Revision Notes: Consolidaated Fund, Contingency Fund and the Finance Commission | Indian Polity for UPSC CSE PDF Download

| Table of contents |

|

| Introduction |

|

| Contingency Fund of India |

|

| Finance Commission |

|

| Grants and Loans |

|

| Central Superiority |

|

| Recent Developments |

|

Introduction

The Consolidated Fund of India is a vital financial account where all the money received by or on behalf of the Government of India is deposited. This includes funds collected through various means such as revenues, fresh loans, and repayments of loans.

- Revenues refer to the income generated by the government through taxes and other sources.

- Fresh loans are the new loans taken by the government, while repayment of loans involves the money received back from loans previously given by the government.

It is important to note that money can only be spent from this fund with the approval of the Parliament. This ensures that there is proper oversight and control over government spending, maintaining transparency and accountability in the financial dealings of the government.

Contingency fund of India

Contingency fund of India

However, certain expenses have been charged onthe Consolidated Fund of India and can be drawn without the sanction of the Parliament. Some of the expenses charged on the Consolidated Fund of India include

- salary and allowances of the President and other expenses on his office

- debt charges of the Government of India

- salaries, allowances and pensions of judges of the Supreme Court and High Courts

- salaries, allowances and pensions of the Comptroller and Auditor General of India

- sums payable as a result of judgement, decree or award of a court or arbitral tribunal

- other expenses declared by the Constitution or Parliament to be chargeable to the Consolidated Fund

Contingency Fund of India

The Contingency Fund of India was constituted through an act of Parliament in 1950 in exercise of powers vested in it by Article 267 of the Constitution. The Fund has been placed at the disposal of the President. He can make advance out of this fund to meet unforeseen expenses. However, these expenses must be subsequently authorised by Parliament and recovered through supplementary, additional, or excess grants.

Finance Commission

According to Article 280 of the Constitution it is to be constituted by the President once every five years and consists of a Chairman and four other members appointed by the President. Their qualifications were to be determined by Parliament. The duty of the Commission is to make recommendations to the President as to:

- the distribution between the Union and the States of the net proceeds of taxes which are to be divided between them and the allocation between the States themselves of the respective shares of such proceeds;

- the principles which should govern the grants-inaid of the revenues of the States out of the Consolidated Fund of India;

- any other matter referred to the Commission by the President in the interests of sound finances.

According to the Finance Commission Act of 1951,the Chairman of the Commission must be a person having ‘experience in public affairs’, the other four members must be from among the following:

- a High Court Judge or one qualified to be so;

- a person having special knowledge of the finances and accounts of the governments,

- a person having wide experience in financial matters and administration;

- a person with special knowledge of economics.

Reservation of a Bill by Governor:

- A Governor usually reserves for the consideration of the President, any Bill which, in the Governor’s opinion, would be derogatory to the powers of the High Court if it became law, and endanger the position of that Court (Art. 200).

- When a Bill is so reserved, the President has two options—either (a) he declares that he assents to the Bill, or (b) he withholds his assent to the Bill.

- The power vested in the Governor in this regard is discretionary.

- In the event of the Bill not being a Money Bill, the President may direct the Governor to return the bill to the House which, after reconsideration, may pass it with or without amendment, within six months; the Bill is re-presented to the President for his consideration.

- The President is not, however, bound to give his assent.

- If he chooses to withhold the bill, it is deemed to be vetoed.

Distribution of Taxes

Tax Revenue Distribution Between the Union and the States

Tax revenue in India is distributed between the Union and the States based on specific categories of taxes and duties. Here's a detailed breakdown:

(i) Taxes Belonging to the Union Exclusively

- Customs Duties

- Corporation Tax

- Taxes on the Capital Value of Assets of Individuals and Companies

- Surcharge on Income Tax

- Fees for Matters Listed in the Union List (List I)

(ii) Taxes Belonging to the States Exclusively

- Land Revenue

- Stamp Duty (except for documents included in the Union List)

- Succession Duty, Estate Duty, and Income Tax on Agricultural Land

- Taxes on Passengers and Goods Carried on Inland Waterways

- Taxes on Lands and Buildings, Mineral Rights

- Taxes on Animals and Boats, Road Vehicles, Advertisements, Consumption of Electricity, Luxuries, and Amusements

- Taxes on Entry of Goods into Local Areas

- Sales Tax

- Tolls

- Fees for Matters Listed in the State List

- Taxes on Professions and Trades (not exceeding Rs. 2,500 per annum)

(iii) Duties Levied by the Union but Collected and Appropriated by the States

- Stamp Duties on Bills of Exchange, etc.

- Excise Duties on Medicinal and Toilet Preparations containing Alcohol

- These duties are included in the Union List and levied by the Union but are collected by the States within their respective territories and form part of the States' revenue (Article 268).

(iv) Taxes Levied and Collected by the Union but Assigned to the States

- Duties on Succession to Property (other than Agricultural Land)

- Estate Duty on Property (other than Agricultural Land)

- Terminal Taxes on Goods or Passengers carried by Railway, Air, or Sea

- Taxes on Railway Fares and Freights

- Taxes on Sales of and Advertisements in Newspapers

- Taxes on Sale or Purchase of Goods (other than Newspapers) in the Course of Inter-State Trade or Commerce

- Taxes on Inter-State Consignment of Goods (Article 269)

(v) Taxes Levied and Collected by the Union but Distributed Between the Union and the States

- Taxes on Income (other than Agricultural Income) (Article 270)

- Duties of Excise included in the Union List (except for Medicinal and Toilet Preparations), which may also be distributed if provided by law (Article 272)

(vi) Principal Sources of Non-Tax Revenues of the Union

- Receipts from Railways

- Posts and Telegraph

- Broadcasting

- Opium

- Currency and Mint

- Industrial and Commercial Undertakings of the Central Government relating to subjects under Union jurisdiction

Examples of industrial and commercial undertakings include:

- Industrial Finance Corporation

- Air Corporations

- Industries with Government of India investments, such as Sindri Fertilisers and Chemicals Ltd., Hindustan Shipyard Ltd., Indian Telephone Industries Ltd., etc.

(vii) Principal Sources of Non-Tax Revenues of the States

States generate non-tax revenues from:

- Forests

- Irrigation

- Commercial Enterprises (e.g., Electricity, Road Transport)

- Industrial Undertakings (e.g., soap, sandalwood, iron and steel in Karnataka; paper in Madhya Pradesh; milk supply in Bombay; deep sea fishing and silk in West Bengal)

Leader of the Opposition in Parliament

- The role of the Leader of the Opposition in a parliamentary democracy is crucial, and thus, statutory recognition has been granted to this position in both the Lok Sabha and Rajya Sabha.

- Besides a salary, the Leaders of the Opposition are provided with certain generous perquisites to facilitate the efficient discharge of their responsibilities in Parliament.

- In 1977, Parliament passed necessary legislation to formalize this recognition, and the accompanying rules came into effect on November 1, 1977.

- The late Y.B. Chavan of the Congress (I) was the first to be accorded the official status of the Leader of the Opposition with the rank of a Cabinet Minister in the Lok Sabha. This recognition was granted by the Janta Party Government led by Morarji Desai.

- Hence, Y.B. Chavan became the first Leader of the Opposition in India to enjoy the status equivalent to that of a Cabinet Minister.

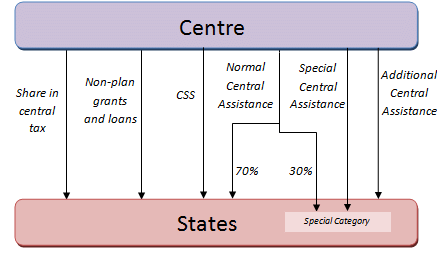

Grants and Loans

In addition to revenue devolution, the Union government supports the financial needs of States through the following methods:

Grants-in-Aid and Other Grants:

- The Union provides grants-in-aid to assist State revenues and also makes other types of grants. While both the Union and the States have the authority to make grants as per the Constitution, the Union's capacity to do so is greater due to its larger financial resources.

Loans:

- The Union also extends financial support to States by offering loans. This mechanism helps States meet their financial requirements for various projects and initiatives.

special category status and centre- state finances

special category status and centre- state finances

Grants by the Union

- The Union can provide grants for purposes that are outside its legislative jurisdiction. This is the basis for many large capital grants aimed at national development schemes.

- Grant-in-aid may be given to a state to cover its budgetary deficits or as a specific budget grant. Generally, grant-in-aid is based on budgetary need, assisting states whose revenues, even after devolution, fall short of their expenditures.

Borrowing Powers of the Union and State Governments

Union Government:

- The Union government has the unlimited power to borrow both within India and from abroad. This power is subject only to limits set by Parliament.

State Governments:

- The borrowing power of state governments is subject to several constitutional limitations:

- Prohibition on Foreign Borrowing: States are not allowed to borrow from outside India.

- Internal Borrowing: States can borrow within India against their revenues, but this is subject to certain conditions:

- Legislative Limitations: The State Legislature can impose limitations on borrowing.

- Union Guarantee: If the Union Government has guaranteed an outstanding loan of the State, the State cannot raise a fresh loan without the Union's consent.

- Central Loans: The Government of India can offer loans to a State under a law made by Parliament. As long as any part of such a loan remains outstanding, the State cannot raise a fresh loan without the Union's consent.

Central Superiority

- The Centre has a stronger position in managing State finances, overseeing them through the Comptroller and Auditor-General.

- During a financial emergency, the President can instruct States to cut their expenses and can suspend the rules regarding tax distribution.

- Parliament has the authority to increase duties or taxes by a surcharge for Union purposes, with all proceeds going to the Union and becoming part of the Consolidated Fund of India.

- Due to the Centre's dominant role, States have been seeking greater autonomy.

- In June 1983, the Sarkaria Commission was established to address the issue of Centre-State relations, and it submitted its report in October 1987.

Recent Developments

- Finance Commission

- The Fifteenth Finance Commission (2019–2025) has completed its term.

- The Sixteenth Finance Commission was constituted in 2024, chaired by Arvind Panagariya. It will recommend the distribution of financial resources between the Union and States for the period 2026–2031.

- Goods and Services Tax (GST) Reform

- Since 2017, GST has subsumed many Union and State taxes.

- Abolished/subsumed taxes include:

- Central Sales Tax (CST) on inter-state trade.

- Entry Tax, Octroi, and most State-level indirect taxes.

- Taxes on Railway fares and freights, advertisements in newspapers, etc.

- Distribution of GST revenue is governed by Articles 246A, 269A, and the GST Council (Art. 279A).

- Only a few taxes like customs duty, corporation tax, and excise on petroleum/tobacco remain with the Union.

- Abolished or Dormant Taxes

- Estate Duty: Abolished in 1985.

- Wealth Tax: Abolished in 2015.

- Taxes on capital value of assets: No longer levied.

- Non-Tax Revenue Sources

- Old references such as Posts and Telegraph, Opium revenue, Sindri Fertilizers, Air Corporations are outdated.

- Major current non-tax revenue sources include:

- Dividends and profits from Public Sector Enterprises.

- Surplus transfer from the Reserve Bank of India (RBI).

- Spectrum auctions and telecom license fees.

- User charges from railways, power, and other government services.

- Several PSUs listed earlier (e.g., Air India, Sindri Fertilizers) have been privatized or closed.

- Special Category Status

- The concept of Special Category States was phased out after the 14th Finance Commission (2015).

- Hill and North-Eastern states continue to receive special assistance through centrally sponsored schemes, but no state is formally designated as “Special Category” anymore.

- Centre–State Relations

- While the Sarkaria Commission (1983–87) was foundational, the Punchhi Commission (2007–2010) gave updated recommendations on Centre–State relations, including financial matters and cooperative federalism.

|

142 videos|780 docs|202 tests

|

FAQs on Revision Notes: Consolidaated Fund, Contingency Fund and the Finance Commission - Indian Polity for UPSC CSE

| 1. What is the Contingency Fund of India and its purpose? |  |

| 2. How does the Finance Commission work in India? |  |

| 3. What are the key differences between the Consolidated Fund and the Contingency Fund of India? |  |

| 4. What types of grants and loans does the Finance Commission recommend? |  |

| 5. What is meant by Central Superiority in the context of the Finance Commission? |  |