Project Planning and Financial Analysis of Irrigation Project, Irrigation Engineering | Irrigation Engineering Notes - Agricultural Engineering PDF Download

A project is a specific activity in which resources are used over a specified period of time with the expectation of a greater flow of benefits to an individual or a community. A common feature of all projects is that they can be planned, financed and implemented. During planning the costs and returns of a project are estimated.

Agricultural development is a process that involves changes in production techniques and methods on the different farming units including both which are large-scale and small-scale. Changes do not always bring positive benefits to the farmer. They have to be analyzed and measured against the prevailing situation. Choices should be made between alternative plans and ideas. Farmers, investors and society all need an objective way of making these analyses and choices. Resources are limited and all organizations and institutions have to make choices regarding the allocation and investment of human and financial resources in development of projects. Project appraisal helps to determine if the investment is viable, usually according to quantitative financial and economic criteria. Projects may be financed by the government, donor agencies, farmers, or a combination of these three.

47.1 Project Planning

This is a continuous process that involves sequential steps that form a kind of cycle, usually called the “project cycle”. The sequence is as follows

47.1.1 Identification

A project may be designed to address an identified constraint in the community or to exploit an opportunity. Ideas of pursuing an irrigation project may be prompted by the following

- Low yields due to poor rainfall patterns

- Low incomes from rain fed crop production

- Presence of water resources and irrigable land

- Market opportunities due to proximity to a large market (consumer and/or industrial, for example a processing factory).

Project identification aims at undertaking a preliminary assessment of a project idea before important planning resources, like money and skills, are utilized in detailed project design and appraisal. It involves the development of the concept and initial ideas. Project identification is initiated when farmers, extension workers, or NGO or donor agency staff recommend for a prospective project.

47.1.2 Project Preparation and Analysis

Once a project has been identified, the process of progressively more detailed preparation and analysis of project plan starts. This process includes all the work necessary to bring the project to the point at which a careful review or appraisal can be undertaken. Then, if it is determined to be a good project, implementation can begin. Typically, the first step in project preparation and analysis is to undertake a feasibility study that will provide enough information for deciding whether to begin more advanced planning. The feasibility study should clearly define the objectives of the project. It should explicitly address the question of whether alternative ways to achieve the same objectives may be preferable. This stage is concerned with the study of a limited number of project alternatives and will enable project planners to exclude poor alternatives.

47.1.3 Project Appraisal

After the project preparation phase, a critical review of the project is conducted to re-examine every aspect of the project plan in order to assess whether proposal is appropriate and sound before financial commitment. Time frame is also checked for implementation feasibility. Appraisal process builds on the plan by gathering new information as required by the specialists.

47.1.4 Project Implementation

Implementation commences when appraisal and financial commitments have been approved. It involves

- Preparation of an action plan and budget for the project

- Mobilization of resources (human, material and financial) and assigning responsibilities

- Mobilization of farmers to participate fully in the project right from the start

- Initiation of fieldwork, for example laying out of engineering works, crop production, etc.

47.1.5 Project Monitoring and Evaluation

Monitoring takes place throughout project implementation and helps management keep track of the project progress. Monitoring can also be used to improve the management of the irrigated plot in terms of which agronomic technologies to use, the allocation of resources and decisions on what to produce. Evaluations consist of

- Project objective deadlines.

- Implementation of activities as planned.

- Achievement of anticipated benefits.

Evaluation is not limited to completed projects. It is a most important managerial tool in ongoing projects and formalized evaluation might take place several times during the lifetime of the project.

47.2 Financial Analysis of an Irrigation Project

Analyzing the financial benefits of an irrigation project involves looking at the two levels: - farmer level and the ii) scheme level. At farmer level, we look at production levels, labour requirements and net income ‘with’ and ‘without’ the project. At scheme level, we look at costs incurred in constructing, operating and managing the whole scheme.

Financial Analysis of an irrigation project consists of the following:-

47.2.1 Farm Income Analysis

During project analysis, the underlying assumption made is that for farming community or for a farm, the objective will be maximization of income that the families will earn as a result of the participation in the project. The resources used are land, water, electricity and labour. The tools to evaluate these resources are: -

(i) Cropping Patterns: When an irrigation project is introduced, the area of irrigation comes from the participating farmers’ landholdings being used for rainfed cultivation.

If the farmers become full time irrigators, this will mean that income from cultivation is lost and income from irrigation is gained. In order to assess the impact of this, cropping patterns are analyzed and suitable decisions are taken.

(ii) Labour Requirements: Labour requirements are calculated on crop by crop basis and added to estimate the total requirements in any given situation. Where an exhaustive survey on the labour schemes has been carried out, this provides the data associated with various operations in the proposed scheme. When calculating the requirements for each crop, not only the total requirements but also the distribution over the cropping period will have to be established so that labour requirements in the peak periods can be determined.

(iii) Crop Budgets/Gross Margin Analysis: Crop Budgets contain the evaluation of gross margins per hectare for the different crops. Gross margin is the income generated from a production activity and is equal to the difference between the total gross income and the total variable costs.

47.2.2 Scheme Investment Analysis

The scheme investment analysis looks at the scheme income based on the gross margins, investment costs and the operations and maintenance costs. The analysis seeks to judge the likely incremental benefits project participants and the incentive for farmers to participate in the project, thus looking at the attractiveness of the project to the indulging farmers.

Scheme investment analysis depends on the following:-

(a) Investment: Investment refers to the amount put in a project irrespective of its type. Investment can also be termed as initial costs incurred to kick start a project.

(b) Land: Land for any irrigation project must appear in the investment analysis of the project. Similarly, rent should also appear as a cost in the investment analysis if the land has been rented.

(c) Operating Costs: The operating expenditure is calculated for the costs of equipment utilized in making the investment work functional and would include

- Replacement Costs: These are the costs incurred to replace specific items.

- Energy Costs: This depends on the elevation of the water source relative to the elevation of the scheme, which determines whether water should be pumped in order to reach the scheme and the irrigation system used.

- Repair and Maintenance Costs: These costs are usually assumed to depend on the cost of the equipment utilized. Thus a percentage of the cost of the equipment (generally between 1.5-5%) is taken as the repair and maintenance costs per year.

- Water Charges: These are the charges payable to whoever supplies the water, for example the national water authority. Where water is purchased, the water charges should be indicated as a cost.

(d) Other Costs: Following come under the other costs

- Sunk Cost: A cost incurred in the past projects that cannot be recovered again.

- Residual Value: This is the value of the asset remaining unused at the end of a project. The asset can be termed as an residual asset.

47.2.3 Setting Up the investment budget

Having assessed the costs and benefits, the budget of the irrigation project is set up.

47.2.4 Project Period

This is defined as the time duration for which the project will the carried out. If the project centers on only one major asset, say the irrigation system, then the usual project period is said to be 20 years. For external funding, the projects get wrapped up by 5-7 years.

47.2.5 Time Value of Money

When costs and benefits are spread over time, then the future income has to be reduced to its present worth. This is based on the principle that a dollar buys more today than it will buy tomorrow.

Determining the discount rate: The factor used to reduce projected future income or to accumulate loans now, is the discount rate or interest. There are two main explanations for interest namely, time preference and opportunity cost of capital.

47.2.6 Measuring the Project Worthiness

The viability or worthiness of the project that takes the timing of costs and benefits into account can be measured using the following indicators

(a) Net Present Value (NPV): In financial terms, the net present value (NPV) or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values (PVs) of the individual cash flows of the same entity. In the case when all future cash flows are incoming (such as coupons and principal of a bond) and the only outflow of cash is the purchase price, the NPV is simply the PV of future cash flows minus the purchase price (which is its own PV). NPV is a central tool in discounted cash flow (DCF) analysis and is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting and widely used throughout economics, finance, and accounting, it measures the excess or shortfall of cash flows, in present value terms, above the cost of funds.

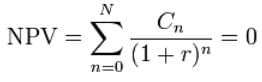

Formula for NPV is

where,

t – time of the cash flow

i – discount rate (the rate of return that could be earned on an investment in the financial markets with similar risk.)

Rt – the net cash flow i.e. cash inflow – cash outflow, at time t. For educational purposes

R0 - is commonly placed to the left of the sum to emphasize its role as (minus) the investment.

The result of this formula is multiplied with the Annual Net cash in-flows and reduced by Initial Cash outlay the present value but in cases where the cash flows are not equal in amount, then the previous formula will be used to determine the present value of each cash flow separately. Any cash flow within 12 months will not be discounted for NPV purpose, nevertheless the usual initial investments during the first year R0 are summed up a negative cash flow.

(b) Benefit/Cost Ratio: A benefit-cost ratio (BCR) is an indicator, used in the formal discipline of cost-benefit analysis, that attempts to summarize the overall value for money of a project or proposal. A BCR is the ratio of the benefits of a project or proposal, expressed in monetary terms, relative to its costs, also expressed in monetary terms. All benefits and costs should be expressed in discounted present values. Benefit cost ratio (BCR) takes into account the amount of monetary gain realized by performing a project versus the amount it costs to execute the project. The higher the BCR the better the investment. General rule of thumb is that if the benefit is higher than the cost the project is a good investment.

(c) Internal Rate of Return: The internal rate of return on an investment or project is the "annualized effective compounded return rate" or "rate of return" that makes the net present value (NPV as NET*1/(1+IRR)^year) of all cash flows (both positive and negative) from a particular investment equal to zero. It can also be defined as the discount rate at which the present value of all future cash flow is equal to the initial investment or in other words the rate at which an investment breaks even.

In more specific terms, the IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment.

IRR calculations are commonly used to evaluate the desirability of investments or projects. The higher a project's IRR, the more desirable it is to undertake the project. Assuming all projects require the same amount of up-front investment, the project with the highest IRR would be considered the best and undertaken first.

A firm (or individual) should, in theory, undertake all projects or investments available with IRRs that exceed the cost of capital. Investment may be limited by availability of funds to the firm and/or by the firm's capacity or ability to manage numerous projects.

Given a collection of pairs (time, cash flow) involved in a project, the internal rate of return follows from the net present value as a function of the rate of return. A rate of return for which this function is zero is an internal rate of return.

Given the (period, cash flow) pairs (η, Cn) where is a positive integer, the total number of periods , and the net present value , the internal rate of return is given by in:

The period is usually given in years, but the calculation may be made simpler if is calculated using the period in which the majority of the problem is defined (e.g., using months if most of the cash flows occur at monthly intervals) and converted to a yearly period thereafter.

Any fixed time can be used in place of the present (e.g., the end of one interval of an annuity); the value obtained is zero if and only if the NPV is zero.

In the case that the cash flows are random variables, such as in the case of a life annuity, the expected values are put into the above formula.

Often, the value of cannot be found analytically. In this case, numerical methods or graphical methods must be used.

47.3 Irrigation Project Costs

Irrigation project costs include all the expenditure made to establish, maintain and operate a project. Costs are estimated on an annual basis. The annual cost of a project includes both fixed and variable costs.

47.3.1 Fixed Costs

Fixed costs, also referred as investment or initial costs, include the following, as applicable:

(a) Costs of obtaining water right and permits.

(b) Planning and design costs.

(c) Land purchase and rehabilitation of the population in the areas affected by the water resources project.

(d) Cost of storage reservoirs, head regulator and canal water distribution system, including associated structures and controls.

(e) Command area development surveying, land development operations and on-farm water conveyance and control.

(f) Drainage system main drains, link drains, and no-farm drainage system surface and sub-surface.

(g) Cost of wells, pumps, electric motors/engines and pumping plant accessories, and their installation.

(h) Pump house

(i) Electric Power connection, metering and recording equipment.

(j) Automation equipment/remote control, if used.

(k) Inspection and approach roads.

(l) Equipment for water application, sprinkler/drip irrigation equipment, if used.

The above costs are incurred at the initial stages of the project, while others are paid annually. Annual fixed costs include the interest on the total investment on the project.

47.3.2 Variable costs

Variable costs are recurring in nature and computed on an annual basis. They are operation and maintenance costs as well as levies and charges on insurance and miscellaneous operating costs of recurring nature. The variable annual costs may be enumerated as follows:

(a) Maintenance of structures and water distribution network.

(b) Costs of fuel, namely, diesel or other fuels and electricity.

(c) Lubricants, minor repairs, and painting.

(d) Layout of field for surface irrigation renewal of borders, ridges and field channels.

(e) Maintenance of drainage system desilting, weed control etc.

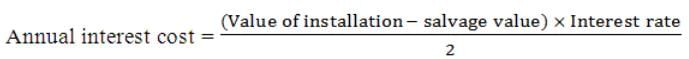

(f) Operating manpower cost (Manpower costs include salaries, social benefits, housing, insurance, medical treatment, transportation and similar items).A simple procedure, commonly used for preliminary cost estimates is to calculate the interest on the average value of the installation at the prevailing interest rate:

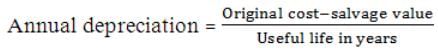

47.3.3 Depreciation

It is a provision of funds over the life time of the project for its replacement. Depreciation is excluded from the economic appraisal of a project as it is only an accounting concept. Depreciation is the anticipated reduction in the value of an asset due to physical use of the equipment/structure or obsolescence. In the conventional analysis, the annual depreciation is computed as follows:

Depreciation refers to the process of allocating a portion of the original cost of a fixed asset to each accounting period so that the value is gradually written off during the course of the estimated useful life of the asset. Allowance may be made for the asset’s estimated resale value, if any, at the end of the useful life of the enterprise.

In discounted cash flow analysis, depreciation is not treated as a cost. The cost of an asset is shown in the year it is incurred and the benefits are shown in the year they are obtained. Since this is done over the entire life of the project, it is not necessary to show the value of the asset apportioned in any given year as depreciation. That would amount to double counting.

Service Period of Wells and Pumps Projects

In the case of ground water and lift irrigation projects, when the expected service period of wells and pumps is specified in hours of operation, same in years is calculated by dividing the total hours of operation by the average annual hours of operation by the average annual hours of operation.

Variable Costs of Irrigation Projects

If the electrical connection charges are paid in lump sum, the annualized cost may be estimated, assuming an expected service life of about 25 years. If the charges are to be paid annually, the same are to be added to the operation and maintenance cost, to arrive at the annual variable cost.

Variable costs of surface irrigation projects include the costs on regulation of the conveyance system as well as maintenance and repairs. In case of wells and pumps, they include the cost of power/fuel (electricity/diesel), cost of lubricants, labour charges for operating the pumping units and the expenditure on repairs and maintenance of the equipment and accessories.

The cost of power is often the most important component of variable costs in the case of pumping systems. The usual practice is to operation from the known discharge rate of the pumping plant, total operating head and its overall efficiency. The requirement of power is expressed in kilowatt-hour per hour for electricity and liters of diesel per hour of operation of engines.

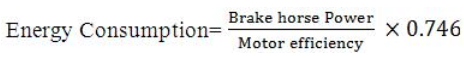

The energy consumption of an electric motor is computed as follows:

Efficiencies of electric motor may be obtained from the performance data supplied by the manufacturers. Motor efficiencies usually vary from 75 to 90 per cent.

The demand of electrical power for hourly operation is multiplied by the annual hours of operation to arrive at the total annual energy consumption. The annual power cost is determined by multiplying the annual energy demand by the prevailing cost per unit of electrical energy.

In case of engine, the cost of fuel is computed as follows:

Fuel cost = BHP× Specific fuel consumption ×Cost of fuel per liter

A realistic estimate of the rate of fuel consumption for a given engine can be made if the manufacturer’s fuel consumption curve for the engine is available. Fuel consumption of diesel commonly used in irrigation pumping vary from 0.2 L to 0.29 L per bhp hour. An average value of 0.23 L/bhp-h can be assumed in the absence of better data.

The consumption of lubrication oil is usually assumed to be 4.5 L per 1000 bhp-h. Many manufacturers provide values for the consumption of lubricants of their products. From the cost of lubricants per hour of operation, the annual cost of lubricants is computed.

The repair and maintenance costs of the component parts of an irrigation system may be assumed as per the norms given in Table. 47.1. or an average value may be assumed on based on field evaluation studies or local experience.

Table 47.1. Guidelines for estimation of service life and annual maintenance and repair costs of irrigation structures and equipment

Component | Expected duration (operation hours) | Expected economic life in years | Annual maintenance and repair charge as % of initial investment |

Dams | - | 50-150 | - |

Masonry wells | - | 50-170 | 0.2-0.5 |

Ponds and tanks | - | 20-50 | - |

Tubewell screen and casing(mild steel) | - | 20-50 | 0.5-1.5 |

Pump house and foundation | - | 40-50 | 0.5-1.5 |

Bowls of turbine pumps (about 50% of the cost of the pump unit) | 16000-20000 | 8-10 | 5-7 |

Columns of turbine pump | 32000-40000 | 16-20 | 3-5 |

Centrifugal pump | 32000-50000 | 15-20 | 3-5 |

Gear head | 30000-36000 | 14-20 | 5-7 |

V-belt | 6000 | 3 | 5-7 |

Flat belt (leather) | 20000 | 10 | 5-7 |

Electric motor | 50000-70000 | 25-35 | 1.5-2.5 |

Diesel engine | 28000 | 15 | 5-8 |

Petrol engine | 14000-18000 | 8-12 | 5-10 |

Galvanized iron pipes | - | 25-50 | 1-2 |

Concrete pipes | - | 20-60 | 2-4 |

Portable aluminum pipes | - | 10-15 | 2-4 |

Plastic pipes (underground) | - | 20-40 | 1.5-2.5 |

Asbestos cement pipes | - | 20-40 | 1-1.5 |

Hydrants | - | 20-40 | 1-2 |

Water meters | - | 20-40 | 2-4 |

Sprinkler nozzle | - | 5-10 | 2-3 |

Fittings of portable pipes | - | 15 | 2-3 |

47.4 Basic Concepts and Terminologies in Economic Analysis

(i) Economic Rate of Return (ERR): The internal rate of return is calculated using economic values. Interest rate at which the cost and benefits of aproject, discounted over its life, are equal. ERR differs from the financial rate of return. It takes into account the effects of factors such as price controls, subsidies, and tax breaks.

(ii) Economic Analysis: A systematic approach to determining the optimum use of scarce resources, involving comparison of two or more alternatives in achieving a specific objective under the given assumptions and constraints. Economic analysis takes into account the opportunity costs of resources employed and attempts to measure in monetary terms the private and social costs and benefits of a project to the community oreconomy.

(iii) Economic Value: It is the amount by which the return or output from a project changes the national income.

(iv) Financial Rate of Return: The internal rate of return calculated using market values.

(v) National Income: National Income is the money value of all goods and services produced by an economy in a given period of time for a country. National income measures the money value of the flow of output of goods and services produced within an economy over a period of time. The level and rate of growth of national income provide various purposes regarding economy, production, trade, consumption, policy formulation, etc.

(vi) Gross Domestic Product (GDP): The monetary value of all the finished goods and services produced within a country's borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all the private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

GDP = C + G + I + NX

where,

C is equal to all private consumption, or consumer spending, in a nation's economy

G is the sum of government spending

I is the sum of all the country's businesses spending on capital

NX is the nation's total net exports, calculated as total exports minus total imports. (NX = Exports - Imports)

(vii) Net Benefit: The benefits from an irrigation project minus the costs. It is often calculated as the present value of benefits minus the present value of costs.

Gross Benefit: The incremental value of output from a project shows the gross benefit.

(viii) Incremental Net Benefit: The increase in net benefit with the project is called its incremental net benefit. It shows the incremental cash flow.

(xi) Indirect Benefit: The secondary benefits resulting from a project is called as indirect benefit.

(xii) Opportunity cost: The opportunity cost is the benefit foregone by investing capital in a particular project, instead of its next best alternative use. It usually form the basis for selecting the discount rate for calculating the benefit cost ratio and the net present worth of the investment.

(xiii) Discount rate: It is the interest rate used to determine the present worth of a future values in discounted cash flow analysis.

(xiv) Efficiency Price: It is the economic value used in economic analysis. Efficiency prices reflect the opportunity cost or value of a good or services used or generated by a project. The price used may be the market price adjusted for market distortions or shadow price. Efficiency price is used in economic analysis when the objective is to maximize the national income. Hence the procedure is also sometime called as efficiency analysis.

(xv) Imputed Price: It is a price or economic values obtained by some computation rather than using an observed market price. It is better to avoid using an imputed price in project analysis, to the extent possible.

(xvi) Inflation: The rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Inflation occurs when the quantity of money in circulation rises relative to the quantity of goods and services which are available. Reserve Bank of India attempts to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum. In analysis, it is usual to consider constant prices rather than the current prices and to consider that inflation will affect prices of all costs and benefits equally. It is assumed that the prices will affect both the costs and benefits to the same extent, and hence the general relationship between costs and products and inputs and benefits will remain same.

(xvii) Shadow Price: Shadow price is the value used in economic analysis for cost or benefits in a project when it is considered that the market price may not provide a realistic estimate of the economic value. Shadow price usually means the accounting price under such a situation. Shadow price usually is derived using the mathematical model such as linear programming.

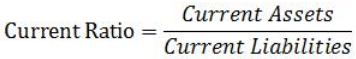

(xviii) Current ratio: The current ratio measures a company's ability to pay short-term obligations.

It is computed by the formula:

It is also known as "liquidity ratio", "cash asset ratio" and "cash ratio".

(xix) Current Price: It is the price or the value which includes the effect of change in the price of a commodity or service due to inflation. It could be a past value or price, as recorded, or a value or price which is expected to occur in normal conditions.

(xx) Farm Gate Price: A cultivated product in agriculture or aquaculture is the net value of the product when it leaves the farm, after marketing costs have been subtracted. Since many farms do not have significant marketing costs, it is often understood as the price of the product at which it is sold by the farm (the farm gate price). The farm gate value is typically lower than the retail price consumers pay in a store as it does not include costs for shipping, handling, storage, marketing, and profit margins of the involved companies.

(xxi) Cut-off Rate: It is the rate below which a project cannot be accepted as economically viable. The opportunity cost of the capital is usually taken as the cut off rate. It is the minimum acceptable internal rate of return.

(xxii) Transfer Payment: It is a payment made without receiving any goods or services in return. In irrigation projects, the most common transfer payments are the taxes of different types and the subsidies received for growing specialized crops and adopting water-saving irrigation methods like sprinkler and drip irrigation systems.

(xxiii) Economic Life: The period during which a fixed asset is capable of yielding services to its owner.

(xxiv) Grace Period: In credit transactions during the grace period allowed, the holder need not repay principal, and sometimes the interest.

(xxv) Grants: A payment made to an individual or a co-operative enterprise by a government or other agency without expectation of goods or services in return.

The purpose is to encourage a specific activity. A grant is a transfer payment in economic appraisal.

(xxvi) Work Day: The time devoted to an activity by one person during one day. In developing countries, the duration in agricultural operations is usually taken as 8 hours per day.

(xxvii) Equity: It is the ownership right in an enterprise. Equity capital is the residual amount left after deducting the total liabilities from the total assets.