Redemption of Debentures ( Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 10.30:

Question 7:

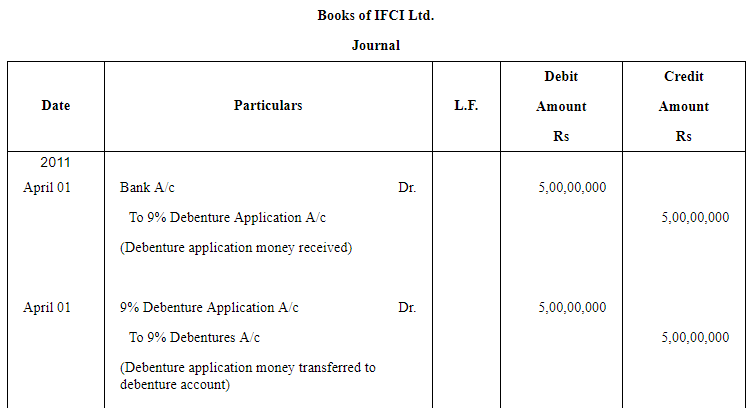

IFCI Ltd.(An All India Financial Institution) issued 10,00,000; 9% Debentures of ₹ 50 each on 1st April, 2011 redeemable on 1st April, 2019. How much amount of Debentures Redemption Reserve is required before the redemption of debentures? Also, pass Journal entries for issue and redemption of debentures.

ANSWER:

Notes:

1. All India Financial Institutions are exempted from creating DRR. Hence, in this case, no DRR is to be created.

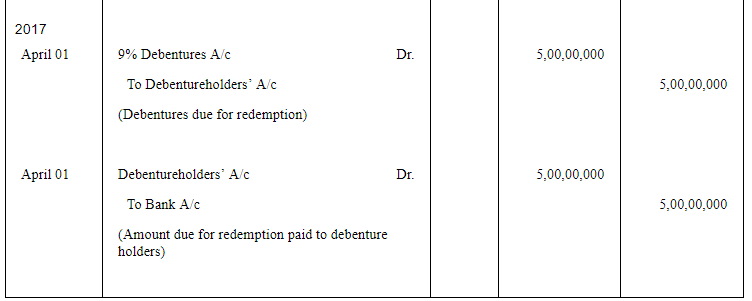

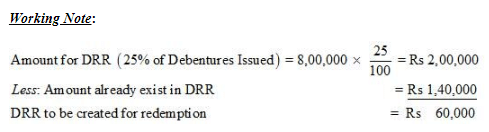

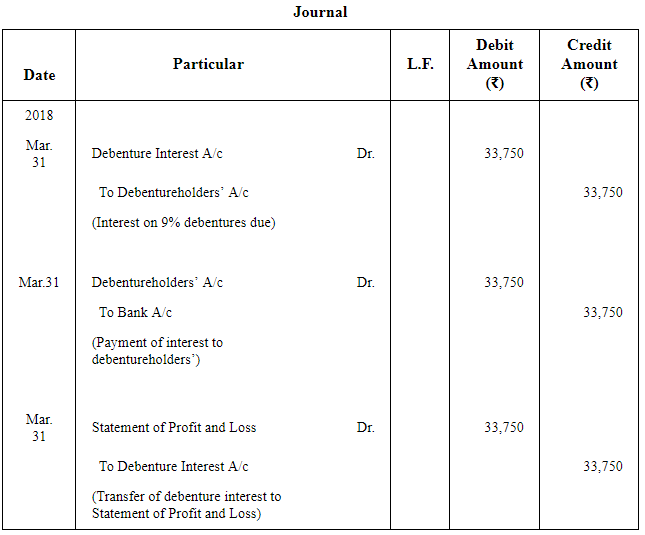

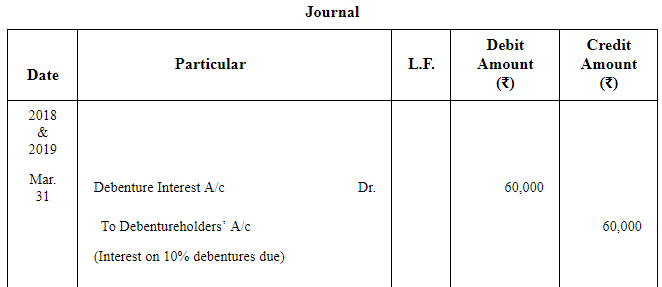

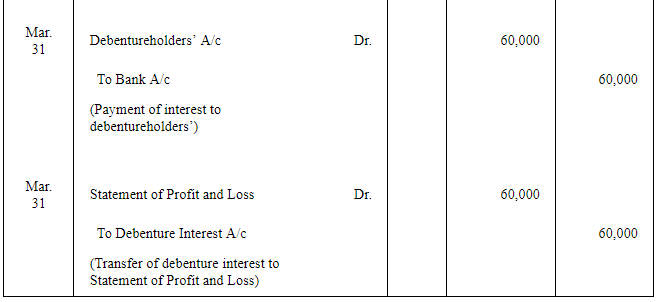

2. Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures every year from April 01, 2011 to March 31, 2017 as given below.

Question 8:

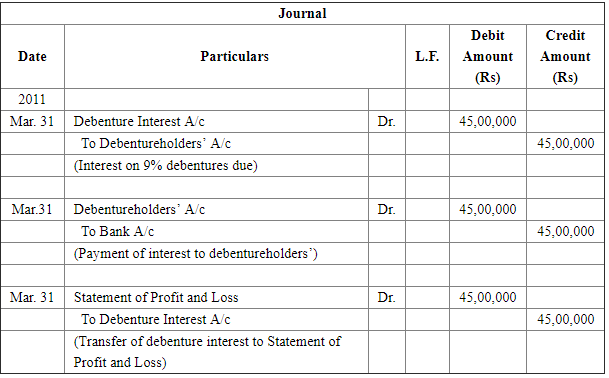

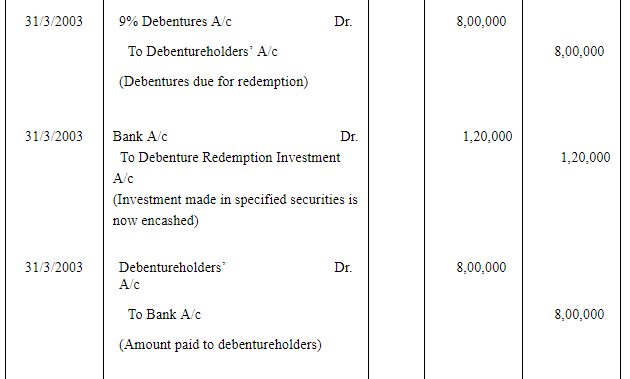

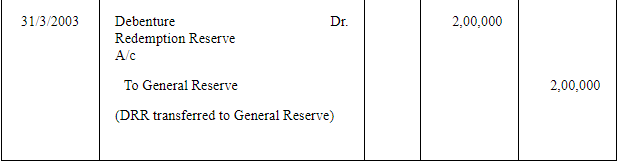

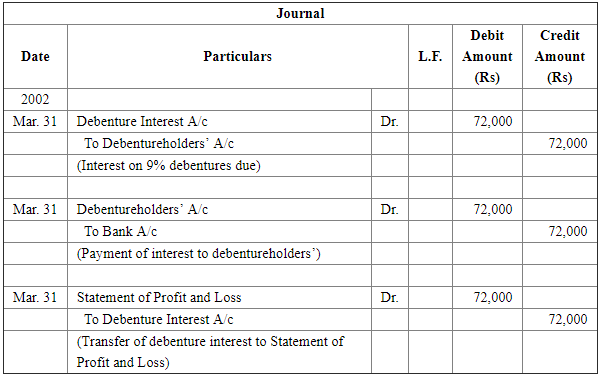

On 31st March, 2003, G Ltd. had ₹ 8,00,000;9% Debentures due for redemption. The company had a balance of ₹ 1,40,000 in its Debentures Redemption Reserve . Pass necessary journal entries for redemption of debentures.

ANSWER:

Notes:

1. Interest is not calculated on Investment as rate of interest is not provided.

2. Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures for the years ending March 31, 2002 and March 31, 2003 as given below.

*As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accodingly, entries for DRR and Investment have been passed in the previous accounting year.

Question 9:

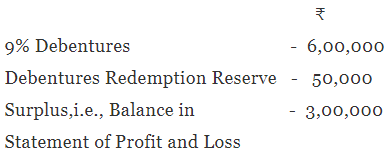

On 31st March, 2018, W Ltd. had the following balances in its books:

On that date, the company decided to transfer ₹ 1,00,000 to Debentures Redemption Reserve. It also decided to redeem debentures of ₹ 3,00,000 on 30th June, 2018.

Pass necessary Journal entries in the books of the company.

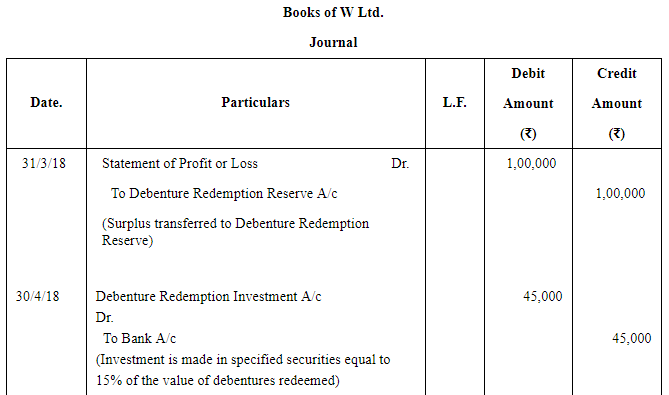

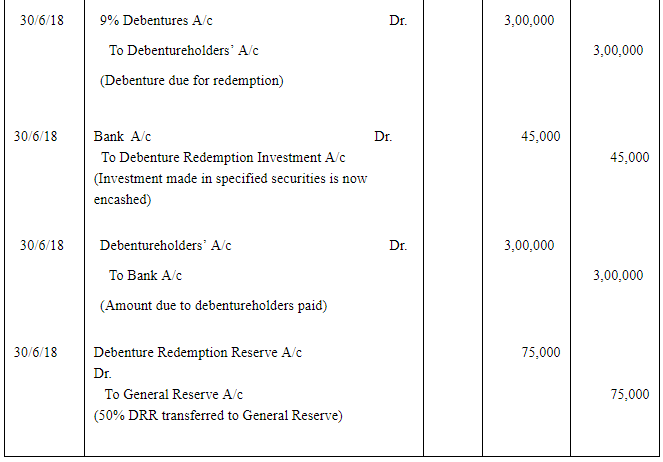

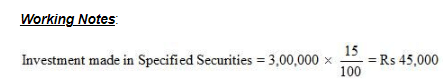

ANSWER:

Note:

1. Here, the entry for transferring the amount of DRR to General Reserve A/c has been passed with 50% of DRR amount, since the company has not fully redeemed all its debentures. Therefore, 50% of DRR amount i.e. 50% of 1,50,000, transferred to General Reserve.

2. Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures as given below.

Question 10:

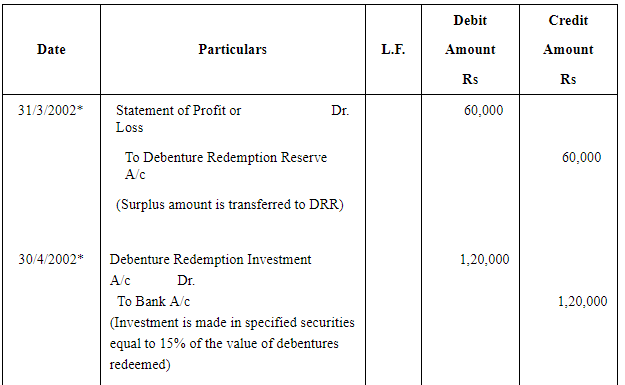

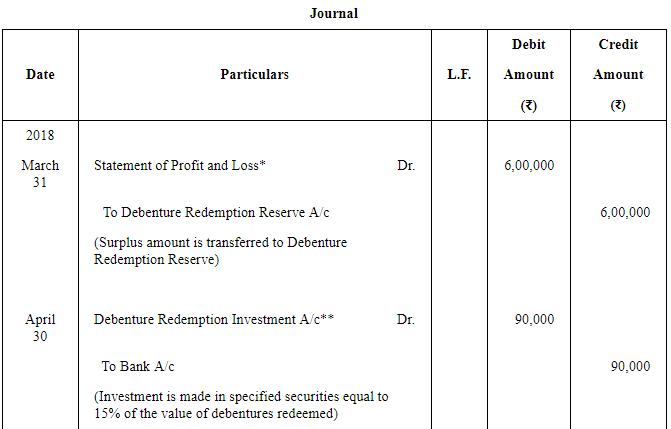

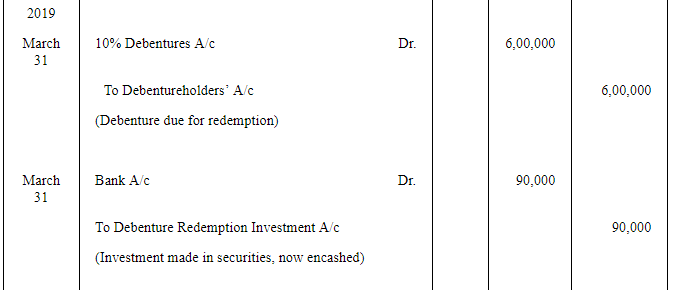

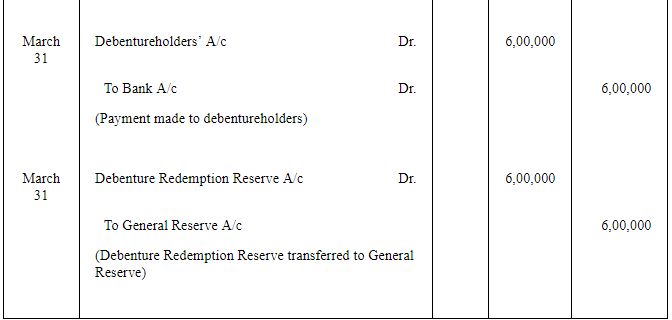

Mansi Ltd. had 6,000; 10% Debentures of ₹ 100 each due for redemption on 31st March, 2019. Assuming that the debentures were redeemed out of profits, pass necessary Journal entries for the redemption of debentures. There was a credit balance of ₹ 6,00,000 in Surplus, i.e., Balance in Statement of Profit and Loss.

ANSWER:

*In case of redemption of debentures by profits, 100% of the nominal value of debentures is transferred to DRR A/c.

**As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entries for DRR and Investment have been passed in the previous accounting year.

Note: Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures as given below.

|

42 videos|199 docs|43 tests

|

FAQs on Redemption of Debentures ( Part - 2) - Accountancy Class 12 - Commerce

| 1. What is the meaning of redemption of debentures? |  |

| 2. How are debentures redeemed? |  |

| 3. What is a Debenture Redemption Reserve (DRR)? |  |

| 4. Can a company redeem its debentures before the maturity date? |  |

| 5. What are the consequences of non-redemption of debentures? |  |