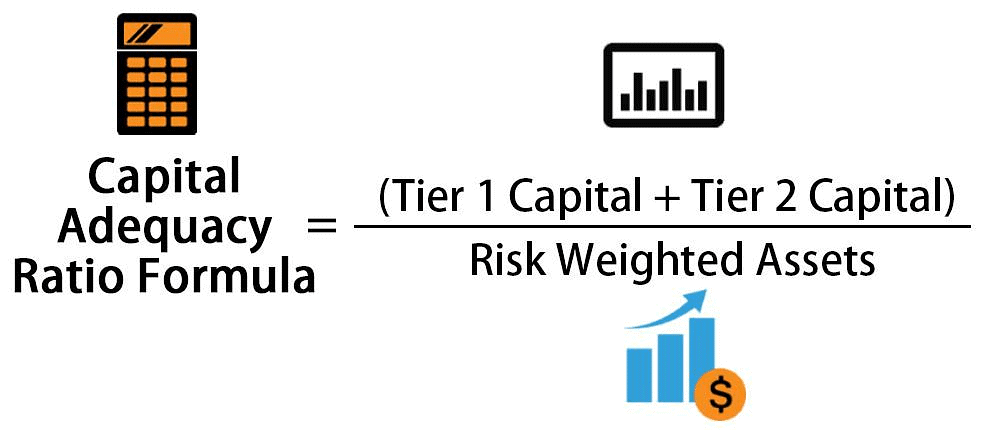

Capital Adequacy Ratio

- The capital adequacy ratio (CAR) norm has been the last provision to emerge in the area of regulating the banks in such a way that they can sustain the probable risks and uncertainties of lending.

- It was in 1988 that the central banking bodies of the developed economies agreed upon such a provision, the CAR—also known as the Basel Accord. The accord was agreed upon at Basel, Switzerland at a meeting of the Bank for International Settlements (BIS).

- It was at this time that the Basel-I norms of the capital adequacy ratio were agreed upon—a requirement was imposed upon the banks to maintain a certain amount of free capital (i.e., ratio) to their assets (i.e., loans and investments by the banks) as a cushion against probable losses in investments and loans. In 1988, this ratio capital was decided to be 8 per cent.

- It means that if the total investments and loans forwarded by a bank amounts to ₹100, the bank needs to maintain a free capital of ₹8 at that particular time.

- The capital adequacy ratio is the percentage of total capital to the total risk—weighted assets.

- CAR, a measure of a bank's capital, is expressed as a percentage of a bank's risk weighted credit exposures:

CAR = Total of the Tier 1 & Tier 2 capitals * Risk Weighted Assets

- 'Capital to Risk Weighted Assets Ratio (CRAR)' this ratio is used to protect depositors and promote the stability and efficiency of financial systems around the world. Two types of capital were measured as per the Basel II norms: Tier 1 capital, which can absorb losses without a bank being required to cease trading, and Tier 2 capital, which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. The new norms (Basel III) has devised a third category of capital, i.e., Tier 3 capital.

- The RBI introduced the capital-to-risk weighted assets ratio (CRAR) system for the banks operating in India in 1992 in accordance with the standards o f the BIS— as part o f the financial sector reforms. In the coming years the Basel norms were extended to term-lending institutions, primary dealers and non-banking financial companies (NBFCs), too.

Basel Accords

- The Basel Accords (i.e., Basel I, II and now III) are a set of agreements, set by the Basel Committee on Bank Supervision (BCBS), which provides recommendations on banking regulations in regards to capital risk, market risk and operational risk.

- The purpose of the accords is to ensure that financial institutions have enough capital on account to meet obligations and absorb unexpected losses. They are of paramount importance to the banking world and are presently implemented by over 100 countries across the world.

- The BIS Accords were the outcome of a long-drawn-out initiative to strive for greater international uniformity in prudential capital standards for banks' credit risk.

- The Basel Capital Adequacy Risk-related Ratio Agreement of 1988 (i.e., Basel I) was not a legal document. It was designed to apply to internationally active banks of member countries of the Basel Committee on Banking Supervision (BCBS) of the BIS at Basel, Switzerland. But the details of its implementation were left to national discretion. This is why Basel I looked GlOcentric.

- Tier 1 Capital : A term used to describe the capital adequacy o f a bank— it can absorb losses without a bank being required to cease trading. This is the core measure of a bank's financial strength from a regulator's point of view (this is the most reliable form of capital). It consists of the types of financial capital considered the most reliable and liquid, primarily stockholders' equity and disclosed reserves of the bank— equity capital can't be redeemed at the option of the holder and disclosed reserves are the liquid assets available with the bank itself.

- Tier 2 Capital : A term used to describe the capital adequacy of a bank— it can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors. Tier II capital is secondary bank capital .This is related to Tier 1 Capital. This capital is a measure of a bank's financial strength from a regulator's point of view. It consists of accumulated after-tax surplus of retained earnings, revaluation reserves of fixed assets and long-term holdings of equity securities, general loan-loss reserves, hybrid (debt/equity) capital instruments, and subordinated debt and undisclosed reserves.

- Tier 3 Capital : A term used to describe the capital adequacy o f a bank— considered the tertiary capital of the banks which are used to meet/support market risk, commodities risk and foreign currency risk. It includes a variety of debt other than Tier 1 and Tier 2 capitals. Tier 3 capital debts may include a greater number of subordinated issues, undisclosed reserves and general loss reserves compared to Tier 2 capital. To qualify as Tier 3 capital, assets must be limited to 250 per cent of a bank's Tier 1 capital, be unsecured, subordinated and have a minimum maturity of two years.

- Basel III Provisions : The Basel III provisions have defined the capital of the banks in different way. They consider common equity and retained earnings as the predominant component of capital, but they restrict inclusion of items such as deferred tax assets, mortgage-servicing rights and investments in financial institutions to no more than 15 per cent of the common equity component. These rules aim to improve the quantity and quality of the capital.

BASEL III COMPLIANCE OF THE PSBS & RRBS

- The capital to risk weighted assets ratio (CRAR) of the scheduled commercial banks of India was 13.02 per cent by March 2014 (Basel-Ill) falling to 12.75 per cent by September 2014.

- The regulatory requirement for CRAR is 9 per cent for 2015. The decline in capital positions at aggregate level, however, was on account of deterioration in capital positions of PSBs.

- While the CRAR of the scheduled commercial banks (SCB) at 12.75 per cent as of September 2014 was satisfactory, going forward the banking sector, particularly PSBs will require substantial capital to meet regulatory requirements with respect to additional capital buffers.

- In order to make the PSBs and RRBs compliant to the Basel III norms, the government has been following a recapitalisation programme for them since 2011-12.

- A High Level Committee on the issue was also set up by the government which has suggested the idea of 'non-operating holding company' (HoldCo) under a special Act of Parliament.

Stock of Money

- In every economy it is necessary for the central bank to know the stock (amount/level) of money available in the economy only then it can go for suitable kind of credit and monetary policy. Saying simply, credit and monetary policy of an economy is all about changing the level of the money flowing in the economic system. But it can be done only when we know the real flow of money. That's why it is necessary to first assess the level of money flowing in the economy.

- These components used to contain money of differing liquidities:

- M Currency & coins with people + Demand deposits of Banks (Current & Saving Accounts) = Other deposits of the RBI.

(i) M = M + Demand deposits of the post offices (i.e. Saving schemes' money).

(ii) M = M + Time / Term deposits of the Banks (i.e. the money lying in the Recurring Deposits & the fixed Deposits).

(iii) M = M + total deposits of the post offices (both, Demand and Term / Time Deposits).

Liquidity of Money

As we move from M to M the liquidity (inertia, stability, spendability) of the money goes on decreasing and in the opposite direction, the liquidity increases.

Narrow Money

In banking terminology, M is called narrow money as it is highly liquid and banks cannot run their lending programmes with this money.

Broad Money

The money component M is called broad money in the banking terminology. With this money (which lies with banks for a known period) banks run their lending programmes.

Money Supply

- The growth rate of broad money i.e., money supply, was not only lower than the indicative growth set by the Reserve Bank of India, but it also witnessed continuous and sequential deceleration in the last 7 quarters and moderated to 11.2 per cent by December 2012.

- Aggregate deposits with the banks were the major component of broad money counting for over 85 per cent remaining almost stable.

- The sources of broad money are net bank credit to the government and to the commercial sector. These two together accounted for nearly 100 per cent of the broad money in 2012-13, compared to 89 per cent in 2009-10.

High Power Money

- The central banks of all the countries are empowered to issue the currency.

- The currency issued by the central bank is called 'high power money' because it is generally backed by supporting 'reserves' and its value is guaranteed by the government and it is the source of all other forms of money.

- The currency issued by the central bank is, in fact, is a liability of the central bank and the government. In general, therefore, this liability must be backed by an equal value of assets consisting mainly, gold and foreign exchange reserves.

- In practice, however, most countries have adopted a 'minimum reserve system'.

- There are two sources of high power money supply:

1. RBI

2. Government of India.

Minimum Reserve

The RBI is required to maintain a reserve equivalent of ^200 crores in gold and foreign currency with itself, of which ₹115 crores should be in gold. Against this reserve, the RBI is empowered to issue currency to any extent. This is being followed since 1957 and is known as the Minimum Reserve System (MRS).

Reserve Money

The gross amount of the following six segments of money at any point of time is known as Reserve Money (RM) for the economy or the government :

- RBI's net credit to the Government;

- RBI's net credit to the Banks;

- RBI's net credit to the commercial banks;

- Net forex reserve with the RBI;

- Government's currency liabilities to the public;

- Net non-monetary liabilities of the RBI. RM = 1 + 2 + 3 + 4 + 5 + 6

Money Multiplier

At end March 2014, the money multiplier (ratio of M to M ) was 5.2, higher than end-March 2015, due to cumulative 125 basis point reduction in CRR. During 2015-16, the money multiplier generally stayed high reflecting again, the CRR cuts. As on 31 December, 2018, the money multiplier was 6.0 compared with 5.5 on the corresponding date of the previous year (as per the RBI).

Credit Counselling

Advising borrowers to overcome their debt burden and improve money management skills is credit counselling. The first such well-known agency was created in the USA when credit granters created National Foundation for Credit Counselling (NFCC) in 1951. India's sovereign debt is usually rated by six major sovereign credit rating agencies (SCRAs) of the world which are :

(i) Fitch Ratings,

(ii) Moody's Investors Service,

(iii) Standard and Poor's (S& P),

(iv) Dominion Bond Rating Service (DBRS),

(v) Japanese Credit Rating Agency (JCRA),

(vi) Rating and Investment Information Inc., Tokyo (R & I).

Credit Rating

To assess the credit worthiness (credit record, integrity, capability) of a prospective (would be) borrower to meet debt obligations is credit rating. Today it is done in the cases of individuals, companies and even countries. There are some world-renowned agencies such as the Moody's, S&P. The concept was first introduced by John Moody in the USA (1909). Usually equity share is not rated here. Primarily, ratings are an investor service.

Recent Developments

1. Regional Rural Banks (RRBs): "One State, One RRB" Reform

As of May 1, 2025, the number of RRBs has been reduced from 43 to 28, implemented across 26 states and 2 Union Territories under the One State, One RRB policy.

This consolidation aimed to enhance capital base, operational viability, technology adoption, and cost-efficiency.

For example:

Karnataka Grameena Bank (merger effective May 1, 2025)

Gujarat Gramin Bank (formed from Baroda Gujarat Gramin Bank & Saurashtra Gramin Bank) .

Odisha Grameen Bank (merger effective May 1, 2025).

Digitization push: NABARD plans to complete IT integration of these merged RRBs by September 15, 2025—introducing new digital platforms to bridge the rural-urban divide.

2. Banking Laws (Amendment) Act, 2025 – Coming into Effect

Took effect from August 1, 2025, introducing 19 amendments across key legislations such as the RBI Act (1934), Banking Regulation Act (1949), SBI Act (1955), and others.

Key changes:

Raised the threshold for “substantial interest” from ₹5 lakh to ₹2 crore, modernizing an outdated benchmark.

Extended the tenure of directors in cooperative banks (excluding chairperson and whole-time directors) from 8 to 10 years, aligning with constitutional norms.

Allowed Public Sector Banks (PSBs) to transfer unclaimed shares, interest, and bond redemption amounts to the Investor Education and Protection Fund (IEPF).

Authorized PSBs to remunerate statutory auditors, enhancing audit quality and accountability.

3. RBI’s New Co-Lending Framework (Effective January 1, 2026)

Finalized guidelines, extending co‑lending arrangements beyond the priority sector, with enhanced clarity and risk discipline.

Key features:

Mandatory 10% loan retention by each lending entity.

Borrowers must be informed clearly about each party’s roles and responsibilities.

Loan sharing must be recorded within 15 days of disbursement; default loss guarantees capped at 5% for originators.

Asset classification is now at the borrower level, meaning default by one lender affects the other’s exposure.

Anticipated outcome: Due to increased regulatory complexity and technical integration hurdles, lenders are expected to transition to simpler direct assignment models, potentially slowing co‑lending volumes.

|

108 videos|425 docs|128 tests

|

FAQs on Ramesh Singh Summary: Banking in India- 2 - Indian Economy for UPSC CSE

| 1. What are the key features of Regional Rural Banks (RRBs)? |  |

| 2. How do Co-Operative Banks differ from Commercial Banks? |  |

| 3. What are the objectives of Financial Sector Reforms in India? |  |

| 4. What is the significance of Capital Adequacy Ratio in banking regulation? |  |

| 5. How does the concept of Insolvency and Bankruptcy apply to the banking sector? |  |