Will under Muslim Law | Civil Law for Judiciary Exams PDF Download

Introduction

- Harmonious Balance: In Muslim Law, a Will signifies a balance between two inclinations, ensuring assets are distributed among rightful heirs as a divine decree.

- Moral Obligation: It is the duty of every Muslim to make provisions for the distribution of their estate after their death.

Meaning and Nature of Will under Muslim Law

- Definition: A Will, termed 'Wasiyat' in Islamic law, is a legal document enabling the transfer of property to chosen beneficiaries upon the testator's demise.

- Key Terminology: The testator executing the Will is the 'legator,' while the beneficiary is the 'legatee.' The Prophet stressed that testamentary powers should not harm rightful heirs.

- Validity Rules: Islamic law permits a Muslim to bequeath assets up to one-third of their property. Beyond this limit, consent from legal heirs is obligatory, irrespective of the intended beneficiary.

- Operative Mechanism: A Will allows a voluntary transfer of ownership through a testamentary document, becoming effective post the testator's death, functioning as a testamentary gift.

Understanding the Requirements for a Valid Will in Islamic Law

- Competence of the Testator: The individual creating a Will in accordance with Muslim Law must be of sound mind and possess the legal capacity to draft a Will.

- Eligibility of the Recipient: The person designated to receive the inheritance must meet the necessary legal criteria to inherit as per Islamic law.

- Property Eligibility: The assets being gifted in the Will must be capable of being legally bequeathed under Islamic principles.

- Consent of Parties: Both the person making the Will and the recipient must willingly agree to the terms outlined in the Will without any coercion.

- Ownership Rights: The individual making the Will must have the rightful ownership and authority over the property being gifted.

For instance, when we talk about the Competence of the Testator, it means that the person creating the Will must be in a sound mental state and possess the necessary legal capacity to understand the implications of the Will they are drafting. In simpler terms, they should be of a clear mind to make decisions about who gets their assets after their passing.

Similarly, Eligibility of the Recipient highlights the importance of ensuring that the person intended to inherit the assets meets the legal requirements set forth by Islamic law. This ensures that the transfer of wealth is done in accordance with the religious guidelines.

Moreover, Property Eligibility emphasizes that the assets being gifted must be legally transferable according to Islamic principles. This requirement ensures that the distribution of assets is valid and conforms to the legal framework.

Furthermore, Consent of Parties stresses the significance of both the testator and the recipient agreeing to the terms of the Will without any form of pressure. This mutual agreement ensures that the distribution of assets is done in a fair and transparent manner.

Lastly, Ownership Rights underscore the necessity for the testator to have the legal authority and ownership over the assets being bequeathed. This criterion ensures that the testator has the rightful control and possession of the property they intend to distribute.

Who is eligible to create a Will under Muslim Law?

- Muslim Identity:

- A Will under Muslim Law is considered valid only if the individual creating it is a Muslim.

- Change in Religious Status:

- Even if a person renounces Islam after creating a Will, the Will remains valid according to Muslim law.

- School of Thought:

- The rules governing a Will depend on the school of thought the individual belongs to at the time of making the Will.

- Soundness of Mind:

- The individual must be of sound mind while creating the Will, understanding the implications of their actions.

- If the individual becomes insane after creating the Will, the Will becomes void.

- Age of Majority:

- The individual must have reached the age of majority, which is typically 18 years, to create a valid Will under Muslim Law.

- If a minor creates a Will, it is considered void until they reach the age of majority and validate the Will.

- Attempted Suicide by Legator:

- Under Shia law, a Will executed by a person who attempted suicide is void due to presumed mental instability.

- However, Sunni law considers a Will valid even if created after an attempted suicide.

- Consent of the Legator:

- Free consent of the individual creating the Will is crucial for its validity.

- Any Will created under coercion, undue influence, or fraud is considered null and void.

This HTML structure summarizes the eligibility criteria for creating a Will under Muslim Law, highlighting key points such as the requirement of Muslim identity, soundness of mind, age of majority, and the importance of free consent. Each criterion is explained in detail with simplified language and examples where necessary.

Who Can Inherit Property through a Will in Islamic Law?

Person Eligibility

- A person designated to inherit a property through a Will must be alive at the time of the testator's passing. This ensures that the inheritance is received by someone who exists when the Will comes into effect.

Non-Discrimination

- A Will can be created in favor of individuals regardless of their religion, age, mental capacity, or other characteristics. The key requirement is that the intended beneficiary must be alive and legally qualified to receive the inheritance. This means minors, non-Muslims, and mentally incapacitated individuals can be rightful heirs under Islamic law.

- Furthermore, charitable or religious organizations can also be beneficiaries of a Will, and it is valid for them to receive assets as per Islamic legal principles.

Unborn Child's Inheritance

- According to Islamic law, a child in the mother's womb is considered a living entity and can inherit under specific conditions. Firstly, the child must be in the womb at the time the Will is made. Secondly, the child must be born alive within six months (Sunni law) or ten months (Shia law) after the Will's creation to be eligible for inheritance.

Legatee's Conduct

- There is a concern that a greedy beneficiary might resort to unlawful means, such as causing the testator's demise, to expedite the inheritance process.

- Under most circumstances, a legatee who causes the death of the testator deliberately or accidentally is disqualified from inheriting under the Will. However, Shia law may permit unintentional or negligent actions by the legatee in certain cases.

Legatee's Consent

- Prior to the transfer of ownership through a Will, the legatee's consent is crucial. The legatee must indicate their willingness to accept the inheritance, either explicitly or implicitly.

- It is within the legatee's rights to reject the bequest under Islamic law. If a beneficiary decides not to accept the inheritance, the Will becomes null and void.

Joint Legatee

- There are situations where a person making a Will names multiple beneficiaries, known as joint legatees.

- When a Will is created under Muslim Law for joint legatees, there are two primary scenarios:

Where the Share is Specified

- If the individual making the Will clearly outlines the share of each beneficiary, there is no confusion about how the property will be distributed.

- For example, if a person leaves a Will for their three sons with a distribution ratio of 3:2:1 for S1, S2, and S3 respectively, the property will be divided accordingly.

Where the Share is Not Specified

- In cases where the share of each beneficiary is not explicitly mentioned, the property is assumed to be divided equally among them.

- When a Will is made for a group of people under Muslim Law, the group is considered a single beneficiary, and each individual within the group gets an equal share.

- For instance, if a person's Will states that the property is to be given to a mosque and the poor in the local area, half will go to the mosque, and the other half will be equally divided among the poor individuals.

What are the Modes of Execution of Will under Muslim Law

- Intention as Key: In Muslim law, specific formalities for executing a Will are absent. The crucial factor lies in the explicit, clear, and unequivocal intention of the legator.

- Oral Will: A simple oral declaration can suffice as a valid Will. While no set process is mandated, proving an oral Will can be challenging and demands substantial corroborative evidence regarding details like date, time, and place.

- Written Will: A Will declared in writing need not adhere to any specific form. The legator's signature or witness attestation is unnecessary. The document's name is immaterial as long as it embodies the essential characteristics of a Will.

- Gestural Will: Islamic law permits a Will to be made through gestures. For instance, if a sick individual, unable to speak, conveys intentions through nods and subsequently passes away without regaining speech, the gesture-based bequest remains valid.

The Subject Matter of a Will under Islamic Law

- Any Property Can Be Included: In Islamic law, any type of property, whether physical or non-physical, movable or immovable, is permissible to be included in a Will.

- Conditions for Inclusion: For a property to be included in a Will, two conditions must be met:

- Ownership at the Time of Death: The person making the Will (legator) must own the property at the time of their death.

- Illustrative Example: For instance, if 'A' writes a Will leaving all their possessions to 'B', 'A' must be the rightful owner of the property at the time of their passing. Even if new properties are acquired after creating the Will, they will also be included in the bequest.

- Transferable Property: The property intended to be transferred through the Will must be capable of being transferred as per Islamic law.

- Legal Restrictions: The property should not be restricted by any legal limitations that would hinder its transfer.

Restrictions on Testamentary Powers under Islamic Law

Limitation on Bequest Amount

- A Muslim is permitted to draft a Will for his assets amounting to a maximum of one-third of his total bequeathable property.

- This one-third restriction is calculated after subtracting expenses like debts and funeral costs.

- Any bequest surpassing the one-third limit will not be valid unless the legator's heirs approve it.

- In the absence of consent from the heirs, the bequest remains valid only up to one-third, with the remaining two-thirds distributed based on intestate succession laws.

- However, if a Muslim lacks legal heirs, he can bequeath his assets to anyone and in any amount without being bound by the one-third limit.

- Yet, if a Muslim bequeaths his assets to a non-heir or a stranger, the approval of legal heirs is necessary if the bequest exceeds one-third of his total property.

Consent of Legal Heirs

- The agreement of the other legal heirs of the legator holds significance when the legatee is one of the heirs, irrespective of the bequest amount.

- This rule aims to prevent potential sibling rivalry and discord among heirs that may arise if one heir is favored in the Will as per Islamic Law.

- In Shia law, no differentiation exists between an heir and a non-heir, allowing a bequest for up to one-third of the property to anyone.

Therefore, Shia law offers more flexibility in making a Will compared to Sunni law, as it imposes fewer restrictions on testamentary powers.

Revocation of a Will under Muslim Law

Legator's Right to Revoke: A legator in Islamic law has the freedom to revoke a Will or any part of it at any time, as this right is seen as empowered for the legator.

Express Revocation

- Express revocation can occur through oral or written means.

- For instance, if a legator leaves a property to someone in a Will and then creates a new Will giving the same property to another individual, the initial Will is automatically void.

- If a legator deliberately destroys the Will by burning or tearing it, this is also seen as express revocation.

- Mere denial of a Will is not enough for revocation; there must be a clear action indicating the intent to revoke.

Implied Revocation

- Implied revocation happens when the legator's actions contradict the bequest in the Will, causing the subject-matter of the bequest to no longer exist.

- For example, if a legator leaves land to someone in a Will and later builds a house on that land, sells it, or gifts it to another person, the Will is considered revoked.

- In both express and implied revocation, the legator's clear intention to revoke is crucial. This intent can be shown through actions or declarations altering the bequests made in the Will.

Construction of a Will under Islamic Law

Interpreting a Will

- When an individual drafts a Will in Islamic law, it is interpreted according to the principles of Islamic jurisprudence.

- The Will is designed to be executed post the individual's demise, aiming to fulfill their intentions.

Role of Heirs in Interpretation

- Heirs are often entrusted with the task of interpreting a Will in case of unclear language or ambiguous intentions.

- Heirs hold the authority to collectively decipher and clarify the Will's content.

- For instance, if a Will assigns a house and a shop to two sons without specifying each property, heirs can decide on the distribution.

Flexibility in Interpretation

- This approach grants flexibility to heirs in making decisions that align with the legator's intent.

- Heirs consider family circumstances and needs when interpreting the Will.

- Encourages consensus and cooperation among heirs to resolve uncertainties or ambiguities in the Will.

Abatement of Legacies

- Abatement refers to reducing the legacies of beneficiaries to follow the rule of bequeathing only one-third of the property.

- In Sunni law, abatement occurs proportionally, meaning each beneficiary's share is decreased according to the ratios specified in the Will, while maintaining equal distribution.

- Conversely, in Shia law, abatement is preferential. The distribution is based on the order of preference as per the Will, with the first legatee mentioned receiving their full share before passing on the remaining property.

- The distribution process in Shia law continues in order of preference until one-third of the property is allocated.

Distribution of Property under Will in Muslim Law

Sunni and Shia laws have different approaches to property distribution under a will.

Sunni Law

- When bequeathable property exceeds one-third of the total property, rateable distribution is applied.

- Beneficiaries receive property in specific ratios, and abatement is done proportionally to maintain fairness.

- Example: If A bequeaths property to B and C in a 2:1 ratio, and abatement is required, both B and C's shares are reduced in the same ratio.

Shia Law

- Preferential distribution is followed when bequeathable property exceeds one-third.

- If heirs reject the excess, there is no reduction in legatees' shares.

- Property distribution follows the order of preference as mentioned in the Will.

- Example: If A mentions B first and C second, B receives their full share before C receives anything.

Rules of abatement and distribution can vary among Islamic schools of law and may be influenced by local customs. Consulting an Islamic scholar or legal expert for precise guidance in specific cases is advisable.

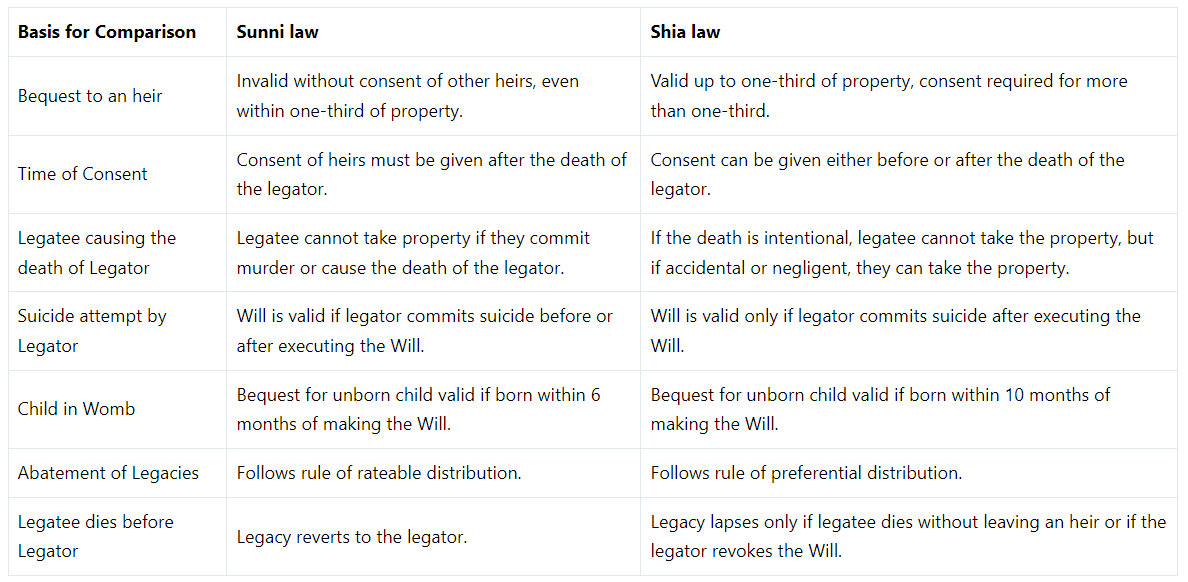

Comparison of Sunni and Shia Law of Will under Muslim Law

Conclusion

- Definition of a Will: A Will, in the legal context, is a document that allows a person (legator) to specify how their property should be distributed after their death.

- Purpose of a Will: Creating a Will enables the legator to have control over who inherits their assets, deviating from the rigid rules of inheritance under Islamic law.

- Flexibility in Distribution: Through a Will, the legator can include individuals not typically entitled to inherit under Islamic law, ensuring a fair distribution according to their wishes.

- Rectifying Estate Distribution: The Islamic law of Will provides an opportunity for the legator to adjust the distribution of their estate, accommodating personal preferences and rectifying any imbalances.

- Balance in Testamentary Disposition: While allowing for personal choices in property distribution, Islamic law ensures a fair balance between testamentary wishes and the rights of legal heirs as outlined in Islamic inheritance principles.

|

363 docs|256 tests

|

FAQs on Will under Muslim Law - Civil Law for Judiciary Exams

| 1. Who is eligible to create a Will under Muslim Law? |  |

| 2. Who Can Inherit Property through a Will in Islamic Law? |  |

| 3. What are the Modes of Execution of Will under Muslim Law? |  |

| 4. What are the Restrictions on Testamentary Powers under Islamic Law? |  |

| 5. How can a Will be revoked under Muslim Law? |  |