Question 11:

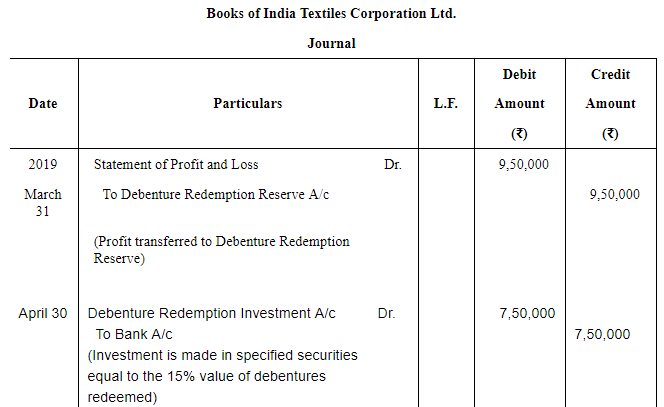

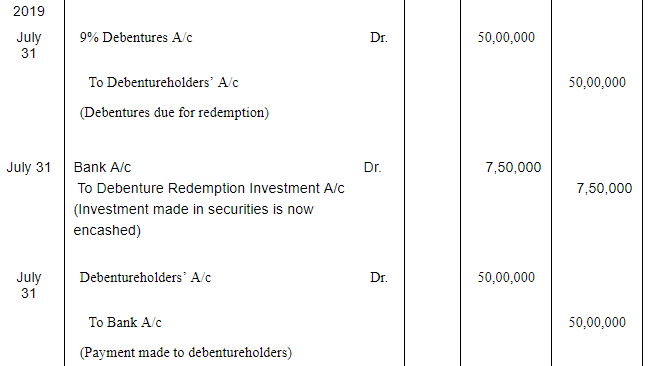

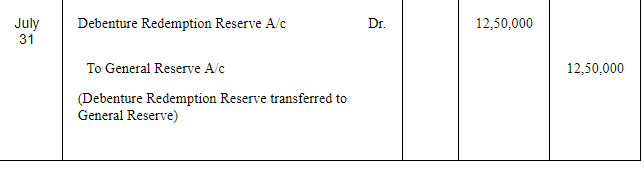

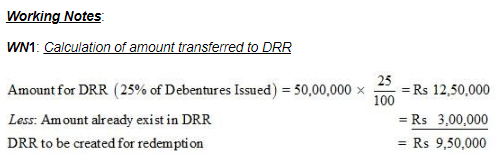

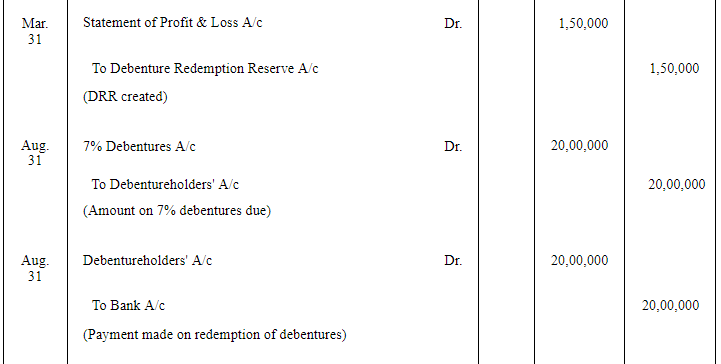

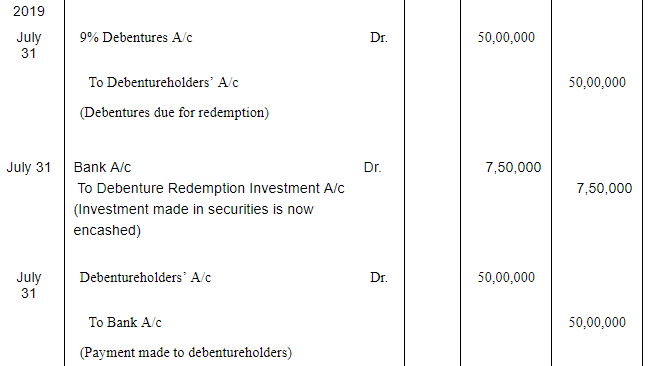

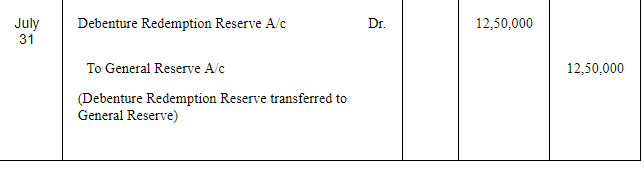

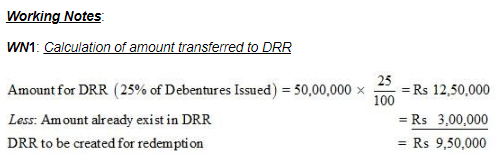

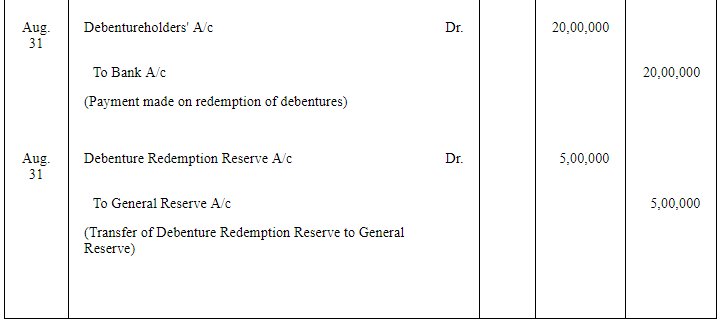

India Textiles Corporation Ltd. has outstanding ₹ 50,00,000; 9% Debentures of ₹ 100 each due for redemption on 31st July, 2019. Pass Journal entries for redemption assuming that there is a balance of ₹ 3,00,000 in Debentures Redemption Reserve on the date of redemption.

ANSWER:

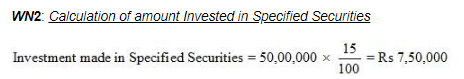

*As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entries for DRR and Investment have been passed in the previous accounting year.

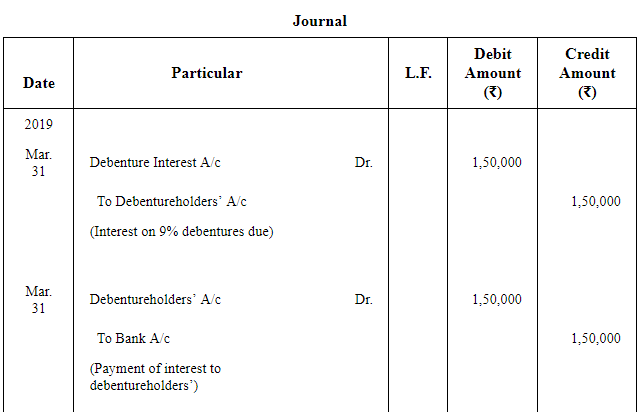

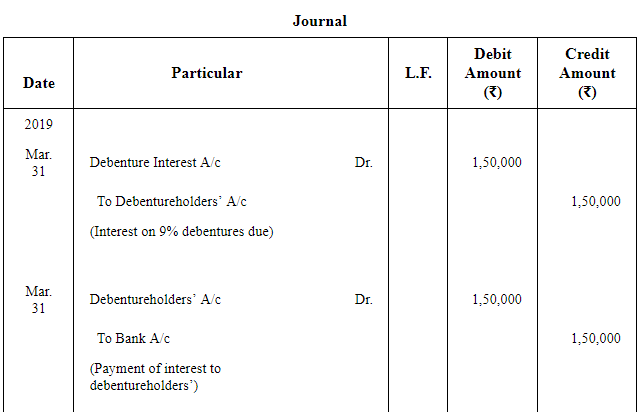

Note: Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures as given below.

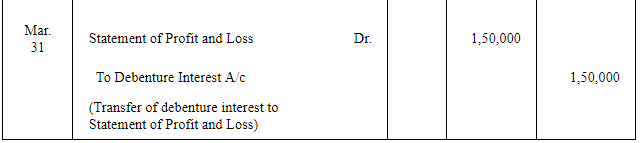

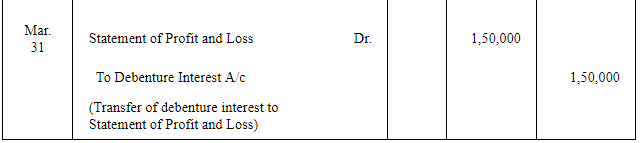

Question 12:

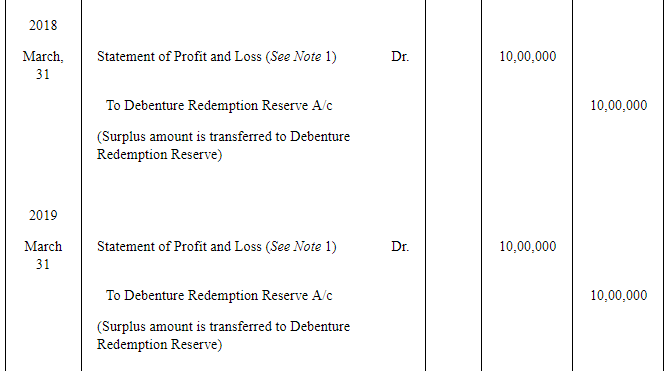

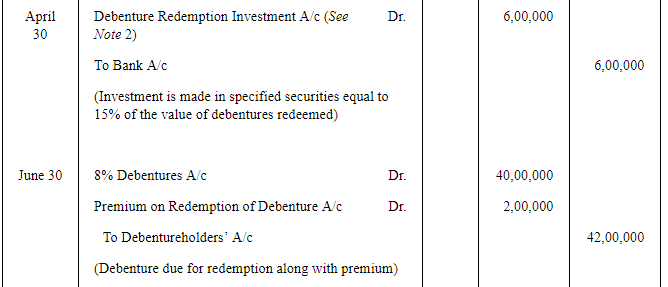

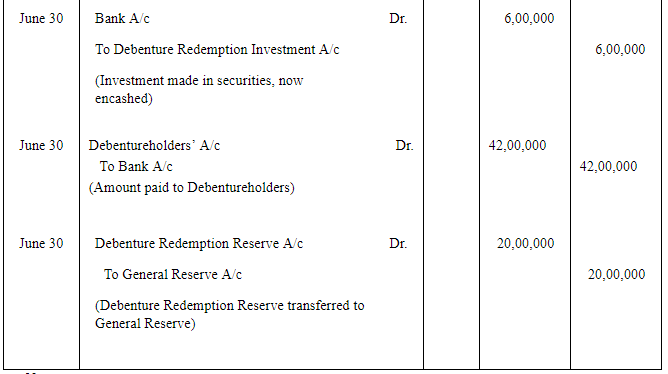

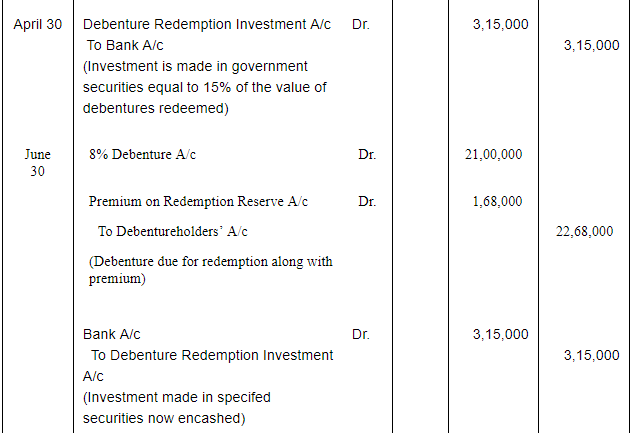

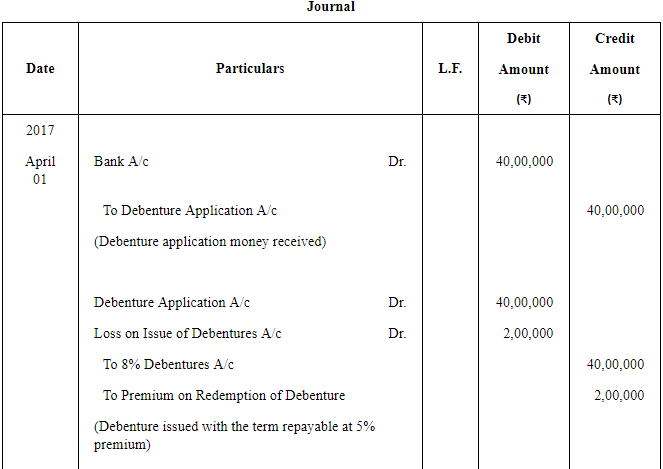

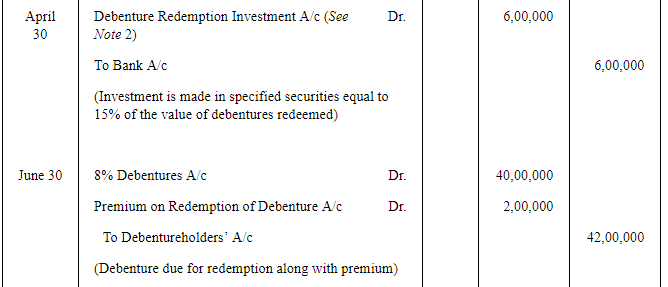

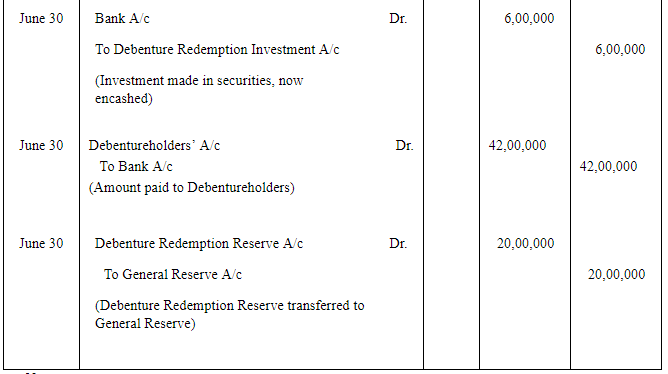

Manish Ltd. issued ₹ 40,00,000; 8% Debentures of ₹ 100 each on 1st April, 2017. The terms of issue stated that the debentures are to be redeemed at a premium of 5% on 30th June, 2019. The company decided to transfer ₹ 10,00,000 out of profits to Debentures Redemption Reserve on 31st March, 2018 and ₹ 10,00,000 on 31st March, 2019.

Pass Journal entries regarding the issue and redemption of debentures, DRR and Investment without providing for the interest or loss on issue of debentures.

ANSWER:

Note:

1. As prescribed by Section 71(4) of the Companies Act, 2013, companies are required to create DRR at 25% of the total value of debentures. However, it purely depends upon a company and its discretion to transfer more amount to DRR than the prescribed amount of 25% in the case of companies for whom it is mandatory to create DRR out of profits. In this case, as explicitly specified about company's discretion, DRR has been created for a total of Rs 20,00,000 which is 50% of the total value of redeemable debentures.

2. As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entries for DRR and Investment have been passed in the previous accounting year.

3. As explicilty stated in the question, entries for interest on debentures has not been passed.

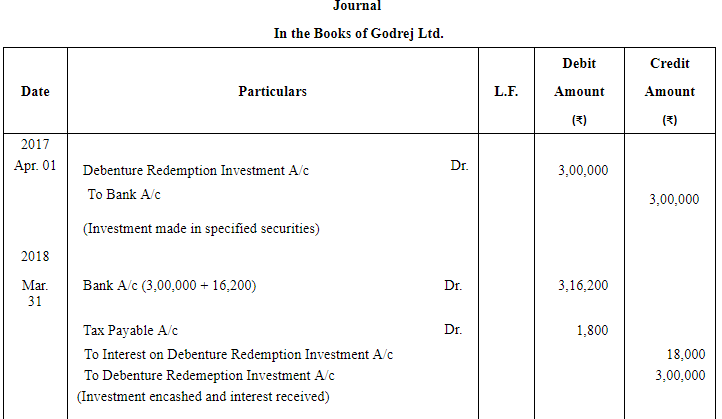

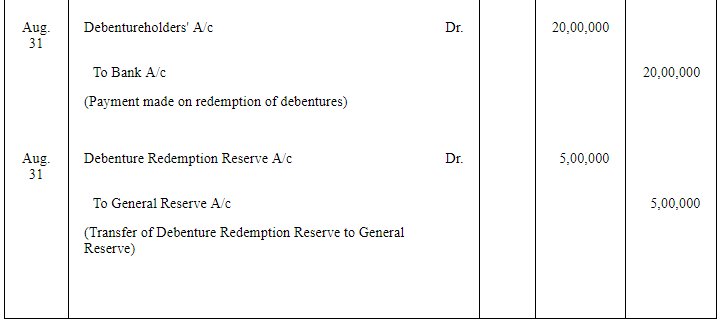

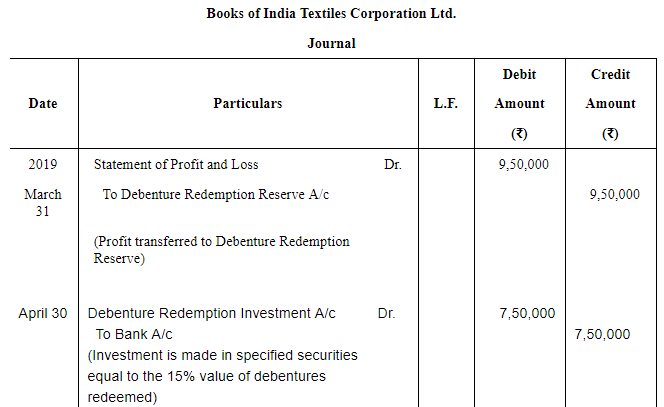

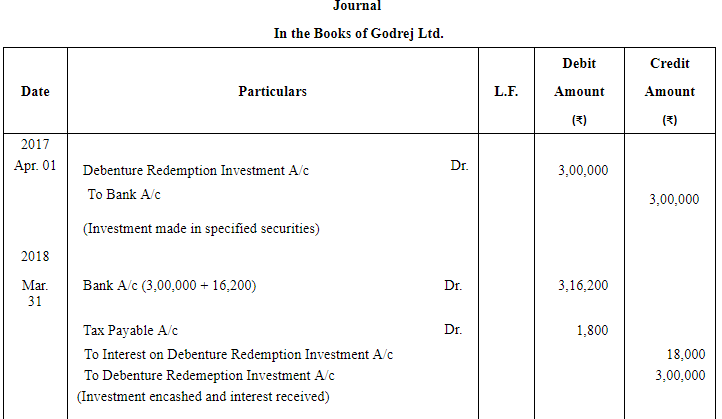

Question 13:

Godrej Ltd. has 20,000; 7% Debentures of ₹ 100 each due for redemption on 31st August, 2018. There is a balance of ₹ 3,50,000 in Debentures Redemption Reserve Account as on 31st March, 2016. Investment, as required by the Companies Act, 2013 is made on 1st April, 2017 in fixed deposit bearing interest @ 6% p.a. Bank deducted TDS @ 10% on its maturity which is 31st March, 2018.

Pass Journal entries for redemption of debentures.

ANSWER:

Note:

1. The year of transfer to DRR and investment has been assumed to be in 2014 in order to maintain consistency with the guidelines issued by Ministry of Corporate Affairs which requires that every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entries for DRR and investment if passed in any of the year then redemption would take place in the following year.

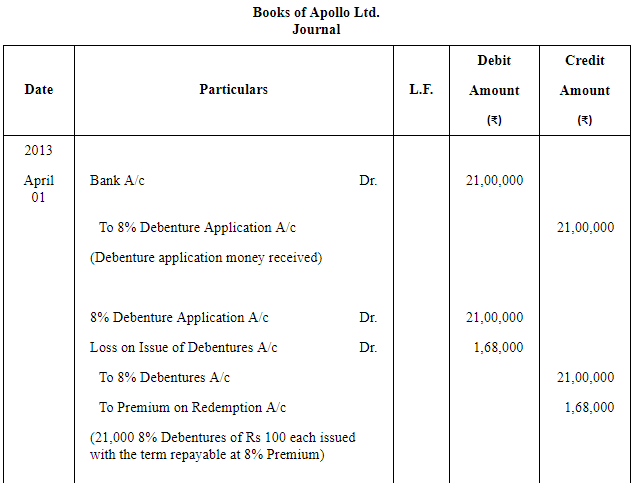

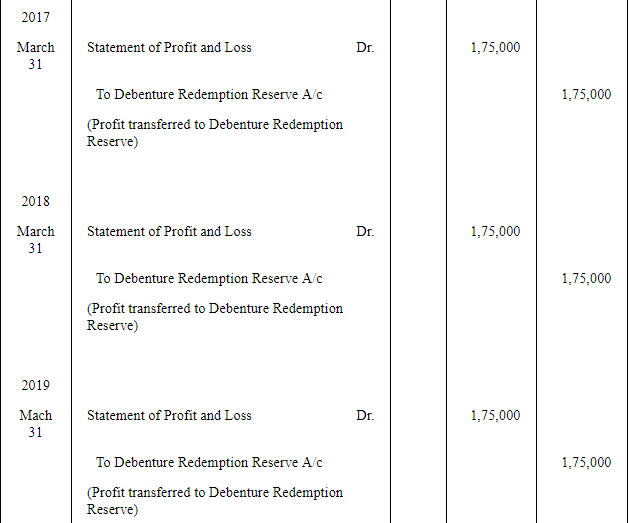

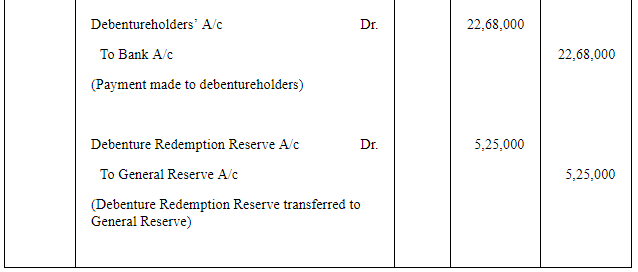

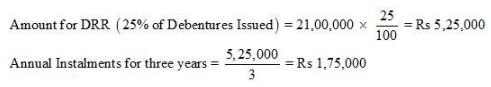

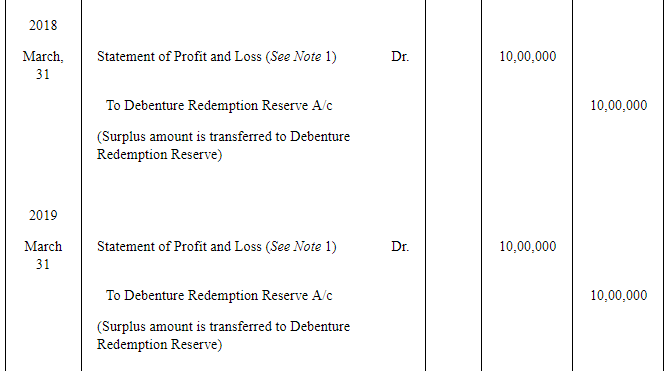

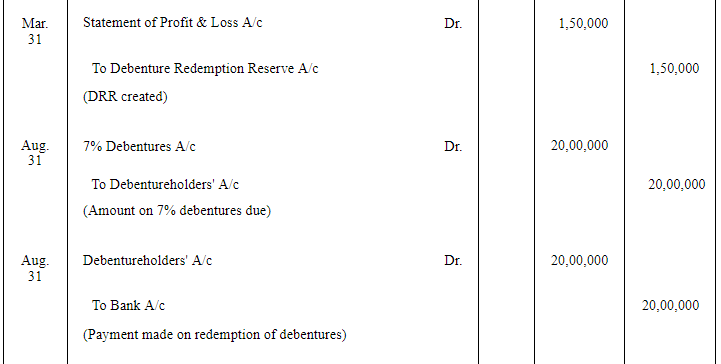

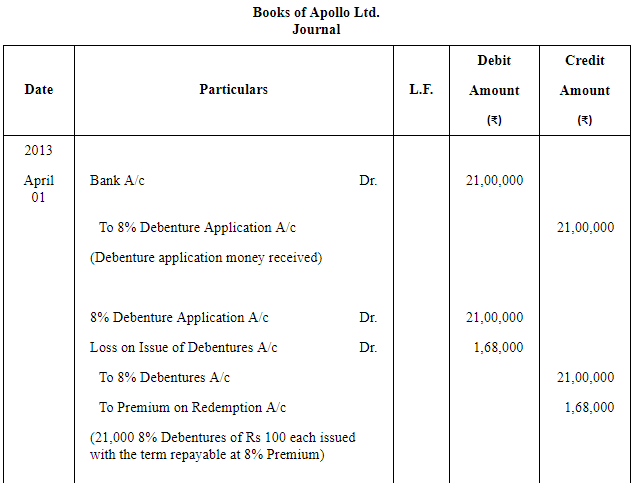

Question 14:

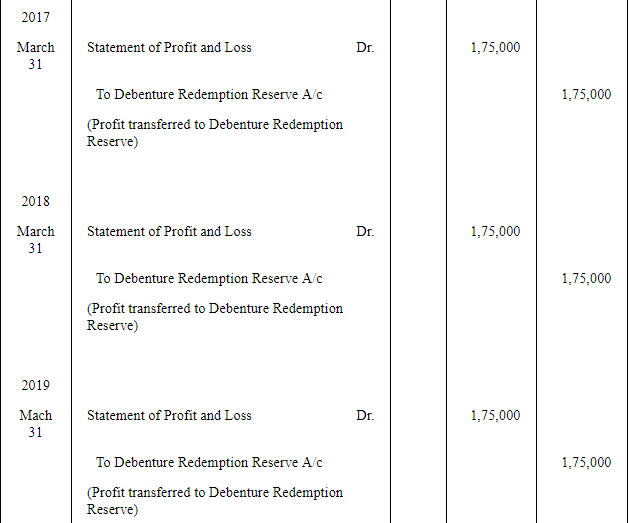

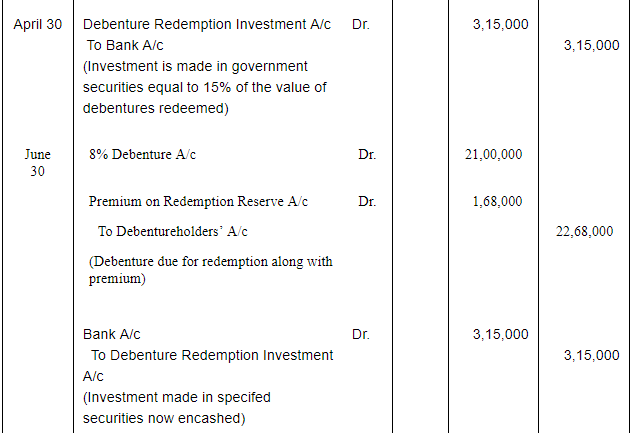

Apollo Ltd.issued 21,000; 8% Debentures of ₹ 100 each on 1st April, 2013 redeemable at a premium of 8% on 30th June, 2019. The company decided to transfer the required amount to Debentures Redemption Reserve in three equal annual instalments starting with 31st March, 2017. Required investment was made in Government Securities on 30th April, 2019. Ignore interest on debentures and also investment.

Pass necessary Journal entries regarding issue, transfer to DRR, investment, and redemption of debentures.

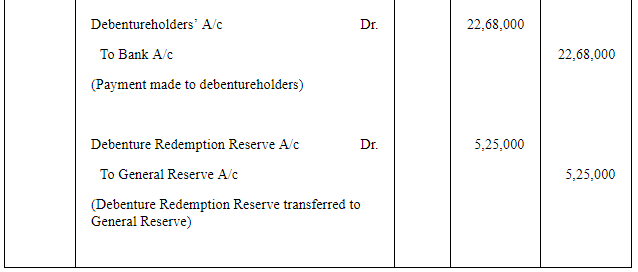

ANSWER:

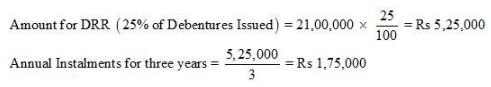

Working Note: Calculation of Amount transferred to DRR

As prescribed by Section 71(4) of the Companies Act, 2013, companies are required to create DRR at 25% of the total value of debentures. Here, debentures worth Rs 21,00,000 are to be redeemed, so, the amount of DRR will be:

Note:R to be created =6,00,000 × 25100=Rs 1,50,000

1. As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entries for DRR and Investment have been passed in the previous accounting year.