Retirement/Death of a Partner (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 6.77:

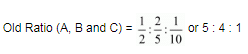

Question 1: A, B and C were partners sharing profits in the ratio of 1/2, 2/5 and 1/10. Find the new ratio of the remaining partners if C retires.

ANSWER:

As we can see, no information is given as to how A and B are acquiring C's profit share after his retirement, so the new profit sharing ratio between A and B is calculated just by crossing out the C’s share. That is, the new ratio becomes 5 : 4.

∴ New Profit Ratio (A and B) = 5 : 4

Page No 6.77:

Question 2: From the following particulars, calculate new profit-sharing ratio of the partners:

(a) Shiv, Mohan and Hari were partners in a firm sharing profits in the ratio of 5 : 5 : 4. Mohan retired and his share was divided equally between Shiv and Hari.

(b) P, Q and R were partners sharing profits in the ratio of 5 : 4 : 1. P retires from the firm.

ANSWER:

(b) Old Ratio (P, Q and R) = 5 : 4 : 1

P’s Profit Share =

As we can see, no information is given as to how Q and R are acquiring P's profit share after his retirement, so the new profit sharing ratio between Q and R is calculated just by crossing out the P’s share. That is, the new ratio becomes 4 : 1

∴ New Profit Ratio (Q and R) = 4 : 1

Page No 6.77:

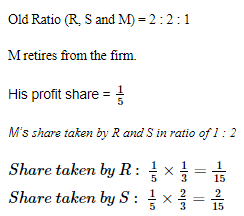

Question 3: R, S and M are partners sharing profits in the ratio of 2/5, 2/5 and 1/5. M decides to retire from the business and his share is taken by R and S in the ratio of 1 : 2. Calculate the new profit-sharing ratio.

ANSWER:

Page No 6.77:

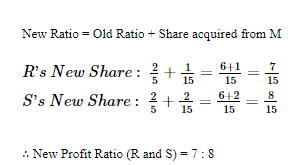

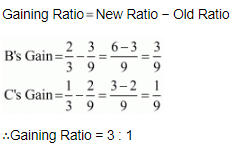

Question 4: A, B and C were partners sharing profits in the ratio of 4 : 3 : 2. A retires, assuming B and C will share profits in the ratio of 2 : 1. Determine the gaining ratio.

ANSWER:

Old Ratio (A, B and C) = 4 : 3 : 2

New Ratio (B and C) = 2 : 1

Page No 6.77:

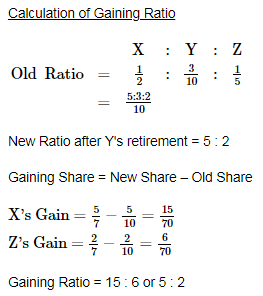

Question 5: X, Y and Z are partners sharing profits in the ratio of 1/2, 3/10, and 1/5. Calculate the gaining ratio of remaining partners when Y retires from the firm.

ANSWER:

Page No 6.77:

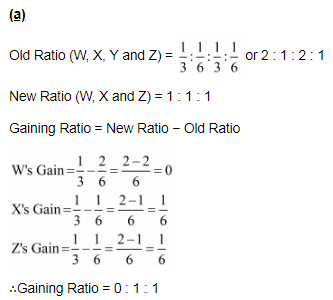

Question 6: (a) W, X, Y and Z are partners sharing profits and losses in the ratio of 1/3, 1/6, 1/3 and 1/6 respectively. Y retires and W, X and Z decide to share the profits and losses equally in future.

Calculate gaining ratio.

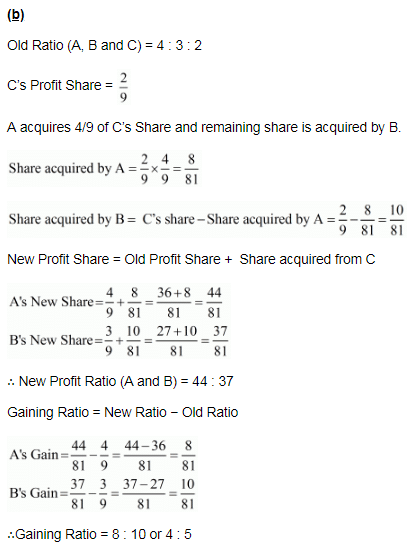

(b) A, B and C are partners sharing profits and losses in the ratio of 4 : 3 : 2. C retires from the business. A is acquiring 4/9 of C's share and balance is acquired by B. Calculate the new profit-sharing ratio and gaining ratio.

ANSWER:

Page No 6.78:

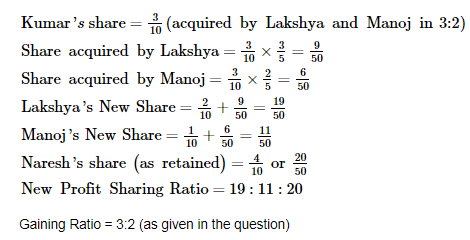

Question 7: Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3 : 2. Calculate new profit-sharing ratio and gaining ratio of the remaining partners.

ANSWER:

Page No 6.78:

Question 8: A, B, and C were partners in a firm sharing profits in the ratio of 8 : 4 : 3. B retires and his share is taken up equally by A and C. Find the new profit-sharing ratio.

ANSWER:

Page No 6.78:

Question 9: A, B, and C are partners sharing profits in the ratio of 5 : 3 : 2. C retires and his share is taken by A. Calculate new profit-sharing ratio of A and B.

ANSWER:

Page No 6.78:

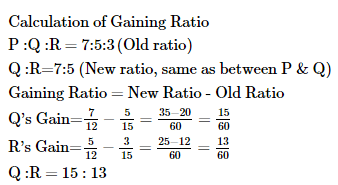

Question 10: P, Q and R are partners sharing profits in the ratio of 7 : 5 : 3. P retires and it is decided that profit-sharing ratio between Q and R will be same as existing between P and Q. Calculate New profit-sharing ratio and Gaining Ratio.

ANSWER:

Page No 6.78:

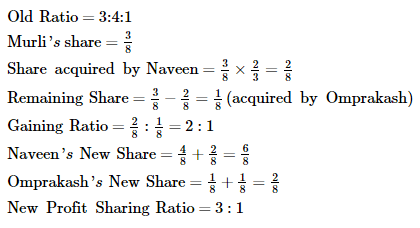

Question 11: Murli, Naveen and Omprakash are partners sharing profits in the ratio of 3/8, 1/2 and 1/8. Murli retires and surrenders 2/3rd of his share in favour of Naveen and remaining share in favour of Omprakash. Calculate new profit-sharing ratio and gaining ratio of the remaining partners.

ANSWER:

Page No 6.78:

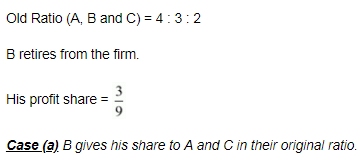

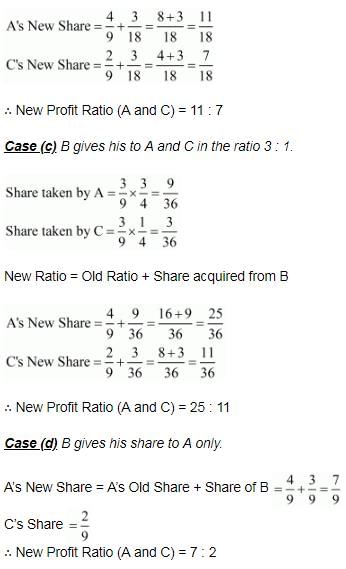

Question 12: A, B and C are partners in a firm sharing profits and losses in the ratio of 4 : 3 : 2. B decides to retire from the firm. Calculate new profit-sharing ratio of A and C in the following circumstances:

(a) If B gives his share to A and C in the original ratio of A and C.

(b) If B gives his share to A and C in equal proportion.

(c) If B gives his share to A and C in the ratio of 3 : 1.

(d) If B gives his share to A only.

ANSWER:

Page No 6.78:

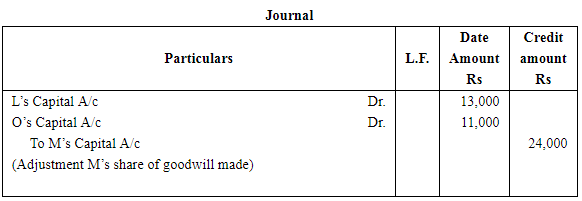

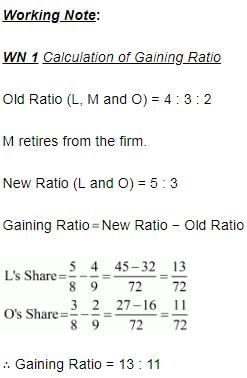

Question 13: L, M and O are partners sharing profits and losses in the ratio of 4 : 3 : 2. M retires and the goodwill is valued at ₹ 72,000. Calculate M's share of goodwill and pass the Journal entry for Goodwill. L and O decided to share the future profits and losses in the ratio of 5 : 3.

ANSWER:

Page No 6.78:

Page No 6.78:

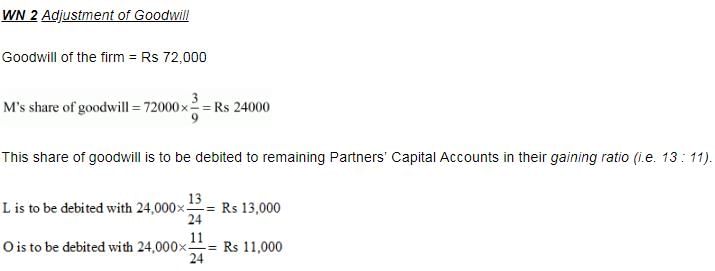

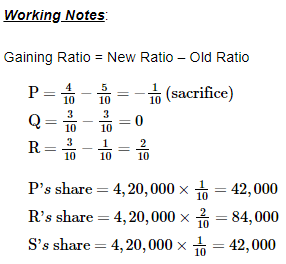

Question 14: P, Q, R and S were partners in a firm sharing profits in the ratio of 5 : 3 : 1 : 1. On 1st January, 2019, S retired from the firm. On S's retirement, goodwill of the firm was valued at ₹ 4,20,000. New profit-sharing ratio among P, Q and R will be 4 : 3 : 3.

Showing your working notes clearly, pass necessary Journal entry for the treatment of goodwill in the books of the firm on S's retirement.

ANSWER:

Page No 6.78:

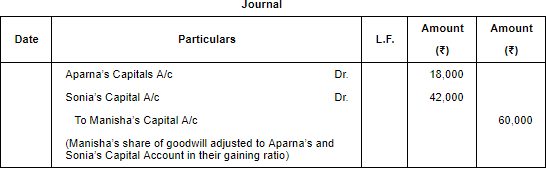

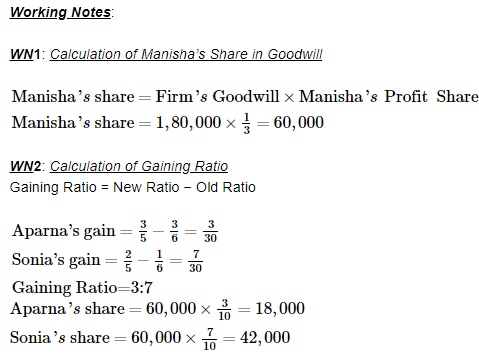

Question 15: Aparna, Manisha and Sonia are partners sharing profits in the ratio of 3 : 2 : 1. Manisha retired and goodwill of the firm is valued at ₹ 1,80,000. Aparna and Sonia decided to share future profits in the ratio of 3 : 2. Pass necessary Journal entries.

ANSWER:

Page No 6.78:

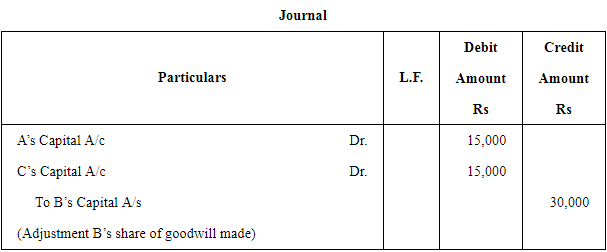

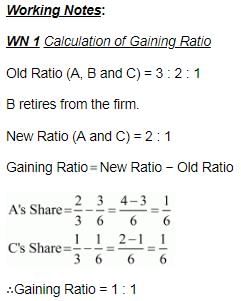

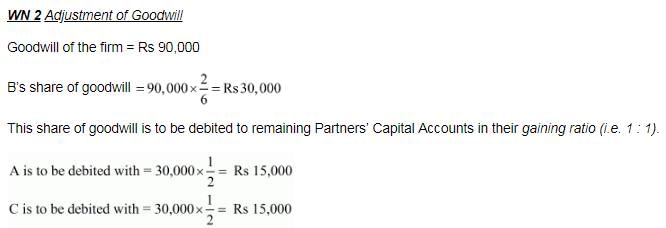

Question 16: A, B and C are partners sharing profits in the ratio of 3 : 2 : 1. B retired and the new profit-sharing ratio between A and C was 2 : 1. On B's retirement, the goodwill of the firm was valued at ₹ 90,000. Pass necessary Journal entry for the treatment of goodwill on B's retirement.

ANSWER:

Page No 6.79:

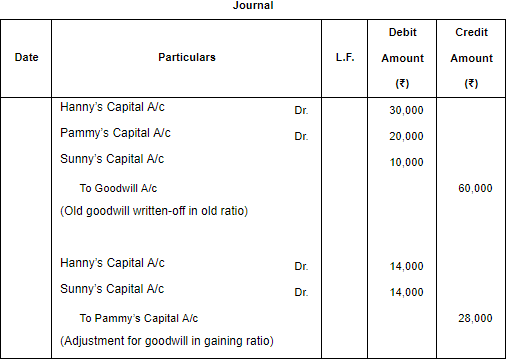

Question 17: Hanny, Pammy and Sunny are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill is appearing in the books at a value of ₹ 60,000. Pammy retires and at the time of Pammy's retirement, goodwill is valued at ₹ 84,000. Hanny and Sunny decided to share future profits in the ratio of 2 : 1. Record the necessary Journal entries.

ANSWER:

Working Notes:

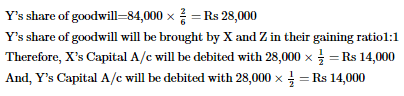

WN1: Calculation of Pammy’s Share in Goodwill

Pammy's share=Firm's Goodwill×Pammy's Profit Share

Pammy's share=84,000×2/6=28,000 (to be borne by gaining partners in gaining ratio)

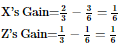

WN2: Calculation of Gaining Ratio

Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio=1:1

Page No 6.79:

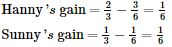

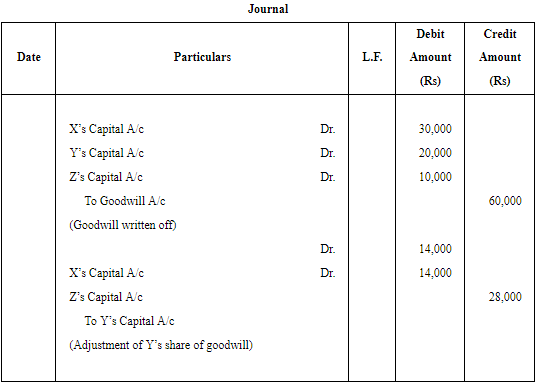

Question 18: X, Y and Z are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill is appearing in the books at a value of ₹ 60,000. Y retires and at the time of Y's retirement, goodwill is valued at ₹ 84,000. X and Z decided to share future profits in the ratio of 2 : 1. Pass the necessary Journal entries through Goodwill Account.

ANSWER:

Working Notes:

WN1: Calculation of Gaining Ratio

X :Y :Z=3:2:1(Old ratio)

X :Z = 2:1(New ratio)

Gaining Ratio = New Ratio - Old Ratio

X:Z=1:1

WN2: Calculation of Retiring Partner’s Share of Goodwill

Page No 6.79:

Question 19: A, B and C are partners sharing profits in the ratio of 4/9 : 3/9 : 2/9. B retires and his capital after making adjustments for reserves and gain (profit) on revaluation stands at ₹ 1,39,200. A and C agreed to pay him ₹ 1,50,000 in full settlement of his claim. Record necessary Journal entry for adjustment of goodwill if the new profit-sharing ratio is decided at 5 : 3.

ANSWER:

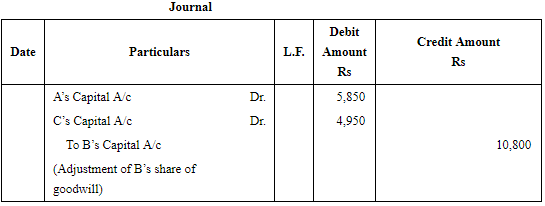

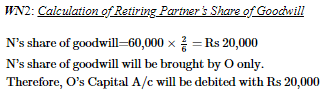

Working Notes

i. Calculation of B’s share of goodwill

A, B and C are sharing profits in ratio 4/9 : 3/9 : 2/9

B retires from the firm. Remaining partners agreed to pay him Rs 1,50,000

B’s capital after making necessary adjustments Rs 1,39,200

Therefore, Hidden Goodwill is Rs (1,50,000 – 1,39,200) i.e. Rs 10,800

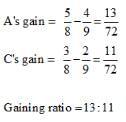

ii Gaining Ratio

New profit sharing ratio between A and B is 5:3

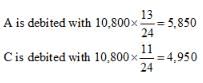

Thus, B’s share of goodwill will be brought in by A and C in the gaining ratio 13:11 i.e.

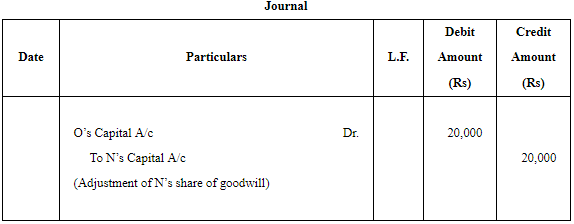

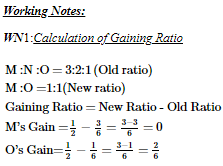

Question 20: M, N and O are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Goodwill has been valued at ₹ 60,000. On N's retirement, M and O agree to share profits equally. Pass the necessary Journal entry for treatment of N's share of goodwill.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Retirement/Death of a Partner (Part - 1) - Accountancy Class 12 - Commerce

| 1. What is retirement? |  |

| 2. How does retirement impact financial planning? |  |

| 3. What is the importance of retirement savings? |  |

| 4. What are some common retirement planning mistakes to avoid? |  |

| 5. What happens to retirement savings in the event of a partner's death? |  |