Ramesh Singh Summary: Banking in India- 3 | Indian Economy for UPSC CSE PDF Download

| Table of contents |

|

| Non-Resident Indian Deposits |

|

| Small & Payment Banks |

|

| Financial Inclusion |

|

| Gold Investment Schemes |

|

| Mudra Bank |

|

| Crypto Ecosystem |

|

Non-Resident Indian Deposits

- Foreign Exchange Management (Deposit) Regulations, 2000 permits Non- Resident Indians (NRIs) to have deposit accounts with authorised dealers and with banks authorised by the Reserve Bank of India (RBI) which include :

(i) Foreign Currency Non-Resident (Bank) Account [FCN R(B] Account]

(ii) Non-Resident External Account (NRE Account)

(iii) Non-Resident Ordinary Rupee Account (NRO Account) - FCNR (B) accounts can be opened by NRIs and Overseas Corporate Bodies (OCBs) with an authorised dealer. The accounts can be opened in the form of term deposits. Deposits of funds are allowed in Pound Sterling, US Dollar, Japanese Yen and Euro. Rate of interest applicable to these accounts are in accordance with the directives issued by RBI from time to time.

- There were two more NRI deposit accounts in operation, viz., Non -Resident (Non Repatriable] Rupee Deposit Account and Non-Resident (Special) Rupee Account— an amendment to Foreign Exchange Management (Deposit] Regulations.

- Repatriation of funds in FCN R(B) and NRE accounts is permitted. Hence, deposits in these accounts are included in India's external debt outstanding. While the principal of NRO deposits is non-repatriable, current income and interest earning is repatriable.

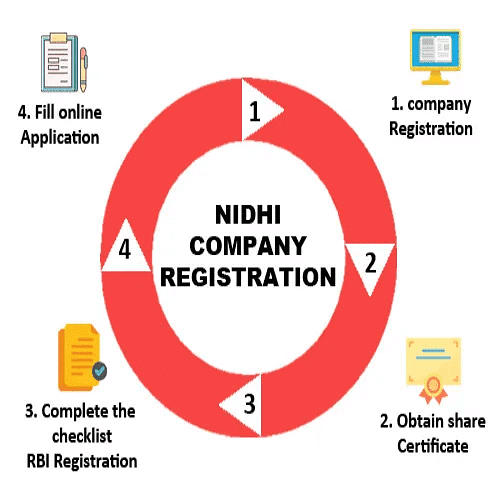

NIDHI

- Union Government as a Nidhi Company. They are created mainly for cultivating the habit of thrift and savings amongst its members.

- The companies doing Nidhi business, viz., borrowing from members and lending to members only, are known under different names such as Nidhi, Permanent Fund, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Company.

- Nidhis are more popular in South India and are highly localised single office institutions.

- They are mutual benefit societies, because their dealings are restricted only to the members; and membership is limited to individuals. The principal source of funds is the contribution from the members.

- Nidhis are companies registered under the Companies Act, 1956 and are regulated by the Ministry of Corporate Affairs (MCA).

- Nidhis are also included in the definition of NBFCs, which operate mainly in the unorganised money market.

- The Central Government in March 2000 constituted a committee to examine the various aspects of the functioning of Nidhi Companies. There was no government notification defining the word 'Nidhi'.

- Sabanayagam Committee in its report and also to prevent unscrupulous persons using the word 'Nidhi' in their name without being incorporated by the Department of Company Affairs (DCA) and yet doing Nidhi business , the committee suggested the following definition for Nidhis.

CHIT FUND

- Chit Fund was in centre of news after the Kolkata-based Saradha Chit Fund scam came to light. Most of the media people were themselves not very clear about the 'finer' points related to the idea of 'chits ' in India, but they kept on highlighting chits as they needed to report on the scam.

- Chit funds are essentially saving institutions. They are of various forms and lack any standardised form. Chit funds have regular members who make periodical subscriptions to the fund.

- Chit fund business is regulated under the Central Chit Funds Act, 1982 and the rules framed under this Act by the various state governments for this purpose. The Central Government has not framed any rules of operation for them.

- Chit funds are the Indian versions of 'Rotating Savings and Credit Associations' found across the globe.

- As per the Chit Funds Act, 1982, chit means "a transaction whether called chit, chit fund, chitty, kurior by any other name by or under which a person enters into an agreement with a specified number of persons that every one of them shall subscribe a certain sum of money by way of periodical installments over a definite period and that each such subscriber shall, in his turn , as determined by lot or by auction or by tender or in such other manner as may be specified in the chit agreement, be entitled to the prize amount".

1 Foreign Currency Non-Resident (Bank) Account (FCNR Account)

2 Non-Resident External Account (NRE Account)

3 Non-Resident Non-Repatriable Rupee Deposit Account

4 Non-Resident (Special) Rupee Account

Small & Payment Banks

By mid-July 2014, the RBI issued the draft guidelines for setting up small banks and payment banks. The guidelines said that both are 'niche' or 'differentiated ' banks with the common objective of furthering financial inclusion. It is in pursuance of the announcement made in the Union Budget 2014-15.

Small Banks

- The purpose of the small banks will be to provide a whole suite of basic banking products such as deposits and supply of credit, but in a limited are a of operation.

- The objective of the Small Banks to increase financial inclusion by provision of savings vehicles to under-served and unserved sections of the population , supply of credit to small farmers, micro and small industries, and other unorganised sector entities through high technology low-cost operations.

- Resident individuals with 10 years of experience in banking and finance, companies and Societies will be eligible as promoters to set up small banks. NFBCs, micro finance institutions (MFIs), and Local Area Banks (LABS') can convert their operations into those of a small bank. Local focus and ability to serve smaller customers will be a key criterion in licensing such banks.

- The area of operations would normally be restricted to contiguous districts in a homogenous cluster of states or union territories so that the Small Bank has a 'local feel' and culture. However, if necessary, it would be allowed to expand its area of operations beyon contiguous districts in one or more states with reasonable geographical proximity.

- The promoters' other financial and non-financial services activities, if any, should be distinctly ring- fenced and not co-mingled with banking business.

- A robust risk management framework is required and the banks would be subject to all prudential norms and RBI regulations that apply to existing commercial banks, including maintenance of CRR and SLR.

- The maximum loan size and investment limit exposure to single/group borrowers/issuers would be restricted to 15 per cent of capital funds.

Payments Banks

- The objective of payments banks is to increase financial inclusion by providing small savings accounts, payment/remittance services to migrant labour, low income households, small businesses, other unorganised sector entities and other users by enabling high volume-low value transactions in deposits and payments/remittance services in a secured technology-driven environment.

- Those who can promote a payments banks can be a non-bank PPIs, NBFCs, corporate's, mobile telephone companies, super market chains, real sector cooperatives companies and public sector entities. Even banks can take equity in Payments Banks.

- Payments Banks can accept demand deposits (only current account and savings accounts). They would initially be restricted to holding a maximum balance of ₹100,000 per customer. Based on performance, the RBI could enhance this limit.

- The banks can offer payments and remittance services, issuance of prepaid payment instruments, internet banking, functioning as business correspondent for other banks.

- Payments Banks cannot set up subsidiaries to undertake NBFC business.

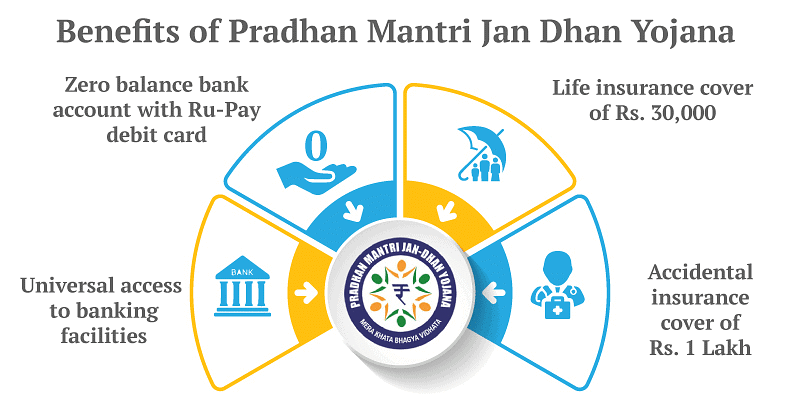

Financial Inclusion

Financial inclusion is an important priority of the government. The objective is to ensure the excluded sections, i.e., weaker sections and low income groups, access to various financial services such as a basic savings bank account, need-based credit, remittance facility, insurance and pension.

The government has recently launched an effective scheme to promote the cause of financial inclusion—the PMJDY :

Pradhan Mantri Jan-Dhan Yojana

- To achieve the objective of financial inclusion by extending financial services to the large hitherto unserved population of the country and to unlock its growth potential, the Pradhan Mantri Jan-Dhan Yojana (PMJDY) was launched on 28 August 2014. The Yojana envisages—

- Universal access to banking facilities with at least one basic banking account for every household.

- Financial literacy, access to credit and insurance.

- In addition, there is a life insurance cover of ₹30,000 to those who opened their bank accounts for the first time between 15 August 2014 and 26 January 2015 and meet other eligibility conditions of the Yojana.

- The Yojana had entered the Guinness World Records for opening most bank accounts during the week starting 23 August, 2014 as part of the financial campaign.

Gold Investment Schemes

Two new gold investment schemes were launched by the Government of India by November 2015 — the Sovereign Gold Bonds and Gold Monetisation Schemes. The schemes are aimed at twin objectives:

1. Reducing the demand for physical gold.

2. Shifting a part of the gold imported every year for investment purposes into financial savings.

Sovereign Gold Bonds

These are issued by RBI on behalf of the Gol in rupees and denominated in grams of gold and restricted for sale to the resident Indian entities only, both in demat and paper form. The minimum and maximum investment limits are two grams and 500 grams of gold per person per fiscal year, respectively.

Gold Monetisation Scheme

- BIS (Bureau of Indian Standards) certified CPTCs (Collection, Purity Testing Centres) collect the gold from the customer on behalf of the banks. The minimum quantity of gold (bullion or jewellery) which can be deposited is 30 grams and there is no limit for maximum deposit.

- Gold Saving Account can be opened with any of the designated bank and denomination in grams of gold for short-term period of 1-3 years, a medium-term period of 5-7 years and a long term period of 12-15 years. The CPTCs transfer the gold to the refiners. The banks will have a tripartite / bipartite legal agreement with refiners and CPTCs.

- Redemption is made in cash/gold for short term and in cash for medium and long term deposits. The difference between the current borrowing cost for the government and the interest rate paid by the government under the medium / long term deposit will be credited to the Gold Reserve Fund.

Mudra Bank

- As per the Government of India, large industries provide employment to only 1.25 crore people in the country while the micro un its employ around 12 crore people.

- There is a need to focus on these 5.75 crore self-employed people (owners of the micro units) who use funds of ₹11 lakh crore, with an average per unit debt of merely ₹ 17,000. Capital is the key to the small entrepreneurs.

- These entrepreneurs depend heavily on the local money lenders for their fund requirements.

- the Government of India launched (April 2015) the Micro Units Development and Refinance Agency Bank (MUDRA Bank) with the aim of funding these unfunded non-corporate enterprises. This was launched as the PMMY (Prime Minister Mudra Yojana).

- March 2020, a total of 22.53 crore loans were sanctioned since launch of the scheme — total loans disbursed being to the tune of around ₹11.51 lakh crores. Around 70 per cent of the loan beneficiaries are women under the scheme.

- Meanwhile, the rise in the non-performing assets in case of the Mudra loans have been a matter of concern for the Government and the RBI alike. As per the Ministry of Finance, between April-December 2019, the net NPAs under the Mudra loans increased to 2.88 per cent.

Crypto Ecosystem

- The Economic Survey 2022 highlights the vulnerabilities of the cryptocurrency market ecosystem, particularly brought to the forefront by the collapse of the crypto exchange FTX and subsequent sell-offs in the crypto markets.

- Regulators worldwide are increasingly expressing concerns about these crypto assets, commonly referred to as cryptocurrencies.

Nature of Crypto Assets

- Crypto assets are described as self-referential instruments, lacking intrinsic cash flows typically associated with traditional financial assets.

- Notably, regulators in the USA have deemed Bitcoin, Ether, and various other crypto assets as not meeting the criteria to be classified as securities.

Regulatory Response in the USA

- On January 3, 2023, a rare joint statement was issued by prominent financial regulatory bodies in the USA, including the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC).

- The statement underscored concerns regarding crypto-asset risks to the banking system, indicating a heightened level of regulatory scrutiny.

Global Regulatory Landscape

- Given the geographically pervasive nature of the crypto ecosystem, there is a growing recognition of the need for a unified approach to regulate these volatile instruments.

- The response to cryptocurrency regulation is evolving globally, with leading economies such as the USA, European Union, Japan, Switzerland, UK, Albania, and Nigeria taking active roles in shaping regulatory frameworks.

Key Concerns

- Market Stability: The collapse of FTX and subsequent market sell-offs highlight concerns about the stability and resilience of the cryptocurrency market.

- Investor Protection: Regulatory efforts are aimed at safeguarding investors from potential risks associated with investing in cryptocurrencies, including market volatility and lack of investor protections.

- Systemic Risks: The joint statement by major US regulatory bodies reflects concerns about the potential systemic risks posed by crypto assets to the broader financial system.

Future Outlook

- The regulatory landscape for cryptocurrencies is likely to continue evolving as regulators seek to address emerging risks and ensure the stability and integrity of financial markets.

- Collaboration among regulators at the national and international levels will be crucial in developing effective regulatory frameworks that balance innovation with investor protection and systemic stability.

The Economic Survey underscores the need for comprehensive regulatory oversight of the cryptocurrency market to address vulnerabilities and mitigate risks to financial stability. Efforts are underway globally to develop cohesive regulatory frameworks that strike a balance between fostering innovation and safeguarding the interests of investors and the financial system as a whole.

Central Bank Digital Currency

In recent years, numerous countries have taken steps towards introducing their digital currencies, commonly known as Central Bank Digital Currency (CBDC), which are intended to be issued by the central banks. As of July 2022, 105 countries, representing 95% of the global GDP, were in the process of exploring CBDC, with many having already launched it, while others were in the pilot stage. The introduction of CBDC in India is anticipated to offer several benefits:

- Reduction in operational costs associated with physical cash management,

- Promotion of financial inclusion,

- Enhancement of resilience, efficiency, and innovation in the payments system,

- Stimulation of innovation in the payments space, and

- Providing the public with the advantages offered by any private virtual currencies without associated risks.

RBI's Initiative

The Reserve Bank of India (RBI) has taken significant steps in this direction, launching pilot projects in both the wholesale and retail segments. These projects include:

- The pilot for Digital Rupee-Wholesale, initiated on November 1, 2022, focuses on the limited use case of settling secondary market transactions in government securities, aiming to enhance efficiency in the inter-bank market.

- The pilot for Digital Rupee-Retail, started on December 1, 2022, within a closed user group of participating customers and merchants. For full operationalization of CBDC, RBI plans to gradually expand the pilot's scope, including more banks, users, and locations based on feedback received during the pilot phase.

Neobanks

There has been a consistent increase in the number of neo-banking platforms and global investments in the neo-banking segment in the country over the past few years. Neo-banks, operating under the umbrella of mainstream finance, offer specific services traditionally associated with institutions like banks and payment providers. Key facts related to these banks include:

- They operate exclusively online without physical branches but maintain offline offices.

- Their growth is driven by the demand for 'on-demand' and 'easier-to-access' financial solutions, particularly from a young and digitally savvy population.

- They ensure widespread availability and provide access to financial services for MSMEs and underbanked customers in various areas.

Over the past several years, the government has also initiated the establishment of Digital Banking Units, as proposed in the Union Budget 2022-23.

Way Forward

The global financial system has encountered various disruptions, and India has felt their impact. Looking ahead to 2023-24 and the subsequent years, the government remains optimistic, despite expressing concerns:

- Given the commitment of central banks worldwide, particularly those of advanced economies, to a 'hawkish' monetary policy stance to combat higher inflation, global monetary conditions are expected to remain tight.

- On the domestic front, the Reserve Bank of India (RBI) is committed to supporting growth, ensuring ample liquidity in financial markets.

- Banks and institutions are anticipated to contribute to increased capital expenditure from the private sector, signaling the return of the investment cycle.

- The lending-investment cycle will require ongoing risk monitoring by regulators.

- India's robust macroeconomic fundamentals will attract global capital flows back to the country once the fog of uncertainty clears. The financial system will play a crucial role in achieving the objectives of Amrit Kaal.

|

108 videos|425 docs|128 tests

|

FAQs on Ramesh Singh Summary: Banking in India- 3 - Indian Economy for UPSC CSE

| 1. What are the different types of banking services available in India? |  |

| 2. How can I open a bank account in India? |  |

| 3. What is the role of the Reserve Bank of India (RBI) in the Indian banking sector? |  |

| 4. How can I apply for a loan from a bank in India? |  |

| 5. What are the benefits of using online banking services in India? |  |