Weekly Current Affairs (8th to 14th May 2024) Part - 2 | General Test Preparation for CUET UG - CUET Commerce PDF Download

Socio-Ecological Impact of LPG Price Escalation

Context

- Recent study reveals heavy reliance on fuelwood despite government efforts to promote LPG.

- Highlights high LPG prices, environmental impact of fuelwood reliance, and need for accessible alternatives.

Key Findings

Dependence on Forests for Fuelwood:

- Local communities heavily rely on forests due to limited access to alternative cooking fuels.

Economic Constraints:

- Cost of commercial LPG cylinders is considered exorbitant for many households.

Government Initiatives:

- PMUY facilitated transition to LPG but price increase posed a challenge.

- Efforts to increase LPG penetration face hurdles due to high costs.

Environmental and Social Implications:

- Fuelwood usage contributes to forest degradation and human-wildlife conflicts.

Sustainable Alternatives:

- Collaborative efforts aim to promote sustainable forest management practices.

- Initiatives include planting high fuelwood value saplings and promoting efficient cooking stoves.

Government's Efforts to Promote LPG

- Launched schemes like Rajiv Gandhi Gramin LPG Vitrak to expand LPG distribution.

- Implemented programs such as 'PAHAL' and 'Give it Up' to encourage LPG adoption.

- Introduced PMUY to provide LPG connections and subsidies to below-poverty-line households.

Factors Driving High LPG Prices in India

Dependency on Imports:

- India heavily relies on imports for LPG, influencing pricing dynamics.

Import Dynamics:

- Import dynamics and global market trends significantly impact India's LPG prices.

Impact on Consumers:

- Taxes and dealer commissions contribute minimally to retail prices, with LPG costs dominating.

Potential Solutions for Reducing Fuelwood Dependency

Promoting Renewable Energy Sources:

- Encouraging adoption of solar, wind, and hydropower to reduce fuelwood reliance.

Improved Cookstoves:

- Distributing Improved Cookstoves can significantly reduce fuelwood consumption.

- Example: Projects in Nepal show that ICS use can halve fuelwood needs.

Alternative Fuels:

- Promoting biogas, pellets, or briquettes made from agricultural waste as sustainable energy sources.

Sustainable Forest Management:

- Ensuring sustainable forest practices to balance fuelwood extraction and regeneration.

Strengthening of Rupee

Context:

- The Indian Rupee has experienced a significant depreciation of about 27.6% against the US dollar over the last decade.

- However, when compared to major global currencies, the rupee has actually gained in real value.

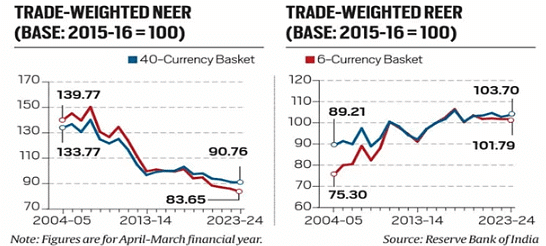

Decadal Journey

- Between 2004 and 2014, the rupee depreciated by 26.5% against the US dollar.

- From 2014 to 2024, it further depreciated by 27.6% against the US dollar.

- Overall, from 2004 to 2024, the rupee saw a decline of 32.2% in a 40-currency basket NEER and 40.2% in a 6-currency basket NEER.

- The average exchange rate against the US dollar dropped by 45.7% during this period.

Appreciation and Depreciation

- Appreciation and depreciation of currency signify changes in value concerning other currencies in the foreign exchange market.

- The rupee has shown a smaller depreciation against major trading partners compared to its fall solely against the US dollar.

Real Effective Exchange Rate

- The rupee has strengthened in real terms over time, especially when considering trade-weighted REER for both 40-currency and 6-currency baskets.

- Rupee's trade-weighted REER has generally increased, indicating a strengthening trend from 2004-05 to 2023-24.

Exchange Rate Overview

Definition:

- An exchange rate reflects the value at which one currency can be exchanged for another.

- It typically denotes the amount of one currency required to purchase a single unit of another currency.

Types:

- Fixed Exchange Rate: Set by governments or central banks, maintaining value via currency transactions in foreign exchange markets.

- Floating Exchange Rate: Determined by market forces of supply and demand.

- Managed Float: A hybrid system involving occasional government interventions for stability.

- Factors Influencing Exchange Rates:

- Interest Rates, Inflation, Economic Growth, Political Stability, and Supply and Demand dynamics collectively impact exchange rates.

Effective Exchange Rate (EER)

Definition:

- The Effective Exchange Rate (EER) represents a weighted average of a currency's exchange rates against others, adjusted for inflation and trade competitiveness.

- Currency weights are derived from individual countries' shares in India's total foreign trade.

Types:

- Nominal Effective Exchange Rate (NEER): A simple average of bilateral exchange rates weighted by trade shares, indicating overall currency strength or weakness without considering inflation.

- Real Effective Exchange Rate (REER): Adjusts NEER for inflation differences, providing a more accurate measure of trade competitiveness.

Implications of Currency Depreciation on Indian Economy

- Positive Impacts:

- Boosts Exports: Cheaper Indian products may lead to increased demand and higher export earnings.

- Inward Remittances: Weaker rupee benefits overseas workers sending more money home, potentially boosting disposable income.

- Negative Impacts:

- Higher Import Costs: Imported goods become pricier, potentially leading to inflation and affecting purchasing power.

- Costlier Foreign Debt: Repayment of foreign debt in a weaker rupee can strain government finances.

- Discourages Foreign Investment: A depreciating rupee may signal economic instability, deterring foreign investors.

Devaluation vs. Depreciation of Currency

- Devaluation:

- Occurs due to deliberate government actions to weaken the currency for economic benefits.

- Under a fixed exchange rate system, governments control the currency's value.

- Depreciation:

- Natural decline in currency value driven by market forces of demand and supply.

- In a floating exchange rate system, market dynamics determine the currency's value.

Question on Existence of Article 31C

Context:

- A recent nine-judge Bench of the Supreme Court has taken up the issue of the existence of Article 31C. This comes in light of a case addressing the government's authority to acquire and redistribute private property.

What is Article 31C?

About Article 31C:

- Article 31C safeguards laws formulated to promote societal objectives, ensuring the equitable distribution of community resources for the collective welfare (Article 39B).

- It aims to prevent the aggregation of wealth and resources to the detriment of the common good (Article 39C).

Introduction of Article 31C:

- Enacted in 1971 through the 25th Constitutional Amendment in response to the R.C. Cooper v. Union of India case (Bank Nationalisation Case,1969).

- In this instance, the Supreme Court nullified the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1969 due to issues concerning the compensation offered.

Purpose of Article 31C:

- Article 31C shields directive principles (Articles 39B and 39C) from being contested on grounds of equality (Article 14) or rights under Article 19 (freedoms like speech and peaceful assembly).

Legal and Constitutional Challenges Associated with Article 31C

Kesavananda Bharati Case (1973):

- The Supreme Court introduced the "basic structure doctrine," positing that certain core aspects of the Constitution are beyond Parliament's alteration.

- A segment of Article 31C was invalidated, establishing that laws tied to specific government policies cannot evade scrutiny for failing to fulfill their intended goals.

Constitution (Forty-second) Amendment Act, (CAA) 1976 and Minerva Mills Case (1980):

- The CAA, 1976 broadened Article 31C's protective scope to encompass all directive principles outlined in Articles 36-51.

- Sections 4 and 5 of the CAA, 1976 curtailed the courts' authority to challenge constitutional amendments, emphasizing the primacy of implementing directive principles over certain fundamental rights.

- The Minerva Mills Case (1980) overturned clauses 4 and 5 of the CAA, 1976, highlighting constraints on Parliament's extensive amending powers.

Arguments Regarding Article 31C

Argument Against Automatic Revival:

- The original Article 31C was entirely replaced by an expanded version in the 42nd Amendment. Consequently, the original provision couldn't automatically revive post its annulment.

- Legal principle dictates that once substituted, the original ceases to exist unless explicitly reinstated.

Argument for Doctrine of Revival:

- The doctrine of revival advocates for the automatic reinstatement of the original Article 31C.

- Precedents such as the National Judicial Appointments Commission ruling suggest that if subsequent amendments are invalidated, the pre-amended Article 31C should resurface.

Indian Space Situational Assessment Report 2023

Context:

- The Indian Space Research Organisation (ISRO) has published the Indian Space Situational Assessment Report (ISSAR) for 2023. This report offers a detailed overview of India's space assets and their susceptibility to potential space collisions.

Key Highlights of ISSAR 2023 Report

Space Object Population:

- Global Increase: In 2023, a total of 3,143 objects were introduced globally through 212 launches and on-orbit breakup events.

- Indian Additions: India contributed 127 satellites by the end of December 2023, including successful launches such as SSLV-D2/EOS7, LVM3-M3/ONEWEB 2, and more.

Indian Space Assets:

- Operational Satellites: India had 22 operational satellites in Low Earth Orbit (LEO) and 29 in Geostationary Orbit (GEO) by December 31, 2023.

- Deep Space Missions: Active missions include Chandrayaan-2 Orbiter, Aditya-L1, and Chandrayaan-3 Propulsion Module.

Space Situational Awareness Activities:

- ISRO regularly analyzes and predicts close approaches by other space objects to safeguard its assets.

- About 1 lakh close approach alerts were received from USSPACECOM, with over 3,000 alerts for close approaches within a 1 km distance for ISRO satellites.

Collision Avoidance Maneuvers (CAMs):

- ISRO conducted 23 CAMs in 2023 to protect Indian space assets, showcasing a notable increase compared to previous years.

Satellites Re-entry:

- In 2023, 8 Indian satellites successfully re-entered, including the controlled de-orbiting of Megha-Tropiques-1, demonstrating ISRO's commitment to responsible space debris management.

International Cooperation on Space Sustainability:

- ISRO actively engages in various international forums and initiatives to address space debris and ensure the long-term sustainability of outer space activities.

- ISRO, as the chair of IADC for 2023-24, hosted the 42nd annual IADC meeting, contributing significantly to discussions on space sustainability.

Challenge of Space Debris:

- The report acknowledges the persisting challenge of space debris, noting the presence of 82 rocket bodies from Indian launches in orbit.

Way Forward

- Establish a global framework for Space Traffic Management (STM) to standardize procedures for collision avoidance and inter-operator coordination.

- Promote responsible space practices, including debris mitigation measures and sustainable satellite deployment.

- Encourage innovation in active debris removal and on-orbit servicing technologies.

- Facilitate international collaboration to share resources, expertise, and data for enhanced space situational awareness.

- Review and update space regulations to adapt to the evolving needs of the space sector and raise awareness about space sustainability.

Allegations of Child Labour in Trade Negotiations with Australia

Context:

- Indian Ministry of Commerce and Industry denies child labour allegations from Australia's Joint Standing Committee on Trade and Investment Growth.

- Allegations emerged during ongoing negotiations for the Comprehensive Economic Cooperation Agreement (CECA) between India and Australia.

Allegations by the Australian Panel

- Australian report raised concerns about child and forced labour in India based on claims by the CPSU and SPSF Group.

- Recommendation to include human rights, labour, and environmental chapters in trade agreements aligning with UN and ILO conventions.

Facts Supporting Australia's Claim

- Walk Free's 2023 Global Slavery Index estimated 11 million people in modern slavery in India in 2021.

- India's Census 2011 showed 10.1 million child workers aged 5-14 and more than 42.7 million out-of-school children.

India's Response

- Indian government refutes allegations, citing existing rules against child and bonded labour.

- Constitution safeguards labour rights and empowers governments to enact laws like the Bonded Labour System (Abolition) Act, 1976.

- All businesses in India must comply with labour laws and maintain comprehensive records.

India's Legal Framework on Child and Forced Labour

- Constitutional articles like 23, 24, and 39 protect against forced labour and child exploitation.

- Legislations like the Child Labour (Prohibition & Regulation) Act, 1986, and Juvenile Justice Act, 2015, combat child labour.

- Efforts like the National Policy on Child Labour (1987) and RTE Act, 2009, focus on child welfare and education.

Legislations Against Forced Labour

- Bonded Labour System (Abolition) Act, 1976, criminalizes bonded labour and provides for rehabilitation.

- Central Sector Scheme for Rehabilitation of Bonded Labourer aids in the financial recovery of freed bonded labourers.

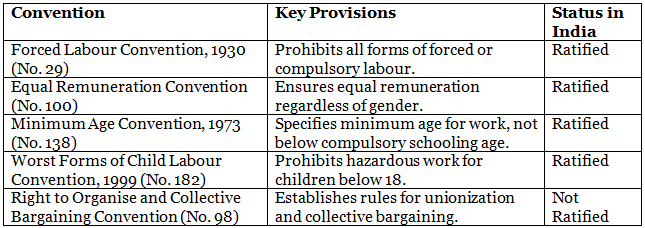

ILO Conventions on Child Labour

Vietnam Push for Non-Market Economy Status

Context:

- Vietnam has requested the United States to swiftly change its classification from "non-market economy" to "market economy."

- This shift would be beneficial for Vietnam as goods imported from Southeast Asian nations currently face high import taxes.

USA's Concept of Non-Market Economies (NME)

About:

- In the United States, a Non-Market Economy (NME) pertains to any foreign nation identified by the US Department of Commerce as not adhering to market-based cost or pricing structures.

- Consequently, sales of goods in these countries might not accurately reflect their fair value.

Criteria:

The US designates a country as a non-market economy based on various factors, such as:

- If the country's currency is convertible.

- If wage rates are determined through free bargaining between labor and management.

- If joint ventures or foreign investments are permitted.

- Whether the means of production are state-owned.

- If the state controls resource allocation, prices, and output decisions.

- Other considerations like human rights.

Anti-Dumping Duty on Non-market Economy:

- The classification of a 'non-market economy' enables the US to impose Anti-dumping duties on imports from designated countries.

- Dumping in international trade occurs when a country deliberately sells its exports at lower prices than domestic prices, harming industries in the importing nation.

Determining the Level of Anti-Dumping Duty

- The US establishes anti-dumping duties for non-market economies like Vietnam by comparing the product's value to a third country, such as Bangladesh, considered a market economy.

- This comparison assumes the production cost for companies in non-market economies.

NME and World Trade Organisation (WTO)

- The WTO does not explicitly recognize NME status but permits members to use alternative methodologies to calculate normal values in anti-dumping investigations.

- The WTO Antidumping Agreement allows flexibility for members to select an appropriate methodology for NMEs without specifying a particular approach.

Vietnam's Arguments Regarding its Non-Market Economy (NME) Status

Vietnam's Arguments:

- Currency Convertibility: Vietnam's currency is transparently convertible based on market principles.

- Wage Determination: Wage rates result from free negotiations between labor and management.

- Foreign Investment: Vietnam welcomes foreign investment and has become an appealing destination for it.

- Means of Production: The government does not significantly own or control production means.

- Resource Allocation: The government lacks significant control over resource allocation and price/output decisions.

- Market Principles: Vietnam's economy functions on market principles encompassing legal frameworks, corporate governance, and diverse foreign relations.

- Flaws in Calculations: Vietnam's Center for WTO and International Trade highlights flaws in the method used to compute anti-dumping duties, leading to artificially high dumping margins that don't truly reflect Vietnamese companies' practices.

US Apprehensions:

- The US Commerce Department is evaluating Vietnam's status.

- US steelmakers and the American Shrimp Processors Association oppose changing Vietnam's status to a market economy.

- They cite Vietnam's restrictions on land ownership, weak labor laws, and reduced shrimp duties as reasons for their stance.

- A change in Vietnam's status could benefit Chinese state firms invested in Vietnam by making it easier to avoid US tariffs.

|

164 videos|626 docs|1132 tests

|