Dissolution of a Partnership Firm ( Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 7.57:

Question 22:

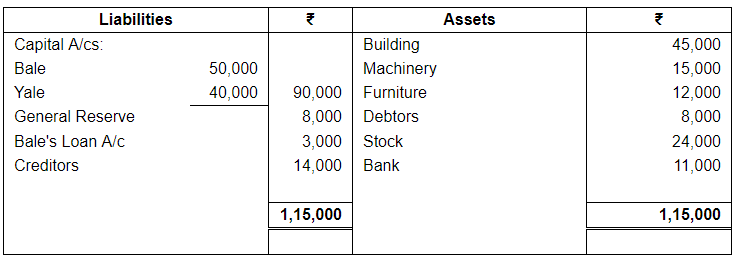

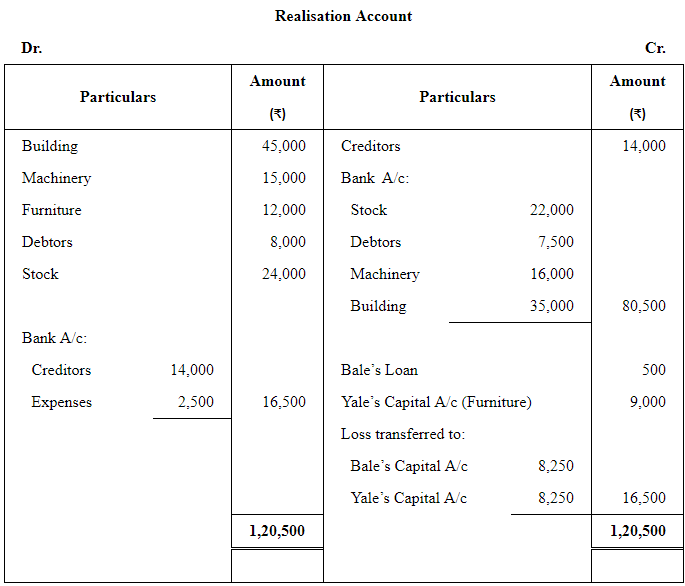

Bale and Yale are equal partners of a firm. They decide to dissolve their partnership on 31st March, 2019 at which date their Balance Sheet stood as:

(a) The assets realised were:

Stock ₹ 22,000; Debtors ₹ 7,500; Machinery ₹ 16,000; Building ₹ 35,000.

(b) Yale took over the Furniture at ₹ 9,000.

(c) Bale agreed to accept ₹ 2,500 in full settlement of his Loan Account.

(d) Dissolution Expenses amounted to ₹ 2,500.

Prepare the:

(i) Realisation Account;

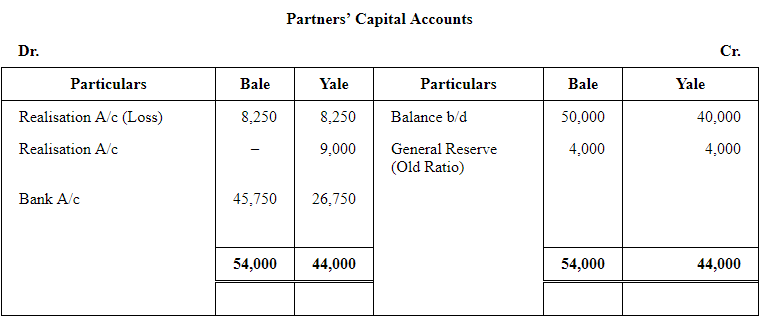

(ii) Capital Accounts of Partners;

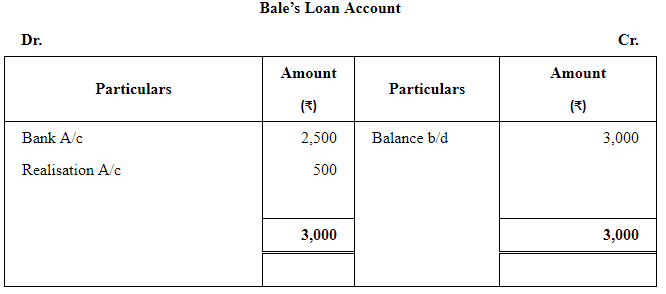

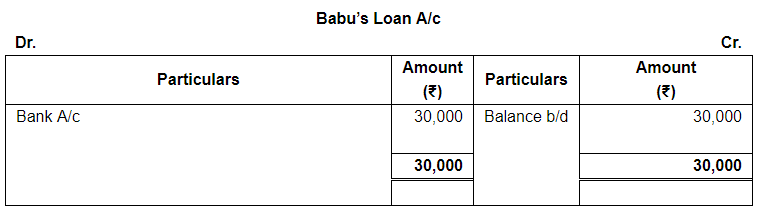

(iii) Bale's Loan Account;

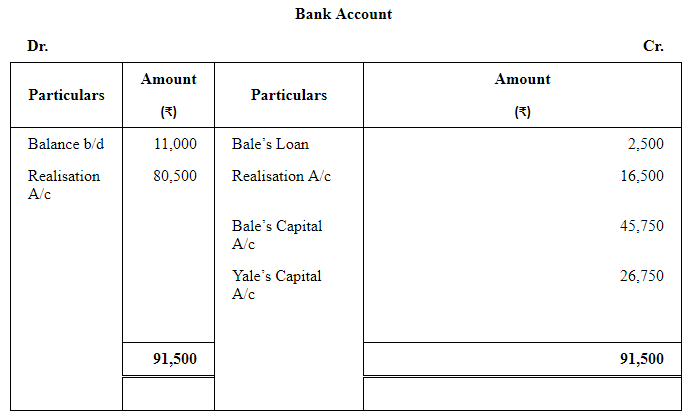

(iv) Bank Account.

ANSWER:

Question 23:

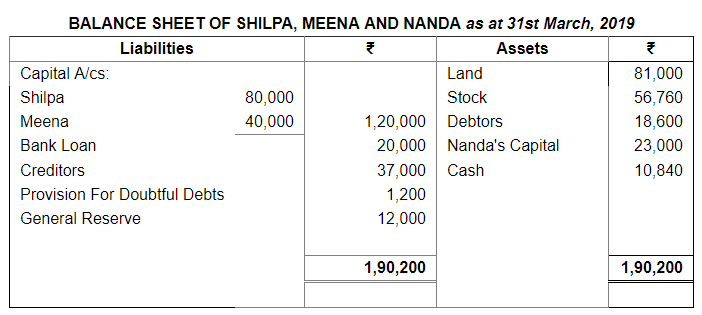

Shilpa, Meena and Nanda decided to dissolve their partnership on 31st March, 2019. Their profit-sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under:

It is agreed as follows:

The stock of value of ₹ 41,660 are taken over by Shilpa for ₹ 35,000 and she agreed to discharge bank loan. The remaining stock was sold at ₹ 14,000 and debtors amounting to ₹ 10,000 realised ₹ 8,000. Land is sold for ₹ 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to ₹ 1,200. There was a typewriter not recorded in the books worth of ₹ 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account, Partners' Capital Accounts, and Cash Account to Close the books of the firm.

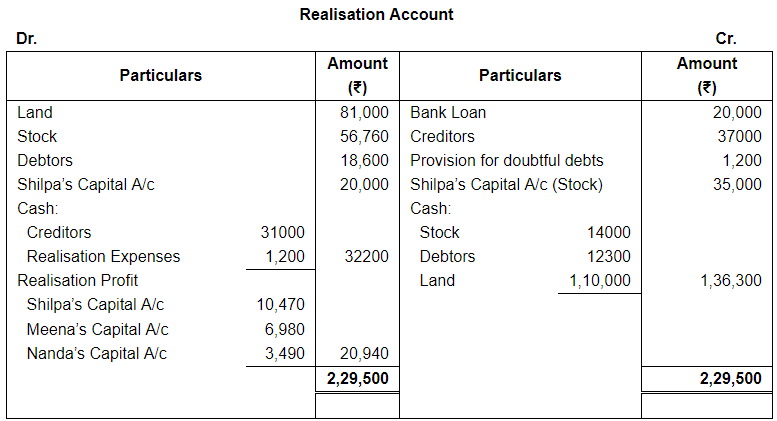

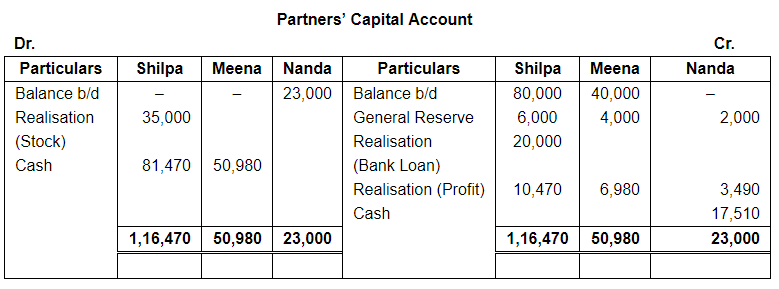

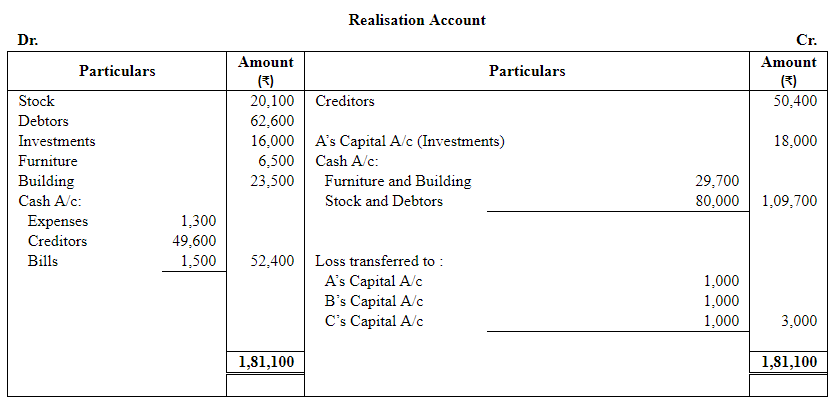

ANSWER:

Page No 7.58:

Question 24:

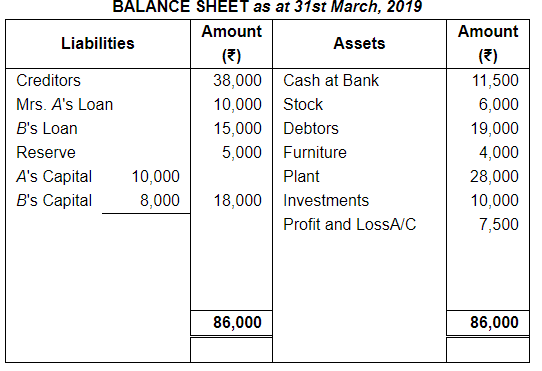

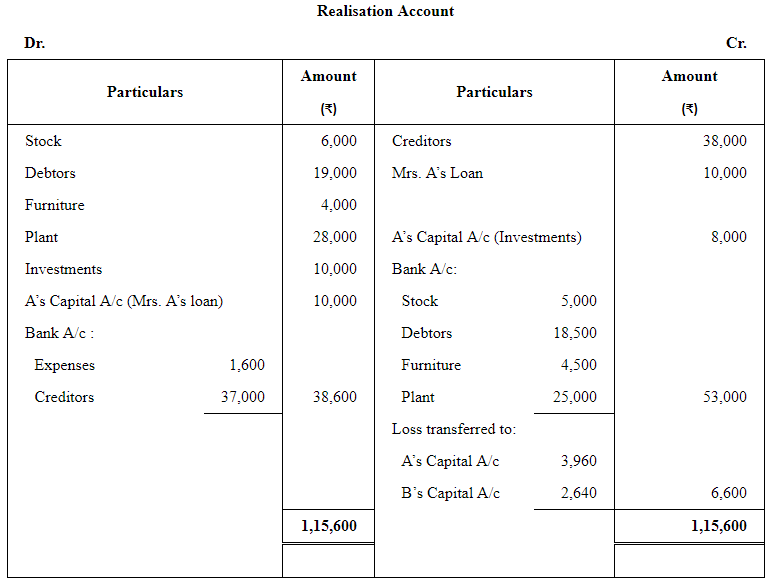

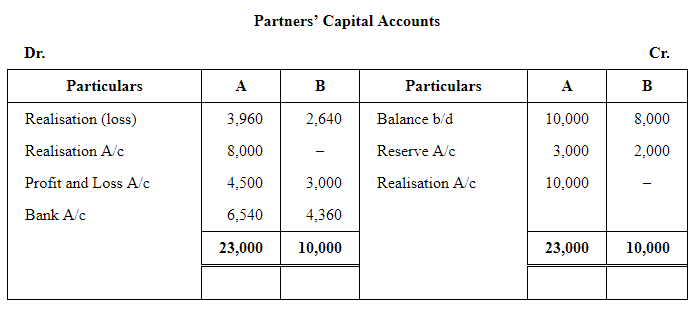

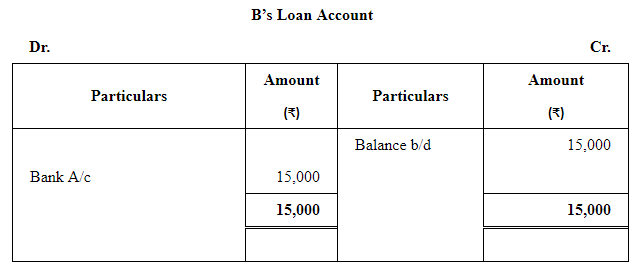

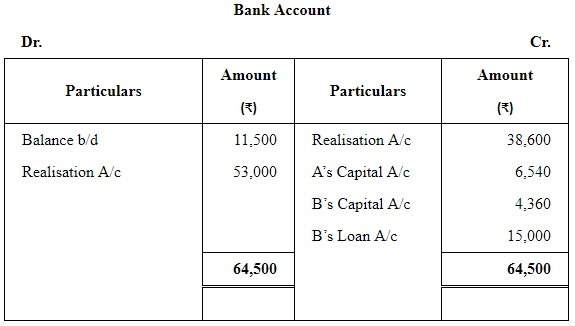

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2019, their Balance Sheet was as follows:

The firm was dissolved on 31st March, 2019 and both the partners agreed to the following:

(a) A took Investments at an agreed value of ₹ 8,000. He also agreed to settle Mrs. A's Loan.

(b) Other assets realised as: Stock − ₹ 5,000; Debtors − ₹ 18,500; Furniture − ₹ 4,500; Plant − ₹ 25,000.

(c) Expenses of realisation came to ₹ 1,600.

(d) Creditors agreed to accept ₹ 37,000 in full settlement of their claims.

Prepare Realisation Account, Partners' Capital Accounts and Bank Account.

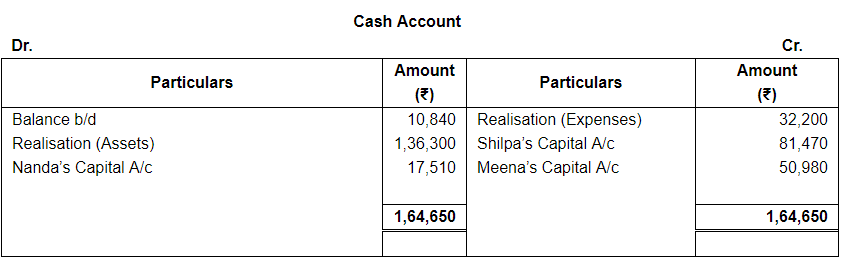

ANSWER:

Page No 7.58:

Question 25:

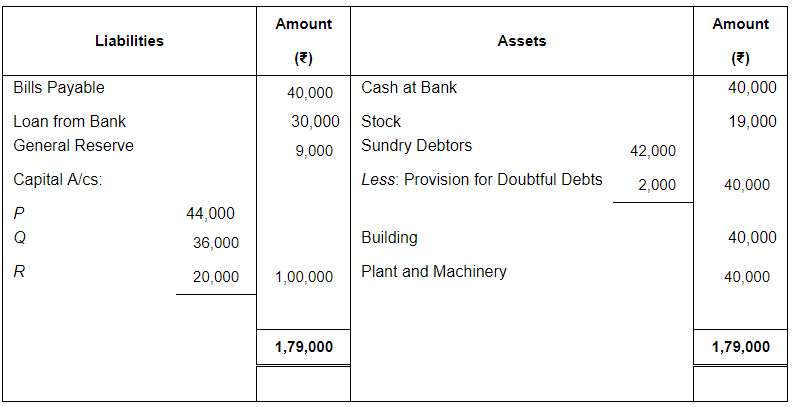

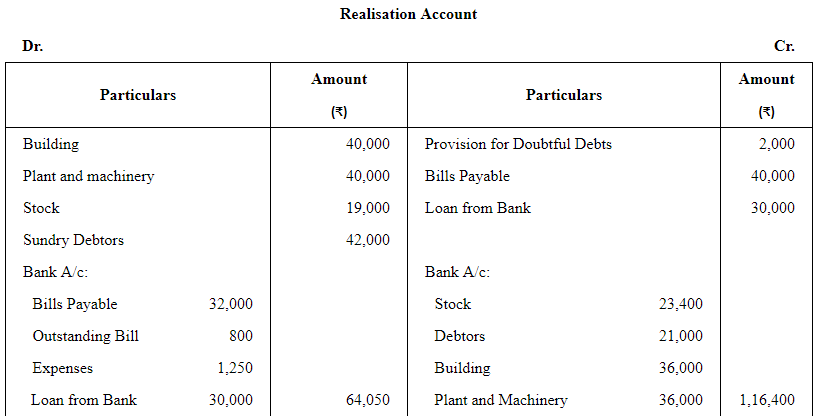

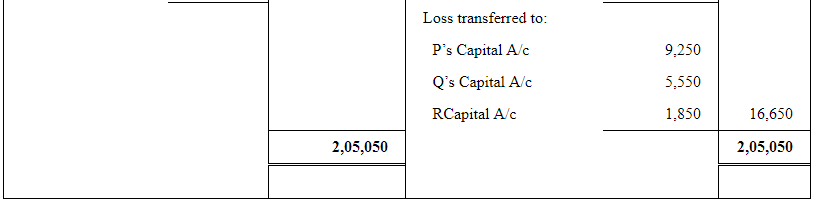

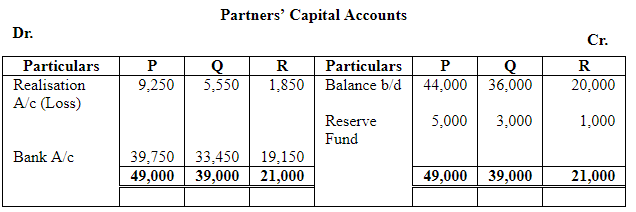

Balance Sheet of P, Q and R as at 31st March, 2019, who were sharing profits in the ratio of 5 : 3 : 1, was:

The partners dissolved the business. Assets realised − Stock ₹ 23,400; Debtors 50%; Fixed Assets 10% less than their book value. Bills Payable were settled for ₹ 32,000. There was an Outstanding Bill of Electricity ₹ 800 which was paid off. Realisation expenses ₹ 1,250 were also paid.

Prepare Realisation Account, Partner's Capital Accounts and Bank Account.

ANSWER:

Question 26:

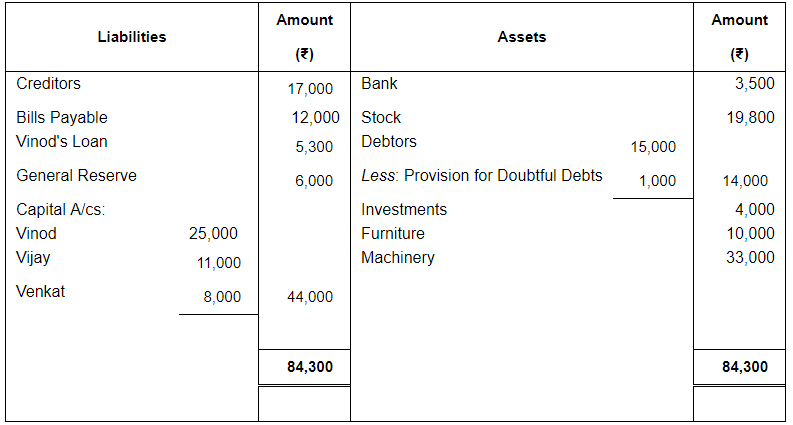

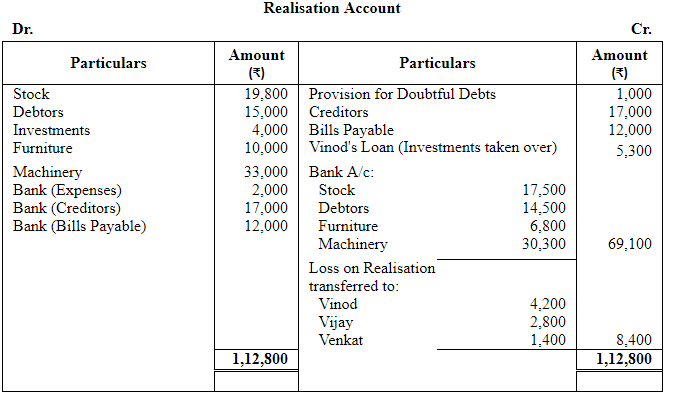

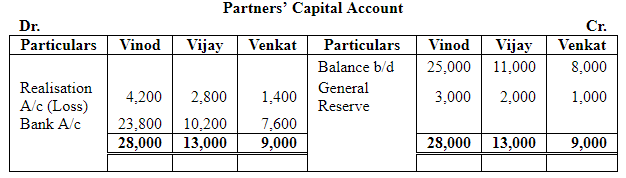

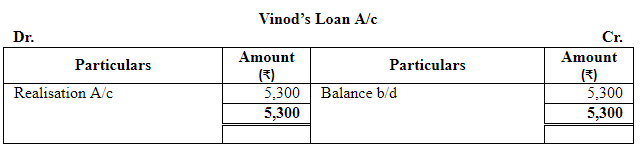

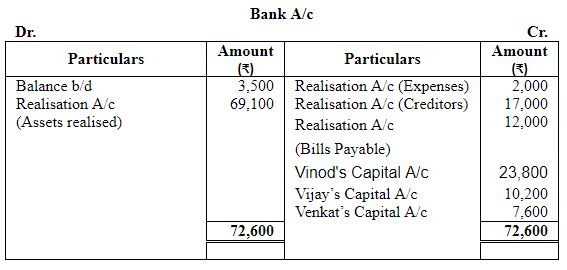

Vinod, Vijay and Venkat are partners sharing profits and losses in the ratio of 3 : 2 : 1. They decided to dissolve their firm on 31st March, 2019, the date on which their Balance Sheet stood as:

The following additional information is given:

(a) The Investments are taken by Vinod for ₹ 5,000 in settlement of his loan

(b)

(c) Expenses on realisation amounted to ₹ 2,000.

Close the books of the firm giving relevant Ledger Accounts.

ANSWER:

Page No 7.59:

Question 27:

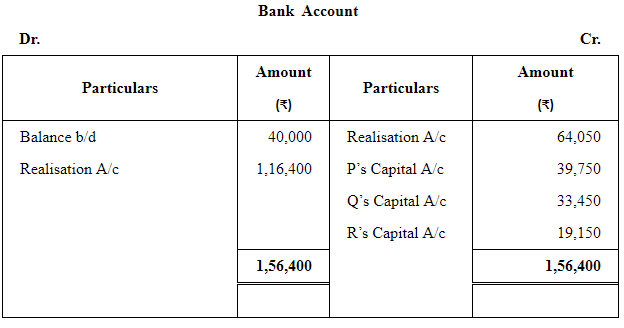

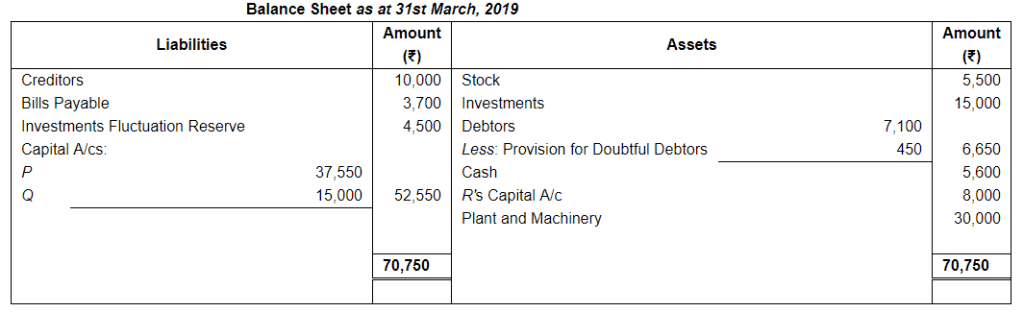

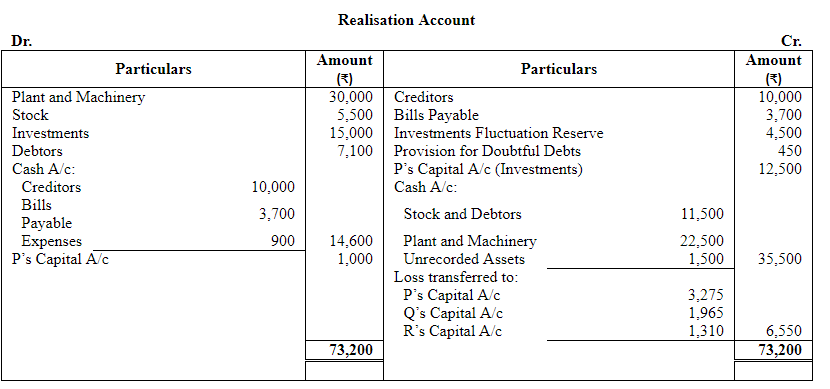

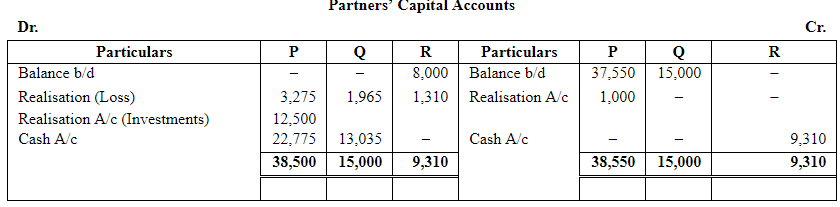

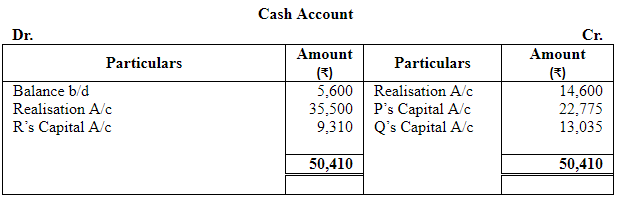

P, Q and R were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. They agreed to dissolve their partnership firm on 31st March, 2019. P was deputed to realise the assets and pay the liabilities. He was paid ₹ 1,000 as commission for his services. The financial position of the firm was:

P took over Investments for ₹ 12,500. Stock and Debtors realised ₹ 11,500. Plant and Machinery were sold to Q for ₹ 22,500 for cash. Unrecorded assets realised ₹ 1,500. Realisation expenses paid amounted to ₹ 900.

Prepare necessary Ledger Accounts to close the books of the firm.

ANSWER:

Question 28:

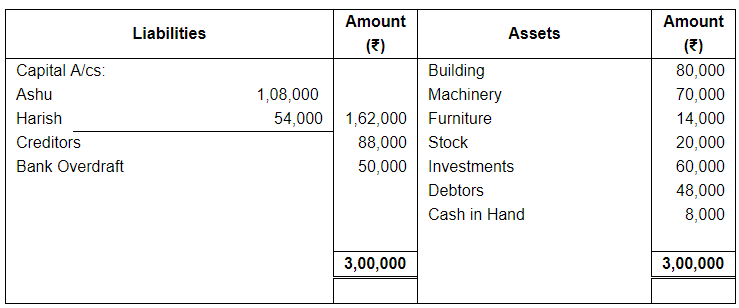

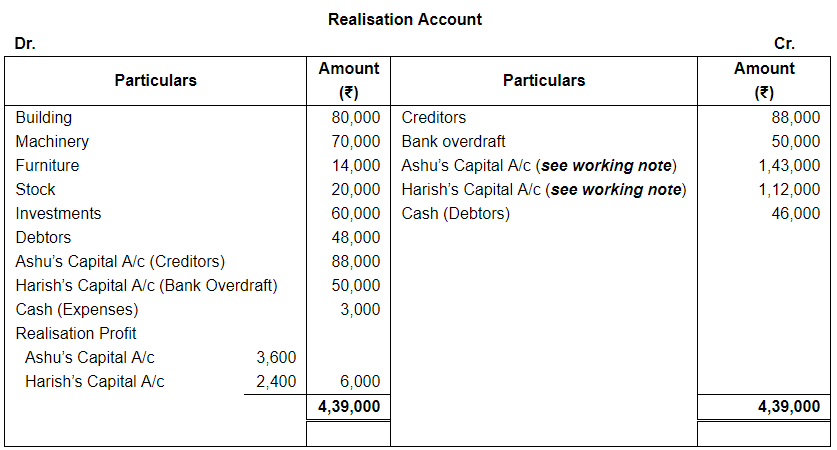

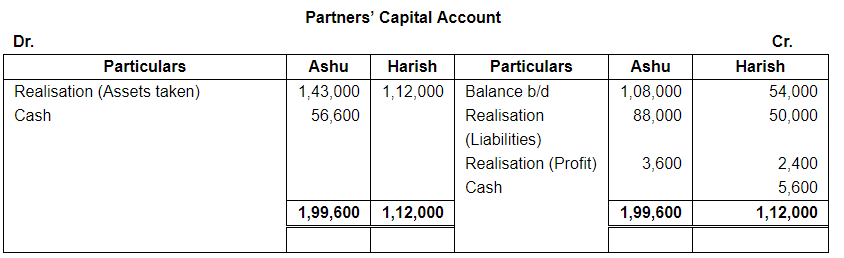

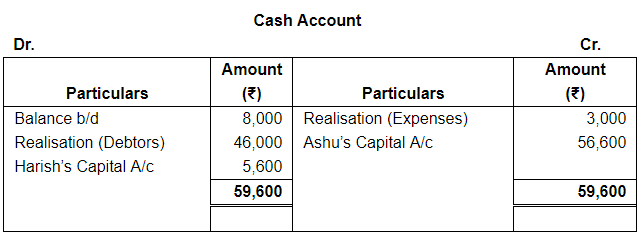

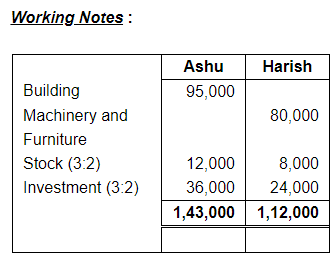

Ashu and Harish are partners sharing profit and losses as 3 : 2 . They decided to dissolve the firm on 31st March, 2019. Their Balance Sheet on the above date was:

Ashu is to take over the building at ₹ 95,000 and Machinery and Furniture is taken over by Harish at value of ₹ 80,000. Ashu agreed to pay Creditor and Harish agreed to meet Bank overdraft. Stock and Investments are taken by both partner in profit-sharing ratio. Debtors realised for ₹ 46,000, expenses of realisation amounted to ₹ 3,000. Prepare necessary Ledger Accounts.

ANSWER:

Page No 7.60:

Question 29:

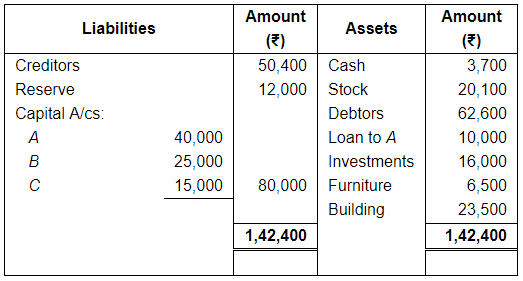

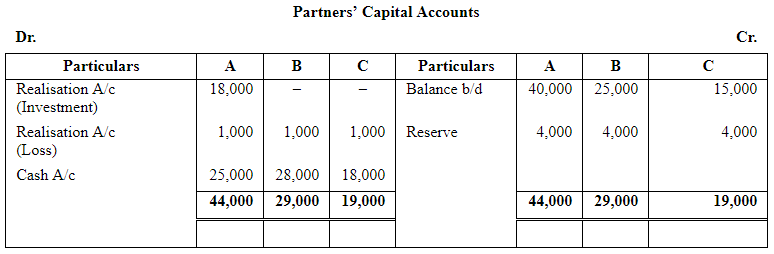

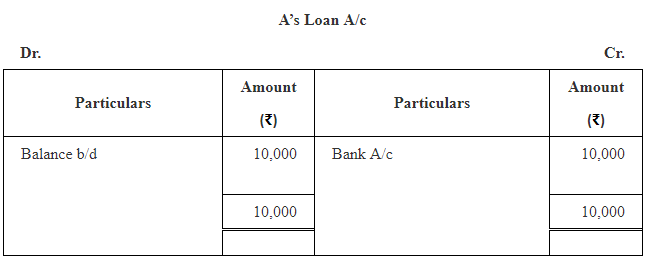

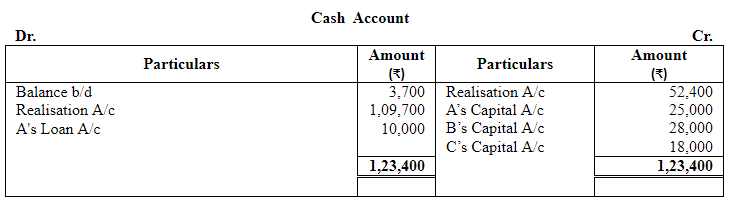

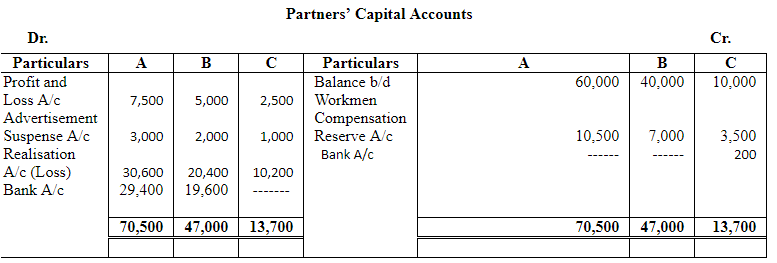

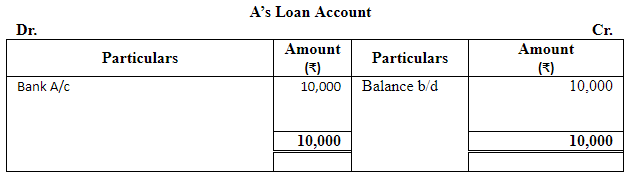

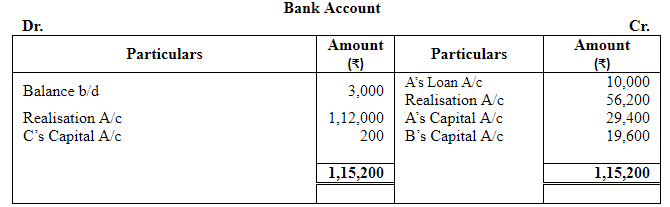

A, B and C were equal partners. On 31st March, 2019, their Balance Sheet stood as:

The firm was dissolved on the above date on the following terms:

(a) For the purpose of dissolution, Investments were valued at ₹ 18,000 and A took over the Investments at this value.

(b) Fixed Assets realised ₹ 29,700 whereas Stock and Debtors realised ₹ 80,000.

(c) Expenses of realisation amounted to ₹ 1,300.

(d) Creditors allowed a discount of ₹ 800.

(e) One Bill receivable for ₹ 1,500 under discount was dishonoured as the acceptor had become insolvent and was unable to pay anything and hence the bill had to be met by the firm.

Prepare Realisation Account, Partner's Capital Accounts and Cash Account showing how the accounts would finally be settled among the partners.

ANSWER:

Question 30:

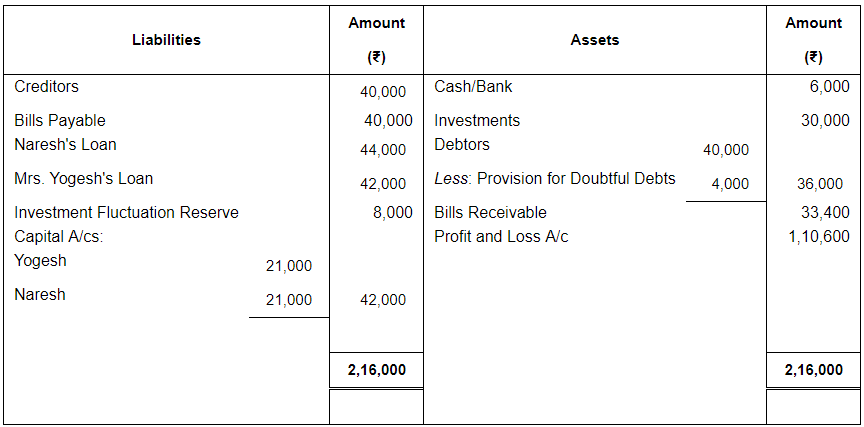

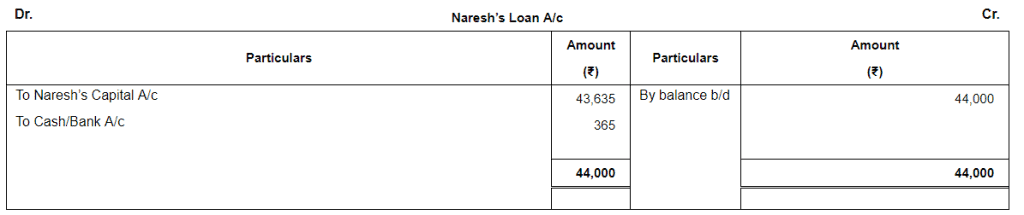

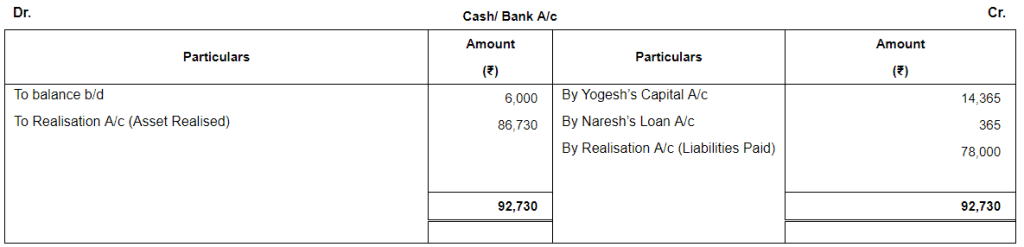

Yogesh and Naresh were partners sharing profits equally. They dissolved the firm on 1st April, 2019. Naresh was assigned the responsibility to realise the assets and pay the liabilities at a remuneration of ₹10,000 including expenses. Balance Sheet of the firm as on that date was as follows:

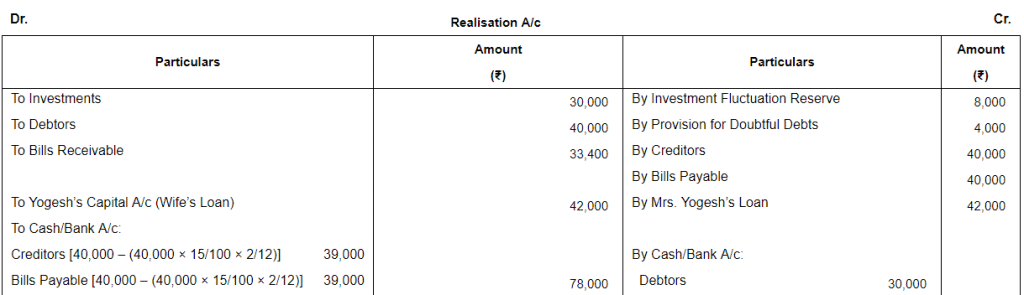

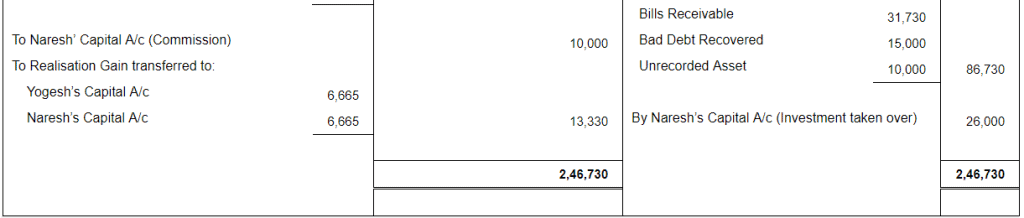

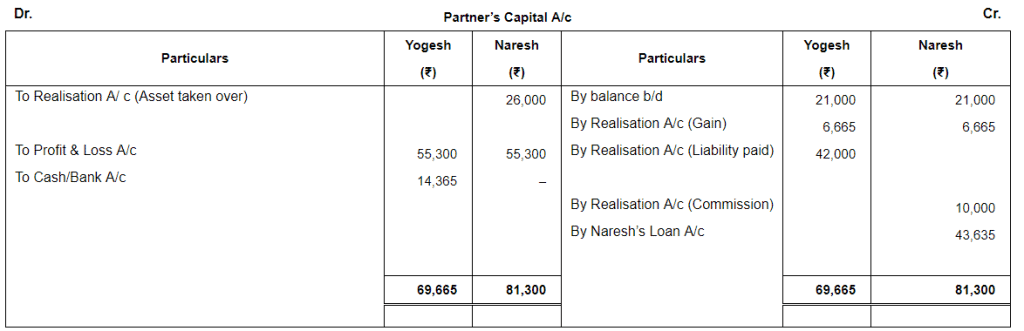

The firm was dissolved on following terms:

(a) Yogesh was to pay his wife's loan.

(b) Debtors realised ₹ 30,000.

(c) Naresh was to take investments at an agreed value of ₹ 26,000.

(d) Creditors and Bills Payable were payable after two months but were paid immediately at a discount of 15% p.a.

(e) Bills Receivable were received allowing 5% rebate.

(f) A Debtor previously written off as Bad Debt paid ₹ 15,000.

(g) An unrecorded asset realised ₹10,000.

Prepare Realisation Account, Partners' Capital Accounts, Partners' Loan Account and Cash/Bank Account.

ANSWER:

Page No 7.61:

Question 31:

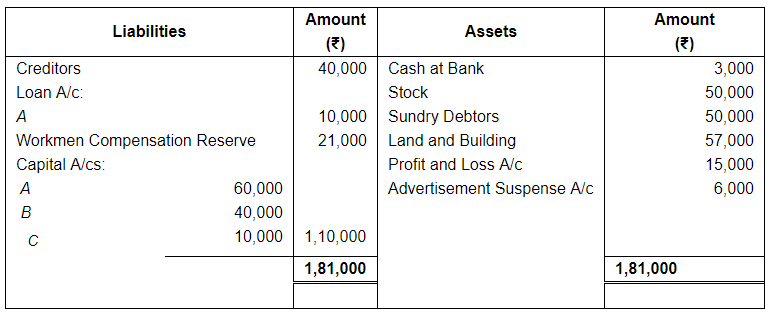

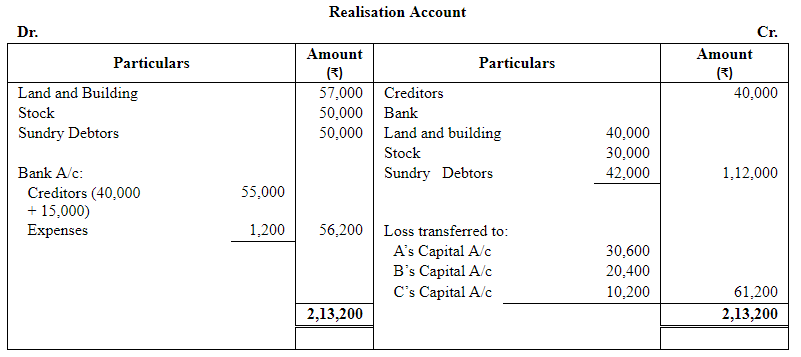

A, B and C are in partnership sharing profits and losses in the proportions of 1/2, 1/3 and 1/6 respectively. On 31st March, 2019, they decided to dissolve the partnership and the position of the firm on this date is represented by the following Balance Sheet:

During the course of realisation, a liability under a suit for damages is settled at ₹ 20,000 as against ₹ 5,000 only provided for in the books of the firm.

Land and Building were sold for ₹ 40,000 and the Stock and Sundry Debtors realised ₹ 30,000 and ₹ 42,000 respectively. The expenses of realisation amounted to ₹ 1,200.

There was a car in the firm, which was completely written off from the books. It was taken by A for ₹ 20,000. He also agreed to pay Outstanding Salary of ₹ 20,000 not provided in books.

Prepare Realisation Account, Partners' Capital Accounts and Bank Account in the books of the firm.

ANSWER:

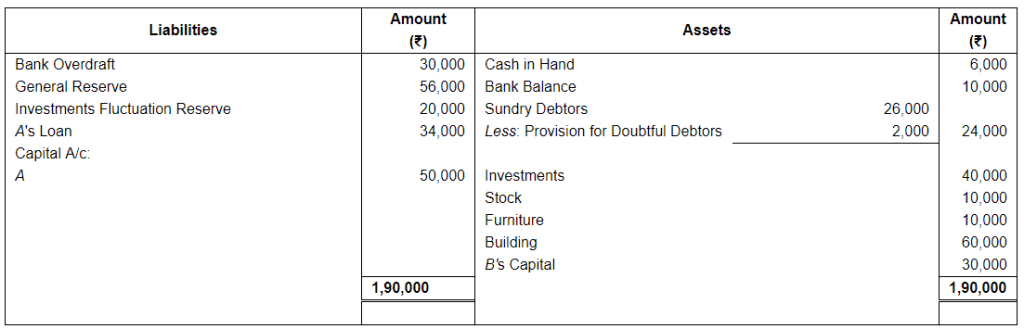

Question 32:

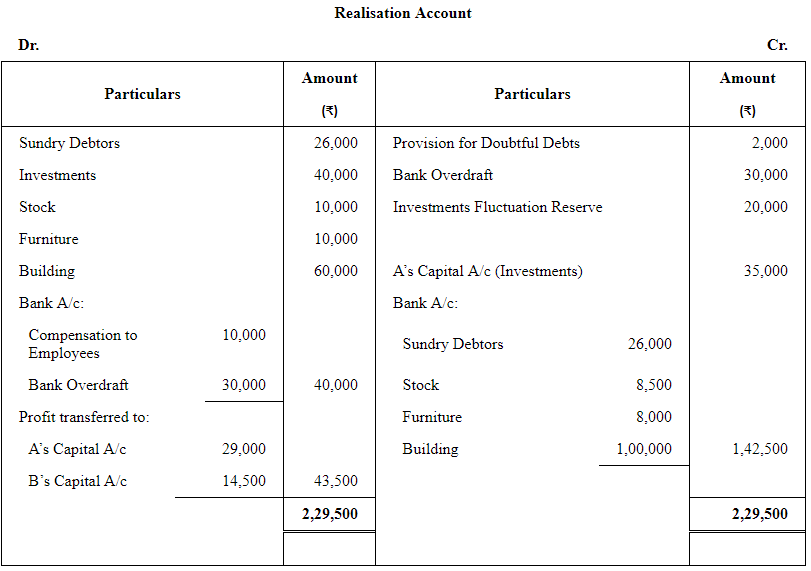

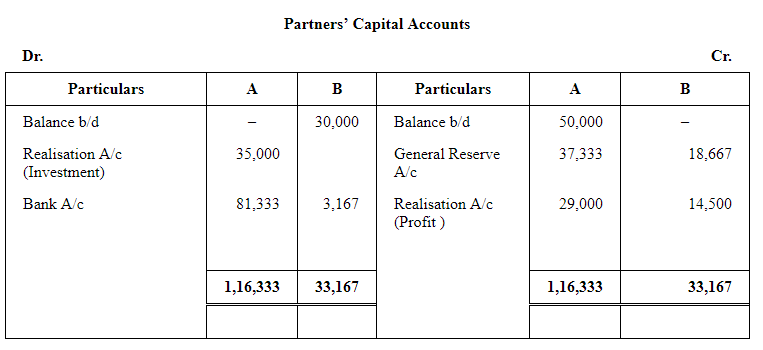

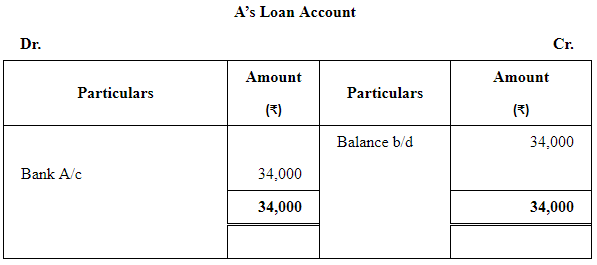

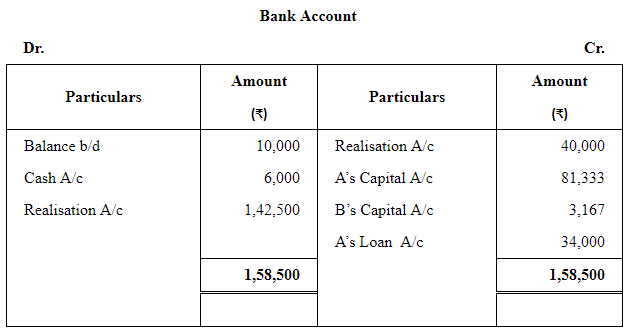

A and B are partners in a firm sharing profits and losses in the ratio of 2 : 1. On 31st March, 2019, their Balance Sheet was:

On that date, the partners decide to dissolve the firm. A took over Investments at an agreed valuation of ₹ 35,000. Other assets were realised as follows:

Sundry Debtors: Full amount. The firm could realise Stock at 15% less and Furniture at 20% less than the book value. Building was sold at ₹ 1,00,000.

Compensation to employees paid by the firm amounted to ₹ 10,000. This liability was not provided for in the above Balance Sheet.

You are required to close the books of the firm by preparing Realisation Account, Partners' Capital Accounts and Bank Account.

ANSWER:

Page No 7.62:

Question 33:

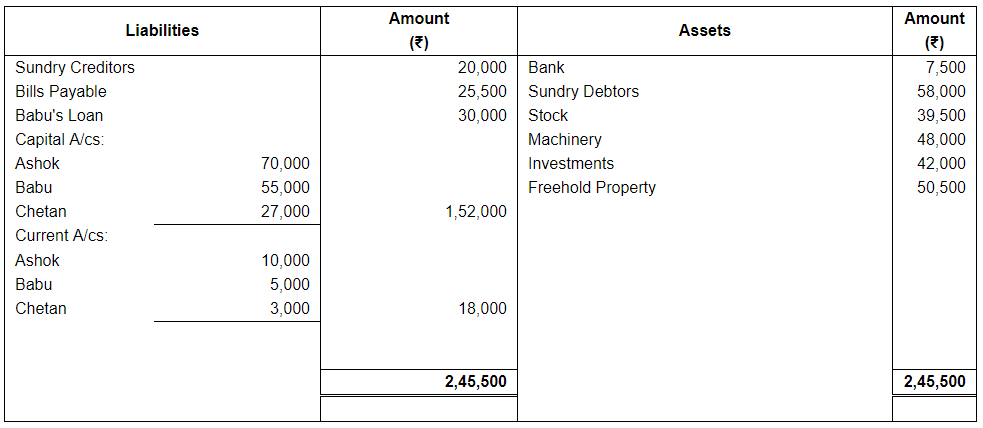

Ashok, Babu and Chetan are in partnership sharing profit in the proportion of 1/2, 1/3, 1/6 respectively. They dissolve the partnership of the 31st March, 2019 when the Balance Sheet of the firm as under:

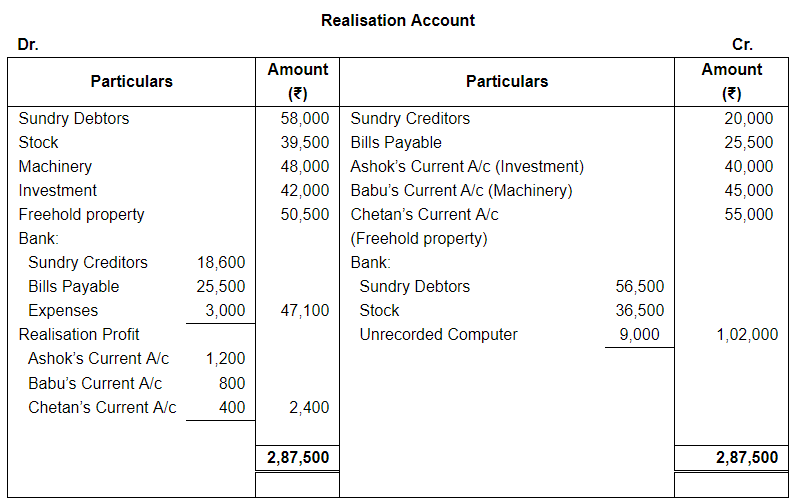

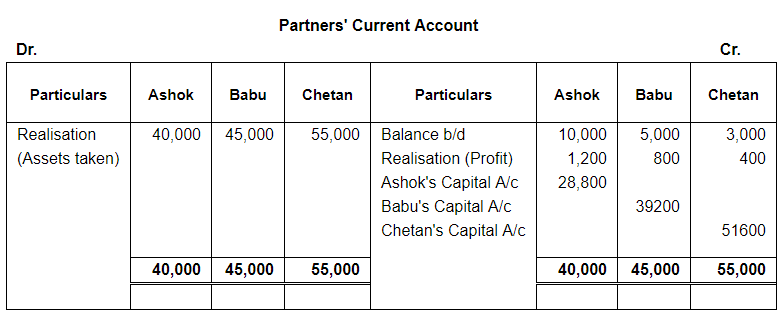

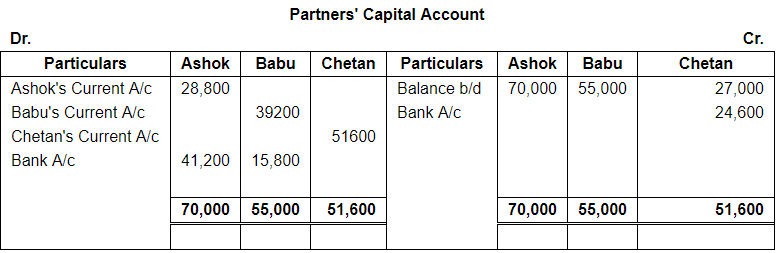

The Machinery was taken over by Babu for ₹ 45,000, Ashok took over the Investments for ₹ 40,000 and Freehold property took over by Chetan at ₹ 55,000. The remaining Assets realised as follows:

Sundry Debtors ₹ 56,500 and Stock ₹ 36,500. Sundry Creditors were settled at discount of 7%. A Office computer, not shown in the books of accounts realised ₹ 9,000. Realisation expenses amounted to ₹ 3,000.

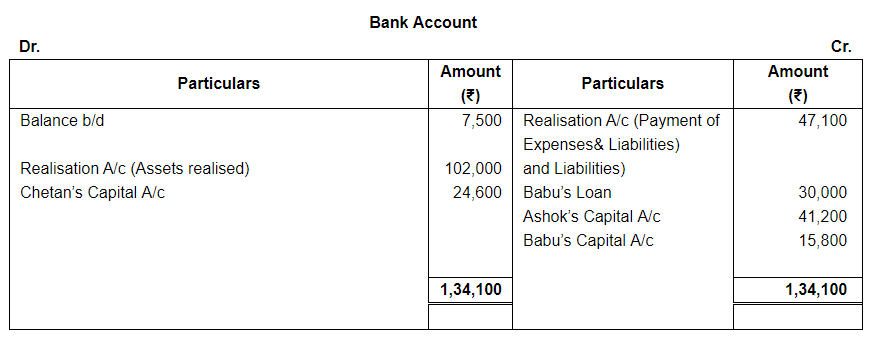

Prepare Realisation Account, Partners' Capital Accounts and Bank Account.

ANSWER:

Page No 7.62:

Question 34:

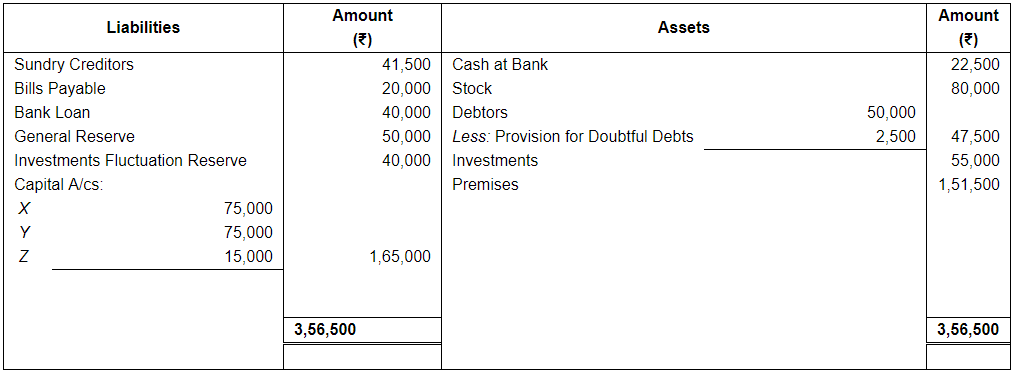

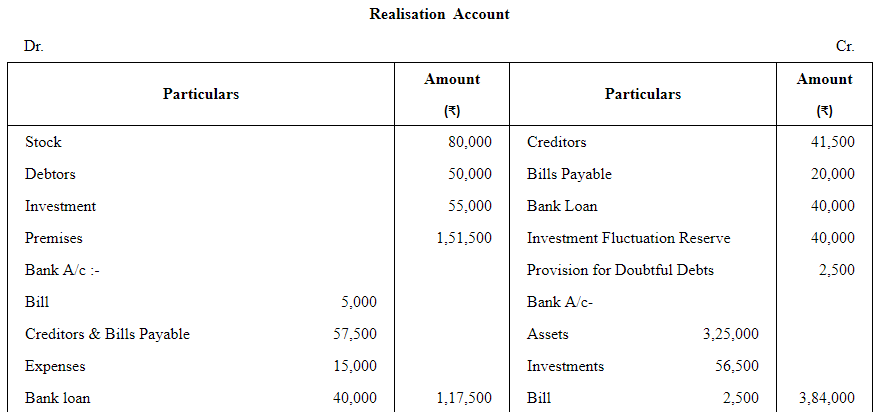

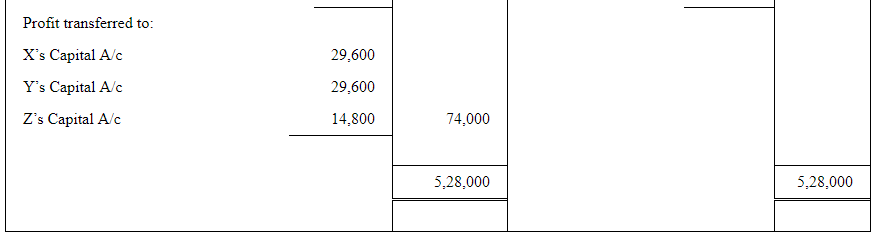

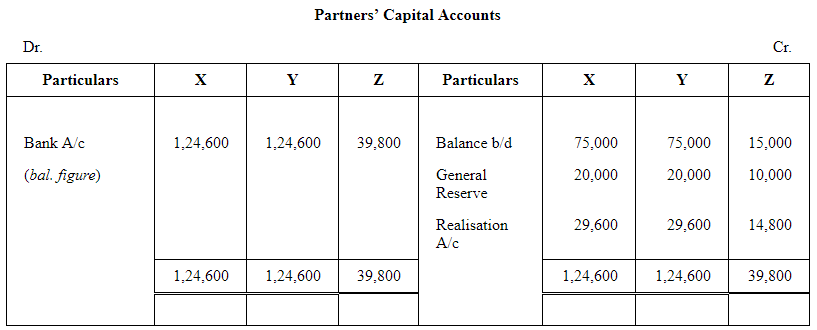

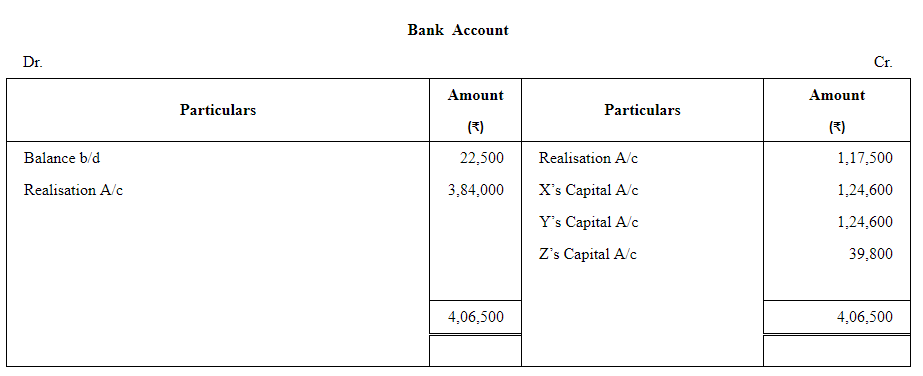

X, Y and Z carrying on business as merchants and sharing profits and losses in the ratio of 2 : 2 : 1, dissolved their firm as at 31st March, 2019 on which date their Balance Sheet was as follows:

A bill for ₹ 5,000 received from Mohan discounted from bank is not met on maturity.

The assets except Cash at Bank and Investments were sold to a company which paid ₹ 3,25,000 in cash.The Investments were sold and ₹ 56,500 were received. Mohan proved insolvent and a dividend of 50% was received from his estate. Sundry Creditors (including Bills Payable) were paid ₹ 57,500 in full settlement. Realisation Expenses amounted to ₹ 15,000.

Prepare Realisation Account, Partners' Capital Accounts and Bank Account.

ANSWER:

|

42 videos|180 docs|43 tests

|

FAQs on Dissolution of a Partnership Firm ( Part - 2) - Accountancy Class 12 - Commerce

| 1. What is the process of dissolving a partnership firm? |  |

| 2. Can a partnership firm be dissolved without the consent of all partners? |  |

| 3. What happens to the debts and liabilities of a partnership firm after dissolution? |  |

| 4. Are there any legal formalities to be followed while dissolving a partnership firm? |  |

| 5. Can a partnership firm be revived after dissolution? |  |