Worksheet Solutions: Dissolution of a Partnership Firm | Accountancy Class 12 - Commerce PDF Download

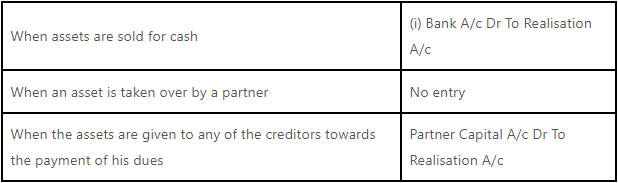

Q1: Match the following

Choose the correct option from below

(a) a(iii), b(ii), c(i)

(b) a(i), b(iii), c(ii)

(c) a(ii), b(iii), c(i)

(d) a(i), b(ii), c(iii)

Ans: (b)

Situation 1 : When assets are sold for cash (Bank A/c Dr. and Realisation A/c Cr.)

Situation 2 : When asset is taken over by a partner (Partner’s Capital A/c Dr. and Realisation A/c Cr.)

Situation 3 : When the assets are given to any of the creditors towards the payment of his dues (No Entry in such case).

Q2: Name the Account which is prepared for finding the profit or loss on getting amount from selling of all assets and paying amount of liabilities.

(a) Dr. side of Realisation Account

(b) Dr. side of Revaluation Account

(c) Realisation Account

(d) Cr. Side of Revaluation Account

Ans: (c)

Realisation account is nominal account. assets sold are recorded on the credit side and liabilities paid off are recorded on the debit side. if credit side is more it is profit and if the debit side is more it is loss.

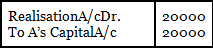

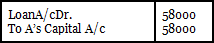

Q3: What should be the journal entry when A takes over loan payable to Mrs. A ₹20000

(a)

(b)

(c)

(d)

Ans: (a)

When a liability is taken over by a partner, in such a case do not use cash/bank account for the settlement of that liability.

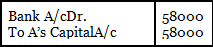

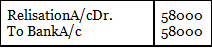

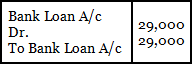

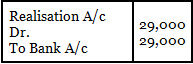

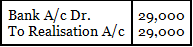

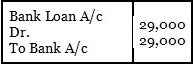

Q4: Bank Loan ₹29,000 was paid at the time of dissolution. What journal entry will be recorded for the same?

(a)

(b)

(c)

(d)

Ans: (b)

Repayment of bank loan will take place in debit side of realization account. This transaction will effect only two accounts i.e. Realisation Account and Bank Account.

Q5: As per which section of the Indian Partnership Act, 1932, at the suit of a partner, the Court may dissolve a firm?

(a) Section 04

(b) Section 44

(c) Section 48

(d) Section 31

Ans: (b) Section 44 of the Indian Partnership Act, 1932 states that at the suit of a partner, the Court may dissolve a firm.

Q6: At the time of the dissolution of the firm, how undistributed profits such as General Reserve, Credit Balance of P&L A/C are dealing with?

Ans: Undistributed profits are distributed among all partners in their profit-sharing ratio in the Cr side of respective partner’s capital account.

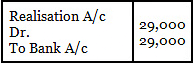

Q7: The firm of Ravi and Mohan was dissolved on 1.3.2013. According to the agreement Ravi had agreed to undertake the dissolution work for an agreed remuneration of Rs.2,000 and bear all realisation expenses. Dissolution expenses were Rs. 1,500 and the same were paid by the firm. Pass necessary journal entry for the payment of dissolution expenses.

Ans: Journal

Note: As Ravi is supposed to bear the Realisation Expenses so if these are paid by the firm; the firm has right to recover it from Ravi. Hence, Ravi’s account has been debited and Bank account has been credited.

Q8: When an asset is taken over by a partner, why is his capital account debited?

Ans: It is debited because the partner’s claim over the firm is decreased by the amount of asset taken over by him, thus his capital account is decreased.

Q9: What is the dissolution of partnership?

Ans: Dissolution of partnership refers to the change in the existing relations of the partners. The firm continues its business.As one or more than one can partner take over the overall business of the firm.

Q10: Identify a situation, under which court may order for dissolution of a partnership firm.

Ans: A court may order for dissolution of a partnership firm on insolvency of all the partners or all the partners except one become insolvent.

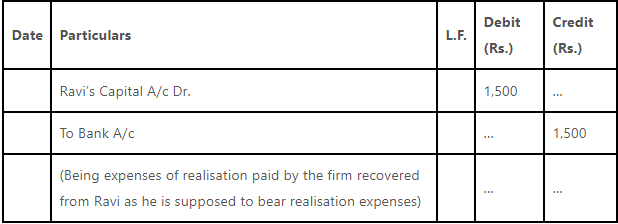

Q11: Pass Journal entries in the following cases-

(i) Expenses of Realisation Rs. 1,500

(ii) Expenses of Realisation Rs. 600, but paid by Mohan, a partner,

(iii) Mohan, one of the partners of the firm, was asked to look into the dissolution of the firm for which he was allowed a commission of Rs. 2,000.

(iv) Motor car of book value 50,000 taken over by creditors of the book value of Rs. 40,000 in final settlement.

Ans: Journal

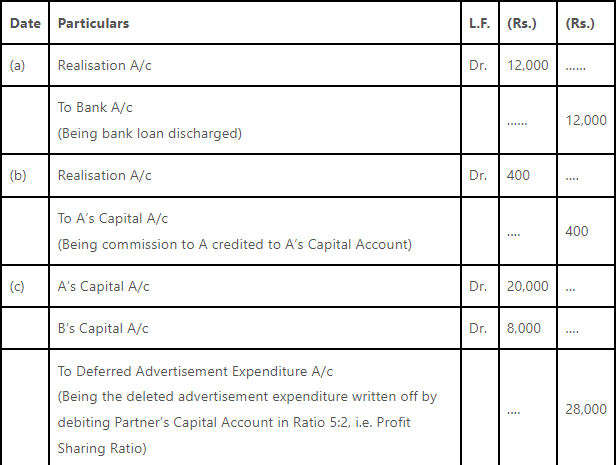

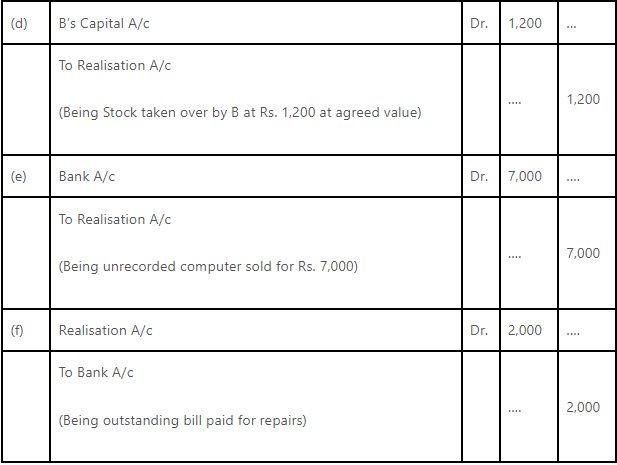

Q12: A and B share profits and losses in the ration of 5:2. They have decided to dissolve the firm. Assets and external liabilities have been transferred to Realisation A/c. Pass the Journal Entries to affect the following:

- Bank Loan of Rs. 12,000 is paid off.

- A was to bear all expenses of Realisation for which he is given to commission of Rs. 400.

- Deferred Advertisement Expenditure A/c appeared in the book at Rs. 28,000.

- Stock worth Rs. 1,600 was taken over by B at Rs. 1,200.

- As unrecorded Computer realized Rs. 7,000.

- There was an outstanding bill for repairs for Rs. 2,000. Which was paid off.

Ans: Journal

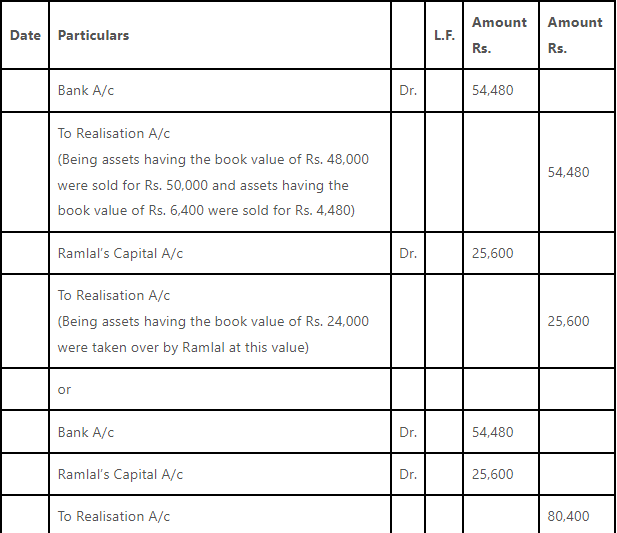

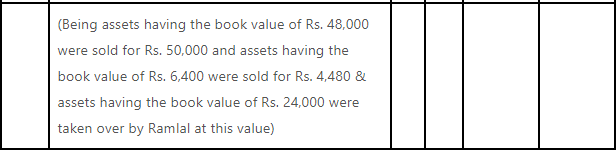

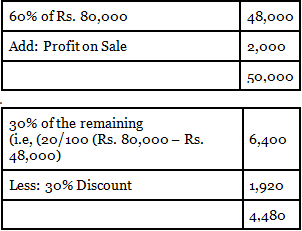

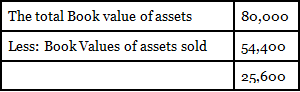

Q13: The amount of sundry assets transferred to Realisation Account was Rs 80,000. 60% of them have been sold at a profit of Rs. 2,000. 20% of the remaining were sold at a discount of 30% and remaining were taken over by Ramlal (a partner) at book value. Journalise.

Ans: JOURNAL

Working Notes :

- Calculation of amount realised from assets

Total amount realised from assets Rs. 50,000 + Rs. 4,480 = Rs. 54,480 - Calculation of value of assets taken off by Ramlal

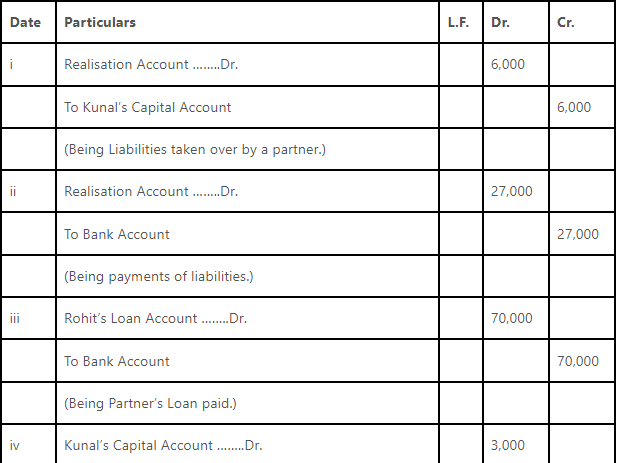

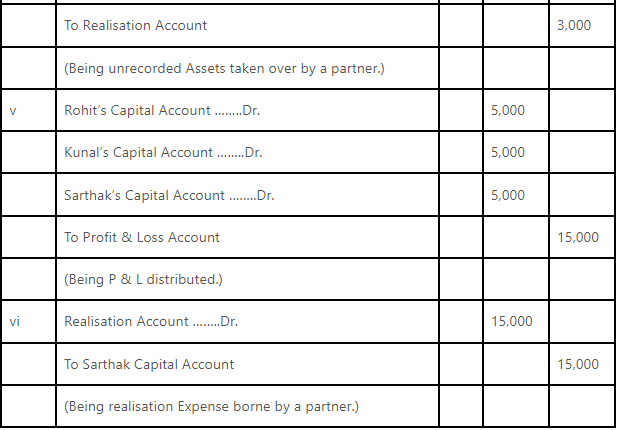

Q14: Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other then Cash and Bank) and the third party liability have been transferred to Realisation Account:

- Kunal agreed to pay off his wife’s loan of Rs. 6,000.

- Total Creditors of the firm were Rs. 40,000. Creditors worth Rs. 10,000 were given a piece of furniture costing Rs. 8,000 in full and final settlement. Remaining Creditors allowed a discount of 10%.

- Rohit had given a loan of Rs. 70,000 to the firm which was duly paid.

- A machine which was not recorded in the books was taken over by Kunal at Rs. 3,000 whereas its expected value was Rs. 5,000.

- The firm had a debit balance of Rs. 15,000 in the Profit and Loss Account on the date of dissolution.

- Sarthak paid the realisation expenses of Rs. 16,000 out of his private funds, who was to get a remuneration of Rs. 15,000 for completing dissolution process and was responsible to bear all the realisation expenses.

Ans: Journal Entries

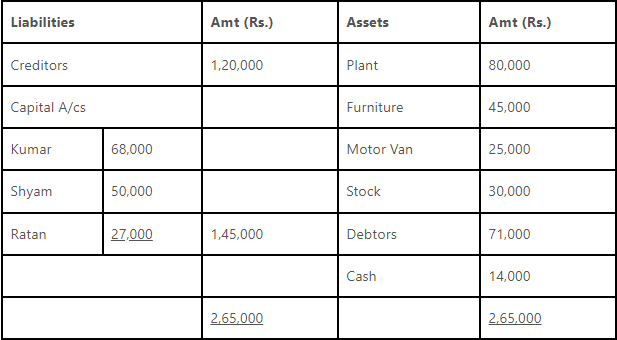

Q15: Kumar, Shy am and Ratan were partners in a firm sharing profits in the ratio of 5: 3 : 2 respectively. They decided to dissolve the firm with effect from 1st April, 2013. On that date, the balance sheet of the firm was as follows Balance Sheet as at 1st April, 2013

The dissolution resulted in the following

- Plant of Rs. 40,000 was taken over by Kumar at an agreed value of Rs. 45,000 and remaining plant realised Rs. 50,000.

- Furniture realised Rs. 40,000.

- Motor van was taken over by Shyam for Rs. 30,000.

- Debtors realised Rs. 1,000 less.

- Creditors for Rs. 20,000 were untraceable and the remaining creditors were paid in full.

- Realisation expenses amounted to Rs. 5,000.

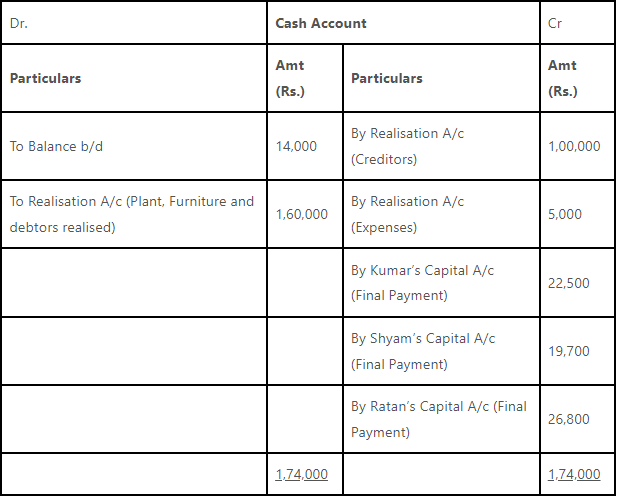

Prepare the realisation account, capital accounts of partners and bank account of the firm.

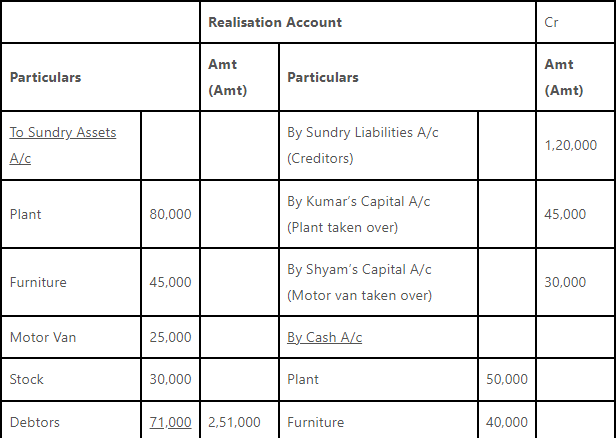

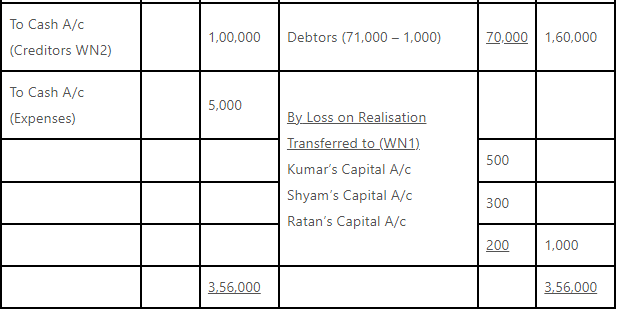

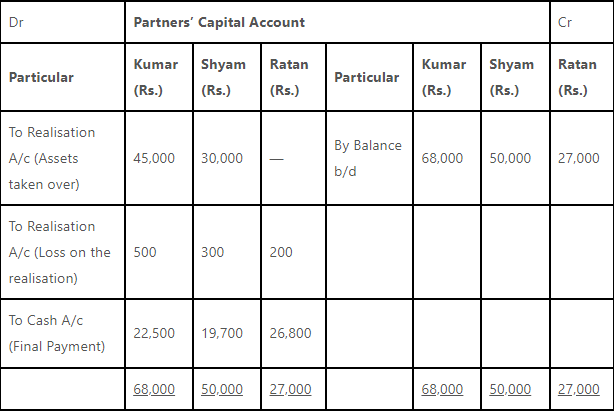

Ans:

NOTE : In the absence of any information of realisation of an asset, it has been assumed that nothing is realised from that asset (e.g. stock in this case).

working notes:

1. Loss on Realisation = 1,000

Loss on Realisation transferred to Kumar’s capital account = 1,000×5/10 = 500

Loss on Realisation transferred to Shyam’s capital account = 1,000 × 3/10 = 300

Loss on Realisation transferred to Ratan’s capital account=1,000 × 2 = 200

2. Creditors = 1,20,000

Out of which 20,000 were untraceable

So the creditors were paid in full settlement amounting 1,20,000 – 20,000 = 1,00,000.

|

42 videos|168 docs|43 tests

|