Sample Paper-01, Accountancy, Class 11 | Sample Papers for Class 11 Commerce PDF Download

General Instructions:

1. All questions are compulsory.

2. Show your working notes clearly.

PART A (FINANCIAL ACCOUNTING - I)

Q.1. Which accounts are not considered while preparing the trial balance? (1 mark)

Ans. While preparing the trial balance by balance method, accounts having no balance are not considered.

Q.2. Choose the correct answer from the options given below:

What should be the rectifying entry for Rs.1, 50,000 spent on a family trip enjoyed by Mr. Khanna and recorded them by debiting to Office Expenses A/c? (1 mark)

(a) Drawings A/c Dr. 1,50,000

To Cash A/c 1, 50,000

(b) Drawings A/c Dr. 1,50,000

To Office Expenses A/c 1, 50,000

(c) Office Expenses A/c Dr. 1,50,000

To Drawings A/c 1, 50,000

(d) Cash A/c Dr. 1,50,000

To Office Expenses A/c 1, 50,000

Ans. Option B: Drawings A/c Dr. 1, 50,000

To Office Expenses A/c 1, 50,000

Q.3. What will be the rate of depreciation if the asset was purchased for Rs.80, 000 with a salvage value of Rs.10, 000 at the end of its useful life of 7 years? (1 mark)

Ans. 12.5% p.a.

Q.4. Name the process of transferring entries from the journal to their respective accounts in the ledger. (1 mark)

Ans. Posting is the process of transferring entries from the journal to their respective accounts in the ledger.

Q.5. Whether the following statement is True or False: “Closing Stock appearing at Rs.56, 000 on 31st March, 2018 after sales during the year, is regarded as an Event.” (1 mark)

Ans. True

Q.6. Choose the correct answer from the options given below: Which of the following branches of accounting helps overcome one of the limitations of accounting, that is, it ignores the effect of price level changes? (1 mark)

(a) Cost Accounting

(b) Financial Accounting

(c) Inflation Accounting

(d) Management Accounting

Ans. (C)

Q.7. Why are rules of debit and credit same for liability and capital? (1 mark)

Ans. Rules of debit and credit same for liability and capital because of business entity concept. According to the concept, business is a separate and distinct entity from its owner.

Q.8. Mr. Karan, accountant at M/s Das & Das follows different methods of inventory valuation every year. Which of the following attributes of accounting information would be affected due to practice adopted by Mr. Karan above? (1 mark)

Ans. Comparability

Q.9. A Gross Profit Rs 15,000, Carriage Inwards Rs 4,000, Rent Rs 4,500, Drawings Rs 6,000, Freight Outward Rs 5,000, Repairs & Maintenance Rs 4,800, Manufacturing Wages Rs 5,000, Bad Debts Recovered Rs 3,000. What is the amount of net profit/loss? (1 mark)

Ans. Net Profit of Rs. 3, 700

Q.10. Which document is evidencing for the credit granted to the named person for the reason stated therein? (1 mark)

Ans. Credit note is a document evidencing for the credit granted to the named person for the reason stated therein.

Q.11. Wages paid for installation of newly purchased machinery are debited to Wages Account. Such type of error is known as ________________. (1 mark)

Ans. Error of Principle

Q.12. Is trial balance a statement or an account? (1 mark)

Ans. Trial balance is a statement which is prepared with the debit and credit balances of the ledger accounts to check the arithmetic accuracy of the books. It can be prepared on any date. While preparing trial balance all accounts are considered. These ledger accounts except cash and bank balances are taken from the ledger.

Q.13. Choose the correct answer from the options given below:

If Salaries of Rs.15, 000 paid to X have been debited to his personal account. What should be the rectifying entry required to be passed to correct this error? (1 mark)

(a) Salaries A/c Dr. 15,000

To Cash A/c 15,000

(b) Salaries A/c Dr. 15,000

To X’s A/c 15,000

(c) X’s A/c Dr. 15,000

To Salaries A/c 15,000

(d) Cash A/c Dr. 15,000

To Salaries A/c 15,000

Ans. B: Salaries A/c Dr. 15,000

To X’s A/c 15,000

Q.14. From the following information, compute the amount of profit: Capital at the end of the year ₹5, 00,000 Capital in the beginning of the year ₹7, 50,000 Drawings made during the period ₹3, 75, 000. Additional capital introduced ₹50,000. (3 mark)

OR

Explain the following terms:

i. Capital

ii. Drawings

iii. Account

Ans. Profit = Closing Capital + Drawing – Opening Capital - Capital Introduced

=5, 00,000 + 3, 75,000 - 7, 50,000 – 50,000

= 75,000

OR

(i) Capital: It is the amount invested by the proprietor in a business. If the business earns profit or invests additional amount, the amount of capital increases in the business. On the other hand, if the business incurs losses or withdraws the amount invested, the amount of capital decreases.

(ii) Drawings: It is the amount of cash or goods withdrawn from the business by the proprietor for personal use.

(iii) Account: It is a record of transactions (cash or credit) maintained under a particular head which shows the transactions and the effect of such transactions in the books of accounts.

Q.15. Explain Historical Cost Principle and Consistency Assumption of Accounting. (4 mark)

Ans. According to historical cost principle, all assets are recorded in the books of accounts at the purchase price which includes the purchase price, cost of acquisition and installation. The purchase price will remain same for all further accounting even though there is change in the market value. For example, a machine is purchased for ₹ 250,000, its acquisition cost is ₹ 10,000, transportation cost is ₹ 5000 and the installation cost is ₹ 12,000. Hence, the cost of machine will be entered in the books of accounts as ₹ 277,000. If the market value of machine is increased to ₹ 300,000, this change in the cost will not be reflected in the books of accounts. It does not maintain the true value of machine. According to consistency assumption of accounting, accounting policies and practices followed by an enterprise should be uniform and consistent over a period of time. For example, if an enterprise followed different methods in two years for depreciation of its assets, then the financial information will not be comparable. Hence, the personal bias gets eliminate through the practice of consistency. However, consistency does allow changes in accounting policies but it should be disclosed.

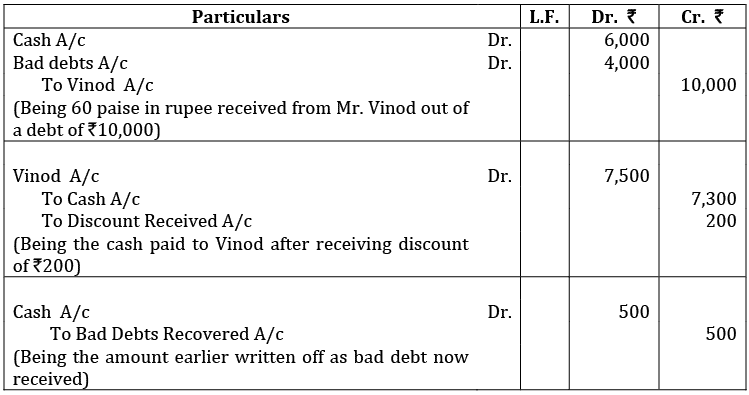

Q.16. Give journal entries for the following: (4 mark)

(i) Received only 60 paise in rupee from official receiver of Mr.Vinod who owed ₹10,000.

(ii) Paid ₹7,300 to Vinod in full settlement of his account of ₹7,500.

(iii) Received cash from Vinod for a bad debt written off last year ₹500.

OR

Explain the Accrual Basis of Accounting.

Ans. Journal In the Books of ……….

OR

Accrual Basis of Accounting:

(i) Under this system of accounting, income is recorded as income when it is earned or accrued and expense will be recorded as an expense when the expense is incurred even if the payment has not been made.

(ii) This system is based on the concept of realisation and expiration and follows two basic accounting principles namely, Revenue Recognition and Matching Principle.

(iii) Under this system, outstanding and prepaid expenses and incomes are to be adjusted in order to ascertain the correct profit or loss for the accounting period.

(iv) It is considered as an important basis of accounting because as per the Companies Act, 2013 companies are required to follow this basis of accounting in maintaining their books of account.

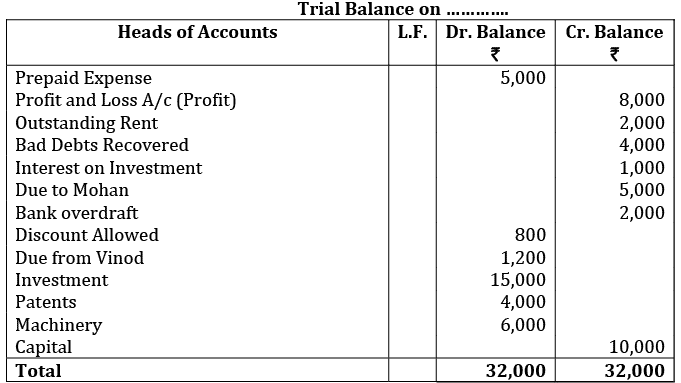

Q.17. Prepare Trial Balance from the following information: Prepaid Expense ₹5,000, Profit & Loss A/c (Profit) ₹8,000, Outstanding Rent ₹2,000, Bad Debts Recovered ₹4,000, Interest on Investment ₹1,000, Due to Mohan ₹5,000, Bank overdraft ₹2,000, Discount Allowed ₹800, Due from Vinod ₹1,200, Investment ₹15,000, Patents ₹4,000, Machinery ₹6,000, Capital ₹10,000. (4 mark)

Ans.

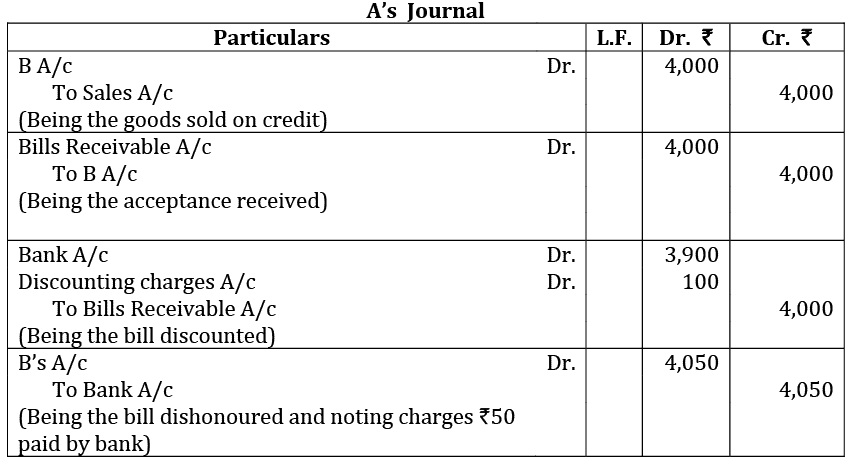

Q.18. A sold goods to B for ₹4,000 and drew a bill for the amount due at 3 months for the amount. B after giving his acceptance returned the bill to A. A discounted it from his bank for ₹3,900. On due date, bill returned dishonoured and bank paid ₹50 as noting charges. Give journal entries in the books of A only. (4 mark)

Ans.

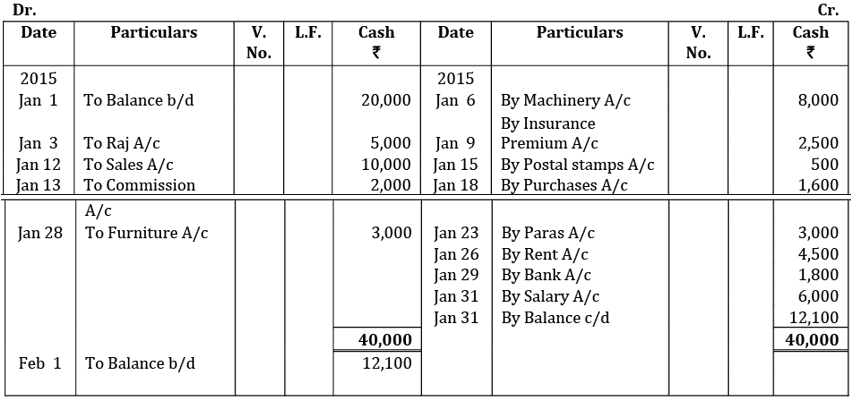

Q.19. Record the following transactions in Simple Cash Books of Harsh Traders for the month January 2015. (6 mark)

1: Cash in hand ₹20,000.

3: Received cash on account from Raj ₹5,000.

6: Purchased machinery ₹8000.

9: Insurance premium paid ₹2,500.

12: Sold goods for cash ₹10,000.

13: Received commission ₹2,000.

15: Purchased postal stamps ₹500.

18: Purchased goods for cash from Omkar Brothers ₹1,600.

23: Cash paid to Paras ₹3,000 on account.

26: Paid rent ₹4,500.

28: Sold old furniture ₹3,000.

29: Deposited into bank ₹1,800.

31: Paid salary to office staff ₹6,000.

Ans. In the Books of Harsh Traders Cash Book (Simple)

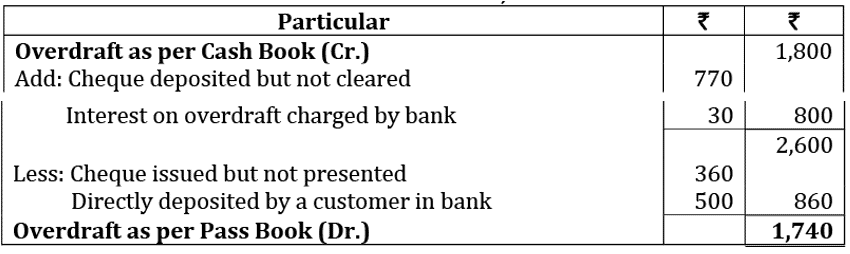

Q.20. Prepare a Bank Reconciliation Statement on 31st December 2015 for the following when credit balance as per bank column of cash book is ₹1,800:

(i) Cheques issued, but not presented for payment ₹360.

(ii) Cheque deposited but not collected by the bank. ₹70

(iii) Interest on overdraft charged by the bank ₹30.

(iv) A customer directly deposited in bank ₹500. (6 mark)

Ans. Bank Reconciliation Statement as on 31st December, 2015

Q.21. Explain Readymade and Customized software with their advantages & limitations. (8 mark)

Ans. Readymade Software: These software’s are ready to use, easy to handle or easy to operate. These software’s save time and cost. The best example for accounting software is 'Tally' Advantages of Readymade Software’s

(i) Suitable for small business firms.

(ii) Easily available.

(iii) Affordable (Less expensive)

(iv) User friendly (No special training required)

Limitations of Readymade Software’s

(i) Knowledge of computer is required (as well as knowledge of accounting is also required).

(ii) Costly and installation problems.

(iii) Not safe. Customized Software: Readymade software’s are modified as per the requirement. It is known as customized Software’s. The cost of customised software is higher than the readymade software cost and this cost is paid by the user.

Advantages of Customised Software’s

(i) Suitable for medium and large business houses.

(ii) All transactions are recorded in a systematic manner.

(iii) Software is customised according to the requirement.

(iv) Reliable.

Limitations of Customised Software’s

(i) Special training is required to handle these types of software’s.

(ii) Costly.

(iii) Outdated software’s may cause problems.

PART B (FINANCIAL ACCOUNTING – II)

Q.22. Adjustments for outstanding expenses, prepaid expenses or depreciation are not made in receipts and payments accounts. Why? (1 mark)

Ans. Because receipts and payment Account records all cash receipts and cash payments. It is a consolidated cash book. It starts with opening balance of cash & bank and ends with closing balance of cash & bank, It does not take into consideration outstanding amounts of receipts and payments.

Q.23. Choose the correct answer from the options given below: Which of the following is not an example of indirect manufacturing expenses: (1 mark)

(a) Depreciation on Machinery

(b) Repairs & Maintenance

(c) Insurance Premium for goods

(d) Raw Materials Consumed

Ans. (d)

Q.24. Choose the correct answer from the options given below: The capital of a sole trader would change as a result of __________________. (1 mark)

(a) Credit Purchase of Raw Material

(b) Wages paid in cash

(c) Credit Purchase of Fixed Assets

(d) Creditor being paid his account by cheque

Ans. (b)

Q.25. Name the accounting software appropriate for small business organizations, having one user and single office location. (1 mark)

Ans. Ready to use/Readymade software is appropriate for small business organizations, having one user and single office location.

Q.26. Whether the following statement is True or False: (1 mark)

‘Goodwill is a Tangible Fixed Asset.’

Ans. False

Q.27. Complete the following statement: (1 mark)

A prepayment of insurance premium will appear in the Balance Sheet as _____________________.

Ans. A Current Asset

Q.28. Choose the correct answer from the options given below: (1 mark)

Which of the following is not a limitation of Financial Statements?

(a) True and fair view of the Business

(b) Different Accounting Policies

(c) Historical Records

(d) Affected by Estimates

Ans. (a)

Q.29. Differentiate between Manual accounting and Computerised accounting system. (3 mark)

Ans. Manual Vs Computerised Accounting System:

Manual

(i) Accounting principles are used to identify the transactions.

(ii) Transactions are recorded in the books of original entries and balancing of various accounts is done.

(iii) Financial statements are prepared at the end of the accounting period by using the trial balance and additional information.

Computerised

(i) Identification process is same as manual accounting.

(ii) Transactions are stored in a database systematically which adjust the data automatically in a systematic manner and there is no need for separate ledger accounts

(iii) Financial statements are prepared systematically and opening balance for next accounting period is available in Database system.

Q.30. Accounting software is an integral part of the computerized accounting system. An important factor to be considered before acquiring accounting software is the accounting expertise of people responsible in organisation for accounting work. In the light of this statement, briefly discuss various types of accounting software.

OR

Rahul runs a small business of stationery where he buys the goods from the wholesaler and sells it to the ultimate consumers. There are no much transactions taking place and therefore, he maintains his books on Single Entry System of Accounting to keep it simple. In order to apply for business loans, he is required to submit complete set of final accounts of his business. According to Rahul, since he has been maintaining his records it is very easy to prepare the Trial Balance and Final Accounts from the record maintained by him. Determine whether Rahul is correct in preparing Trial Balance and Final Accounts from records maintained as per single entry system. (4 mark)

Ans. The various types of accounting softwares are:

(i) Ready-to-use Readymade softwares are softwares, which are available off the shelf. These softwares are for the users at large and not user specific. These softwares are suited for organisations running small/ conventional business where the frequency or volume of accounting transactions is very low.

(ii) Customised The term ‘customised software’ means making changes in the ready made

software to suit the specific requirement of the user i.e , make it user specific. These softwares are available off the shelf and are changed to suit the requirement of the user. The developer, to meet specific user requirement, can modify all the readymade softwares. The user has to bear to cost of such changes.

Customised software are best suited for large and medium businesses and can linked to the other information system.

(iii) Tailored The term ‘tailor made software’ refers to designing and developing user specific software. These softwares, being user specific, are not available off the shelf but are developed on the basis of discussions between the user and developers.

These softwares are suited for large business organization with multi- users and geographically scattered locations.

The tailored software is designed to meet the specific requirements of the users and form an important part of the organizations.

OR

Based on the information given in the question, Rahul is not correct in preparing Trial Balance and Final Accounts from the records maintained under Single Entry System of Accounting because such system is subject to the following disadvantages:

(i) Trial Balance cannot be prepared: Under this system, complete information of the transactions is not recorded and therefore, no trial balance can be prepared.

(ii) Difficult to ascertain profitability: It is very difficult to prepare the various accounts as no complete record is available and therefore, it is not easy to ascertain the correct profitability of the entity for a particular period of time.

(iii) Incapable of ascertaining true financial position: Since, the Real and nominal accounts are not prepared in this system of accounting, the true financial position of the business cannot be ascertained

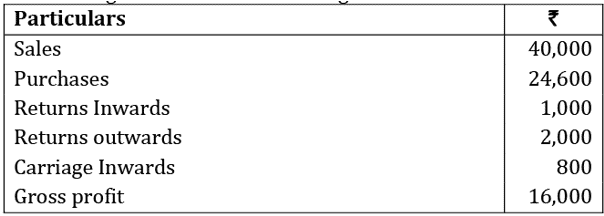

Q.31. Calculate closing stock from the following: (6 mark)

Is it correct that debit balance in the profit and loss account is profit?

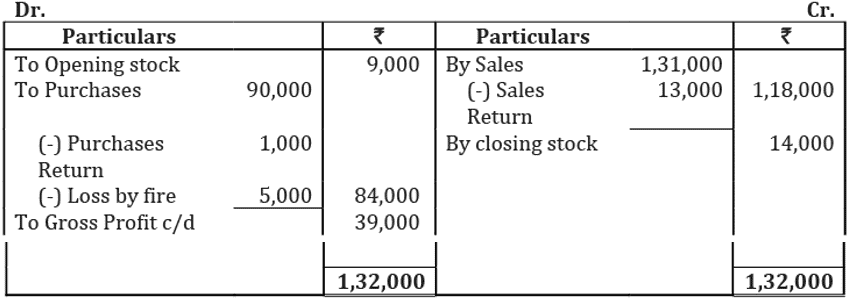

Ans. Trading Account

No, it is not correct; debit balance in profit and loss account implies loss as expenses are more than the revenue.

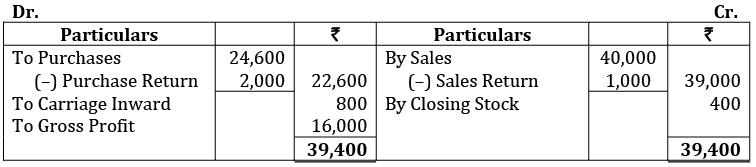

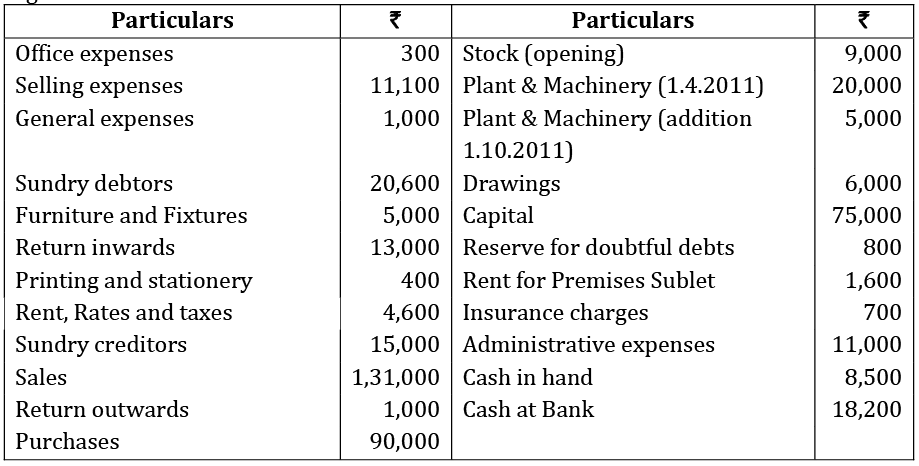

Q.32. From the following Trial Balance of M/s. Vinod and Sons as on 31st March 2014, prepare Trading and Profit & Loss Account and Balance Sheet. (8 mark)

Adjustments:

(i) Stock in hand at the end ₹14,000.

(ii) Write off ₹600 as bad debts.

(iii) Create 5% provision for bad and doubtful debts.

(iv) Depreciate furniture and fixtures at 5% p.a. and Plant & Machinery at 20% p.a

(v) Insurance prepaid was ₹100.

(vi) A fire occurred in the godown and stock of the value of ₹5,000 was destroyed. It was insured and the insurance company admitted full claim.

OR

Explain Single Entry System of Accounting and its features.

Ans. Trading Account for the year ended 31st March 2014

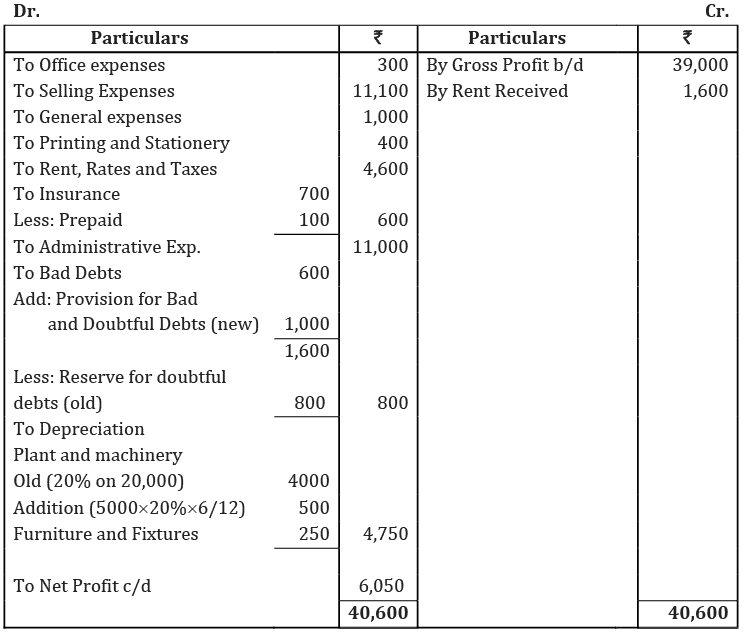

Profit and Loss Account for the year ended 31st March 2014

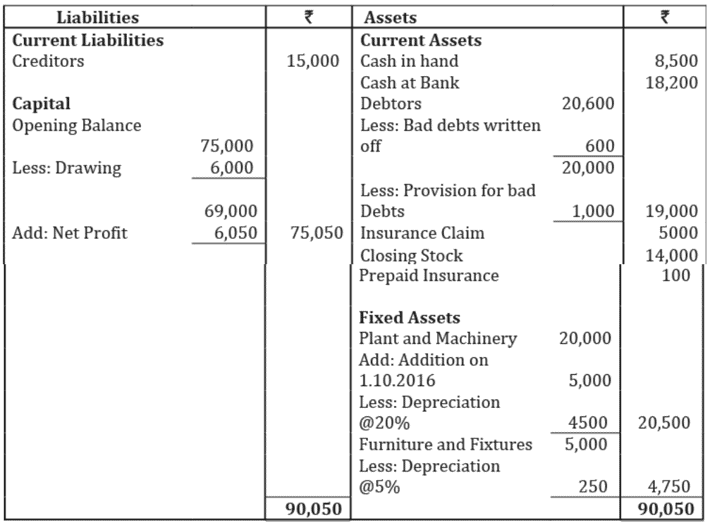

Balance sheet as on 31st March 2014

OR

Meaning: It is the method of accounting which does not follow the principle of double entry system. In this method, only one account is given debit or credit for each transaction. In this method, only personal accounts are maintained and impersonal account may not be maintained.

Features

Following are the features of Single Entry System:

(i) Suitable for small-size business: It is considered suitable for small-size business having less number of transactions.

(ii) No Uniformity: It is a mere adjustment to double entry system of accounting based on the requirements and convenience. Therefore, it may differ from firm to firm.

(iii) Personal Accounts Only: It maintains only personal accounts and ignores preparation of real and nominal accounts.

(iv) Cash Book: It maintains cash book which mixes the business and personal transactions.

(v) Information based on Vouchers: It takes into consideration information available from the respective vouchers.

(vi) Difficult to prepare final accounts: It is very difficult to prepare final accounts as no complete record is available to ascertain the correct profitability and determine the exact financial position of the entity.

FAQs on Sample Paper-01, Accountancy, Class 11 - Sample Papers for Class 11 Commerce

| 1. What is Accountancy? |  |

| 2. What are the basic principles of accounting? |  |

| 3. What is a ledger in accounting? |  |

| 4. What is the difference between bookkeeping and accounting? |  |

| 5. What are the different types of financial statements in accounting? |  |