Page No 9.51:

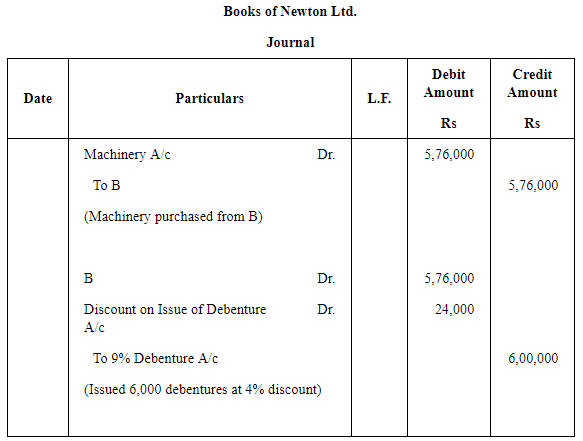

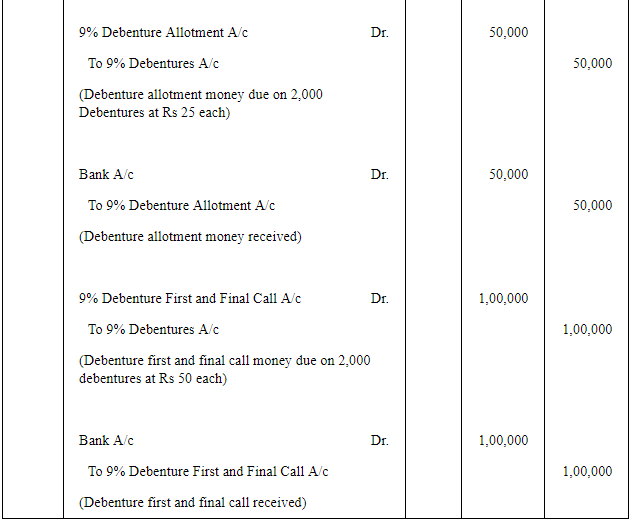

Question 1:

Vishwas Ltd. issued 2,000; 9% Debentures of ₹100 each payable as follows:

₹25 on application; ₹25 on allotment and ₹50 on first and final call.

Applications were received for all the debentures along with the application money did allotment was made . Call money was also received on the due date.

Pass necessary Journal entries in the books of the company.

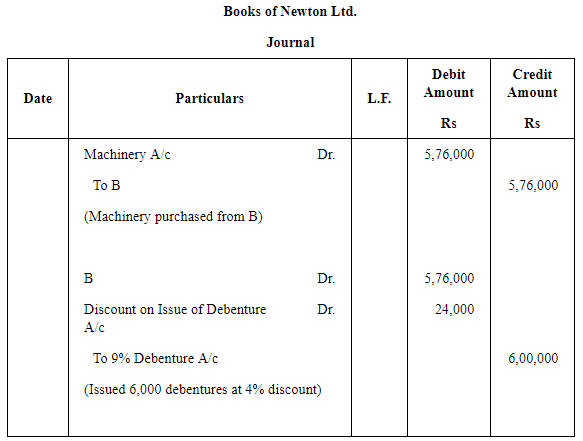

ANSWER:

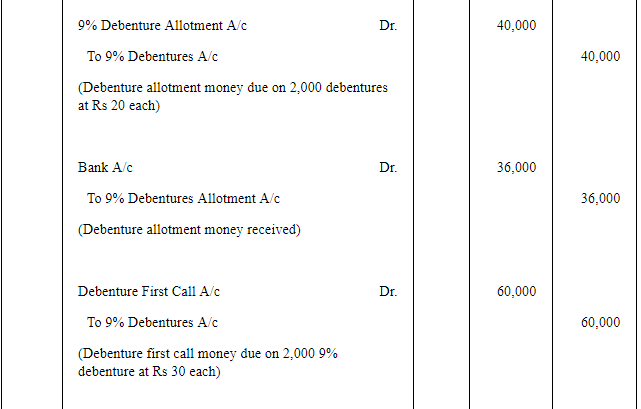

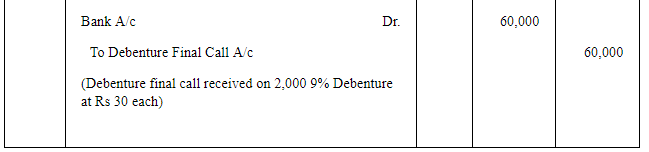

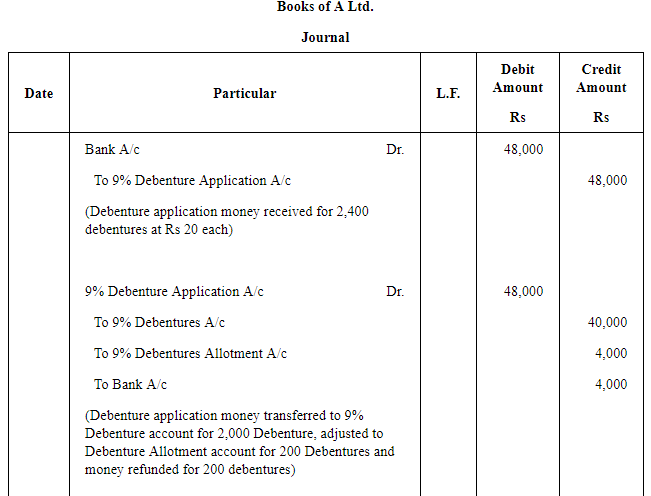

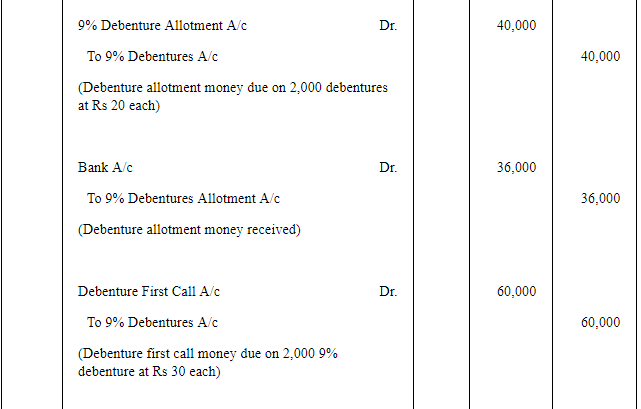

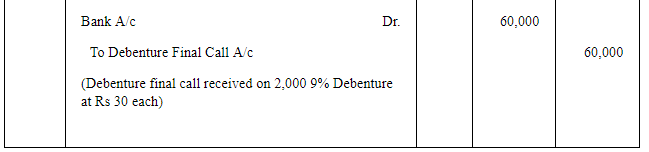

Question 2:

A Ltd. issued 2,000; 9% Debentures of ₹100 each on the following terms:

₹20 on applications; ₹20 on allotment; ₹30 on first call ; ₹30 on final call.

The public applied for 2,400 debentures. Applications for 1,800 debentures were accepted in full. Applications for 400 debentures were allotted 200 debentures and applications for 200 debentures were rejected . Pass necessary Journal entries .

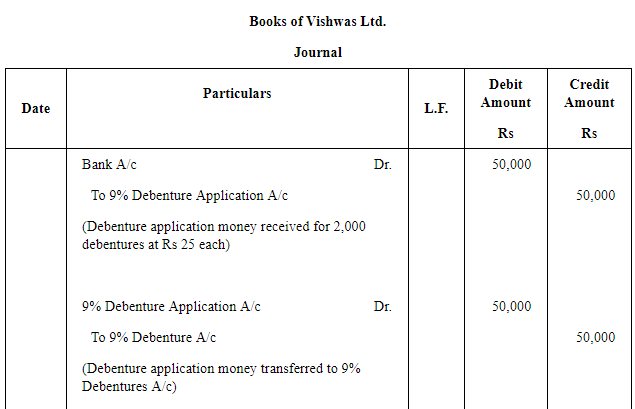

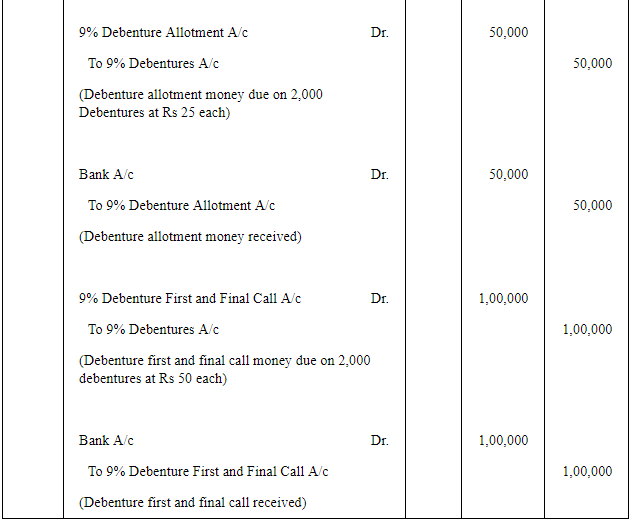

ANSWER:

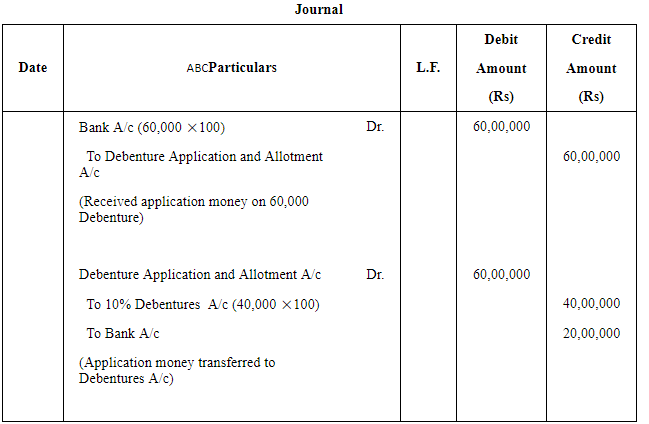

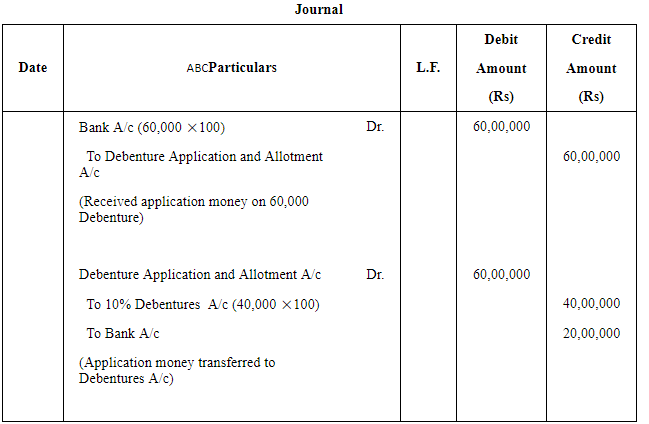

Question 3:

ABC Ltd. issued 40,000; 10% Debentures of ₹100 each at par for cash payable in full along with the application. Applications were received for 60,000 debentures. Debentures were allotted and excess application money was refunded. Pass Journal entries in the books of the company.

ANSWER:

Page No 9.52:

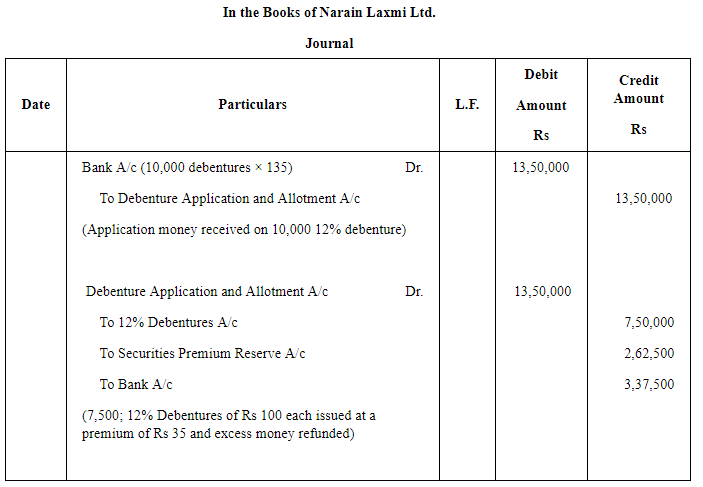

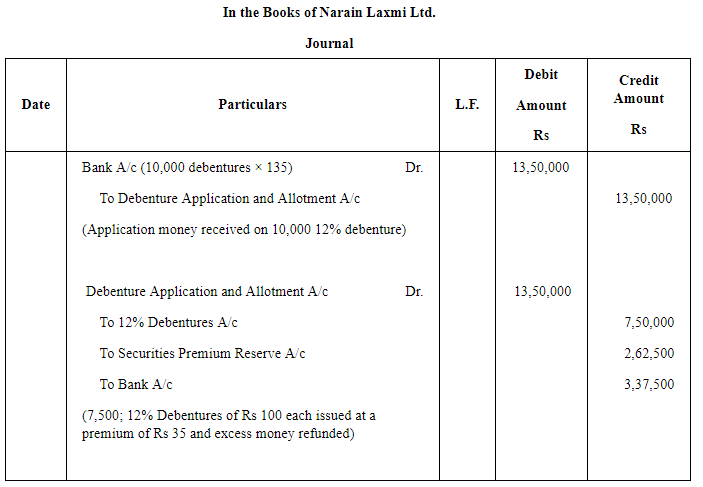

Question 4:

Narain Laxmi Ltd. invited applications for issuing 7,500; 12% Debentures of ₹100 each at a premium of ₹35 per debenture . The full amount was payable on application. Applications were received for 10,000 Debentures. Allotment was made to all the applications on pro rata.

Pass necessary Journal entries for the above transactions in the books of Narain Laxmi Ltd.

ANSWER:

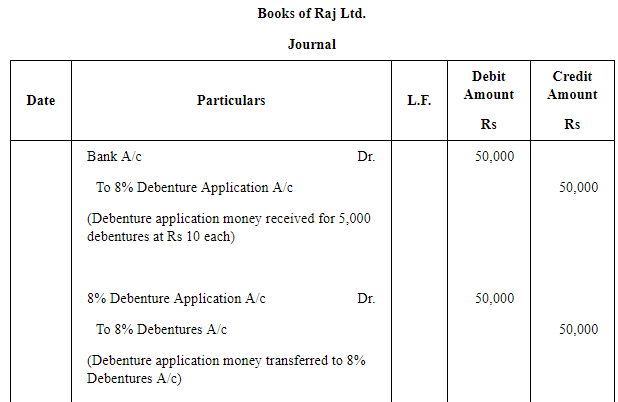

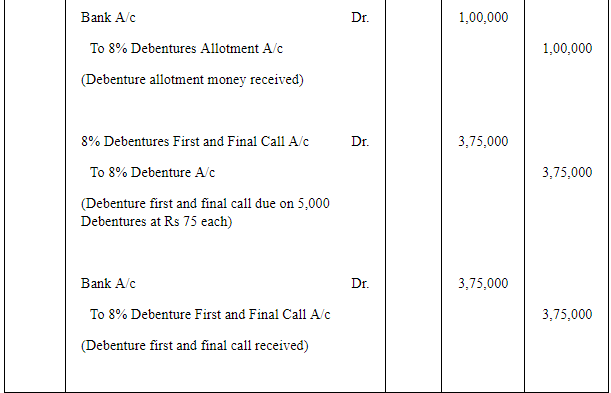

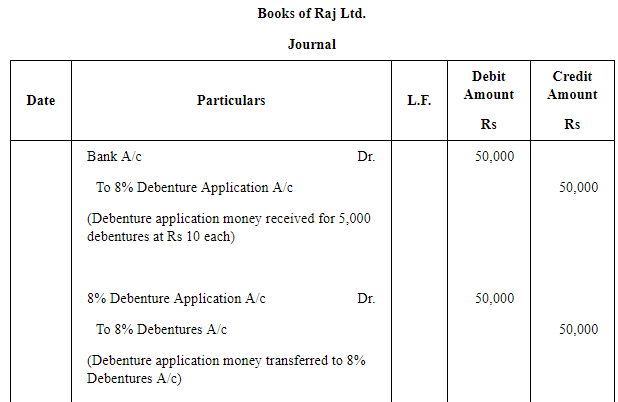

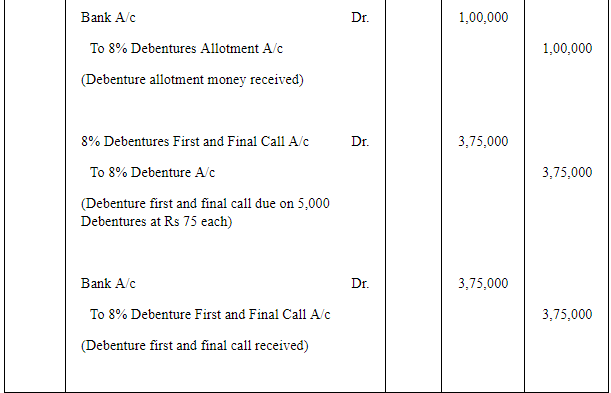

Question 5:

Raj Ltd. issued 5,000; 8% Debentures of ₹100 each at a premium of 5% payable as follows:

₹10 on application; ₹20 along with premium on allotment and balance on first and final call.

Pass necessary Journal entries.

ANSWER:

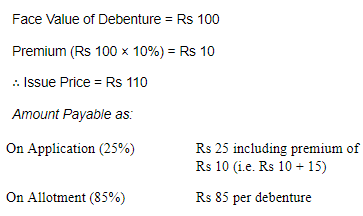

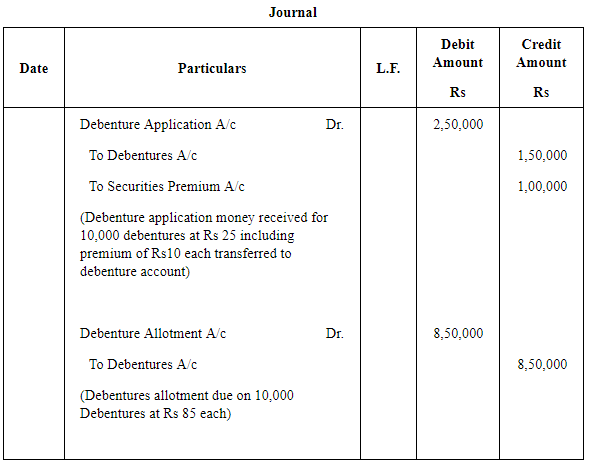

Question 6:

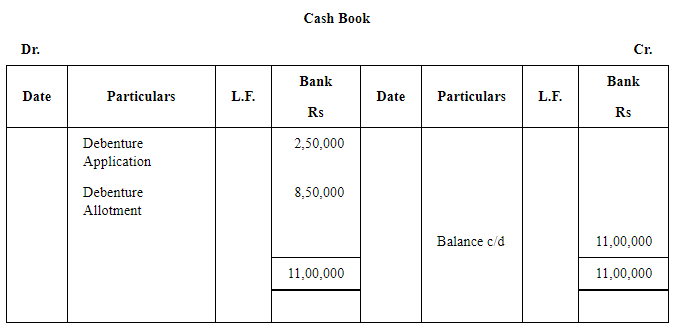

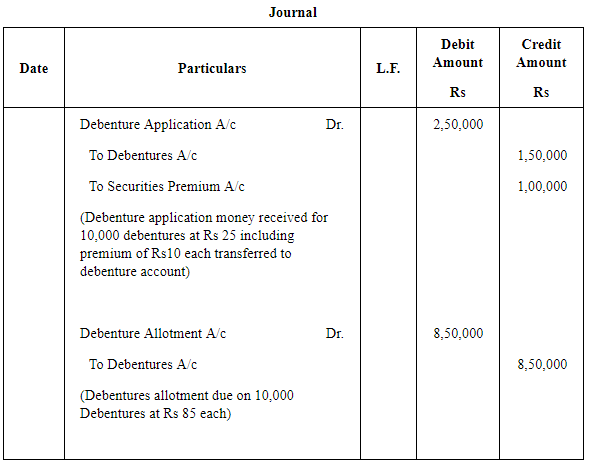

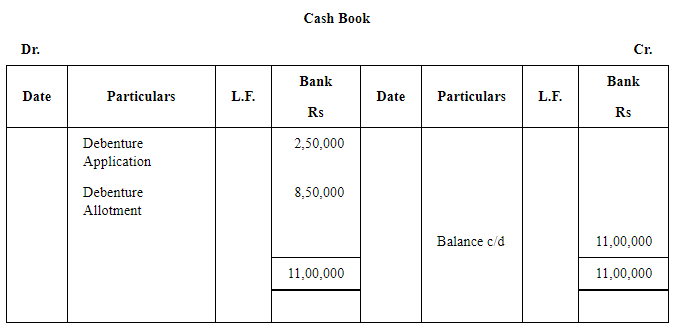

Nipa Limited issued ₹10,00,000 Debentures of ₹100 each at a premium of 10% , payable 25% on application (including premium) and the balance on allotment. The debentures were applied for and the amount was dully received.

You are required to give Journal entries and prepare Cash Book.

ANSWER:

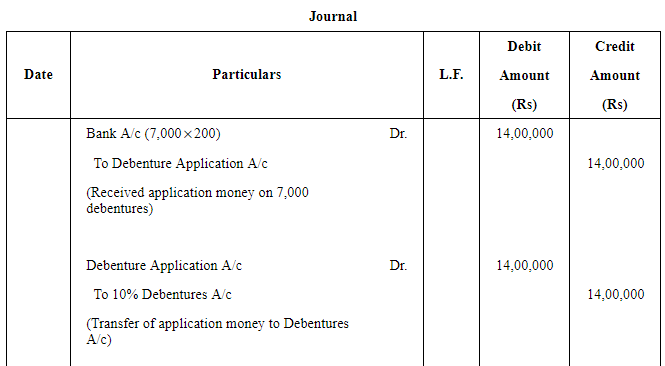

Question 7:

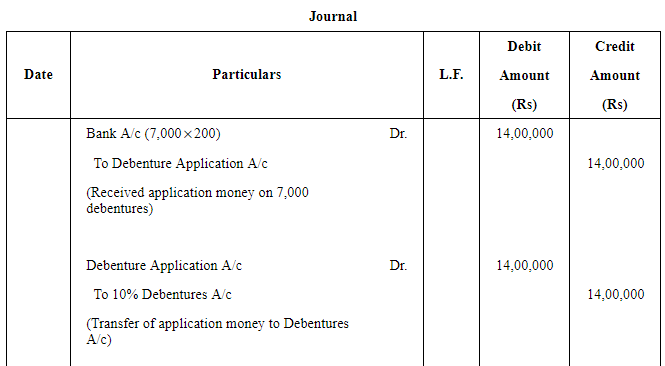

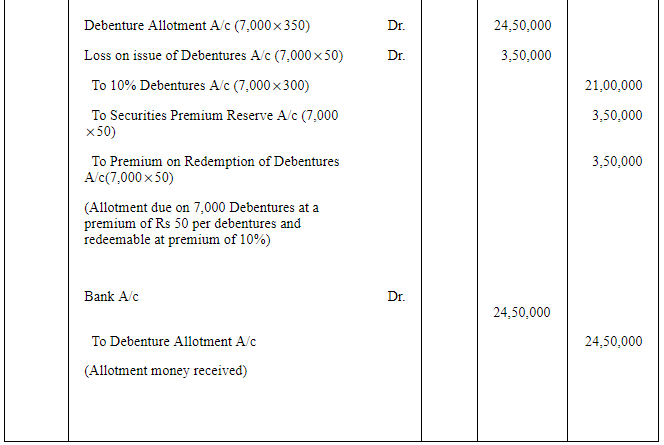

Alok Ltd. issued 7,000, 10% Debentures of ₹500 each at a premium of ₹50 per debenture redeemable at a premium of 10% after 5 years. According to the terms of issue, ₹200 was payable on application and balance on allotment.

Record necessary Journal entries at the time of issue of 10% Debentures.

ANSWER:

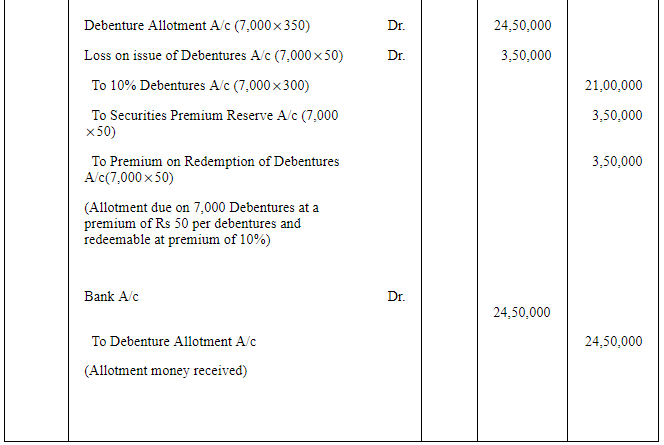

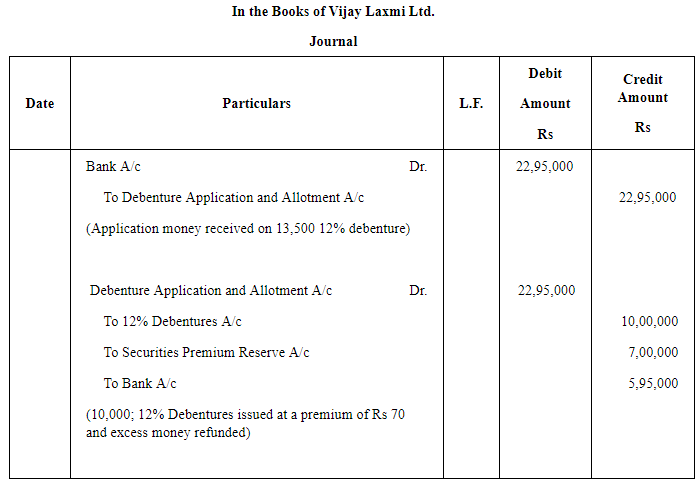

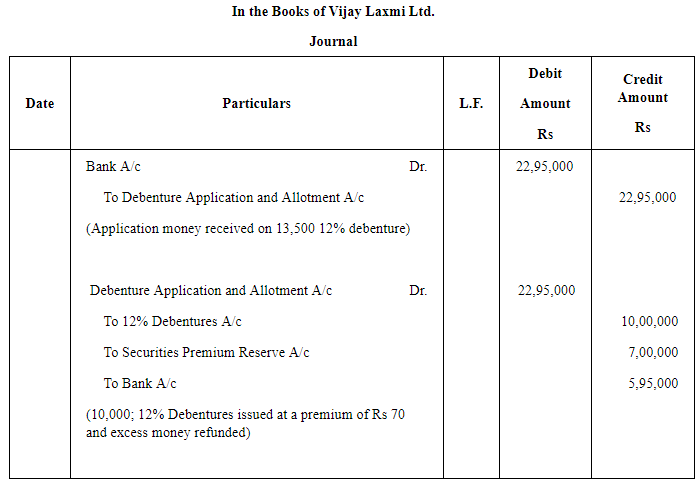

Question 8:

Vijay Laxmi Ltd. invited applications for 10,000; 12% Debentures of ₹100 each at a premium of ₹70 per debenture .The full amount was payable on application.

Applications were received for 13,500 debentures. Applications for 3,500 debentures were rejected and application money was refunded. Debentures were allotted to the remaining applications.

ANSWER:

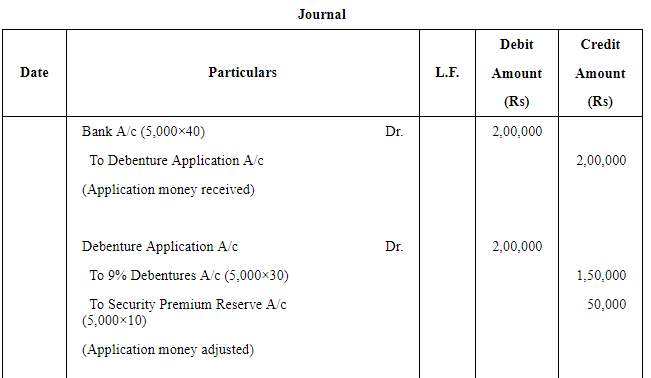

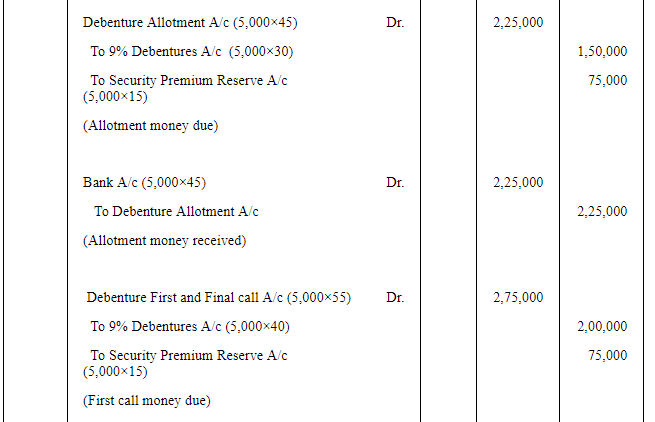

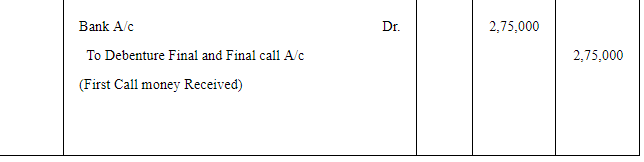

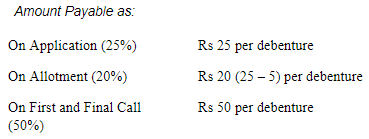

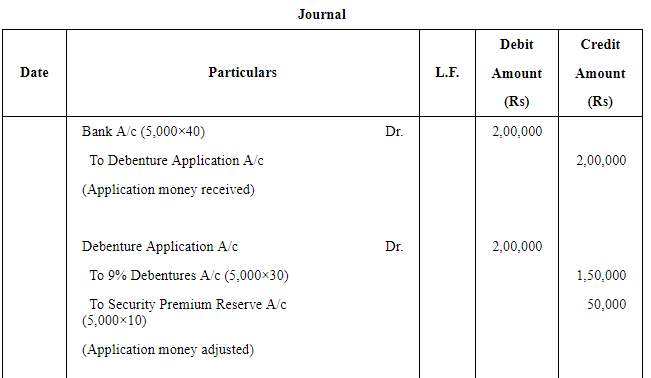

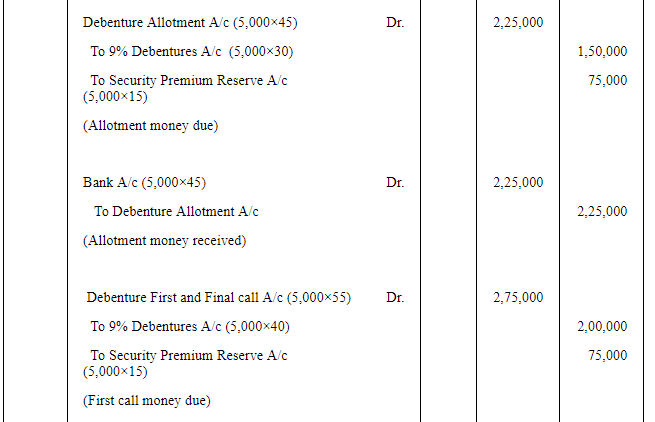

Question 9:

Iron Products Ltd. issued 5,000; 9% Debentures of ₹100 each at a premium of ₹40 payable as follows;

(i) ₹40, including premium of ₹10 on applications;

(ii) ₹45, including premium of ₹15 on allotment; and

(iii) Balance as first and final call.

The issue was subscribed and allotment made. Calls were made and due amount was received.

Pass Journal entries.

ANSWER:

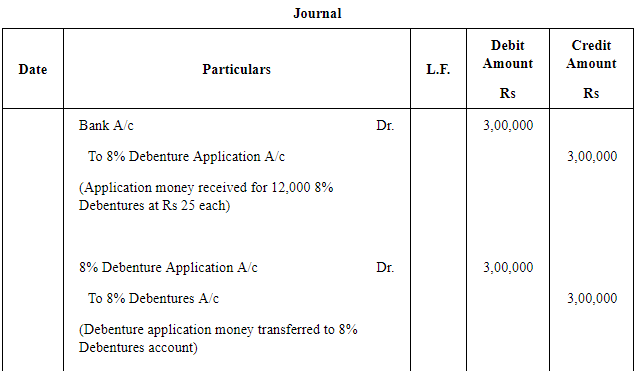

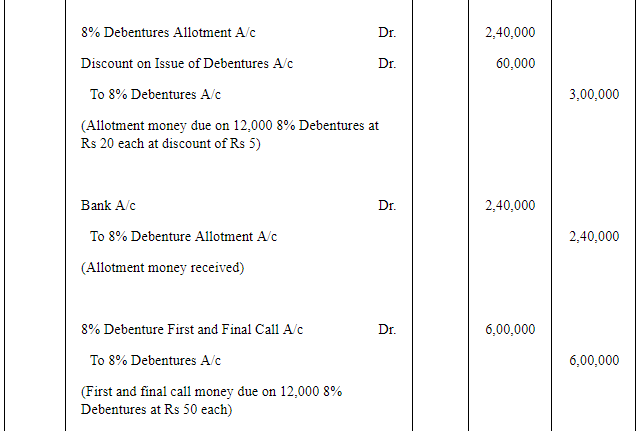

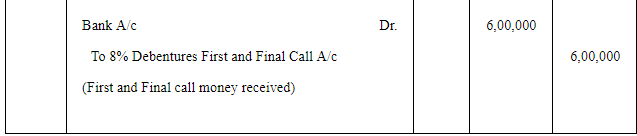

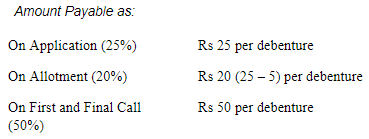

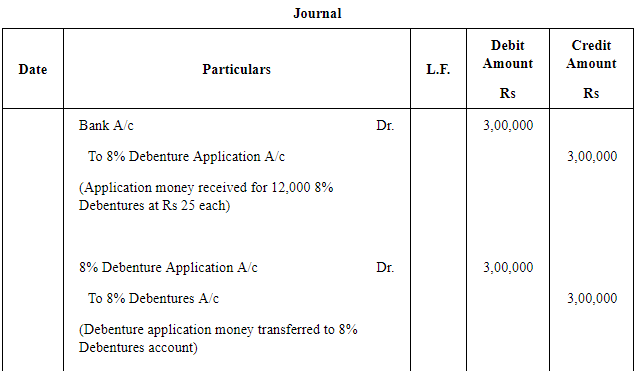

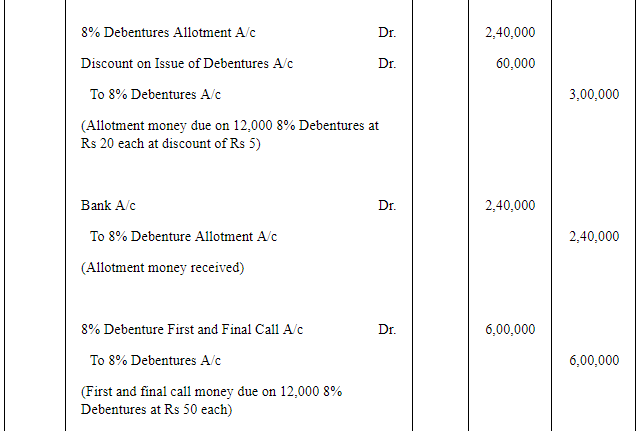

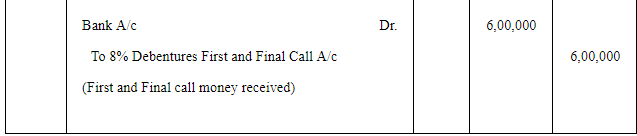

Question 10:

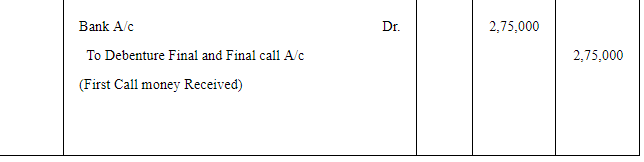

X Ltd . issued 12,000; 8% Debentures of ₹ 100 each at a discount of 5% payable as 25% on application;20% on allotment and balance after three months.

Pass Journal entries.

ANSWER:

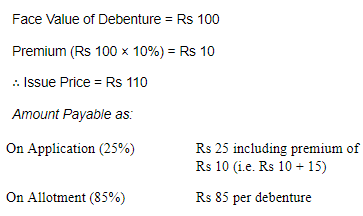

Face Value of Debenture = Rs 100

Discount (Rs 100 × 5%) = Rs 5

∴ Issue Price = Rs 95

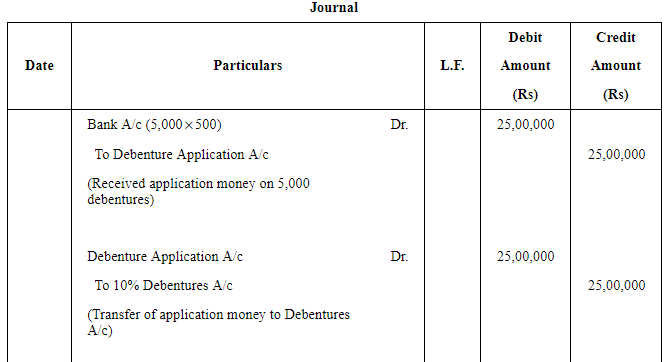

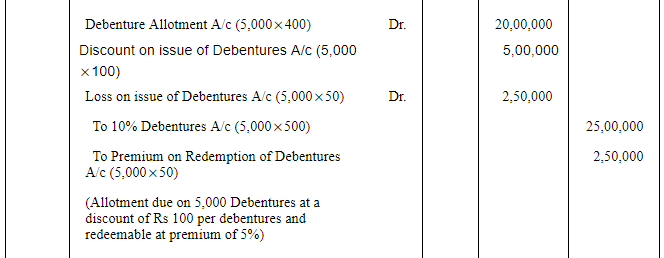

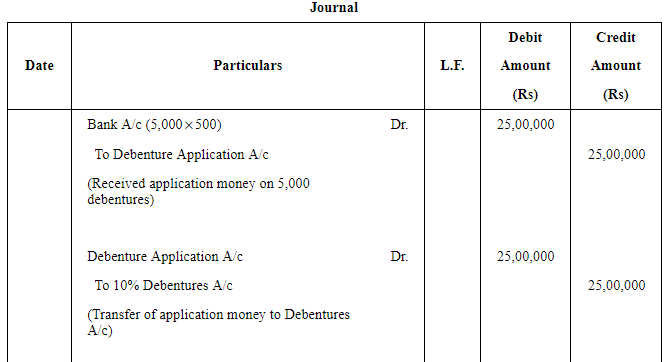

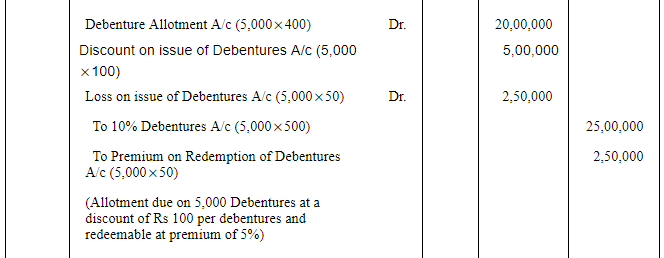

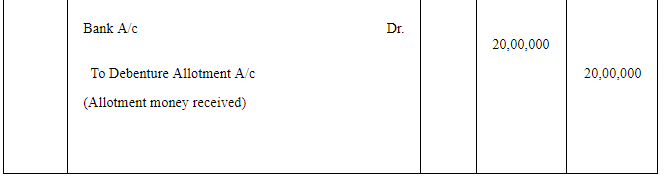

Question 11:

Alka Ltd. issued 5,000, 10% Debentures of ₹ 1,000 each at a discount of 10% redeemable at a premium of 5% after 5 years. According to the terms of issue ₹ 500 was payable on application and the balance amount on allotment of debentures. Record necessary entries regarding issue of 10% Debentures.

ANSWER:

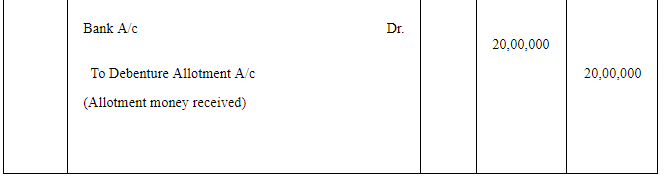

Question 12:

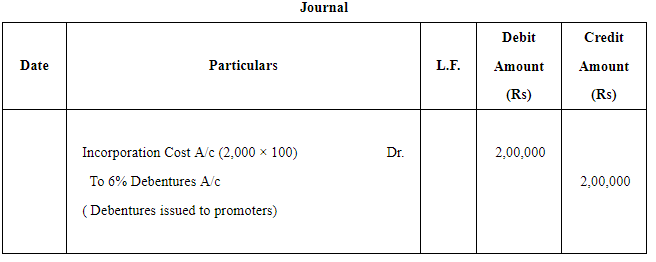

Amrit Ltd. was promoted by Amrit and Bhaskar with an authorised capital of ₹ 10,00,000 divide into 1,00,000 shares of ₹ 10 each.

The company decided to issue 1,000,6% Debentures of ₹ 100 each to Amrit and Bhaskar each for their services in incorporating the company.

Pass journal entry.

ANSWER:

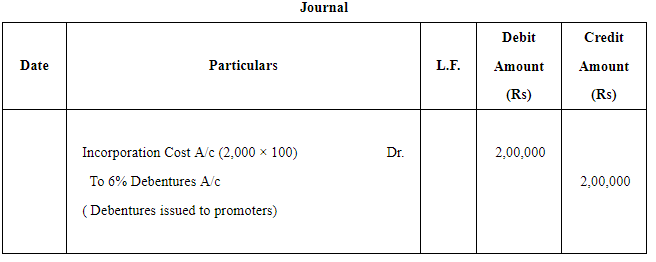

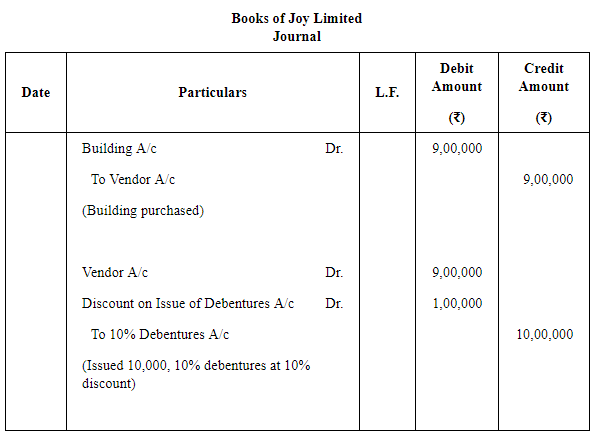

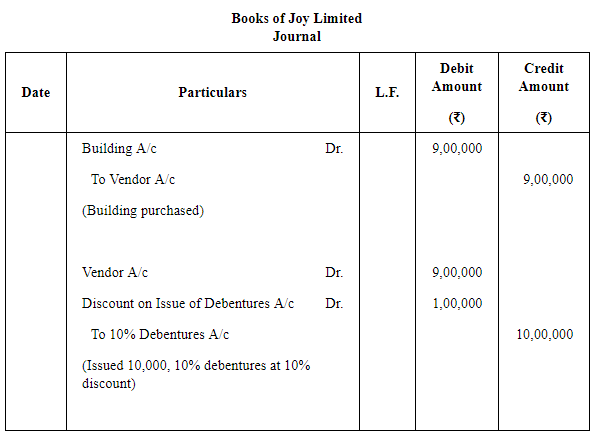

Question 13:

Joy Ltd. company bought a Building for ₹ 9,00,000 and the consideration was paid by issuing 10% Debentures of the normal (face) value of ₹100 each at a discount of 10%.

Give Journal entries.

ANSWER:

Page No 9.53:

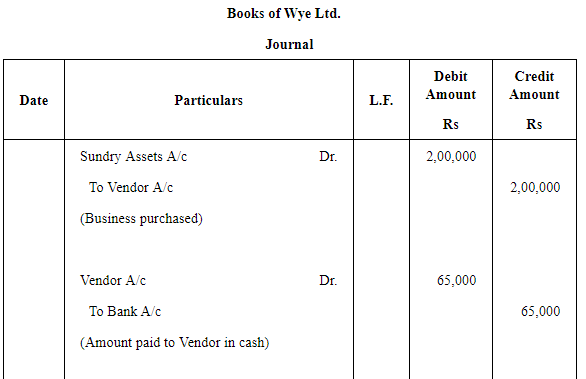

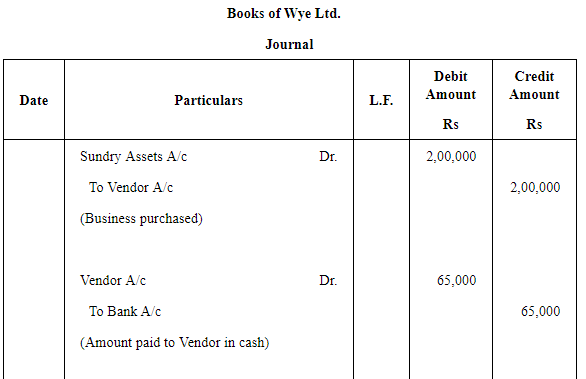

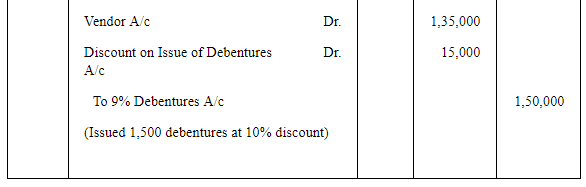

Question 14:

Wye Ltd. purchased an established business for ₹ 2,00,000 payable as ₹ 65,000 by cheque and the balance by issuing 9% Debentures of ₹ 100 each at a discount of 10%.

Give journal entries in the books of Wye Ltd.

ANSWER:

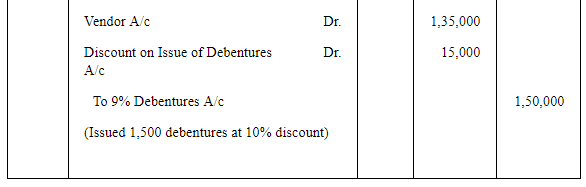

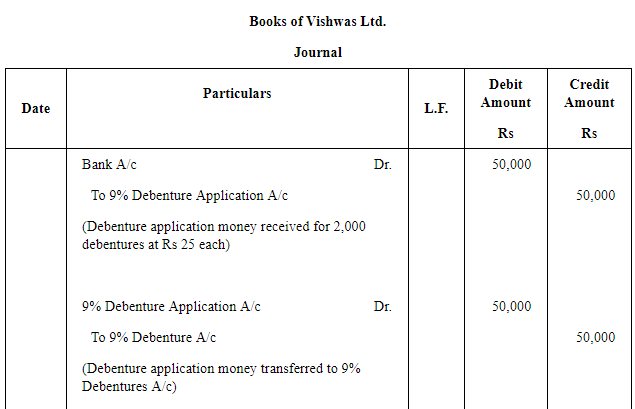

Question 15:

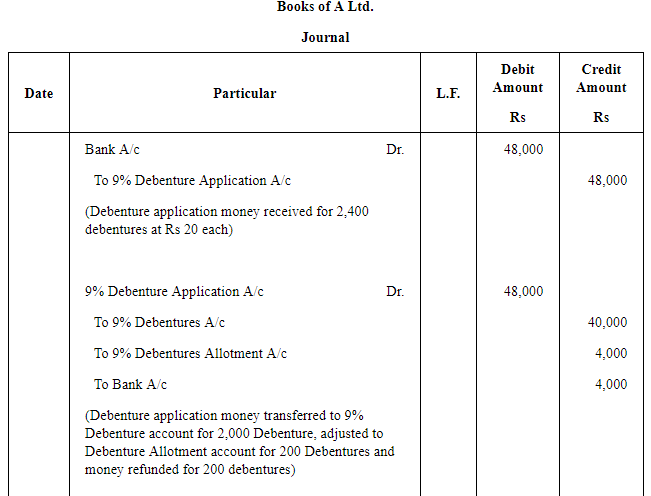

Newton Ltd. purchased a Machinery from B for ₹ 5,76,000 to be paid by the issue of 9% Debentures of ₹ 100 each at 4% discount. Journalise the trasactions.

ANSWER: